Hello is there a conversation that explains how to use the RSI L or its concept it seems like traders like It would like to understand it more thanks@markos

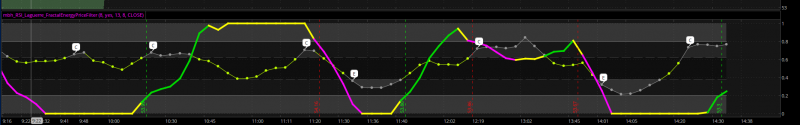

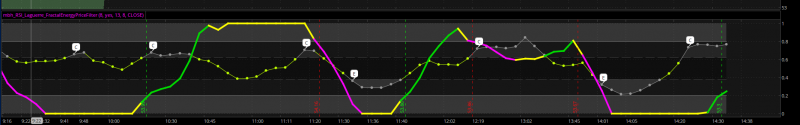

Made a few changes to the RSIlg. May be easier to understand and use. "C" = FE_Consolidation and "E" = FE_Exhaustion for the gamma line.

Rich (BB code):RSI.DefineColor("Up", CreateColor( 0, 220, 0)); RSI.DefineColor("Down", Color.MAGENTA); RSI.SetLineWeight(4); RSI.AssignValueColor(if RSI > RSI[1] and RSI[1] > RSI [2] then RSI.Color("Up") else if RSI < RSI[1] and RSI[1] < RSI [2] then RSI.Color("Down") else color.YELLOW); #Gamma Line Color gamma.DefineColor("Con", CreateColor( 153, 153, 153)); gamma.DefineColor("EX", CreateColor( 153, 153, 153)); gamma.AssignValueColor(if gamma > .62 then gamma.Color("Con") else if gamma < .38 then gamma.Color("EX") else color.LIME); AddCloud(gamma, .62, Color.GRAY, Color.Current); AddCloud(gamma, .38, Color.Current, Color.GRAY);

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Repaints

- Status

- Not open for further replies.

Volatility Trading Range

VTR is a momentum indicator that shows if a stock is overbought or oversold based on its Weekly and Monthly average volatility trading range.

Ben I appreciate your patience but I duplicated this and still getting the same error message so I give up.

Would have been nice to scan for them.

I found a solution and is very simple.

1. You need to obtain the SCAN (if you have already the indicator only take the scan otherwise you will need to download both) from the First Page(Original Thread) : https://usethinkscript.com/threads/trend-reversal-indicator-with-signals-for-thinkorswim.183/

2. If you impor the indicator or scan via TOS link, TOS will automatically save the scan or indicator to "Studies" then you need to go

Scan > add study filter > modify in edit and when you get here(Picture 1) please take note that there should be one and only one INPUT (in the picture i change the of the scan but you get the idea). If you have more that one input that is the first error. Other error please see the size of the ThinkScript code. Scan should be shorter then the indicator. At the end if get to the Picture 1 added here you will be fine and TOS will let you save the scan.

I hope you can get it done, Sorry if I am not very well explaning things you can answer me to this if you have any trouble.

Hello Ben, I read te 14 pages. I have the indicator and the scan already in my TOS, now i know about the false, repainting things. I am trying to do swing trading, my questions would be....

how I can test this Indicator if i am using 1 day interval in the on demand section in TOS?

Do you think the false signals would be less in the 1 day interval? and with this I mean like, the bigger the internal is the less false signals will be... do think this would be possible?

I saw another post that you were working with this indicator and the advance market move indicator, I think, did you find something? and were i can

find that post? maybe I can help or try to give something.

Thank you in advance.

@nassau35 I'm no longer using this indicator to trade. I used to but not anymore. I recommend playing around with it in ThinkorSwim, especially during market hours, so you can watch how the signals get repainted. You can also use onDemand as well. How often does it repaint? Will there be less repainting on the 1min? Those are some of the questions I can't say for sure. Again, you would have to explore it yourself.

I wouldn't recommend this to anyone new to trading. If you don't know what you're doing, the last thing you want to do is play around with an indicator that give repainting signals.

I did release the enhanced version of the original trend reversal, however, it still repaint. You can take a look at it here.

I wouldn't recommend this to anyone new to trading. If you don't know what you're doing, the last thing you want to do is play around with an indicator that give repainting signals.

I did release the enhanced version of the original trend reversal, however, it still repaint. You can take a look at it here.

I can give my two ticks on this one. Nassau, this indi can work and I've used it on a 5 minute and my entry on a one minute. As Ben has said it repaints A LOT on the one and cant be trusted. I am currently trying to do this and what I've found is that WITH lower indis it is possible. I've noticed before the open that the five-minute label in premarket USUALLY gets the direction right but you have to use other lowers for confirm. I still don't trust it but put it on your 5-minute chart and take a look. What I have been working on is using the 5-minute for direction and using the one minute as my pullback entry. Both the five and one can have the same direction in premarket but the one can change. Er ... how to explain? If both labels are red premarket, sometimes the one will change to green so I wait for the green one minute to turn red and that would be the entry for the five-minute red. I also use lowers. Makes sense? It's a quirky indicator and complicated to explain. Maybe do yourself a favor and just use the dang SMA10! This indi looks so pretty after the fact but not as easy as it seems. Nothing worth having comes easy :::grumble:::Hello Ben, I read te 14 pages. I have the indicator and the scan already in my TOS, now i know about the false, repainting things. I am trying to do swing trading, my questions would be....

how I can test this Indicator if i am using 1 day interval in the on demand section in TOS?

Do you think the false signals would be less in the 1 day interval? and with this I mean like, the bigger the internal is the less false signals will be... do think this would be possible?

I saw another post that you were working with this indicator and the advance market move indicator, I think, did you find something? and were i can

find that post? maybe I can help or try to give something.

Thank you in advance.

Last edited:

Preferably NOT on a chart within the last month. None of my bell and whistle indis work lately.I can give my two ticks on this one. Nassau, this indi can work and I've used it on a 5 minute and my entry on a one minute. As Ben has said it repaints A LOT on the one and cant be trusted. I am currently trying to do this and what I've found is that WITH lower indis it is possible. I've noticed before the open that the five-minute label in premarket USUALLY gets the direction right but you have to use other lowers for confirm. I still don't trust it but put it on your 5-minute chart and take a look. What I have been working on is using the 5-minute for direction and using the one minute as my pullback entry. Both the five and one can have the same direction in premarket but the one can change. Er ... how to explain? If both labels are red premarket, sometimes the one will change to green so I wait for the green one minute to turn red and that would be the entry for the five-minute red. I also use lowers. Makes sense? It's a quirky indicator and complicated to explain. Maybe do yourself a favor and just use the dang SMA10! This indi looks so pretty after the fact but not as easy as it seems. Nothing worth having comes easy :::grumble::: and trust me, that is coming from a female! ;D

I'm just using the 10SMA and a lower.

Hi Ben,

Please help if it is possible to convert this into a Strategy, I really liked this and I observed too many signals but would like to find the best time frame by performing a back test using this as strategy.

any help is appreciated ..

If there is a process to covered indicator into strategy, I can follow the same.

Thx

Suresh

Please help if it is possible to convert this into a Strategy, I really liked this and I observed too many signals but would like to find the best time frame by performing a back test using this as strategy.

any help is appreciated ..

If there is a process to covered indicator into strategy, I can follow the same.

Thx

Suresh

@2sureshk Try this. Add it as a Strategy.

Code:

# Trend Reversal Scanner

# Scanner by https://usethinkscript.com/u/theelderwand

# Discuss https://usethinkscript.com/d/183-trend-reversal-indicator-with-signals-for-thinkorswim

# Modified into a Strategy for backtesting. Not recommended since this indicator reapaint.

def price = close;

def superfast_length = 9;

def fast_length = 14;

def slow_length = 21;

def displace = 0;

def mov_avg9 = ExpAverage(price[-displace], superfast_length);

def mov_avg14 = ExpAverage(price[-displace], fast_length);

def mov_avg21 = ExpAverage(price[-displace], slow_length);

#moving averages

def Superfast = mov_avg9;

def Fast = mov_avg14;

def Slow = mov_avg21;

def buy = mov_avg9 > mov_avg14 and mov_avg14 > mov_avg21 and low > mov_avg9;

def stopbuy = mov_avg9 <= mov_avg14;

def buynow = !buy[1] and buy;

def buysignal = CompoundValue(1, if buynow and !stopbuy then 1 else if buysignal[1] == 1 and stopbuy then 0 else buysignal[1], 0);

def Buy_Signal = buysignal[1] == 0 and buysignal == 1;

def Momentum_Down = buysignal[1] == 1 and buysignal == 0;

def sell = mov_avg9 < mov_avg14 and mov_avg14 < mov_avg21 and high < mov_avg9;

