JOSHTHEBANKER

Member

can anyone provide me with instructions on how to create a watchlist that would signal when this indicator triggers in either direction?

Here is the basic structure. Clean it up, and modify it to your needs.can anyone provide me with instructions on how to create a watchlist that would signal when this indicator triggers in either direction?

#//@version=4

#//author: @kivancozbilgic

#https://www.tradingview.com/script/pB5nv16J/

#study(title="Turtle Trade Channels Indicator", shorttitle="TuTCI"

# Converted and modifiedTrueRange by Sam4COK@Samer800 - 08/2022

input EntryLength = 20; # "Entry Length"

input ExitLength = 10; # "Exit Length"

#barssince(Condition) =>

script barssince {

input Condition = 0;

def barssince = if Condition then 1 else barssince[1] + 1;

plot return = barssince;

}

def TFLow = low;

def TFHigh = high;

def TFClose = close;

def up = Highest(TFHigh, EntryLength);

def down = Lowest(TFLow, EntryLength);

def sup = Highest(TFHigh, ExitLength);

def sdown = Lowest(TFLow, ExitLength);

def K1 = if barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]) then down else up;

def K2 = If(barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]), sdown, sup);

def K3 = If(TFClose > K1, down, double.NaN);

def K4 = If(TFClose < K1, up, double.NaN);

def lower = Lowest(TFLow, EntryLength);

def upper = Highest(TFHigh, EntryLength);

def buySignal = TFHigh == upper[1] or TFHigh crosses above upper[1];

def sellSignal = TFLow == lower[1] or lower[1] crosses above TFLow;

def buyExit = TFLow == sdown[1] or sdown[1] crosses above TFLow;

def sellExit = TFHigh == sup[1] or TFHigh crosses above sup[1];

def O1 = barssince(buySignal);

def O2 = barssince(sellSignal);

def O3 = barssince(buyExit);

def O4 = barssince(sellExit);

def E1 = barssince(buySignal[1]);

def E2 = barssince(sellSignal[1]);

def E3 = barssince(buyExit[1]);

def E4 = barssince(sellExit[1]);

AddLabel(yes,

if buyExit and O1 < O3[1] then "buyExit" else

if sellExit and O2 < O4[1] then "sellExit" else

if buySignal and O3 < O1[1] then "buySignal" else

if sellSignal and O4 < O2[1] then "sellSignal" else " ");

AssignBackgroundColor(

if buyExit and O1 < O3[1] then color.red else

if sellExit and O2 < O4[1] then color.dark_orange else

if buySignal and O3 < O1[1] then color.green else

if sellSignal and O4 < O2[1] then color.plum else color.light_gray);OMG Thank you so much! Is this for daily chart?

#//@version=4

#//author: @kivancozbilgic

#https://www.tradingview.com/script/pB5nv16J/

#study(title="Turtle Trade Channels Indicator", shorttitle="TuTCI"

# Converted and modifiedTrueRange by Sam4COK@Samer800 - 08/2022

# Added strategy by TradingNumbers

input EntryLength = 20; # "Entry Length"

input ExitLength = 10; # "Exit Length"

input ShowLines = yes; # "Show Lines?"

input showSignals = yes; # "Show Entry/Exit Signals ?"

input SignalOnPrice = no; # "Show Entry/Exit Signals on Price?"

input ShowCloud = yes; # "Highlighter On/Off ?"

input UseChartTime = yes; # "Use Chart timeframe or Aggregation?"

input aggregation = AggregationPeriod.DAY;

def na = Double.NaN;

#barssince(Condition) =>

script barssince {

input Condition = 0;

def barssince = if Condition then 1 else barssince[1] + 1;

plot return = barssince;

}

#//MTF

def TFLow;

def TFHigh;

def TFClose;

if UseChartTime

then {

TFLow = low;

TFHigh = high;

TFClose = close;

} else {

TFLow = low(period = aggregation);

TFHigh = high(period = aggregation);

TFClose = close(period = aggregation);

}

def up = Highest(TFHigh, EntryLength);

def down = Lowest(TFLow, EntryLength);

def sup = Highest(TFHigh, ExitLength);

def sdown = Lowest(TFLow, ExitLength);

def K1 = if barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]) then down else up;

def K2 = If(barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]), sdown, sup);

def K3 = If(TFClose > K1, down, na);

def K4 = If(TFClose < K1, up, na);

plot TrendLine = K1;

TrendLine.SetDefaultColor(CreateColor(255, 82, 82));

TrendLine.SetLineWeight(2);

TrendLine.SetHiding(!ShowLines);

plot ExitLine = K2;

ExitLine.SetStyle(Curve.POINTS);

ExitLine.SetDefaultColor(CreateColor(0, 148, 255));

ExitLine.SetHiding(!ShowLines);

def lower = Lowest(TFLow, EntryLength);

def upper = Highest(TFHigh, EntryLength);

plot u = upper;

plot l = lower;

u.SetDefaultColor(CreateColor(0, 148, 255));

u.SetHiding(!ShowLines);

l.SetDefaultColor(CreateColor(0, 148, 255));

l.SetHiding(!ShowLines);

def buySignal = TFHigh == upper[1] or TFHigh crosses above upper[1];

def sellSignal = TFLow == lower[1] or lower[1] crosses above TFLow;

def buyExit = TFLow == sdown[1] or sdown[1] crosses above TFLow;

def sellExit = TFHigh == sup[1] or TFHigh crosses above sup[1];

def O1 = barssince(buySignal);

def O2 = barssince(sellSignal);

def O3 = barssince(buyExit);

def O4 = barssince(sellExit);

def E1 = barssince(buySignal[1]);

def E2 = barssince(sellSignal[1]);

def E3 = barssince(buyExit[1]);

def E4 = barssince(sellExit[1]);

plot LongExit = if buyExit and O1 < O3[1] then up else na;

LongExit.SetPaintingStrategy(PaintingStrategy.POINTS);

LongExit.SetDefaultColor(CreateColor(0, 148, 255));

LongExit.SetLineWeight(3);

LongExit.SetHiding(!ShowLines);

plot ShortExit = if sellExit and O2 < O4[1] then down else na;

ShortExit.SetPaintingStrategy(PaintingStrategy.POINTS);

ShortExit.SetDefaultColor(CreateColor(0, 148, 255));

ShortExit.SetLineWeight(3);

ShortExit.SetHiding(!ShowLines);

plot LongEntry = if buySignal and O3 < O1[1] then down else na;

LongEntry.SetPaintingStrategy(PaintingStrategy.POINTS);

