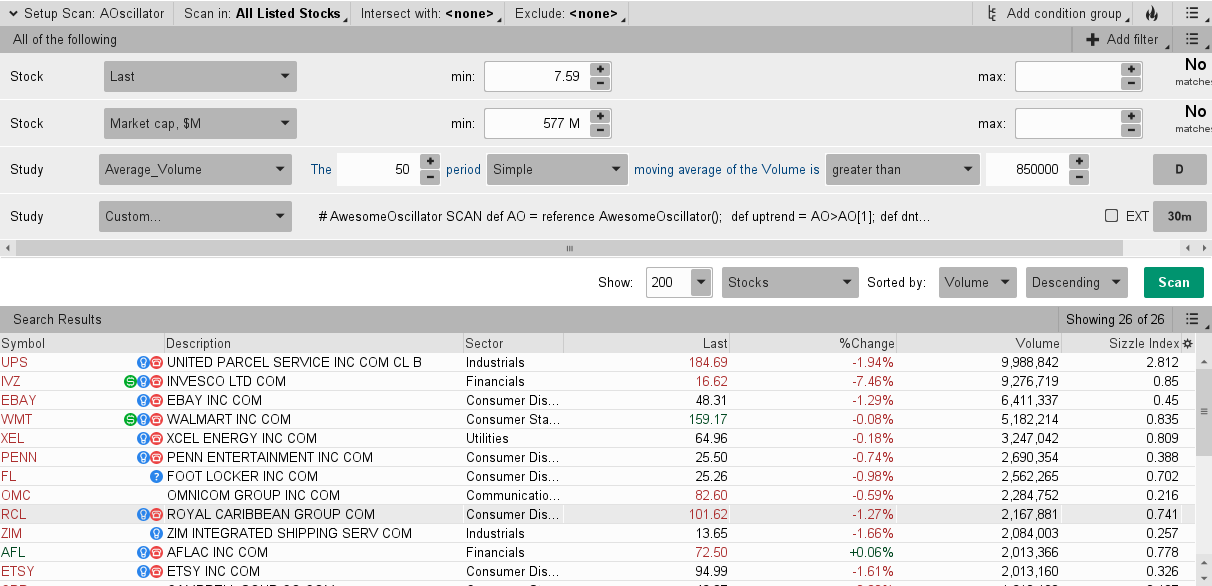

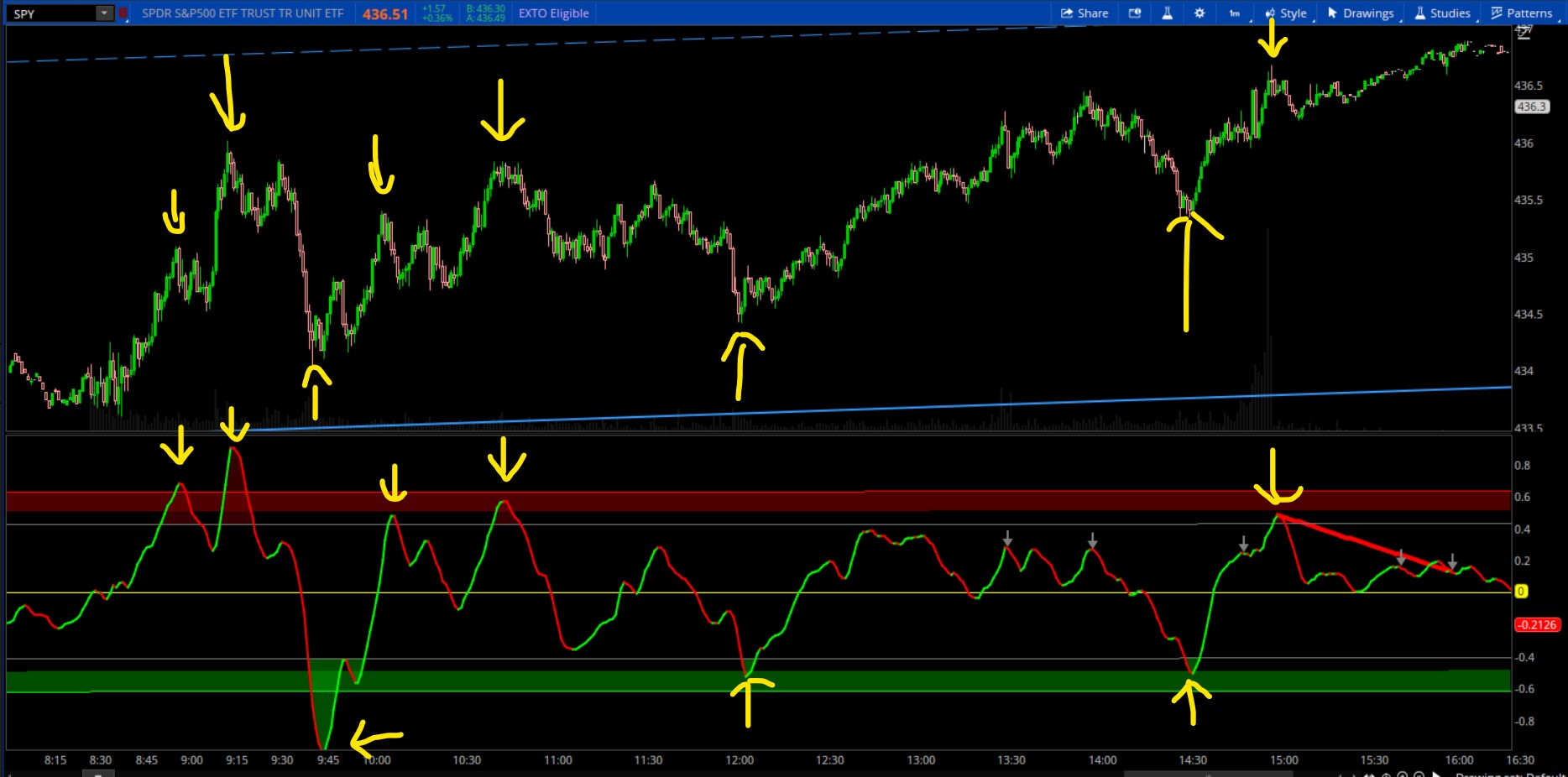

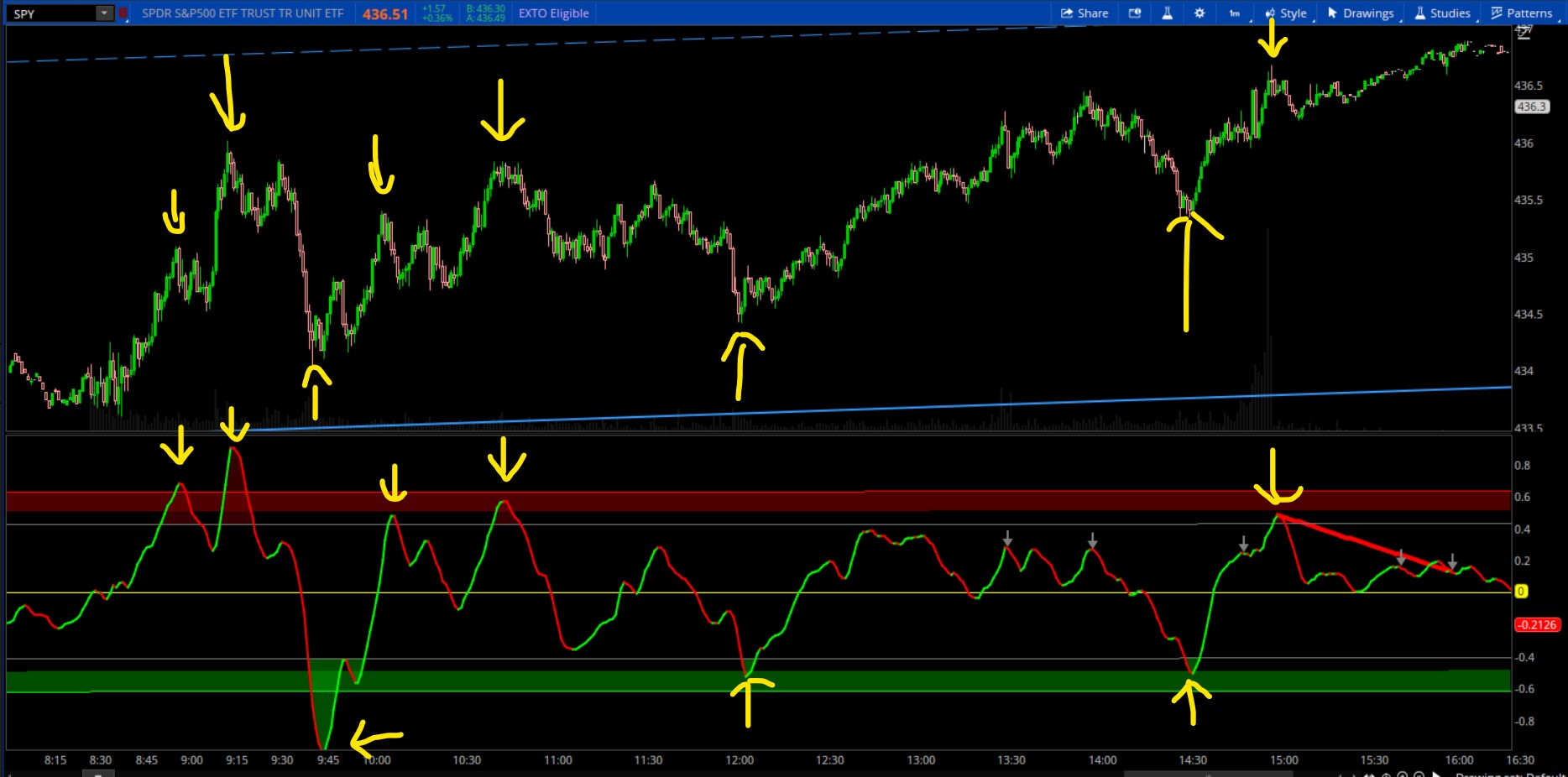

This is the standard "Awesome Oscillator" but formatted into a line. I added standard deviation levels that can be used as Overbought/Oversold areas. I also added a divergence plot as well. Upper chart can also turn on candle colors in the settings. This example is SPY on the 1 min chart.

Shareable Link:

http://tos.mx/er3g0T8

Shareable Link:

http://tos.mx/er3g0T8

Code:

#Awesome Line Oscillator with standard deviation levels and divergence plot

