Do you have TMO by Mobius installed? If so, make sure it's scanning from the TMO that you have installed.. Settings for TMO are 30,6,6.Had a question on this scanner you sent the link before when i click on edit i see those errors at the bottom is that normal ? Thx for taking the time

View attachment 19240

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Big Four Chart SetUp For ThinkOrSwim

- Thread starter TradingNumbers

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

This what I have so far let me know if its right if not can you please share the workspace if possible and thanks for replying backDo you have TMO by Mobius installed? If so, make sure it's scanning from the TMO that you have installed.. Settings for TMO are 30,6,6.

MOD NOTE: Do NOT share workspace links on this forum.

Workspaces cannot be shared. They are backups stored on your computer and only work on that computer.

Last edited by a moderator:

I was watching DOCU on 7/14 using the 30M and 1H. I came very close to taking this trade but instead chose FCX using 30M on 7/14. I bought 4 28-JUL Puts and closed 3 for 29% (7/17) and the last one for 17% (7/19) Only reason I didn't choose DOCU was because I have never traded that symbol and I have FCX. However, with that being said even though you might have gotten stopped out on DOCU...you had a nice down candle the next morning at the open that you could have secured nice profits...but if you didn't sell then and got stopped out it reconfirmed bearish on 7/20 and this trade would be working well. However, that 2nd confirmation signal I might not have entered because by this time it was trading in a range and that would have prevented me from entering...perhaps.Hello @illbdam69 / @cocojumbo,

Please see the attached photos for BABA and DOCU, which both had a down signal on 7/17/23 on the 1 hour timeframe. I was paper trading these and I would've been stopped out both times. I was watching the scanner and both of these popped up. Curious if you would've taken this trade as well, or if there is something that you would've seen and stayed out. Thanks for your time!View attachment 19237View attachment 19238

If you are buying contracts that don't expire for 2-3 weeks out...the first entry on 7/17 could be green or very close even with that big swing higher to $55.

With my trading style I am willing to give the trade more time...I am also willing to risk losing 100%... My stop loss is the amount I risk for the trade. So, my style might be different to make a trade work out...but I prolly would have added to my original contracts on the 2nd down confirmation to bring my cost basis down.

One more thing, I didn't take many trades this week...FCX (7/14-7/19) AMZN (50%), GOOGL (25%), RCL (30%), MRK, F (used 30M). AMZN, GOOGL, RCL were all closed for profits. I had to take this week's expirationon these 3 because earnings releases next week are jacking the price of their options. This week's weren't jacked since they don't report till after this week. MRK 28-JUL 106 calls are up 138%.

BABA you might have to tight of a stop loss or expirations that are too short? It should have paid the next day on that gap down....and it continued down for couple more dollars. Then it broke supertrend at eod on Tuesday...

You need to change the scan to match your Big Four and your TMO. Otherwise, delete yours and reinstall the ones I have posted. Hope this helps!This what I have so far let me know if its right if not can you please share the workspace if possible and thanks for replying back

View attachment 19242

Maybe this will work.Dont see a picture can you please repost the pic

I will try and let you know thanksYou need to change the scan to match your Big Four and your TMO. Otherwise, delete yours and reinstall the ones I have posted. Hope this helps!

Can you please give us a example of the stop loss you used on fcx play when you get time ThxI was watching DOCU on 7/14 using the 30M and 1H. I came very close to taking this trade but instead chose FCX using 30M on 7/14. I bought 4 28-JUL Puts and closed 3 for 29% (7/17) and the last one for 17% (7/19) Only reason I didn't choose DOCU was because I have never traded that symbol and I have FCX. However, with that being said even though you might have gotten stopped out on DOCU...you had a nice down candle the next morning at the open that you could have secured nice profits...but if you didn't sell then and got stopped out it reconfirmed bearish on 7/20 and this trade would be working well. However, that 2nd confirmation signal I might not have entered because by this time it was trading in a range and that would have prevented me from entering...perhaps.

If you are buying contracts that don't expire for 2-3 weeks out...the first entry on 7/17 could be green or very close even with that big swing higher to $55.

With my trading style I am willing to give the trade more time...I am also willing to risk losing 100%... My stop loss is the amount I risk for the trade. So, my style might be different to make a trade work out...but I prolly would have added to my original contracts on the 2nd down confirmation to bring my cost basis down.

One more thing, I didn't take many trades this week...FCX (7/14-7/19) AMZN (50%), GOOGL (25%), RCL (30%), MRK, F (used 30M). AMZN, GOOGL, RCL were all closed for profits. I had to take this week's expirationon these 3 because earnings releases next week are jacking the price of their options. This week's weren't jacked since they don't report till after this week. MRK 28-JUL 106 calls are up 138%.

