##########################################################################################

##########################################################################################

### ###

### ############################# ######### ######### ###

### ################################# ######### ######### ###

### #################################### ######### ######### ###

### ######## ######### ######### ######### ###

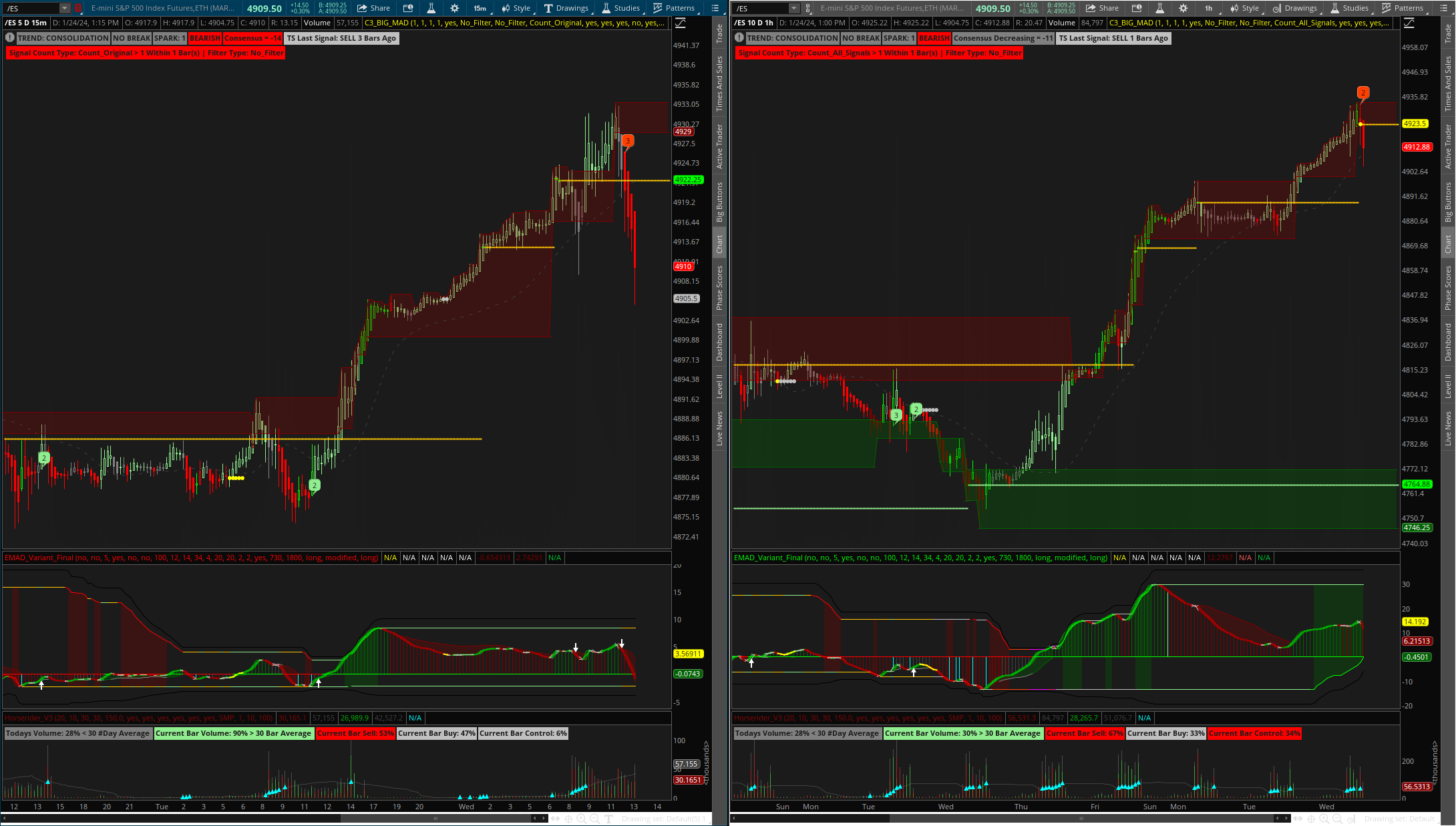

### ######## C3_BIG_SPARK_MAX ######### ######### ######### ###

### ######## +TSV9 ######### ######### ######### ###

### ######## @Christopher84 ######### ######### ######### ###

### ######## ######### ######### ######### ###

### ###################################### ################################## ###

### #################################### ################################## ###

### ################################# ################################## ###

### #################################### ################################## ###

### ######## ######### ######### ###

### ######## @Horserider ######### ######### ###

### ######## HORSERIDER VOLUME ######### ######### ###

### ######## TRIPLE EXHAUSTION ######### ######### ###

### ######## @chence27 ######### ######### ###

### ######## ######### ######### ###

### #################################### ######### ###

### ################################## ######### ###

### ############################### ######### ###

### ###

##########################################################################################

##########################################################################################

declare upper;

input Filter = {default EMAD_Filter, Phase_Filter, No_Filter};

input x = 5;

input Ehlers_Length = 34;

input Big4_Confirmation_Factor = 4; #hint Big4

input ATR_Period_TSV9 = 11;

input ATR_Factor_TSV9 = 2.2;

input Color_Candles = yes;

input Show_EMA_Cloud = yes;

input Show_HL_LH = no;

input Show_EMAD_Arrows = no;

input Show_Labels = yes;

input TradeDaytimeOnly = yes; #hint tradeDaytimeOnly: (IntraDay Only) Only perform trades during hours stated

input OpenTime = 0730; #hint OpenTime: Opening time of market hides arrows

input CloseTime = 1800; #hint CloseTime: Closing time of market hides arrows

input FirstTrade_Squeeze = {default long, short};

input TrailType = {default modified, unmodified};

input FirstTrade = {default long, short};

input MACD_AverageType = {SMA, default EMA};

input DMI_averageType = AverageType.WILDERS;

input AvgType = AverageType.HULL;

########################################################

## COLOR DEFINITIONS ##

########################################################

DefineGlobalColor("Green", CreateColor(0, 155, 0));

DefineGlobalColor("Red", CreateColor(225, 105, 105));

DefineGlobalColor("Gray", CreateColor(192, 192, 192));

DefineGlobalColor("Yellow", CreateColor(231, 190, 0));

########################################################

## ##

########################################################

def bn = barnumber();

def Begin = SecondsFromTime(OpenTime);

def End = SecondsTillTime(CloseTime);

def isIntraDay = if GetAggregationPeriod() > 14400000 or GetAggregationPeriod() == 0 then 0 else 1;

def MarketOpen = if !tradeDaytimeOnly or !isIntraDay then 1 else if tradeDaytimeOnly and isIntraDay and Begin > 0 and End > 0 then 1 else 0;

def LongTrades = yes; #hint LongTrades: perform long tradesvb balanceOfMarketPower AbandonedBaby b bbbbbbbbg

def ShortTrades = yes; #hint ShortTrades: perform short trades

def useStops = no; #hint useStops: use stop orders

def useAlerts = no; #hint useAlerts: use alerts on signals

########################################################

## ##

########################################################

def Cloud_Lookback = 20;

def HL_LH_Lookback = 20;

def Previous_Steps_Down = 2; #hint filter for hiding arrows

def Previous_Steps_Up = 2; #hint filter for hiding arrows

def Length_MAD = 4;

def Band_Length = 100;

def Smooth_Length = 12;

def Smooth_Length_2 = 14;

def Fast_Length = 10;

def Slow_Length = 35;

def Made_Avg_Length = 3;

def ATR_Period_Squeeze = 5;

def ATR_Factor_Squeeze = 2.0;

def Length_3x = 1000;

def AverageType = AverageType.WILDERS;

def AverageType_Squeeze = AverageType.SIMPLE;

def EMAD_EMA_lineweight = 2;

def Step_lookback = 10;

def FastExpAvg = ExpAverage(close, fast_Length);

def SlowExpAvg = ExpAverage(close, slow_Length);

def EMAD_Fast = (close - fastExpAvg);

def EMAD_Slow = (close - slowExpAvg);

def EMAD_Avg = (EMAD_Fast + EMAD_Slow) / 2;

#####################################################

## UPPER EMA ##

#####################################################

def Upper_EMAD_EMA = ExpAverage(EMAD_Avg, smooth_Length);

def EMAD_Open = (Upper_EMAD_EMA + Upper_EMAD_EMA[1]) / 2;

def EMAD_High = Max(Upper_EMAD_EMA, Upper_EMAD_EMA[1]);

def EMAD_Low = Min(Upper_EMAD_EMA, Upper_EMAD_EMA[1]);

def EMAD_Close = Upper_EMAD_EMA;

def Bottom = Min(EMAD_Close[1], EMAD_Low);

def TR = TrueRange(EMAD_High, EMAD_Close, EMAD_Low);

def PTR = tr / (bottom + tr / 2);

def APTR = MovingAverage(averageType, ptr, smooth_Length_2);

def UpperBand = EMAD_Close[1] + (APTR * EMAD_Open);

def LowerBand = EMAD_Close[1] - (APTR * EMAD_Open);

#####################################################

## LOWER EMA ##

#####################################################

def Lower_EMAD_EMA = (upperBand + lowerBand) / 2;

#####################################################

## TOP BAND ##

#####################################################

def TopBand = Highest(Lower_EMAD_EMA, band_Length);

#####################################################

## BOTTOM BAND ##

#####################################################

def BottomBand = Lowest(Lower_EMAD_EMA, band_Length);

