// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Dr_Roboto

//

//@version=4

//

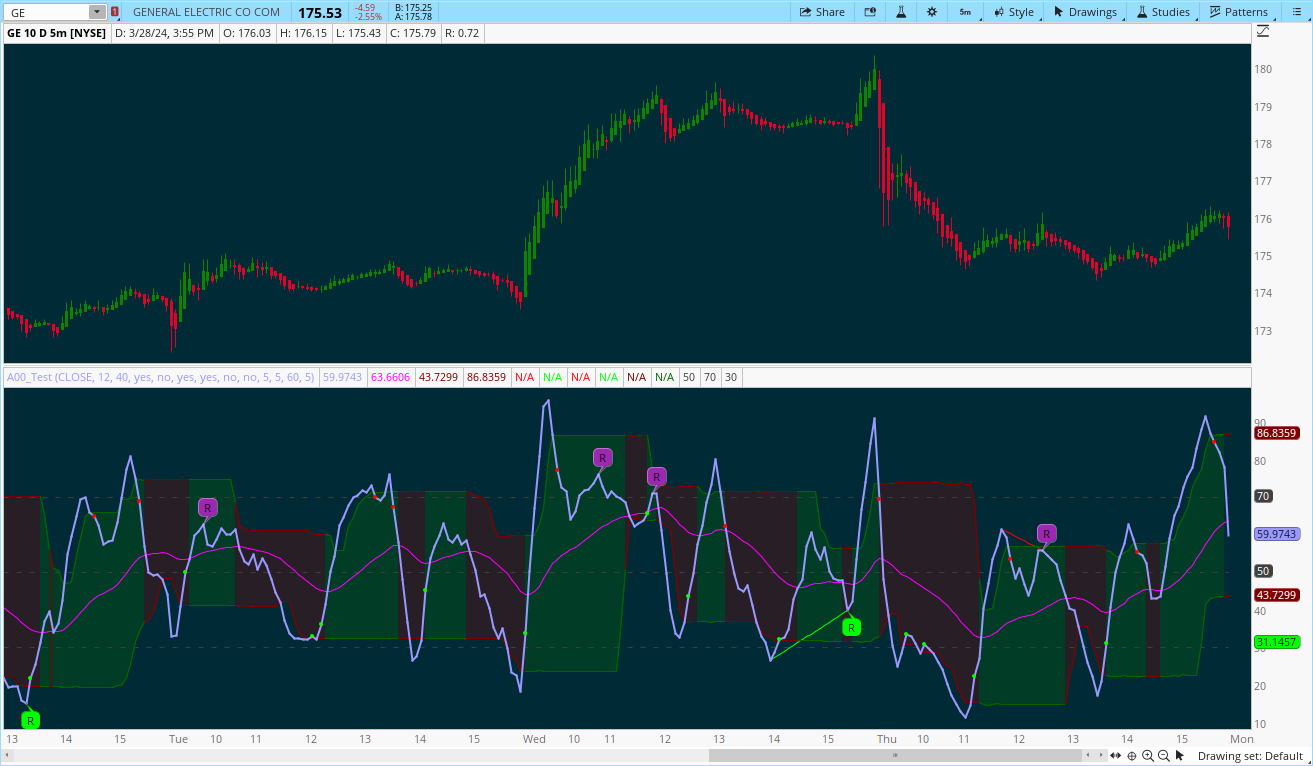

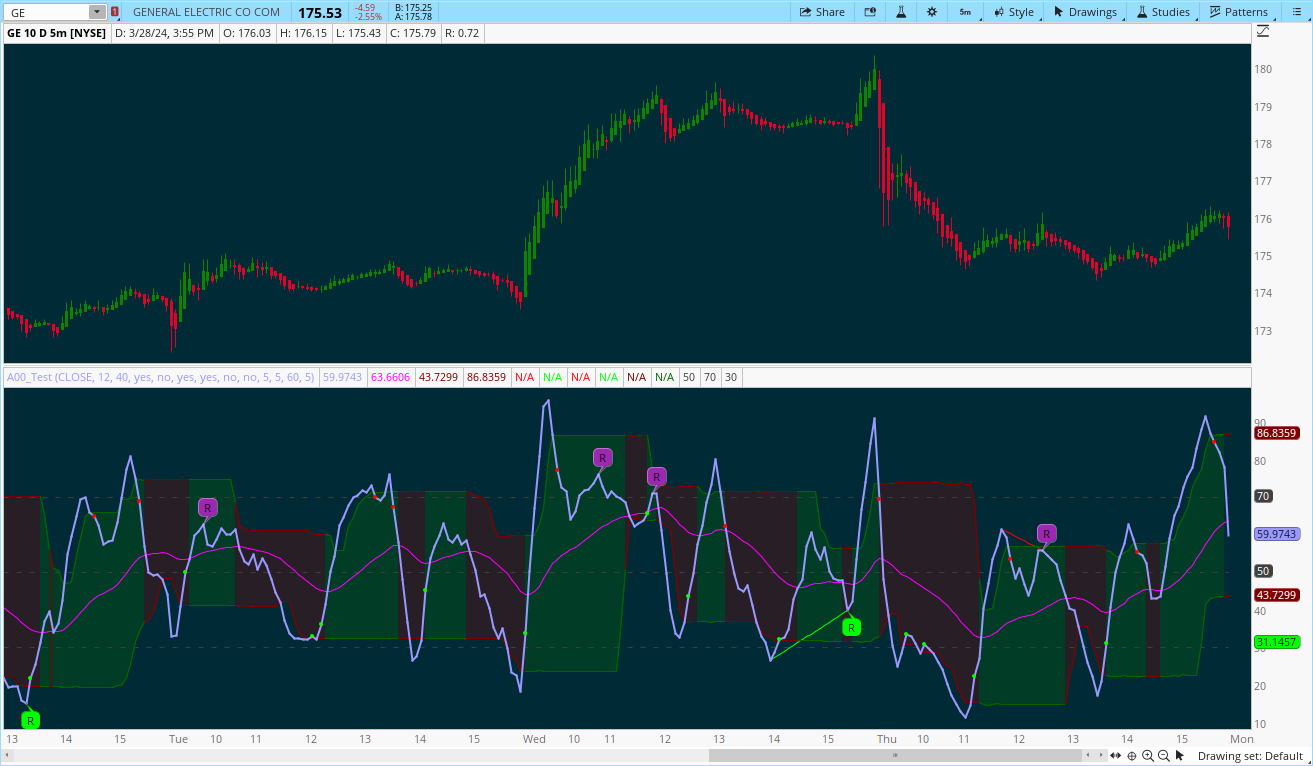

// This indicator uses the cyclic smoothed Relative Strength Index (cRSI) instead of the traditional Relative Strength Index (RSI). See below for more info on the benefits to the cRSI.

//

// My key contributions

// 1) A Weighted Moving Average (WMA) to track the general trend of the cRSI signal. This is very helpful in determining when the equity switches from bullish to bearish, which can be used to determine buy/sell points.

// This is then is used to color the region between the upper and lower cRSI bands (green above, red below).

// 2) An attempt to detect the motive (impulse) and corrective and waves. Corrective waves are indicated A, B, C, D, E, F, G. F and G waves are not technically Elliot Waves, but the way I detect waves it is really hard

// to always get it right. Once and a while you could actually see G and F a second time. Motive waves are identified as s (strong) and w (weak). Strong waves have a peak above the cRSI upper band and weak waves have a peak below the upper band.

// 3) My own divergence indicator for bull, hidden bull, bear, and hidden bear. I was not able to replicate the TradingView style of drawing a line from peak to peak, but for this indicator I think in the end it makes the chart cleaner.

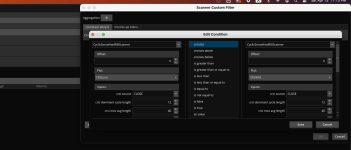

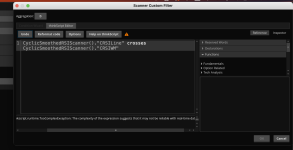

// 4) I have also added "alert conditions" for most of the key events. Select the equity you want (such as: SPX) and the desired timeframe (such as: D).

// Go to the TradingView "Alerts" tab (click the alarm clock icon) --> Create Alert (alarm clock with a +) --> Change the first condition drop down to "Cyclic Smoothed RSI with Motive-Corrective Wave Indicator" --> in the

// drop down below that select the alert that you want (such as: Bull - cRSI Above WMA). You will want to give the alert a good name that includes the ticker name and time frame, for example "SPX 1D: Bull - cRSI above WMA"

//

// There is a latency issue with an indicator like this that is based on moving averages. That means they tend to trigger right after key events. Perfect timing is not possible strictly with these indicators, but they do work

// very well "on average." However, my implementation has minimal latency as peaks (tops/bottoms) only require one bar to detect.

//

// As a bit of an Easter Egg, this code can be tweaked and run as a strategy to get buy/sell signals. I use this code for both my indicator and for trading strategy. Just copy and past it into a new strategy script and just

// change it from study to something like.

// strategy("cRSI + Waves Strategy with VWMA overlay", overlay=overlay)

// The buy/sell code is at the end and just needs to be uncommented. I make no promises or guarantees about how good it is as a strategy, but it gives you some code and ideas to work with.

//

// Tuning

// 1) Volume Weighted Moving Average (VWMA): This is a “hidden strategy” feature implemented that will display the high-low bands of the VWMA on the price chart if run the code using “overlay = true”.

// - [Use Volume for VWMA] If the equity does not have volume, then the VWMA will not show up. Uncheck this box and it will use the regular WMA (no volume).

// - [VWMA Length] defines how far back the WMA averages price.

//

// 2) cRSI (Black line in the indicator)

// - [CRSI Dominate Cycle Length] Increase to length that amount of time a band (upper/lower) stays high/low after a peak. Reduce the value to shorten the time. Just increment it up/down to see the effect.

// - [CRSI Moving Average Length] defines how far back the SMA averages the cRSI. This affects the purple line in the indicator.

// - [CRSI Top/Bottom Detector Lookback] defines how many bars back the peak detector looks to determine if a peak has occurred. For example, a top is detected like this: current-bar down relative to the 1-bar-back,

// 1-bar-back up relative to 2-bars-back (look back = 1), c) 2-bars-back up relative to 3-bars-back (lookback = 2), and d) 3-bars-back up relative to 4-bars-back (lookback = 3). I hope that makes sense. There are

// only 2 options for this setting: 2 or 3 bars. 2 bars will be able to detect small peaks but create more “false” peaks that may not be meaningful. 3 bars will be more robust but can miss short duration peaks.

//

// 3) Waves

// - The check boxes are self explanatory for which labels they turn on and off on the plot.

//

// 4) Divergence Indicators

// - The check boxes are self explanatory for which labels they turn on and off on the plot.

//

// Hints

// - The most common parameter to change is the [CRSI Top/Bottom Detector Lookback]. Different stocks will have different levels of strength in their peaks. A setting of 2 may generate too many corrective waves.

// - Different times scales will give you different wave counts. This is to be expected. A conunter impulse wave inside a corrective wave may actually go above the cRSI WMA on a smaller time frame. You may need to increase it one or two levels to see large waves.

// - Just because you see divergence (bear or hidden bear) does not mean a price is going to go down. Often price continues to rise through bears, so take note and that is normal. Bulls are usually pretty good indicators especially if you see them on C,E,G waves.

//

//

// ---------------------------------------

// cyclic smoothed RSI (cRSI) indicator

// ---------------------------------------

// The “core” code for the cyclic smoothed RSI (cRSI) indicator was written by Lars von Theinen and is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/. Copyright (C) 2017 CC BY,

// whentotrade / Lars von Thienen. For more details on the cRSI Indicator: https://www.tradingview.com/script/TmqiR1jp-RSI-cyclic-smoothed-v2/

//

// The cyclic smoothed RSI indicator is an enhancement of the classic RSI, adding

// 1) additional smoothing according to the market vibration,

// 2) adaptive upper and lower bands according to the cyclic memory and

// 3) using the current dominant cycle length as input for the indicator.

