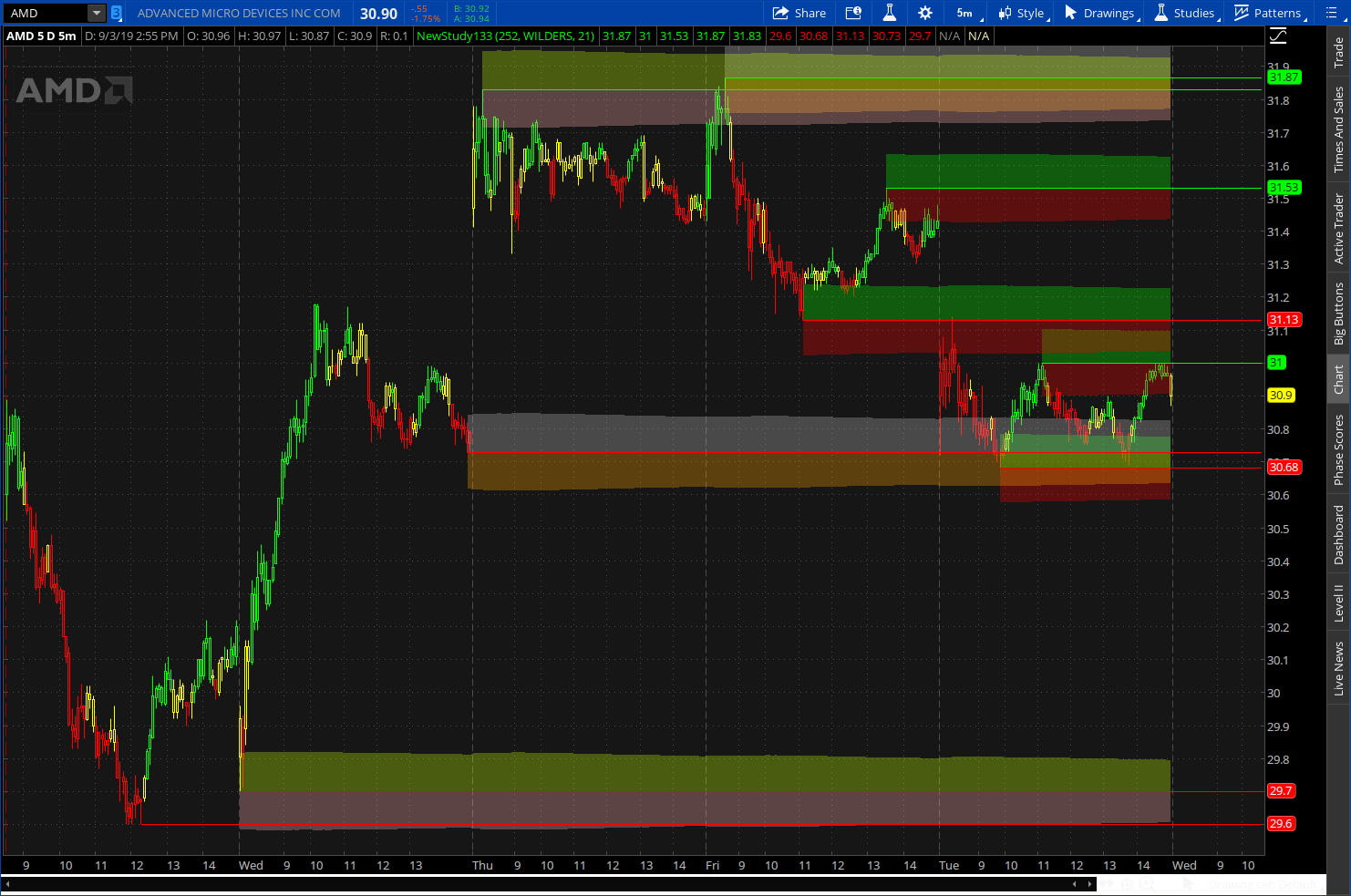

Support/Resistance or Supply/Demand whichever you prefer. Based on pivots and ATR. Change the n to get zones for the time you wish.

Update: ATR is now straight lines and user can input ATR multiple.

New share: https://tos.mx/Lv0FsZi

https://tos.mx/VeGhwv

Update: ATR is now straight lines and user can input ATR multiple.

New share: https://tos.mx/Lv0FsZi

https://tos.mx/VeGhwv

Code:

# Support/Resistance Zones around pivot S/R points.

#Added the zones using ATR to the Theotrade Pivots study.

#Additions by Horserider 9/30/2019

input length = 252;

input averageType = AverageType.WILDERS;

def ATR = MovingAverage(averageType, TrueRange(high, close, low), length);

# User Inputs

input n = 21; #hint n: periods used for pivot calculations.

def Num_Dev_Dn = ATR;

def Num_Dev_up = -ATR;

# Internal Script Reference

script LinePlot {

input BarID = 0;

input Value = 0;

input BarOrigin = 0;

def ThisBar = HighestAll(BarOrigin);

def ValueLine = if BarOrigin == ThisBar

then Value

else Double.NaN;

plot P = if ThisBar - BarID <= BarOrigin

then HighestAll(ValueLine)

else Double.NaN;

}

# Variables

def o = open;

def h = high;

def l = low;

def c = close;

def bar = BarNumber();

def BBar = bar == HighestAll(bar);

# Parent High

def ParentHigh = HighestAll(h);

def ParentHBarOrigin = if h == ParentHigh

then bar

else ParentHBarOrigin[1];

def ParentHBarID = bar - HighestAll(ParentHBarOrigin);

# R1

def hh = fold i = 1 to n + 1

with p = 1

while p

do h > GetValue(h, -i);

def PivotH = if (bar > n and

h == Highest(h, n) and

hh)

then h

else Double.NaN;

def PHValue = if !IsNaN(PivotH)

then PivotH

else PHValue[1];

def PHBarOrigin = if !IsNaN(PivotH)

then bar

else PHBarOrigin[1];

def PHBarID = bar - PHBarOrigin;

# R2

def R2PHValue = if PHBarOrigin != PHBarOrigin[1]

then PHValue[1]

else R2PHValue[1];

def R2PHBarOrigin = if PHBarOrigin != PHBarOrigin[1]

then PHBarOrigin[1]

else R2PHBarOrigin[1];

def R2PHBarID = bar - R2PHBarOrigin;

# R3

def R3PHValue = if R2PHBarOrigin != R2PHBarOrigin[1]

then R2PHValue[1]

else R3PHValue[1];

def R3PHBarOrigin = if R2PHBarOrigin != R2PHBarOrigin[1]

then R2PHBarOrigin[1]

else R3PHBarOrigin[1];

def R3PHBarID = bar - R3PHBarOrigin;

# R4

def R4PHValue = if R3PHBarOrigin != R3PHBarOrigin[1]

then R3PHValue[1]

else R4PHValue[1];

def R4PHBarOrigin = if R3PHBarOrigin != R3PHBarOrigin[1]

then R3PHBarOrigin[1]

else R4PHBarOrigin[1];

def R4PHBarID = bar - R4PHBarOrigin;

# Parent Low

def ParentLow = LowestAll(l);

def ParentLBarOrigin = if l == ParentLow

then bar

else ParentLBarOrigin[1];

def ParentLBarID = bar - HighestAll(ParentLBarOrigin);

# S1

def ll = fold j = 1 to n + 1

with q = 1

while q

do l < GetValue(l, -j);

def PivotL = if (bar > n and

l == Lowest(l, n) and

ll)

then l

else Double.NaN;

def PLValue = if !IsNaN(PivotL)

then PivotL

else PLValue[1];

def PLBarOrigin = if !IsNaN(PivotL)

then bar

else PLBarOrigin[1];

def PLBarID = bar - PLBarOrigin;

# S2

def S2PLValue = if PLBarOrigin != PLBarOrigin[1]

then PLValue[1]

else S2PLValue[1];

def S2PLBarOrigin = if PLBarOrigin != PLBarOrigin[1]

then PLBarOrigin[1]

else S2PLBarOrigin[1];

def S2PLBarID = bar - S2PLBarOrigin;

# S3

def S3PLValue = if S2PLBarOrigin != S2PLBarOrigin[1]

then S2PLValue[1]

else S3PLValue[1];

def S3PLBarOrigin = if S2PLBarOrigin != S2PLBarOrigin[1]

then S2PLBarOrigin[1]

else S3PLBarOrigin[1];

def S3PLBarID = bar - S3PLBarOrigin;

# S4

def S4PLValue = if S3PLBarOrigin != S3PLBarOrigin[1]

then S3PLValue[1]

else S4PLValue[1];

def S4PLBarOrigin = if S3PLBarOrigin != S3PLBarOrigin[1]

then S3PLBarOrigin[1]

else S4PLBarOrigin[1];

def S4PLBarID = bar - S4PLBarOrigin;

# Plots

plot PR1 = LinePlot(BarID = ParentHBarID,

Value = ParentHigh,

BarOrigin = HighestAll(ParentHBarOrigin));

PR1.SetDefaultColor(Color.GREEN);

#addChartBubble(Bar == HighestAll(ParentHBarOrigin), ParentHigh, "High", color.yellow, 1);

plot R1 = LinePlot(BarID = PHBarID,

Value = PHValue,

BarOrigin = PHBarOrigin);

R1.SetDefaultColor(Color.GREEN);

#AddChartBubble(bar == HighestAll(PHBarOrigin), PHValue, "R1", Color.GREEN, 1);

plot LowerBandr1 = R1 + Num_Dev_Dn ;

plot UpperBandr1 = R1 + Num_Dev_up ;

AddCloud(UpperBandr1, R1, Color.GREEN, Color.RED );

AddCloud(LowerBandr1, R1, Color.GREEN, Color.RED );

lowerbandr1.hide();

upperbandr1.hide();

plot R2 = LinePlot(BarID = R2PHBarID,

Value = R2PHValue,

BarOrigin = R2PHBarOrigin);

R2.SetDefaultColor(Color.GREEN);

