You should upgrade or use an alternative browser.

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Thread starter HODL-Lay-HE-hoo!

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

I loaded the code to my six charts running. There was a brief small uptick in computer resources as the charts were loading. But quickly returned to the normal less than 50% where most of my charts run.I tried the code in my system, it makes my computer very slow. does anybody have the same problem?

Generally, if the ToS app is lagging, you will find it is for one of these reasons:

https://usethinkscript.com/threads/ideal-memory-usage-settings-for-thinkorswim.10201/#post-128355

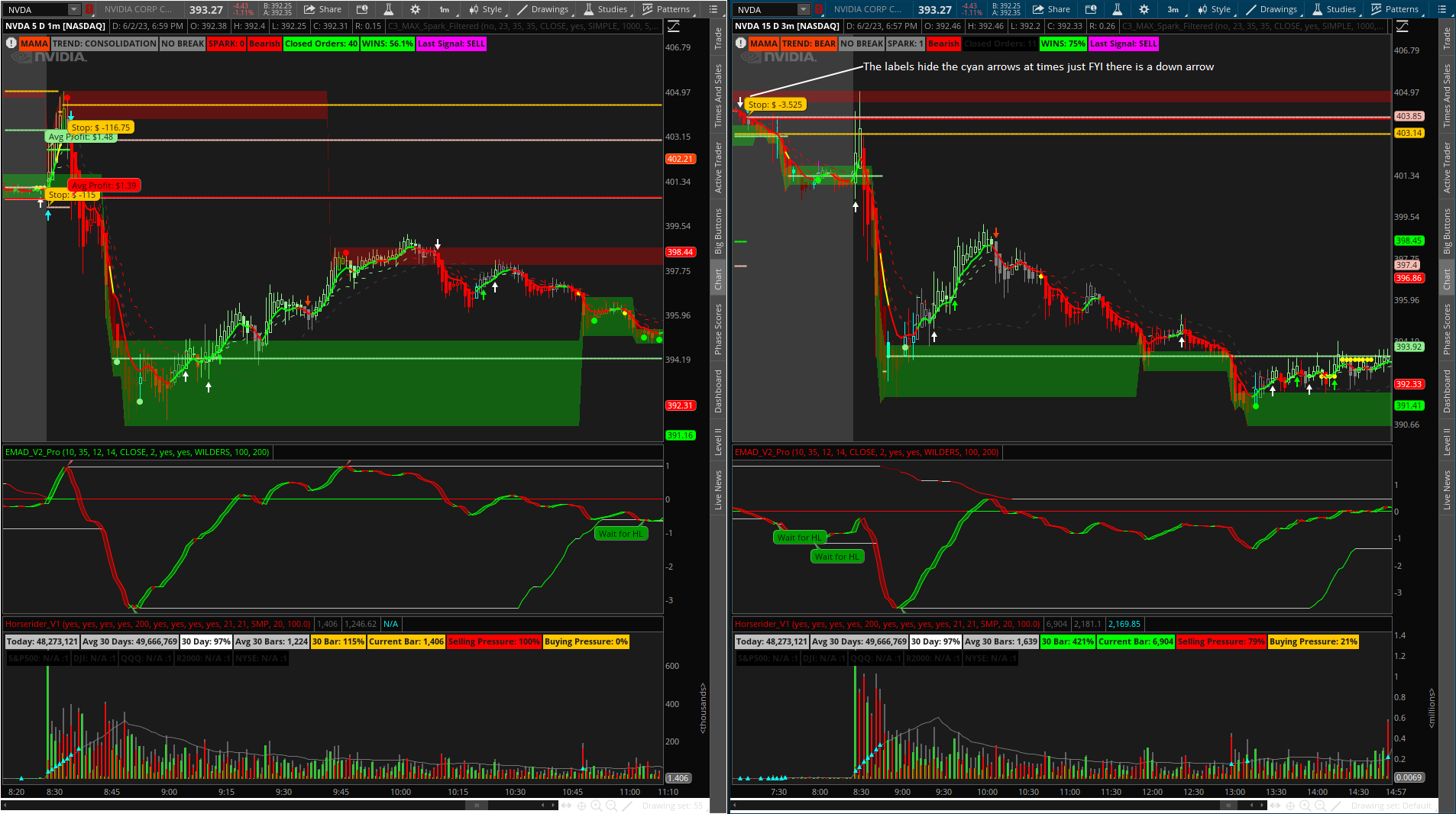

Here is a recent C3 Max TS_V9 (combined study - will need to turn off colored candles if you want the "Big7" candle painting like my screenshots on page one) anyway it has 2 aggregations (as opposed to 3 on TS_V9_Filtered) (also I will add a single agg version soon) https://usethinkscript.com/threads/confirmation-candles-indicator-for-thinkorswim.6316/post-127540I tried the code in my system, it makes my computer very slow. does anybody have the same problem?

* Just to note agg 2 will be set to 1 hour default so for trading shorter term you can lower it to whatever you so choose *

Here are 2 videos of QQQ on the 1 min TF

@Wockets about to have 1million subscribers... Well done sir!

For the record as your enemy, I will say, you have done an excellent job of illustrating everything. Great Job. and thanks. I know that take a ton of time.@Wockets my friend (unlike @METAL - my enemy) Check out the new "Previous Overbought Oversold Levels" in this post: https://usethinkscript.com/threads/...-all-be-all-for-thinkorswim.15257/post-124250 explaining why I no longer use the C3_MF_Line (which is still good just redundant now come to find out - in my opinion)

Is it possible have a signal when the HL occurs on the EMAD? Maybe like a vertical line or another bubble. For me, it is difficult to see the HL sometimes.

