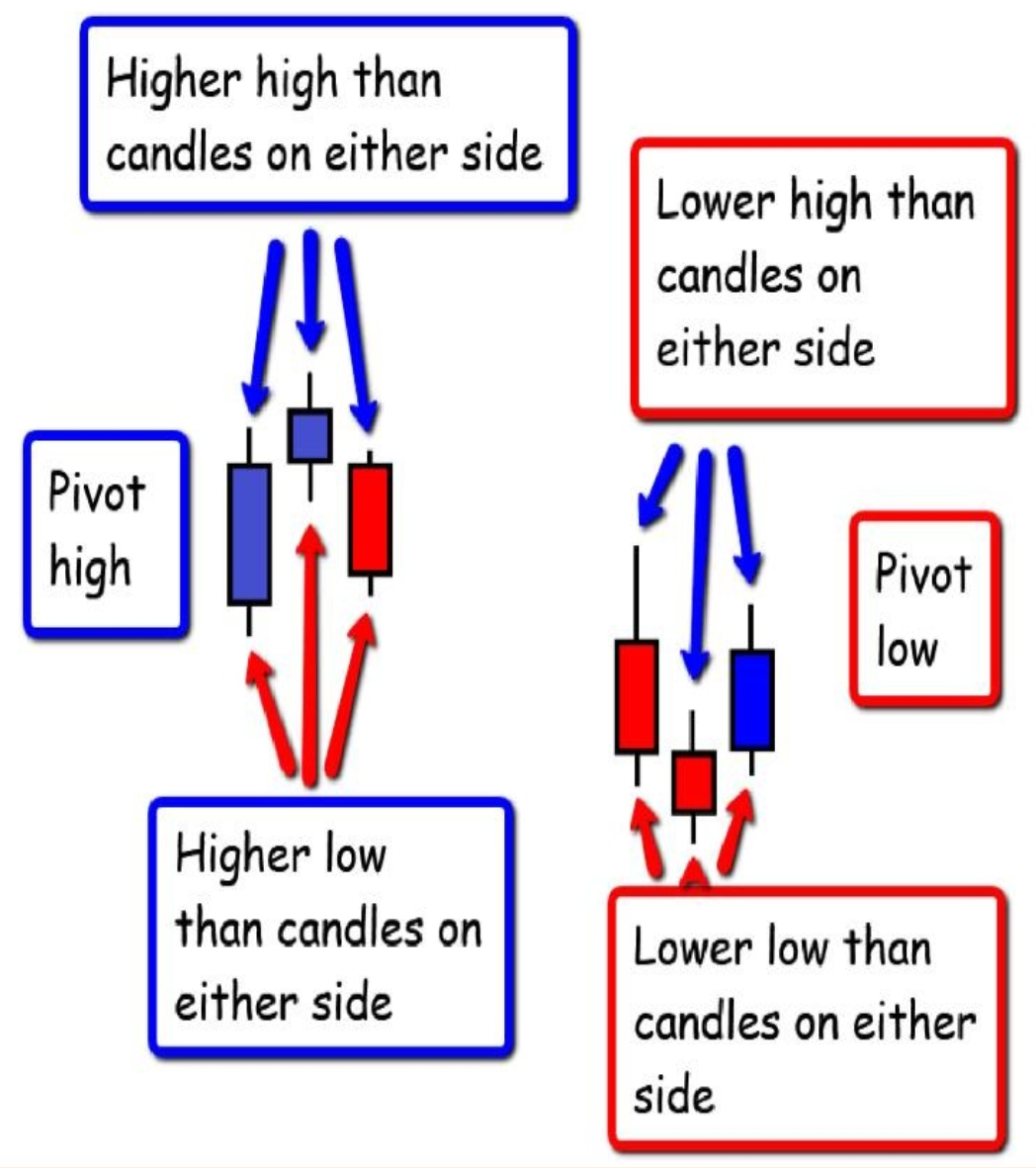

#Swing High/Low (Fractal)

#Higher Highs or Higher Lows are designated by green dots and/or green horizontal lines

#Lower Highs or Lower Lows are designated by red dots and/or red horizontal lines

#User input to select how many horizontal lines are plotted

#User input to plot lines connecting swing highs to each other and swing lows to each other

#User input to plot lines connecting swing highs to swing lows

input swing = 1;

input spacer = 0;

def swinghigh = if Round(Highest(high[1], swing), 2) < Round(high, 2) and

Round(high, 2) > Round(Highest(high[-swing], swing), 2) and

Round(Lowest(low[1], swing), 2) < Round(Lowest(low[-swing], swing), 2)

then 1

else 0;

def fast = if swinghigh == 1 then high else fast[1];

plot sh1 = if swinghigh == 1 then high + spacer * TickSize() else Double.NaN;

sh1.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

sh1.AssignValueColor(if fast[1] < fast

then Color.GREEN

else if fast[1] == fast

then Color.YELLOW

else Color.RED);

sh1.SetLineWeight(4);

sh1.HideBubble();

def swinglow = if Round(low, 2) < Round(Lowest(low[1], swing), 2) and

Round(low) < Round(Lowest(low[-swing], swing), 2) and

Round(Highest(high[1], swing), 2) > Round(Highest(high[-swing], swing), 2)

then 1

else 0;

def slow = if swinglow == 1 then low else slow[1];

plot sl1 = if swinglow == 1 then low - spacer * TickSize() else Double.NaN;

sl1.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

sl1.AssignValueColor(if slow[1] < slow

then Color.GREEN

else if slow[1] == slow

then Color.YELLOW

else Color.RED);

sl1.SetLineWeight(4);

sl1.HideBubble();

def sh11 = if !IsNaN(sh1) then high else Double.NaN;

def sl11 = if !IsNaN(sl1) then low else Double.NaN;

def swhigh = if !IsNaN(sh1) then sh1 else swhigh[1];

def swlow = if !IsNaN(sl1) then sl1 else swlow[1];

def shcolor = if swhigh != swhigh[1] and swhigh > swhigh[1]

then 1

else if shcolor[1] == 1 and swhigh == swhigh[1]

then 1

else 0;

def slcolor = if swlow != swlow[1] and swlow > swlow[1]

then 1

else if slcolor[1] == 1 and swlow == swlow[1]

then 1

else 0;

#Swing Line from High to Low

input showswinghightolowline = yes;

plot hilowline = if showswinghightolowline == no then Double.NaN else if swinghigh then sh11 else sl11;

hilowline.EnableApproximation();

hilowline.SetDefaultColor(Color.BLACK);

hilowline.HideBubble();

#Price Bubbles @Swing

input showbubbles = yes;

AddChartBubble(showbubbles and sh1, high, high, if shcolor == 1 then Color.LIGHT_GREEN else Color.LIGHT_RED, yes);

AddChartBubble(showbubbles and sl1, low, low, if slcolor == 1 then Color.LIGHT_GREEN else Color.LIGHT_RED, no);

#Horizontal Lines

input number_swing_horizontalsstoshow = 2;

input show_horizontallines = yes;

def data = CompoundValue(1, if !IsNaN(sh1) then data[1] + 1 else data[1], 0);

def datacount = (HighestAll(data) - data[1]) + 1;

def data1 = CompoundValue(1, if !IsNaN(sl1) then data1[1] + 1 else data1[1], 0);

def datacount1 = (HighestAll(data1) - data1[1]) + 1;

plot swingHp = if show_horizontallines == no

then Double.NaN

else if datacount <= number_swing_horizontalsstoshow

then swhigh

else Double.NaN;

swingHp.SetPaintingStrategy(PaintingStrategy.DASHES);

swingHp.setlineWeight(2);

swingHp.AssignValueColor(if shcolor == 1 then Color.GREEN else Color.RED);

swingHp.HideBubble();

plot swingLp = if show_horizontallines == no

then Double.NaN

else if datacount1 <= number_swing_horizontalsstoshow

then swlow

else Double.NaN;

swingLp.SetPaintingStrategy(PaintingStrategy.DASHES);

swingLp.AssignValueColor(if slcolor == 1 then Color.GREEN else Color.RED);

swinglp.setlineWeight(2);

swingLp.HideBubble();