Target label is from my indicator ...Where do you find target labels per your attached charts and have they been moderately consistent?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Big Four Chart SetUp For ThinkOrSwim

- Thread starter TradingNumbers

- Start date

- Status

- Not open for further replies.

Hi, after the hourly candle confirmation, which lower tf you used to make the entry? I see that 15m chart is fairly aligned interms of TMO criteria than the 5m/3m..I took the LRCX Put based on alert in 1hr chart and sold it for good profit. I scan for the stocks for Big 4 & TMO and check for entry. In options, its difficult to get an exact time. Even if it goes to negative, provided you have good stop loss mechanism, it will turn out good. Thanks to all who worked on this setup.

Here is Big 4 http://tos.mx/stm0Ba7Hi All - Can someone please point me to latest code for Big4 and also a video link if there is one on how to use it? I am new to this website and to trading. Just want to test the indicator and see if it works for me.

Big 4 settings are:

Confirmation factor -- 4

Filter with TMO --NO

Colored candles on --YES

Verticals lines on -- NO

Strategy hold trend -- NO

Add Ehler's Distant Coefficient Filter to the chart...this is part of the Big 4 confirmation signals

Add TMO to the chart with settings 30,6,6 (default is 14,5,3

Here is TMO http://tos.mx/tsstWCX

Hey this would be a great addon if its not too much to ask to make it a big4 w/ optional supertrendWhat are your SuperTrend settings? I’m curious to see if can integrate it into the indicator for specific signals…

Another week of massive gains for me. This is 2 week in a row. I am not sure if I am just lucky but Its not just the market envionment because I played a sh*tload of puts and calls irrelevant on broader markets. I took 10 trades this week. 8/10 winners and 2 loosers turned into winners. I’ll post screenshots and entries exits when I get a second off. Biggest runner UTH calls quadruppled my profit literary in 2 days. I had several 300% and couple 100-200% multi-day winners, 2 scalps today msft and bidu puts 20-30% runners atm entries very generous profits. I closed wmt and cvx puts midweek small loss and flipped to calls closed both for profit today so thats a 10/10 winner week. this is my best run in ages look forward to next week. TY to creators this is life changing profits each of these entries are ~$100-500 on average a pop - if you buy 5-10 and exit w/100-200% profit you do the math…

Last edited:

This is fantastic. Are you taking next week's options? If possible can you share what strikes you are taking? Also, can you take a screenshot or share your layout? Again, congrats on your success.Another week of massive gains for me. This is 2 week in a row. I am not sure if I am just lucky but Its not just the market envionment because I played a sh*tload of puts and calls irrelevant on broader markets. I took 10 trades this week. 8/10 winners and 2 loosers turned into winners. I’ll post screenshots and entries exits when I get a second off. Biggest runner UTH calls quadruppled my profit literary in 2 days. I had several 300% and couple 100-200% multi-day winners, 2 scalps today msft and bidu puts 20-30% runners atm entries very generous profits. I closed wmt and cvx puts midweek small loss and flipped to calls closed both for profit today so thats a 10/10 winner week. this is my best run in ages look forward to next week. TY to creators this is life changing profits each of these entries are ~$100-500 on average a pop - if you buy 5-10 and exit w/100-200% profit you do the math…

Another week of massive gains for me. This is 2 week in a row. I am not sure if I am just lucky but Its not just the market envionment because I played a sh*tload of puts and calls irrelevant on broader markets. I took 10 trades this week. 8/10 winners and 2 loosers turned into winners. I’ll post screenshots and entries exits when I get a second off. Biggest runner UTH calls quadruppled my profit literary in 2 days. I had several 300% and couple 100-200% multi-day winners, 2 scalps today msft and bidu puts 20-30% runners atm entries very generous profits. I closed wmt and cvx puts midweek small loss and flipped to calls closed both for profit today so thats a 10/10 winner week. this is my best run in ages look forward to next week. TY to creators this is life changing profits each of these entries are ~$100-700 a pop if you do x5 at 100-200% profit you do the math…