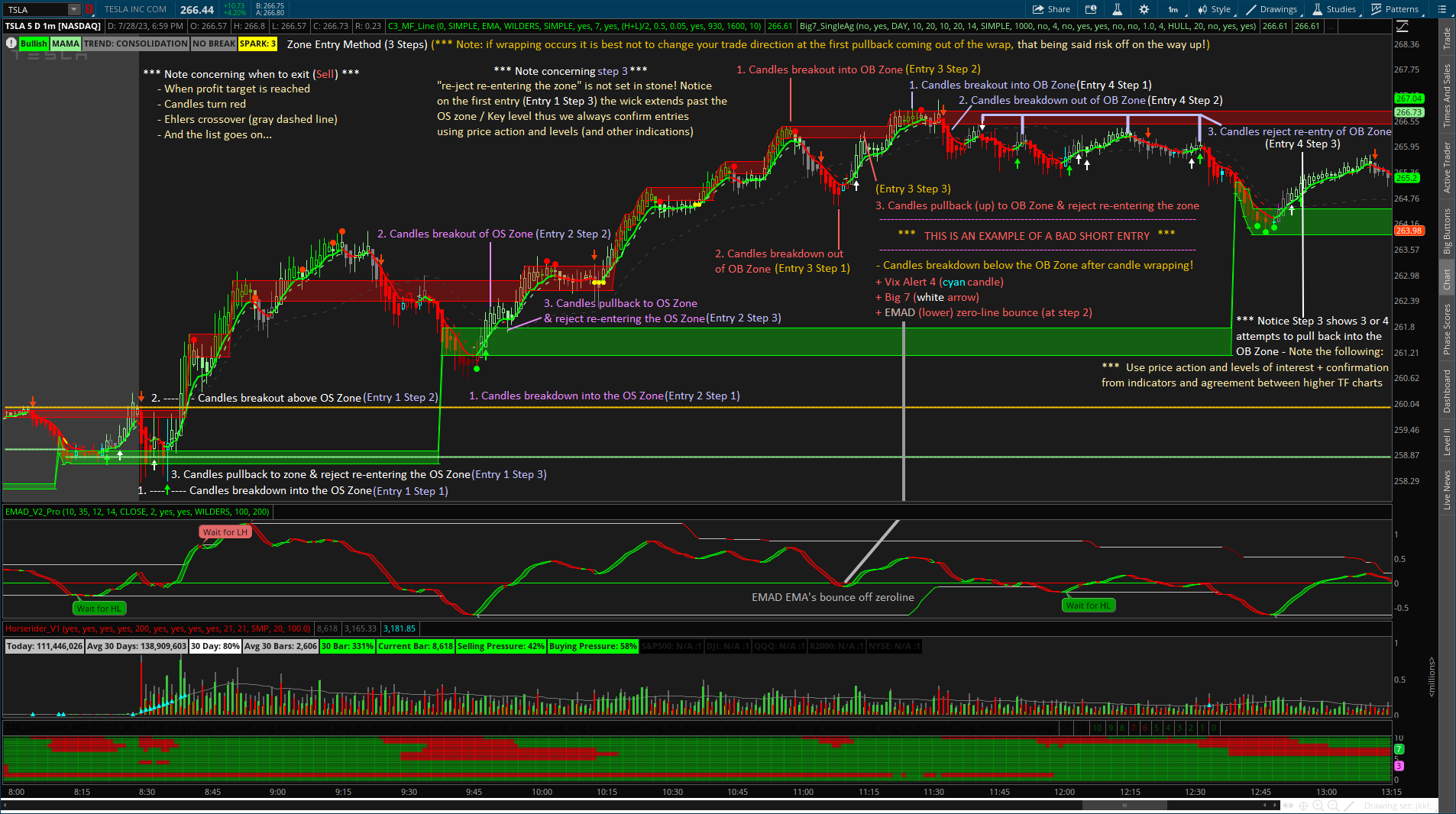

The Zone entry method is tried and true, supply and demand, overbought and oversold, buy and sell… easy right?

Short Entry Step 1. Candles moveinto “overbought zone” (green)

Long Entry Step 1. Candles moveinto “oversold zone” (red)

Short Entry Step 1. Candles moveout of “overbought zone” (green)

Long Entry Step 1. Candles moveout of “oversold zone” (red)

Short Entry Step 1. Candles pullback and reject “overbought zone” (green)

Long Entry Step 1. Candles pullback and reject “oversold zone” (red)

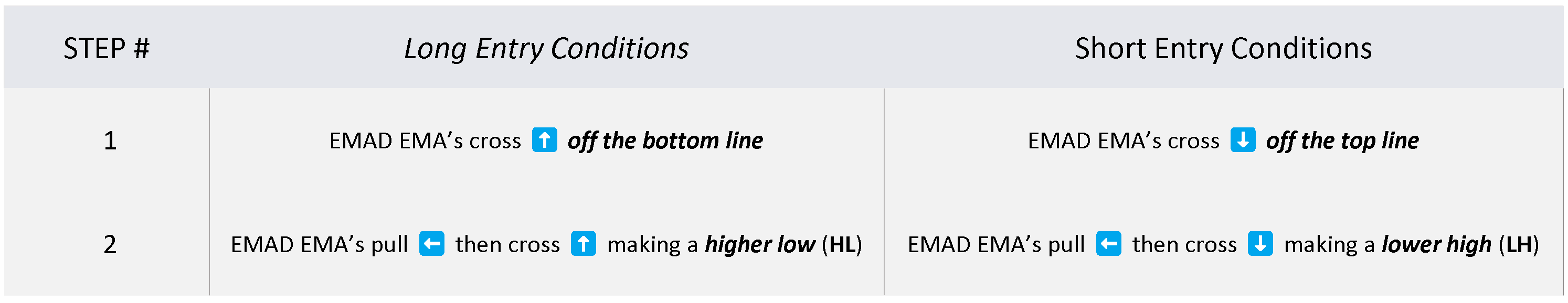

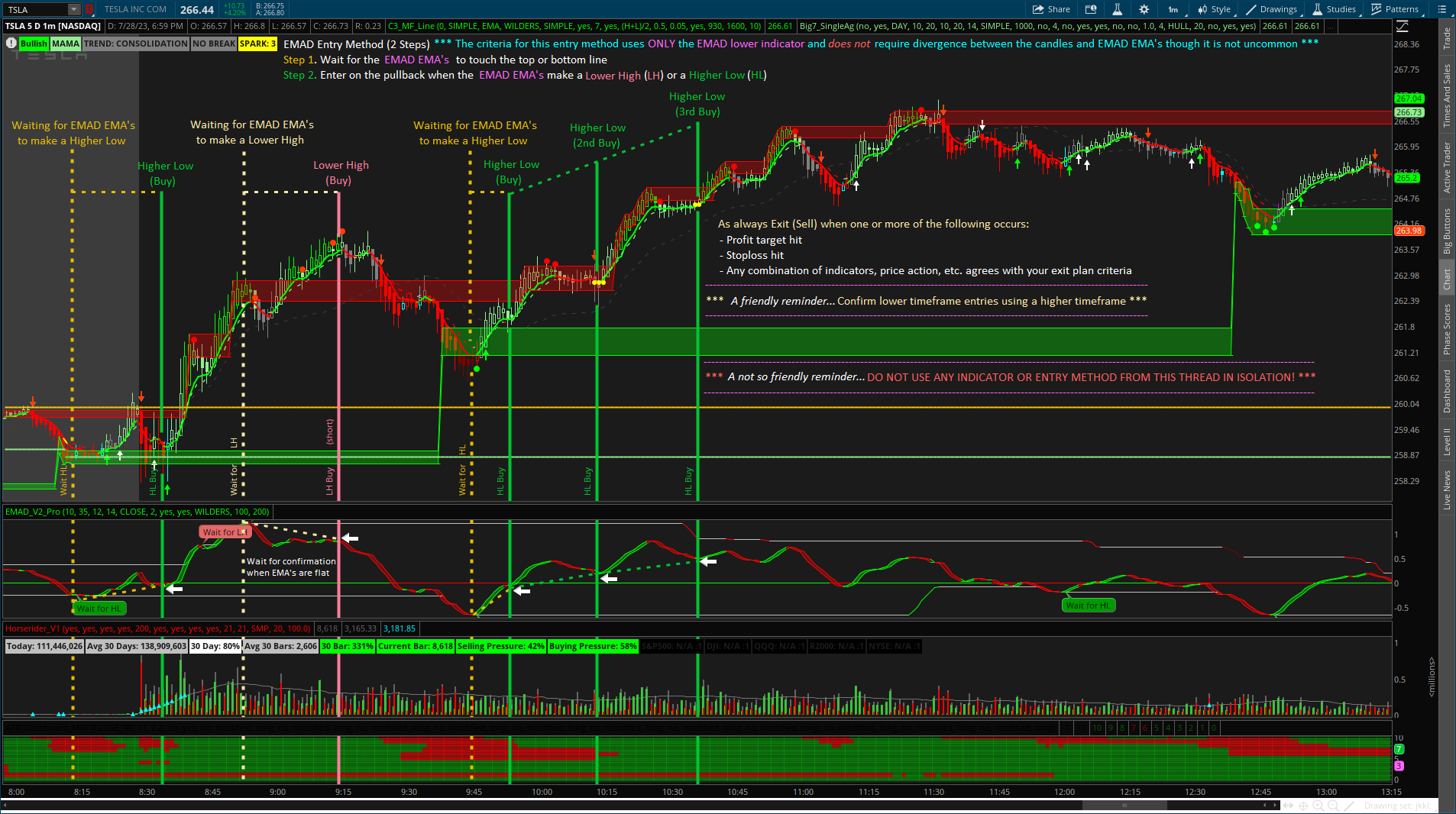

The EMAD entry method is simple and reliable - generally used as confirmation for other entry methods.

