Intrinsic Knowledge

Member

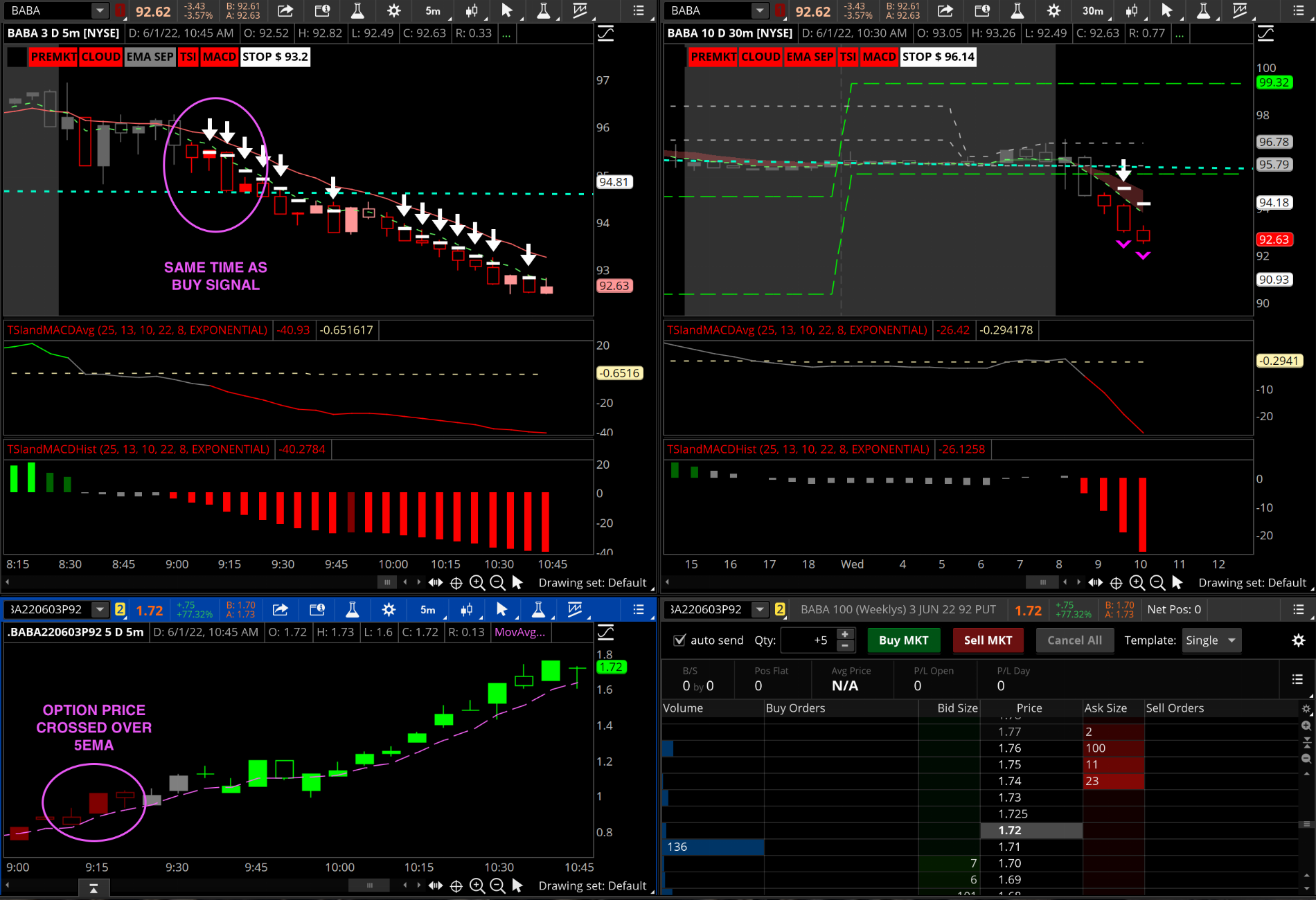

As I was saying this morning. I saw BABA was trending towards 5EMA, price was over-extended yesterday, histogram was trending down on 5 min and 30 min, VIX was going up, buy signal triggered, option price crossed 5EMA so I bought $92 Puts. Made 100%. Had to set a stop loss because I am at work and it triggered

Refer to the bottom of post# 1 for further explanation.

Edit. Go look at where the price bounced and tell me the 5EMA is not magic!

Hi bro, I think if you might want to consider to plot the daily EMA into the 5min or 30min TF so that you could refer to just 1 chart. Just my 2cents! Cheers bro, very much appreciated your sharing.