You should upgrade or use an alternative browser.

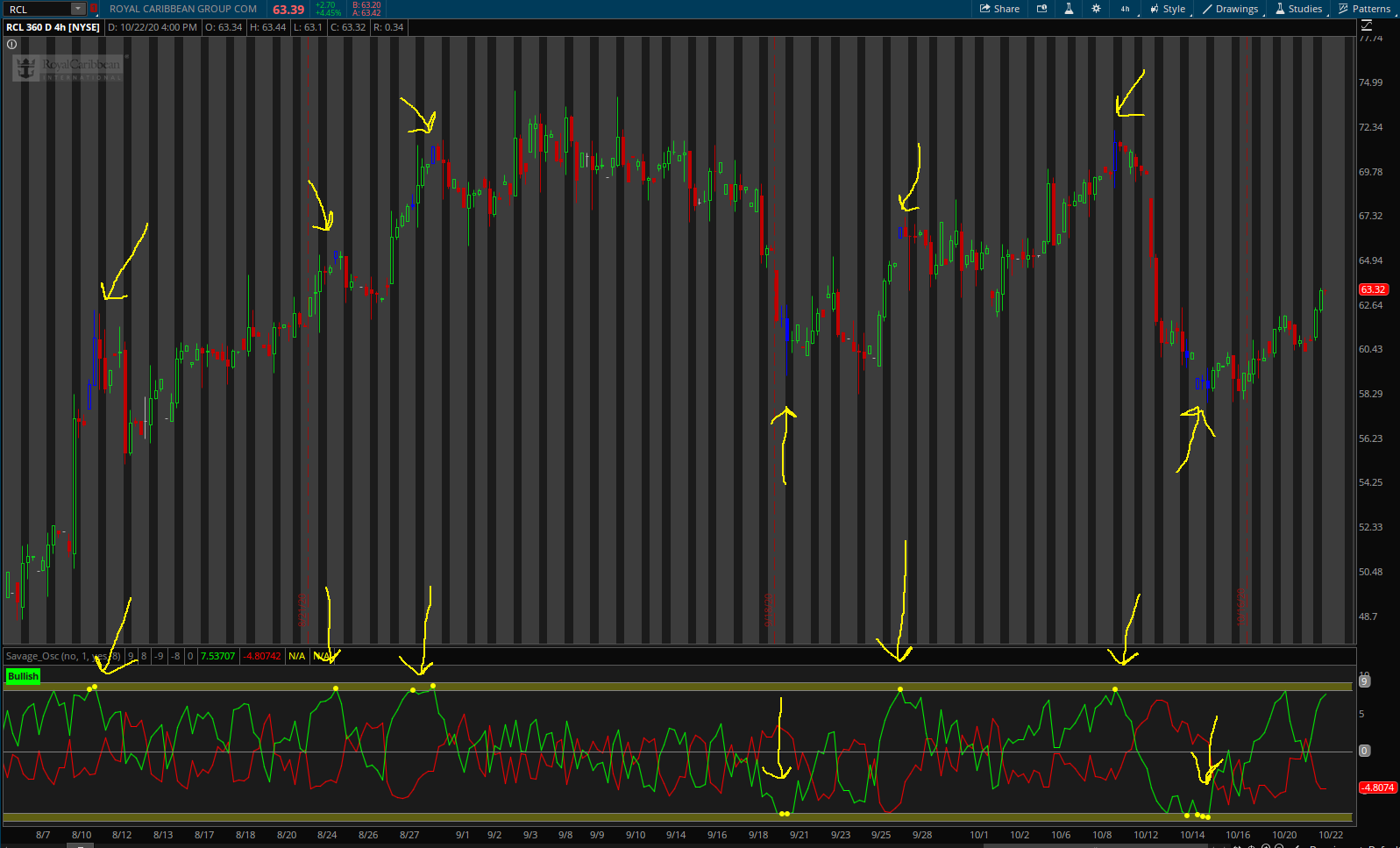

Savage Oscillator for ThinkorSwim

- Thread starter FateOwnzYou

- Start date

crawford5002

Member

great work, are the new added additional Feature in the original code?Added an Additional Feature that should help identify the tops and bottoms, or when a stock is close to turning retracing.

Option to add price action color change or just leave on lower indicator

crawford5002

Member

Thank You@crawford5002 yes it is

I have actually ported it to TradingView, but am having problems getting the results to line up exactly with ToS since there is no StochasticFull function in TradingView, so I have had to recreate this manually. I have been tinkering with this the last few days, but have not been able to get this to work perfectly. If you want to troubleshoot the code, let me know, and we can try to figure this out together. It might just be that I am not understanding the Stochastic calculation.Love it. Any plans to port it to tradingview?

@FateOwnzYou

For these 2 lines of code, would you happen to know the exact settings for K% and D% you are using? I tried fiddling around with what you have below but have not gotten an exact match. If not, no worries. Thanks!

ToS:

Def S1 = Max(-100, Min(100, (StochasticFull(KPeriod = 8, slowing_period = 5, averageType = AverageType.EXPONENTIAL))) - 50) / 50.01;

Def S2 = Max(-100, Min(100, (StochasticFull(KPeriod = 17, slowing_period = 5, averageType = AverageType.EXPONENTIAL))) - 50) / 50.01;

TV:

k1 = ema(stoch(close, high, low, 8), 5)

d1 = ema(k1, 5)

k2 = ema(stoch(close, high, low, 17), 5)

d2 = ema(k2, 5)

No worries. Thanks!@egshih I wish I could help more with that. I actually have never even used trading view, I know nothing of how their script works. Sorry

Added into the original script

input volumeAveragingLength = 20;

input volumePercentThreshold = 50;

def aVol = Average(volume, volumeAveragingLength);

def pVol = 100 * ((volume - aVol[1]) /aVol[1]);

def pDot = pVol >= volumePercentThreshold;

plot volumeStrength = if pDot and (Bull or Bear) then hl2 else Double.NaN;

volumeStrength.SetPaintingStrategy(PaintingStrategy.POINTS);

volumeStrength.SetLineWeight(3);

volumeStrength.SetDefaultColor(color.cyan);

volumeStrength.hideBubble();Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Awesome Line Oscillator with OB/OS Levels for ThinkorSwim | Indicators | 15 | |

|

|

L3 Banker Fund Flow Trend Oscillator for ThinkOrSwim | Indicators | 45 | |

| C | Bull Bear Power VOID Oscillator For ThinkOrSwim | Indicators | 21 | |

| M | SuperTrend Oscillator [LUX] For ThinkOrSwim | Indicators | 6 | |

|

|

Klinger Volume Oscillator for ThinkorSwim | Indicators | 5 |

Similar threads

-

Awesome Line Oscillator with OB/OS Levels for ThinkorSwim

- Started by chewie76

- Replies: 15

-

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Awesome Line Oscillator with OB/OS Levels for ThinkorSwim

- Started by chewie76

- Replies: 15

-

-

-

-

Similar threads

-

Awesome Line Oscillator with OB/OS Levels for ThinkorSwim

- Started by chewie76

- Replies: 15

-

-

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/