Dublin_Capital

Member

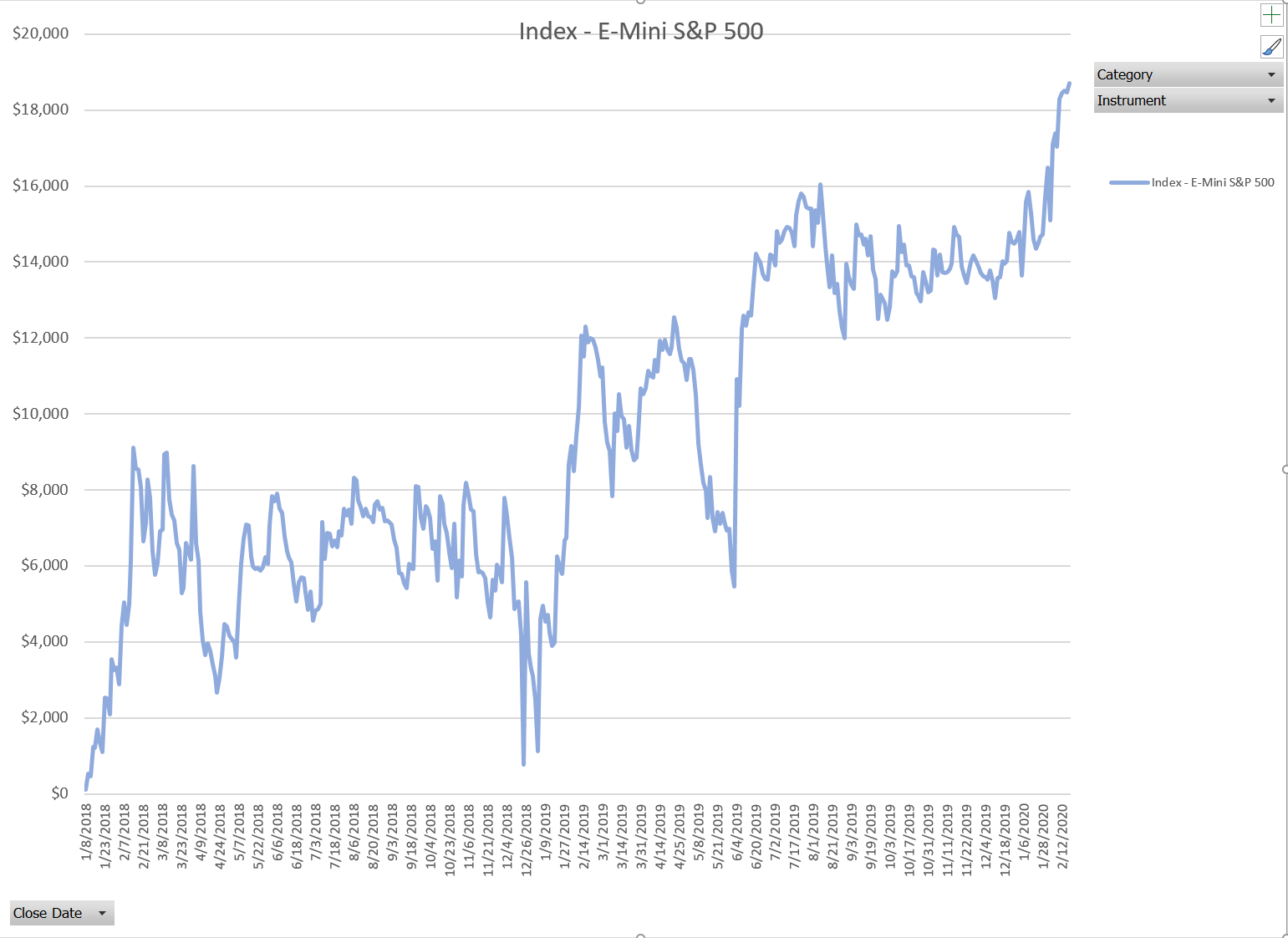

Here is a backtest of the 30 minute chart (2018 - present)

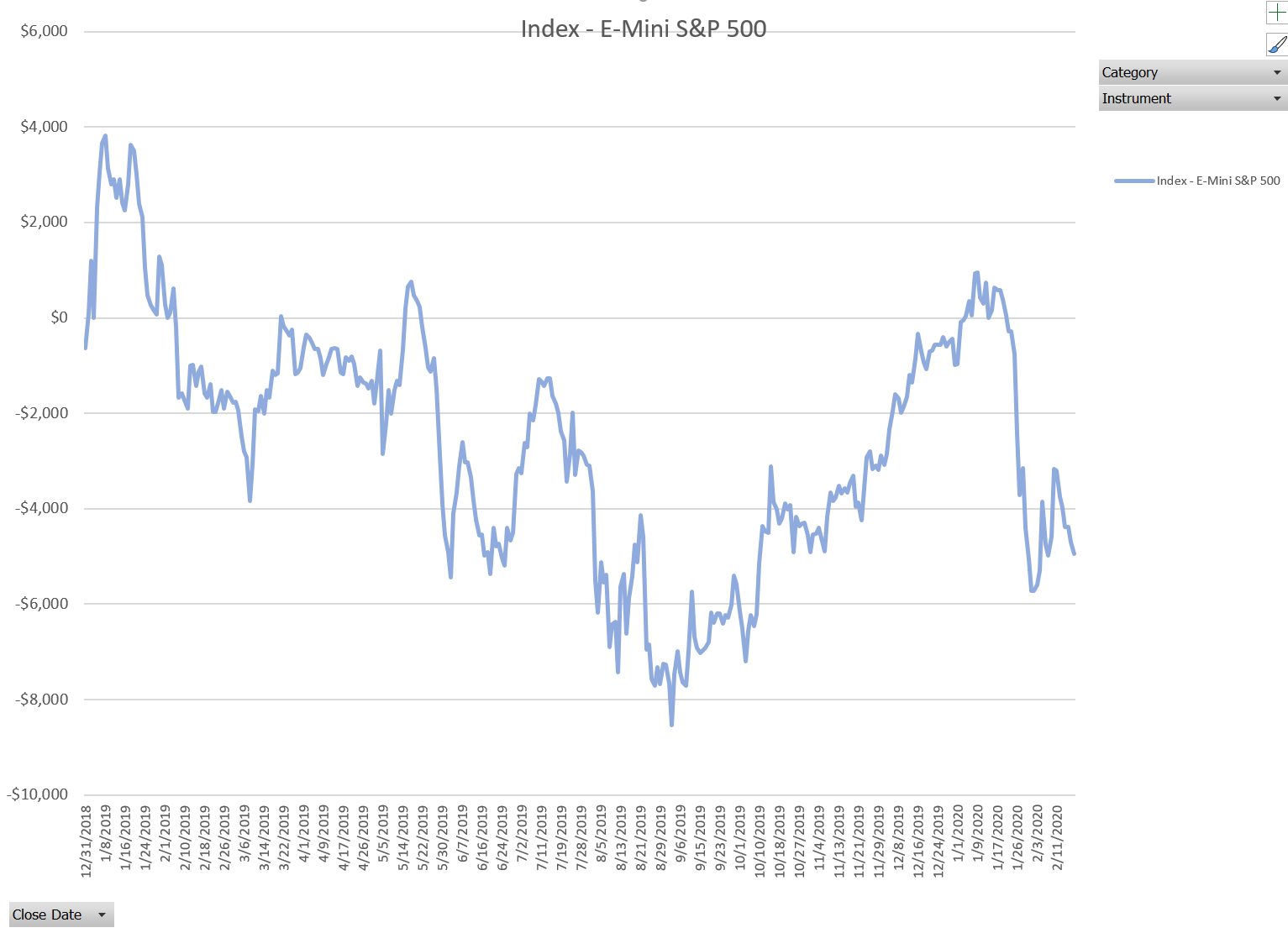

And a 5 minute chart (December 2018 - present):

And a 5 minute chart (December 2018 - present):

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

I sure hope the backtest wasnt on my post of a set up, because no set up can be followed 100% because of changing market conditions, especially this volatile market. I wouldnt use this unless it's set up in a way understood by me, my set up, and monitored if market movement requires management, as it does. I personally use a simple system of trend, no complicated formulas, algorithms, earnings plays, etc......mainly working off important scans......

Unfortunately, external factors, black swan events are the factors that need to be aware of. Here's a site that maybe some use.I backtested the code that was in the original post in this thread, because the poster asked for backtesters.

By definition, the backtest took every trade that the strategy signaled. My goal is to take myself out of the equation. I don't want to think about all those external factors you listed.

Which chart referenced tooI loaded this study and my chart looks nothing like the chart above. Please help

Main TOS chart page > setup>open shared item/paste https://tos.mx/veElNOuThe original post #1

What do you use to backtest?The drawdown in 2018 is easier to see on this chart, which uses Trade # as the X axis

Thats saying page not foundMain TOS chart page > setup>open shared item/paste https://tos.mx/veElNOu

I don't know how to backtest, or what to use?? I just trade, as my account grows, I know I'm trading well,....take profits in strength, alway adding money to the account. I spent a year and a half working with Doug learning options, and follow my plan,.......example is video with explanation,What do you use to backtest?

What do you use to backtest?

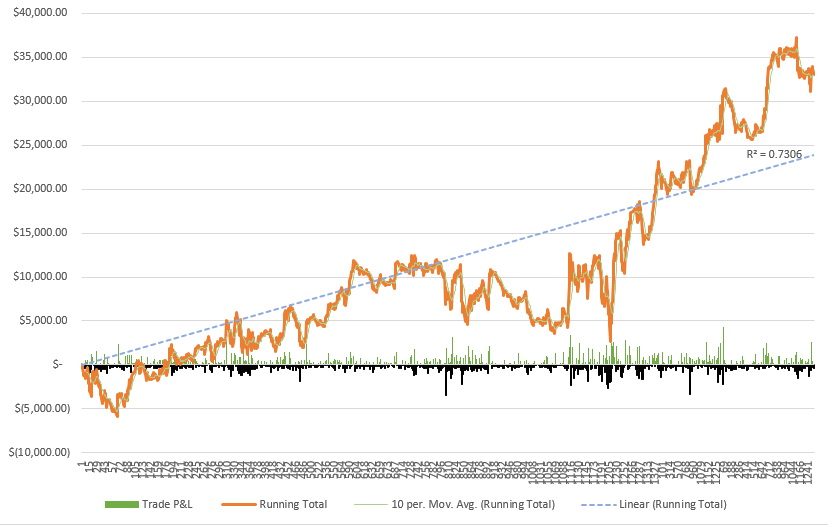

Sorry I could add any ammo to the subject, Tradinformed was something I thought looked great, but I couldn't figure out his ecel and then he went and made it a pay site, so I ran.I use Excel / Power Query. I wrote a query that will transform the backtest report .cvs files from ThinkorSwim into a spreadsheet that can be used for charting / analysis.

It's not perfect, as it only works if trading a simple enter / exit strategy with a fixed lot size. It doesn't work with complicated entries, options, position increases, partial exits, etc.

It's still a work in progress - I will share with the community at some point.

I use Doug's lessons on value plays, out of favor, or MOMO.........Sorry I could add any ammo to the subject, Tradinformed was something I thought looked great, but I couldn't figure out his ecel and then he went and made it a pay site, so I ran.

def ST = if close < ST[1] then UP else DN;"ST," supertrend,....if the close less than supertrend yesterday, then up, else downI am trying to break down the code in this strategy and am confused. Can anyone help me understand how this line in the original code works?

Code:def ST = if close < ST[1] then UP else DN;

it is defining ST, using ST[1]. "ST" is nowhere in the code prior to this line, so it seems like a circular reference. How (and what) are we referencing when using the ST[1] in the definition of ST?

The code seems to work, as it doesn't create an error in my thinkscript editor, but I have no idea HOW it works or what it is calculating. Can anyone help?

@DBSully It's magic.

Think about the only variable in the code. Maybe that will tell you what ST is defined as.

def ST = if close < ST[1] then UP else DN;

plot SuperTrend = ST;

SuperTrend.AssignValueColor(if close < ST then Color.RED else Color.GREEN);

SuperTrend.SetHiding(hideSuperTrendAtr);

def SuperTrendUP = if ST crosses below close[-1] then 1 else 0;

def isSuperTrendUP = SuperTrend > close;

def SuperTrendDN = if ST crosses above close[-1] then 1 else 0;

def isSuperTrendDN = SuperTrend < close;| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Slim Miller's Long-Term Trend Trading Chart | Indicators | 9 | |

|

|

Donchian Trend Ribbon For ThinkOrSwim | Indicators | 18 | |

|

|

Slimmer Ribbon Indicator for ThinkorSwim | Indicators | 20 | |

|

|

Repaints Cup and Handle Indicator for ThinkorSwim | Indicators | 25 | |

|

|

The Ultimate Buy and Sell Indicator for ThinkOrSwim | Indicators | 6 |

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.