// It is much more responsive to market moves than the basic RSI. The indicator uses the dominant cycle as input to optimize signal, smoothing, and cyclic memory. To get more in-depth information on the cyclic-smoothed

// RSI indicator, please read Decoding The Hidden Market Rhythm - Part 1: Dynamic Cycles (2017), Chapter 4: "Fine-tuning technical indicators." You need to derive the dominant cycle as input parameter for the cycle length as described in chapter 4.

//=================================================================================================================================

//=================================================================================================================================

overlay = true // plots VWMA (need to close and re-added)

// overlay = false // plots cRSI (need to close and re-added)

strategy("cRSI + Waves Strategy with VWMA overlay", overlay=overlay, max_bars_back=300)

//=================================================================================================================================

//=================================================================================================================================

// Disables cRSI and VWMA plotting so debug data can be plotted

// DEBUG = true

DEBUG = false

//=================================================================================================================================

//=================================================================================================================================

// Helper Functions

//=================================================================================================================================

//=================================================================================================================================

// function to convert bool to int

b2i(bval) =>

ival = bval ? 1 : 0

// function to look for a price in the lookback that is recently above the current price

recentAbove(in, thresh, lookback) =>

found = false

for i=0 to lookback

if in >= thresh

found := true

break

if found

res = true

else

res = false

// is value rising or falling based on history

isRisingFalling(in, lookback) =>

cntThresh = round(lookback*0.6) // majority = greater than 50%

cntUp = 0

cntDown = 0

rising = false

falling = false

// count up the times it is above or below the current value

for i=1 to lookback

if in[0] > in

cntUp := cntUp + 1

else if in[0] < in

cntDown := cntDown + 1

// rising

if cntUp > cntThresh

rising := true

else

rising := false

// falling

if cntDown > cntThresh

falling := true

else

falling := false

// flat

flat = not(rising) and not(falling)

// if flat, then select preivous value for rising and falling

if flat

rising := rising[1]

falling := falling[1]

// return tuple

[rising,falling,flat]

// Do the last several prices form a top

isTop(price, lookback) =>

if lookback == 3

// 3 prices back -> 3rd check helps ensure there was a down trend, but can miss some small reversals

// up->up->down

if (price[2] > price[3]) and (price[1] > price[2]) and (price[0] < price[1])

top = true

else

top = false

else

// 2 places back

// up->down

if (price[1] > price[2]) and (price[0] < price[1])

top = true

else

top = false

// Do the last several prices form a bottom

isBottom(price, lookback) =>

if lookback == 3

// 3 prices back -> 3rd check helps ensure there was a down trend, but can miss some small reversals

// down->down->up

if (price[2] < price[3]) and (price[1] < price[2]) and (price[0] > price[1])

bottom = true

else

bottom = false

else

// 2 prices back

// down->up

if (price[1] < price[2]) and (price[0] > price[1])

bottom = true

else

bottom = false

// function to filter multiple signals in a row

filterSignal(signalFlag, lookback) =>

signalFlagFilt = signalFlag

for i = 1 to lookback

signalFlagFilt := signalFlagFilt[0] == true and signalFlagFilt == true ? false : signalFlagFilt

//=================================================================================================================================

//=================================================================================================================================

// Price Movement

//=================================================================================================================================

//=================================================================================================================================

priceRising = close[0] >= close[1] and close[1] >= close[2]

priceFalling = close[0] <= close[1] and close[1] <= close[2]

// plot(priceRising?1.0:0,color=color.green)

// plot(priceFalling?1.0:0,color=color.red)

//=================================================================================================================================

//=================================================================================================================================

// Volume Weighted Moving Average (VWMA)

//=================================================================================================================================

//=================================================================================================================================

plotVWMA = overlay and not(DEBUG)

// check if volume is available for this equity

useVolume = input(title="Use Volume for VWMA (uncheck if equity does not have volume)", defval=true)

vwmaLen = input(defval=21, title="VWMA Length", type=input.integer, minval=1, maxval=200)

vwma = vwma(close, vwmaLen)

vwma_high = vwma(high, vwmaLen)

vwma_low = vwma(low, vwmaLen)

if not(useVolume)

vwma := wma(close, vwmaLen)

vwma_high := wma(high, vwmaLen)

vwma_low := wma(low, vwmaLen)

// +1 when above, -1 when below, 0 when inside

vwmaSignal(priceOpen, priceClose, vwmaHigh, vwmaLow) =>

sig = 0

color = color.gray

if priceClose > vwmaHigh

sig := 1

color := color.green

else if priceClose < vwmaLow

sig := -1

color := color.red

else

sig := 0

color := color.gray

[sig,color]

[vwma_sig, vwma_color] = vwmaSignal(open, close, vwma_high, vwma_low)

priceAboveVWMA = vwma_sig == 1 ? true : false

priceBelowVWMA = vwma_sig == -1 ? true : false

// plot(priceAboveVWMA?2.0:0,color=color.blue)

// plot(priceBelowVWMA?2.0:0,color=color.maroon)

// bandTrans = input(defval=70, title="VWMA Band Transparancy (100 invisible)", type=input.integer, minval=0, maxval=100)

// fillTrans = input(defval=70, title="VWMA Fill Transparancy (100 invisible)", type=input.integer, minval=0, maxval=100)

bandTrans = 70

fillTrans = 70

// ***** Plot VWMA *****

highband = plot(plotVWMA?fixnan(vwma_high):na, title='VWMA High band', color = vwma_color, linewidth=1, transp=bandTrans)

lowband = plot(plotVWMA?fixnan(vwma_low):na, title='VWMA Low band', color = vwma_color, linewidth=1, transp=bandTrans)

fill(lowband, highband, title='VWMA Band fill', color=vwma_color, transp=fillTrans)

plot(plotVWMA?vwma:na, title='VWMA', color = vwma_color, linewidth=3, transp=0)

//=================================================================================================================================

//=================================================================================================================================

// Moving Average (VWMA)

//=================================================================================================================================

//=================================================================================================================================

smaLineWidth = 8

smaLen1 = input(defval=50, title="SMA #1 Length", type=input.integer, minval=1, maxval=200)

plot(sma(close,smaLen1), title='SMA', color = color.blue, linewidth=smaLineWidth)

smaLen2 = input(defval=100, title="SMA #2 Length", type=input.integer, minval=1, maxval=200)

plot(sma(close,smaLen2), title='SMA', color = color.black, linewidth=smaLineWidth)

//=================================================================================================================================

//=================================================================================================================================

// Moving Average Convergence Divergence (MACD)

//=================================================================================================================================

//=================================================================================================================================

[macdLine, signalLine, histLine] = macd(close, 12, 26, 9)

// Is the histogram rising or falling

histLineRising = histLine[0] >= histLine[1] and histLine[1] >= histLine[2]

histLineFalling = histLine[0] <= histLine[1] and histLine[1] <= histLine[2]

// Did the histogram cross over zero

histLineCrossNeg2Pos = histLine[0] >= 0.0 and histLine[1] < 0.0

histLineCrossPos2Neg = histLine[0] <= 0.0 and histLine[1] > 0.0

// plot(histLineRising?1.0:0,color=color.green)

// plot(histLineFalling?1.0:0,color=color.red)

// plot(histLineCrossNeg2Pos?1.0:0,color=color.green)

// plot(histLineCrossPos2Neg?1.0:0,color=color.red)

//=================================================================================================================================

//=================================================================================================================================

// Cyclic Smoothed Relative Strength Index (cRSI)

//=================================================================================================================================

//=================================================================================================================================

plotCRSI = not(overlay) and not(DEBUG)

//src = input(title="cRSI Source", defval=close)

src = close

domcycle = input(10, minval=5, title="cRSI Dominant Cycle Length (persist after high/low)") //12

crsi = 0.0

cyclelen = domcycle / 2

vibration = 10

leveling = 10.0

cyclicmemory = domcycle * 2

//set min/max ranges?

torque = 2.0 / (vibration + 1)

phasingLag = (vibration - 1) / 2.0

up = rma(max(change(src), 0), cyclelen)

down = rma(-min(change(src), 0), cyclelen)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

crsi := torque * (2 * rsi - rsi[phasingLag]) + (1 - torque) * nz(crsi[1])

// there is a bug that can cause the lower bound to be bigger than the upper bound with a value of 999999.0

// lmax = -999999.0

// lmin = 999999.0

lmax = 0.0 // don't konw why, but this fixes the bug

lmin = 0.0

for i = 0 to cyclicmemory - 1 by 1

if nz(crsi, -999999.0) > lmax

lmax := nz(crsi)

lmax

else

if nz(crsi, 999999.0) < lmin

lmin := nz(crsi)

lmin

mstep = (lmax - lmin) / 100

aperc = leveling / 100

crsiLowband = 0.0

for steps = 0 to 100 by 1

testvalue = lmin + mstep * steps

above = 0

below = 0

for m = 0 to cyclicmemory - 1 by 1

below := below + iff(crsi[m] < testvalue, 1, 0)

below

ratio = below / cyclicmemory

if ratio >= aperc

crsiLowband := testvalue

break

else

continue

crsiHighband = 0.0

for steps = 0 to 100 by 1

testvalue = lmax - mstep * steps

above = 0

for m = 0 to cyclicmemory - 1 by 1

above := above + iff(crsi[m] >= testvalue, 1, 0)

above

ratio = above / cyclicmemory

if ratio >= aperc

crsiHighband := testvalue

break

else

continue

//=================================================================================================================================

//=================================================================================================================================

// cRSI moving average

//=================================================================================================================================

//=================================================================================================================================

crsiMaLen = input(title="cRSI Moving Average Length", defval=50, minval=0, step=5, type=input.integer)

// crsiSMA = sma(crsi,crsiMaLen)

// crsiEMA = ema(crsi,crsiMaLen)

crsiWMA = wma(crsi,crsiMaLen)

// plot(crsiSMA, "CRSI SMA", color.red, linewidth=2)

// plot(crsiEMA, "CRSI EMA", color.green, linewidth=2)

// plot(crsiWMA, "CRSI WMA", color.fuchsia, linewidth=2)

//=================================================================================================================================

//=================================================================================================================================

// cRSI Feature Analysis

//=================================================================================================================================

//=================================================================================================================================

// Crossing of upper band

crsiAboveHighband = crsi >= crsiHighband

crsiBelowHighband = not(crsiAboveHighband)

crsiCrossAboveHighband = crsiAboveHighband[0] and crsiBelowHighband[1] ? true : false

crsiCrossBelowHighband = crsiBelowHighband[0] and crsiAboveHighband[1] ? true : false

// plot(crsiAboveHighband?2.0:0,color=color.black)

// plot(crsiBelowHighband?2.25:0,color=color.red)

// plot(crsiCrossAboveHighband?2.5:0,color=color.green)

// plot(crsiCrossBelowHighband?2.75:0,color=color.blue)

//-----------------------------------------------------------------------------

// Crossing of lower band

crsiAboveLowband = crsi >= crsiLowband

crsiBelowLowband = not(crsiAboveLowband)

crsiCrossAboveLowband = crsiAboveLowband[0] and crsiBelowLowband[1] ? true : false

crsiCrossBelowLowband = crsiBelowLowband[0] and crsiAboveLowband[1] ? true : false

// plot(crsiAboveLowband?1.0:0,color=color.black)

// plot(crsiBelowLowband?1.25:0,color=color.red)

// plot(crsiCrossAboveLowband?1.5:0,color=color.green)

// plot(crsiCrossBelowLowband?1.75:0,color=color.blue)

//-----------------------------------------------------------------------------

// Crossing of WMA

crsiAboveWMA = crsi >= crsiWMA

crsiBelowWMA = not(crsiAboveWMA)

crsiCrossAboveWMA = crsiAboveWMA[0] and crsiBelowWMA[1] ? true : false

crsiCrossBelowWMA = crsiBelowWMA[0] and crsiAboveWMA[1] ? true : false

// plot(crsiAboveWMA?1.0:0,color=color.black)

// plot(crsiBelowWMA?1.25:0,color=color.red)