#####################################################

## ZERO LINE ##

#####################################################

def ZeroLineData = if IsNaN(close) then Double.NaN else 0;

def EMAD_Above_Zero = Upper_EMAD_EMA > zeroLineData;

def EMAD_Below_Zero = Upper_EMAD_EMA < zeroLineData;

def EMAD_EMA_down = (Lower_EMAD_EMA > Upper_EMAD_EMA);

def EMAD_EMA_up = (Upper_EMAD_EMA >= Lower_EMAD_EMA);

#####################################################

## MASTER EMA ##

#####################################################

def Master_EMAD_EMA = (Upper_EMAD_EMA + Lower_EMAD_EMA) / 2;

def TopBand_StepDown = if topBand < topBand[1] then 1 else 0;

def TopBand_StepUp = if topBand > topBand[1] then 1 else 0;

def BottomBand_StepDown = if bottomBand < bottomBand[1] then 1 else 0;

def BottomBand_StepUp = if bottomBand > bottomBand[1] then 1 else 0;

def BothBands_Down = bottomBand_StepDown and TopBand_StepDown;

def BothBands_Up = bottomBand_StepUp and TopBand_StepUp;

def BottomBand_Above_Zero = (bottomBand > zeroLineData);

def TopBand_below_Zero = (topBand < zeroLineData);

def TopBand_PushUp = Master_EMAD_EMA >= TopBand;

def BottomBand_PushDown = Master_EMAD_EMA <= bottomBand;

def MidBand = (upperBand + lowerBand) / 2;

def EMA_CrossUp = if (midBand[1] > Upper_EMAD_EMA[1]) and (midBand < Upper_EMAD_EMA) then 1 else 0;

def EMA_CrossDown = if (Upper_EMAD_EMA[1] > midBand[1]) and (Upper_EMAD_EMA < midBand) then 1 else 0;

def Value_At_CrossUp = if EMA_CrossUp then midBand else 0;

def Value_At_CrossDown = if EMA_CrossDown then midBand else 0;

def CrossUp_BottomBand = if (Value_At_CrossUp - bottomBand) == 0 then 1 else 0;

def CrossDown_TopBand = if (Value_At_CrossDown - topBand) == 0 then 1 else 0;

def CrossUp_Zeroline = if (Value_At_CrossUp) == 0 then 1 else 0;

def CrossDown_Zeroline = if (Value_At_CrossDown) == 0 then 1 else 0;

def CrossUp_BottomBand_bn = if CrossUp_Bottomband and !CrossUp_Bottomband[1] then bn else CrossUp_Bottomband_bn[1];

def CrossDown_TopBand_bn = if CrossDown_topband and !CrossDown_topband[1] then bn else CrossDown_TopBand_bn[1];

def CrossUp_BottomBand_Within = if CrossUp_Bottomband_bn < bn then bn - CrossUp_Bottomband_bn else CrossUp_BottomBand_Within[1];

def CrossDown_TopBand_Within = if CrossDown_TopBand_bn < bn then bn - CrossDown_TopBand_bn else CrossDown_TopBand_Within[1];

def Band_Crossed_First = CrossUp_Bottomband_bn > CrossDown_TopBand_bn;

#####################################################

## EMAD CLOUD CONDITIONS ##

#####################################################

def EMAD_Green_Cloud_1 = if TopBand_StepUp and TopBand_PushUp and !TopBand_below_Zero then 1 else 0;

def EMAD_Green_Cloud_2 = if BottomBand_StepUp and !EMAD_Below_Zero then 1 else 0;

def EMAD_Red_Cloud_1 = if BottomBand_StepDown and BottomBand_PushDown and !BottomBand_Above_Zero then 1 else 0;

def EMAD_Red_Cloud_2 = if TopBand_StepDown and !EMAD_Above_Zero then 1 else 0;

def EMAD_Gray_Cloud_1 = if BottomBand_Above_Zero and !TopBand_PushUp then 1 else 0;

def EMAD_Gray_Cloud_2 = if TopBand_below_Zero and !BottomBand_PushDown then 1 else 0;

#####################################################

## HIGHER LOW - LOWER HIGH ##

#####################################################

def HL = CrossUp_Bottomband == 0 and CrossDown_topband == 0 and Upper_EMAD_EMA crosses above Lower_EMAD_EMA; #Normal HL LH condition

def LH = CrossDown_topband == 0 and CrossUp_Bottomband == 0 and Upper_EMAD_EMA crosses below Lower_EMAD_EMA; #Normal HL LH condition

def bounceUpOnce = CrossUp_Bottomband <> CrossUp_Bottomband[1]; #XUpBtm happened previous bar or on current bar (<> = is NOT equal to)

def bounceDnOnce = CrossDown_topband <> CrossDown_topband[1];

def trackCrUp = if bounceUpOnce then 0 else if HL then 1 else trackCrUp[1];

def trackCrDn = if bounceDnOnce then 0 else if LH then 1 else trackCrDn[1];

def HLalready = if trackCrUp and !trackCrUp[1] then 1 else 0;

def LHalready = if trackCrDn and !trackCrDn[1] then 1 else 0;

def HL2_EMAD = HLalready == 0 and Upper_EMAD_EMA crosses above Lower_EMAD_EMA;

def LH2_EMAD = LHalready == 0 and Upper_EMAD_EMA crosses below Lower_EMAD_EMA;

def crossedUpOnce = HLalready <> HLalready[1];

def crossedDnOnce = LHalready <> LHalready[1];

def trackCrUp2 = if crossedUpOnce then 0 else if HL2_EMAD then 1 else trackCrUp2[1];

def trackCrDn2 = if crossedDnOnce then 0 else if LH2_EMAD then 1 else trackCrDn2[1];

#####################################################

## SQUEEZE ##

#####################################################

def HiLo_Squeeze = Min(high - low, 1.5 * Average(high - low, ATR_Period_Squeeze));

def HRef_Squeeze = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef_Squeeze = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def trueRange_Squeeze;

switch (trailType) {

case modified:

trueRange_Squeeze = Max(HiLo_Squeeze, Max(HRef_Squeeze, LRef_Squeeze));

case unmodified:

trueRange_Squeeze = TrueRange(high, close, low);

}

def loss_Squeeze = ATR_Factor_Squeeze * MovingAverage(averageType_Squeeze, trueRange_Squeeze, ATR_Period_Squeeze);

def state_Squeeze = {default init, long, short};

def trail_Squeeze;

switch (state_Squeeze[1]) {

case init:

if (!IsNaN(loss_Squeeze)) {

switch (firstTrade) {

case long:

state_Squeeze = state_Squeeze.long;

trail_Squeeze = close - loss_Squeeze;

case short:

state_Squeeze = state_Squeeze.short;

trail_Squeeze = close + loss_Squeeze;

}

} else {

state_Squeeze = state_Squeeze.init;

trail_Squeeze = Double.NaN;

}

case long:

if (close > trail_Squeeze[1]) {

state_Squeeze = state_Squeeze.long;

trail_Squeeze = Max(trail_Squeeze[1], close - loss_Squeeze);

} else {

state_Squeeze = state_Squeeze.short;

trail_Squeeze = close + loss_Squeeze;

}

case short:

if (close < trail_Squeeze[1]) {

state_Squeeze = state_Squeeze.short;

trail_Squeeze = Min(trail_Squeeze[1], close + loss_Squeeze);

} else {

state_Squeeze = state_Squeeze.long;

trail_Squeeze = close - loss_Squeeze;

}

}

def TrailingStop_Squeeze = trail_Squeeze;

def H = Highest(TrailingStop_Squeeze, 12);

def L = Lowest(TrailingStop_Squeeze, 12);

def Bandwidth_Squeeze = (H - L);

def IntermSupport2 = Lowest(Bandwidth_Squeeze, Band_Length);

def Squeeze_Trigger = Bandwidth_Squeeze <= IntermSupport2;

def Squeeze_Level = if !Squeeze_Trigger[1] and Squeeze_Trigger then hl2 else if !Squeeze_Trigger then Double.NaN else Squeeze_Level[1];

def Squeeze_Alert_1 = if Squeeze_Level then (Upper_EMAD_EMA + Lower_EMAD_EMA) / 2 else (Upper_EMAD_EMA + Lower_EMAD_EMA) / 2 ;

#####################################################

## TS V9 ##

#####################################################

def HiLo_TSV9 = Min(high - low, 1.5 * Average(high - low, ATR_Period_TSV9));

def HRef_TSV9 = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef_TSV9 = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def trueRange_TSV9;

switch (trailType) {

case modified:

trueRange_TSV9 = Max(HiLo_TSV9, Max(HRef_TSV9, LRef_TSV9));

case unmodified:

trueRange_TSV9 = TrueRange(high, close, low);

}

def loss_TSV9 = ATR_Factor_TSV9 * MovingAverage(averageType, trueRange_TSV9, ATR_Period_TSV9);

def state_TSV9 = {default init, long, short};

def trail_TSV9;

switch (state_TSV9[1]) {

case init:

if (!IsNaN(loss_TSV9)) {

switch (firstTrade) {

case long:

state_TSV9 = state_TSV9.long;

trail_TSV9 = close - loss_TSV9;

case short:

state_TSV9 = state_TSV9.short;

trail_TSV9 = close + loss_TSV9;

}

} else {

state_TSV9 = state_TSV9.init;

trail_TSV9 = Double.NaN;

