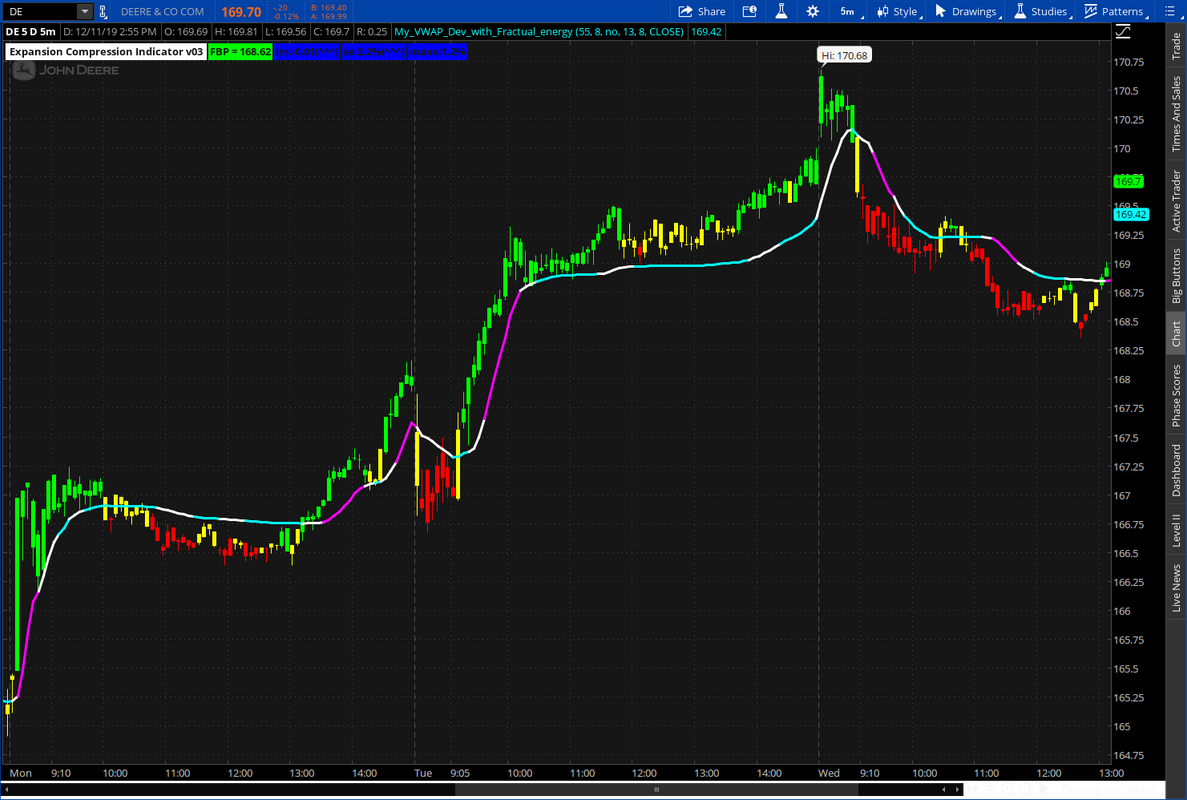

For VWAP and Fractual Energy fans. Deviation scaled MA of the VWAP. You can adjust the length to fit your trading. The fractual energy is added as a coloring of the plot line. The FE does not give an indication of direction. It shows energy of the trend. Magenta is an exhaustion in the trend

(below .382). Cyan is a compression or squeeze ( above .618) and may hint a breakout one way or the other may occur.

(below .382). Cyan is a compression or squeeze ( above .618) and may hint a breakout one way or the other may occur.

Code:

# Deviation Scaled VWAP with Fractual Energy Coloring.

# Adapted from ToS DSMA

# Mobius FE added with two choices of coloring in the code,

# < > .5

# and > .618 between and below .382

#

# Horserider 12/1/2019

input length = 55;

def zeros = vwap - vwap[2];

def filter = reference EhlersSuperSmootherFilter(price = zeros, "cutoff length" = 0.5 * length);

def rms = Sqrt(Average(Sqr(filter), length));

def scaledFilter = filter / rms;

def alpha = 5 * AbsValue(scaledFilter) / length;

def deviationScaledVWAP = CompoundValue(1, alpha * vwap + (1 - alpha) * deviationScaledVWAP[1], vwap);

#Inputs:

input nFE = 8;#hint nFE: length for Fractal Energy calculation.

input AlertOn = no;

input Glength = 13;

input betaDev = 8;

input data = close;

def w = (2 * Double.Pi / Glength);

def beta = (1 - Cos(w)) / (Power(1.414, 2.0 / betaDev) - 1 );

def alphafe = (-beta + Sqrt(beta * beta + 2 * beta));

def Go = Power(alphafe, 4) * open +

4 * (1 – alphafe) * Go[1] – 6 * Power( 1 - alphafe, 2 ) * Go[2] +

4 * Power( 1 - alphafe, 3 ) * Go[3] - Power( 1 - alphafe, 4 ) * Go[4];

def Gh = Power(alphafe, 4) * high +

4 * (1 – alphafe) * Gh[1] – 6 * Power( 1 - alphafe, 2 ) * Gh[2] +

4 * Power( 1 - alphafe, 3 ) * Gh[3] - Power( 1 - alphafe, 4 ) * Gh[4];

def Gl = Power(alphafe, 4) * low +

4 * (1 – alphafe) * Gl[1] – 6 * Power( 1 - alphafe, 2 ) * Gl[2] +

4 * Power( 1 - alphafe, 3 ) * Gl[3] - Power( 1 - alphafe, 4 ) * Gl[4];

def Gc = Power(alphafe, 4) * data +

4 * (1 – alphafe) * Gc[1] – 6 * Power( 1 - alphafe, 2 ) * Gc[2] +

4 * Power( 1 - alphafe, 3 ) * Gc[3] - Power( 1 - alphafe, 4 ) * Gc[4];

# Variables:

def o;

def h;

def l;

def c;

def CU1;

def CU2;

def CU;

def CD1;

def CD2;

def CD;

def L0;

def L1;

def L2;

def L3;

# Calculations

o = (Go + Gc[1]) / 2;

h = Max(Gh, Gc[1]);

l = Min(Gl, Gc[1]);

c = (o + h + l + Gc) / 4;

def gamma = Log(Sum((Max(Gh, Gc[1]) - Min(Gl, Gc[1])), nFE) /

(Highest(Gh, nFE) - Lowest(Gl, nFE)))

/ Log(nFE);

L0 = (1 – gamma) * Gc + gamma * L0[1];

L1 = -gamma * L0 + L0[1] + gamma * L1[1];

L2 = -gamma * L1 + L1[1] + gamma * L2[1];

L3 = -gamma * L2 + L2[1] + gamma * L3[1];

if L0 >= L1

then {

CU1 = L0 - L1;

CD1 = 0;

} else {

CD1 = L1 - L0;

CU1 = 0;

}

if L1 >= L2

then {

CU2 = CU1 + L1 - L2;

CD2 = CD1;

} else {

CD2 = CD1 + L2 - L1;

CU2 = CU1;

}

if L2 >= L3

then {

CU = CU2 + L2 - L3;

CD = CD2;

} else {

CU = CU2;

CD = CD2 + L3 - L2;

}

plot DSVWAP = deviationScaledVWAP;

#DSVWAP.SetDefaultColor(GetColor(1));

#DSVWAP.DefineColor("Up", GetColor(1));

#DSVWAP.DefineColor("Down", GetColor(0));

#DSVWAP.AssignValueColor(if gamma < .5 then DSVWAP.Color("Down") else DSVWAP.Color("Up"));

DSVWAP.AssignValueColor(if gamma > .618 then Color.CYAN else

if gamma < .382 then Color.MAGENTA else Color.WHite);

Last edited: