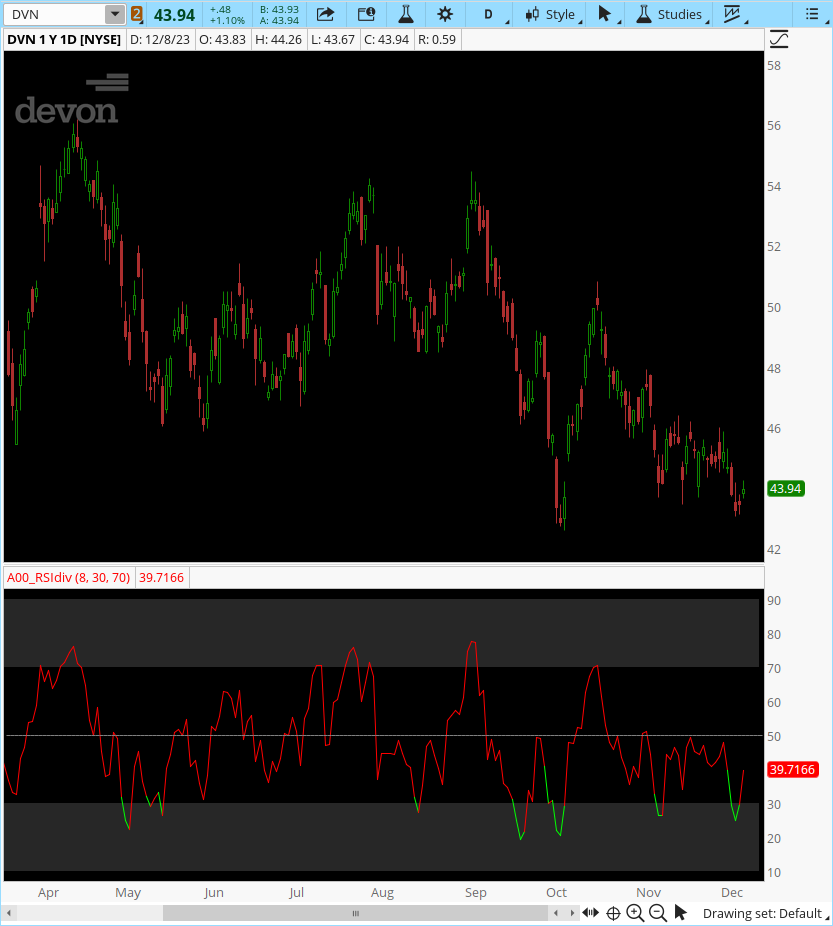

This statment gets, Invalid statment :RSI

rsi = RSI(close, n);

isDivergenceUp = (rsi > Over_Bought) and (close < high[n]);

isDivergenceDown = (rsi < Over_Sold) and (close > high[n]);

Error here: rsi.AssignValueColor(if rsi > Over_Bought then Color.Red else if rsi < Over_Sold then Color.Green

else if (isDivergenceUp) then

else Color.Yellow);

rsi = RSI(close, n);

isDivergenceUp = (rsi > Over_Bought) and (close < high[n]);

isDivergenceDown = (rsi < Over_Sold) and (close > high[n]);

Error here: rsi.AssignValueColor(if rsi > Over_Bought then Color.Red else if rsi < Over_Sold then Color.Green

else if (isDivergenceUp) then

else Color.Yellow);