Author Message:

How It Works:

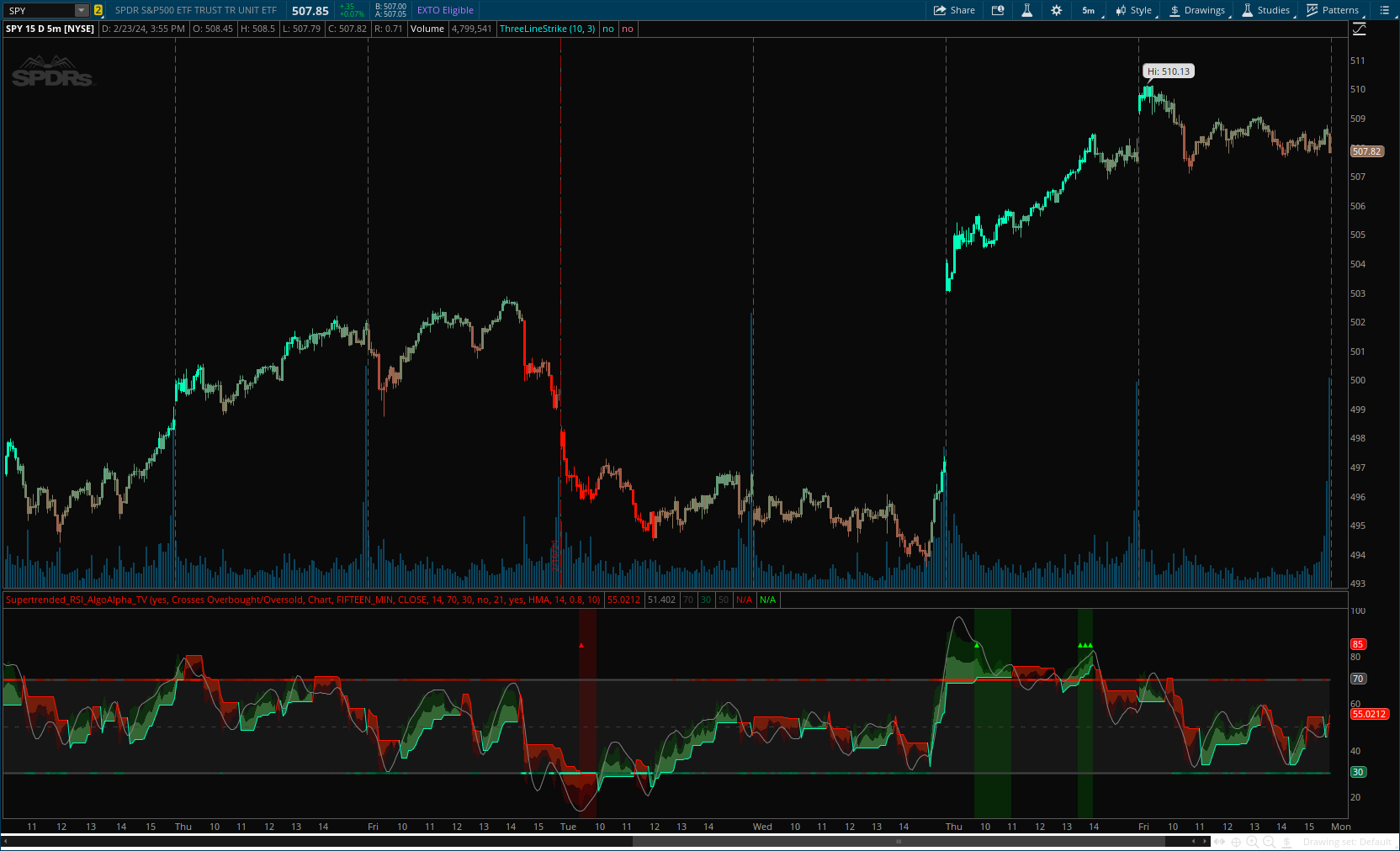

At the core of this indicator is the combination of the Relative Strength Index (RSI) and the Supertrend framework, it does so by applying the SuperTrend on the RSI. The RSI settings can be adjusted for length and smoothing, with the option to select the data source. The Supertrend calculation takes into account a specified trend factor and the Average True Range (ATR) over a given period to determine trend direction.

Visual elements include plotting the RSI, its moving average, and the Supertrend line, with customizable colors for clarity. Overbought and oversold conditions are highlighted, and trend changes are filled with distinct colors.

CODE:

CSS:

# https://www.tradingview.com/v/tjP35RG5/

#// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

#// © AlgoAlpha

#indicator("Supertrended RSI [AlgoAlpha]", overlay = false, timeframe = "")

# Converted and mod by Sam4Cok@Samer800 - 02/2024

declare lower;

input colorBars = yes;

input signalType = {Default "Crosses Supertrend/RSI", "Crosses Overbought/Oversold", "Don't Show"};

input timeframe = {Default "Chart", "Custom"};

input customTimeframe = AggregationPeriod.FIFTEEN_MIN;

input rsiSource = FundamentalType.CLOSE; # "RSI Source"

input rsiLength = 14; # "RSI Length"

input overbought = 70;

input oversold = 30;

input SmoothRsi = no; # "Smooth RSI?"

input smoothingLength = 21; # "RSI Smoothing Length"

input showMovingAverage = yes; # "Show RSI MA?"

input movingAverageType = {"SMA", default "HMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"}; # "MA Type"

input movingAverageLength = 14; # "MA Length"

input trendFactor = 0.80; # "Factor"

input atrLength = 10; # "ATR Length"

def na = Double.NaN;

def last = isNaN(close);

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

def dont = signalType==signalType."Don't Show";

def cross = signalType==signalType."Crosses Supertrend/RSI" and !dont;

def obos = signalType==signalType."Crosses Overbought/Oversold" and !dont;

def src;def vol;

Switch (timeframe) {

Case "Custom" :

src = Fundamental(FundamentalType = rsiSource, Period = customTimeframe);

vol = Volume(Period = customTimeframe);

Default :

src = Fundamental(FundamentalType = rsiSource);

vol = volume;

}

#-- Color

DefineGlobalColor("Up", CreateColor(0, 255, 187)); # "Up Color"

DefineGlobalColor("Dn", CreateColor(255, 17, 0)); # "Up Color"

DefineGlobalColor("bg", CreateColor(51, 51, 51)); # "Up Color"

#vwma(source, length)

script VWMA {

input src = close;

input len = 14;

input vol = volume;

def nom = Average(src * vol, len);

def den = Average(vol, len);

def VWMA = nom / den;

Plot result = VWMA;

}

#// Function to calculate Supertrend

script Supertrend {

input factor = 0.8;

input atrPeriod = 10;

input source = close;

def highestHigh = Highest(source, atrPeriod);

def lowestLow = Lowest(source, atrPeriod);

def trueRange = if isNaN(highestHigh[1]) then highestHigh - lowestLow else TrueRange(highestHigh, source, lowestLow);

def nATR = WildersAverage(trueRange, atrPeriod);

def upper = source + factor * nATR;

def lower = source - factor * nATR;

def lowerBand;

def upperBand;

def prevLowerBand = if lowerBand[1] then lowerBand[1] else lower;

def prevUpperBand = if upperBand[1] then upperBand[1] else upper;

lowerBand = if lower > prevLowerBand or source[1] < prevLowerBand then lower else prevLowerBand;

upperBand = if upper < prevUpperBand or source[1] > prevUpperBand then upper else prevUpperBand;

def trendDirection;

def supertrendValue;

def prevSupertrend = if isNaN(supertrendValue[1]) then upper else supertrendValue[1];

if nATR[1]==0 {

trendDirection = 1;

} else if prevSupertrend == prevUpperBand {

trendDirection = if source > upperBand then -1 else 1;

} else {

trendDirection = if source < lowerBand then 1 else -1;

}

supertrendValue = if trendDirection == -1 then lowerBand else upperBand;

plot ST = if supertrendValue then supertrendValue else Double.NaN;

plot dir = if trendDirection then trendDirection else Double.NaN;

}

#// Calculating RSI

def nRSI = RSI(Price = src, Length = rsiLength);

def rsiValue = if SmoothRsi then HullMovingAvg(nRSI, smoothingLength) else nRSI;

def rsiMovingAverage;

switch (movingAverageType) {

case "SMA" :

rsiMovingAverage = Average(rsiValue, movingAverageLength);

case "EMA" :

rsiMovingAverage = ExpAverage(rsiValue, movingAverageLength);

case "SMMA (RMA)" :

rsiMovingAverage = WildersAverage(rsiValue, movingAverageLength);

case "WMA" :

rsiMovingAverage = WMA(rsiValue, movingAverageLength);

case "VWMA" :

rsiMovingAverage = VWMA(rsiValue, movingAverageLength, vol);

default :

rsiMovingAverage = HullMovingAvg(rsiValue, movingAverageLength);

}

#// Calculating Supertrend based on RSI values

def rsiST = Supertrend(trendFactor, atrLength, rsiValue).ST;

def Dir = Supertrend(trendFactor, atrLength, rsiValue).DIR;

#/ Plotting

plot supertrend = rsiST; # "Supertrend"

plot rsiMa = if showMovingAverage then rsiMovingAverage else na;

plot overboughtLine = if last then na else overbought;

plot oversoldLine = if last then na else oversold;

plot midLine = if last then na else (overboughtLine + oversoldLine) / 2;

supertrend.AssignValueColor(if Dir == -1 then GlobalColor("Up") else GlobalColor("Dn"));

rsiMa.SetDefaultColor(Color.GRAY);

midLine.SetStyle(Curve.SHORT_DASH);

overboughtLine.SetLineWeight(2);

oversoldLine.SetLineWeight(2);

midLine.SetDefaultColor(Color.DARK_GRAY);

overboughtLine.AssignValueColor(if rsiValue>=overbought then GlobalColor("Dn") else

if rsiValue<=midLine then Color.DARK_GRAY else CreateColor(rsiValue * 2.55, rsiValue/3, 0));

oversoldLine.AssignValueColor(if rsiValue<=oversold then GlobalColor("Up") else

if rsiValue>=midLine then Color.DARK_GRAY else CreateColor(0, rsiValue * 2.55, rsiValue*1.5));

AssignPriceColor(if !colorBars then Color.CURRENT else

if rsiValue>=overbought then GlobalColor("Up") else

if rsiValue<=oversold then GlobalColor("Dn") else CreateColor(255 - rsiValue * 2.55,rsiValue * 2.55, rsiValue*2));

#// Filling

AddCloud(overboughtLine, oversoldLine, GlobalColor("bg")); # "Overbought/Oversold Fill"

AddCloud(if Dir == 1 then supertrend else na, rsiValue, Color.DARK_RED); # "Trend Fill"

AddCloud(if Dir == 1 then na else rsiValue, supertrend, Color.DARK_GREEN); # "Trend Fill"

AddCloud(if Dir == 1 then supertrend else na, (supertrend+rsiValue)/2, Color.LIGHT_RED); # title="Trend Fill")

AddCloud(if Dir == 1 then na else (supertrend+rsiValue)/2, supertrend, Color.LIGHT_GREEN); # title="Trend Fill")

#// Char plotting for crossover and crossunder

def bgcrossDn = cross and (rsiST > overbought) and (rsiST > rsiValue);

def bgcrossUp = cross and (rsiST < oversold) and (rsiST < rsiValue);

def bgUp = obos and (rsiST > overbought) and Dir==-1;

def bgDn = obos and (rsiST < oversold) and Dir== 1;

def SigDnS1 = cross and (rsiST > rsiValue) and rsiST > overbought;

def sigUpS1 = cross and (rsiST < rsiValue) and rsiST < oversold;

def SigDnS2 = obos and (rsiST < oversold) and rsiST < rsiST[1] and Dir==1;

def sigUpS2 = obos and (rsiST > overbought) and rsiST > rsiST[1] and Dir==-1;

def sigUp1 = (sigUpS1 and !sigUpS1[1]) or (sigUpS2 and !sigUpS2[1]);

def sigDn1 = (SigDnS1 and !sigDnS1[1]) or (SigDnS2 and !sigDnS2[1]);

plot SigDn = if sigDn1 then 85 else na; # "Crossover Down"

plot sigUp = if sigUp1 then 85 else na; # "Crossunder Up"

SigDn.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

SigUp.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

SigDn.SetDefaultColor(Color.RED);

sigUp.SetDefaultColor(Color.GREEN);

AddCloud(if bgcrossDn or bgcrossDn[-1] then pos else na, neg, Color.DARK_RED);

AddCloud(if bgcrossUp or bgcrossUp[-1] then pos else na, neg, Color.DARK_GREEN);

AddCloud(if bgDn or bgDn[-1] then pos else na, neg, Color.DARK_RED);

AddCloud(if bgUp or bgUp[-1] then pos else na, neg, Color.DARK_GREEN);

#-- END of CODE