@ace_wheelie I actually moved your thread here. The Slim ribbon indicator posted on the first page of this thread doesn't satisfy your request? How is it different? You may want to post some more details. No need to create a separate thread. Feel free to add more info here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SLIM Ribbon Indicator for ThinkorSwim

- Thread starter markos

- Start date

-

- Tags

- trend unanswered

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

ace_wheelie

New member

I was watching Slim's Market Week video for this week and he was demonstrating his new indicator in which he combined the slim ribbon with the projection oscillator. Seemed to work really well with the daily/2hr chart combo. @markos would that be a relative 'easy' thing to code? It's way out of my pay grade or I would attempt it myself.

Here is the video, about 10 minutes in he starts to demonstrate the indicator

Here is the video, about 10 minutes in he starts to demonstrate the indicator

Last edited:

T

Thomas

Guest

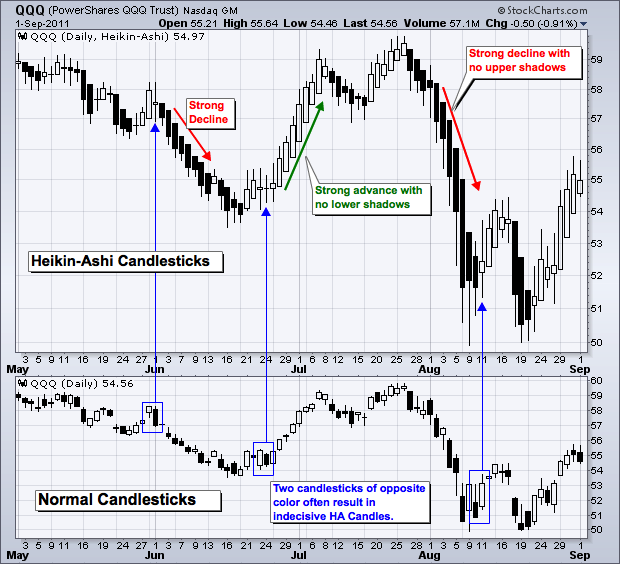

Can I just add,....When using Heiken,....when candles are trending higher they have no lower wicks, when trending lower they have upper wicks, when they come to a point where there is a change Doji's/Spinning tops form, multiples with uncertainty of direction change, none if the direction is quick change, that is what to look for. Make sure the trends are strong, easier to see any changes in Heiken candles.@thinky & @tenacity11 I don't remember which one of you asked me about using HA candles vs. standard Candles on my Slim Ribbon chart.

There was a question about potential lag. I have part of an answer from school.stockcharts.com :

I see that in addition to the SlimRibbon study there is also a study called SimRibbon_PO.

Has anyone created something similar to SlimRibbon_PO study?

It appears that it might be some kind of price oscillator(or RSI etc.) with SlimRibbon signals and coloring added to it.

You can see the SimRibbon_PO study in the video in post #142 above.

View the video in Post # 142 on this useThinkScript web page. - Time into video = 14.0 minutes.

https://usethinkscript.com/threads/slim-ribbon-indicator-for-thinkorswim.245/page-8

Or,

At 1.0 minute into this video by Slim.

Has anyone created something similar to SlimRibbon_PO study?

It appears that it might be some kind of price oscillator(or RSI etc.) with SlimRibbon signals and coloring added to it.

You can see the SimRibbon_PO study in the video in post #142 above.

View the video in Post # 142 on this useThinkScript web page. - Time into video = 14.0 minutes.

https://usethinkscript.com/threads/slim-ribbon-indicator-for-thinkorswim.245/page-8

Or,

At 1.0 minute into this video by Slim.

Last edited:

@markos @BenTen I see a ton of slim ribbon posts, do you know if there's a stream for the Slim MTF code?This may seem odd to you, but I don't backtest. I wish I could help but I don't do strategy's either. Did you watch slim miller's video as mentioned elsewhere here? Read the study, it comes complete with Arrows and Alerts galore.

Editing this Oct 1, 2020: @korygill @BenTen & @mc01439 I feel the SlimRibbon Study is worthy of a backtest. (Not the TMO) Could one of you run it through it's paces if you have time?

Anyway to add a label to this indicator? I cant seem to get three way color changes on the label.

If you are referring to the code in Post #1 the three way coloring is used in the very last line of code... That code should be the last (third) parameter of your AddLabel() code...

I think its the sequence of events Im not getting right, this is the best I've gotten...

Code:

###SLIM

#Mr Slim Miller at askSLIM dot com

#SlimRibbonCustom_markos9-7-18

input price300 = close;

input superfast_length = 8;

input fast_length = 13;

input slow_length = 21;

input displace300 = 0;

def mov_avg8 = ExpAverage(price300[-displace300], superfast_length);

def mov_avg13 = ExpAverage(price300[-displace300], fast_length);

def mov_avg21 = ExpAverage(price300[-displace300], slow_length);

#moving averages

def Superfast = mov_avg8;

def Fast = mov_avg13;

def Slow = mov_avg21;

def buy = mov_avg8 > mov_avg13 and mov_avg13 > mov_avg21 and low > mov_avg8;

def stopbuy = mov_avg8 <= mov_avg13;

def buynow = !buy[1] and buy;

def buysignal2 = CompoundValue(1, if buynow and !stopbuy then 1 else if buysignal2[1] == 1 and stopbuy then 0 else buysignal2[1], 0);

def sell = mov_avg8 < mov_avg13 and mov_avg13 < mov_avg21 and high < mov_avg8;

def stopsell = mov_avg8 >= mov_avg13;

def sellnow = !sell[1] and sell;

def sellsignal2 = CompoundValue(1, if sellnow and !stopsell then 1 else if sellsignal2[1] == 1 and stopsell then 0 else sellsignal2[1], 0);

plot Colorbars = if buysignal2 ==1 then 1 else if sellsignal2 ==1 then 2 else if buysignal2 ==0 or sellsignal2==0 then 3 else 0;

colorbars.hide();

Colorbars.definecolor("Buy_Signal_Bars", color.Green);

Colorbars.definecolor("Sell_Signal_Bars", color.red);

Colorbars.definecolor("Neutral", color.gray);

AddLabel(yes, if Colorbars ==1 then "SLIM:Up" else "SLIM:Down",

if Colorbars ==2 then Color.RED else Color.GREEN);@Woodman78 Try this code... I didn't check the logic of the entire script, I only corrected to AddLabel() logic to match the previous logic...

Ruby:

###SLIM

#Mr Slim Miller at askSLIM dot com

#SlimRibbonCustom_markos9-7-18

input price300 = close;

input superfast_length = 8;

input fast_length = 13;

input slow_length = 21;

input displace300 = 0;

def mov_avg8 = ExpAverage(price300[-displace300], superfast_length);

def mov_avg13 = ExpAverage(price300[-displace300], fast_length);

def mov_avg21 = ExpAverage(price300[-displace300], slow_length);

#moving averages

def Superfast = mov_avg8;

def Fast = mov_avg13;

def Slow = mov_avg21;

def buy = mov_avg8 > mov_avg13 and mov_avg13 > mov_avg21 and low > mov_avg8;

def stopbuy = mov_avg8 <= mov_avg13;

def buynow = !buy[1] and buy;

def buysignal2 = CompoundValue(1, if buynow and !stopbuy then 1 else if buysignal2[1] == 1 and stopbuy then 0 else buysignal2[1], 0);

def sell = mov_avg8 < mov_avg13 and mov_avg13 < mov_avg21 and high < mov_avg8;

def stopsell = mov_avg8 >= mov_avg13;

def sellnow = !sell[1] and sell;

def sellsignal2 = CompoundValue(1, if sellnow and !stopsell then 1 else if sellsignal2[1] == 1 and stopsell then 0 else sellsignal2[1], 0);

plot Colorbars = if buysignal2 == 1 then 1

else if sellsignal2 == 1 then 2

else if buysignal2 == 0 or sellsignal2 == 0 then 3

else 0;

colorbars.hide();

Colorbars.definecolor("Buy_Signal_Bars", color.Green);

Colorbars.definecolor("Sell_Signal_Bars", color.red);

Colorbars.definecolor("Neutral", color.gray);

AddLabel(yes,

if Colorbars == 1 then "SLIM:Up" else if Colorbars == 2 then "SLIM:Down" else "SLIM:Neutral",

if Colorbars == 1 then Colorbars.Color("Buy_Signal_Bars")

else if Colorbars == 2 then Colorbars.Color("Sell_Signal_Bars")

else Colorbars.Color("Neutral")

);Is there a Scanner for this Study?

Something to this nature - Buy Signal one bar prior and Sell signal one bar prior.

@madantv73 Could you please clarify whether you're asking to be able to predict the future by signaling a bar before the even happens...???

There is currently scan code in Post #117...

See post above yours.Hey I was wondering if someone could attempt to make me a scanner for this indicator. Preferably id like one that is based off the one hour. If someone could please take their time I'd really appreciate it.

Is there a scanner that shows where all the lines cross for a bearish momentum. The current scanner just shows an ongoing trend. Not when it starts.See post above yours.

Copy script: https://usethinkscript.com/threads/slim-ribbon-indicator-for-thinkorswim.245/page-6#post-21700Is there a scanner that shows where all the lines cross for a bearish momentum. The current scanner just shows an ongoing trend. Not when it starts.

and add this to the bottom

Code:

plot momo_down = SCANNER_MOMENTUM_DOWN;The SlimRibbon strategy found here: https://usethinkscript.com/threads/slim-ribbon-indicator-for-thinkorswim.245/page-5#post-16433Any good strategies for options with this?

was found to not be good in option trading

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Slim Miller's Long-Term Trend Trading Chart | Indicators | 9 | |

|

|

Donchian Trend Ribbon For ThinkOrSwim | Indicators | 18 | |

|

|

Slimmer Ribbon Indicator for ThinkorSwim | Indicators | 20 | |

|

|

Repaints Cup and Handle Indicator for ThinkorSwim | Indicators | 25 | |

|

|

The Ultimate Buy and Sell Indicator for ThinkOrSwim | Indicators | 6 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

900

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.