LongEntry.SetDefaultColor(Color.GREEN);

LongEntry.SetLineWeight(3);

LongEntry.SetHiding(!ShowLines);

plot ShortEntry = if sellSignal and O4 < O2[1] then up else na;

ShortEntry.SetPaintingStrategy(PaintingStrategy.POINTS);

ShortEntry.SetDefaultColor(CreateColor(255, 82, 82));

ShortEntry.SetLineWeight(3);

ShortEntry.SetHiding(!ShowLines);

#### Bubbles

def SignalUp = if showSignals then if SignalOnPrice then high else up else na;

def SignalDn = if showSignals then if SignalOnPrice then low else down else na;

def ExitLong = if buyExit and SignalUp and O1 < O3[1] then up else na;

AddChartBubble(ExitLong, SignalUp, "Exit Long", CreateColor(0, 148, 255), yes);

def ExitShort = if sellExit and SignalDn and O2 < O4[1] then down else na;

AddChartBubble(ExitShort, SignalDn, "Exit Short", CreateColor(0, 148, 255), no);

def Long = if buySignal and SignalDn and O3 < O1[1] then down else na;

AddChartBubble(Long, SignalDn, "Long Entry", Color.GREEN, no);

def Short = if sellSignal and SignalUp and O4 < O2[1] then up else na;

AddChartBubble(Short, SignalUp, "Short Entry", Color.RED, yes);

#### Cloud

def color1 = if ShowCloud and (Min(Min(O1, O2), O3) == O1) then 1 else na;

def color2 = if ShowCloud and (Min(Min(O1, O2), O4) == O2) then 1 else na;

AddCloud(if color1 then u else na, ExitLine, Color.DARK_GREEN);

AddCloud(if color2 then ExitLine else na, l, Color.DARK_RED);

### Strategy

AddOrder(type = OrderType.BUY_TO_OPEN, condition = LongEntry);

AddOrder(type = OrderType.SELL_TO_CLOSE, condition = LongExit);

AddOrder(type = OrderType.SELL_TO_OPEN, condition = ShortEntry);

AddOrder(type = OrderType.BUY_TO_CLOSE, condition = ShortExit);

##### ENDCould you add an input to turn odd the long or turn off the short so there both not on the chart?

I added to the below more setting to remove/add lines and signals with option to use the indicator in different timeframe.

Release Note:

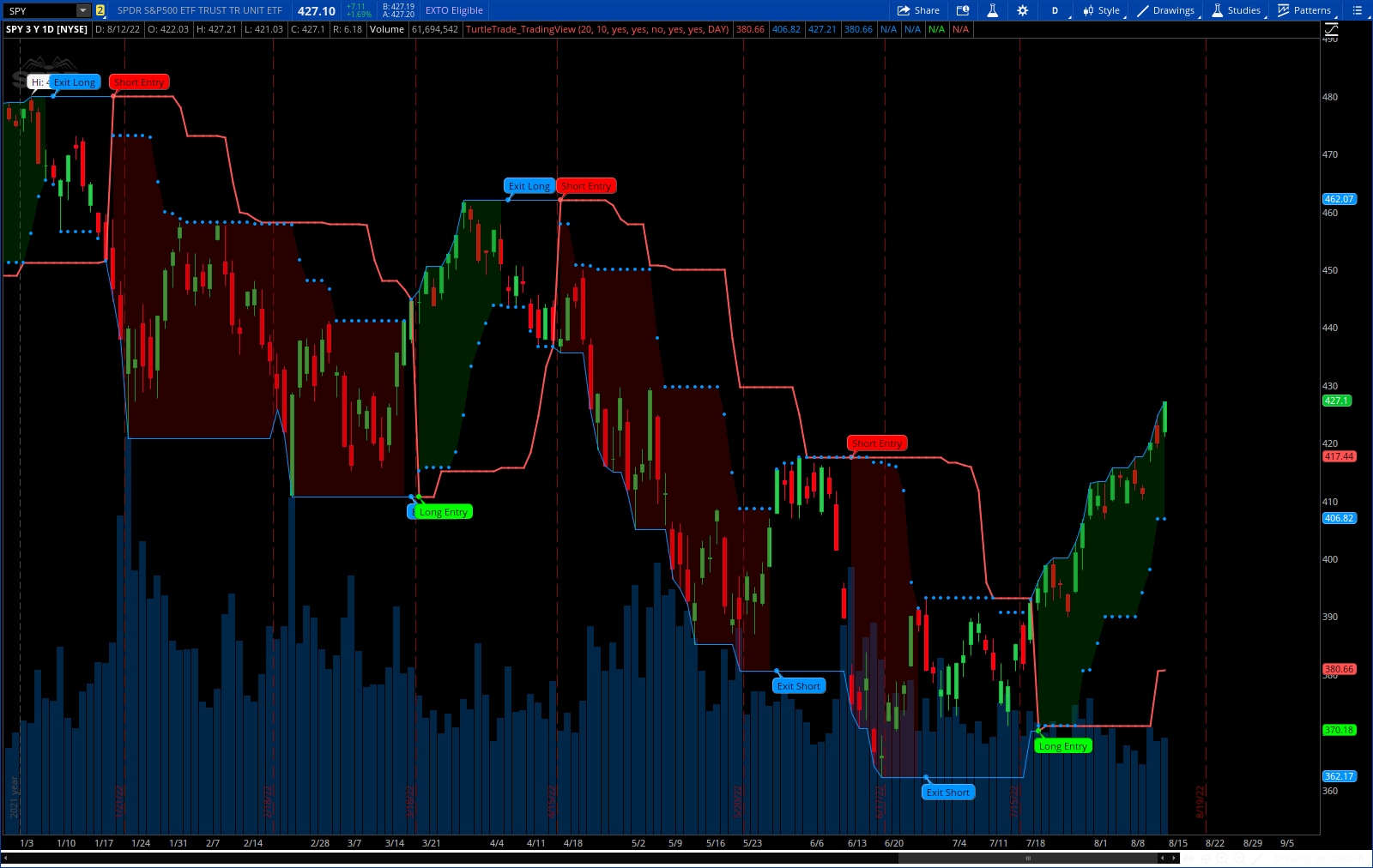

Legendary trade system which proved that great traders can be made, not born.

Turtle Trade Experiment made 80% annual return for 4 years and made 150 million $

Turtle Trade trend following system is a complete opposite to the "buy low and sell high" approach.

This trend following system was taught to a group of average and normal individuals, and almost everyone turned into a profitable trader.

They used the basis logic of well known DONCHIAN CHANNELS which developed by Richard Donchian .

The main rule is "Trade an 20-day breakout and take profits when an 10-day high or low is breached ". Examples:

Buy a 20-day breakout and close the trade when price action reaches a 10-day low.

Go short a 20-day breakout and close the trade when price action reaches a 10-day high.

In this indicator,

The red line is the trading line which indicates the trend direction:

Price bars over the trend line indicates uptrend

Price bars under the trend line means downtrend

The dotted blue line is the exit line.

Original system is:

Go long when the price High is equal to or above previous 20 day Highest price.

Go short when the price Low is equal to or below previous 20 day Lowest price.

Exit long positions when the price touches the exit line

Exit short positions when the price touches the exit line

Recommended initial stop-loss is ATR * 2 from the opening price.

Default system parameters were 20,10 and 55,20.

Original Turtle Rules:

To trade exactly like the turtles did, you need to set up two indicators representing the main and the failsafe system.

Set up the main indicator with EntryPeriod = 20 and ExitPeriod = 10 (A.k.a S1) (My comments: Good for Swing - Long timeframe)

Set up the failsafe indicator with EntryPeriod = 55 and ExitPeriod = 20 using a different color. (A.k.a S2) (My comment: Good for intraday - Short timeframe)

The entry strategy using S1 is as follows

Buy 20-day breakouts using S1 only if last signaled trade was a loss.

Sell 20-day breakouts using S1 only if last signaled trade was a loss.

If last signaled trade by S1 was a win, you shouldn't trade -Irregardless of the direction or if you traded last signal it or not-

The entry strategy using S2 is as follows:

Buy 55-day breakouts only if you ignored last S1 signal and the market is rallying without you

Sell 55-day breakouts only if you ignored last S1 signal and the market is pluging without you

You can Highlight the chart with provided trade signals:

Green cloud color when Long

Red cloud color when Short

No cloud color when flat

CSS:#//@version=4 #//author: @kivancozbilgic #https://www.tradingview.com/script/pB5nv16J/ #study(title="Turtle Trade Channels Indicator", shorttitle="TuTCI" # Converted and modifiedTrueRange by Sam4COK@Samer800 - 08/2022 input EntryLength = 20; # "Entry Length" input ExitLength = 10; # "Exit Length" input ShowLines = yes; # "Show Lines?" input showSignals = yes; # "Show Entry/Exit Signals ?" input SignalOnPrice = no; # "Show Entry/Exit Signals on Price?" input ShowCloud = yes; # "Highlighter On/Off ?" input UseChartTime = yes; # "Use Chart timeframe or Aggregation?" input aggregation = AggregationPeriod.DAY; def na = Double.NaN; #barssince(Condition) => script barssince { input Condition = 0; def barssince = if Condition then 1 else barssince[1] + 1; plot return = barssince; } #//MTF def TFLow; def TFHigh; def TFClose; if UseChartTime then { TFLow = low; TFHigh = high; TFClose = close; } else { TFLow = low(period = aggregation); TFHigh = high(period = aggregation); TFClose = close(period = aggregation); } def up = Highest(TFHigh, EntryLength); def down = Lowest(TFLow, EntryLength); def sup = Highest(TFHigh, ExitLength); def sdown = Lowest(TFLow, ExitLength); def K1 = if barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]) then down else up; def K2 = If(barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]), sdown, sup); def K3 = If(TFClose > K1, down, na); def K4 = If(TFClose < K1, up, na); plot TrendLine = K1; TrendLine.SetDefaultColor(CreateColor(255, 82, 82)); TrendLine.SetLineWeight(2); TrendLine.SetHiding(!ShowLines); plot ExitLine = K2; ExitLine.SetStyle(Curve.POINTS); ExitLine.SetDefaultColor(CreateColor(0, 148, 255)); ExitLine.SetHiding(!ShowLines); def lower = Lowest(TFLow, EntryLength); def upper = Highest(TFHigh, EntryLength); plot u = upper; plot l = lower; u.SetDefaultColor(CreateColor(0, 148, 255)); u.SetHiding(!ShowLines); l.SetDefaultColor(CreateColor(0, 148, 255)); l.SetHiding(!ShowLines); def buySignal = TFHigh == upper[1] or TFHigh crosses above upper[1]; def sellSignal = TFLow == lower[1] or lower[1] crosses above TFLow; def buyExit = TFLow == sdown[1] or sdown[1] crosses above TFLow; def sellExit = TFHigh == sup[1] or TFHigh crosses above sup[1]; def O1 = barssince(buySignal); def O2 = barssince(sellSignal); def O3 = barssince(buyExit); def O4 = barssince(sellExit); def E1 = barssince(buySignal[1]); def E2 = barssince(sellSignal[1]); def E3 = barssince(buyExit[1]); def E4 = barssince(sellExit[1]); plot LongExit = if buyExit and O1 < O3[1] then up else na; LongExit.SetPaintingStrategy(PaintingStrategy.POINTS); LongExit.SetDefaultColor(CreateColor(0, 148, 255)); LongExit.SetLineWeight(3); LongExit.SetHiding(!ShowLines); plot ShortExit = if sellExit and O2 < O4[1] then down else na; ShortExit.SetPaintingStrategy(PaintingStrategy.POINTS); ShortExit.SetDefaultColor(CreateColor(0, 148, 255)); ShortExit.SetLineWeight(3); ShortExit.SetHiding(!ShowLines); plot LongEntry = if buySignal and O3 < O1[1] then down else na; LongEntry.SetPaintingStrategy(PaintingStrategy.POINTS); LongEntry.SetDefaultColor(Color.GREEN); LongEntry.SetLineWeight(3); LongEntry.SetHiding(!ShowLines); plot ShortEntry = if sellSignal and O4 < O2[1] then up else na; ShortEntry.SetPaintingStrategy(PaintingStrategy.POINTS); ShortEntry.SetDefaultColor(CreateColor(255, 82, 82)); ShortEntry.SetLineWeight(3); ShortEntry.SetHiding(!ShowLines); #### Bubbles def SignalUp = if showSignals then if SignalOnPrice then high else up else na; def SignalDn = if showSignals then if SignalOnPrice then low else down else na; def ExitLong = if buyExit and SignalUp and O1 < O3[1] then up else na; AddChartBubble(ExitLong, SignalUp, "Exit Long", CreateColor(0, 148, 255), yes); def ExitShort = if sellExit and SignalDn and O2 < O4[1] then down else na; AddChartBubble(ExitShort, SignalDn, "Exit Short", CreateColor(0, 148, 255), no); def Long = if buySignal and SignalDn and O3 < O1[1] then down else na; AddChartBubble(Long, SignalDn, "Long Entry", Color.GREEN, no); def Short = if sellSignal and SignalUp and O4 < O2[1] then up else na; AddChartBubble(Short, SignalUp, "Short Entry", Color.RED, yes); #### Cloud def color1 = if ShowCloud and (Min(Min(O1, O2), O3) == O1) then 1 else na; def color2 = if ShowCloud and (Min(Min(O1, O2), O4) == O2) then 1 else na; AddCloud(if color1 then u else na, ExitLine, Color.DARK_GREEN); AddCloud(if color2 then ExitLine else na, l, Color.DARK_RED); ##### END

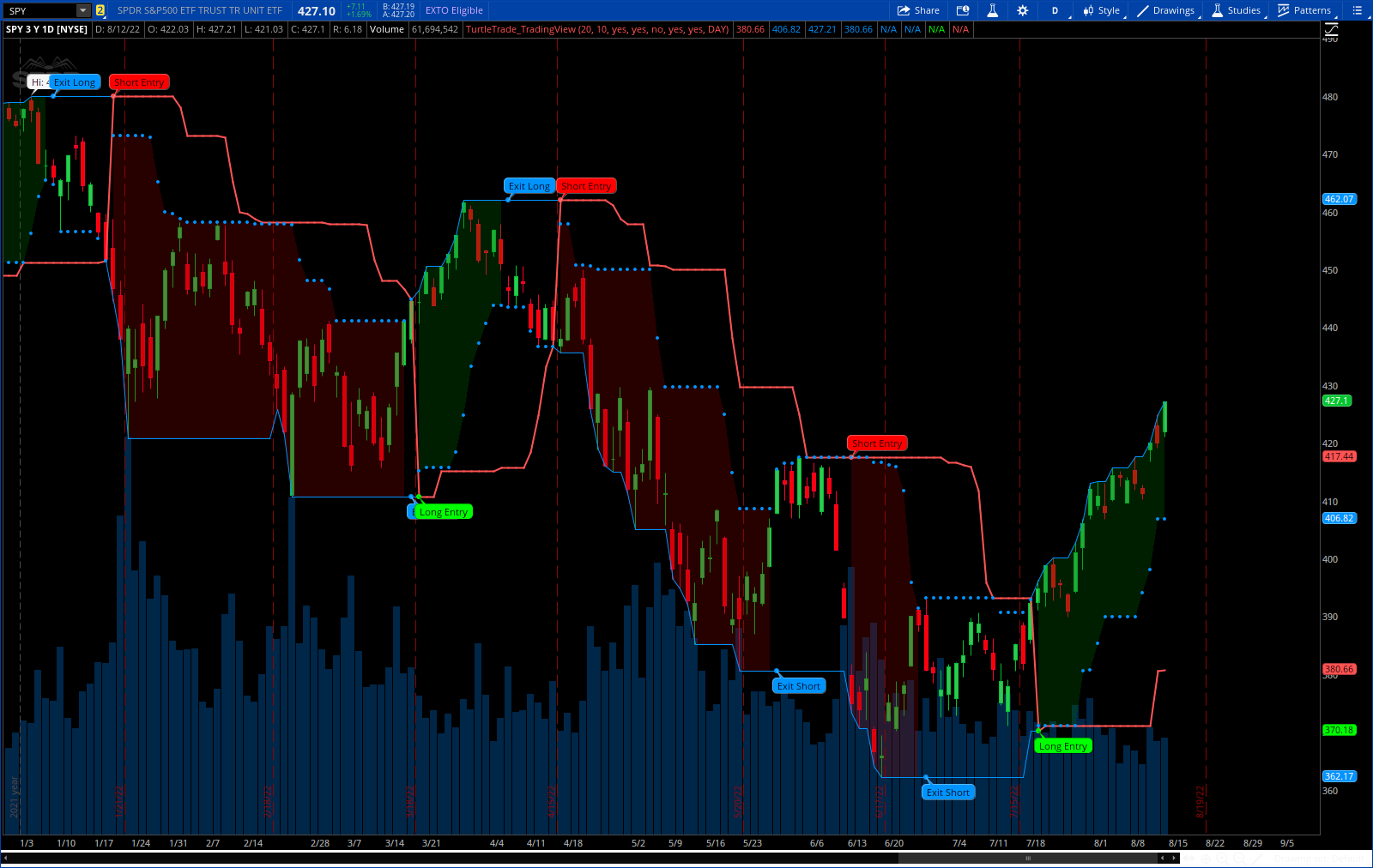

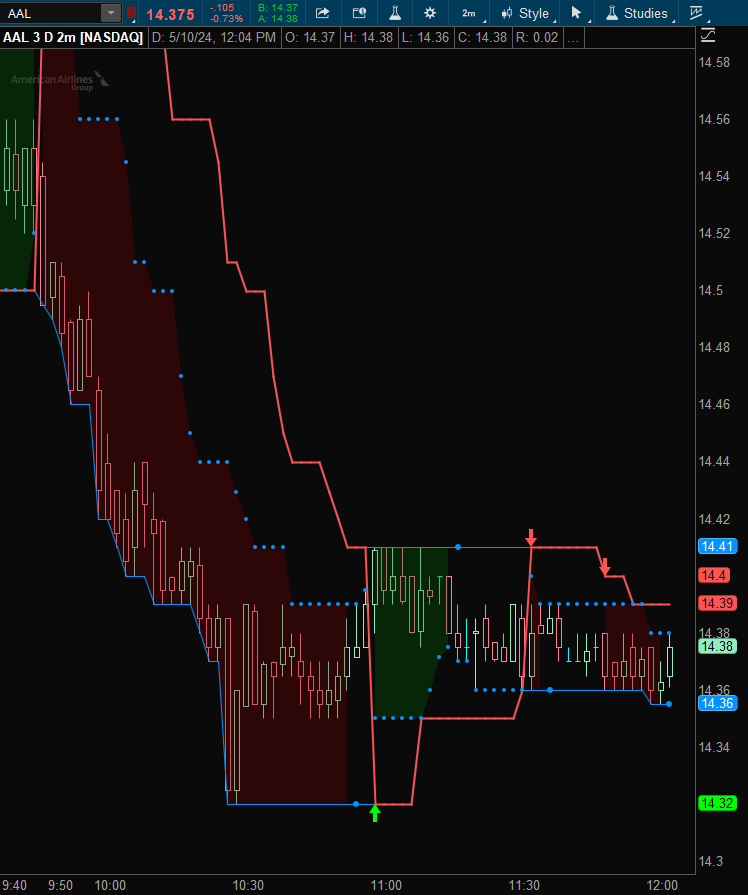

@samer800 Code could have an error, testing the lower times frames like this chart on the 5 min for Globex futures and you will notice there's no short exit

I added to the below more setting to remove/add lines and signals with option to use the indicator in different timeframe.

Release Note:

Legendary trade system which proved that great traders can be made, not born.

Turtle Trade Experiment made 80% annual return for 4 years and made 150 million $

Turtle Trade trend following system is a complete opposite to the "buy low and sell high" approach.

This trend following system was taught to a group of average and normal individuals, and almost everyone turned into a profitable trader.

They used the basis logic of well known DONCHIAN CHANNELS which developed by Richard Donchian .

The main rule is "Trade an 20-day breakout and take profits when an 10-day high or low is breached ". Examples:

Buy a 20-day breakout and close the trade when price action reaches a 10-day low.

Go short a 20-day breakout and close the trade when price action reaches a 10-day high.

In this indicator,

The red line is the trading line which indicates the trend direction:

Price bars over the trend line indicates uptrend

Price bars under the trend line means downtrend

The dotted blue line is the exit line.

Original system is:

Go long when the price High is equal to or above previous 20 day Highest price.

Go short when the price Low is equal to or below previous 20 day Lowest price.

Exit long positions when the price touches the exit line

Exit short positions when the price touches the exit line

Recommended initial stop-loss is ATR * 2 from the opening price.

Default system parameters were 20,10 and 55,20.

Original Turtle Rules:

To trade exactly like the turtles did, you need to set up two indicators representing the main and the failsafe system.

Set up the main indicator with EntryPeriod = 20 and ExitPeriod = 10 (A.k.a S1) (My comments: Good for Swing - Long timeframe)

Set up the failsafe indicator with EntryPeriod = 55 and ExitPeriod = 20 using a different color. (A.k.a S2) (My comment: Good for intraday - Short timeframe)

The entry strategy using S1 is as follows

Buy 20-day breakouts using S1 only if last signaled trade was a loss.

Sell 20-day breakouts using S1 only if last signaled trade was a loss.

If last signaled trade by S1 was a win, you shouldn't trade -Irregardless of the direction or if you traded last signal it or not-

The entry strategy using S2 is as follows:

Buy 55-day breakouts only if you ignored last S1 signal and the market is rallying without you

Sell 55-day breakouts only if you ignored last S1 signal and the market is pluging without you

You can Highlight the chart with provided trade signals:

Green cloud color when Long

Red cloud color when Short

No cloud color when flat

CSS:#//@version=4 #//author: @kivancozbilgic #https://www.tradingview.com/script/pB5nv16J/ #study(title="Turtle Trade Channels Indicator", shorttitle="TuTCI" # Converted and modifiedTrueRange by Sam4COK@Samer800 - 08/2022 input EntryLength = 20; # "Entry Length" input ExitLength = 10; # "Exit Length" input ShowLines = yes; # "Show Lines?" input showSignals = yes; # "Show Entry/Exit Signals ?" input SignalOnPrice = no; # "Show Entry/Exit Signals on Price?" input ShowCloud = yes; # "Highlighter On/Off ?" input UseChartTime = yes; # "Use Chart timeframe or Aggregation?" input aggregation = AggregationPeriod.DAY; def na = Double.NaN; #barssince(Condition) => script barssince { input Condition = 0; def barssince = if Condition then 1 else barssince[1] + 1; plot return = barssince; } #//MTF def TFLow; def TFHigh; def TFClose; if UseChartTime then { TFLow = low; TFHigh = high; TFClose = close; } else { TFLow = low(period = aggregation); TFHigh = high(period = aggregation); TFClose = close(period = aggregation); } def up = Highest(TFHigh, EntryLength); def down = Lowest(TFLow, EntryLength); def sup = Highest(TFHigh, ExitLength); def sdown = Lowest(TFLow, ExitLength); def K1 = if barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]) then down else up; def K2 = If(barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]), sdown, sup); def K3 = If(TFClose > K1, down, na); def K4 = If(TFClose < K1, up, na); plot TrendLine = K1; TrendLine.SetDefaultColor(CreateColor(255, 82, 82)); TrendLine.SetLineWeight(2); TrendLine.SetHiding(!ShowLines); plot ExitLine = K2; ExitLine.SetStyle(Curve.POINTS); ExitLine.SetDefaultColor(CreateColor(0, 148, 255)); ExitLine.SetHiding(!ShowLines); def lower = Lowest(TFLow, EntryLength); def upper = Highest(TFHigh, EntryLength); plot u = upper; plot l = lower; u.SetDefaultColor(CreateColor(0, 148, 255)); u.SetHiding(!ShowLines); l.SetDefaultColor(CreateColor(0, 148, 255)); l.SetHiding(!ShowLines); def buySignal = TFHigh == upper[1] or TFHigh crosses above upper[1]; def sellSignal = TFLow == lower[1] or lower[1] crosses above TFLow; def buyExit = TFLow == sdown[1] or sdown[1] crosses above TFLow; def sellExit = TFHigh == sup[1] or TFHigh crosses above sup[1]; def O1 = barssince(buySignal); def O2 = barssince(sellSignal); def O3 = barssince(buyExit); def O4 = barssince(sellExit); def E1 = barssince(buySignal[1]); def E2 = barssince(sellSignal[1]); def E3 = barssince(buyExit[1]); def E4 = barssince(sellExit[1]); plot LongExit = if buyExit and O1 < O3[1] then up else na; LongExit.SetPaintingStrategy(PaintingStrategy.POINTS); LongExit.SetDefaultColor(CreateColor(0, 148, 255)); LongExit.SetLineWeight(3); LongExit.SetHiding(!ShowLines); plot ShortExit = if sellExit and O2 < O4[1] then down else na; ShortExit.SetPaintingStrategy(PaintingStrategy.POINTS); ShortExit.SetDefaultColor(CreateColor(0, 148, 255)); ShortExit.SetLineWeight(3); ShortExit.SetHiding(!ShowLines); plot LongEntry = if buySignal and O3 < O1[1] then down else na; LongEntry.SetPaintingStrategy(PaintingStrategy.POINTS); LongEntry.SetDefaultColor(Color.GREEN); LongEntry.SetLineWeight(3); LongEntry.SetHiding(!ShowLines); plot ShortEntry = if sellSignal and O4 < O2[1] then up else na; ShortEntry.SetPaintingStrategy(PaintingStrategy.POINTS); ShortEntry.SetDefaultColor(CreateColor(255, 82, 82)); ShortEntry.SetLineWeight(3); ShortEntry.SetHiding(!ShowLines); #### Bubbles def SignalUp = if showSignals then if SignalOnPrice then high else up else na; def SignalDn = if showSignals then if SignalOnPrice then low else down else na; def ExitLong = if buyExit and SignalUp and O1 < O3[1] then up else na; AddChartBubble(ExitLong, SignalUp, "Exit Long", CreateColor(0, 148, 255), yes); def ExitShort = if sellExit and SignalDn and O2 < O4[1] then down else na; AddChartBubble(ExitShort, SignalDn, "Exit Short", CreateColor(0, 148, 255), no); def Long = if buySignal and SignalDn and O3 < O1[1] then down else na; AddChartBubble(Long, SignalDn, "Long Entry", Color.GREEN, no); def Short = if sellSignal and SignalUp and O4 < O2[1] then up else na; AddChartBubble(Short, SignalUp, "Short Entry", Color.RED, yes); #### Cloud def color1 = if ShowCloud and (Min(Min(O1, O2), O3) == O1) then 1 else na; def color2 = if ShowCloud and (Min(Min(O1, O2), O4) == O2) then 1 else na; AddCloud(if color1 then u else na, ExitLine, Color.DARK_GREEN); AddCloud(if color2 then ExitLine else na, l, Color.DARK_RED); ##### END

I noticed that the Short exit was turned off in the code. It should work properly now.@samer800 Code could have an error, testing the lower times frames like this chart on the 5 min for Globex futures and you will notice there's no short exit

Hi, Is it possible you can take another look at this code? It doesn't seem to be matching up with the (strategy) Example I only use this strategy on the Daily time frame-I just got a short entry lable on the chart but it is not reflected on the watch list?Here is the basic structure. Clean it up, and modify it to your needs.

If you are utilizing the MTF option, the watchlist will not match your charts.

The ToS platform does not support the use of multiple timeframes in Watchlists, Scans, Chart Alerts, Conditional Orders.

Turtle Trade Channels Watchlist

Shared Watchlist Link: http://tos.mx/LIHeKX5 Click here for --> Easiest way to load shared links

View attachment 17672

Ruby:#//@version=4 #//author: @kivancozbilgic #https://www.tradingview.com/script/pB5nv16J/ #study(title="Turtle Trade Channels Indicator", shorttitle="TuTCI" # Converted and modifiedTrueRange by Sam4COK@Samer800 - 08/2022 input EntryLength = 20; # "Entry Length" input ExitLength = 10; # "Exit Length" #barssince(Condition) => script barssince { input Condition = 0; def barssince = if Condition then 1 else barssince[1] + 1; plot return = barssince; } def TFLow = low; def TFHigh = high; def TFClose = close; def up = Highest(TFHigh, EntryLength); def down = Lowest(TFLow, EntryLength); def sup = Highest(TFHigh, ExitLength); def sdown = Lowest(TFLow, ExitLength); def K1 = if barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]) then down else up; def K2 = If(barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]), sdown, sup); def K3 = If(TFClose > K1, down, double.NaN); def K4 = If(TFClose < K1, up, double.NaN); def lower = Lowest(TFLow, EntryLength); def upper = Highest(TFHigh, EntryLength); def buySignal = TFHigh == upper[1] or TFHigh crosses above upper[1]; def sellSignal = TFLow == lower[1] or lower[1] crosses above TFLow; def buyExit = TFLow == sdown[1] or sdown[1] crosses above TFLow; def sellExit = TFHigh == sup[1] or TFHigh crosses above sup[1]; def O1 = barssince(buySignal); def O2 = barssince(sellSignal); def O3 = barssince(buyExit); def O4 = barssince(sellExit); def E1 = barssince(buySignal[1]); def E2 = barssince(sellSignal[1]); def E3 = barssince(buyExit[1]); def E4 = barssince(sellExit[1]); AddLabel(yes, if buyExit and O1 < O3[1] then "buyExit" else if sellExit and O2 < O4[1] then "sellExit" else if buySignal and O3 < O1[1] then "buySignal" else if sellSignal and O4 < O2[1] then "sellSignal" else " "); AssignBackgroundColor( if buyExit and O1 < O3[1] then color.red else if sellExit and O2 < O4[1] then color.dark_orange else if buySignal and O3 < O1[1] then color.green else if sellSignal and O4 < O2[1] then color.plum else color.light_gray);

see attached image for example-- IBM signaling short on chart but watch list says buy signal?Hi, Is it possible you can take another look at this code? It doesn't seem to be matching up with the (strategy) Example I only use this strategy on the Daily time frame-I just got a short entry lable on the chart but it is not reflected on the watch list?

No, there is not a way to make the MTF indicator plot like the non-MTF due to the repainting of the MTFHi, Is it possible you can take another look at this code? It doesn't seem to be matching up with the (strategy) Example I only use this strategy on the Daily time frame-I just got a short entry lable on the chart but it is not reflected on the watch list?

see attached image for example-- IBM signaling short on chart but watch list says buy signal?

@samer800 Could you provide the code or make an update for a label on the chart for the upper left corner for Bullish when the system is a buy or Bearish when the system turns to a sell (for MTF as well if possible)?View attachment 15487

I added to the below more setting to remove/add lines and signals with option to use the indicator in different timeframe.

Release Note:

Legendary trade system which proved that great traders can be made, not born.

Turtle Trade Experiment made 80% annual return for 4 years and made 150 million $

Turtle Trade trend following system is a complete opposite to the "buy low and sell high" approach.

This trend following system was taught to a group of average and normal individuals, and almost everyone turned into a profitable trader.

They used the basis logic of well known DONCHIAN CHANNELS which developed by Richard Donchian .

The main rule is "Trade an 20-day breakout and take profits when an 10-day high or low is breached ". Examples:

Buy a 20-day breakout and close the trade when price action reaches a 10-day low.

Go short a 20-day breakout and close the trade when price action reaches a 10-day high.

In this indicator,

The red line is the trading line which indicates the trend direction:

Price bars over the trend line indicates uptrend

Price bars under the trend line means downtrend

The dotted blue line is the exit line.

Original system is:

Go long when the price High is equal to or above previous 20 day Highest price.

Go short when the price Low is equal to or below previous 20 day Lowest price.

Exit long positions when the price touches the exit line

Exit short positions when the price touches the exit line

Recommended initial stop-loss is ATR * 2 from the opening price.

Default system parameters were 20,10 and 55,20.

Original Turtle Rules:

To trade exactly like the turtles did, you need to set up two indicators representing the main and the failsafe system.

Set up the main indicator with EntryPeriod = 20 and ExitPeriod = 10 (A.k.a S1) (My comments: Good for Swing - Long timeframe)

Set up the failsafe indicator with EntryPeriod = 55 and ExitPeriod = 20 using a different color. (A.k.a S2) (My comment: Good for intraday - Short timeframe)

The entry strategy using S1 is as follows

Buy 20-day breakouts using S1 only if last signaled trade was a loss.

Sell 20-day breakouts using S1 only if last signaled trade was a loss.

If last signaled trade by S1 was a win, you shouldn't trade -Irregardless of the direction or if you traded last signal it or not-

The entry strategy using S2 is as follows:

Buy 55-day breakouts only if you ignored last S1 signal and the market is rallying without you

Sell 55-day breakouts only if you ignored last S1 signal and the market is pluging without you

You can Highlight the chart with provided trade signals:

Green cloud color when Long

Red cloud color when Short

No cloud color when flat

CSS:#//@version=4 #//author: @kivancozbilgic #https://www.tradingview.com/script/pB5nv16J/ #study(title="Turtle Trade Channels Indicator", shorttitle="TuTCI" # Converted and modifiedTrueRange by Sam4COK@Samer800 - 08/2022 input EntryLength = 20; # "Entry Length" input ExitLength = 10; # "Exit Length" input ShowLines = yes; # "Show Lines?" input showSignals = yes; # "Show Entry/Exit Signals ?" input SignalOnPrice = no; # "Show Entry/Exit Signals on Price?" input ShowCloud = yes; # "Highlighter On/Off ?" input UseChartTime = yes; # "Use Chart timeframe or Aggregation?" input aggregation = AggregationPeriod.DAY; def na = Double.NaN; #barssince(Condition) => script barssince { input Condition = 0; def barssince = if Condition then 1 else barssince[1] + 1; plot return = barssince; } #//MTF def TFLow; def TFHigh; def TFClose; if UseChartTime then { TFLow = low; TFHigh = high; TFClose = close; } else { TFLow = low(period = aggregation); TFHigh = high(period = aggregation); TFClose = close(period = aggregation); } def up = Highest(TFHigh, EntryLength); def down = Lowest(TFLow, EntryLength); def sup = Highest(TFHigh, ExitLength); def sdown = Lowest(TFLow, ExitLength); def K1 = if barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]) then down else up; def K2 = If(barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]), sdown, sup); def K3 = If(TFClose > K1, down, na); def K4 = If(TFClose < K1, up, na); plot TrendLine = K1; TrendLine.SetDefaultColor(CreateColor(255, 82, 82)); TrendLine.SetLineWeight(2); TrendLine.SetHiding(!ShowLines); plot ExitLine = K2; ExitLine.SetStyle(Curve.POINTS); ExitLine.SetDefaultColor(CreateColor(0, 148, 255)); ExitLine.SetHiding(!ShowLines); def lower = Lowest(TFLow, EntryLength); def upper = Highest(TFHigh, EntryLength); plot u = upper; plot l = lower; u.SetDefaultColor(CreateColor(0, 148, 255)); u.SetHiding(!ShowLines); l.SetDefaultColor(CreateColor(0, 148, 255)); l.SetHiding(!ShowLines); def buySignal = TFHigh == upper[1] or TFHigh crosses above upper[1]; def sellSignal = TFLow == lower[1] or lower[1] crosses above TFLow; def buyExit = TFLow == sdown[1] or sdown[1] crosses above TFLow; def sellExit = TFHigh == sup[1] or TFHigh crosses above sup[1]; def O1 = barssince(buySignal); def O2 = barssince(sellSignal); def O3 = barssince(buyExit); def O4 = barssince(sellExit); def E1 = barssince(buySignal[1]); def E2 = barssince(sellSignal[1]); def E3 = barssince(buyExit[1]); def E4 = barssince(sellExit[1]); plot LongExit = if buyExit and O1 < O3[1] then up else na; LongExit.SetPaintingStrategy(PaintingStrategy.POINTS); LongExit.SetDefaultColor(CreateColor(0, 148, 255)); LongExit.SetLineWeight(3); LongExit.SetHiding(!ShowLines); plot ShortExit = if sellExit and O2 < O4[1] then down else na; ShortExit.SetPaintingStrategy(PaintingStrategy.POINTS); ShortExit.SetDefaultColor(CreateColor(0, 148, 255)); ShortExit.SetLineWeight(3); ShortExit.SetHiding(!ShowLines); plot LongEntry = if buySignal and O3 < O1[1] then down else na; LongEntry.SetPaintingStrategy(PaintingStrategy.POINTS); LongEntry.SetDefaultColor(Color.GREEN); LongEntry.SetLineWeight(3); LongEntry.SetHiding(!ShowLines); plot ShortEntry = if sellSignal and O4 < O2[1] then up else na; ShortEntry.SetPaintingStrategy(PaintingStrategy.POINTS); ShortEntry.SetDefaultColor(CreateColor(255, 82, 82)); ShortEntry.SetLineWeight(3); ShortEntry.SetHiding(!ShowLines); #### Bubbles def SignalUp = if showSignals then if SignalOnPrice then high else up else na; def SignalDn = if showSignals then if SignalOnPrice then low else down else na; def ExitLong = if buyExit and SignalUp and O1 < O3[1] then up else na; AddChartBubble(ExitLong, SignalUp, "Exit Long", CreateColor(0, 148, 255), yes); def ExitShort = if sellExit and SignalDn and O2 < O4[1] then down else na; AddChartBubble(ExitShort, SignalDn, "Exit Short", CreateColor(0, 148, 255), no); def Long = if buySignal and SignalDn and O3 < O1[1] then down else na; AddChartBubble(Long, SignalDn, "Long Entry", Color.GREEN, no); def Short = if sellSignal and SignalUp and O4 < O2[1] then up else na; AddChartBubble(Short, SignalUp, "Short Entry", Color.RED, yes); #### Cloud def color1 = if ShowCloud and (Min(Min(O1, O2), O3) == O1) then 1 else na; def color2 = if ShowCloud and (Min(Min(O1, O2), O4) == O2) then 1 else na; AddCloud(if color1 then u else na, ExitLine, Color.DARK_GREEN); AddCloud(if color2 then ExitLine else na, l, Color.DARK_RED); ##### END

This is wonderful...Here's a decent write up on the Turtle method:

https://www.tradingsim.com/day-trading/would-the-turtle-trading-system-work-now

The "turtle trading" implies that your methods and strategies are so balanced that you can enter with confidence after a trade failed and expect reasonable odds, rather than trying to investigate your model to worry about what went wrong...

I got this indicator here.

https://usethinkscript.com/threads/turtle-trade-channels-indicator-tutci-for-thinkorswim.12231/

I am not sure how to change the bubbles that paint on the chart to just an arrow. Please help

Thank you

Vitale

input showarrows = yes;

input showexitbubbles = no;

input showsignalbubbles = no;

input showentrybubbles = no;

Code:#//@version=4 #//author: @kivancozbilgic #https://www.tradingview.com/script/pB5nv16J/ #study(title="Turtle Trade Channels Indicator", shorttitle="TuTCI" # Converted and modifiedTrueRange by Sam4COK@Samer800 - 08/2022 input EntryLength = 20; # "Entry Length" input ExitLength = 10; # "Exit Length" input ShowLines = yes; # "Show Lines?" input showSignals = yes; # "Show Entry/Exit Signals ?" input SignalOnPrice = no; # "Show Entry/Exit Signals on Price?" input ShowCloud = yes; # "Highlighter On/Off ?" input UseChartTime = yes; # "Use Chart timeframe or Aggregation?" input showarrows = yes; input showexitbubbles = no; input showsignalbubbles = no; input showentrybubbles = no; input aggregation = AggregationPeriod.DAY; def na = Double.NaN; #barssince(Condition) => script barssince { input Condition = 0; def barssince = if Condition then 1 else barssince[1] + 1; plot return = barssince; } #//MTF def TFLow; def TFHigh; def TFClose; if UseChartTime then { TFLow = low; TFHigh = high; TFClose = close; } else { TFLow = low(period = aggregation); TFHigh = high(period = aggregation); TFClose = close(period = aggregation); } def up = Highest(TFHigh, EntryLength); def down = Lowest(TFLow, EntryLength); def sup = Highest(TFHigh, ExitLength); def sdown = Lowest(TFLow, ExitLength); def K1 = if barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]) then down else up; def K2 = If(barssince(TFHigh >= up[1]) <= barssince(TFLow <= down[1]), sdown, sup); def K3 = If(TFClose > K1, down, na); def K4 = If(TFClose < K1, up, na); plot TrendLine = K1; TrendLine.SetDefaultColor(CreateColor(255, 82, 82)); TrendLine.SetLineWeight(2); TrendLine.SetHiding(!ShowLines); plot ExitLine = K2; ExitLine.SetStyle(Curve.POINTS); ExitLine.SetDefaultColor(CreateColor(0, 148, 255)); ExitLine.SetHiding(!ShowLines); def lower = Lowest(TFLow, EntryLength); def upper = Highest(TFHigh, EntryLength); plot u = upper; plot l = lower; u.SetDefaultColor(CreateColor(0, 148, 255)); u.SetHiding(!ShowLines); l.SetDefaultColor(CreateColor(0, 148, 255)); l.SetHiding(!ShowLines); def buySignal = TFHigh == upper[1] or TFHigh crosses above upper[1]; def sellSignal = TFLow == lower[1] or lower[1] crosses above TFLow; def buyExit = TFLow == sdown[1] or sdown[1] crosses above TFLow; def sellExit = TFHigh == sup[1] or TFHigh crosses above sup[1]; def O1 = barssince(buySignal); def O2 = barssince(sellSignal); def O3 = barssince(buyExit); def O4 = barssince(sellExit); def E1 = barssince(buySignal[1]); def E2 = barssince(sellSignal[1]); def E3 = barssince(buyExit[1]); def E4 = barssince(sellExit[1]); plot LongExit = if buyExit and O1 < O3[1] then up else na; LongExit.SetPaintingStrategy(PaintingStrategy.POINTS); LongExit.SetDefaultColor(CreateColor(0, 148, 255)); LongExit.SetLineWeight(3); #LongExit.SetHiding(!ShowLines); plot ShortExit = if sellExit and O2 < O4[1] then down else na; ShortExit.SetPaintingStrategy(PaintingStrategy.POINTS); ShortExit.SetDefaultColor(CreateColor(0, 148, 255)); ShortExit.SetLineWeight(3); #ShortExit.SetHiding(!ShowLines); plot LongEntry = if buySignal and O3 < O1[1] then if !SignalOnPrice then down else low else na; LongEntry.SetPaintingStrategy(if !showarrows then na else PaintingStrategy.ARROW_UP); LongEntry.SetDefaultColor(Color.GREEN); LongEntry.SetLineWeight(3); #LongEntry.SetHiding(!ShowLines); plot ShortEntry = if sellSignal and O4 < O2[1] then if !SignalOnPrice then up else high else na; ShortEntry.SetPaintingStrategy(if !showarrows then na else PaintingStrategy.ARROW_DOWN); ShortEntry.SetDefaultColor(CreateColor(255, 82, 82)); ShortEntry.SetLineWeight(3); #ShortEntry.SetHiding(!ShowLines); #### Bubbles def SignalUp = if !showsignalbubbles then na else if showSignals then if SignalOnPrice then high else up else na; def SignalDn = if !showsignalbubbles then na else if showSignals then if SignalOnPrice then low else down else na; def ExitLong = if buyExit and SignalUp and O1 < O3[1] then up else na; AddChartBubble(if !showexitbubbles then na else ExitLong, SignalUp, "Exit Long", CreateColor(0, 148, 255), yes); def ExitShort = if sellExit and SignalDn and O2 < O4[1] then down else na; AddChartBubble(if !showexitbubbles then na else ExitShort, SignalDn, "Exit Short", CreateColor(0, 148, 255), no); def Long = if buySignal and SignalDn and O3 < O1[1] then down else na; AddChartBubble(if !showentrybubbles then na else Long, SignalDn, "Long Entry", Color.GREEN, no); def Short = if sellSignal and SignalUp and O4 < O2[1] then up else na; AddChartBubble(if !showentrybubbles then na else Short, SignalUp, "Short Entry", Color.RED, yes); #### Cloud def color1 = if ShowCloud and (Min(Min(O1, O2), O3) == O1) then 1 else na; def color2 = if ShowCloud and (Min(Min(O1, O2), O4) == O2) then 1 else na; AddCloud(if color1 then u else na, ExitLine, Color.DARK_GREEN); AddCloud(if color2 then ExitLine else na, l, Color.DARK_RED); ##### END

I appreciate this. Is it possible to separate the lines and the exit dots. When you click no for the lines the stop dots go away as well.

What does "signal on price" (yes or no) in study parameters mean?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.