def stopsell = mov_avg9 >= mov_avg14;

def sellnow = !sell[1] and sell;

def sellsignal = CompoundValue(1, if sellnow and !stopsell then 1 else if sellsignal[1] == 1 and stopsell then 0 else sellsignal[1], 0);

def Sell_Signal = sellsignal[1] == 0 and sellsignal;

input method = {default average, high_low};

def bubbleoffset = .0005;

def percentamount = .01;

def revAmount = .05;

def atrreversal = 2.0;

def atrlength = 5;

def pricehigh = high;

def pricelow = low;

def averagelength = 5;

def averagetype = AverageType.EXPONENTIAL;

def mah = MovingAverage(averagetype, pricehigh, averagelength);

def mal = MovingAverage(averagetype, pricelow, averagelength);

def priceh = if method == method.high_low then pricehigh else mah;

def pricel = if method == method.high_low then pricelow else mal;

def EI = ZigZagHighLow("price h" = priceh, "price l" = pricel, "percentage reversal" = percentamount, "absolute reversal" = revAmount, "atr length" = atrlength, "atr reversal" = atrreversal);

rec EISave = if !IsNaN(EI) then EI else GetValue(EISave, 1);

def chg = (if EISave == priceh then priceh else pricel) - GetValue(EISave, 1);

def isUp = chg >= 0;

def EIL = if !IsNaN(EI) and !isUp then pricel else GetValue(EIL, 1);

def EIH = if !IsNaN(EI) and isUp then priceh else GetValue(EIH, 1);

def dir = CompoundValue(1, if EIL != EIL[1] or pricel == EIL[1] and pricel == EISave then 1 else if EIH != EIH[1] or priceh == EIH[1] and priceh == EISave then -1 else dir[1], 0);

def signal = CompoundValue(1, if dir > 0 and pricel > EIL then if signal[1] <= 0 then 1 else signal[1] else if dir < 0 and priceh < EIH then if signal[1] >= 0 then -1 else signal[1] else signal[1], 0);

def bullish2 = signal > 0 and signal[1] <= 0;

plot upArrow = bullish2;

upArrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

upArrow.SetDefaultColor(CreateColor(145, 210, 144));

def bearish2 = signal < 0 and signal[1] >= 0;

plot downArrow = bearish2;

downArrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

downArrow.SetDefaultColor(CreateColor(255, 15, 10));

AddOrder(OrderType.BUY_TO_OPEN, condition = bullish2, price = close,100, tickcolor = Color. GREEN, arrowcolor = Color.GREEN, name = "BUY");

AddOrder(OrderType.SELL_TO_CLOSE, condition = bearish2, price = close,100, tickcolor = Color.RED, arrowcolor = Color.RED, name = "SELL");It's not possible at all to my knowledge so I wouldn't even be waiting for it. @jan_angel

@Trading51 If you haven't found it yet, there is quite a bit that I have written in Tutorials thread.Hello is there a conversation that explains how to use the RSI L or its concept it seems like traders like It would like to understand it more thanks

Please put something like this in a questions thread next time. Luckily, I just happened to come across this.

Markos thanks, im learning the way it works around here thanks for the heads up!!@Trading51 If you haven't found it yet, there is quite a bit that I have written in Tutorials thread.

Please put something like this in a questions thread next time. Luckily, I just happened to come across this.

undefined@Likos Unfortunately not possible to work on mobile at the moment. It ****s that the mobile app can barely display any custom indicators properly, even for some of their built-in ones.

Hi Ben

Can I setup alert with this indicator for any specific stock?

Please share if there is a separate code

Thx

Suresh

@2sureshk Look through this page https://usethinkscript.com/search/10966/?q=alert&t=post&c[thread]=183&o=date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim | Indicators | 125 | |

|

|

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim | Indicators | 10 | |

| C | AGAIG Trend Vertical Line For ThinkOrSwim | Indicators | 11 | |

| D | Trend Trader Buy/Sell Signals For ThinkOrSwim | Indicators | 9 | |

|

|

LNL Trend System for ThinkOrSwim | Indicators | 27 |

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

687

Online

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

Similar threads

-

Repaints Enhanced Trend Reversal Indicator for ThinkorSwim

- Started by BenTen

- Replies: 125

-

Reversal Candles (Saikou / Hikui) Trend Change for ThinkorSwim

- Started by BenTen

- Replies: 10

-

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.