Touché! thank you good sir.For the record as your enemy, I will say, you have done an excellent job of illustrating everything. Great Job. and thanks. I know that take a ton of time.

Man if it is possible I would sure love to know how... I gave it a college try and it was all over the place. I dont even use the bubble because it does not indicate all occurrences and the bubble gets cut off at times also. When I attempted the HL LH code the problem was all the little crossovers... like the ones that are flat or compressed... I thought maybe I could get ride of the very short term crossovers by just adding a condition the crossover had to be true for x number of bars also tried referencing the width between the bands to avoid insignificant crossovers... I may give it another shot but it wasnt producing trustworthy results thats for sure. But if you have any ideas let me know.Is it possible have a signal when the HL occurs on the EMAD? Maybe like a vertical line or another bubble. For me, it is difficult to see the HL sometimes.

@Wockets my friend (unlike @METAL - my enemy) Check out the new "Previous Overbought Oversold Levels" in this post: https://usethinkscript.com/threads/...-all-be-all-for-thinkorswim.15257/post-124250 explaining why I no longer use the C3_MF_Line (which is still good just redundant now come to find out - in my opinion)

I understand your idea

Key levels = Supply / Demand zones with a white bar in front

Could you give future downloaders the option to show the bar though , I like the zone with bar vs zones without bar.

the orange / light green bar is more obvious than the white candle , to me.

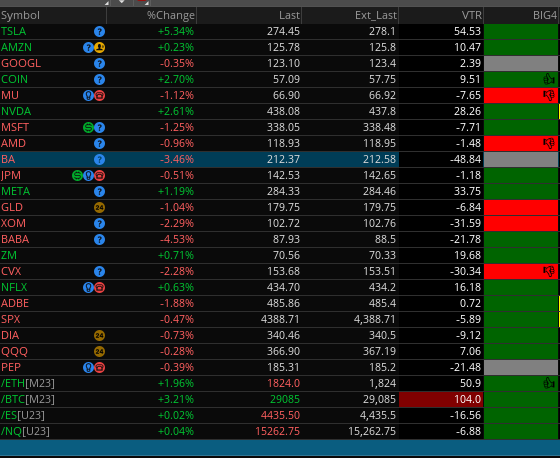

I dont see a script for adding the EMAD Watch List. Can you help? Many ThanksWatchlist Columns

This post will provide links and explanations various watchlist columns related to studies within the Confirmation Trend Chart Style (though some are not named directly their code is within one of the aforementioned studies).

Big4 Watchlist Column

Share link - https://tos.mx/cn1MD6S

Code:#Big_4 watchlist column ####################################### ## Create Labels ####################################### input showtitle = no; input showlabels = yes; def AutoAgg = yes; def AutoAgg2 = yes; def ag_skip = no; def ag_skip2 = no; def ag_skip_lbl = no; def agperiod1 = GetAggregationPeriod(); input timeframe = aggregationperiod.DAY; input length = 10; input length2 = 20; def Vol = volume(period = timeframe); def at_High = high(period = timeframe); def at_Open = open(period = timeframe); def at_Close = close(period = timeframe); def at_Low = low(period = timeframe); def Vol1 = volume(period = timeframe); def at_High1 = high(period = timeframe); def at_Open1 = open(period = timeframe); def at_Close1 = close(period = timeframe); def at_Low1 = low(period = timeframe); # Buy_Volume forumla is volume * (close_price minus low_price) / (High_price minus low_price) def Buy_Volume = RoundUp(Vol * (at_Close - at_Low) / (at_High - at_Low)); def Buy_percent = RoundUp((Buy_Volume / Vol) * 100); #Buy_percent.SetPaintingStrategy(PaintingStrategy.LINE); #Buy_percent.SetLineWeight(1); #Buy_percent.SetDefaultColor(Color.GREEN); #Sell_Volume forumla is volume * (High_price minus Close_price) / (High_price minus Low_price) def Sell_Volume = RoundDown(Vol1 * (at_High1 - at_Close1) / (at_High1 - at_Low1)); def Sell_percent = RoundUp((Sell_Volume / Vol1) * 100); #input price = close; input length_BB = 10; input length_BB2 = 20; plot avg = ExpAverage(close(period = agperiod1), length_BB); #plot avg = ExpAverage((price), length); def height = avg - avg[length]; avg.SetStyle(Curve.SHORT_DASH); avg.SetLineWeight(1); AddLabel(showtitle, " Big_6: ", Color.Light_gray); # AK Trend def aktrend_input1 = 3; def aktrend_input2 = 8; def aktrend_price = close; def aktrend_fastmaa = MovAvgExponential(aktrend_price, aktrend_input1); def aktrend_fastmab = MovAvgExponential(aktrend_price, aktrend_input2); def aktrend_bspread = (aktrend_fastmaa - aktrend_fastmab) * 1.001; def cond1_UP = if aktrend_bspread > 0 then 1 else 0; def cond1_DN = if aktrend_bspread <= 0 then -1 else 0; # ZSCORE def zscore_price = close; def zscore_length = 20; def zscore_ZavgLength = 20; def zscore_oneSD = StDev(zscore_price, zscore_length); def zscore_avgClose = SimpleMovingAvg(zscore_price, zscore_length); def zscore_ofoneSD = zscore_oneSD * zscore_price[1]; def zscore_Zscorevalue = ((zscore_price - zscore_avgClose) / zscore_oneSD); def zscore_avgZv = Average(zscore_Zscorevalue, 20); def zscore_Zscore = ((zscore_price - zscore_avgClose) / zscore_oneSD); def zscore_avgZscore = Average(zscore_Zscorevalue, zscore_ZavgLength); def cond2_UP = if zscore_Zscore > 0 then 1 else 0; def cond2_DN = if zscore_Zscore <= 0 then -1 else 0; # Ehlers def ehlers_length = 34; def ehlers_price = (high + low) / 2; def ehlers_coeff = ehlers_length * ehlers_price * ehlers_price - 2 * ehlers_price * Sum(ehlers_price, ehlers_length)[1] + Sum(ehlers_price * ehlers_price, ehlers_length)[1]; def ehlers_Ehlers = Sum(ehlers_coeff * ehlers_price, ehlers_length) / Sum(ehlers_coeff, ehlers_length); def cond3_UP = if close > ehlers_Ehlers then 1 else 0; def cond3_DN = if close <= ehlers_Ehlers then -1 else 0; # Anchored Momentum def amom_src = close; def amom_MomentumPeriod = 10; def amom_SignalPeriod = 8; def amom_SmoothMomentum = no; def amom_SmoothingPeriod = 7; def amom_p = 2 * amom_MomentumPeriod + 1; def amom_t_amom = if amom_SmoothMomentum == yes then ExpAverage(amom_src, amom_SmoothingPeriod) else amom_src; def amom_amom = 100 * ( (amom_t_amom / ( Average(amom_src, amom_p)) - 1)); def amom_amoms = Average(amom_amom, amom_SignalPeriod); def cond4_UP = if amom_amom > 0 then 1 else 0; def cond4_DN = if amom_amom <= 0 then -1 else 0; # TMO def tmo_length = 30; #def 14 def tmo_calcLength = 6; #def 5 def tmo_smoothLength = 6; #def 3 def tmo_data = fold i = 0 to tmo_length with s do s + (if close > GetValue(open, i) then 1 else if close < GetValue(open, i) then - 1 else 0); def tmo_EMA5 = ExpAverage(tmo_data, tmo_calcLength); def tmo_Main = ExpAverage(tmo_EMA5, tmo_smoothLength); def tmo_Signal = ExpAverage(tmo_Main, tmo_smoothLength); def tmo_color = if tmo_Main > tmo_Signal then 1 else -1; def cond5_UP = if tmo_Main <= 0 then 1 else 0; def cond5_DN = if tmo_Main >= 0 then -1 else 0; # Strategy input Strategy_Confirmation_Factor = 4; input Strategy_FilterWithTMO = no; input Strategy_FilterWithTMO_arrows = yes; input Strategy_ColoredCandlesOn = yes; input Strategy_VerticalLinesOn = no; input Strategy_HoldTrend = no; def cond_UP = cond1_UP + cond2_UP + cond3_UP + cond4_UP; def cond_DN = cond1_DN + cond2_DN + cond3_DN + cond4_DN; def direction = if cond_UP >= Strategy_Confirmation_Factor and (!Strategy_FilterWithTMO or cond5_UP) then 1 else if cond_DN <= -Strategy_Confirmation_Factor and (!Strategy_FilterWithTMO or cond5_DN) then -1 else if !Strategy_HoldTrend and direction[1] == 1 and cond_UP < Strategy_Confirmation_Factor and cond_DN > -Strategy_Confirmation_Factor then 0 else if !Strategy_HoldTrend and direction[1] == -1 and cond_DN > -Strategy_Confirmation_Factor and cond_UP < Strategy_Confirmation_Factor then 0 else direction[1]; def direction2 = if cond_UP >= Strategy_Confirmation_Factor and (!Strategy_FilterWithTMO_arrows or cond5_UP) then 1 else if cond_DN <= -Strategy_Confirmation_Factor and (!Strategy_FilterWithTMO_arrows or cond5_DN) then -1 else if !Strategy_HoldTrend and direction2[1] == 1 and cond_UP < Strategy_Confirmation_Factor and cond_DN > -Strategy_Confirmation_Factor then 0 else if !Strategy_HoldTrend and direction2[1] == -1 and cond_DN > -Strategy_Confirmation_Factor and cond_UP < Strategy_Confirmation_Factor then 0 else direction2[1]; def signal_up = direction2 == 1 and direction2[1] < 1; def signal_dn = direction2 == -1 and direction2[1] > -1; addlabel(yes, if signal_up then "👍" else if signal_dn then "👎" else " ", color.black); Assignbackgroundcolor(if direction == 1 then Color.dark_GREEN else if direction == -1 then Color.RED else Color.gray);

TS_V9 Watchlist Column

Watchlist Column Share Link - http://tos.mx/SD7Fqm7 (4/25/23)

Description

The watchlist column for TS_V9 is from the original study code not the filtered code as watchlist columns do not support more than one aggregation.

- Signals present within 3 bars indicate “Buy” or “Sell”

- Signals not present within 3 bars indicate the most recent signal “Last Buy” or “Last Sell”

Code:#TS_V9 Watchlist Column - HODL - 4/25/23 #TS Strategy_V9 Created by Christopher84 08/10/2021 #Modified 05/23/2022 to include Chart Bubbles and Labels. #Modified 05/25/2022 to include Targets and Stoplosses. #Modified 05/26/2022 to include Line Labels by Dcstocks #Modified 05/27/2022 to include target 7. input trailType = {default modified, unmodified}; input ATRPeriod = 11; input ATRFactor = 2.2; input firstTrade = {default long, short}; input averageType = AverageType.SIMPLE; input price = close; input coloredCandlesOn = yes; input LabelsOn = yes; Assert(ATRFactor > 0, "'atr factor' must be positive: " + ATRFactor); def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod)); def HRef = if low <= high[1] then high - close[1] else (high - close[1]) - 0.5 * (low - high[1]); def LRef = if high >= low[1] then close[1] - low else (close[1] - low) - 0.5 * (low[1] - high); def trueRange; switch (trailType) { case modified: trueRange = Max(HiLo, Max(HRef, LRef)); case unmodified: trueRange = TrueRange(high, close, low); } def loss = ATRFactor * MovingAverage(averageType, trueRange, ATRPeriod); def state = {default init, long, short}; def trail; switch (state[1]) { case init: if (!IsNaN(loss)) { switch (firstTrade) { case long: state = state.long; trail = close - loss; case short: state = state.short; trail = close + loss; } } else { state = state.init; trail = Double.NaN; } case long: if (close > trail[1]) { state = state.long; trail = Max(trail[1], close - loss); } else { state = state.short; trail = close + loss; } case short: if (close < trail[1]) { state = state.short; trail = Min(trail[1], close + loss); } else { state = state.long; trail = close - loss; } } #def isnan = double.nan; def bn = barnumber(); def TrailingStop = trail; def LongEnter = (price crosses above TrailingStop) within 3 bars; def LongEnterbn = if longenter then bn else longenterbn[1]; def LongExit = (price crosses below TrailingStop)within 3 bars; def LongExitbn = if LongExit then bn else LongExitbn[1]; def Hold_signal = if LongEnterbn > LongExitbn then 1 else 0; #plot value = if LongEnter then 1 else if LongExit then 0 else double.nan; AssignbackgroundColor( if longenter then color.Dark_Green else if !longenter and (Hold_signal == 1) then Color.green else if longexit then Color.Dark_Red else if !longexit and (Hold_signal == 0) then Color.Red else color.dark_Gray); AddLabel(yes, if (longenter) then "TS_1H" else if !longenter and (Hold_signal == 1) then "Last: BUY" else if (longexit) then "TS_1H" else if !longexit and (Hold_signal == 0) then "Last: SELL" else " ", if longenter then color.white else if !longenter and (Hold_signal == 1) then Color.black else if longexit then Color.white else if !longexit and (Hold_signal == 0) then Color.black else color.dark_Gray); #AddLabel(yes, if (price crosses above TrailingStop) then "Long" #else if (price crosses below TrailingStop) then "Short" ##else "NO BREAK", if conditionBD then Color.RED ##else if conditionBO then Color.GREEN #else " "); #AssignvalueColor(if coloredCandlesOn and ((price > TrailingStop)) then Color.GREEN else if coloredCandlesOn and ((price < TrailingStop)) then Color.RED else Color.GRAY); #def upsignal = (price crosses above TrailingStop); #def downsignal = (price crosses below TrailingStop); ###------------------------------------------------------------------------------------------ # Profit and Loss Labels # # Fill in the 0>0 in the Create Signals section below to match your buy and sell signal conditions # # When using large amounts of hisorical data, P/L may take time to calculate ###------------------------------------------------------------------------------------------

EMAD Watchlist Column

EMAD Watchlist Column Share Link - http://

Description

The EMAD watchlist column indicates the location of the EMAs within the range and changes colors accordingly.

- Above or below zero line

- EMA cross up or down off line

Code:code

Horserider Volume Watchlist Column

Volume_%_30Bar Watchlist Column Share Link - http://tos.mx/u3K4CTM

Description

The volume percent 30 bar watchlist column shows the percent value of 30 bars of volume

Code:#Volume Buy Sell Pressure with Hot Percent for ThinkorSwim # Show total volume in gray. Buying volume in green. Sell Volume in red. # Volume average is gray line. # Specified percent over average volume is cyan triangles. # Horserider 12/30/2019 derived from some already existing studies. declare lower; #Inputs input Show30DayAvg = yes; input ShowTodayVolume = yes; input ShowPercentOf30DayAvg = yes; input UnusualVolumePercent = 200; input Show30BarAvg = yes; input ShowCurrentBar = yes; input ShowPercentOf30BarAvg = yes; input ShowSellVolumePercent = yes; def O = open; def H = high; def C = close; def L = low; def V = volume; def buying = V*(C-L)/(H-L); def selling = V*(H-C)/(H-L); # Selling Volume Plot SellVol = selling; SellVol.setPaintingStrategy(PaintingStrategy.Histogram); SellVol.SetDefaultColor(Color.Red); SellVol.HideTitle(); SellVol.HideBubble(); SellVol.SetLineWeight(1); # Total Volume # Note that Selling + Buying Volume = Volume. plot TV = volume; TV.SetPaintingStrategy(PaintingStrategy.HISTOGRAM); TV.SetDefaultColor(Color.GRAY); #TV.HideTitle(); #TV.HideBubble(); TV.SetLineWeight(1); Plot BuyVol = buying; BuyVol.setPaintingStrategy(PaintingStrategy.Histogram); BuyVol.SetDefaultColor(Color.Green); BuyVol.HideTitle(); BuyVol.HideBubble(); BuyVol.SetLineWeight(5); #Volume Data def volLast30DayAvg = (volume(period = "DAY")[1] + volume(period = "DAY")[2] + volume(period = "DAY")[3] + volume(period = "DAY")[4] + volume(period = "DAY")[5] + volume(period = "DAY")[6] + volume(period = "DAY")[7] + volume(period = "DAY")[8] + volume(period = "DAY")[9] + volume(period = "DAY")[10] + volume(period = "DAY")[11] + volume(period = "DAY")[12] + volume(period = "DAY")[13] + volume(period = "DAY")[14] + volume(period = "DAY")[15] + volume(period = "DAY")[16] + volume(period = "DAY")[17] + volume(period = "DAY")[18] + volume(period = "DAY")[19] + volume(period = "DAY")[20] + volume(period = "DAY")[21] + volume(period = "DAY")[22] + volume(period = "DAY")[23] + volume(period = "DAY")[24] + volume(period = "DAY")[25] + volume(period = "DAY")[26] + volume(period = "DAY")[27] + volume(period = "DAY")[28] + volume(period = "DAY")[29] + volume(period = "DAY")[30]) / 30; def today = volume(period = "DAY"); def percentOf30Day = Round((today / volLast30DayAvg) * 100, 0); def avg30Bars = (volume[1] + volume[2] + volume[3] + volume[4] + volume[5] + volume[6] + volume[7] + volume[8] + volume[9] + volume[10] + volume[11] + volume[12] + volume[13] + volume[14] + volume[15] + volume[16] + volume[17] + volume[18] + volume[19] + volume[20] + volume[21] + volume[22] + volume[23] + volume[24] + volume[25] + volume[26] + volume[27] + volume[28] + volume[29] + volume[30]) / 30; def curVolume = volume; def percentOf30Bar = Round((curVolume / avg30Bars) * 100, 0); def SellVolPercent = Round((Selling / Volume) * 100, 0); # Labels #AddLabel(Show30BarAvg, "30 Bar: " + Round(avg30Bars, 0), Color.white); #AddLabel(ShowCurrentBar, "Cur Bar: " + curVolume, (if percentOf30Bar >= UnusualVolumePercent then Color.GREEN else if PercentOf30Bar >= 100 then Color.ORANGE else Color.LIGHT_GRAY)); #AddLabel(ShowPercentOf30BarAvg, PercentOf30Bar + "%", (if PercentOf30Bar >= UnusualVolumePercent then Color.GREEN else if PercentOf30Bar >= 100 then Color.Light_Green else Color.WHITE) ); assignBackgroundColor(if PercentOf30Bar >= UnusualVolumePercent then color.GREEN else if PercentOf30Bar >= 100 then color.RED else color.white); AddLabel(ShowPercentOf30BarAvg, PercentOf30Bar + "%",Color.Black); #AddLabel(buying >= selling, ""+BuyVolPercent, color.black); #AddLabel(ShowSellVolumePercent, "Cur Bar Sell %: " + SellVolPercent, (if SellVolPercent > 51 then Color.RED else if SellVolPercent < 49 then Color.GREEN else Color.ORANGE)); #input length = 21; #input length2 = 21; #plot VolAvg = Average(volume, length); #plot VolAvg1= Average(volume, length2); #VolAvg.SetDefaultColor(GetColor(1)); #VolAvg1.SetDefaultColor(GetColor(3)); #def crossover = if (VolAvg2 crosses below VolAvg4) then 1 else 0; #def crossunder = if (VolAvg2 crosses above VolAvg4) and (volume<volavg) then 1 else 0; #AddVerticalLine(if crossover ==1 then 1 else 0,"",color.cyan); #AddVerticalLine(if crossunder ==1 then 1 else 0); # hiVolume indicator # source: http://tinboot.blogspot.com # author: allen everhart #input type = { default SMP, EXP } ; #input length_HV = 20 ; #input HotPct = 100.0 ; #def MA = #if type == type.SMP then #SimpleMovingAvg(volume, length_HV) #else #MovAvgExponential(volume, length_HV); #plot HV = ##ma #else #Double.NaN; #hv.SetDefaultColor( Color.CYAN); #hv.SetLineWeight(1) ; #hv.SetPaintingStrategy( PaintingStrategy.TRIANGLES);

Vix Alert 4 Watchlist Column

Vix_Alert4 Watchlist Column Share Link - http://tos.mx/qmsqFqB (4/25/23)

Description

The Vix Alert 4 indicates a potential reversal.

- Colors cell if condition exists within 3 bars

Code:# Source? # VixAlert4 WL Column - HODL # Williams Vix Fix Formula input pd = 22; input bbl = 20; input mult = 2.0; input lb = 50; input ph = 0.85; input pl = 1.01; # Downtrend Criteria input ltLB = 40; input mtLB = 14; input str = 3; def wvf = ((highest(close, pd) - low) / (highest(close, pd))) * 100; def sDev = mult * stdev(wvf, bbl); def midLine = SimpleMovingAvg(wvf, bbl); def lowerBand = midLine - sDev; def upperBand = midLine + sDev; def rangeHigh = (highest(wvf, lb)) * ph; # Filtered Bar Criteria def upRange = low > low[1] and close > high[1]; def upRange_Aggr = close > close[1] and close > open[1]; # Filtered Criteria def filtered = ((wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and(wvf<upperBand and wvf<rangeHigh)); def filtered_Aggr = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]); # Alerts Criteria def alert1 = wvf >= upperBand or wvf >= rangeHigh; def alert2 = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh); def alert3 = upRange and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered; def alert4 = upRange_Aggr and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered_Aggr; AssignbackgroundColor(if alert4 within 2 bars then color.orange else color.Dark_Gray); AddLabel(yes, if (Alert4) within 2 bars then "Alert 4 Day" + " " else " ", color.black);

Blast Off Watchlist Column

Blast_Off Watchlist Column Share Link - http://tos.mx/gVd03PO (4/25/23)

Description

Code:# Blast Off Indicator # Should use on the Daily chart # Assembled by BenTen at useThinkScript.com # Converted from https://www.tradingview.com/script/V9Mi6eOO-CM-Blast-Off-V1-Alerts-Ready/ input trig = 20; input paintbar = yes; def val = AbsValue(close - open); def range = high - low; def blastOffVal = (val / range) * 100; def trigger = trig; def alert1 = blastOffVal < trig; def col = blastOffVal < trig; plot value = if col then 1 else 0; addlabel(yes, "Blast Off ", if value == 1 then color.black else color.Dark_Gray); AssignBackgroundColor(if col then Color.orange else Color.Dark_GRAY);

Triple Exhaustion Watchlist Column

Triple_Exhaustion Watchlist Column Share Link - http://tos.mx/L4uOP8M

Description

The Triple Exhaustion watchlist column indicates the end of exhaustion.

