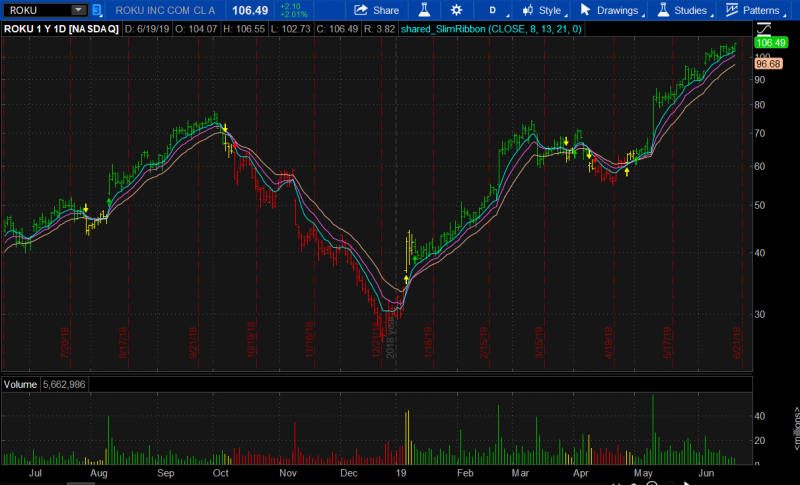

Mr. Slim Miller was one of the original OEX pit traders at the CBOE. His website is askSLIM dot com.

This indicator is very customizable. Alerts are built in, you can use regular candles if you wish, you can turn all of the EMA's off and the color of the ribbon will still be there.

If you cannot find what you are looking for when you click the cog, open the code itself and take a look at what is there. This indicator also overrides the color of your volume bars. Lastly, this indicator is good for any timeframe without adjusting the EMA's.

Try it with a TMO or the RSI Laguerre on the bottom. Good trading, Markos.

This indicator is very customizable. Alerts are built in, you can use regular candles if you wish, you can turn all of the EMA's off and the color of the ribbon will still be there.

If you cannot find what you are looking for when you click the cog, open the code itself and take a look at what is there. This indicator also overrides the color of your volume bars. Lastly, this indicator is good for any timeframe without adjusting the EMA's.

Try it with a TMO or the RSI Laguerre on the bottom. Good trading, Markos.

thinkScript Code

Rich (BB code):

#Mr Slim Miller at askSLIM dot com

#SlimRibbonCustom_markos9-7-18

input price = close;

input superfast_length = 8;

input fast_length = 13;

input slow_length = 21;

input displace = 0;

def mov_avg8 = ExpAverage(price[-displace], superfast_length);

def mov_avg13 = ExpAverage(price[-displace], fast_length);

def mov_avg21 = ExpAverage(price[-displace], slow_length);

plot Slow = mov_avg21;

def buy = mov_avg8 > mov_avg13 and mov_avg13 > mov_avg21 and low > mov_avg8;

def stopbuy = mov_avg8 <= mov_avg13;

def buynow = !buy[1] and buy;

def buysignal = CompoundValue(1, if buynow and !stopbuy then 1 else if buysignal[1]==1 and stopbuy then 0 else buysignal[1], 0);

def sell = mov_avg8 < mov_avg13 and mov_avg13 < mov_avg21 and high < mov_avg8;

def stopsell = mov_avg8 >= mov_avg13;

def sellnow = !sell[1] and sell;

def sellsignal = CompoundValue(1, if sellnow and !stopsell then 1 else if sellsignal[1]==1 and stopsell then 0 else sellsignal[1], 0);

# Charting & Formatting

Plot Superfast = mov_avg8;

plot Fast = mov_avg13;

plot Buy_Signal = buysignal[1] == 0 and buysignal==1;

Buy_signal.setpaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

Buy_signal.setdefaultColor(color.dark_GREEN);

Buy_signal.hidetitle();

plot Momentum_Down = buysignal[1] ==1 and buysignal==0;

Momentum_down.setpaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

Momentum_Down.setdefaultColor(color.yellow);

Momentum_down.hidetitle();

Plot Sell_Signal = sellsignal[1] ==0 and sellsignal;

Sell_signal.setpaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_down);

sell_signal.setDefaultColor(color.red);

Sell_signal.hidetitle();

Plot Momentum_Up = sellsignal[1]==1 and sellSignal==0;

Momentum_up.setpaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_up);

Momentum_up.setDefaultColor(color.yellow);

Momentum_up.hidetitle();

Alert(condition = buysignal[1] == 0 and buysignal == 1, text = "Buy Signal", sound = Sound.Bell, "alert type" = Alert.BAR);

Alert(condition = buysignal[1] == 1 and buysignal == 0, text = "Momentum_Down", sound = Sound.Bell, "alert type" = Alert.BAR);

Alert(condition = sellsignal[1] == 0 and sellsignal == 1, text = "Sell Signal", sound = Sound.Bell, "alert type" = Alert.BAR);

Alert(condition = sellsignal[1] == 1 and sellSignal == 0, text = "Momentum_Up", sound = Sound.Bell, "alert type" = Alert.BAR);

plot Colorbars = if buysignal ==1 then 1 else if sellsignal ==1 then 2 else if buysignal ==0 or sellsignal==0 then 3 else 0;

colorbars.hide();

Colorbars.definecolor("Buy_Signal_Bars", color.dark_green);

Colorbars.definecolor("Sell_Signal_Bars", color.red);

Colorbars.definecolor("Neutral", color.yellow);

AssignPriceColor(

if Colorbars ==1 then colorbars.color("buy_signal_bars") else

if colorbars ==2 then colorbars.color("Sell_Signal_bars") else colorbars.color("neutral"));

#endShareable Link

https://tos.mx/zbybTcAttachments

Last edited by a moderator: