Author Message:

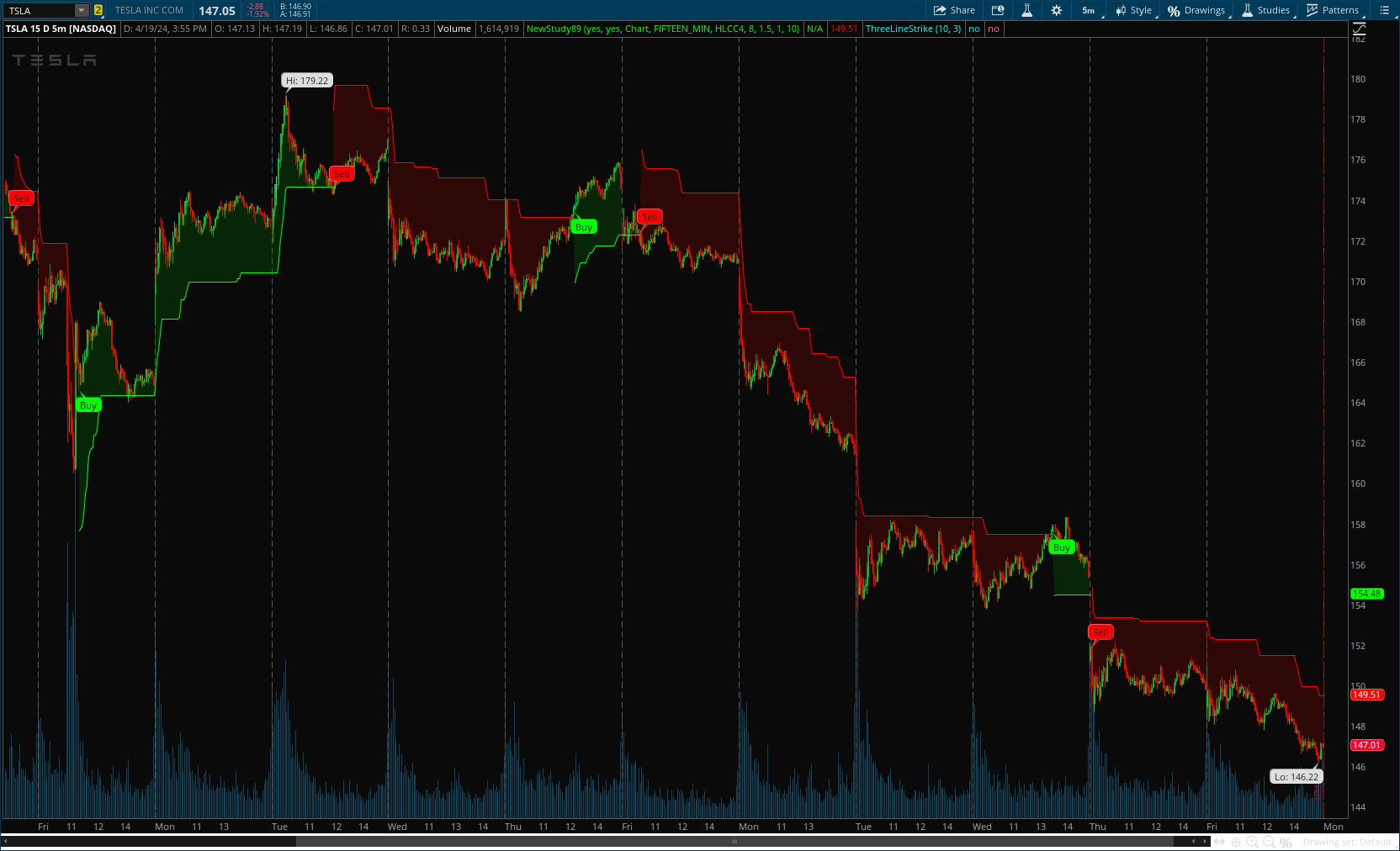

Developed this TP/SL and eventually made it into a full fledge strategy and found it did well enough to publish. This strategy can be used as a standalone or tacked onto another strategy as a TP/SL. It does function as both with a single line. This strategy has been tested with TSLA , AAPL, NVDA, on the 15 minutes timeframe.

STRATEGY:

Using the source , when it crosses up or down relative to the selected band, we enter a long or short respectively.

This may not be the most superb independent strategy, but it can be very useful as a TP/SL for your chosen entry conditions, especially in volatile markets or tickers.

More Details: https://www.tradingview.com/v/hZLgJ29l/

CODE:

CSS:

#https://www.tradingview.com/v/hZLgJ29l/

#//@joseph_lemery

#strategy("RSI Trend Reversal", "RSI and ATR Trend Reversal SL/TP")

# Converted by Sam4Cok@Samer800 - 04/2024

#//INPUTS

input showSignals = yes;

input showCloud = yes;

input timeframe = {default "Chart", "Manual"};

input manualTimeframe = AggregationPeriod.FIFTEEN_MIN;

input source = {default "Close", "HL2", "HLC3", "OHLC4", "HLCC4"}; # "Source Input"

input trendLenght = 8; # "Lenght"

input Multiplier = 1.50; # "Multiplier"

input DelayToPreventIdealization = 1; # "Delay to prevent idealization"

input MinimumDifference = 10; # "Minimum Difference"

def na = Double.NaN;

def last = IsNaN(close);

def src;

def hi;

def cl;

def lo;

def op;# = close(Period = tf); #(open + high + low + close) / 4;

switch (timeframe) {

case "Manual" :

src = ohlc4(Period = manualTimeframe); #Fundamental(FundamentalType = FundamentalType.OHLC4, Period = manualTimeframe);

op = open(Period = manualTimeframe);

hi = high(Period = manualTimeframe);

cl = close(Period = manualTimeframe);

lo = low(Period = manualTimeframe);

default :

src = ohlc4; #Fundamental(FundamentalType = source);

op = open;

hi = high;

cl = close;

lo = low;

}

def haClose = src;

def haOpen = CompoundValue(1, (haOpen[1] + haClose[1]) / 2, (op + cl) / 2);

def haHigh = Max(Max(hi, haOpen), haClose);

def haLow = Min(Min(lo, haOpen), haClose);

#"Close", "HL2", "HLC3", "OHLC4", "HLCC4"

def hclose;

switch (source) {

case "HL2":

hclose = (haHigh + haLow) / 2;

case "HLC3" :

hclose = (haHigh + haLow + haClose) / 3;

case "OHLC4" :

hclose = (haOpen + haHigh + haLow + haClose) / 4;

case "HLCC4" :

hclose = (haHigh + haLow + haClose + haClose) / 4;

default :

hclose = haClose;

}

#/FUNCTION INITILIZATION

script highest_custom {

input src = close;

input len = 8;

# def src = if !isNaN(source) then source else src[1];

def length = if IsNaN(len) then 0 else len;

def x = fold i = 0 to length with p = src do

if GetValue(src, i) > p then GetValue(src, i) else p;

plot out = x;

}

script lowest_custom {

input src = close;

input len = 8;

# def src = if !isNaN(source) then source else src[1];

def length = if IsNaN(len) then 0 else len;

def x = fold i = 0 to length with p = src do

if GetValue(src, i) < p then GetValue(src, i) else p;

plot out = x;

}

script rsilev {

input src = close;

input length = 8;

input mult = 1.5;

input sltp = 10;

input natr = 1;

def na = Double.NaN;

def bar = BarNumber();

def sl = (100 - sltp) / 100;

def tp = (100 + sltp) / 100;

def crossup; # = na

def crossdn; # = na

def crossup1 = if IsNaN(crossup[1]) then 0 else crossup[1];

def crossdn1 = if IsNaN(crossdn[1]) then 0 else crossdn[1];

def BullGuy = if (crossup[1] or crossdn[1]) then 0 else BullGuy[1] + 1;

def BearGuy = if IsNaN(BullGuy) then BearGuy[1] + 1 else BullGuy;

def rsilower = RSI(Price = src, Length = length);

def rsiupper = AbsValue(100 - rsilower);

def atr = natr / src;

def hi = highest_custom(src, BearGuy);

def lo = lowest_custom(src, BearGuy);

def hiBear = hi * (1 - (atr + (1 / rsilower * mult)));

def loBear = lo * (1 + (atr + (1 / rsiupper * mult)));

def hhiBear = highest_custom(hiBear, BearGuy);

def lloBear = lowest_custom(loBear, BearGuy);

def maxHi = Max(hhiBear, src * sl);

def minLo = Min(lloBear, src * tp);

def lower = highest_custom(maxHi, BearGuy);

def upper = lowest_custom(minLo, BearGuy);

def direction = if isNaN(direction[1]) then 1 else

if (crossdn1) then -1 else

if (crossup1) then 1 else direction[1];

def thresh = if bar < 1 then lower else

if direction == 1 then lower else

if direction == -1 then upper else thresh[1];

crossup = (src crosses above thresh);

crossdn = (src crosses below thresh);

plot trend = if IsNaN(thresh) then lower else thresh;

plot dir = if !direction then if(src>trend,1, -1) else direction;

}

def tick = tickSize();

def trRaw = TrueRange(hi, cl, lo);

def tr = if IsNaN(trRaw) then (hi - lo) else if trRaw <=0 then tick else trRaw;

def atr = WildersAverage(tr, trendLenght);

def rsiclose = rsilev(hclose, trendLenght, Multiplier, MinimumDifference, atr).trend;

def dir = rsilev(hclose, trendLenght, Multiplier, MinimumDifference, atr).dir;

#//PLOTTING

plot rsiTrendUp = if !last and dir>0 and rsiclose then rsiclose else na;

plot rsiTrendDn = if !last and dir<0 and rsiclose then rsiclose else na;

rsiTrendUp.SetDefaultColor(Color.GREEN);

rsiTrendDn.SetDefaultColor(Color.RED);

#-- Cloud

AddCloud(if showCloud then ohlc4 else na, rsiclose, Color.DARK_GREEN, Color.DARK_RED);

#/STRATEGY

def buy = (src crosses above rsiclose);

def sell = (src crosses below rsiclose);

def cntUp = if buy then 0 else cntUp[1] + 1;

def cntDn = if sell then 0 else cntDn[1] + 1;

def sigUp = cntUp == DelayToPreventIdealization;

def sigDn = cntDn == DelayToPreventIdealization;

AddChartBubble(showSignals and sigUp and !sigUp[1], low, "Buy", Color.GREEN, no);

AddChartBubble(showSignals and sigDn and !sigDn[1], high, "Sell", Color.RED);

#-- END of CODE