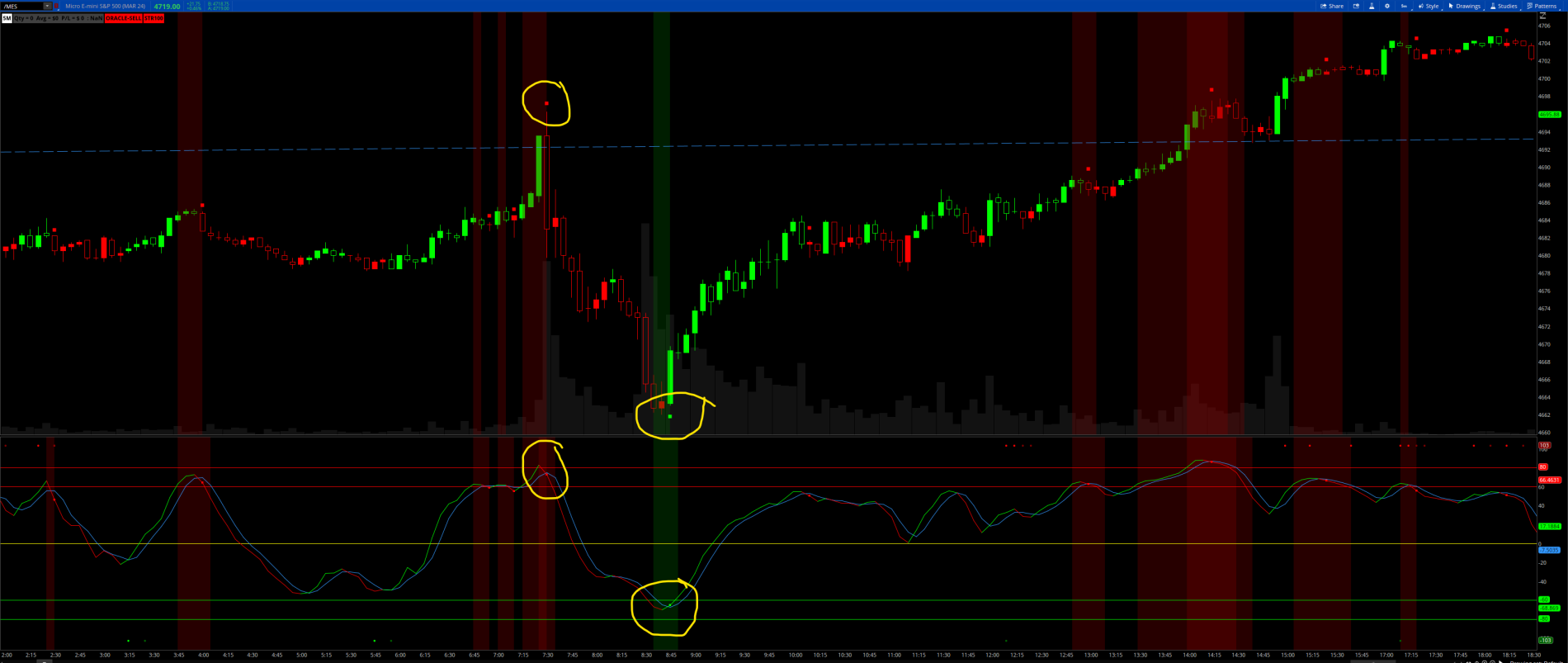

I made an UPPER version of the Sharkwave. It shows the colored clouds and square dots. Also included colored candles.

Code:

#Sharkwave_UPPER

#study(title = 'SharkWaveTrend', shorttitle = 'SharkWaveTrend')

# Converted by Sam4Cok@Samer800 - 12/2023

# Assembled for Upper chart, cloud and dots by Chewie

declare upper;

input colorBars = no;

input SharkCloud = yes;

input ColorBar = yes;

input vwapShow = no;#(true, title = 'Show Fast WT', type = input.bool)

input wtChannelLen = 9;#, title = 'WT Channel Length', type = input.integer)

input wtAverageLen = 12;#, title = 'WT Average Length', type = input.integer)

input wtMASource = hlc3;#, title = 'WT MA Source', type = input.source)

input wtMaLen = 3;#, title = 'WT MA Length', type = input.integer)

input obLevel = 53;#, title = 'WT Overbought Level 1', type = input.integer)

input osLevel = -53;#, title = 'WT Oversold Level 1', type = input.integer)

input wtShowDiv = yes;#(true, title = 'Show WT Regular Divergences', type = input.bool)

input wtShowHiddenDiv = no;#(false, title = 'Show WT Hidden Divergences', type = input.bool)

input showHiddenDiv_nl = yes;#(true, title = 'Not apply OB/OS Limits on Hidden Divergences', type = input.bool)

input wtDivOBLevel = 45;#, title = 'WT Bearish Divergence min', type = input.integer)

input wtDivOSLevel = -65;#, title = 'WT Bullish Divergence min', type = input.integer)

input wtDivOBLevel_addshow = yes;#(true, title = 'Show 2nd WT Regular Divergences', type = input.bool)

input wtDivOBLevel_add = 15;#, title = 'WT 2nd Bearish Divergence', type = input.integer)

input wtDivOSLevel_add = -40;#, title = 'WT 2nd Bullish Divergence 15 min', type = input.integer)

input rsiMFIShow = no;#(true, title = 'Show MFI', type = input.bool)

input rsiMFIperiod = 60;#,title = 'MFI Period', type = input.integer)

input rsiMFIMultiplier = 150;#, title = 'MFI Area multiplier', type = input.float)

input rsiMFIPosY = 2.5;#, title = 'MFI Area Y Pos', type = input.float)

input showRsiLine = no; #(false, title = 'Show RSI', type = input.bool)

input rsiSRC = close;#(close, title = 'RSI Source', type = input.source)

input rsiLen = 12;#, title = 'RSI Length', type = input.integer)

#input rsiOversold = 30;#, title = 'RSI Oversold', minval = 50, maxval = 100, type = input.integer)

#input rsiOverbought = 60;#, title = 'RSI Overbought', minval = 0, maxval = 50, type = input.integer)

input rsiShowDiv = yes;#(false, title = 'Show RSI Regular Divergences', type = input.bool)

input rsiShowHiddenDiv = no;#(false, title = 'Show RSI Hidden Divergences', type = input.bool)

input rsiDivOBLevel = 60;#, title = 'RSI Bearish Divergence min', type = input.integer)

input rsiDivOSLevel = 30;#, title = 'RSI Bullish Divergence min', type = input.integer)

input stochShow = no;#(true, title = 'Show Stochastic RSI', type = input.bool)

input stochUseLog = yes;#(true, title=' Use Log?', type = input.bool)

input stochAvg = no;#(false, title='Use Average of both K & D', type = input.bool)

input stochSRC = close;#(close, title = 'Stochastic RSI Source', type = input.source)

input stochLen = 14;#, title = 'Stochastic RSI Length', type = input.integer)

input stochRsiLen = 14;#, title = 'RSI Length ', type = input.integer)

input stochKSmooth = 3;#, title = 'Stochastic RSI K Smooth', type = input.integer)

input stochDSmooth = 3;#, title = 'Stochastic RSI D Smooth', type = input.integer)

input stochShowDiv = yes;#(false, title = 'Show Stoch Regular Divergences', type = input.bool)

input stochShowHiddenDiv = no;#(false, title = 'Show Stoch Hidden Divergences', type = input.bool)

input rsiLengthInput = 12;#, minval=1, title="RSI Length", group="Shark")

input rsiSourceInput = close;#, "Source", group="Shark")

input length2 = 30;#, minval=1, group="Shark")

input src = close;#, title="Source", group="Shark")

input mult = 2.0;#, minval=0.001, maxval=50, title="StdDev", group="Shark")

input offset = 0;#, "Offset", minval = -500, maxval = 500, group="Shark")

input HighlightBreaches = yes;#, title="Highlight Oversold/Overbought", group="Shark")

input bApply25and75 = no;#, title="Apply 25/75 RSI rule", group="Shark")

def na = Double.NaN;

def last = IsNaN(close);

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

DefineGlobalColor("intense_red", Color.RED);#CreateColor(255, 35, 35));

DefineGlobalColor("regular_red", Color.DARK_RED);#CreateColor(255, 82, 82));

DefineGlobalColor("intense_green", Color.GREEN);#CreateColor(0, 230, 118));

DefineGlobalColor("regular_green", Color.DARK_GREEN);#CreateColor(76, 175, 80));

#DefineGlobalColor("wt1", CreateColor(217,205,205));

DefineGlobalColor("wt1", color.white);

DefineGlobalColor("wt2", CreateColor(51, 153, 255));

#DefineGlobalColor("wt2", CreateColor(29, 63, 97));

#// } FUNCTIONS

#f_findDivs(src, topLimit, botLimit, useLimits) =>

script f_findDivs {

input src = close;

input topLimit = 70;

input botLimit = 30;

input useLimits = yes;

def na = Double.NaN;

def topfractal = src[4] < src[2] and src[3] < src[2] and src[2] > src[1] and src[2] > src[0];

def botfractal = src[4] > src[2] and src[3] > src[2] and src[2] < src[1] and src[2] < src[0];

def top_fractal = if isNaN(topfractal) then 0 else topfractal;

def bot_fractal = if isNaN(botfractal) then 0 else botfractal;

def fractalize = if top_fractal then 1 else if bot_fractal then -1 else 0;

def fractalTop = if fractalize > 0 and (if useLimits then src[2] >= topLimit else yes) then src[2] else na;

def fractalBot = if fractalize < 0 and (if useLimits then src[2] <= botLimit else yes) then src[2] else na;

def TopCond = if !IsNaN(fractalTop) and fractalTop then fractalTop else 0;

def BotCond = if !IsNaN(fractalBot) and fractalBot then fractalBot else 0;

def highPrev0;

def highPrev1;

def highPrice0;

def highPrice1;

if TopCond {

highPrev1 = highPrev0[1];

highPrev0 = src[2];

highPrice1 = highPrice0[1];

highPrice0 = high[2];

} else {

highPrev1 = highPrev1[1];

highPrev0 = highPrev0[1];

highPrice1 = highPrice1[1];

highPrice0 = highPrice0[1];

}

def highPrev = highPrev1[2];#if highPrev1 != highPrev1[1] then highPrev1[1] else highPrev[1];

def highPrice = highPrice1[2];#if highPrice1 != highPrice1[1] then highPrice1[1] else highPrice[1];

def lowPrev0;

def lowPrev1;

def lowPrice0;

def lowPrice1;

if BotCond {

lowPrev1 = lowPrev0[1];

lowPrev0 = src[2];

lowPrice1 = lowPrice0[1];

lowPrice0 = low[2];

} else {

lowPrev1 = lowPrev1[1];

lowPrev0 = lowPrev0[1];

lowPrice1 = lowPrice1[1];

lowPrice0 = lowPrice0[1];

}

def lowPrev = lowPrev1[2];#if lowPrev1 != lowPrev1[1] then lowPrev1[1] else lowPrev[1];

def lowPrice = lowPrice1[2];#if lowPrice1 != lowPrice1[1] then lowPrice1[1] else lowPrice[1];

def bearSignal = TopCond and high[2] > highPrice and src[2] < highPrev;

def bullSignal = BotCond and low[2] < lowPrice and src[2] > lowPrev;

def bearDivHidden = TopCond and high[2] < highPrice and src[2] > highPrev;

def bullDivHidden = BotCond and low[2] > lowPrice and src[2] < lowPrev;

plot top = if isNaN(TopCond) then 0 else TopCond;#fractalTop;

plot bot = if isNaN(BotCond) then 0 else BotCond;#fractalBot;

plot lowP = lowPrev;

plot sigBear = if isNaN(bearSignal) then 0 else bearSignal;

plot sigBull = if isNaN(bullSignal) then 0 else bullSignal;

plot hidBear = if isNaN(bearDivHidden) then 0 else bearDivHidden;

plot hidBull = if isNaN(bullDivHidden) then 0 else bullDivHidden;

}

#// Stochastic RSI

script f_stochrsi {

input _src = close;

input _stochlen = 14;

input _rsilen = 14;

input _smoothk = 3;

input _smoothd = 3;

input _log = yes;

input _avg = no;

def src = if _log then Log(_src) else _src;

def rsi = RSI(Price = src, Length = _rsilen);

def stoch = 100 * (rsi - Lowest(rsi, _stochlen)) / (Highest(rsi, _stochlen) - Lowest(rsi, _stochlen));

def kk = Average(stoch, _smoothk);

def d1 = Average(kk, _smoothd);

def avg_1 = (kk + d1) / 2;

def k = if _avg then avg_1 else kk;

plot stochK = k;

plot stochD = d1;

}

#/ RSI+MFI

script f_rsimfi {

input _period = 60;

input _multiplier = 150;

input rsiMFIPosY = 2.5;

def c = close;

def o = open;

def h = high;

def l = low;

def dif = (c - o) / (h - l);

def diff = if !isNaN(dif) then dif else 0;

def rsimfi = Average(diff * _multiplier, _period) - rsiMFIPosY;

plot f_rsimfi = rsimfi;

}

#// WaveTrend

script f_wavetrend {

#def wt1 = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, obLevel, osLevel).wt_1;

input wtMASource = close;

input wtChannelLen = 9;

input wtAverageLen = 12;

input wtMALen = 3;

input obLevel = 53;

input osLevel = -53;

def tfsrc = wtMASource;

def esa = ExpAverage(tfsrc, wtChannelLen);

def de = ExpAverage(AbsValue(tfsrc - esa), wtChannelLen);

def ci = (tfsrc - esa) / (0.015 * de);

def wt1 = ExpAverage(ci, wtAverageLen);

def wt2 = Average(wt1, wtMALen);

def wtVwap = wt1 - wt2;

def wtOversold = wt2 <= osLevel;

def wtOverbought = wt2 >= obLevel;

def wtCross = Crosses(wt1, wt2, CrossingDirection.ANY);

def wtCrossUp = (wt2 - wt1) <= 0;

def wtCrossDown = (wt2 - wt1) >= 0;

def wtCrosslast = Crosses(wt1[2], wt2[2], CrossingDirection.ANY);

def wtCrossUplast = (wt2[2] - wt1[2]) <= 0;

def wtCrossDownlast = (wt2[2] - wt1[2]) >= 0;

plot wt_1 = wt1;

plot wt_2 = wt2;

plot wt_OS = wtOversold;

plot wt_OB = wtOverbought;

plot wt_cross = wtCross;

plot wt_CrossUp = wtCrossUp;

plot wt_CrossDn = wtCrossDown;

plot wt_Vwap = wtVwap;

}

#// CALCULATE INDICATORS {

#// RSI

def rsi = RSI(Price = rsiSRC, Length = rsiLen);

#// RSI + MFI Area

def rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, rsiMFIPosY);

#// Calculates WaveTrend

def wt1 = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, obLevel, osLevel).wt_1;

def wt2 = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, obLevel, osLevel).wt_2;

def wtOversold = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, obLevel, osLevel).wt_OS;

def wtOverbought = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, obLevel, osLevel).wt_OB;

def wtCross = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, obLevel, osLevel).wt_cross;

def wtCrossUp = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, obLevel, osLevel).wt_CrossUp;

def wtCrossDown = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, obLevel, osLevel).wt_CrossDn;

def wtVwap = f_wavetrend(wtMASource, wtChannelLen, wtAverageLen, wtMALen, obLevel, osLevel).wt_Vwap;

#// Stochastic RSI

def stochK = f_stochrsi(stochSRC, stochLen, stochRsiLen, stochKSmooth, stochDSmooth, stochUseLog, stochAvg).stochK;

def stochD = f_stochrsi(stochSRC, stochLen, stochRsiLen, stochKSmooth, stochDSmooth, stochUseLog, stochAvg).stochD;

#// WT Divergences

def wtBearDiv = f_findDivs(wt2, wtDivOBLevel, wtDivOSLevel, yes).sigBear;

def wtBullDiv = f_findDivs(wt2, wtDivOBLevel, wtDivOSLevel, yes).sigBull;

def wtBearDivHidden = f_findDivs(wt2, wtDivOBLevel, wtDivOSLevel, yes).hidBear;

def wtBullDivHidden = f_findDivs(wt2, wtDivOBLevel, wtDivOSLevel, yes).hidBull;

def wtBearDiv_add = f_findDivs(wt2, wtDivOBLevel_add, wtDivOSLevel_add, yes).sigBear;

def wtBullDiv_add = f_findDivs(wt2, wtDivOBLevel_add, wtDivOSLevel_add, yes).sigBull;

def wtBearDivHidden_add = f_findDivs(wt2, wtDivOBLevel_add, wtDivOSLevel_add, yes).hidBear;

def wtBullDivHidden_add = f_findDivs(wt2, wtDivOBLevel_add, wtDivOSLevel_add, yes).hidBull;

def wtBearDivHidden_nl = f_findDivs(wt2, 0, 0, no).hidBear;

def wtBullDivHidden_nl = f_findDivs(wt2, 0, 0, no).hidBull;

def wtBearDivHidden_ = if showHiddenDiv_nl then wtBearDivHidden_nl else wtBearDivHidden;

def wtBullDivHidden_ = if showHiddenDiv_nl then wtBullDivHidden_nl else wtBullDivHidden;

def wtBearDivColor_add = (wtShowDiv and (wtDivOBLevel_addshow and wtBearDiv_add)) or (wtShowHiddenDiv and (wtDivOBLevel_addshow and wtBearDivHidden_add));# ? RED #9a0202 : na

def wtBullDivColor_add = (wtShowDiv and (wtDivOBLevel_addshow and wtBullDiv_add)) or (wtShowHiddenDiv and (wtDivOBLevel_addshow and wtBullDivHidden_add));# ? GREEN #1b5e20 : na

#// RSI Divergences

def rsiBearDiv = f_findDivs(rsi, rsiDivOBLevel, rsiDivOSLevel, yes).sigBear;

def rsiBullDiv = f_findDivs(rsi, rsiDivOBLevel, rsiDivOSLevel, yes).sigBull;

#// Stoch Divergences

def stochBearDiv = f_findDivs(stochK, 0, 0, no).sigBear;

def stochBullDiv = f_findDivs(stochK, 0, 0, no).sigBull;

def stochBearDivHidden = f_findDivs(stochK, 0, 0, no).hidBear;

def stochBullDivHidden = f_findDivs(stochK, 0, 0, no).hidBull;

def stochBearDivColor = (stochShowDiv and stochBearDiv) or (stochShowHiddenDiv and stochBearDivHidden);#red

def stochBullDivColor = (stochShowDiv and stochBullDiv) or (stochShowHiddenDiv and stochBullDivHidden);#green

#// Buy signal.

def buySignal = wtCross and wtCrossUp and wtOversold;

def buySignalDiv = (wtShowDiv and wtBullDiv) or

(wtShowDiv and wtBullDiv_add) or

(stochShowDiv and stochBullDiv) or

(rsiShowDiv and rsiBullDiv);

#// Sell signal

def sellSignal = wtCross and wtCrossDown and wtOverbought;

def sellSignalDiv = (wtShowDiv and wtBearDiv) or

(wtShowDiv and wtBearDiv_add) or

(stochShowDiv and stochBearDiv) or

(rsiShowDiv and rsiBearDiv);

#// } CALCULATE INDICATORS

#// WT Areas

def wtWave1 = wt1; # 'WT Wave 1'

def wtWave2 = wt2; # 'WT Wave 2'

plot sqBuy = if buySignal then low - ATR(60)/2 else na; # 'Buy circle'

plot sqSell = if sellSignal then high + ATR(60)/2 else na; # 'Sell circle'

sqBuy.SetLineWeight(4);

sqSell.SetLineWeight(4);

sqBuy.SetPaintingStrategy(PaintingStrategy.SQUARES);

sqSell.SetPaintingStrategy(PaintingStrategy.SQUARES);

sqBuy.SetDefaultColor(Color.green);

sqSell.SetDefaultColor(Color.red);

AssignPriceColor(if !ColorBar then Color.CURRENT else

if wtWave1 > wtWave2

then Color.green

else if wtWave1 < wtWave2

then Color.RED else Color.YELLOW);

AddCloud(

if SharkCloud and wtwave1 > 60 then Double.POSITIVE_INFINITY else Double.NaN,

if SharkCloud and wtwave1 > 60 then Double.NEGATIVE_INFINITY else Double.NaN, Color.dark_RED);

AddCloud(

if SharkCloud and wtwave1 > 79 then Double.POSITIVE_INFINITY else Double.NaN,

if SharkCloud and wtwave1 > 79 then Double.NEGATIVE_INFINITY else Double.NaN, Color.dark_red);

AddCloud(

if SharkCloud and wtwave1 < -60 then Double.POSITIVE_INFINITY else Double.NaN,

if SharkCloud and wtwave1 < -60 then Double.NEGATIVE_INFINITY else Double.NaN, Color.dark_green);

AddCloud(

if SharkCloud and wtwave1 < -79 then Double.POSITIVE_INFINITY else Double.NaN,

if SharkCloud and wtwave1 < -79 then Double.NEGATIVE_INFINITY else Double.NaN, Color.dark_green);