One thing I forgot to mention. I used the famous Mobius TMO for that call. It had bottomed out and it was also crossing it's midline. If I would've seen the TMO, I wouldn't have taken the put. It was nearly at the bottom of it's range. So, maybe something to consider to filter out false signals. I'm going to keep testing. Props on the strategy. It's pretty solid@king_louie I'm still kicking myself for not getting in that call signal at 3:30ET today....the premium I looked at first was $11.20 and it went all the way to $19.00!! I've always been hesitant about getting in one that late in the day.

And 12:20 your time was at the bottom for that put...i noticed that put too, but didn't go down like i wished it had. As far as entry, its best to see "daylight" between the dot and the zero line.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SPX Trading Strategy for ThinkorSwim

- Thread starter Hypoluxa

- Start date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Hypoluxa

Well-known member

I'm currently working on a tighter and easier to enter strategy for both SPX calls and puts. I'll try to get it posted this weekend or at least Monday since the market is closed.One thing I forgot to mention. I used the famous Mobius TMO for that call. It had bottomed out and it was also crossing it's midline. If I would've seen the TMO, I wouldn't have taken the put. It was nearly at the bottom of it's range. So, maybe something to consider to filter out false signals. I'm going to keep testing. Props on the strategy. It's pretty solid

Nice! Can't wait to try it outI'm currently working on a tighter and easier to enter strategy for both SPX calls and puts. I'll try to get it posted this weekend or at least Monday since the market is closed.

Trader_Rich

Member

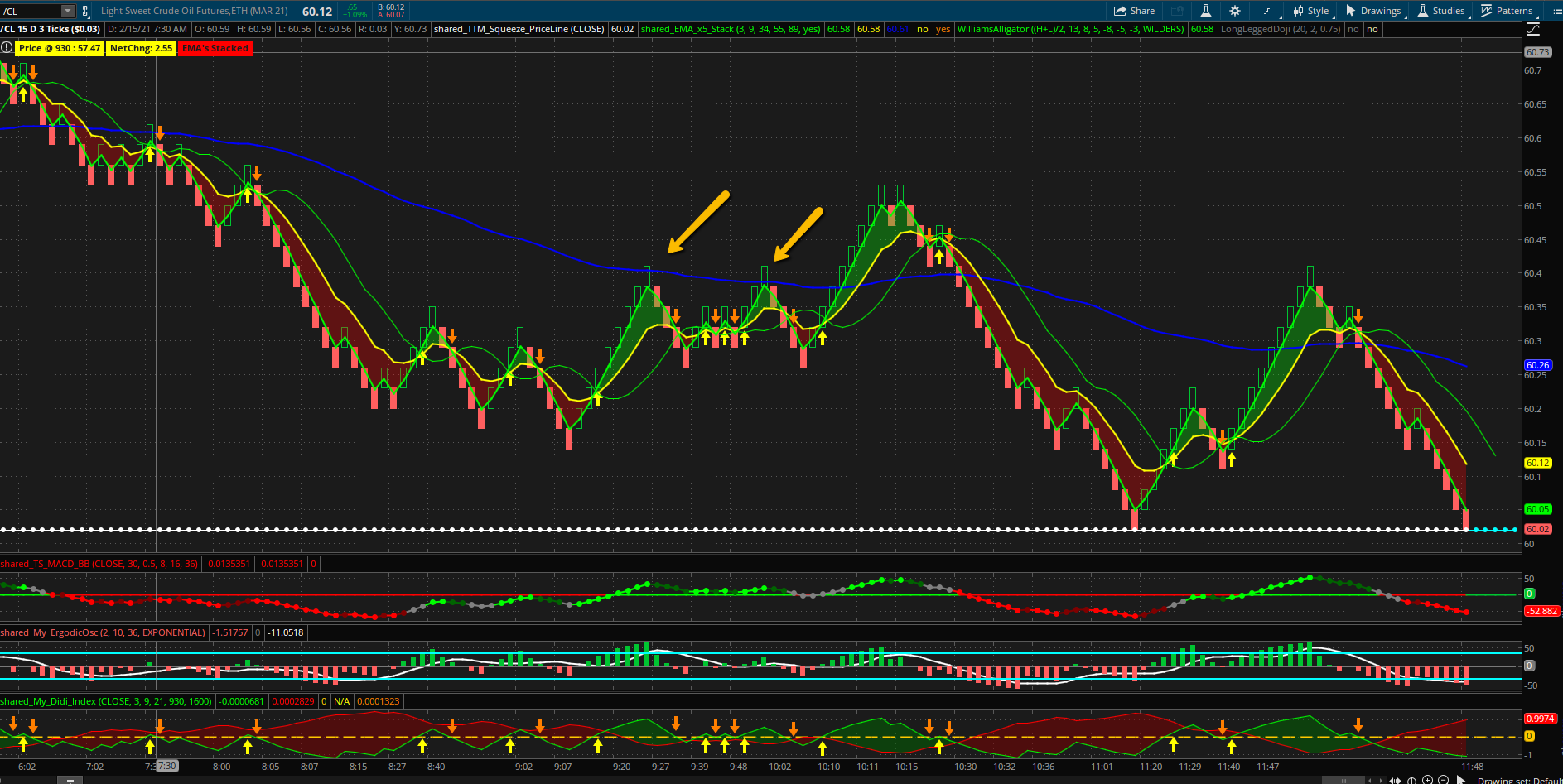

@Hypoluxa Do you wait to take a long or short once the EMA 1&2 (lengths of 3 & 9) have crossed the EMA 5, given that all of the other conditions are met? I had 2 trades today on /CL that were stopped out and am wondering if waiting for the 1 and/or 2 to cross the 5 was something I had missed out on. I've attached a screenshot below with arrows pointing to the two trades that stopped me out.

Last edited by a moderator:

Hypoluxa

Well-known member

Hi @Trader_Rich ....If you're using this for something other than SPX...I can't answer that for you. And i don't use an EMA 5.

Trader_Rich

Member

The 5th EMA is the 89 Length. I should have clarified that.

Hypoluxa

Well-known member

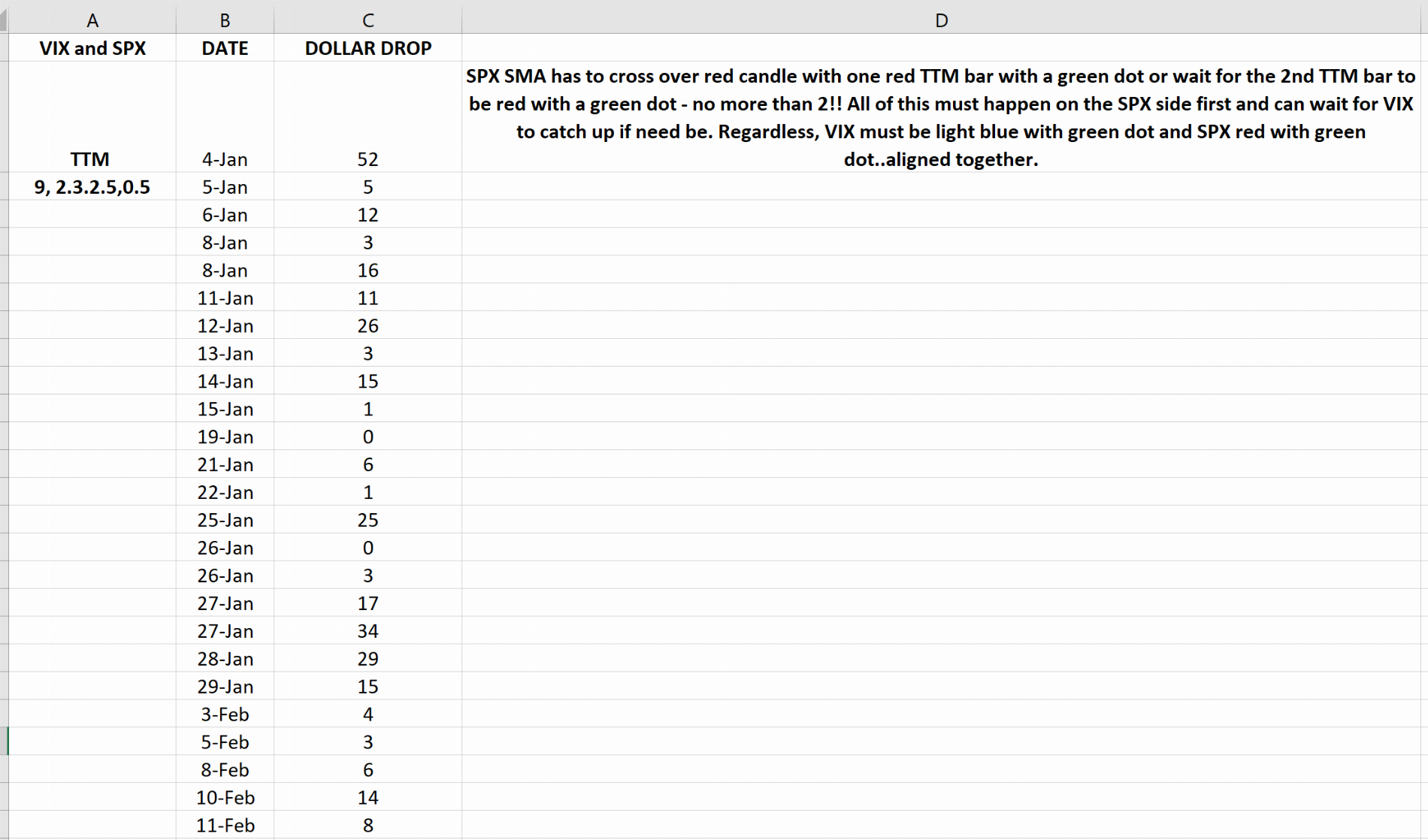

I've done a complete revamp of SPX...but for PUTS ONLY. It's really hard to dial in calls for this one. Watch this setup this week and see what you think. I've attached a spreadsheet with the dollar amount each day it triggered a signal.Nice! Can't wait to try it out

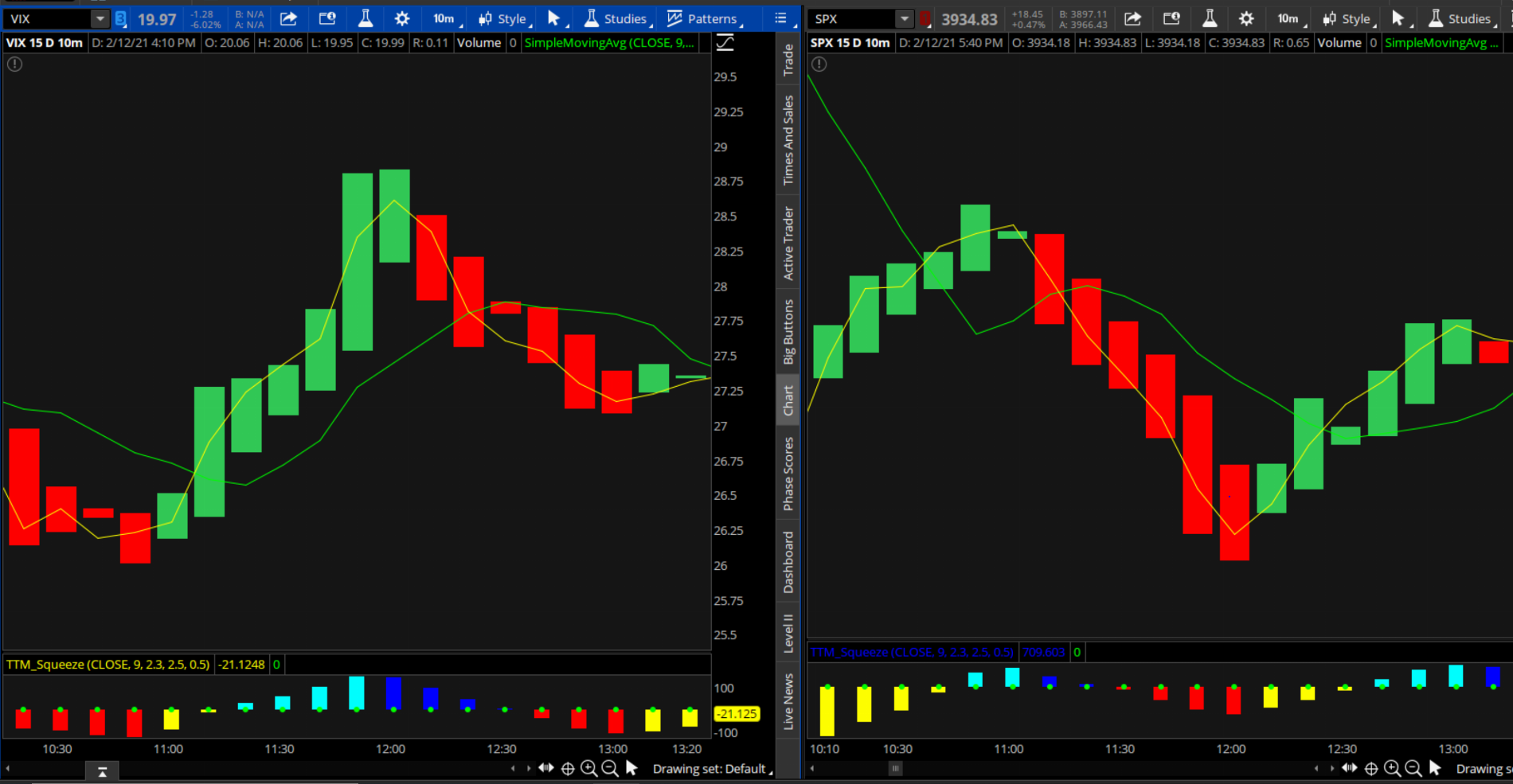

You will need to have VIX pulled up on one screen and SPX on another....both 1day 10mins. VIX and SPX are inverted from each other, so make sure VIX has a green candle with a light blue TTM bar with a green dot on top....SPX will need a red candle with red TTM bar and green dot. The TOS screenshot, you will see the alignment at 11:30. SMA 3 and 9....TTM Squeeze 9, 2.3, 2.5, 0.5

And yes....there are some single digit days....but we all have to live with that risk in order to hit the big ones.

Hypoluxa

Well-known member

Sure thing. Here’s the link to the original post from Ben.@Hypoluxa:

Thank you! I'm gonna try this strategy tomorrow. Can you please post code for MACDBB Zero line, I like the color change. Appreciate it

https://usethinkscript.com/threads/macd-with-bollinger-bands-indicator-for-thinkorswim.287/

@Hypoluxa

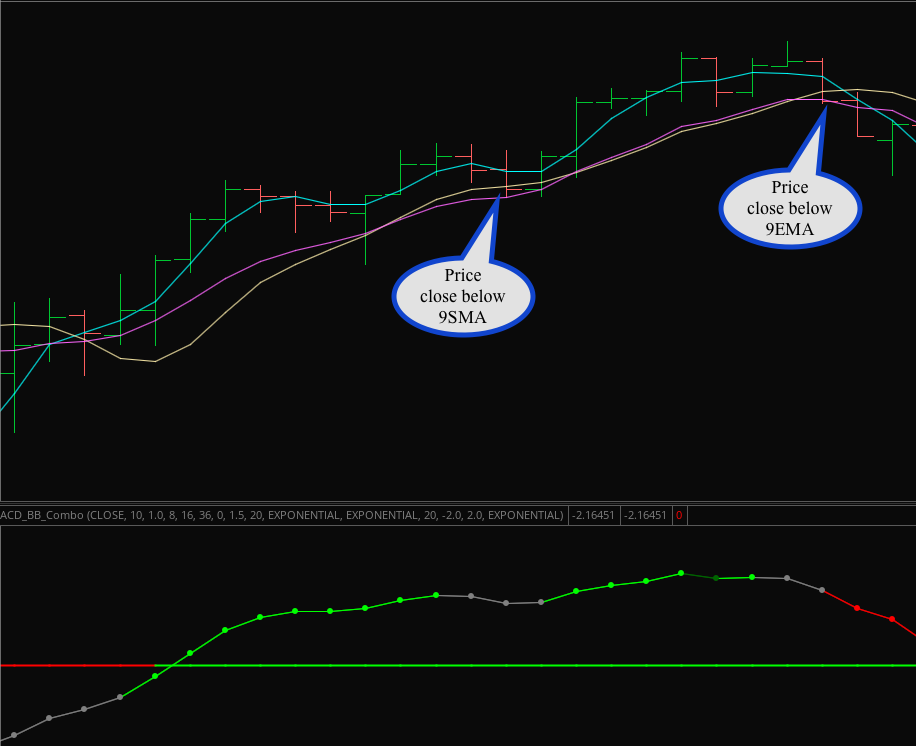

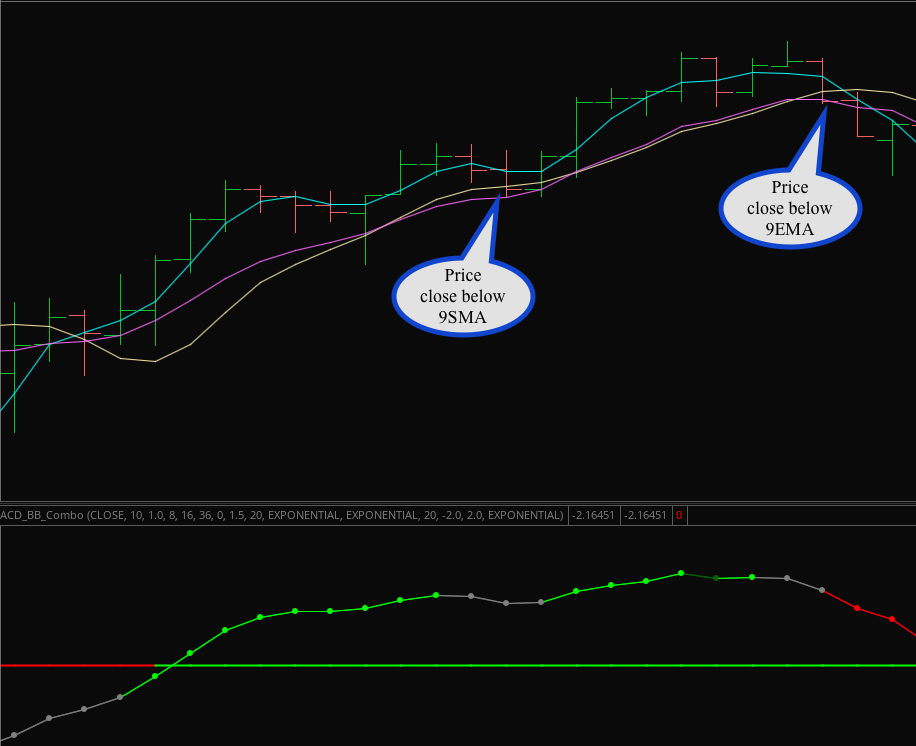

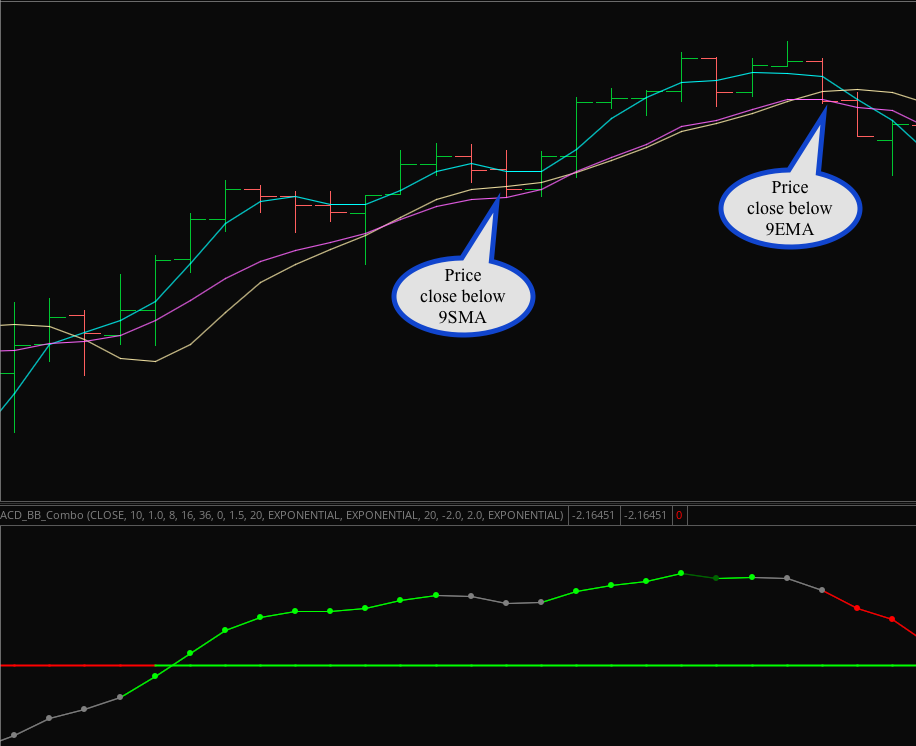

Not sure you mentioned the exit plan for this strategy. I figured your exits are either at MA crossovers ( late profit target, allowing to leave the money on table ) or gray MACD dots or price close below 9SMA? Please correct me if i'm wrong on my assumptions.

Played around and found these below settings to get almost the same entry as per your settings, but allowing to extend the profit run to max (almost $5 extra! in this test on SPX). Neither to wait for MA cross nor panic to exit early for minor pull backs or for gray MACD dots. I used bar graph for better visual clarity on OHLC's.

Adjusted setting : Slow MA = 9 EMA instead of 9 SMA.

Long Entry: Same as per your guide lines (MA cross and the MACD green dot is at or above zero line)

Long Exit: Let it run its course till the price closes below 9EMA. 9EMA acts like a support for pull backs and can be used as a trailing stop as-well.

For Short: Opposite of Long

Screen shot below for reference:

Cyan: 3 SMA

Yellow: 9SMA

Magenta: 9EMA

Not sure you mentioned the exit plan for this strategy. I figured your exits are either at MA crossovers ( late profit target, allowing to leave the money on table ) or gray MACD dots or price close below 9SMA? Please correct me if i'm wrong on my assumptions.

Played around and found these below settings to get almost the same entry as per your settings, but allowing to extend the profit run to max (almost $5 extra! in this test on SPX). Neither to wait for MA cross nor panic to exit early for minor pull backs or for gray MACD dots. I used bar graph for better visual clarity on OHLC's.

Adjusted setting : Slow MA = 9 EMA instead of 9 SMA.

Long Entry: Same as per your guide lines (MA cross and the MACD green dot is at or above zero line)

Long Exit: Let it run its course till the price closes below 9EMA. 9EMA acts like a support for pull backs and can be used as a trailing stop as-well.

For Short: Opposite of Long

Screen shot below for reference:

Cyan: 3 SMA

Yellow: 9SMA

Magenta: 9EMA

Last edited:

shivpatel582

New member

@HypoluxaI've done a complete revamp of SPX...but for PUTS ONLY. It's really hard to dial in calls for this one. Watch this setup this week and see what you think. I've attached a spreadsheet with the dollar amount each day it triggered a signal.

You will need to have VIX pulled up on one screen and SPX on another....both 1day 10mins. VIX and SPX are inverted from each other, so make sure VIX has a green candle with a light blue TTM bar with a green dot on top....SPX will need a red candle with red TTM bar and green dot. The TOS screenshot, you will see the alignment at 11:30. SMA 3 and 9....TTM Squeeze 9, 2.3, 2.5, 0.5

And yes....there are some single digit days....but we all have to live with that risk in order to hit the big ones.

If possible, can you please provide a link to this chart set up.

Hypoluxa

Well-known member

Awesome, I’ll def be adding and watching this setup tomorrow too.@Hypoluxa

Not sure you mentioned the exit plan for this strategy. I figured your exits are either at MA crossovers ( late profit target, allowing to leave the money on table ) or gray MACD dots or price close below 9SMA? Please correct me if i'm wrong on my assumptions.

Played around and found these below settings to get almost the same entry as per your settings, but allowing to extend the profit run to max (almost $5 extra! in this test on SPX). Neither to wait for MA cross nor panic to exit early for minor pull backs or for gray MACD dots. I used bar graph for better visual clarity on OHLC's.

Adjusted setting : Slow MA = 9 EMA instead of 9 SMA.

Long Entry: Same as per your guide lines (MA cross and the MACD green dot is at or above zero line)

Long Exit: Let it run its course till the price closes below 9EMA. 9EMA acts like a support for pull backs and can be used as a trailing stop as-well.

For Short: Opposite of Long

Screen shot below for reference:

Cyan: 3 SMA

Yellow: 9SMA

Magenta: 9EMA

Hi Hypoluxa.....Hello everyone and Happy New year! I've come across another strategy that I wanted to share with you guys for SPX only.

Setup:

- 10 Min chart

- Heikin Ashi candles

- SMA 3/9

- MACD Bollinger Bands (the one Ben has posted on here a while back) 8,16,36 and uncheck "show plot" on the BB upper, BB lower and BB mid line. You will only be using the zero line, MACD dots and MACD Line for entry purposes. The inputs of "b length" and "bb num dev" are irrelevant here since you will remove the the plots that I mentioned.

- ErgodicOsc 2,10,36 (changed the default negative to red)

Option call logic:

1. The SMA's have to cross first.

2. For a call opportunity, you will then wait to see if the MACD dots cross above the MACD zero line. Its critical here to wait until one dot has cleared the zero line...you MUST see a gap....never enter with the dot on the line. Dots must be consistent as well...if its going up...then they must all be white...if a red dot populates between the time a white dot hits the zero line and the time one crosses clear....don't enter. I have a screenshot below showing this example - 13:00 a red dot appears.

3. The ErgodicOsc HAS to be green when the MACD dot crosses above the zero line. You can hold the trade most of the time until this turns from green to red....but I always set a sell limit just in case it whips back in the opposite direction.

Option put logic:

Obviously its the complete opposite of what I've described above for a call. BUT - the SMA's still have to cross first.

I backtested this 90 days and it came back with 95 opportunities. 75 were positive and 20 were breakeven or didn't move more than $1-$2 on the next candle before it changed to the opposite color candle.

For the positives, SPX only needs to move a minimum of $3 for the option premium to move to quick and decent profit. I generally buy 10 contracts with a delta of at least .35 or higher. So there were 75 times the past 90 days that SPX moved $3 or more (up or down) to be claimed a positive for me.

FYI - Since SPX doesn't begin trading until the opening bell, make sure you have your chart set to at least 1 day/10 mins. The 1 day will allow you to get a clear view of the chart and indicators, otherwise it will fill your entire screen if you use current day.

There's 2 opportunities on the attached screenshot: a put at 11:20 and a call at 14:10.

I hope those of you that trade SPX have the same success and feel free to ask questions regarding this strategy.

You mentioned in your first post of Jan 6 about this strategy that there were two opportunities one put at 11:20 and a call at 14:10 (your time). Please let me know why you did not buy a put at 11:40? Thanks

Bpositive

Bpositive, Let me take a shot at it  . I'm thinking Hypoluxa didn't take that trade because the market just emerged to be very slightly bullish before it made that move down at 11:20 time, notice the several MACDBB dots were already under and on Zero line. It didn't even cross above the zero line for that slight bullish move. So, perhaps he noticed that the market testing the S/R level there. The previous few MACD dots were sustained there on at Zero line confirming the S/R test. According to his theory, in this test case, only take the Put trade if the market bounced back immediately after the first dot on the zero line.

. I'm thinking Hypoluxa didn't take that trade because the market just emerged to be very slightly bullish before it made that move down at 11:20 time, notice the several MACDBB dots were already under and on Zero line. It didn't even cross above the zero line for that slight bullish move. So, perhaps he noticed that the market testing the S/R level there. The previous few MACD dots were sustained there on at Zero line confirming the S/R test. According to his theory, in this test case, only take the Put trade if the market bounced back immediately after the first dot on the zero line.

Ofcourse, @Hypoluxa, please correct me if I'm wrong on my analysis and understanding.

Ofcourse, @Hypoluxa, please correct me if I'm wrong on my analysis and understanding.

Last edited:

Hi BpositiveHi Hypoluxa.....

You mentioned in your first post of Jan 6 about this strategy that there were two opportunities one put at 11:20 and a call at 14:10 (your time). Please let me know why you did not buy a put at 11:40? Thanks

Bpositive

In the initial message, the put was purchased at 11:20. I understand you hold it until the target is met [price change >$3.00] or indicator changes. The MACDBB changed at 12:00 for a run of approx. $4, which is a succesful trade according to the rules. Wait for @Hypoluxa for validation of this interpretation.

Hypoluxa

Well-known member

At 11:40? If the signal was at 11:20....I’d never get in 20 mins later...one thing about trading that you never want to do....is chase the stock. I scalp options...so if I’m not in it at the exact moment the signal shows up...then I don’t get in it...especially not 20 mins later.Hi Hypoluxa.....

You mentioned in your first post of Jan 6 about this strategy that there were two opportunities one put at 11:20 and a call at 14:10 (your time). Please let me know why you did not buy a put at 11:40? Thanks

Bpositive

Hypoluxa

Well-known member

do you have the link for the MACDBB Combo? I only have the MACDBB@Hypoluxa

Not sure you mentioned the exit plan for this strategy. I figured your exits are either at MA crossovers ( late profit target, allowing to leave the money on table ) or gray MACD dots or price close below 9SMA? Please correct me if i'm wrong on my assumptions.

Played around and found these below settings to get almost the same entry as per your settings, but allowing to extend the profit run to max (almost $5 extra! in this test on SPX). Neither to wait for MA cross nor panic to exit early for minor pull backs or for gray MACD dots. I used bar graph for better visual clarity on OHLC's.

Adjusted setting : Slow MA = 9 EMA instead of 9 SMA.

Long Entry: Same as per your guide lines (MA cross and the MACD green dot is at or above zero line)

Long Exit: Let it run its course till the price closes below 9EMA. 9EMA acts like a support for pull backs and can be used as a trailing stop as-well.

For Short: Opposite of Long

Screen shot below for reference:

Cyan: 3 SMA

Yellow: 9SMA

Magenta: 9EMA

I named it like that in my studies repository when i saved it, its the same code you provided. Sorry for the confusion there.do you have the link for the MACDBB Combo? I only have the MACDBB

- Status

- Not open for further replies.

Ben's Swing Trading Strategy + Indicator

I wouldn't call this a course. My goal is zero fluff. I will jump right into my current watchlist, tell you the ThinkorSwim indicator that I'm using, and past trade setups to help you understand my swing trading strategy.

Similar threads

-

SPX 0 DTE Non-Directional Options Setup For ThinkOrSwim

- Started by Drum Rocker

- Replies: 7

-

Opinions: Profitable SPX Options Indicator/Strategy For ThinkOrSwim

- Started by epete

- Replies: 6

-

401k Market Timing SPX Strategy for ThinkorSwim

- Started by conceptcar3

- Replies: 3

-

SPX Fear & Greed Mean Reversion Strategy Indicator for ThinkorSwim

- Started by BenTen

- Replies: 10

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 24

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

687

Online

Similar threads

-

SPX 0 DTE Non-Directional Options Setup For ThinkOrSwim

- Started by Drum Rocker

- Replies: 7

-

Opinions: Profitable SPX Options Indicator/Strategy For ThinkOrSwim

- Started by epete

- Replies: 6

-

401k Market Timing SPX Strategy for ThinkorSwim

- Started by conceptcar3

- Replies: 3

-

SPX Fear & Greed Mean Reversion Strategy Indicator for ThinkorSwim

- Started by BenTen

- Replies: 10

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 24

Similar threads

-

SPX 0 DTE Non-Directional Options Setup For ThinkOrSwim

- Started by Drum Rocker

- Replies: 7

-

Opinions: Profitable SPX Options Indicator/Strategy For ThinkOrSwim

- Started by epete

- Replies: 6

-

401k Market Timing SPX Strategy for ThinkorSwim

- Started by conceptcar3

- Replies: 3

-

SPX Fear & Greed Mean Reversion Strategy Indicator for ThinkorSwim

- Started by BenTen

- Replies: 10

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 24

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.