You should upgrade or use an alternative browser.

TTM Squeeze Format, Scan, Watchlist, Label For ThinkOrSwim

MatthewA

Active member

You may like the IronRod indicator that @MerryDay uses.Hello all, I'm looking for a ttm squeeze histogram turns up or down signal where it labels an arrow sign up or down on a chart. Please point me to the direction.

Thanks in advance

https://usethinkscript.com/threads/mobius’-momentum-squeeze-for-thinkorswim.1123/post-74526

pacificatrader

New member

hi @wtf_dude ! i love your shares. Is there any way to make these into labels for the chart? interested in the histo flip pos/neg, the histo shift from red/yellow and teal/royalblue, and last and best... the dots!!!!Oh no, you have to put it with the code I posted earlier. Just create a new study, call it something like AdvancedSqueezeScanner and paste all of this and then use it on the scan tab. Should be go to go.

Code:# AdvancedSqueezeScanner # Momentum Squeeze open coding by Moebius, based on John Carter # Scan by WTF_Dude # Added Squeeze Label with directional color # Label is green when momentum is ascending, red when descending declare lower; input length = 20; #hint length: Length for average calculation input price = close; input SDmult = 2.0; input ATRmult = 1.5; def K = (Highest(High, length) + Lowest(low, length)) / 2 + ExpAverage(close, length); def Momo = Inertia(price - K / 2, length); def SD = StDev(close, length); def Avg = Average(close, length); def ATR = Average(TrueRange(high, close, low), length); def SDup = Avg + (SdMult * Sd); def ATRup = Avg + (AtrMult * ATR); def Squeeze = SDup < ATRup; def zero = if IsNaN(close) or !IsNaN(Squeeze) then Double.NaN else 0; def momobullup = Momo > Momo[1] and Momo > 0; def momobulldown = Momo > 0 and Momo < Momo[1]; def momobeardown = Momo > Momo[1] and Momo > 0; def momobearup = Momo < 0 and Momo > Momo[1]; Plot BreakoutEitherDirection = squeeze[1] is true and squeeze is false; plot BreakoutBull = squeeze[1] is true and squeeze is false and momobullup; plot BreakoutBear = squeeze[1] is true and squeeze is false and momobulldown; Plot BullTrendReversal = momobulldown is true and momobulldown[1] is false; Plot BearTrendReversal = momobearup is true and momobearup[1] is false; plot Squeeze_ChangetoBull = BearTrendReversal and squeeze is true; plot Squeeze_ChangetoBear = BullTrendReversal and squeeze is true; #End Code

Ddstephens247

New member

I'm looking for a scanner that will find tickers in the TTM Squeeze at the first yellow bar.

Try this in the scanner

Code:

Code:def ttm_histogram = TTM_Squeeze(); def red_squeeze = if ttm_histogram < 0 and ttm_histogram < ttm_histogram[1] then 1 else 0; plot first_yellow = if red_squeeze[1] == 1 and !red_squeeze and ttm_histogram < 0 then 1 else 0; AddChartBubble(first_yellow, 0, first_yellow, Color.YELLOW); #

ThanksThe ToS platform does not make the TTM Squeeze source code available for customizations.

@entercode27 @mchapma72

Hi Madhu,Hi Everyone,

I am using TTM squeeze.

Can someone help me please to scan histogram is lightblue (cyan)and having a squeeze?

Thanks

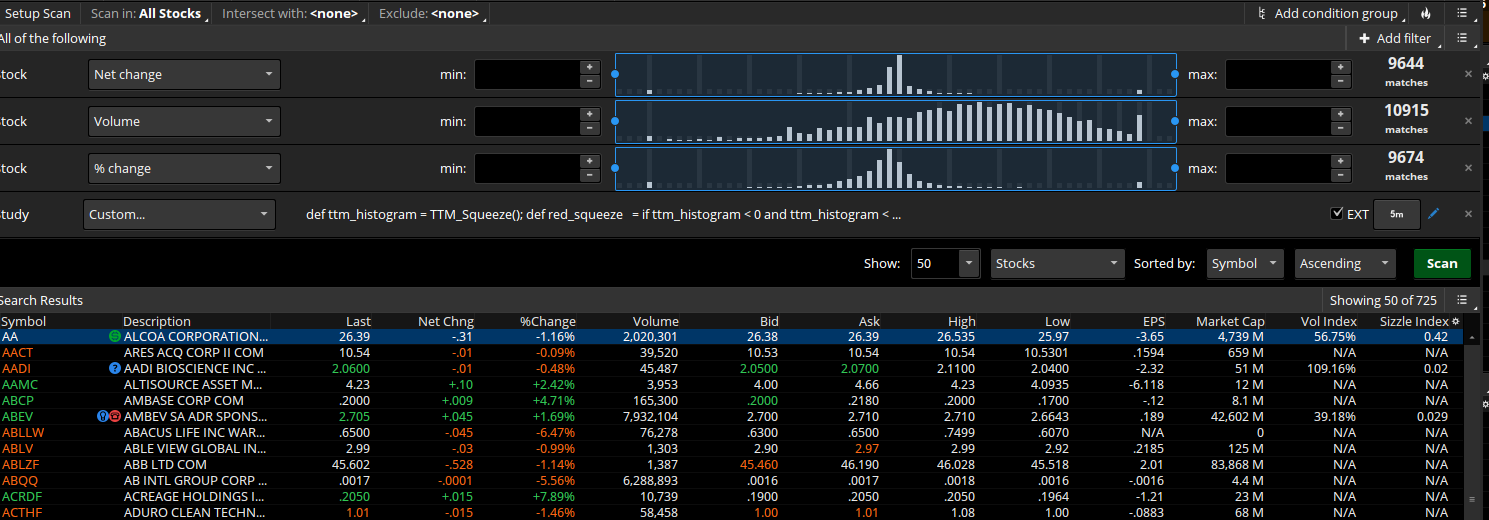

This works. Setup up two filters like the screenshot

The first filter will contain:

TTM_Squeeze().SqueezeAlert == 0

the second filter will contain a few lines:

def hist = reference TTM_Squeeze.Histogram;

# any Cyan Histogram Bar

plot scan = if hist > 0 and hist > hist[1] then 1 else Double.NaN;

Thank youHi Madhu,

This works. Setup up two filters like the screenshot

View attachment 24121

The first filter will contain:

TTM_Squeeze().SqueezeAlert == 0

the second filter will contain a few lines:

def hist = reference TTM_Squeeze.Histogram;

# any Cyan Histogram Bar

plot scan = if hist > 0 and hist > hist[1] then 1 else Double.NaN;

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| C | TTM Squeeze Fire Signal - Another Take! | Indicators | 19 | |

|

|

TTM Squeeze Clouds Indicator for ThinkorSwim | Indicators | 42 | |

| D | TTM Trend Source Code For ThinkOrSwim | Indicators | 2 | |

| H | My version of the TTM Trend for ThinkorSwim | Indicators | 12 | |

| T | Beardy Squeeze Pro For ThinkOrSwim | Indicators | 28 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

Similar threads

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/