- Color changes green or red when condition exists within 3 bars

- If you so choose change the number "3" to any number (I added within x bars bc there were few indications for the current bar)

Code:## Triple Exhaustion Watchlist Column ## ## ## CREDITS ## Requested by @Chence27 from criteria listed here https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## ## ## Removing the header Credit credits and description is not permitted, any modification needs to be shared. ## ## V 1.0 : @cos251 - Initial release per request from www.usethinkscript.com forum thread: ## : https://usethinkscript.com/threads/triple-exhaustion-indicator.9001/ ## ## ## # --- Inputs input over_bought = 80; input over_sold = 20; input KPeriod = 10; input DPeriod = 10; input priceH = high; input priceL = low; input priceC = close; input averageType = AverageType.SIMPLE; input length = 1000; input paintBars = yes; input showLabels = yes; # --- Indicators - StochasticSlow / MACD / MACD StDev / DMI+/- def SlowK = reference StochasticFull(over_bought, over_sold, KPeriod, DPeriod, priceH, priceL, priceC, 3, averageType).FullK; def MACD = reference MACD()."Value"; def priceMean = Average(MACD, length); def MACD_stdev = (MACD - priceMean) / StDev(MACD, length); def dPlus = reference DMI()."DI+"; def dMinus = reference DMI()."DI-"; # --- End Indicators # --- Conditions def sellerRegular = SlowK < 20 and MACD_stdev < -1 and dPlus < 15; def sellerExtreme = SlowK < 20 and MACD_stdev < -2 and dPlus < 15; def buyerRegular = SlowK > 80 and MACD_stdev > 1 and dMinus < 15; def buyerExtreme = SlowK > 80 and MACD_stdev > 2 and dMinus < 15; # --- End Conditions # -- Price Color AssignPriceColor( if paintBars and sellerExtreme then Color.CYAN else if buyerExtreme and paintBars then Color.GREEN else if paintBars and sellerRegular then Color.YELLOW else if buyerRegular and paintBars then Color.DARK_GREEN else if paintBars then Color.GRAY else Color.Current); # --- Arrows/Triggers plot RegularBuy = if sellerRegular[1] and !sellerRegular then 1 else 0; plot ExtremeBuy = if sellerExtreme[1] and !sellerExtreme then 1 else 0; RegularBuy.SetPaintingStrategy(PaintingSTrategy.ARROW_UP); ExtremeBuy.SetPaintingSTrategy(paintingSTrategy.Arrow_UP); RegularBuy.SetDefaultColor(Color.green); ExtremeBuy.SetDefaultColor(Color.Dark_GREEN); plot RegularSell = if buyerRegular[1] and !buyerRegular then 1 else 0; plot ExtremeSell = if buyerExtreme[1] and !buyerExtreme then 1 else 0; RegularSell.SetPaintingStrategy(PaintingSTrategy.ARROW_down); ExtremeSell.SetPaintingSTrategy(paintingSTrategy.Arrow_DOWN); RegularSell.SetDefaultColor(Color.red); ExtremeSell.SetDefaultColor(Color.Dark_red); # --- Labels# #AddLabel(showLabels,"SellerRegular",Color.YELLOW); #AddLabel(showLabels,"SellerExtreme",Color.CYAN); #AddLabel(showLabels,"BuyerRegular",Color.DARK_GREEN); #AddLabel(showLabels,"BuyerExtreme",Color.GREEN); #Addlabel (yes, "3X EXH:", Color.Gray); #Addlabel (yes, if sellerExtreme then " " else # if buyerExtreme then " " else # if sellerRegular then " " else # if buyerRegular then " " else # if sellerExtreme then " " else " ", # if buyerExtreme then Color.MAGENTA else # if sellerRegular then Color.GREEN else # if buyerRegular then Color.RED else # if sellerExtreme then Color.Cyan else # Color.yellow); #Addlabel (yes, " 3X ARW: ", Color.Gray); addLabel (yes, if extremeSell within 3 bars then "3X" else if extremebuy within 3 bars then "3X" else if regularsell within 3 bars then "3XT" else if regularbuy within 3 bars then "3XT" else " "); AssignbackgroundColor( if extremeSell within 3 bars then Color.Dark_red else if extremebuy within 3 bars then Color.Dark_green else if regularsell within 3 bars then Color.dark_red else if regularbuy within 3 bars then Color.dark_green else Color.dark_gray);

MAMA Watchlist Column

MAMA Watchlist Column Share Link - http://tos.mx/AvGKZ10 (4/25/23)

Description

The MAMA watchlist column indicates bullish or bearish price action which (I believe - will verify) is based on the agreement level between 16 different indicators

