You should upgrade or use an alternative browser.

SPX Trading Strategy for ThinkorSwim

- Thread starter Hypoluxa

- Start date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Hypoluxa

Well-known member

Good luck. And just so I'm clear once again.....this setup has only been tested on SPX. There is zero guarantee that it will carry over to another stock without doing some tweaks.GOOGL is just about there to meet your conditions, 10 mins chart. About to pull the trigger on a buy PUT in next 8 mins when the bar closes in favor.

Hypoluxa

Well-known member

indicators look good so farOk, took the trade. Lets see, will be a good test. hoping for a nice run

Entered trade: Open to buy 1 PUT contract of 5 mar 21, 2125 strike at $49.70; [all conditions met for the strategy]

Highest Option price yield at the peak of this run: $54.50, yielding a benefit of $480.00

Option value at Close to Sell 1 PUT contract is at: $51.30, yielding a benefit of $160.00

Although I closed the position due to EOD and at the time of my exit, price was hovering above 9EMA, at closing bell, the price moved down below 9EMA and the closing bar was clear from stop loss zone, so the position has not met the exit criteria yet and can still be open.

From a PnL perspective, on close: realized value $160/$4970 = ~ 3% yield

Potential yield: $480/$4970 = ~ 9.65 % yield

So I guess, we can easily set a profit target of 9 to 10% ROI and a trailing stop loss of close above 9EMA. Not bad at all.

That said, the strategy seems to be solid. Thanks much Hypoluxo for the strategy and a cool $160.00 to my pocket

Hope this test was of some use to the community here.

Below is the screen shot:

Current status:

Agreed@Sree That isn't scalping, that's torture... Take the profit when it presents itself as you may never see that level of profit again...

Hypoluxa

Well-known member

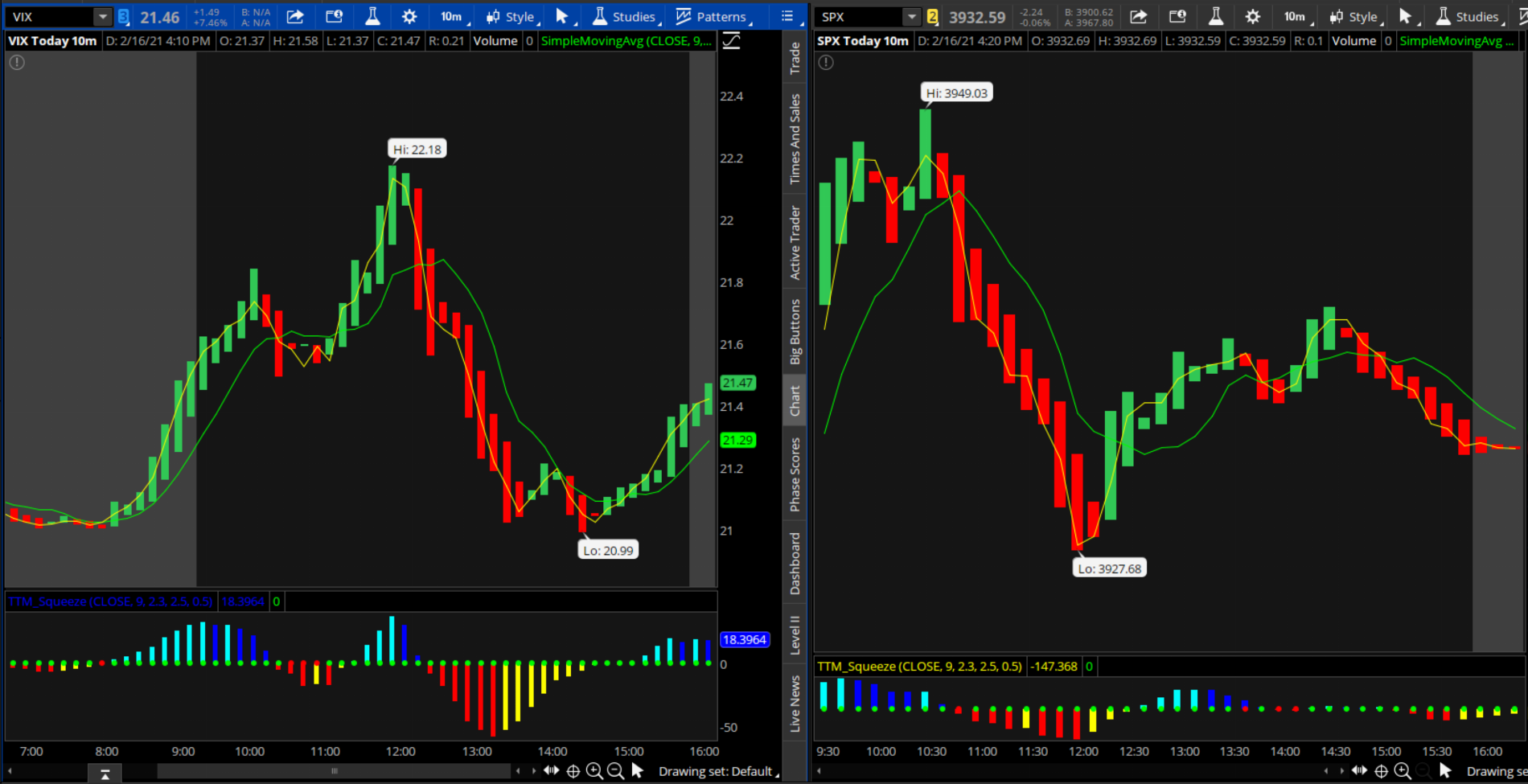

VIX and SPX lined up for a SPX put at 11:40ET ($6 SPK price drop) and again at 15:20ET ($3 SPX price drop). The $3 stock drop on a put premium I watched increased $2+.

Thank you for sharing your strategies. I am going to be doing some testing on the original post on SPX myself. My only issue is I’m trading from mobile on TOS. Do you know what changes the color of the dots on the MACDBB script?@king_louie the new setup I sent you worked twice today for SPX.

VIX and SPX lined up for a SPX put at 11:40ET ($6 SPK price drop) and again at 15:20ET ($3 SPX price drop). The $3 stock drop on a put premium I watched increased $2+.

This is the code:

(if MACD_Line > MACD_Line[1] then Color.White

else Color.DARK_RED);

But I’m unsure as the what the [1] is referencing in the script. If it’s something I can script for mobile or reference another way that would help! I asked Ben Ten in the original thread as well. Thanks!

Hypoluxa

Well-known member

No, sorry...I can't be much help with scripts or reading them. Good luck tho!Thank you for sharing your strategies. I am going to be doing some testing on the original post on SPX myself. My only issue is I’m trading from mobile on TOS. Do you know what changes the color of the dots on the MACDBB script?

This is the code:

(if MACD_Line > MACD_Line[1] then Color.White

else Color.DARK_RED);

But I’m unsure as the what the [1] is referencing in the script. If it’s something I can script for mobile or reference another way that would help! I asked Ben Ten in the original thread as well. Thanks!

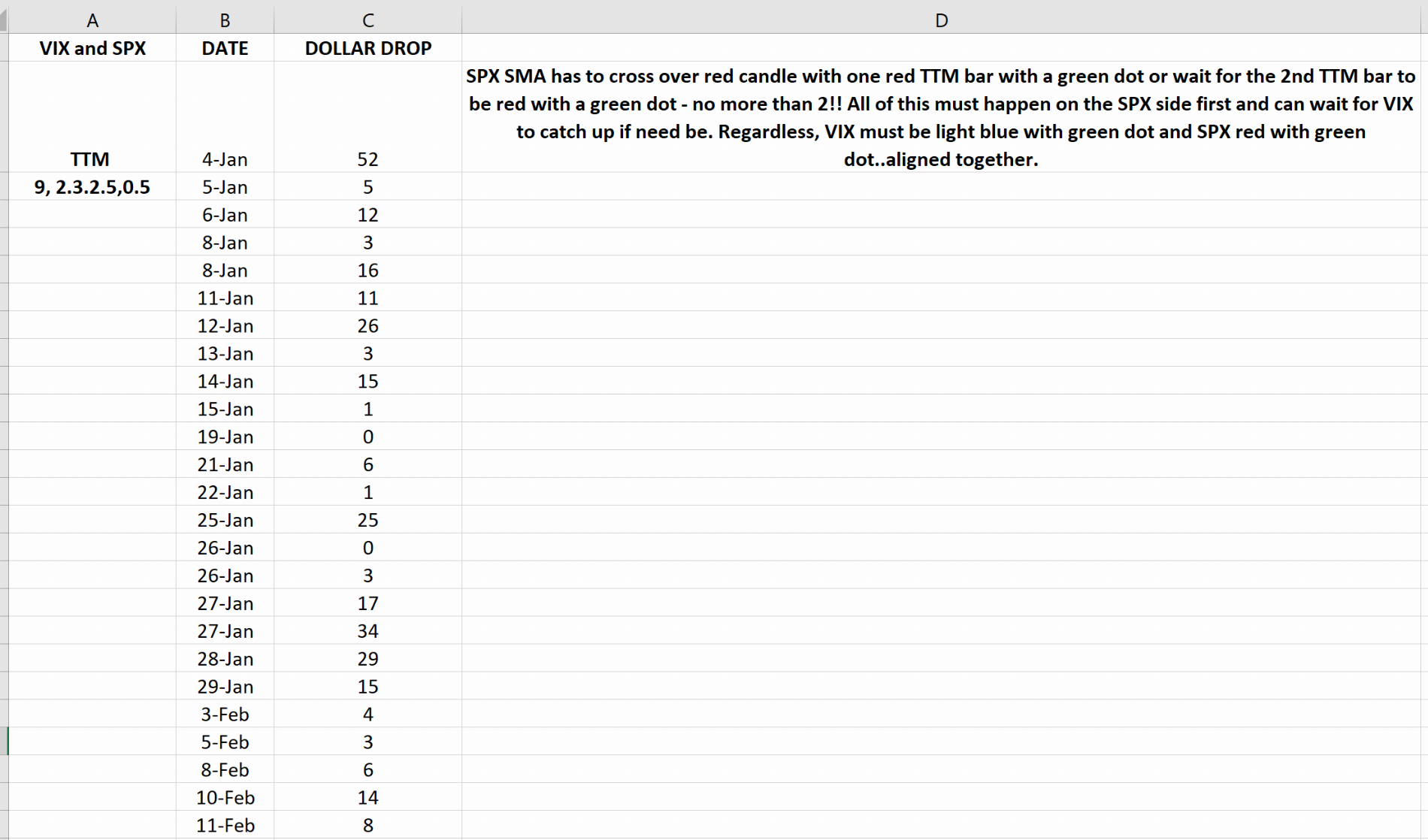

Sweet! My TOS was down for a few days (Torture!) Will keep an eye out for thisI've done a complete revamp of SPX...but for PUTS ONLY. It's really hard to dial in calls for this one. Watch this setup this week and see what you think. I've attached a spreadsheet with the dollar amount each day it triggered a signal.

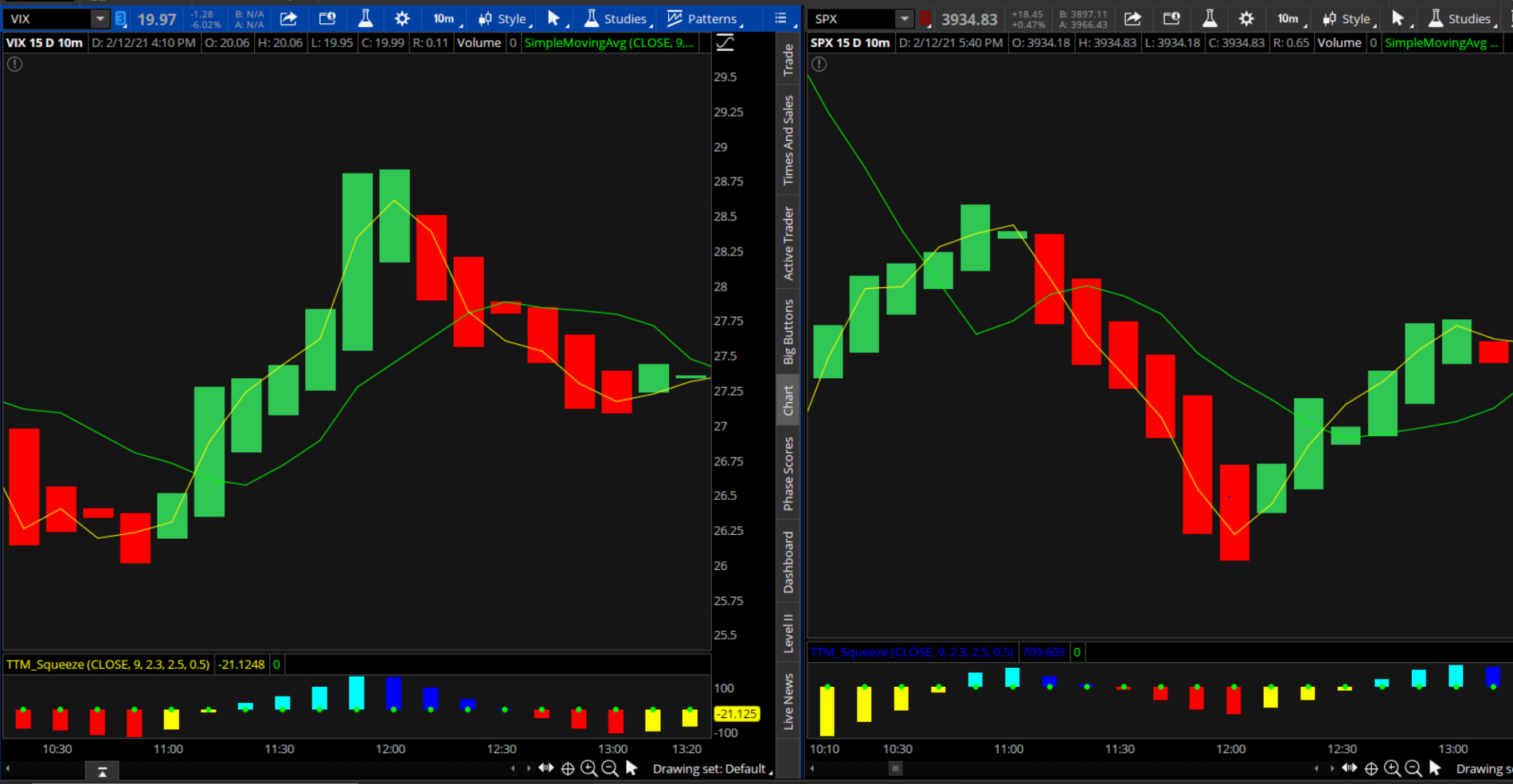

You will need to have VIX pulled up on one screen and SPX on another....both 1day 10mins. VIX and SPX are inverted from each other, so make sure VIX has a green candle with a light blue TTM bar with a green dot on top....SPX will need a red candle with red TTM bar and green dot. The TOS screenshot, you will see the alignment at 11:30. SMA 3 and 9....TTM Squeeze 9, 2.3, 2.5, 0.5

And yes....there are some single digit days....but we all have to live with that risk in order to hit the big ones.

- Status

- Not open for further replies.

Ben's Swing Trading Strategy + Indicator

I wouldn't call this a course. My goal is zero fluff. I will jump right into my current watchlist, tell you the ThinkorSwim indicator that I'm using, and past trade setups to help you understand my swing trading strategy.

Similar threads

-

SPX 0 DTE Non-Directional Options Setup For ThinkOrSwim

- Started by Drum Rocker

- Replies: 7

-

Opinions: Profitable SPX Options Indicator/Strategy For ThinkOrSwim

- Started by epete

- Replies: 6

-

401k Market Timing SPX Strategy for ThinkorSwim

- Started by conceptcar3

- Replies: 3

-

SPX Fear & Greed Mean Reversion Strategy Indicator for ThinkorSwim

- Started by BenTen

- Replies: 10

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 24

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

SPX 0 DTE Non-Directional Options Setup For ThinkOrSwim

- Started by Drum Rocker

- Replies: 7

-

Opinions: Profitable SPX Options Indicator/Strategy For ThinkOrSwim

- Started by epete

- Replies: 6

-

401k Market Timing SPX Strategy for ThinkorSwim

- Started by conceptcar3

- Replies: 3

-

SPX Fear & Greed Mean Reversion Strategy Indicator for ThinkorSwim

- Started by BenTen

- Replies: 10

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 24

Similar threads

-

SPX 0 DTE Non-Directional Options Setup For ThinkOrSwim

- Started by Drum Rocker

- Replies: 7

-

Opinions: Profitable SPX Options Indicator/Strategy For ThinkOrSwim

- Started by epete

- Replies: 6

-

401k Market Timing SPX Strategy for ThinkorSwim

- Started by conceptcar3

- Replies: 3

-

SPX Fear & Greed Mean Reversion Strategy Indicator for ThinkorSwim

- Started by BenTen

- Replies: 10

-

Repaints AGAIG Rinse & Repeat Trading For ThinkOrSwim

- Started by csricksdds

- Replies: 24

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/