#Formatted by Chewie 6-21-2023

declare lower;

declare zerobase;

input ColorBar = no;

plot AO = Average(hl2, 5) - Average(hl2, 34);

plot Zero = 0;

#AO.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

AO.SetLineWeight(2);

AO.DefineColor("Up", Color.GREEN);

AO.DefineColor("Down", Color.RED);

AO.AssignValueColor(if AO > AO[1] then AO.color("Up") else if AO < AO[1] then AO.color("Down") else GetColor(1));

Zero.SetDefaultColor(COLOR.YELLOW);

# 2 Standard Deviation Full

input deviation = 1.68;

input deviations = 2.0;

input deviations2 = 2.5;

input fullRange = Yes;

input length = 21;

def regression;

def stdDeviation;

if (fullRange) {

regression = InertiaAll(AO);

stdDeviation = StDevAll(AO);

} else {

regression = InertiaAll(AO, length);

stdDeviation = StDevAll(AO, length);

}

def UpperLine = regression + deviations * stdDeviation;

def LowerLine = regression - deviations * stdDeviation;

plot Caution = regression - deviation * stdDeviation;

plot CautionH = regression + deviation * stdDeviation;

#UpperLine.SetDefaultColor(Color.RED);

#LowerLine.SetDefaultColor(Color.GREEN);

#UpperLine.SetLineWeight(1);

#LowerLine.SetLineWeight(1);

#Upperline.HideBubble();

