# ttm_stats_counts_durations

#https://usethinkscript.com/threads/ttm-squeeze.16135/

#TTM Squeeze

#AlphaOptions Oct 3, 2019 #1

#About two years ago I saw where a thinkscripter had developed labels to set general expectations for squeeze history, but I did not save the script unfortunately. While this label is not a trade trigger type of indicator, it can be used to quickly set expectations for squeeze occurrence frequency and duration. I would like to see if I can get some help building it as follows and others might also like to learn from the process as we go. Here are the steps I would propose:

#Start with a label (or what will be the initial showing in the ultimate label) that shows the number of bars in the chart being viewed (i.e. there are X number of bars on this chart).

#The next part of the label will say there are X total bars in the TTM squeeze on this chart.

#The other parts of the label are then just mathematical derivative parts of the label from these two measures which most interesting are:

#What percent of bars are in a squeeze (number of squeezes / total bars as a % ) - this shows how frequently this occurs of all bars

#How frequently does a squeeze series initiate - so number of unbroken series (prior bar no squeeze but current bar is squeeze) shows the number of not just the frequency of all bar in squeeze but how frequently a squeeze sequence initiates

#Average squeeze duration - shows of all the unbroken series how many bars would be in a squeeze - this is perhaps the most useful as you can characterize and instrument (or at least its period in the chart) to set expectations on how long that might last

#Other things are also possible like shortest, longest, longest between squeeze series ...

#Once the framework design is made, it is conceivable that any indicator occurrence could be substituted for the squeeze.

#--------------------------

def na = double.nan;

def bn = barnumber();

#--------------------------

# ref signal

# TTM_Squeeze

# TD Ameritrade IP Company, Inc. (c) 2009-2023

declare lower;

input price = CLOSE;

input length = 20;

input nK = 1.5;

input nBB = 2.0;

input alertLine = 1.0;

#plot Histogram = Double.NaN;

#plot VolComp = Double.NaN;

#plot SqueezeAlert = Double.NaN;

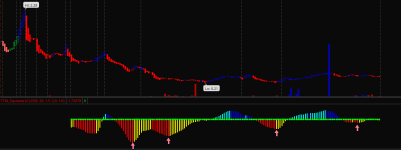

def ttm_histo = TTM_Squeeze(price, length, nk, nbb, alertline).histogram;

def ttm_volcomp = TTM_Squeeze(price, length, nk, nbb, alertline).volcomp;

def ttm_sqz = TTM_Squeeze(price, length, nk, nbb, alertline).SqueezeAlert;

# ttm_sqz , 1 , green , no squeeze . 0 , red , squeeze

input show_histo = yes;

plot zttm_histo = if isnan(close) then na else ttm_histo;

zttm_histo.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

zttm_histo.AssignValueColor(

if ttm_histo > 0 and ttm_histo > ttm_histo[1] then color.cyan

else if ttm_histo > 0 and ttm_histo < ttm_histo[1] then color.blue

else if ttm_histo < 0 and ttm_histo > ttm_histo[1] then color.yellow

else if ttm_histo < 0 and ttm_histo < ttm_histo[1] then color.red

else color.gray);

zttm_histo.setlineweight(3);

zttm_histo.SetHiding(!show_histo);

def offpt = 5;

input offset_points = yes;

def pt = if !offset_points then 0

else if ttm_histo > 0 then -offpt

else if ttm_histo < 0 then offpt

else 0;

input show_sqz_points = yes;

plot zsqz = if isnan(close) then na else pt;

zsqz.SetPaintingStrategy(PaintingStrategy.POINTS);

zsqz.AssignValueColor(if ttm_sqz then color.green else color.red);

zsqz.setlineweight(3);

zsqz.SetHiding(!show_sqz_points);

#--------------------------

# ttm_sqz = 0

def signal_start = !ttm_sqz;

# ttm_sqz = 1

def signal_end = ttm_sqz;

# create a pulse, stays = 1 during signals , until a non signal, then 0

def signal = if bn == 1 then 0

else if signal_end then 0

else if signal_start then 1

else signal[1];

#--------------------------

# labels,

# 1. there are X number of bars on this chart

def bar_cnt = highestall(if isnan(close) then 0 else bn);

# 2. there are X total bars in the TTM squeezes on this chart.

def sig_cnt = if bn == 1 then 0

else if signal == 1 then sig_cnt[1] + 1

else sig_cnt[1];

# 3a. What percent of bars are in a squeeze (number of squeezes / total bars as a % ) - this shows how frequently this occurs of all bars

# count how many squeezes, count the groups of signals

def sig_group_cnt = if bn == 1 then 0

else if signal_start and signal_end[1] then sig_group_cnt[1] + 1

else sig_group_cnt[1];

# calc with bn, not bncnt, to use the qty of bars up to the active bar (not all of them. (the last bar will use all the bars)

def sqz_bars_per = round(100 * sig_group_cnt / bn, 1);

# 3b how frequently does a squeeze series initiate - so number of unbroken series (prior bar no squeeze but current bar is squeeze) shows the number of not just the frequency of all bar in squeeze but how frequently a squeeze sequence initiates

# ????

# same as 3a % ?

# 3c. Average squeeze duration - shows of all the unbroken series how many bars would be in a squeeze

# this is perhaps the most useful as you can characterize and instrument (or at least its period in the chart) to set expectations on how long that might last

# avg bar len of groups (sqz)

def avg_group_len = round(sig_cnt/sig_group_cnt, 1);

# Other things are also possible like shortest, longest, longest between squeeze series ...

#----------------

# if last bar has a signal (in a sqz)

# then plot a vert line after last bar, to show est last bar of current sqz, based on the avg group (sqz) len

def lastbar_sig = if (bn == bar_cnt and signal_start) then 1 else 0;

def n = 400;

def last_group_bars = if bn == 1 then 0

else if lastbar_sig then fold e = 0 to n

with p

while getvalue(signal_start, e)

do p + 1

else lastbar_sig[1];

def future_bars = if isnan(close) then future_bars[1]

else if last_group_bars > 0 then (rounddown(avg_group_len,0) - last_group_bars)

else 0;

#def x = !isnan(close[future_bars+1]) and isnan(close[future_bars+0]);

def x = !isnan(getvalue(close, future_bars+1)) and isnan(getvalue(close, future_bars+0));

addverticalline(x, future_bars, color.cyan);

#----------------

input show_labels = yes;

addlabel(show_labels, bar_cnt + " total bars", color.yellow);

addlabel(show_labels, sig_cnt + " signals", color.yellow);

addlabel(show_labels, sig_group_cnt + " groups", color.yellow);

addlabel(show_labels, sqz_bars_per + " % of bars in groups", color.yellow);

#addlabel(show_labels, , color.yellow);

addlabel(show_labels, avg_group_len + " avg group len", color.yellow);

addlabel(show_labels, last_group_bars + " last group len", color.green);

addlabel(show_labels, future_bars + " bars remaining", color.green);

#------------------------

# test stuff

addchartbubble(0, 0,

ttm_histo + " h\n" +

ttm_volcomp + " v\n" +

ttm_sqz + "sqz"

, color.yellow, no);

addchartbubble(0, 50,

# ttm_histo + " h\n" +

ttm_volcomp + " v\n"

# ttm_sqz + "sqz"

, (if ttm_volcomp then color.yellow else color.gray), yes);

input test1_data = no;

addchartbubble(test1_data and !isnan(close), -15,

bn + "\n" +

bar_cnt + " bn\n" +

sig_cnt + " Sbars\n" +

sig_group_cnt + " Sqty\n" +

sqz_bars_per + " %bars\n" +

avg_group_len + " avg len\n" +

last_group_bars + " last"

#future_bars

#x

, color.yellow, no);

input test2_data = no;

addchartbubble(test2_data, -15,

avg_group_len + " avg len\n" +

last_group_bars + " last\n" +

future_bars + " x\n" +

x

, color.yellow, no);

#