}

case long:

if (close > trail_TSV9[1]) {

state_TSV9 = state_TSV9.long;

trail_TSV9 = Max(trail_TSV9[1], close - loss_TSV9);

} else {

state_TSV9 = state_TSV9.short;

trail_TSV9 = close + loss_TSV9;

}

case short:

if (close < trail_TSV9[1]) {

state_TSV9 = state_TSV9.short;

trail_TSV9 = Min(trail_TSV9[1], close + loss_TSV9);

} else {

state_TSV9 = state_TSV9.long;

trail_TSV9 = close - loss_TSV9;

}

}

def Price = close;

def TrailingStop_TSV9 = trail_TSV9;

def LongEnter = (price crosses above TrailingStop_TSV9);

def LongExit = (price crosses below TrailingStop_TSV9);

def Upsignal = (price crosses above TrailingStop_TSV9);

def Downsignal = (price crosses below TrailingStop_TSV9);

def PLBuyStop = if !useStops then 0 else if (0 > 0) then 1 else 0 ; # insert condition to stop in place of the 0<0

def PLSellStop = if !useStops then 0 else if (0 > 0) then 1 else 0 ; # insert condition to stop in place of the 0>0

def PLMktStop = if MarketOpen[-1] == 0 then 1 else 0; # If tradeDaytimeOnly is set, then stop at end of day

def PLBuySignal = if MarketOpen and (upsignal) then 1 else 0 ; # insert condition to create long position in place of the 0>0

def PLSellSignal = if MarketOpen and (downsignal) then 1 else 0; # insert condition to create short position in place 0>0

def CurrentPosition; # holds whether flat = 0 long = 1 short = -1

if (BarNumber() == 1) or IsNaN(CurrentPosition[1]) {

CurrentPosition = 0;

} else {

if CurrentPosition[1] == 0 { # FLAT

if (PLBuySignal and LongTrades) {

CurrentPosition = 1;

} else if (PLSellSignal and ShortTrades) {

CurrentPosition = -1;

} else {

CurrentPosition = CurrentPosition[1];

}

} else if CurrentPosition[1] == 1 { # LONG

if (PLSellSignal and ShortTrades) {

CurrentPosition = -1;

} else if ((PLBuyStop and useStops) or PLMktStop or (PLSellSignal and ShortTrades == 0)) {

CurrentPosition = 0;

} else {

CurrentPosition = CurrentPosition[1];

}

} else if CurrentPosition[1] == -1 { # SHORT

if (PLBuySignal and LongTrades) {

CurrentPosition = 1;

} else if ((PLSellStop and useStops) or PLMktStop or (PLBuySignal and LongTrades == 0)) {

CurrentPosition = 0;

} else {

CurrentPosition = CurrentPosition[1];

}

} else {

CurrentPosition = CurrentPosition[1];

}

}

def isLong = if CurrentPosition == 1 then 1 else 0;

def isShort = if CurrentPosition == -1 then 1 else 0;

def isFlat = if CurrentPosition == 0 then 1 else 0;

def BuySig = if marketopen and (((isShort[1] and LongTrades) or (isFlat[1] and LongTrades)) and PLBuySignal) then 1 else 0;

def SellSig = if marketopen and (((isLong[1] and ShortTrades) or (isFlat[1] and ShortTrades)) and PLSellSignal) then 1 else 0;

def BuySig_TSV9_bn = if upsignal[1] then BN else BuySig_TSV9_bn[1];

def SellSig_TSV9_bn = if downsignal[1] then BN else SellSig_TSV9_bn[1];

def TS_Last = if BuySig_TSV9_bn > SellSig_TSV9_bn then 1 else 0;

def cond13_TS_Buy = Buysig;

def cond13_TS_Sell = Sellsig;

#####################################################

## TRIPLE EXHAUSTION ##

#####################################################

def OB_3x = 80;

def OS_3x = 20;

def KPeriod_3x = 10;

def DPeriod_3x = 10;

def SlowK_3x = reference StochasticFull(OB_3x, OS_3x, KPeriod_3x, DPeriod_3x, EMAD_High, EMAD_Low, EMAD_Close, 3, if (averageType == 1) then AverageType.SIMPLE else AverageType.EXPONENTIAL).FullK;

def MACD_3x = reference MACD()."Value";

def Price_Avg_3x = Average(MACD_3x, length_3x);

def MACD_stdev_3x = (MACD_3x - Price_Avg_3x) / StDev(MACD_3x, length_3x);

def DPlus_3x = reference DMI()."DI+";

def DMinus_3x = reference DMI()."DI-";

def SellerRegular = SlowK_3x < 20 and MACD_stdev_3x < -1 and dPlus_3x < 15;

def SellerExtreme = SlowK_3x < 20 and MACD_stdev_3x < -2 and dPlus_3x < 15;

def BuyerRegular = SlowK_3x > 80 and MACD_stdev_3x > 1 and dMinus_3x < 15;

def BuyerExtreme = SlowK_3x > 80 and MACD_stdev_3x > 2 and dMinus_3x < 15;

def Extreme_Buy = if sellerExtreme[1] and !sellerExtreme then 1 else 0;

def Extreme_Sell = if buyerExtreme[1] and !buyerExtreme then 1 else 0;

def Regular_Sell = if buyerRegular[1] and !buyerRegular then 1 else 0;

def Regular_Buy = if sellerRegular[1] and !sellerRegular then 1 else 0;

#####################################################

## C3 MAX YELLOW CANDLE ##

#####################################################

def Displace = 0;

def FactorK2 = 3.25;

def LengthK2 = 20;

def TrueRangeAverageType = AverageType.SIMPLE;

def ATR_length = 15;

def SMA_lengthS = 6;

def Multiplier_factor = 1.25;

def ValS = Average(price, SMA_lengthS);

def Average_true_range = Average(TrueRange(high, close, low), length = ATR_length);

def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace];

def Middle_BandS = valS[-displace];

def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace];

def shiftK2 = factorK2 * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK2);

def averageK2 = MovingAverage(averageType, price, lengthK2);

def AvgK2 = averageK2[-displace];

def Upper_BandK2 = averageK2[-displace] + shiftK2[-displace];

def Lower_BandK2 = averageK2[-displace] - shiftK2[-displace];

def Condition_BandRevDn = (Upper_BandS > Upper_BandK2);

def Condition_BandRevUp = (Lower_BandS < Lower_BandK2);

def FastLength = 12;

def SlowLength = 26;

def MACDLength = 9;

def FastEMA = ExpAverage(price, fastLength);

def SlowEMA = ExpAverage(price, slowLength);

def Value;

def Avg;

switch (MACD_AverageType) {

case SMA:

Value = Average(price, fastLength) - Average(price, slowLength);

Avg = Average(Value, MACDLength);

case EMA:

Value = fastEMA - slowEMA;

Avg = ExpAverage(Value, MACDLength);

}

def Diff = Value - Avg;

def MACDLevel = 0.0;

def Level = MACDLevel;

def condition1_Yellow_Candle = Value[1] <= Value;

def condition1D_Yellow_Candle = Value[1] > Value;

#####################################################

## RSI ##

#####################################################

def RSI_length = 14;

def RSI_AverageType = AverageType.WILDERS;

def RSI_OB = 70;

def RSI_OS = 30;

def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length);

def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def condition2_RSI = (RSI[3] < RSI) is true or (RSI >= 80) is true;

def condition2D_RSI = (RSI[3] > RSI) is true or (RSI < 20) is true;

def conditionOB1_RSI = RSI > RSI_OB;

def conditionOS1_RSI = RSI < RSI_OS;

#####################################################

## MONEY FLOW INDEX ##

#####################################################

def MFI_Length = 14;

def MFIover_Sold = 20;

def MFIover_Bought = 80;

def movingAvgLength = 1;

def MoneyFlowIndex = Average(MoneyFlow(high, close, low, volume, MFI_Length), movingAvgLength);

def MFIOverBought = MFIover_Bought;

def MFIOverSold = MFIover_Sold;

def condition3_MFI = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true;

def condition3D_MFI = (MoneyFlowIndex[2] > MoneyFlowIndex) is true or (MoneyFlowIndex < 20) is true;

def conditionOB2_MFI = MoneyFlowIndex > MFIover_Bought;

def conditionOS2_MFI = MoneyFlowIndex < MFIover_Sold;

#####################################################

## FORECAST ##

#####################################################

def na = Double.NaN;

def MidLine = 50;

def Momentum = MarketForecast().Momentum;

def NearT = MarketForecast().NearTerm;

def Intermed = MarketForecast().Intermediate;

def FOB = 80;

def FOS = 20;

def upperLine = 110;

def condition4_Forcast = (Intermed[1] <= Intermed) or (NearT >= MidLine);

def condition4D_Forcast = (Intermed[1] > Intermed) or (NearT < MidLine);

def conditionOB3_Forcast = Intermed > FOB;

def conditionOS3_Forcast = Intermed < FOS;

def conditionOB4_Forcast = NearT > FOB;

def conditionOS4_Forcast = NearT < FOS;

#####################################################

## CHANGE IN PRICE ##

#####################################################

def lengthCIP = 5;

def CIP = (price - price[1]);

def AvgCIP = ExpAverage(CIP[-displace], lengthCIP);

def CIP_UP = AvgCIP > AvgCIP[1];

def CIP_DOWN = AvgCIP < AvgCIP[1];

def condition5_CIP = CIP_UP;

def condition5D_CIP = CIP_DOWN;

#####################################################

## EMA 1 ##

#####################################################

def EMA_length = 8;

def AvgExp = ExpAverage(price[-displace], EMA_length);

def condition6_EMA_1 = (price >= AvgExp) and (AvgExp[2] <= AvgExp);

def condition6D_EMA_1 = (price < AvgExp) and (AvgExp[2] > AvgExp);

#####################################################

## EMA 2 ##

#####################################################

def EMA_2length = 20;

def displace2 = 0;

def AvgExp2 = ExpAverage(price[-displace2], EMA_2length);

def condition7_EMA_2 = (price >= AvgExp2) and (AvgExp2[2] <= AvgExp);

def condition7D_EMA_2 = (price < AvgExp2) and (AvgExp2[2] > AvgExp);

#####################################################

## DMI OSCILLATOR ##

#####################################################

def DMI_length = 5; #Typically set to 10

def diPlus = DMI(DMI_length, DMI_averageType)."DI+";

def diMinus = DMI(DMI_length, DMI_averageType)."DI-";

def Osc = diPlus - diMinus;

def Hist = Osc;

def ZeroLine = 0;

def condition8_DMI = Osc >= ZeroLine;

def condition8D_DMI = Osc < ZeroLine;

#####################################################

## TREND PERIODS ##

#####################################################

def TP_fastLength = 3;#Typically 7

def TP_slowLength = 4;#Typically 15

def Periods = Sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength));

def condition9_Trend = Periods > 0;

def condition9D_Trend = Periods < 0;

#####################################################

## POLARIZED FRACTAL EFFICIENCY ##

#####################################################

def PFE_length = 5;#Typically 10

def smoothingLength = 2.5;#Typically 5

def PFE_diff = close - close[PFE_length - 1];

def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / Sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1);

def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength);

def UpperLevel = 50;

def LowerLevel = -50;

def condition10_PFE = PFE > 0;

def condition10D_PFE = PFE < 0;

def conditionOB5_PFE = PFE > UpperLevel;

def conditionOS5_PFE = PFE < LowerLevel;

#####################################################

## BOLLINGER BANDS ##

#####################################################

input AverageType_BB = AverageType.SIMPLE;

def BBPB_length = 20; #Typically 20

def Num_Dev_Dn = -2.0;

def Num_Dev_up = 2.0;

def BBPB_OB = 100;

def BBPB_OS = 0;

def upperBand_BB = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, AverageType_BB).UpperBand;

def lowerBand_BB = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, AverageType_BB).LowerBand;

def PercentB = (price - lowerBand_BB) / (upperBand_BB - lowerBand_BB) * 100;

def HalfLine = 50;

def UnitLine = 100;

def condition11_BB = PercentB > HalfLine;

def condition11D_BB = PercentB < HalfLine;

def conditionOB6_BB = PercentB > BBPB_OB;

def conditionOS6_BB = PercentB < BBPB_OS;

def condition12_BB = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS);

def condition12D_BB = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS);

#####################################################

## KLINGER HISTOGRAM ##

#####################################################

def Klinger_Length = 13;

def KVOsc = KlingerOscillator(Klinger_Length).KVOsc;

def KVOH = KVOsc - Average(KVOsc, Klinger_Length);

def condition13_KH = (KVOH > 0);

def condition13D_KH = (KVOH < 0);

#####################################################

## PROJECTION OSCILLATOR ##

#####################################################

def ProjectionOsc_length = 30;#Typically 10

def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length));

def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length));

def ProjectionOsc_diff = MaxBound - MinBound;

def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0;

def PROSC_OB = 80;

def PROSC_OS = 20;

def condition14_PO = PROSC > 50;

def condition14D_PO = PROSC < 50;

def conditionOB7_PO = PROSC > PROSC_OB;

def conditionOS7_PO = PROSC < PROSC_OS;

#####################################################

## AK TREND ##

#####################################################

def aktrend_input1 = 3;

def aktrend_input2 = 8;

def aktrend_price = close;

def aktrend_fastmaa = MovAvgExponential(aktrend_price, aktrend_input1);

def aktrend_fastmab = MovAvgExponential(aktrend_price, aktrend_input2);

def aktrend_bspread = (aktrend_fastmaa - aktrend_fastmab) * 1.001;

def cond1_UP_AK = if aktrend_bspread > 0 then 1 else 0;

def cond1_DN_AK = if aktrend_bspread <= 0 then -1 else 0;

#####################################################

## ZSCORE ##

#####################################################

def zscore_price = close;

def zscore_length = 20;

def zscore_ZavgLength = 20;

def zscore_oneSD = StDev(zscore_price, zscore_length);

def zscore_avgClose = SimpleMovingAvg(zscore_price, zscore_length);

def zscore_ofoneSD = zscore_oneSD * zscore_price[1];

def zscore_Zscorevalue = ((zscore_price - zscore_avgClose) / zscore_oneSD);

def zscore_avgZv = Average(zscore_Zscorevalue, 20);

def zscore_Zscore = ((zscore_price - zscore_avgClose) / zscore_oneSD);

def zscore_avgZscore = Average(zscore_Zscorevalue, zscore_ZavgLength);

def cond2_UP_ZSCORE = if zscore_Zscore > 0 then 1 else 0;

def cond2_DN_ZSCORE = if zscore_Zscore <= 0 then -1 else 0;

#####################################################

## EMAD EHLERS ##

#####################################################

def Price_Ehlers_EMAD = (EMAD_High + EMAD_Low) / 2;

def Coeff = Ehlers_length * Price_Ehlers_EMAD * Price_Ehlers_EMAD - 2 * Price_Ehlers_EMAD * sum(Price_Ehlers_EMAD, Ehlers_length)[1] + sum(Price_Ehlers_EMAD * Price_Ehlers_EMAD, Ehlers_length)[1];

def Ehlers_EMAD = sum(coeff * Price_Ehlers_EMAD, Ehlers_length) / sum(coeff, Ehlers_length);

#####################################################

## EHLERS ##

#####################################################

def Price_Ehlers = (high + low) / 2;

def Ehlers_Coeff = ehlers_length * Price_Ehlers * Price_Ehlers - 2 * Price_Ehlers * Sum(Price_Ehlers, ehlers_length)[1] + Sum(Price_Ehlers * Price_Ehlers, ehlers_length)[1];

def Ehlers = Sum(ehlers_coeff * Price_Ehlers, ehlers_length) / Sum(ehlers_coeff, ehlers_length);

def Ehlers_Avg_Length = 9;

def Ehlers_Avg = average(Ehlers, Ehlers_Avg_Length);

def cond3_UP_Ehlers = if close > Ehlers_Avg then 1 else 0;

def cond3_DN_Ehlers = if close <= Ehlers_Avg then -1 else 0;

#####################################################

## ANCHORED MOMENTUM ##

#####################################################

def amom_src = close;

def amom_MomentumPeriod = 10;

def amom_SignalPeriod = 8;

def amom_SmoothMomentum = no;

def amom_SmoothingPeriod = 7;

def amom_p = 2 * amom_MomentumPeriod + 1;

def amom_t_amom = if amom_SmoothMomentum == yes then ExpAverage(amom_src, amom_SmoothingPeriod) else amom_src;

def amom_amom = 100 * ( (amom_t_amom / ( Average(amom_src, amom_p)) - 1));

def amom_amoms = Average(amom_amom, amom_SignalPeriod);

def cond4_UP_AM = if amom_amom > 0 then 1 else 0;

def cond4_DN_AM = if amom_amom <= 0 then -1 else 0;

#####################################################

## TMO ##

#####################################################

def tmo_length = 30; #def 14

def tmo_calcLength = 6; #def 5

def tmo_smoothLength = 6; #def 3

def tmo_data = fold i = 0 to tmo_length with s do s + (if close > GetValue(open, i) then 1 else if close < GetValue(open, i) then - 1 else 0);

def tmo_EMA5 = ExpAverage(tmo_data, tmo_calcLength);

def tmo_Main = ExpAverage(tmo_EMA5, tmo_smoothLength);

def tmo_Signal = ExpAverage(tmo_Main, tmo_smoothLength);

def tmo_color = if tmo_Main > tmo_Signal then 1 else -1;

def cond5_UP_TMO = if tmo_Main <= 0 then 1 else 0;

def cond5_DN_TMO = if tmo_Main >= 0 then -1 else 0;

#####################################################

## MADE AVERAGE (EMAD) ##

#####################################################

def dataA = Master_EMAD_EMA;

def dataA1 =

fold aD = 0

to Length_MAD

with k = 0

do k + dataA[aD];

def MAEMAD = dataA1 / LengtH_MAD;

def MADehlers = (MAEMAD - Ehlers_EMAD)/2;

def Madebad = madehlers + Ehlers_EMAD;

def Madebad_Avg = average(madebad, Made_Avg_Length);

def Madebad_CrossUp = if (madebad < Master_EMAD_EMA) and (madebad > madebad[1]) and (EMAD_Above_Zero > 0) then 1 else 0;

def Madebad_CrossDown = if (madebad > Master_EMAD_EMA) and (madebad < madebad[1]) and (EMAD_Below_Zero > 0) then 1 else 0;

def Madebad_CrossCondition = if (madebad < Master_EMAD_EMA) and (madebad > madebad[1]) and (EMAD_Above_Zero > 0) then 1

else if (madebad > Master_EMAD_EMA) and (madebad < madebad[1]) and (EMAD_Below_Zero > 0) then -1

else 0;

def Madebad_Condition = if (!Madebad_CrossCondition[1] or !Madebad_CrossCondition[2]) and (Madebad_CrossCondition == 0) then 1 else 0;