// plot(crsiCrossAboveWMA?1.5:0,color=color.blue)

// plot(crsiCrossBelowWMA?1.75:0,color=color.maroon)

//-----------------------------------------------------------------------------

// Crossing of 50 level

crsiAbove50 = crsi >= 50

crsiBelow50 = not(crsiAbove50)

crsiCrossAbove50 = crsiAbove50[0] and crsiBelow50[1] ? true : false

crsiCrossBelow50 = crsiBelow50[0] and crsiAbove50[1] ? true : false

//-----------------------------------------------------------------------------

// CRSI falling or rising

crsiRising = crsi[0] >= crsi[1]

crsiFalling = crsi[0] < crsi[1]

// plot(crsiRising?3.0:0,color=color.green)

// plot(crsiFalling?3.0:0,color=color.red)

//-----------------------------------------------------------------------------

// Compare cRSI to crsiWMA to determine if equity is bullish (motive) or bearish (corrective)

bull = crsiAboveWMA

bear = not(bull)

bullBearColor = bull ? color.green : color.red

bullStart = bull[0] and bear[1] ? true : false

bearStart = bear[0] and bull[1] ? true : false

alertcondition(bullStart, title='Bull - cRSI above WMA', message='Bull - cRSI above WMA')

alertcondition(bearStart, title='Bear - cRSI below WMA', message='Bear - cRSI below WMA')

//=================================================================================================================================

//=================================================================================================================================

// Plot cRSI colored by Bull or Bear

//=================================================================================================================================

//=================================================================================================================================

// Basic RSI

hline(plotCRSI?50:na, title="Middle Line", linestyle=hline.style_dashed, linewidth=2)

h2 = hline(plotCRSI?70:na, title="Overbought", linestyle=hline.style_dashed, linewidth=2)

h1 = hline(plotCRSI?30:na, title="Oversold", linestyle=hline.style_dashed, linewidth=2)

fill(h1, h2, color=color.silver, transp=80)

// cRSI

crsiLB2 = plot(plotCRSI?crsiLowband:na, "cRSI LowBand", bullBearColor)

crsiHB2 = plot(plotCRSI?crsiHighband:na, "cRSI HighBand", bullBearColor)

fill(crsiLB2, crsiHB2, bullBearColor, transp=75)

plot(plotCRSI?crsiWMA:na, "CRSI WMA", color.fuchsia, linewidth=2)

plot(plotCRSI?crsi:na, "CRSI", color.black, linewidth=4)

//=================================================================================================================================

//=================================================================================================================================

// Moitve (impulse) and Corrective Waves

//=================================================================================================================================

//=================================================================================================================================

// THIS IS A MAJOR ASSUMPTION TO THIS APPROACH!!!

motiveWave = bull

correctiveWave = bear

// TOP AND BOTTOM ARE DETECTED ONE BAR LATE!!!

topBottomLookback = input(title="cRSI Top/Bottom Detector Lookback (3 is more robust but misses smaller)", defval=2, minval=2, maxval=3, step=1, type=input.integer)

crsiTop = isTop(crsi, topBottomLookback)

crsiBottom = isBottom(crsi,topBottomLookback)

// Top above high band

crsiTopAboveHighband = crsiTop and crsiAboveHighband[1]

waveStrongImpulse = crsiTopAboveHighband

// Top that does not break high band but is above WMA

crsiTopBelowHighband = (crsiTop and crsiBelowHighband[1]) and (crsi > crsiWMA)

waveWeakImpulse = crsiTopBelowHighband

//-----------------------------------------------------------------------------

// Determine the ABC, ABCDE, ABCDEFG sequence

// Note that ABCDEFG is not a true Elliott corrective wave sequence, but for this approach is shows up once in a blue moon

possibleWaveA = crsiBottom and crsiBelowLowband[1]

possibleWaveB = (crsiTop and crsiBelowWMA[1]) or (crsiTop and crsiBelow50[1]) // Also catch the tops that are above wma but stay under RSI 50 (rare)

possibleWaveC = possibleWaveA or (crsiBottom and crsiBelowWMA[1]) // sometimes wave C is above the lower band but below the WMA

// Wave AB

findWaveAB(possibleWaveA, possibleWaveB, correctiveWave) =>

isWaveAB = false

foundMatch = false

// start with Wave B

if possibleWaveB

// search backwards and look for wave A

for i=1 to 50

// Equity must be in correction else invalidated

if correctiveWave

if possibleWaveA

foundMatch := true

break

//else

// keep looping

else

// motive wave invalidates search

foundMatch := false

break

// Did we match an A and B wave?

if foundMatch

isWaveAB := true

else

isWaveAB := false

else

isWaveAB := false

waveAB = findWaveAB(possibleWaveA, possibleWaveB, correctiveWave)

// Wave ABC

findWaveABC(possibleWaveC, waveAB, correctiveWave) =>

isWaveABC = false

foundMatch = false

if possibleWaveC

// search backwards and look for wave AB

for i=1 to 50

// Equity must be in correction else invalidated

if correctiveWave

if waveAB

foundMatch := true

break

//else

// keep looping

else

// motive wave invalidates search

foundMatch := false

break

// Did we match a waveAB with C?

if foundMatch

isWaveABC := true

else

isWaveABC := false

else

isWaveABC := false

waveABC = findWaveABC(possibleWaveC, waveAB, correctiveWave)

// Wave ABCD

findWaveABCD(possibleWaveB, waveABC, correctiveWave) =>

isWaveABCD = false

foundMatch = false

if possibleWaveB

// search backwards and look for wave ABC

for i=1 to 50

// Equity must be in correction else invalidated

if correctiveWave

if waveABC

foundMatch := true

break

//else

// keep looping

else

// motive wave invalidates search

foundMatch := false

break

// Did we match a waveABC with D?

if foundMatch

isWaveABCD := true

else

isWaveABCD := false

else

isWaveABCD := false

waveABCD = findWaveABCD(possibleWaveB, waveABC, correctiveWave)

// Wave ABCDE

findWaveABCDE(possibleWaveC, waveABCD, correctiveWave) =>

isWaveABCDE = false

foundMatch = false

if possibleWaveC

// search backwards and look for another wave ABC in this correction

for i=1 to 50

// Equity must be in correction else invalidated

if correctiveWave

if waveABCD

foundMatch := true

break

//else

// keep looping

else

// motive wave invalidates search

foundMatch := false

break

// Did we match a waveABC with another waveABC?

if foundMatch

isWaveABCDE := true

else

isWaveABCDE := false

else

isWaveABCDE := false

waveABCDE = findWaveABCDE(possibleWaveC, waveABCD, correctiveWave)

// Wave ABCDEF

findWaveABCDEF(possibleWaveB, waveABCDE, correctiveWave) =>

isWaveABCDEF = false

foundMatch = false

if possibleWaveB

// search backwards and look for another wave ABC in this correction

for i=1 to 50

// Equity must be in correction else invalidated

if correctiveWave

if waveABCDE

foundMatch := true

break

//else

// keep looping

else

// motive wave invalidates search

foundMatch := false

break

// Did we match a waveABC with another waveABC?

if foundMatch

isWaveABCDEF := true

else

isWaveABCDEF := false

else

isWaveABCDEF := false

waveABCDEF = findWaveABCDEF(possibleWaveB, waveABCDE, correctiveWave)

// Wave ABCDEFG

findWaveABCDEFG(possibleWaveC, waveABCDEF, correctiveWave) =>

isWaveABCDEFG = false

foundMatch = false

if possibleWaveC

// search backwards and look for another wave ABC in this correction

for i=1 to 50

// Equity must be in correction else invalidated

if correctiveWave

if waveABCDEF

foundMatch := true

break

//else

// keep looping

else

// motive wave invalidates search

foundMatch := false

break

// Did we match a waveABC with another waveABC?

if foundMatch

isWaveABCDEFG := true

else

isWaveABCDEFG := false

else

isWaveABCDEFG := false

waveABCDEFG = findWaveABCDEFG(possibleWaveC, waveABCDEF, correctiveWave)

// Determine individual corrective waves

waveA = possibleWaveA and not(waveABC) and not(waveABCDE)

waveB = waveAB and not(waveABCD)

waveC = waveABC

waveD = waveABCD

waveE = waveABCDE

waveF = waveABCDEF

waveG = waveABCDEFG

//-----------------------------------------------------------------------------

// Plot key cRSI points

// plot(crsiCrossBelowHighband?crsi:na, title='cRSI cross below high band', color=color.red, linewidth=7, style=plot.style_circles)

// plot(crsiCrossAboveLowband?crsi:na, title='cRSI cross above low band', color=color.green, linewidth=7, style=plot.style_circles)

// plot(crsiCrossBelowWMA?crsi:na, title='cRSI cross below WMA', color=color.red, linewidth=5, style=plot.style_cross)

// plot(crsiCrossAboveWMA?crsi:na, title='cRSI cross above WMA', color=color.green, linewidth=5, style=plot.style_cross)

// plot(crsiCrossAbove50?crsi:na, title='cRSI cross above 50', color=color.black, linewidth=7, style=plot.style_circles)

// plot(crsiCrossBelow50?crsi:na, title='cRSI cross below 50', color=color.black, linewidth=7, style=plot.style_circles)

// plot(crsiTop?crsi[1]:na, title='cRSI Top', color=color.blue, linewidth=4, style=plot.style_cross, offset=-1)

// plot(crsiBottom?crsi[1]:na, title='cRSI Top', color=color.purple, linewidth=4, style=plot.style_cross, offset=-1)

//--------------------

// Impulse waves

plotStrong = input(title="Plot Strong Impulse Waves (above upper band)", defval=true) and plotCRSI

plotWeak = input(title="Plot Weak Impulse Waves (below upper band)", defval=true) and plotCRSI

impWaveSz = size.tiny

plotshape(plotStrong and waveStrongImpulse?crsi[1]:na, text="s", title='Strong Impulse', style=shape.labeldown, location=location.absolute, color=color.navy, transp=0, offset=-1, textcolor=color.white, size=impWaveSz)

plotshape(plotWeak and waveWeakImpulse?crsi[1]:na, text="w", title='Weak Impulse', style=shape.labeldown, location=location.absolute, color=color.purple, transp=0, offset=-1, textcolor=color.white, size=impWaveSz)

//---------------------

// Corrective waves

// plot(possibleWaveC?crsi[1]:na, title='Possible Wave C', color=color.green, linewidth=6, style=plot.style_circles, offset=-1)

// plot(possibleWaveB?crsi[1]:na, title='Possible Wave B', color=color.blue, linewidth=6, style=plot.style_circles, offset=-1)

// plot(possibleWaveA?crsi[1]:na, title='Possible Wave A', color=color.purple, linewidth=6, style=plot.style_circles, offset=-1)

// plot(waveAB?crsi[1]:na, title='Wave AB', color=color.black, linewidth=5, style=plot.style_cross, offset=-1)

// plot(waveABC?crsi[1]:na, title='Wave ABC', color=color.black, linewidth=7, style=plot.style_cross, offset=-1)

// plot(waveABCDE?crsi[1]:na, title='Wave ABCDE', color=color.black, linewidth=9, style=plot.style_cross, offset=-1)

// plotshape(waveAB?crsi[1]:na, title='Wave AB', style=shape.triangledown, location=location.absolute, color=color.orange, transp=0, offset=-1, text="AB", textcolor=color.orange, size=size.small)

// plotshape(waveABC?crsi[1]:na, title='Wave ABC', style=shape.triangleup, location=location.absolute, color=color.blue, transp=0, offset=-1, text="ABC", textcolor=color.blue, size=size.small)

// plotshape(waveABCD?crsi[1]:na, title='Wave ABCD', style=shape.triangledown, location=location.absolute, color=color.red, transp=0, offset=-1, text="ABCD", textcolor=color.red, size=size.small)

// plotshape(waveABCDE?crsi[1]:na, title='Wave ABCDE', style=shape.triangleup, location=location.absolute, color=color.green, transp=0, offset=-1, text="ABCDE", textcolor=color.green, size=size.small)

plotWaves = input(title="Plot Corrective Waves (ABC,ABCDE)", defval=true) and plotCRSI

corWaveSz = size.small

plotshape(plotWaves and waveA?crsi[1]:na, text="A", title='Wave A', style=shape.labelup, location=location.absolute, color=color.blue, transp=0, offset=-1, textcolor=color.white, size=corWaveSz)

plotshape(plotWaves and waveB?crsi[1]:na, text="B", title='Wave B', style=shape.labeldown, location=location.absolute, color=color.red, transp=0, offset=-1, textcolor=color.white, size=corWaveSz)

plotshape(plotWaves and waveC?crsi[1]:na, text="C", title='Wave C', style=shape.labelup, location=location.absolute, color=color.green, transp=0, offset=-1, textcolor=color.white, size=corWaveSz)

plotshape(plotWaves and waveD?crsi[1]:na, text="D", title='Wave D', style=shape.labeldown, location=location.absolute, color=color.maroon, transp=0, offset=-1, textcolor=color.white, size=corWaveSz)

plotshape(plotWaves and waveE?crsi[1]:na, text="E", title='Wave E', style=shape.labelup, location=location.absolute, color=color.lime, transp=0, offset=-1, textcolor=color.white, size=corWaveSz)

plotshape(plotWaves and waveF?crsi[1]:na, text="F", title='Wave F', style=shape.labeldown, location=location.absolute, color=color.fuchsia, transp=0, offset=-1, textcolor=color.white, size=corWaveSz)

plotshape(plotWaves and waveG?crsi[1]:na, text="G", title='Wave G', style=shape.labelup, location=location.absolute, color=color.aqua, transp=0, offset=-1, textcolor=color.white, size=corWaveSz)

//---------------------

// PRICE CHANGE BETWEEN IMPULSE AND WAVE A

//=================================================================================================================================

//=================================================================================================================================

// Divergence Indicator Using cRSI

//=================================================================================================================================

//=================================================================================================================================

plotBull = input(title="Plot Bullish (cRSI Higher-Low : Price Lower-Low)", defval=true) and plotCRSI

plotHiddenBull = input(title="Plot Hidden Bullish (cRSI Lower-Low : Price Higher-Low)", defval=true) and plotCRSI

plotBear = input(title="Plot Bearish (cRSI Lower-High : Price Higher-High", defval=true) and plotCRSI

plotHiddenBear = input(title="Plot Hidden Bearish (cRSI Higher-High : Price Lower-High)", defval=true) and plotCRSI

//------------------------------------------------------------------------------

crsiHighs = waveStrongImpulse or waveWeakImpulse

crsiLows = possibleWaveA or possibleWaveC

//------------------------------------------------------------------------------

// Regular Bullish --> cRSI makes a Higher-Low, but price makes a Lower-Low

// Hidden Bullish --> cRSI makes a Lower-Low, but price makes a Higher-Low

bullish(crsiLows, crsi, price) =>

foundLow = false

crsiHigherLow = false

priceHigher = false

regularBullish = false

hiddenBullish = false

if crsiLows[0] == true

for i=1 to 50

if crsiLows == true

foundLow := true

// crsi higher or lower?

if crsi[0] > crsi

crsiHigherLow := true

else

crsiHigherLow := false

// price higher or lower

if price[0] > price

priceHigher := true

else

priceHigher := false

// found low, stop looking

break

else

continue

if foundLow

// Regular Bullish --> cRSI makes a Higher-Low, but price makes a Lower-Low

if (crsiHigherLow==true) and (priceHigher==false)

regularBullish := true

hiddenBullish := false

// Hidden Bullish --> cRSI makes a Lower-Low, but price makes a Higher-Low

else if (crsiHigherLow==false) and (priceHigher==true)

regularBullish := false

hiddenBullish := true

else

regularBullish := false

hiddenBullish := false

else

regularBullish := false

hiddenBullish := false

else

// this is not a low

regularBullish := false

hiddenBullish := false

// return tuple

[regularBullish,hiddenBullish]

[regularBullish,hiddenBullish] = bullish(crsiLows, crsi, close)

plotshape(plotBull and regularBullish?crsi[1]-12:na, text="Bull", title='Bull', style=shape.labelup, location=location.absolute, color=color.green, transp=0, offset=-1, textcolor=color.white, size=corWaveSz)

plotshape(plotHiddenBull and hiddenBullish?crsi[1]-12:na, text="H Bull", title='Hidden Bull', style=shape.labelup, location=location.absolute, color=color.green, transp=20, offset=-1, textcolor=color.white, size=corWaveSz)

//------------------------------------------------------------------------------

// Regular Bearish --> cRSI makes a Lower-High, but price makes a Higher-High

// Hidden Bearish --> cRSI makes a Higher-High, but price makes a Lower-High

bearish(crsiHighs, crsi, price) =>

foundHigh = false

crsiHigherHigh = false

priceHigher = false

regularBearish = false

hiddenBearish = false

if crsiHighs[0] == true

for i=1 to 50

if crsiHighs == true

foundHigh := true

// crsi higher or lower?

if crsi[0] > crsi

crsiHigherHigh := true

else

crsiHigherHigh := false

// price higher or lower

if price[0] > price

priceHigher := true

else

priceHigher := false

// found high, stop looking

break

else

continue

if foundHigh

// Regular Bearish --> cRSI makes a Lower-High, but price makes a Higher-High

if (crsiHigherHigh==false) and (priceHigher==true)

regularBearish := true

hiddenBearish := false

// Hidden Bearish --> cRSI makes a Higher-High, but price makes a Lower-High

else if (crsiHigherHigh==true) and (priceHigher==false)

regularBearish := false

hiddenBearish := true

else

regularBearish := false

hiddenBearish := false

else

regularBearish := false

hiddenBearish := false

else

// this is not a low

regularBearish := false

hiddenBearish := false

// return tuple

[regularBearish,hiddenBearish]

[regularBearish,hiddenBearish] = bearish(crsiHighs, crsi, close)

plotshape(plotBear and regularBearish?crsi[1]+10:na, text="Bear", title='Bear', style=shape.labeldown, location=location.absolute, color=color.red, transp=0, offset=-1, textcolor=color.white, size=corWaveSz)

plotshape(plotHiddenBear and hiddenBearish?crsi[1]+10:na, text="H Bear", title='Hidden Bear', style=shape.labeldown, location=location.absolute, color=color.red, transp=20, offset=-1, textcolor=color.white, size=corWaveSz)

//==================================================================================================================================================================================================================================================================

//==================================================================================================================================================================================================================================================================

//==================================================================================================================================================================================================================================================================

// Buy/Sell Strategy

//==================================================================================================================================================================================================================================================================

//==================================================================================================================================================================================================================================================================

//==================================================================================================================================================================================================================================================================

// Remove duplicate buy/sells if one was already executed recently

filterLookback = 5

// normalize a value in a range between min and max

normalize(val, valMin, valMax) =>

valNorm = val

valNorm := valNorm < valMin ? valMin : valNorm

valNorm := valNorm > valMax ? valMax : valNorm

valNorm := (valNorm-valMin) / (valMax-valMin)

recentWave(wave, lookback) =>

ret = false

found = false

for i=0 to lookback

if wave == true

found := true

break

if found

ret := true

else

ret := false

//-----------------------------------------------------------------------------

// Levels for upper band - High

crsiHighband_extremeHighLevel = 90

crsiHighband_highLevel = 70

crsiHighband_highWeight = normalize(crsiHighband, crsiHighband_highLevel, crsiHighband_extremeHighLevel)

// Levels for upper band - Low

crsiHighband_extremeLowLevel = 45

crsiHighband_lowLevel = 55

crsiHighband_lowWeight = 1.0 - normalize(crsiHighband, crsiHighband_extremeLowLevel, crsiHighband_lowLevel)

// plot(crsiHighband_highWeight,color=color.blue)

// plot(crsiHighband_lowWeight,color=color.red)

//-----------------------------------------------------------------------------

// // Levels for lower band - High

crsiLowband_extremeHighLevel = 80

crsiLowband_highLevel = 60

crsiLowband_higheight = normalize(crsiLowband, crsiLowband_highLevel, crsiLowband_extremeHighLevel)

// Levels for lower band - Low

crsiLowband_extremeLowLevel = 20

crsiLowband_lowLevel = 45

crsiLowband_lowWeight = 1.0 - normalize(crsiLowband, crsiLowband_extremeLowLevel, crsiLowband_lowLevel)

// plot(crsiLowband_highWeight,color=color.blue)

// plot(crsiLowband_lowWeight,color=color.red)

//--------------------------------------------------------------------------------------------

// SELL

//--------------------------------------------------------------------------------------------

maxSellOrderSize = 10

crsiHighband_above_crsiHighband_highLevel = crsiHighband > crsiHighband_highLevel ? true : false

Sell1 = waveStrongImpulse

Sell2 = crsiAboveHighband and crsiFalling ? true : false // Above high band and now falling

Sell3 = crsiAboveHighband[1] and crsiFalling ? true : false // 1x previous was above high band and now falling (sometimes it can be off by a bar)

Sell4 = crsiAboveHighband[2] and crsiFalling ? true : false // 2x previous was above high band and now falling (sometimes it can be off by a bar)

//Sell = Sell1 //and crsiHighband_above_crsiHighband_highLevel

// Sell = Sell1 //and crsiHighband_above_crsiHighband_highLevel

// Sell = (Sell1 or Sell2) //and crsiHighband_above_crsiHighband_highLevel

// Sell = (Sell1 or Sell2 or Sell3) //and crsiHighband_above_crsiHighband_highLevel

Sell = (Sell1 or Sell2 or Sell3 or Sell4) and crsiHighband_above_crsiHighband_highLevel

Sell := filterSignal(Sell, filterLookback)

// Base sell size on how high the Highband is

sellSize = crsiHighband_highWeight *maxSellOrderSize // When in doubt, DON'T SELL! Stonks only go up ;)

// extreme cRSI

sellSize := crsi > crsiHighband_extremeHighLevel ? 1.5*maxSellOrderSize : sellSize

// if the sell size is small, just make min sell

sellSize := sellSize < maxSellOrderSize/3 ? 0 : sellSize

sellSize := round(sellSize)

if Sell

strategy.order("Sell", false, sellSize)

//--------------------------------------------------------------------------------------------

// BUY - Price can continue to fall even when cRSI is rising!!!

//--------------------------------------------------------------------------------------------

maxBuyOrderSize = 10

// Wait until it crosses back above WMA so it is clear that motive wave is clear.

// Buying at the bottom is really hard because RSI can start to rise yet price will continue to fall

Buy1 = bullStart

// Using waves can help do a better job timing the bottom, but big corrections can go much deeper than just Wave C (Zig Zag)

Buy2 = waveA and regularBullish

Buy3 = waveC and regularBullish

Buy4 = waveE and (topBottomLookback == 3) // usullay max is a wave E with topBottomLookback == 3

Buy5 = waveG and (topBottomLookback == 2) // can see a G wave when topBottomLookback == 2

Buy = Buy1 or Buy2 or Buy3 or Buy4 or Buy5

Buy := filterSignal(Buy, filterLookback)

// Base buy size on how low the Lowband is

buySize = crsiLowband_lowWeight*maxBuyOrderSize

// buySize := buySize < 1 ? 1 : buySize // When in doubt, BUY! Stonks only go up ;)

// Look for recent wave endings that can increase our guess of buying at a low

recentWaveC = recentWave(waveC, 10)

recentWaveE = recentWave(waveE, 10)

recentWaveG = recentWave(waveG, 10)

// buySize := recentWaveE ? 1.5*maxBuyOrderSize : buySize

// buySize := recentWaveG ? 1.5*maxBuyOrderSize : buySize

buySize := recentWaveE ? maxBuyOrderSize : buySize

buySize := recentWaveG ? maxBuyOrderSize : buySize

// if the buy size is small, just make min buy

buySize := buySize < maxSellOrderSize/3 ? 0 : buySize

buySize := round(buySize)

if Buy

strategy.order("Buy", true, buySize)