BABA you might have to tight of a stop loss or expirations that are too short? It should have paid the next day on that gap down....and it continued down for couple more dollars. Then it broke supertrend at eod on Tuesday...

@illbdam69 , When you get a second, Would you look at the charts I posted above and let me know what you think? With this strategy, Does TMO need to be above zero on the 15/30 min TF? I notice that you use the 30m for most of your setups. Do you make sure the 1hr confirms? Thanks for your help.

You have extended hours on. I don't use extended hours except on 1 Min chart. I personally do not wait for the TMO to be above/below zero on the lower timeframes...If it's below the zero on the 1H and signals bullish I will only use support and resistant areas, supertrend, and pivot's for entries on the lower time frames. However, I do occasionally (thurs/fri when I am home) trade SPX on 3Min and will be out within an hour of entry and I do use the TMO rule for this trade.Maybe this will work.

Thank you. I trade SPX mostly 1 and 5m scalping. Do you use this method when you are trading SPX?You have extended hours on. I don't use extended hours except on 1 Min chart. I personally do not wait for the TMO to be above/below zero on the lower timeframes...If it's below the zero on the 1H and signals bullish I will only use support and resistant areas, supertrend, and pivot's for entries on the lower time frames. However, I do occasionally (thurs/fri when I am home) trade SPX on 3Min and will be out within an hour of entry and I do use the TMO rule for this trade.

Here is a example for FCX that illbdam69 talked about on 7/14 if you see in the pic Big 4 gave a arrow downwards on 30 min chart you could play it and got out before close or next morning by 7 am pst if you pulls up the 15 min chart you will see a better picMaybe this will work.

Yep. I already looked at the trades he took. I was curious if TMO on 15m or 30m TF was a must if the 1Hr is showing good. He answered it above.Here is a example for FCX that illbdam69 talked about on 7/14 if you see in the pic Big 4 gave a arrow downwards on 30 min chart you could play it and got out before close or next morning by 7 am pst if you pulls up the 15 min chart you will see a better pic

View attachment 19243

@illbdam69 , When you get a second, Would you look at the charts I posted above and let me know what you think? With this strategy, Does TMO need to be above zero on the 15/30 min TF? I notice that you use the 30m for most of your setups. Do you make sure the 1hr confirms? Thanks for your help.

Yes most definitely! I use the big 4 on the 3m for SPX 0dte options...I'll usually wait until after 1PM EST to make this trade when the options are cheaper. I also copy & paste the option that I want to trade to a separate 3 min chart and wait for the big 4, TMO, supertrend to confirm on the options before entry. As you know SPX options can move very fast. They can go from $1.00 to $4.00 in a blink of an eye...1 nice big green or red candle. I'll typically buy the options that are trading in the $1-$2 range for SPX. Here is my SPX 4940P trade from y'day. $1.25 to $4.25.Thank you. I trade SPX mostly 1 and 5m scalping. Do you use this method when you are trading SPX?

I actually HAVE used the 1H for most of my setups since June 1st. I have just recently "trialed" the 30m setup for only 2-3 trades. I started noticing that KO looked really good on the 30m. I would attribute this to the stock likes to cross strike prices but within a narrow range from $60-$64 and not always from 60 to 64 or 64 to 60. but from 60-61 and back to 60...then back to 62...then back to 61...lol. Using the 1H within such a small range the 1H doesn't give you the best entry/exit's for most of the move. make sense?

I've traded FCX on the 30m with ok results. And the Ford (F) trade this past week and so far it's underwater...but these are 4-Aug expirations and I'm waiting for the 1H to confirm bullish and may add 10 more contracts if this happens...or add further dated contracts.

Attached is Friday 7/21 0dte

Last edited by a moderator:

Great trade huh! lol Maybe you turned it off...but if not, you need to add Ehler's Distant Coefficient Filter....this is part of the Big 4 bullish/bearish signals. It's part of TOS so it's already included in your indicators.Here is a example for FCX that illbdam69 talked about on 7/14 if you see in the pic Big 4 gave a arrow downwards on 30 min chart you could play it and got out before close or next morning by 7 am pst if you pulls up the 15 min chart you will see a better pic

View attachment 19243

yes great trade for sure Thanks for sharing could you please let us know how you use your stop for any plays and spx 0dteGreat trade huh! lol Maybe you turned it off...but if not, you need to add Ehler's Distant Coefficient Filter....this is part of the Big 4 bullish/bearish signals. It's part of TOS so it's already included in your indicators.

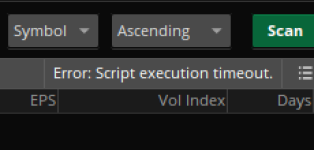

hmm? I am not sure what the issue is. The bottom screenshot is not for scans as I believe this is the thinkscript editor for creating indicators, strategies, etc. The top screenshot is the scan and from what I can tell...it should work...maybe someone else can chime in?

I wouldn't scan "all stocks" at least reduce this to only optionable, weekly's or S&P. I scan my "favorites" watchlist which consist about 2-300 stocks that I have filtered by bid/ask spreads, OI and Vol.

I will try and get back the second screenshot was to show you the details anyway how do you use the fav watchlist to scan if possible and how do you use stop losshmm? I am not sure what the issue is. The bottom screenshot is not for scans as I believe this is the thinkscript editor for creating indicators, strategies, etc. The top screenshot is the scan and from what I can tell...it should work...maybe someone else can chime in?

I wouldn't scan "all stocks" at least reduce this to only optionable, weekly's or S&P. I scan my "favorites" watchlist which consist about 2-300 stocks that I have filtered by bid/ask spreads, OI and Vol.

How has your SPX win percentage been since you started your testing? LLY, EBAY, and JPM looks to be setting up. Let me know if you see the same.Yes most definitely! I use the big 4 on the 3m for SPX 0dte options...I'll usually wait until after 1PM EST to make this trade when the options are cheaper. I also copy & paste the option that I want to trade to a separate 3 min chart and wait for the big 4, TMO, supertrend to confirm on the options before entry. As you know SPX options can move very fast. They can go from $1.00 to $4.00 in a blink of an eye...1 nice big green or red candle. I'll typically buy the options that are trading in the $1-$2 range for SPX. Here is my SPX 4940P trade from y'day. $1.25 to $4.25.

I actually HAVE used the 1H for most of my setups since June 1st. I have just recently "trialed" the 30m setup for only 2-3 trades. I started noticing that KO looked really good on the 30m. I would attribute this to the stock likes to cross strike prices but within a narrow range from $60-$64 and not always from 60 to 64 or 64 to 60. but from 60-61 and back to 60...then back to 62...then back to 61...lol. Using the 1H within such a small range the 1H doesn't give you the best entry/exit's for most of the move. make sense?

I've traded FCX on the 30m with ok results. And the Ford (F) trade this past week and so far it's underwater...but these are 4-Aug expirations and I'm waiting for the 1H to confirm bullish and may add 10 more contracts if this happens...or add further dated contracts.

Attached is Friday 7/21 0dte

mod note:

TDA throttles scans which use excess resources and returns a: "script execution timeout".

Some scripts are too complex or require too many resources and won't run in any circumstances.

For other scripts, there are some workarounds:

1. within x bars requires x iterations

Either reduce the number of x bars or remove within x bars totally.

2. Scan for each of your filters separately.

3. DO NOT run against the Universe of Stocks.

Create a scan that makes a small list.

@smallstacks @illbdam69

TDA throttles scans which use excess resources and returns a: "script execution timeout".

Some scripts are too complex or require too many resources and won't run in any circumstances.

For other scripts, there are some workarounds:

1. within x bars requires x iterations

Either reduce the number of x bars or remove within x bars totally.

2. Scan for each of your filters separately.

3. DO NOT run against the Universe of Stocks.

Create a scan that makes a small list.

Specify a dollar range for price.

Specify a minimum amount for volume.

Limit market cap to eliminate the garbage stocks.

Change "scan in" to "all listed stocks" to remove the OTC, etc...

Add some filters like these to your scan (but modify to fit your strategy)

Scan Hacker Shared Link: http://tos.mx/DpaFv9d Click here for --> Easiest way to load shared links

@smallstacks @illbdam69

Last edited:

- Status

- Not open for further replies.

Similar threads

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 133

-

Repaints AGAIG Visual Options Trading Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 60

-

Repaints AGAIG High Profit Options Trading Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 37

-

Repaints AGAIG Stars Aligned Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 23

-

Repaints AGAIG The Trading Edge Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 9

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1339

Online

Similar threads

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 133

-

Repaints AGAIG Visual Options Trading Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 60

-

Repaints AGAIG High Profit Options Trading Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 37

-

Repaints AGAIG Stars Aligned Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 23

-

Repaints AGAIG The Trading Edge Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 9

Similar threads

-

Repaints AGAIG A Choice Chart Setup for Trading or Scalping with ThinkOrSwim

- Started by csricksdds

- Replies: 133

-

Repaints AGAIG Visual Options Trading Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 60

-

Repaints AGAIG High Profit Options Trading Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 37

-

Repaints AGAIG Stars Aligned Chart For ThinkOrSwim

- Started by csricksdds

- Replies: 23

-

Repaints AGAIG The Trading Edge Chart for ThinkOrSwim

- Started by csricksdds

- Replies: 9

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.