#####################################################

## ALERT4 ##

#####################################################

def PD = 22;

def BBL = 20;

def MULT = 2.0;

def LB = 50;

def PH = 0.85;

def LTLB = 40;

def MTLB = 14;

def STR = 3;

def WVF = ((Highest(close, pd) - low) / (Highest(close, pd))) * 100;

def StDev = mult * StDev(wvf, bbl);

def MidLine1 = SimpleMovingAvg(wvf, bbl);

def UpperBand1_Alert4 = midLine1 + StDev;

def Range_High = (Highest(wvf, lb)) * ph;

def UpRange = low > low[1] and close > high[1];

def UpRange_Aggr = close > close[1] and close > open[1];

def Filtered = ((wvf[1] >= UpperBand1_Alert4[1] or wvf[1] >= Range_High[1]) and (wvf < UpperBand1_Alert4 and wvf < Range_High));

def Filtered_Aggr = (wvf[1] >= UpperBand1_Alert4[1] or wvf[1] >= Range_High[1]);

def Alert4 = upRange_Aggr and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered_Aggr;

def Alert4close = if alert4 then close else 0;

def Made_Down = (madebad > Master_EMAD_EMA);

def Made_Up = (madebad < Master_EMAD_EMA);

def Made_Bottom_MA = if !Made_Down and (Madebad_Avg <= zerolinedata) then Madebad_Avg else double.nan;

def Made_Top_MA = if !Made_Up and (Madebad_Avg >= zerolinedata) then Madebad_Avg else double.nan;

def MadeAvg_Master_Cross_Up = if Madebad_Avg crosses below Master_EMAD_EMA then 1 else 0;

def MadeAvg_Master_Cross_Down = if Madebad_Avg crosses above Master_EMAD_EMA then 1 else 0;

def Cross_Up_MadeAvg_Master = if MadeAvg_Master_Cross_Up and !MadeAvg_Master_Cross_Up[1] then 1 else 0;

def Cross_Down_MadeAvg_Master = if MadeAvg_Master_Cross_Down and !MadeAvg_Master_Cross_Down[1] then 1 else 0;

def MadeAvg_Master_Up_Condition = if Cross_Up_MadeAvg_Master and Band_Crossed_First and EMAD_EMA_Up[1] then 1 else 0;

def MadeAvg_Master_Down_Condition = if Cross_Down_MadeAvg_Master and !Band_Crossed_First and EMAD_EMA_down[1] then 1 else 0;

def EMA_Push_StepUp = if topBand_StepUp and EMAD_EMA_Up and (((Upper_EMAD_EMA) - topband) == 0) then 1 else 0;;

def EMA_Push_StepDown = if bottomBand_StepDown and EMAD_EMA_down and (((Lower_EMAD_EMA) - bottomband) == 0) then 1 else 0;

def First_HL_1 = if Marketopen and Show_HL_LH and trackCrUp and !trackCrUp[1] then low else double.nan;

def First_LH_1 = if Marketopen and Show_HL_LH and trackCrDn and !trackCrDn[1] then high else double.nan;

def Second_HL_1 = if Marketopen and Show_HL_LH and trackCrUp2 and !trackCrUp2[1] and !CrossUp_Bottomband then low else double.nan;

def Second_LH_1 = if Marketopen and Show_HL_LH and trackCrDn2 and !trackCrDn2[1] and !CrossDown_Topband then high else double.nan;

#####################################################

## FOLD CONDITIONS (EMAD) ##

#####################################################

def TopBandStepDown_lookback = fold index1 = 1 to Step_lookback with x1 do x1 + topBand_StepDown[index1];

def TopBandStepUp_lookback = fold index2 = 1 to Step_lookback with x2 do x2 + topBand_StepUp[index2];

def BottomBandStepDown_lookback = fold index3 = 1 to Step_lookback with x3 do x3 + bottomBand_StepDown[index3];

def BottomBandStepUp_lookback = fold index4 = 1 to Step_lookback with x4 do x4 + bottomBand_StepUp[index4];

def Madebad_Condition_lookback = fold index5 = 1 to Cloud_lookback with x5 do x5 + Madebad_Condition[index5];

def HL_lookback = fold index6 = 1 to HL_LH_Lookback with x6 do x6 + First_HL_1[index6];

def LH_lookback = fold index7 = 1 to HL_LH_Lookback with x7 do x7 + First_LH_1[index7];

def HL2_lookback = fold index8 = 1 to HL_LH_Lookback with x8 do x8 + Second_HL_1[index8];

def LH2_lookback = fold index9 = 1 to HL_LH_Lookback with x9 do x9 + Second_LH_1[index9];

#####################################################

## HIDE ARROW CONDITIONS ##

#####################################################

def Hide_Arrow_TopBand_StepDown = topBandStepDown_lookback > Previous_Steps_Down;

def Hide_Arrow_TopBand_StepUp = topBandStepup_lookback > Previous_Steps_Up;

def Hide_Arrow_BottomBand_StepDown = bottomBandStepDown_lookback > Previous_Steps_Down;

def Hide_Arrow_BottomBand_StepUp = bottomBandStepup_lookback > Previous_Steps_Up;

def UP1 = if marketopen and Show_EMAD_Arrows and (!Hide_Arrow_TopBand_StepDown or !Hide_Arrow_BottomBand_StepDown) and !EMA_Push_StepDown and MadeAvg_Master_Up_Condition then 1 else 0;

def DOWN1 = if marketopen and Show_EMAD_Arrows and (!Hide_Arrow_TopBand_StepUp or !Hide_Arrow_BottomBand_StepUp) and !EMA_Push_StepUp and MadeAvg_Master_Down_Condition then 1 else 0;

def UP1_1 = if UP1 then lowest(low,2) else double.nan;

def DOWN1_1 = if DOWN1 then highest(high,2) else double.nan;

#####################################################

## MARKET PHASES ##

#####################################################

def Fastavg_Phases = 50;

def Slowavg_Phases = 200;

def Fastsma_Phases = Average( close, Fastavg_Phases);

def Slowsma_Phases = Average(close, Slowavg_Phases);

def Bullphase = fastsma_Phases > slowsma_Phases && close > fastsma_Phases && close > slowsma_Phases; # Accumulation Phase : close > 50 SMA, close > 200 SMA, 50 SMA < 200 SMA

def Accphase = fastsma_Phases < slowsma_Phases && close > fastsma_Phases && close > slowsma_Phases;# Recovery Phase : close > 50 SMA, close < 200 SMA, 50 SMA < 200 SMA

def Recphase = fastsma_Phases < slowsma_Phases && close < slowsma_Phases && close > fastsma_Phases;# Bearish Phase : close < 50 SMA, close < 200 SMA, 50 SMA < 200 SMA

def Bearphase = fastsma_Phases < slowsma_Phases && close < fastsma_Phases && close < slowsma_Phases;# Distribution Phase : close < 50 SMA, close < 200 SMA, 50 SMA > 200 SMA

def Distphase = fastsma_Phases > slowsma_Phases && close < fastsma_Phases && close < slowsma_Phases;# Warning Phase : close < 50 SMA, close > 200 SMA, 50 SMA > 200 SMA

def Warnphase = fastsma_Phases> slowsma_Phases && close > slowsma_Phases && close < fastsma_Phases;

#####################################################

## BIG 4 DIRECTION ##

#####################################################

def Strategy_FilterWithTMO = no;

def Strategy_FilterWithTMO_arrows = yes;

def Strategy_HoldTrend = no;

def Strategy_ColoredCandlesOn = yes;

def coloredCandlesOn = yes;

def cond_UP = cond1_UP_AK + cond2_UP_ZSCORE + cond3_UP_Ehlers + cond4_UP_AM;

def cond_DN = cond1_DN_AK + cond2_DN_ZSCORE + cond3_DN_Ehlers + cond4_DN_AM;

def direction = if cond_UP >= Big4_Confirmation_Factor and (!Strategy_FilterWithTMO or cond5_UP_TMO) then 1

else if cond_DN <= - Big4_Confirmation_Factor and (!Strategy_FilterWithTMO or cond5_DN_TMO) then -1

else if !Strategy_HoldTrend and direction[1] == 1 and cond_UP < Big4_Confirmation_Factor and cond_DN > - Big4_Confirmation_Factor then 0

else if !Strategy_HoldTrend and direction[1] == -1 and cond_DN > -Big4_Confirmation_Factor and cond_UP < Big4_Confirmation_Factor then 0

else direction[1];

def direction2 = if cond_UP >= Big4_Confirmation_Factor and (!Strategy_FilterWithTMO_arrows or cond5_UP_TMO) then 1

else if cond_DN <= - Big4_Confirmation_Factor and (!Strategy_FilterWithTMO_arrows or cond5_DN_TMO) then -1

else if !Strategy_HoldTrend and direction2[1] == 1 and cond_UP < Big4_Confirmation_Factor and cond_DN > - Big4_Confirmation_Factor then 0

else if !Strategy_HoldTrend and direction2[1] == -1 and cond_DN > - Big4_Confirmation_Factor and cond_UP < Big4_Confirmation_Factor then 0

else direction2[1];

def direction_Equals_zero = direction == 0;

#####################################################

## TREND CONFIRMATION CALCULATOR ##

#####################################################

def Confirmation_Factor = 7;

def Agreement_LevelOB = 12;

def Agreement_LevelOS = 2;

def HideBoxLines = no;

def HideCloud = no;

def HideLabels = no;

def factorK = 2.0;

def lengthK = 20;

def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK);

def averageK = MovingAverage(averageType, price, lengthK);

def AvgK = averageK[-displace];

def Upper_BandK = averageK[-displace] + shift[-displace];

def Lower_BandK = averageK[-displace] - shift[-displace];

def conditionK1UP = price >= Upper_BandK;

def conditionK2UP = (Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK);

def conditionK3DN = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK);

def conditionK4DN = price < Lower_BandK;

#######################################################

## AGREEMENT LEVEL ##

#######################################################

def Agreement_Level = condition1_Yellow_Candle + condition2_RSI + condition3_MFI + condition4_Forcast

+ condition5_CIP + condition6_EMA_1 + condition7_EMA_2 + condition8_DMI + condition9_Trend

+ condition10_PFE + condition11_BB + condition12_BB + condition13_KH + condition14_PO

+ conditionK1UP + conditionK2UP;

def Agreement_LevelD = (condition1D_Yellow_Candle + condition2D_RSI + condition3D_MFI + condition4D_Forcast + condition5D_CIP

+ condition6D_EMA_1 + condition7D_EMA_2 + condition8D_DMI + condition9D_Trend + condition10D_PFE

+ condition11D_BB + condition12D_BB + condition13D_KH + condition14D_PO + conditionK3DN

+ conditionK4DN);

#######################################################

## CONSENSUS LEVEL ##

#######################################################

def Consensus_Level = Agreement_Level - Agreement_LevelD;

def Consensus_UP = 6;

def Consensus_DOWN = -6;

def UP_CL = Consensus_Level >= Consensus_UP;

def DOWN_CL = Consensus_Level < Consensus_DOWN;

def priceColor = if UP_CL then 1 else if DOWN_CL then -1 else priceColor[1];

def Consensus_Level_OB = 14;

def Consensus_Level_OS = -12;

def OB_Level = conditionOB1_RSI + conditionOB2_MFI + conditionOB3_Forcast + conditionOB4_Forcast + conditionOB5_PFE + conditionOB6_BB + conditionOB7_PO;

def OS_Level = conditionOS1_RSI + conditionOS2_MFI + conditionOS3_Forcast + conditionOS4_Forcast + conditionOS5_PFE + conditionOS6_BB + conditionOS7_PO;

def Consensus_Line = OB_Level - OS_Level;

def MomentumUP = Consensus_Level[1] < Consensus_Level;

def MomentumDOWN = Consensus_Level[1] > Consensus_Level;

def conditionOB_CL = (Consensus_Level >= 12) and (Consensus_Line >= 4);

def conditionOS_CL = (Consensus_Level <= -12) and (Consensus_Line <= -3);

def Super_OB = 4;

def Super_OS = -4;

def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Consensus_Line > Super_OB) and (Consensus_Level > Consensus_Level_OB);

def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Consensus_Line < Super_OS) and (Consensus_Level < Consensus_Level_OS);

def YHOB = if ((open > Upper_BandS) and (condition_BandRevDn)) then high else Double.NaN;

def YHOS = if ((open < Lower_BandS) and (condition_BandRevUp)) then high else Double.NaN;

def YLOB = if ((open > Upper_BandS) and (condition_BandRevDn)) then low else Double.NaN;

def YLOS = if ((open < Lower_BandS) and (condition_BandRevUp)) then low else Double.NaN;

def YCOB = if !IsNaN(YHOB) then hl2 else Double.NaN;

def YHextOB = if IsNaN(YCOB) then YHextOB[1] else YCOB;

def YHextlineOB = YHextOB;

def YCOS = if !IsNaN(YHOS) then hl2 else Double.NaN;

def YHextOS = if IsNaN(YCOS) then YHextOS[1] else YCOS;

def YHextlineOS = YHextOS;

def BarsUsedForRange = 2;

def BarsRequiredToRemainInRange = 2;

def trig = 20;# for Blast-off candle color

def YC = coloredCandlesOn and priceColor == 1 and open > Upper_BandS and condition_BandRevDn;

def HH = Highest(high[1], BarsUsedForRange);

def LL = Lowest(low[1], BarsUsedForRange);

def maxH = Highest(HH, BarsRequiredToRemainInRange);

def maxL = Lowest(LL, BarsRequiredToRemainInRange);

def HHn = if maxH == maxH[1] or maxL == maxL then maxH else HHn[1];

def LLn = if maxH == maxH[1] or maxL == maxL then maxL else LLn[1];

def Bh = if high <= HHn and HHn == HHn[1] then HHn else Double.NaN;

def Bl = if low >= LLn and LLn == LLn[1] then LLn else Double.NaN;

def CountH = if IsNaN(Bh) or IsNaN(Bl) then 2 else CountH[1] + 1;

def CountL = if IsNaN(Bh) or IsNaN(Bl) then 2 else CountL[1] + 1;

def ExpH = if BarNumber() == 1 then Double.NaN else

if CountH[-BarsRequiredToRemainInRange] >= BarsRequiredToRemainInRange then HHn[-BarsRequiredToRemainInRange] else

if high <= ExpH[1] then ExpH[1] else Double.NaN;

def ExpL = if BarNumber() == 1 then Double.NaN else

if CountL[-BarsRequiredToRemainInRange] >= BarsRequiredToRemainInRange then LLn[-BarsRequiredToRemainInRange] else

if low >= ExpL[1] then ExpL[1] else Double.NaN;

def BoxHigh = if ((DOWN_OB) or (Upper_BandS crosses above Upper_BandK2) or (condition_BandRevDn) and (high > high[1]) and ((price > Upper_BandK2) or (price > Upper_BandS))) then Highest(ExpH) else Double.NaN;

def BoxLow = if (DOWN_OB) or ((Upper_BandS crosses above Upper_BandK2)) then Lowest(low) else Double.NaN;

def BoxHigh2 = if ((UP_OS) or ((Lower_BandS crosses below Lower_BandK2))) then Highest(ExpH) else Double.NaN;

def BH2 = if !IsNaN(BoxHigh2) then high else Double.NaN;

def BH2ext = if IsNaN(BH2) then BH2ext[1] else BH2;

def BH2extline = BH2ext;

def H_BH2extline2 = Lowest(BH2extline, 1);

def BoxLow2 = if ((UP_OS) or (Lower_BandS crosses below Lower_BandK2) or (condition_BandRevUp) and (low < low[1]) and ((price < Lower_BandK2) or (price < Lower_BandS))) or ((UP_OS[1]) and (low < low[1])) then Lowest(low) else Double.NaN;

def BH1 = if !IsNaN(BoxHigh) then high else Double.NaN;

def BH1ext = if IsNaN(BH1) then BH1ext[1] else BH1;

def BH1extline = BH1ext;

def BL1 = if !IsNaN(BoxLow) then low else Double.NaN;

def BL1ext = if IsNaN(BL1) then BL1ext[1] else BL1;

def BL1extline2 = BL1ext;

def BL2 = if !IsNaN(BoxLow2) then low else Double.NaN;

def BL2ext = if IsNaN(BL2) then BL2ext[1] else BL2;

def BL2extline2 = BL2ext;

#####################################################

## KEY LEVELS ##

#####################################################

def KeylevelOB = if ((BH1ext >= YHextlineOB) and (BL1ext <= YHextlineOB)) then 1 else 0;

def KeylevelOS = if ((BH2ext >= YHextlineOS) and (BL2ext <= YHextlineOS)) then 1 else 0;

def keyobpaint = (hl2 < BH1ext) and (hl2 > BL1ext);

def keyospaint = (hl2 < BH2ext) and (hl2 > BL2ext);

def Keylevel2OB = (round(absvalue(close - yhextlineOB),1));

def Keylevel2OS = (round(absvalue(close - yhextlineOS),1));

def control = 13;

def Keylevel2cond = if KeylevelOS and (Keylevel2OS < Keylevel2OB) and (Keylevel2OS < control) then 1 else if KeylevelOB and (Keylevel2OB < Keylevel2OS) and (Keylevel2OB < control) then -1 else 0;

#####################################################

## TESTING ##

#####################################################

#def OB_Cross_Below = if price crosses Below YHextlineOB then 1 else 0;

#def OS_Cross_Above = if price crosses Above YHextlineOS then 1 else 0;

#def Key_Cross_down = if marketopen and keylevelOB and OB_Cross_Below then 1 else 0;

#def Key_Cross_up = if marketopen and keylevelOS and OS_Cross_Above then 1 else 0;

#####################################################

## ##

#####################################################

#plot Key_UP = if Key_Cross_Up then low else double.nan;

#Key_UP.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

#Key_UP.SetDefaultColor(Color.yellow);

#Key_UP.HideBubble();

#Key_UP.HideTitle();

#####################################################

## ##

#####################################################

#plot Key_down = if Key_Cross_Down then high else double.nan;;

#Key_down.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

#Key_down.SetDefaultColor(Color.yellow);

#Key_down.HideBubble();

#Key_down.HideTitle();

#####################################################

## SPARK ##

#####################################################

def Agperiod1 = GetAggregationPeriod();

def timeframe = if agperiod1 <= aggregationperiod.DAY then aggregationperiod.DAY else agperiod1;

def Length9 = 35;

def Length8 = 10;

def AvgExp8 = ExpAverage(price[-displace], length8);

def UPD = AvgExp8[1] < AvgExp8;

def AvgExp9 = ExpAverage(price[-displace], length9);

def UPW = AvgExp9[1] < AvgExp9;

def Below = AvgExp8 < AvgExp9;

def Spark = UPD + UPW + Below;

def UPEMA = AvgExp8[1] < AvgExp8;

def DOWNEMA = AvgExp8[1] > AvgExp8;

def BigUP = direction == 1;

def BigDN = direction == -1;

def BigNa = direction == 0;

def UPEMA2 = AvgExp9[1] < AvgExp9;

def DOWNEMA2 = AvgExp9[1] > AvgExp9;

def UP8 = UPEMA and UPEMA2;

def DOWN8 = DOWNEMA and DOWNEMA2;

def PriceColor8 = if UP8 then 1 else if DOWN8 then -1 else 0;

def UP11 = UPEMA;

def DOWN11 = DOWNEMA;

def PriceColor11 = if UP11 then 1 else if DOWN11 then -1 else 0;

def UP12 = UPEMA2;

def DOWN12 = DOWNEMA2;

def PriceColor12 = if UP12 then 1 else if DOWN12 then -1 else 0;

def CandleColor = if (priceColor == 1) and (priceColor12 == 1) and (Spark >= 2) then 1 else if (priceColor == -1) and (Spark < 1) then -1 else 0;

def SparkUP1 = (Spark == 3) and (CandleColor == 1);

def SparkDN1 = (Spark == 0) and (CandleColor == -1);

def Hide_SparkUP = if SparkUP1 and (SparkUP1[1] or SparkUP1[2] or SparkUP1[3] or SparkUP1[4] or SparkUP1[5]) or (bigdn) then 0 else 1;

def Hide_SparkDN = if SparkDN1 and (SparkDN1[1] or SparkDN1[2] or SparkDN1[3] or SparkDN1[4] or SparkDN1[5]) or (bigup) then 0 else 1;

def Vol = volume(period = timeframe);

def at_High = high(period = timeframe);

def at_Open = open(period = timeframe);

def at_Close = close(period = timeframe);

def at_Low = low(period = timeframe);

def Buy_Volume = RoundUp(Vol * (at_Close - at_Low) / (at_High - at_Low));

def Buy_percent = RoundUp((Buy_Volume / Vol) * 100);

def Sell_Volume = RoundDown(Vol * (at_High - at_Close) / (at_High - at_Low));

def Sell_percent = RoundUp((Sell_Volume / Vol) * 100);

def avg1 = ExpAverage(close(period = agperiod1), length8);

def height = avg1 - avg1[length8];

def avg2 = ExpAverage(close(period = agperiod1), length8);

def Condition1UP = avg1 > avg2;

def Condition1DN = avg1 < avg2;

def Condition2UP = Buy_percent > 50;

def Condition2DN = Buy_percent < 50;

def Condition3UP = if buyerRegular then 1 else 0;

def Condition3DN = if sellerRegular then 1 else 0;

def Condition4UP = if buyerExtreme then 1 else 0;

def Condition4DN = if sellerExtreme then 1 else 0;

#####################################################

## FILTER ##

#####################################################

def Big4_up_1;

def Big4_dn_1;

def TS_UP_1;

def TS_DN_1;

def SparkUP_1;

def SparkDN_1;

switch (Filter) {

case EMAD_Filter:

Big4_up_1 = marketopen and EMAD_Above_Zero and (direction2 == 1 and direction2[1] < 1);

Big4_dn_1 = marketopen and EMAD_Below_Zero and (direction2 == -1 and direction2[1] > -1);

TS_UP_1 = if EMAD_Above_Zero and (upsignal and !direction_Equals_zero) then 1 else 0;

TS_DN_1 = if EMAD_Below_Zero and (downsignal and !direction_Equals_zero) then 1 else 0;

SparkUP_1 = marketopen and EMAD_Above_Zero and (SparkUP1 and hide_SparkUP);

SparkDN_1 = marketopen and EMAD_Above_Zero and (SparkDN1 and hide_SparkDN);

case Phase_Filter:

Big4_up_1 = marketopen and bullphase and (direction2 == 1 and direction2[1] < 1);

Big4_dn_1 = marketopen and bearphase and (direction2 == -1 and direction2[1] > -1);

TS_UP_1 = if (upsignal and bullphase and !direction_Equals_zero) then 1 else 0;

TS_DN_1 = if (downsignal and bearphase and !direction_Equals_zero) then 1 else 0;

SparkUP_1 = marketopen and bullphase and (SparkUP1 and hide_SparkUP);

SparkDN_1 = marketopen and bearphase and (SparkDN1 and hide_SparkDN);

case No_Filter:

Big4_up_1 = marketopen and (direction2 == 1 and direction2[1] < 1);

Big4_dn_1 = marketopen and (direction2 == -1 and direction2[1] > -1);

TS_UP_1 = if (upsignal and !direction_Equals_zero) then 1 else 0;

TS_DN_1 = if (downsignal and !direction_Equals_zero) then 1 else 0;

SparkUP_1 = marketopen and (SparkUP1 and hide_SparkUP);

SparkDN_1 = marketopen and (SparkDN1 and hide_SparkDN);}

#####################################################

## DIRECTION ##

#####################################################

def Big4_up_bn = if Big4_up_1 then bn else Big4_up_bn[1];

def Big4_dn_bn = if Big4_dn_1 then bn else Big4_dn_bn[1];

def TS_Up_bn = if TS_Up_1 then bn else TS_Up_bn[1];

def TS_Dn_bn = if TS_Dn_1 then bn else TS_Dn_bn[1];

def SparkUp_bn = if SparkUP_1 then bn else SparkUP_bn[1];

def SparkDn_bn = if SparkDN_1 then bn else SparkDN_bn[1];

def last_up_bn = if Big4_up_1 or TS_Up_1 or SparkUP_1 then bn else last_up_bn[1];

def last_dn_bn = if Big4_dn_1 or TS_dn_1 or SparkDN_1 then bn else last_dn_bn[1];

def Last_Arrow_Up = if last_up_bn > last_dn_bn then 1 else 0;

def Last_Arrow_Down = if last_dn_bn > last_up_bn then 1 else 0;

#####################################################

## CANDLE COLOR ##

#####################################################

AssignPriceColor(if Color_Candles then

if ALERT4 THEN COLOR.green

else if buyerRegular or buyerExtreme then Color.green

else if buyerRegular[1] or buyerExtreme[1] then Color.red

else if direction == 1 then Color.light_green

else if sellerRegular or sellerExtreme then Color.dark_red

else if sellerRegular[1] or sellerExtreme[1] then Color.green

else if direction == -1 then color.red

else if direction == 0 then Color.gray

else Color.GRAY

else Color.CURRENT);

#####################################################

## LINE PLOTS ##

#####################################################

plot Squeeze_Alert = Squeeze_Level;

plot YCOB_PLOT = if !IsNaN(YHOB) then hl2 else Double.NaN;

plot YHextlineOB_PLOT = YHextlineOB;

plot YCOS_PLOT = if !IsNaN(YHOS) then hl2 else Double.NaN;

plot YHextlineOS_PLOT = YHextlineOS;

plot H_BH2extline = Lowest(BH2extline, 1);

plot BL1extline = BL1ext;

plot BL2extline = BL2ext;

plot H_BH1extline = Highest(BH1extline, 1);

plot L_BL1extline = Highest(BL1extline, 1);

plot L_BL2extline = Lowest(BL2extline, 1);

plot Ehlers_1 = Ehlers_Avg;

#####################################################

## ARROW PLOTS ##

#####################################################

plot UP = UP1_1;

plot DOWN = DOWN1_1;

plot First_HL = First_HL_1;

plot First_LH = First_LH_1;

plot Second_HL = Second_HL_1;

plot Second_LH = Second_LH_1;

plot TS_UP = TS_UP_1;

plot TS_DN = TS_DN_1;

plot SparkUP = SparkUP_1;

plot SparkDN = SparkDN_1;

plot Big4_up = Big4_up_1;

plot Big4_dn = Big4_dn_1;

#####################################################

## ##

#####################################################

Ehlers_1.SetStyle(Curve.SHORT_DASH);

Ehlers_1.SetLineWeight(1);

Ehlers_1.AssignValueColor(color.gray);

#####################################################

## ##

#####################################################

Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.POINTS);

Squeeze_Alert.SetLineWeight(3);

Squeeze_Alert.AssignValueColor(if(direction2 == 1) then color.yellow

else if direction2 == -1 then color.yellow

else if direction2 == 0 then color.light_Gray

else color.yellow);

#####################################################

## ##

#####################################################

YCOB_PLOT.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YCOB_PLOT.SetDefaultColor(Color.GREEN);

YCOB_PLOT.SetLineWeight(1);

YCOB_PLOT.HideTitle();

#####################################################

## ##

#####################################################

YHextlineOB_PLOT.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YHextlineOB_PLOT.SetDefaultColor(Color.ORANGE);

YHextlineOB_PLOT.SetLineWeight(2);

YHextlineOB_PLOT.HideTitle();

#####################################################

## ##

#####################################################

YCOS_PLOT.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YCOS_PLOT.SetDefaultColor(Color.GREEN);

YCOS_PLOT.SetLineWeight(1);

YCOS_PLOT.HideTitle();

#####################################################

## ##

#####################################################

YHextlineOS_PLOT.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

YHextlineOS_PLOT.SetDefaultColor(Color.LIGHT_GREEN);

YHextlineOS_PLOT.SetLineWeight(2);

YHextlineOS_PLOT.HideTitle();

#####################################################

## ##

#####################################################

H_BH2extline.SetDefaultColor(Color.dark_GREEN);

H_BH2extline.SetLineWeight(1);

H_BH2extline.HideBubble();

H_BH2extline.HideTitle();

#####################################################

## ##

#####################################################

BL1extline.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

BL1extline.SetDefaultColor(Color.dark_RED);

BL1extline.SetLineWeight(1);

BL1extline.HideTitle();

#####################################################

## ##

#####################################################

BL2extline.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

BL2extline.SetDefaultColor(Color.dark_GREEN);

BL2extline.SetLineWeight(1);

BL2extline.HideTitle();

#####################################################

## ##

#####################################################

H_BH1extline.SetDefaultColor(Color.dark_RED);

H_BH1extline.SetLineWeight(1);

H_BH1extline.HideBubble();

H_BH1extline.HideTitle();

#####################################################

## ##

#####################################################

L_BL1extline.SetDefaultColor(Color.dark_RED);

L_BL1extline.SetLineWeight(1);

L_BL1extline.HideBubble();

L_BL1extline.HideTitle();

#####################################################

## ##

#####################################################

L_BL2extline.SetDefaultColor(Color.dark_GREEN);

L_BL2extline.SetLineWeight(1);

L_BL2extline.HideBubble();

L_BL2extline.HideTitle();

#####################################################

## ##

#####################################################

UP.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

UP.assignvaluecolor(if alert4 then color.CYAN else Color.white);

UP.HideBubble();

UP.HideTitle();

#####################################################

## ##

#####################################################

DOWN.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

DOWN.SetDefaultColor(Color.white);

DOWN.HideBubble();

DOWN.HideTitle();

#####################################################

## ##

#####################################################

First_HL.SetPaintingStrategy(PaintingStrategy.ARROW_Up);

First_HL.SetDefaultColor(Color.magenta);

First_HL.HideBubble();

First_HL.HideTitle();

#####################################################

## ##

#####################################################

First_LH.SetPaintingStrategy(PaintingStrategy.ARROW_down);

First_LH.SetDefaultColor(Color.magenta);

First_LH.HideBubble();

First_LH.HideTitle();

#####################################################

## ##

#####################################################

Second_HL.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

Second_HL.SetDefaultColor(Color.orange);

Second_HL.HideBubble();

Second_HL.HideTitle();

#####################################################

## ##

#####################################################

Second_LH.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

Second_LH.SetDefaultColor(Color.orange);

Second_LH.HideBubble();

Second_LH.HideTitle();

#####################################################

## ##

#####################################################

Big4_up.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

Big4_up.AssignValueColor(if(direction2 == 1 and direction2[1] < 1)then color.blue else color.gray);

Big4_up.HideBubble();

Big4_up.HideTitle();

#####################################################

## ##

#####################################################

Big4_dn.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

Big4_dn.AssignValueColor(if(direction2 == -1 and direction2[1] > -1) then color.blue else color.gray);

Big4_dn.HideBubble();

Big4_dn.HideTitle();

#####################################################

## ##

#####################################################

TS_UP.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

TS_UP.AssignValueColor(color.cyan);

TS_UP.HideBubble();

TS_UP.HideTitle();

#####################################################

## ##

#####################################################

TS_DN.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

TS_DN.AssignValueColor(color.cyan);

TS_DN.HideBubble();

TS_DN.HideTitle();

#####################################################

## ##

#####################################################

SparkUP.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

SparkUP.AssignValueColor(Color.green);

SparkUP.HideBubble();

SparkUP.HideTitle();

#####################################################

## ##

#####################################################

SparkDN.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

SparkDN.AssignValueColor(Color.Light_red);

SparkDN.HideBubble();

SparkDN.HideTitle();

#####################################################

## ##

#####################################################

AddCloud(if !HideCloud then BH1extline else Double.NaN, BL1extline, Color.DARK_RED, Color.GRAY);

AddCloud(if !HideCloud then BH2extline else Double.NaN, BL2extline, Color.DARK_GREEN, Color.GRAY);

#####################################################

## ##

#####################################################

#AddCloud(if (EMAD_Green_Cloud_1 or EMAD_Green_Cloud_2) then H_BH1extline else double.nan, L_BL2extline, color.dark_green, color.dark_green);

AddCloud(if (EMAD_Gray_Cloud_1 or EMAD_Gray_Cloud_2) then H_BH1extline else double.nan, L_BL2extline, color.dark_gray, color.dark_gray);

#AddCloud(if (EMAD_Red_Cloud_1 or EMAD_Red_Cloud_2) then H_BH1extline else double.nan, L_BL2extline, color.dark_red, color.dark_red);

#####################################################

## lABELS ##

#####################################################

def Buy = UP_OS;

def Sell = DOWN_OB;

def conditionLTB = (conditionK2UP and (Consensus_Level < 0));

def conditionLTS = (conditionK3DN and (Consensus_Level > 0));

def conditionBO = ((Upper_BandS[1] < Upper_BandS))

and ((Lower_BandS[1] < Lower_BandS))

and ((Upper_BandK[1] < Upper_BandK))

and ((Lower_BandK[1] < Lower_BandK));

def conditionBD = ((Upper_BandS[1] > Upper_BandS))

and ((Lower_BandS[1] > Lower_BandS))

and ((Upper_BandK[1] > Upper_BandK))

and ((Lower_BandK[1] > Lower_BandK));

AddLabel(yes, if conditionLTB then "LOOK TO BUY"

else if conditionLTS then "LOOK TO SELL"

else if conditionK2UP then "TREND: BULL"

else if conditionK3DN then "TREND: BEAR" else "TREND: CONSOLIDATION",

if conditionLTB then Color.YELLOW

else if conditionLTS then Color.YELLOW

else if conditionK2UP then Color.LIGHT_GREEN

else if conditionK3DN then Color.RED else Color.GRAY);

AddLabel(yes, if conditionBD then "BREAKDOWN"

else if conditionBO then "BREAKOUT" else "NO BREAK",

if conditionBD then Color.RED

else if conditionBO then Color.GREEN else Color.GRAY);

AddLabel(show_Labels, if (Spark == 3) then "SPARK: " + Round(Spark, 1)

else if (Spark == 0) then "SPARK: " + Round(Spark, 1) else "SPARK: " + Round(Spark, 1),

if (Spark == 3) then Color.orange

else if (Spark == 2) then Color.light_GREEN

else if (Spark == 0) then Color.RED else Color.GRAY);

AddLabel(show_labels, if Condition1UP==1 and Condition2UP == 1 and (Condition3UP == 1 or Condition4UP == 1) then "**CALLS ONLY!**"

else if Condition1UP == 1 and Condition2UP == 1 then "VERY BULLISH"

else if direction == 1 then "BULLISH"

else if Condition1DN == 1 and Condition2DN == 1 and (Condition3DN == 1 or Condition4DN == 1) then "**PUTS ONLY!**"

else if Condition1DN == 1 and Condition2DN == 1 then "VERY BEARISH"

else if direction == -1 then "BEARISH"

else if ((avg[1] > avg) and (avg > avg2) and (Buy_percent > 50)) then "BULLISH RETRACEMENT"

else if ((avg[1] < avg) and (avg < avg2) and (Buy_percent < 50)) then "BEARISH RETRACEMENT" else "CHOP",

if Condition1UP == 1 and Condition2UP == 1 and (Condition3UP == 1 or Condition4UP == 1) then Color.cyan

else if Condition1DN == 1 and Condition2DN == 1 and (Condition3DN == 1 or Condition4DN == 1) then Color.Magenta

else if Condition1UP == 1 and Condition2UP == 1 then Color.light_GREEN

else if direction == 1 then Color.light_green

else if Condition1DN == 1 and Condition2DN == 1 then Color.RED

else if direction == -1 then Color.red

else Color.orange);

AddLabel(yes, if MomentumUP then "Consensus Increasing = " + Round(Consensus_Level, 1)

else if MomentumUP or MomentumDOWN and conditionOB_CL then "Consensus OVERBOUGHT = " + Round(Consensus_Level, 1)

else if MomentumDOWN then "Consensus Decreasing = " + Round(Consensus_Level, 1)

else if MomentumUP or MomentumDOWN and conditionOS_CL then "Consensus OVERSOLD = " + Round(Consensus_Level, 1)

else "Consensus = " + Round(Consensus_Level, 1), if conditionOB_CL then Color.light_green

else if conditionOS_CL then Color.red else Color.GRAY);

AddLabel(squeeze_Alert, "SQUEEZE ALERT", if Squeeze_Alert then Color.YELLOW else Color.GRAY);

AddLabel(KeylevelOS and keyospaint," Near Key Support Level: $" + round(yhextlineOS,0), color.light_green);

AddLabel(KeylevelOB and keyobpaint," Near Key Resistance Level: $" + round(yhextlineOB,0), color.orange);

AddLabel(show_labels,

if TS_Last == 1 then " TS Last Signal: BUY "

else if TS_Last == 0 and ((alert4 or regular_Buy or extreme_buy) within 5 bars) then " TS Last Signal: SELL "

else if TS_Last == 0 then " TS Last Signal: SELL "

else "",

if TS_Last == 1 then color.light_gray

else if TS_Last == 0 and((alert4 or regular_Buy or extreme_buy) within 5 bars) then color.orange

else if TS_Last == 0 then color.light_gray

else color.white);

addlabel(yes, " Filter In Use: " + Filter, color.white);

#####################################################

## END ##

#####################################################