- Green = bullish

- Red = bearish

Code:#Ehler's MAMA Watchlist Column #Created by Christopher84 10/10/2022 script WMA_Smooth { input price = hl2; plot smooth = (4 * price + 3 * price[1] + 2 * price[2] + price[3]) / 10; } input showcloud = no; script Phase_Accumulation { # This is Ehler's Phase Accumulation code. It has a full cycle delay. # However, it computes the correction factor to a very high degree. # input price = hl2; rec Smooth; rec Detrender; rec Period; rec Q1; rec I1; rec I1p; rec Q1p; rec Phase1; rec Phase; rec DeltaPhase; rec DeltaPhase1; rec InstPeriod1; rec InstPeriod; def CorrectionFactor; if BarNumber() <= 5 then { Period = 0; Smooth = 0; Detrender = 0; CorrectionFactor = 0; Q1 = 0; I1 = 0; Q1p = 0; I1p = 0; Phase = 0; Phase1 = 0; DeltaPhase1 = 0; DeltaPhase = 0; InstPeriod = 0; InstPeriod1 = 0; } else { CorrectionFactor = 0.075 * Period[1] + 0.54; # Smooth and detrend my smoothed signal: Smooth = WMA_Smooth(price); Detrender = ( 0.0962 * Smooth + 0.5769 * Smooth[2] - 0.5769 * Smooth[4] - 0.0962 * Smooth[6] ) * CorrectionFactor; # Compute Quadrature and Phase of Detrended signal: Q1p = ( 0.0962 * Detrender + 0.5769 * Detrender[2] - 0.5769 * Detrender[4] - 0.0962 * Detrender[6] ) * CorrectionFactor; I1p = Detrender[3]; # Smooth out Quadrature and Phase: I1 = 0.15 * I1p + 0.85 * I1p[1]; Q1 = 0.15 * Q1p + 0.85 * Q1p[1]; # Determine Phase if I1 != 0 then { # Normally, ATAN gives results from -pi/2 to pi/2. # We need to map this to circular coordinates 0 to 2pi if Q1 >= 0 and I1 > 0 then { # Quarant 1 Phase1 = ATan(AbsValue(Q1 / I1)); } else if Q1 >= 0 and I1 < 0 then { # Quadrant 2 Phase1 = Double.Pi - ATan(AbsValue(Q1 / I1)); } else if Q1 < 0 and I1 < 0 then { # Quadrant 3 Phase1 = Double.Pi + ATan(AbsValue(Q1 / I1)); } else { # Quadrant 4 Phase1 = 2 * Double.Pi - ATan(AbsValue(Q1 / I1)); } } else if Q1 > 0 then { # I1 == 0, Q1 is positive Phase1 = Double.Pi / 2; } else if Q1 < 0 then { # I1 == 0, Q1 is negative Phase1 = 3 * Double.Pi / 2; } else { # I1 and Q1 == 0 Phase1 = 0; } # Convert phase to degrees Phase = Phase1 * 180 / Double.Pi; if Phase[1] < 90 and Phase > 270 then { # This occurs when there is a big jump from 360-0 DeltaPhase1 = 360 + Phase[1] - Phase; } else { DeltaPhase1 = Phase[1] - Phase; } # Limit our delta phases between 7 and 60 if DeltaPhase1 < 7 then { DeltaPhase = 7; } else if DeltaPhase1 > 60 then { DeltaPhase = 60; } else { DeltaPhase = DeltaPhase1; } # Determine Instantaneous period: InstPeriod1 = -1 * (fold i = 0 to 40 with v=0 do if v < 0 then v else if v > 360 then -i else v + GetValue(DeltaPhase, i, 41) ); if InstPeriod1 <= 0 then { InstPeriod = InstPeriod[1]; } else { InstPeriod = InstPeriod1; } Period = 0.25 * InstPeriod + 0.75 * Period[1]; } plot DC = Period; } script Ehler_MAMA { input price = hl2; input FastLimit = 0.5; input SlowLimit = 0.05; rec Period; rec Period_raw; rec Period_cap; rec Period_lim; rec Smooth; rec Detrender; rec I1; rec Q1; rec jI; rec jQ; rec I2; rec Q2; rec I2_raw; rec Q2_raw; rec Phase; rec DeltaPhase; rec DeltaPhase_raw; rec alpha; rec alpha_raw; rec Re; rec Im; rec Re_raw; rec Im_raw; rec SmoothPeriod; rec vmama; rec vfama; def CorrectionFactor = Phase_Accumulation(price).CorrectionFactor; if BarNumber() <= 5 then { Smooth = 0; Detrender = 0; Period = 0; Period_raw = 0; Period_cap = 0; Period_lim = 0; I1 = 0; Q1 = 0; I2 = 0; Q2 = 0; jI = 0; jQ = 0; I2_raw = 0; Q2_raw = 0; Re = 0; Im = 0; Re_raw = 0; Im_raw = 0; SmoothPeriod = 0; Phase = 0; DeltaPhase = 0; DeltaPhase_raw = 0; alpha = 0; alpha_raw = 0; vmama = 0; vfama = 0; } else { # Smooth and detrend my smoothed signal: Smooth = WMA_Smooth(price); Detrender = ( 0.0962 * Smooth + 0.5769 * Smooth[2] - 0.5769 * Smooth[4] - 0.0962 * Smooth[6] ) * CorrectionFactor; Q1 = ( 0.0962 * Detrender + 0.5769 * Detrender[2] - 0.5769 * Detrender[4] - 0.0962 * Detrender[6] ) * CorrectionFactor; I1 = Detrender[3]; jI = ( 0.0962 * I1 + 0.5769 * I1[2] - 0.5769 * I1[4] - 0.0962 * I1[6] ) * CorrectionFactor; jQ = ( 0.0962 * Q1 + 0.5769 * Q1[2] - 0.5769 * Q1[4] - 0.0962 * Q1[6] ) * CorrectionFactor; # This is the complex conjugate I2_raw = I1 - jQ; Q2_raw = Q1 + jI; I2 = 0.2 * I2_raw + 0.8 * I2_raw[1]; Q2 = 0.2 * Q2_raw + 0.8 * Q2_raw[1]; Re_raw = I2 * I2[1] + Q2 * Q2[1]; Im_raw = I2 * Q2[1] - Q2 * I2[1]; Re = 0.2 * Re_raw + 0.8 * Re_raw[1]; Im = 0.2 * Im_raw + 0.8 * Im_raw[1]; # Compute the phase if Re != 0 and Im != 0 then { Period_raw = 2 * Double.Pi / ATan(Im / Re); } else { Period_raw = 0; } if Period_raw > 1.5 * Period_raw[1] then { Period_cap = 1.5 * Period_raw[1]; } else if Period_raw < 0.67 * Period_raw[1] { Period_cap = 0.67 * Period_raw[1]; } else { Period_cap = Period_raw; } if Period_cap < 6 then { Period_lim = 6; } else if Period_cap > 50 then { Period_lim = 50; } else { Period_lim = Period_cap; } Period = 0.2 * Period_lim + 0.8 * Period_lim[1]; SmoothPeriod = 0.33 * Period + 0.67 * SmoothPeriod[1]; if I1 != 0 then { Phase = ATan(Q1 / I1); } else if Q1 > 0 then { # Quadrant 1: Phase = Double.Pi / 2; } else if Q1 < 0 then { # Quadrant 4: Phase = -Double.Pi / 2; } else { # Both numerator and denominator are 0. Phase = 0; } DeltaPhase_raw = Phase[1] - Phase; if DeltaPhase_raw < 1 then { DeltaPhase = 1; } else { DeltaPhase = DeltaPhase_raw; } alpha_raw = FastLimit / DeltaPhase; if alpha_raw < SlowLimit then { alpha = SlowLimit; } else { alpha = alpha_raw; } vmama = alpha * price + (1 - alpha) * vmama[1]; vfama = 0.5 * alpha * vmama + (1 - 0.5 * alpha) * vfama[1]; } plot MAMA = vmama; plot FAMA = vfama; } declare upper; input price = hl2; input FastLimit = 0.5; input SlowLimit = 0.05; DefineGlobalColor("Pre_Cyan", CreateColor(50, 200, 255)) ; DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ; DefineGlobalColor("LabelRed", CreateColor(225, 0, 0)) ; plot MAMA = Ehler_MAMA(price, FastLimit, SlowLimit).MAMA; def UP = price > MAMA; def DOWN = price < MAMA; addlabel(yes, if UP then "👍 1H" else if Down then "👎 1H" else " ", color.white); AssignBackgroundColor(if DOWN then color.dark_RED else if UP then color.dark_green else color.black); #"👍" else if Down then "👎"

Well to be clear...I understand your idea

Key levels = Supply / Demand zones with a white bar in front

Could you give future downloaders the option to show the bar though , I like the zone with bar vs zones without bar.

the orange / light green bar is more obvious than the white candle , to me.

- The white bar is included in the updated link for the Big7 indicator (turned off by default)

- I will not be using the white bar, I added it as a visual aid

- When @Christopher84 the great coded C3_Max_Spark he replaced the C3 MF Line or Candle color code with the "previously overbought (dashed light green line) / previously oversold (dashed orange line)" lines as they represent the same levels (this of course does not account for the green and red portions of the C3 MF Line

* Also to whom it may concern: you may have noticed I now refer to the "supply demand" zones as "overbought oversold" zones which is how @Christopher84 defines them. That being said to me supply demand still makes sense so call them whatever you like. The reason I stopped calling the "supply demand" zones and started calling them "overbought oversold" zones was to avoid confusion... though I may have just caused even more confusion, but you know what I mean haha....*

https://usethinkscript.com/threads/...-all-be-all-for-thinkorswim.15257/post-124254I dont see a script for adding the EMAD Watch List. Can you help? Many Thanks

There you go... I have not finished it 100% but it functions as intended just not as easily understood as I would like... that being said it indicates the following:

EMAD Watchlist Column: http://tos.mx/opqRR2n

Hello , do you have a link to C3_Max_Spark ?. I looked around and could not find it.https://usethinkscript.com/threads/...-all-be-all-for-thinkorswim.15257/post-124254

There you go... I have not finished it 100% but it functions as intended just not as easily understood as I would like... that being said it indicates the following:

EMAD Watchlist Column: http://tos.mx/opqRR2n

Thanks

acording2mike

New member

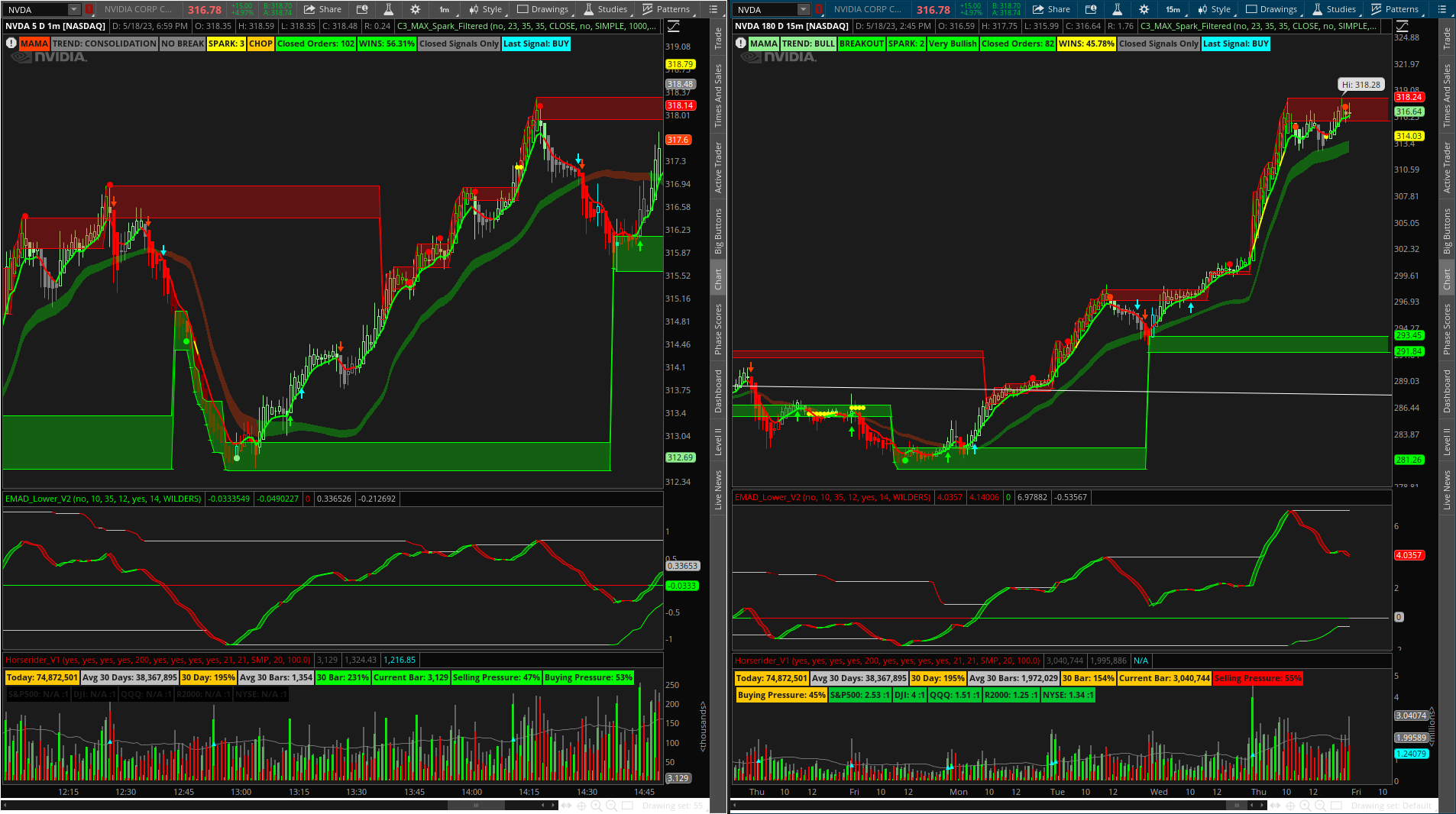

Current chart style(s)

Confirmation Trend | The End All Be All | Chart Style (ema's and ehlers with TS V9 avg and stop levels) - http://tos.mx/7wblVwk (Link posted 6/3/23)

Confirmation Trend | The End All Be All | Chart Style (with stiffness clouds) - http://tos.mx/Sy7Cnm9 (Link posted 5/18/23)

Confirmation Trend | The End All Be All | Chart Style - https://tos.mx/yioyc2k (Link posted 5/11/23)

View attachment 18465

How do I get the "Stop" "Average Profit" Bubbles to disappear?

And if your interested here is the VIP thread (though there is no difference between C3_Max_Spark between this thread and that one) https://usethinkscript.com/threads/the-confirmation-trend-chart-vip.16186/post-129043

Also the chart style images use a different study to paint the candles. In the link provided above - the post contains the shared link and code for the study and screenshots of the study on its own.

Man if it is possible I would sure love to know how... I gave it a college try and it was all over the place. I dont even use the bubble because it does not indicate all occurrences and the bubble gets cut off at times also. When I attempted the HL LH code the problem was all the little crossovers... like the ones that are flat or compressed... I thought maybe I could get ride of the very short term crossovers by just adding a condition the crossover had to be true for x number of bars also tried referencing the width between the bands to avoid insignificant crossovers... I may give it another shot but it wasnt producing trustworthy results thats for sure. But if you have any ideas let me know.

@HODL-Lay-HE-hoo! you and @Christopher84 have given so much to this community. Trying to give back so this is what I came up with that can indicate the first and second higher lows and lower highs off the top and bottom bands.

I used the V2 that you had posted on the 1st page as the basis of the code. Changed both top and bottom band lengths back to 100 and removed the bubbles and replaced them with vertical lines. Also used the fold function to allow the customization of the lookback filter for the bounce up and down indicators.

https://tos.mx/quM6rl1

Feel free to change it up to your format or liking. Hope this helps everyone! @METAL, it looks like you were looking for this so check it out if you're still using EMAD in your trading.

Cool man, I'll check it out!@HODL-Lay-HE-hoo! you and @Christopher84 have given so much to this community. Trying to give back so this is what I came up with that can indicate the first and second higher lows and lower highs off the top and bottom bands.

I used the V2 that you had posted on the 1st page as the basis of the code. Changed both top and bottom band lengths back to 100 and removed the bubbles and replaced them with vertical lines. Also used the fold function to allow the customization of the lookback filter for the bounce up and down indicators.

https://tos.mx/quM6rl1

Feel free to change it up to your format or liking. Hope this helps everyone! @METAL, it looks like you were looking for this so check it out if you're still using EMAD in your trading.

- Status

- Not open for further replies.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

Confirmation Candles Indicator For ThinkorSwim

- Started by Christopher84

- Replies: 3K

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Trend Follow with Noise Reduction For ThinkOrSwim

- Started by rip78

- Replies: 0

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

Confirmation Candles Indicator For ThinkorSwim

- Started by Christopher84

- Replies: 3K

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Trend Follow with Noise Reduction For ThinkOrSwim

- Started by rip78

- Replies: 0

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

Confirmation Candles Indicator For ThinkorSwim

- Started by Christopher84

- Replies: 3K

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Trend Follow with Noise Reduction For ThinkOrSwim

- Started by rip78

- Replies: 0

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/