#Upperline.Hidetitle();

#Lowerline.HideBubble();

#Lowerline.Hidetitle();

Caution.SetDefaultColor(Color.gray);

Caution.SetLineWeight(1);

Caution.HideBubble();

Caution.Hidetitle();

CautionH.SetDefaultColor(Color.gray);

CautionH.SetLineWeight(1);

CautionH.HideBubble();

CautionH.Hidetitle();

plot UpperLine2 = regression + deviations2 * stdDeviation;

plot LowerLine2 = regression - deviations2 * stdDeviation;

UpperLine2.SetDefaultColor(Color.RED);

LowerLine2.SetDefaultColor(Color.GREEN);

UpperLine2.SetLineWeight(1);

LowerLine2.SetLineWeight(1);

UpperLine2.HideBubble();

UpperLine2.Hidetitle();

LowerLine2.HideBubble();

LowerLine2.Hidetitle();

AddCloud(UpperLine2, UpperLine, Color.RED, Color.CURRENT);

AddCloud(LowerLine, LowerLine2, color.green, Color.CURRENT);

AddCloud(AO, CautionH, Color.RED, Color.CURRENT);

AddCloud(Caution, AO, color.green, Color.CURRENT);

#ColorBar

AssignPriceColor(if !ColorBar then Color.CURRENT else

if AO > AO[1] then AO.color("Up") else if AO < AO[1] then AO.color("Down") else GetColor(1));

# DIVERGENCE

input divergenceLength = 30; #hint divergenceLength: The number of bars used to calculate divergences.

input divergenceType = {default regular, reverse}; #hint divergenceType: The type of divergence. A regular divergence is when price is making higher highs (or lower lows), while the indicator is making lower highs (or higher lows). A reverse divergence (also called a hidden divergence) is when the indicator is making higher highs (or lower lows), while price is making lower highs (or higher lows).

#Hint: The output of this indicator is for informational and educational use only, is not an investment recommendation or advice, and should not be relied upon in making the decision to buy or sell a security or pursue a particular investment strategy.

def xDownBars;

def xUpBars;

def xDowns;

def xUps;

def hiBars;

def loBars;

def pivotTop;

def pivotBottom;

def hiInd;

def loInd;

def hiPrice;

def loPrice;

plot bearishd;

plot bullishd;

def K = AO;

def Over_Boughta = cautionh;

def Over_Solda = caution;

#K.SetDefaultColor(color.white);

#K.SetLineWeight(2);

def ind;

ind = K;

# Bearish

pivotTop =

if

divergenceType == divergenceType.regular

then

ind[1] > Over_Boughta and ind[1] == Highest(ind, divergenceLength + 1)

else

ind[1] >= 50 and

ind[1] == Highest(ind, divergenceLength + 1) and

ind[1] == Highest(ind, divergenceLength + 1)[-divergenceLength + 1];

if pivotTop

then {

hiBars = 1;

hiInd = ind[1];

hiPrice = Max(high[2], Max(high[1], high[0]));

}

else {

hiBars = hiBars[1] + 1;

hiInd = hiInd[1];

hiPrice = hiPrice[1];

}

if ind[1] crosses below Over_Boughta

then {

xDownBars = 1;

xDowns = xDowns[1] + 1;

}

else {

xDownBars = xDownBars[1] + 1;

xDowns = if pivotTop[1] then 0 else xDowns[1];

}

def bearCond;

switch (divergenceType) {

case regular:

bearCond =

ind[1] >= zero and

ind < ind[1] and

high[1] == Highest(high, divergenceLength + 1) and

hiBars[1] > xDownBars[1] and

xDowns == 1 and

close < close[1] and

hiPrice[1] < high[1] and

hiInd[1] > ind[1];

case reverse:

bearCond =

ind[1] >= zero and

ind < ind[1] and

# high[1] == Highest(high, divergenceLength) and

# hiBars[1] > xDownBars[1] and

# xDowns == 1 and

close < close[1] and

hiPrice[1] > high[1] and hiPrice[1] > high and

hiInd[1] < ind[1];

}

bearishd =

if

bearCond

then

ind[1]

else

Double.NaN;

;

bearishd.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

bearishd.SetDefaultColor(Color.gray);

bearishd.SetLineWeight(2);

bearishd.HideTitle();

bearishd.HideBubble();

def countBear = if bearCond[-1] then countBear[1] + 1 else countBear[1];

def recentBear = countBear == HighestAll(countBear);

def secHigh = HighestAll(if bearCond[-1] and recentBear then ind else Double.NaN);

#def firstHigh = highestAll(if bearCond and recentBear and ind[1] == secHigh then hiInd[1] else double.NaN);

def FH_bar = HighestAll(if recentBear and bearCond[-1] and ind == secHigh then GetValue(BarNumber(), hiBars) else Double.NaN);

plot bearTrendline =

if

recentBear and bearCond[-1] and ind == secHigh

then

Max(ind[1], ind[0])

else

# if pivotTop and hiInd == firstHigh

if

FH_bar == BarNumber()

then

ind

else

Double.NaN;

bearTrendline.EnableApproximation();

bearTrendline.SetDefaultColor(Color.RED);

bearTrendline.SetLineWeight(4);

bearTrendline.HideBubble();

bearTrendline.HideTitle();

#Bullish

pivotBottom =

if

divergenceType == divergenceType.regular

then

ind[1] < Over_Solda and ind[1] == Lowest(ind, divergenceLength + 1)

else

ind[1] <= 50 and

ind[1] == Lowest(ind, divergenceLength + 1) and

ind[1] == Lowest(ind, divergenceLength + 1)[-divergenceLength + 1];

if pivotBottom

then {

loBars = 1;

loInd = ind[1];

loPrice = Min(low[2], Min(low[1], low[0]));

}

else {

loBars = loBars[1] + 1;

loInd = loInd[1];

loPrice = loPrice[1];

}

if ind[1] crosses above Over_Solda

then {

xUpBars = 1;

xUps = xUps[1] + 1;

}

else {

xUpBars = xUpBars[1] + 1;

xUps = if pivotBottom[1] then 0 else xUps[1];

}

def bullCond;

switch (divergenceType){

case regular:

bullCond =

ind[1] <= zero and

ind > ind[1] and

low[1] == Lowest(low, divergenceLength + 1) and

loBars[1] > xUpBars[1] and

xUps == 1 and

close > close[1] and

loPrice[1] > low[1] and

loInd[1] < ind[1];

case reverse:

bullCond =

ind[1] <= zero and

ind > ind[1] and

# low[1] == Lowest(low, divergenceLength) and

# loBars[1] > xUpBars[1] and

# xUps == 1 and

close > close[1] and

loPrice[1] < low[1] and loPrice[1] < low and

loInd[1] > ind[1];

}

bullishd =

if

bullCond

then

ind[1]

else

Double.NaN;

bullishd.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

bullishd.SetDefaultColor(Color.gray);

bullishd.SetLineWeight(2);

bullishd.HideTitle();

bullishd.HideBubble();

def countBull = if bullCond[-1] then countBull[1] + 1 else countBull[1];

def recentBull = countBull == HighestAll(countBull);

def secLow = HighestAll(if bullCond[-1] and recentBull then ind else Double.NaN);

#def firstLow = highestAll(if bullCond and recentBull and ind[1] == secLow then loInd[1] else double.NaN);

def FL_bar = HighestAll(if recentBull and bullCond[-1] and ind == secLow then GetValue(BarNumber(), loBars) else Double.NaN);

plot bullTrendline =

if

recentBull and bullCond[-1] and ind == secLow

then

Min(ind[1], ind[0])

else

if

# pivotBottom and loInd == firstLow

FL_bar == BarNumber()

then

ind[0]

else

Double.NaN;

bullTrendline.EnableApproximation();

bullTrendline.SetDefaultColor(Color.GREEN);

bullTrendline.SetLineWeight(4);

bullTrendline.HideBubble();

bullTrendline.HideTitle();

Last edited: