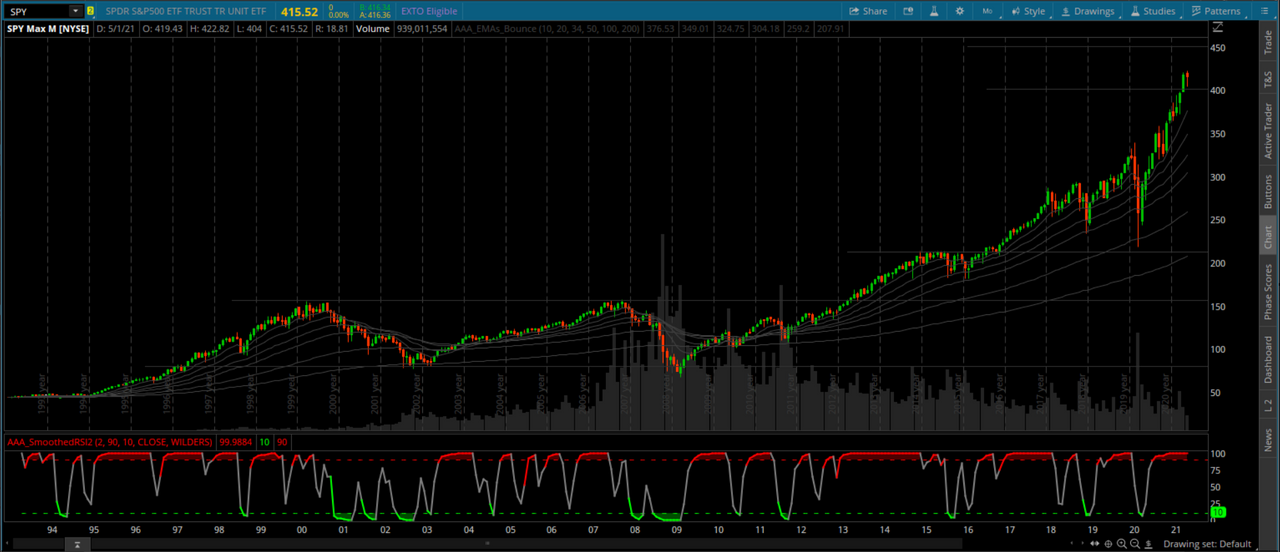

This indicator is a simple modification of the popular RSI, set to 2 periods and using a farther back price value to smooth out much of the chop in the RSI plot. It's been quite helpful to point out dip areas in uptrending stocks; I've yet to find a way to use it on the short side.

Code:

# Smoothed RSI2

# Pensar

# Created early 2020

# Released 05.18.2021 - V.1.0

# This indicator is an simple variation of the Connors 2-period RSI.

# It uses the third price value back to smooth the RSI plot.

declare lower;

input period = 2;

input over_bought = 90;

input over_sold = 10;

input idata = close;

input averageType = AverageType.WILDERS;

def NetChgAvg = MovingAverage(averageType, idata - idata[3], period);

def TotChgAvg = MovingAverage(averageType, AbsValue(idata - idata[3]), period);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

plot RSI = 50 * (ChgRatio + 1);

RSI.DefineColor("OverBought", color.red);

RSI.DefineColor("Normal", color.gray);

RSI.DefineColor("OverSold", color.green);

RSI.AssignValueColor(if RSI > over_Bought then RSI.color("OverBought")

else if RSI < over_Sold then RSI.color("OverSold")

else RSI.color("Normal"));

plot OverSold = over_Sold;

plot OverBought = over_Bought;

OverSold.SetDefaultColor(color.green);

Oversold.setstyle(curve.short_dash);

Oversold.setlineweight(1);

OverBought.SetDefaultColor(color.red);

OverBought.setstyle(curve.short_dash);

Oversold.setlineweight(1);

AddCloud(if RSI > OverBought then RSI else double.nan, Overbought, color.red,color.red);

AddCloud(if RSI < OverSold then RSI else double.nan, OverSold, color.green,color.green);

# End Code