You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trust The Levels - Trade Options In ThinkOrSwim

- Thread starter METAL

- Start date

- Status

- Not open for further replies.

I use the LRC_V2 version. https://tos.mx/!bRJfYOTJ . It depends on the price of the contracts. I typically try to be 2,000.00 and up. If I get an A+ setup along with all other variables, I will go heavier.Thanks so much for the videos and sharing the strategies.

I loaded the chart on my TOS and am confused about the different regression channels even if the anchor is at the same time. Do you know why the channel slopes are so different with different indicators?

I also wanted to know as to about how much money approx. do you put on each trade.

Thanks so much again!!

Yes. Everything is up to date. I use the LRC_V2 version on a 2 m TF. https://tos.mx/!bRJfYOTJ@METAL Just wanted to ask you a question but, before I do I wanted to thank you for your great play by play updates! I been keeping up with it and it looks really good!

Is everything up to date on your 1st page as far as the indicator scripts? Or have they been updated?

Drum Rocker

Member

You got that right! The morning was a complete mess with market internals conflicting, the DJIA down, and NASDAQ up. I had two losing trades in the morning and stopped. Came back in the afternoon and was able to get back to even. There will be days like these!Hope everyone had a great day trading. The price action was rough for the first part of the day, for me at least.

Todays Trades:

A loss with ARM-

View attachment 22221

TSM-

View attachment 22222

SPX-

View attachment 22223

ElGanadero

New member

I appreciate the response! I'm running it now will update next week when I run it live with some funny money I got. I'll keep tracking your progress solid work @METAL.

DING DING DING

This chart setup has climbed up to be in the TOP25 most viewed setups of all time!

https://usethinkscript.com/forums/strategies-chart-setups.5/?order=view_count&direction=desc

Congratulations @METAL! For the excellent support and commentary provided in this thread!

This chart setup has climbed up to be in the TOP25 most viewed setups of all time!

https://usethinkscript.com/forums/strategies-chart-setups.5/?order=view_count&direction=desc

Congratulations @METAL! For the excellent support and commentary provided in this thread!

Workspace: https://tos.mx/!niiF8VvV

Last edited:

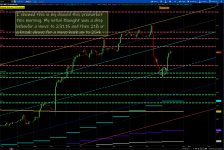

Today was another easy and great day. I have added another tool to help with this strategy. I have added what I call a "Long" LRC. I draw them in manually. The Linear Regression tool is set to:

I use it the following way: Typically on the 1HR TF.

NVDA:

Todays Trades:

TSLA:

AMD-PUTS

SPX - $180.00 loss

SPX Profit:

I use it the following way: Typically on the 1HR TF.

NVDA:

Todays Trades:

TSLA:

AMD-PUTS

SPX - $180.00 loss

SPX Profit:

Attachments

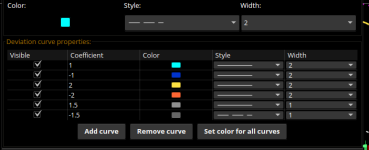

Outstanding work! When you have a moment, no rush, can you post the option strikes of your trades and do you look for certain deltas, near the money, in the money or at the money? Thanks again for all you're doing and posting!Today was another easy and great day. I have added another tool to help with this strategy. I have added what I call a "Long" LRC. I draw them in manually. The Linear Regression tool is set to: View attachment 22361

I use it the following way: Typically on the 1HR TF.

View attachment 22362

NVDA:

View attachment 22363

Todays Trades:

View attachment 22364

TSLA:

View attachment 22365

AMD-PUTS

View attachment 22366

SPX - $180.00 loss

View attachment 22367

SPX Profit:

View attachment 22368

The strike are listed on the attachment where I show the calls and puts. I almost always buy at the money. The only exception would be on Friday. I typically get next weeks ATM. The deltas are usually close to 50 ATM. Of course they vary but I do not concern myself with that too much.Outstanding work! When you have a moment, no rush, can you post the option strikes of your trades and do you look for certain deltas, near the money, in the money or at the money? Thanks again for all you're doing and posting!

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Money Zone Auto Fib Levels For ThinkOrSwim

- Started by BrooklynMintCapital

- Replies: 12

-

Hourly CCI -200/200 levels For ThinkOrSwim

- Started by autoloader

- Replies: 3

-

Swing Trade Stocks Outperforming Market In ThinkOrSwim

- Started by tellyt

- Replies: 15

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

879

Online

Similar threads

-

Money Zone Auto Fib Levels For ThinkOrSwim

- Started by BrooklynMintCapital

- Replies: 12

-

Hourly CCI -200/200 levels For ThinkOrSwim

- Started by autoloader

- Replies: 3

-

Swing Trade Stocks Outperforming Market In ThinkOrSwim

- Started by tellyt

- Replies: 15

-

Similar threads

-

Money Zone Auto Fib Levels For ThinkOrSwim

- Started by BrooklynMintCapital

- Replies: 12

-

Hourly CCI -200/200 levels For ThinkOrSwim

- Started by autoloader

- Replies: 3

-

Swing Trade Stocks Outperforming Market In ThinkOrSwim

- Started by tellyt

- Replies: 15

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.