#AddChartBubble(bar == HighestAll(R2PHBarOrigin), PHValue, "R2", Color.GREEN, 1);

plot LowerBandr2 = R2 + Num_Dev_Dn ;

plot UpperBandr2 = R2 + Num_Dev_up ;

AddCloud(UpperBandr2, R2, Color.GREEN, Color.RED);

AddCloud(LowerBandr2, R2, Color.GREEN, Color.RED);

lowerbandr2.hide();

upperbandr2.hide();

plot R3 = LinePlot(BarID = R3PHBarID,

Value = R3PHValue,

BarOrigin = R3PHBarOrigin);

R3.SetDefaultColor(Color.GREEN);

#AddChartBubble(bar == HighestAll(R3PHBarOrigin), PHValue, "R3", Color.GREEN, 1);

plot LowerBandr3 = R3 + Num_Dev_Dn ;

plot UpperBandr3 = R3 + Num_Dev_up ;

AddCloud(UpperBandr3, R3, Color.LIGHT_GRAY, Color.LIGHT_ORANGE);

AddCloud(LowerBandr3, R3, Color.LIGHT_GRAY, Color.LIGHT_ORANGE);

lowerbandr3.hide();

upperbandr3.hide();

plot R4 = LinePlot(BarID = R4PHBarID,

Value = R4PHValue,

BarOrigin = R4PHBarOrigin);

R4.SetDefaultColor(Color.GREEN);

#AddChartBubble(bar == HighestAll(R4PHBarOrigin), PHValue, "R4", Color.GREEN, 1);

plot LowerBandr4 = R4 + Num_Dev_Dn ;

plot UpperBandr4 = R4 + Num_Dev_up ;

AddCloud(UpperBandr4, R4, Color.LIME, Color.PINK);

AddCloud(LowerBandr4, R4, Color.LIME, Color.PINK);

lowerbandr4.hide();

upperbandr4.hide();

plot PS1 = LinePlot(BarID = ParentLBarID,

Value = ParentLow,

BarOrigin = HighestAll(ParentLBarOrigin));

PS1.SetDefaultColor(Color.RED);

#AddChartBubble(bar == HighestAll(ParentLBarOrigin), ParentLow, "Low", Color.YELLOW, 0);

plot S1 = LinePlot(BarID = PLBarID,

Value = PLValue,

BarOrigin = PLBarOrigin);

S1.SetDefaultColor(Color.RED);

#AddChartBubble(bar == HighestAll(PLBarOrigin), PLValue, "S1", Color.RED, 0);

plot LowerBands1 = S1 + Num_Dev_Dn ;

plot UpperBands1 = S1 + Num_Dev_up ;

AddCloud(UpperBands1, S1, Color.GREEN, Color.RED);

AddCloud(LowerBands1, S1, Color.GREEN, Color.RED);

lowerbands1.hide();

upperbands1.hide();

plot S2 = LinePlot(BarID = S2PLBarID,

Value = S2PLValue,

BarOrigin = S2PLBarOrigin);

S2.SetDefaultColor(Color.RED);

#AddChartBubble(bar == HighestAll(S2PLBarOrigin), PLValue, "S2", Color.RED, 0);

plot LowerBands2 = S2 + Num_Dev_Dn ;

plot UpperBands2 = S2 + Num_Dev_up ;

AddCloud(UpperBands2, S2, Color.GREEN, Color.RED);

AddCloud(LowerBands2, S2, Color.GREEN, Color.RED);

lowerbands2.hide();

upperbands2.hide();

plot S3 = LinePlot(BarID = S3PLBarID,

Value = S3PLValue,

BarOrigin = S3PLBarOrigin);

S3.SetDefaultColor(Color.RED);

#AddChartBubble(bar == HighestAll(S3PLBarOrigin), PLValue, "S3", Color.RED, 0);

plot LowerBands3 = S3 + Num_Dev_Dn ;

plot UpperBands3 = S3 + Num_Dev_up ;

AddCloud(UpperBands3, S3, Color.LIGHT_GRAY, Color.LIGHT_ORANGE);

AddCloud(LowerBands3, S3, Color.LIGHT_GRAY, Color.LIGHT_ORANGE);

lowerbands3.hide();

upperbands3.hide();

plot S4 = LinePlot(BarID = S4PLBarID,

Value = S4PLValue,

BarOrigin = S4PLBarOrigin);

S4.SetDefaultColor(Color.RED);

#AddChartBubble(bar == HighestAll(S4PLBarOrigin), PLValue, "S4", Color.RED, 0);

plot LowerBands4 = S4 + Num_Dev_Dn ;

plot UpperBands4 = S4 + Num_Dev_up ;

AddCloud(UpperBands4, S4, Color.LIME, Color.PINK);

AddCloud(LowerBands4, S4, Color.LIME, Color.PINK);

lowerbands4.hide();

upperbands4.hide();

plot BearScan = if (close crosses below S1) or

(close crosses below S2)

then close

else Double.NaN;

plot BullScan = if (close crosses above R1) or

(close crosses above R2)

then close

else Double.NaN;

# End Code Fractal ArrayAttachments

Last edited: