You should upgrade or use an alternative browser.

Standard Deviation Scan Label Watchlist for ThinkorSwim

- Thread starter shineeey

- Start date

proper readout.

Shared link: https://tos.mx/O5zdWV

wimberly398

New member

The point of the code is to get an alert when the mark crosses below the 1.8 standard deviation but it doesn't seem to be working once the alert is added.

Eventually I want to change it a bit more to become a scanner for stocks crossing below the 1.8 standard deviation, but that's once I get this kink worked out.

input price = close;

input deviation2 = 2.0;

input deviation1 = 1.8;

input fullRange = Yes;

input length = 21;

def regression;

def stdDeviation;

if (fullRange) {

regression = InertiaAll(price);

stdDeviation = StDevAll(price);

} else {

regression = InertiaAll(price, length);

stdDeviation = StDevAll(price, length);

}

plot UpperLine = regression + deviation2 * stdDeviation;

plot MiddleLine = regression;

plot LowerLine = regression - deviation2 * stdDeviation;

UpperLine.SetDefaultColor(GetColor(8));

MiddleLine.SetDefaultColor(GetColor(8));

LowerLine.SetDefaultColor(GetColor(8));

def regression1;

def stdDeviation1;

if (fullRange) {

regression1 = InertiaAll(price);

stdDeviation1 = StDevAll(price);

} else {

regression1 = InertiaAll(price, length);

stdDeviation1 = StDevAll(price, length);

}

plot UpperLine1 = regression1 + deviation1 * stdDeviation1;

plot MiddleLine1 = regression1;

plot LowerLine1 = regression1 - deviation1 * stdDeviation1;

Alert(pricetype.mark < UpperLine1, "BEARISH!", Alert.BAR, Sound.Bell);Side note for why I wanted to use mark was because I was planning on using longer term charts with something like 1day to 1 week aggregation period but I wanted to see about getting alerts on short aggregation periods.

So then I think I would just need something like close( period = AggregationPeriod.Hour) instead, right? Sorry, not at my thinkorswim computer, but I will test it later and let you know how it worked. I appreciate the help Ben.

Would that be possible to tweak this alert into a scanner ?

I would like to scan stocks with prices BELOW the Lowerline of the "StandardDevChannel" study (see picture below)

I tried but I don't have results so I guess I am not doing the correct settings.

I'm new in the script and tweaking world, don't be rude to me lol. Thank you

drakoniano

New member

Thanks a lot

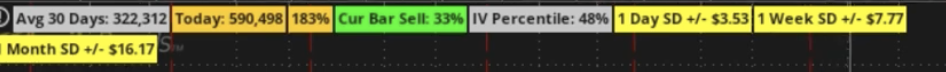

I have seen a few posts on Standard Deviations but nothing conclusive. I am looking for help to build a watchlist with alerts around standard deviations.

I have a watchlist of 200 tickers that I trade normally. I dont trade all of them but watch them on a regular basis.

I am on a Today/1 Minute chart for most of these and am looking to scalp them.

I would like to have two things

1) a Watchlist that would have the following columns

Ticker/Last//%change/Volume which are standard. Now for the custom columns,

Ydays Low, Todays Low, 1STD-LOW/2-STD-LOW, 1-STD-HIGH/2-STD-HIGH, ORB-HIGH, ORB-LOW.

2) An alert when any of the tickers on the watchlist reach 2-STD-LOW OR 2-STD-HIGH.

Wondering if one could guide me in here.

Thanks in advance.

Here is the correct below for what you asked, please not that it will catch crossings, personally i prefer to use the is less than or equal to feature incase there are "jumps" "gaps" in price movement that will trick the scanner. just my personal opinion based of prior experiences with "crossing" on tos

Gogoisgone, know one knows what hi-1-std is or what study you are referring to.

def price = close;

def deviations = 2.0;

def fullRange = Yes;

def length = 21;

def regression;

def stdDeviation;

if (fullRange) {

regression = InertiaAll(price);

stdDeviation = stdevAll(price);

} else {

regression = InertiaAll(price, length);

stdDeviation = stdevAll(price, length);

}

def UpperLine = regression + deviations * stdDeviation;

def MiddleLine = regression;

def LowerLine = regression - deviations * stdDeviation;

plot scan = close is greater than or equal to lowerline;Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

-

-

-

-

Deviation Scaled VWAP with Fractal Energy for ThinkorSwim

- Started by horserider

- Replies: 45

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

-

-

Deviation Scaled VWAP with Fractal Energy for ThinkorSwim

- Started by horserider

- Replies: 45

Similar threads

-

-

-

-

-

Deviation Scaled VWAP with Fractal Energy for ThinkorSwim

- Started by horserider

- Replies: 45

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/