Author Message:

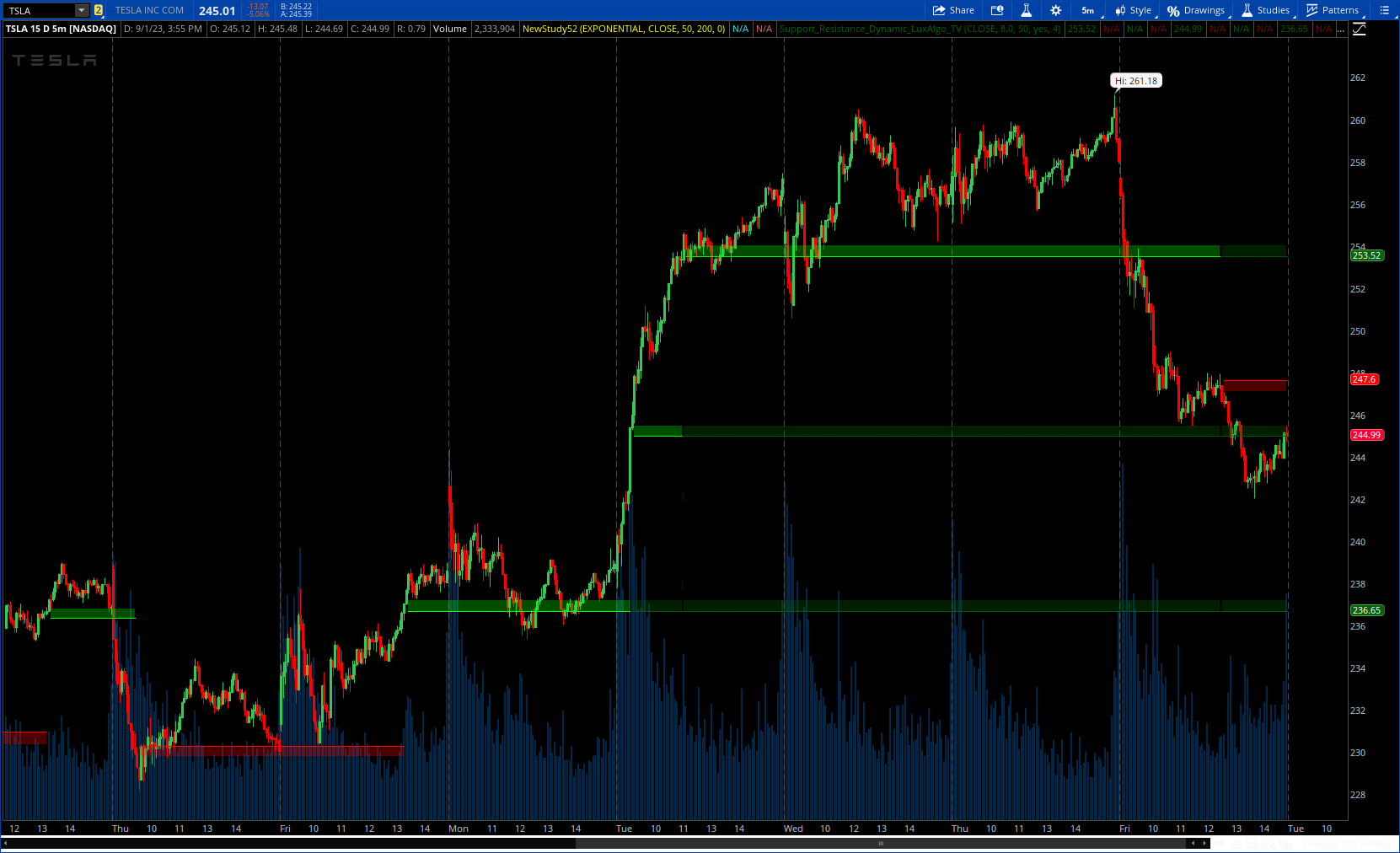

The Support & Resistance Dynamic indicator aims to return real-time predictive support and resistance zones that are relevant to a detected trend. This makes this indicator similar to our previously published Predictive Ranges indicator.

Users can additionally extend the most recent historical support and resistance zones.

CODE:

CSS:

#// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https:#//creativecommons.org/licenses/by-nc-sa/4.0/

#// © LuxAlgo

#indicator("Support & Resistance Dynamic [LuxAlgo]"

# converted by Sam4Cok@Samer800 - 09 / 2023 - My not be typical conv.

#//Settings

input src = close;

input MultiplicativeFactor = 8.0; # 'Multiplicative Factor'

input atrLength = 50; # 'ATR Length'

input ExtendLevels = yes; # 'Extend Levels'

input NoOfExtendedLines = 4; # 'Extend Last'

def na = Double.NaN;

#//Calculation

def n = BarNumber();

def nATR = ATR(LENGTH = atrLength);

def breakout = nATR * MultiplicativeFactor;

def breakout_atr = if IsNaN(breakout) then 0 else breakout;

#def avg;

#def avg_ = if avg[1] then avg[1] else close;

def avg = if AbsValue(src - avg[1]) > breakout_atr then src else avg[1];

def lastAvg = avg ==src;

def hold_atr = if lastAvg then breakout_atr else hold_atr[1];

def os = if avg > avg[1] then 1 else if avg < avg[1] then 0 else os[1];

def avgUpRes = avg + hold_atr / MultiplicativeFactor;

def avgDnRes = avg + hold_atr / MultiplicativeFactor / 2;

def avgUpSup = avg - hold_atr / MultiplicativeFactor / 2;

def avgDnSup = avg - hold_atr / MultiplicativeFactor;

def upper_res = if os == 0 then avgUpRes else na;

def lower_res = if os == 0 then avgDnRes else na;

def upper_sup = if os == 1 then avgUpSup else na;

def lower_sup = if os == 1 then avgDnSup else na;

def uppSup = if !isNaN(upper_sup) then upper_sup else uppSup[1];

def uppRes = if !isNaN(upper_res) then upper_res else uppRes[1];

def change = (uppSup!=uppSup[1]) or (uppRes!=uppRes[1]);

def osDiff = change;#os != os[1];

def cnt = if change then cnt[1]+1 else cnt[1];

def cntHi = highestAll(cnt);

def cntCond = (cnt-1) > (cntHi) - NoOfExtendedLines ;

def plotCond = !lastAvg and cntCond;

script extend {

input data = close;

input plotCond = yes;

def na = Double.NaN;

def last = IsNaN(close);

def cond = !IsNaN(data[1]) and IsNaN(data);

def extend = if !plotCond then na else

if cond then data[1] else extend[1];

plot out = if last then na else if extend then extend else na;

}

script extend2 {

input data = close;

input plotCond = yes;

def na = Double.NaN;

def last = IsNaN(close);

def cond = data != data[1];

def extend = if !plotCond then na else

if cond then data[1] else extend[1];

plot out = if last then na else if extend then extend else na;

}

def upper_sup1 = extend(upper_sup, cntCond and ExtendLevels);

def lower_sup1 = extend(lower_sup, cntCond and ExtendLevels);

def upper_res1 = extend(upper_res, cntCond and ExtendLevels);

def lower_res1 = extend(lower_res, cntCond and ExtendLevels);

def upper_sup2 = extend2(upper_sup, cntCond and ExtendLevels);

def lower_sup2 = extend2(lower_sup, cntCond and ExtendLevels);

def upper_res2 = extend2(upper_res, cntCond and ExtendLevels);

def lower_res2 = extend2(lower_res, cntCond and ExtendLevels);

def upper_sup3 = extend(upper_sup2, cntCond and ExtendLevels);

def lower_sup3 = extend(lower_sup2, cntCond and ExtendLevels);

def upper_res3 = extend(upper_res2, cntCond and ExtendLevels);

def lower_res3 = extend(lower_res2, cntCond and ExtendLevels);

def upper_sup4 = extend2(upper_sup2, cntCond and ExtendLevels);

def lower_sup4 = extend2(lower_sup2, cntCond and ExtendLevels);

def upper_res4 = extend2(upper_res2, cntCond and ExtendLevels);

def lower_res4 = extend2(lower_res2, cntCond and ExtendLevels);

def upper_sup5 = extend(upper_sup4, cntCond and ExtendLevels);

def lower_sup5 = extend(lower_sup4, cntCond and ExtendLevels);

def upper_res5 = extend(upper_res4, cntCond and ExtendLevels);

def lower_res5 = extend(lower_res4, cntCond and ExtendLevels);

def upper_sup6 = extend2(upper_sup4, cntCond and ExtendLevels);

def lower_sup6 = extend2(lower_sup4, cntCond and ExtendLevels);

def upper_res6 = extend2(upper_res4, cntCond and ExtendLevels);

def lower_res6 = extend2(lower_res4, cntCond and ExtendLevels);

#//Plot supports

def upperSup1 = upper_sup1;

plot lowerSup1 = lower_sup1;#if !ExtendLevels or lastAvg then na else lower_sup1;

plot upperres1 = upper_res1;#if !ExtendLevels or lastAvg then na else upper_res1;

def lowerres1 = lower_res1;

def upperSup2 = upper_sup2;

plot lowerSup2 = lower_sup2;#if !ExtendLevels or lastAvg then na else lower_sup2;

plot upperres2 = upper_res2;#if !ExtendLevels or lastAvg then na else upper_res2;

def lowerres2 = lower_res2;

def upperSup3 = upper_sup3;

plot lowerSup3 = lower_sup3;#if !ExtendLevels or lastAvg then na else lower_sup3;

plot upperres3 = upper_res3;#if !ExtendLevels or lastAvg then na else upper_res3;

def lowerres3 = lower_res3;

def upperSup4 = upper_sup4;

plot lowerSup4 = lower_sup4;#if !ExtendLevels or lastAvg then na else lower_sup4;

plot upperres4 = upper_res4;#if !ExtendLevels or lastAvg then na else upper_res4;

def lowerres4 = lower_res4;

def upperSup5 = upper_sup5;

plot lowerSup5 = lower_sup5;#if !ExtendLevels or lastAvg then na else lower_sup5;

plot upperres5 = upper_res5;#if !ExtendLevels or lastAvg then na else upper_res5;

def lowerres5 = lower_res5;

def upperSup6 = upper_sup6;

plot lowerSup6 = lower_sup6;#if !ExtendLevels or lastAvg then na else lower_sup6;

plot upperres6 = upper_res6;#if !ExtendLevels or lastAvg then na else upper_res6;

def lowerres6 = lower_res6;

lowerSup1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

upperres1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

lowerSup2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

upperres2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

lowerSup3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

upperres3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

lowerSup4.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

upperres4.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

lowerSup5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

upperres5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

lowerSup6.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

upperres6.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

def plot_upper_sup = if lastAvg then na else upper_sup; # 'Upper Support'

plot plot_lower_sup = if lastAvg then na else lower_sup; # 'Lower Support'

plot_lower_sup.SetDefaultColor(Color.GREEN);

#//Plot resistances

def plot_lower_res = if lastAvg then na else lower_res;

plot plot_upper_res = if lastAvg then na else upper_res;#, 'Upper Resistance'

plot_upper_res.SetDefaultColor(Color.RED);

#//Fills

AddCloud(plot_upper_sup, plot_lower_sup, Color.GREEN); # 'Support Area')

AddCloud(plot_upper_res, plot_lower_res, Color.RED); # 'Resistance Area')

lowerSup1.SetDefaultColor(Color.DARK_GREEN);

upperres1.SetDefaultColor(Color.DARK_RED);

lowerSup1.SetStyle(Curve.MEDIUM_DASH);

upperres1.SetStyle(Curve.MEDIUM_DASH);

lowerSup2.SetDefaultColor(Color.DARK_GREEN);

upperres2.SetDefaultColor(Color.DARK_RED);

lowerSup2.SetStyle(Curve.MEDIUM_DASH);

upperres2.SetStyle(Curve.MEDIUM_DASH);

lowerSup3.SetDefaultColor(Color.DARK_GREEN);

upperres3.SetDefaultColor(Color.DARK_RED);

lowerSup3.SetStyle(Curve.MEDIUM_DASH);

upperres3.SetStyle(Curve.MEDIUM_DASH);

lowerSup4.SetDefaultColor(Color.DARK_GREEN);

upperres4.SetDefaultColor(Color.DARK_RED);

lowerSup4.SetStyle(Curve.MEDIUM_DASH);

upperres4.SetStyle(Curve.MEDIUM_DASH);

lowerSup5.SetDefaultColor(Color.DARK_GREEN);

upperres5.SetDefaultColor(Color.DARK_RED);

upperres5.SetStyle(Curve.MEDIUM_DASH);

lowerSup6.SetDefaultColor(Color.DARK_GREEN);

upperres6.SetDefaultColor(Color.DARK_RED);

lowerSup6.SetStyle(Curve.MEDIUM_DASH);

upperres6.SetStyle(Curve.MEDIUM_DASH);

AddCloud(upper_Sup1, lower_Sup1, Color.DARK_GREEN);#, 'Support Area')

AddCloud(upper_res1, lower_res1, Color.DARK_RED);#, 'Resistance Area')

AddCloud(upper_Sup2, lower_Sup2, Color.DARK_GREEN);#, 'Support Area')

AddCloud(upper_res2, lower_res2, Color.DARK_RED);#, 'Resistance Area')

AddCloud(upper_Sup3, lower_Sup3, Color.DARK_GREEN);#, 'Support Area')

AddCloud(upper_res3, lower_res3, Color.DARK_RED);#, 'Resistance Area')

AddCloud(upperSup4, lowerSup4, Color.DARK_GREEN);#, 'Support Area')

AddCloud(upperres4, lowerres4, Color.DARK_RED);#, 'Resistance Area')

AddCloud(upperSup5, lowerSup5, Color.DARK_GREEN);#, 'Support Area')

AddCloud(upperres5, lowerres5, Color.DARK_RED);#, 'Resistance Area')

AddCloud(upperSup6, lowerSup6, Color.DARK_GREEN);#, 'Support Area')

AddCloud(upperres6, lowerres6, Color.DARK_RED);#, 'Resistance Area')

#--- END of CODE