I am taking atm or 1-2 max strikes away, 2-3 weeks out but rarely have I held longer than 2-5 days. Looking back, I left lot of money on table. example: AMZN 132 put july 18. I was doing my pm research and saw it was getting rejected all day on july 17 at 135-136 hitting resistance and snapping back. I trade 1H charts and enter on 5 or 15min for better entries. Next morning I saw it open under supertrend, tmo above 0 heavy overbought territory, big4 triggered at open and I got in on 2nd candle when it closed under 50ma breach. switched to 1H candles and watched it through. 9am candle flashed big4 arrow down thats when I am getting my confirmation and watched it unfold. Closed it around noon at that doji candle. That was waay to early tmo was barely in the middle with planty of downside and daylight left. Better exit was today, you can see tmo exaustion price bounced of 200ma, 129/130 should have been the PT.This is fantastic. Are you taking next week's options? If possible can you share what strikes you are taking? Also, can you take a screenshot or share your layout? Again, congrats on your success.

This is a good example how big 4 strategy executed to perfection. I am starting to see these setups daily. My suggestion is don’t rush into a trade take the best setups, avoid ranging stocks and enjoy the profits.

I attached my phone setup. its super simple, supertrend & tmo for planning, big 4 with arrows up/down and 50/200ma’s (pa respects those levels)

Last edited by a moderator:

another quick example AAPL. I took that call midweek but missed the put bec there are soo many of these setups all day every day. look at the chart its rinse repeat big4 setup. short signal eod would habe gotten my attention.. Next day in am rejection of supertrend in downtrend (confirmed) 2nd big4 short signal 9am 1H candle, TMO overbought above 0. At this point you are ready but need to look at 5-15min chart for entry. If you took this trade you would still be in it bec the TMO midway there is planty meat left on the bone.

I see a down arrow on 20th at 10.30a pst for aapl is that one your talking about if not can you please let me know which day and time to you took the entry and exit for 1h and 5 or 15 min chart for applanother quick example AAPL. I took that call midweek but missed the put bec there are soo many of these setups all day every day. look at the chart its rinse repeat big4 setup. short signal eod would habe gotten my attention.. Next day in am rejection of supertrend in downtrend (confirmed) 2nd big4 short signal 9am 1H candle, TMO overbought above 0. At this point you are ready but need to look at 5-15min chart for entry. If you took this trade you would still be in it bec the TMO midway there is planty meat left on the bone.

On this one for AMZN did you take the trade on July 17th @ 8.30am pstI am taking atm or 1-2 max strikes away, 2-3 weeks out but rarely have I held longer than 2-5 days. Looking back, I left lot of money on table. example: AMZN 132 put july 18. I was doing my pm research and saw it was getting rejected all day on july 17 at 135-136 hitting resistance and snapping back. I trade 1H charts and enter on 5 or 15min for better entries. Next morning I saw it open under supertrend, tmo above 0 heavy overbought territory, big4 triggered at open and I got in on 2nd candle when it closed under 50ma breach. switched to 1H candles and watched it through. 9am candle flashed big4 arrow down thats when I am getting my confirmation and watched it unfold. Closed it around noon at that doji candle. That was waay to early tmo was barely in the middle with planty of downside and daylight left. Better exit was today, you can see tmo exaustion price bounced of 200ma, 129/130 should have been the PT.

This is a good example how big 4 strategy executed to perfection. I am starting to see these setups daily. My suggestion is don’t rush into a trade take the best setups, avoid ranging stocks and enjoy the profits.

I attached my phone setup. its super simple, supertrend & tmo for planning, big 4 with arrows up/down and 50/200ma’s (pa respects those levels)

Thursday July18. I trade on 1H and 15 min. most trades I take of 1H confirm watching price action ll, hh, breakouts/downs etc. If got time to catch a play earlier for better entries I am watching on 15min. I am working diring market hours so most trades are on the phone, don’t see the big4 gray color just arrows but thats fine. With this strategy even if you catch a move mid-way you still profit just watch TMO for exaustion/reversals. Respect the zero line even if you are convinced it’s a good entry just dont do it. Fee moments later it saves your *** lol. For exits I’ve been zooming in on 15min and if i see reversals/retest of supertrend with supporting TMO I’ll exit. I don’t wait for big4 arrows for exit.On this one for AMZN did you take the trade on July 17th @ 8.30am pst

View attachment 19234

I have had very similar results. Since June 1st when I started using the BIG 4 on the 1H for bullish/bearish signals....I have done 45 trades. I have had 38 winning trades, 5 losing trades (3 for 100%) and 2 trades are still OPEN. 1 of those open trades (MRK) I opened on Wednesday 7.19. I opened 28-JUL 106 calls for $1.95 and currently at $4.40. Currently at 87% win rate (39/45 assuming MRK stays green). At the end of last week, I had 33 winning trades out of 38 trades for 87% win rate.Another week of massive gains for me. This is 2 week in a row. I am not sure if I am just lucky but Its not just the market envionment because I played a sh*tload of puts and calls irrelevant on broader markets. I took 10 trades this week. 8/10 winners and 2 loosers turned into winners. I’ll post screenshots and entries exits when I get a second off. Biggest runner UTH calls quadruppled my profit literary in 2 days. I had several 300% and couple 100-200% multi-day winners, 2 scalps today msft and bidu puts 20-30% runners atm entries very generous profits. I closed wmt and cvx puts midweek small loss and flipped to calls closed both for profit today so thats a 10/10 winner week. this is my best run in ages look forward to next week. TY to creators this is life changing profits each of these entries are ~$100-500 on average a pop - if you buy 5-10 and exit w/100-200% profit you do the math…

One of my trades that is open and currently under water is 10 4-AUG- F 14 C. I used the 30 min confirmation...instead of the 1H. So, going out a couple weeks gives it plenty of time and if the 1H signal ever confirms I may add to my 10 contracts and possibly go out another week in time.

My normal work schedule only allows me to trade from home on Thurs/Fri. The last 2 weeks I've had to work overtime on Thursday's. It's a lot more difficult to find the best signals from work on my phone, but I have been able to somehow navigate the markets using the Big 4!

I do trend trading (days to weeks), so I rarely use the 1 hour time frame. I find that the utbot indicator also has a high degree of accuracy. The settings should be tweaked to improve accuracy. I'd like to see someone compare the Buy/Sell signals of these 2 indicators, to determine the usefulness of both.

Maybe one indicator can serve as a "Heads Up", with the other confirming the validity of the trade?

Please test this.

Here's a link if someone wants to give it a try:

https://usethinkscript.com/threads/ut-bot-for-thinkorswim.12640/

By the way this indicator is not my creation, I paid a developer to convert it from TradingView.

Maybe one indicator can serve as a "Heads Up", with the other confirming the validity of the trade?

Please test this.

Here's a link if someone wants to give it a try:

https://usethinkscript.com/threads/ut-bot-for-thinkorswim.12640/

By the way this indicator is not my creation, I paid a developer to convert it from TradingView.

lolreconlol

Active member

Hello @illbdam69 / @cocojumbo,

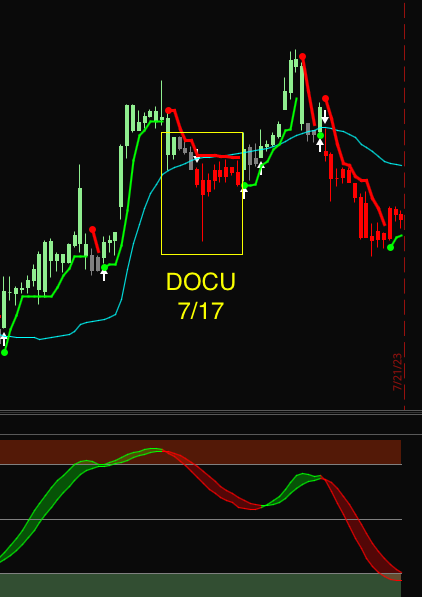

Please see the attached photos for BABA and DOCU, which both had a down signal on 7/17/23 on the 1 hour timeframe. I was paper trading these and I would've been stopped out both times. I was watching the scanner and both of these popped up. Curious if you would've taken this trade as well, or if there is something that you would've seen and stayed out. Thanks for your time!

Please see the attached photos for BABA and DOCU, which both had a down signal on 7/17/23 on the 1 hour timeframe. I was paper trading these and I would've been stopped out both times. I was watching the scanner and both of these popped up. Curious if you would've taken this trade as well, or if there is something that you would've seen and stayed out. Thanks for your time!

Last edited by a moderator:

BABA not the ideal setup, big4 short signal triggered and next ll candle I would execute put buy there. I was watching it actually around those levels but passed. Reason I skipped, I am looking at best setups and I personally didn’t like the choppines all those gap up and downs I skip. I preffer no gaps and smooth defined price action. If you see my attachment it bounced of the 50ma 4-5 times? If I took it I would have gotten out there. Even tho it wasn’t an ideal setup ~$2move lets say $90 PUT at 92-32 range would have given you a solid profit still. Not bad either way

Had a question on this scanner you sent the link before when i click on edit i see those errors at the bottom is that normal ? Thx for taking the timeI have had very similar results. Since June 1st when I started using the BIG 4 on the 1H for bullish/bearish signals....I have done 45 trades. I have had 38 winning trades, 5 losing trades (3 for 100%) and 2 trades are still OPEN. 1 of those open trades (MRK) I opened on Wednesday 7.19. I opened 28-JUL 106 calls for $1.95 and currently at $4.40. Currently at 87% win rate (39/45 assuming MRK stays green). At the end of last week, I had 33 winning trades out of 38 trades for 87% win rate.

One of my trades that is open and currently under water is 10 4-AUG- F 14 C. I used the 30 min confirmation...instead of the 1H. So, going out a couple weeks gives it plenty of time and if the 1H signal ever confirms I may add to my 10 contracts and possibly go out another week in time.

My normal work schedule only allows me to trade from home on Thurs/Fri. The last 2 weeks I've had to work overtime on Thursday's. It's a lot more difficult to find the best signals from work on my phone, but I have been able to somehow navigate the markets using the Big 4!

Thanks for replying so what scanner do you use for these plays if you can share thxThursday July18. I trade on 1H and 15 min. most trades I take of 1H confirm watching price action ll, hh, breakouts/downs etc. If got time to catch a play earlier for better entries I am watching on 15min. I am working diring market hours so most trades are on the phone, don’t see the big4 gray color just arrows but thats fine. With this strategy even if you catch a move mid-way you still profit just watch TMO for exaustion/reversals. Respect the zero line even if you are convinced it’s a good entry just dont do it. Fee moments later it saves your *** lol. For exits I’ve been zooming in on 15min and if i see reversals/retest of supertrend with supporting TMO I’ll exit. I don’t wait for big4 arrows for exit.

What exactly are you looking for on the 5 & 15 min TF? Are you waiting for big4 to signal on these as well before you take the trade?another quick example AAPL. I took that call midweek but missed the put bec there are soo many of these setups all day every day. look at the chart its rinse repeat big4 setup. short signal eod would habe gotten my attention.. Next day in am rejection of supertrend in downtrend (confirmed) 2nd big4 short signal 9am 1H candle, TMO overbought above 0. At this point you are ready but need to look at 5-15min chart for entry. If you took this trade you would still be in it bec the TMO midway there is planty meat left on the bone.

@cocojumbo Do you take PUT trades when the 15 minute TMO is not above zero but the 1 hr is? See example PEP.

Last edited:

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 141

-

Repaints AGAIG Visual Options Trading Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 63

-

Repaints AGAIG High Profit Options Trading Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 37

-

Repaints AGAIG Stars Aligned Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 23

-

Repaints AGAIG The Trading Edge Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 9

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

803

Online

Similar threads

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 141

-

Repaints AGAIG Visual Options Trading Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 63

-

Repaints AGAIG High Profit Options Trading Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 37

-

Repaints AGAIG Stars Aligned Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 23

-

Repaints AGAIG The Trading Edge Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 9

Similar threads

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 141

-

Repaints AGAIG Visual Options Trading Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 63

-

Repaints AGAIG High Profit Options Trading Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 37

-

Repaints AGAIG Stars Aligned Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 23

-

Repaints AGAIG The Trading Edge Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 9

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.