I have made a Momentum Oscillator that I have tried to make it to where it gets you in an out as quickly as possible. It is basically a Bearish Line and Bullish line that will cross depending on price action.

Sensitivity: You can change Sensitivity to whatever suits your trading method. At default I have it set to 1, but ive come to realize that some prefer 3 or 4 to get a smoother line and less consolidation signals. The Higher the number, the smoother it will get, but also the more delayed it will be

Price Color: Yes or No, this will change the color of the price action to show trends. Green up, Red down

Reversal Warning Candle: This will change the color of price action of JUST the candles that are overbought or oversold on the oscillator. These indicate potential reversals. Once the blue goes away is about the time to enter

Reversal Warning: This is the setting that will change the sensitivity of the reversal signals. You will set this setting from 1 to 10. 1 being the weakest and most signals, 10 being the strongest and minimal signals. I have defaulted this to 8. I would recommend 7 to 9 depending on what you want.

Below The pictures I have the Main Script that will give you the lower oscillator, along with option of changing candle color for trends and reversals.

Then a standalone Arrow indicator that will show just the arrows for the reversals

Then I will also have a Script JUST for Candle color change.

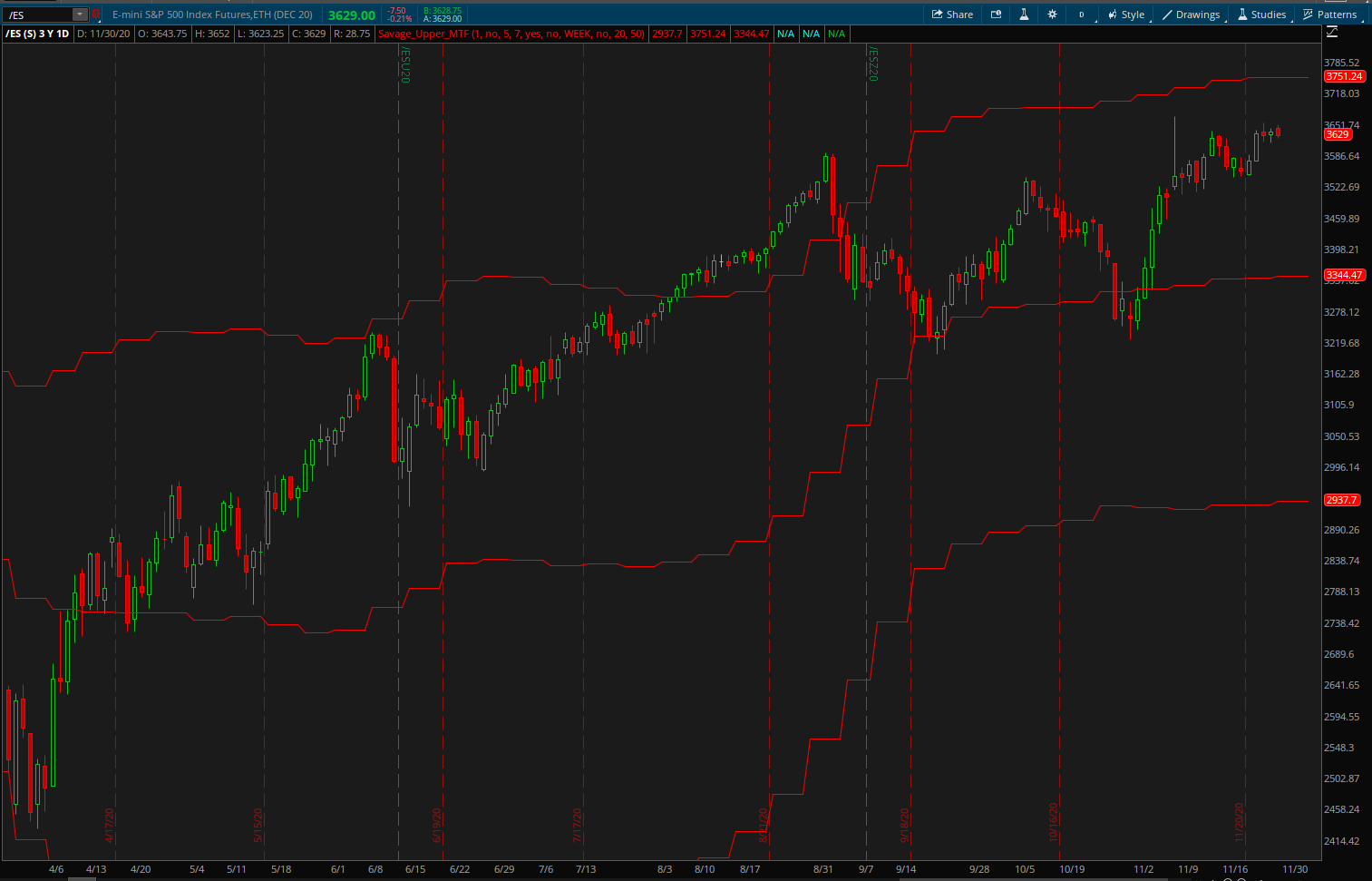

EDIT: I have also just added a full upper version for the reversals on price action. When approaching the outer walls could be nearing a reversal.

It has the option for the high volume (as requested) and will be displayed by changing the color of the midline.

Also has multi-Timeframe capabilities with option to turn off or on if desired

(This script will be posted in the end of this Post)

Savage_Oscillator

Savage_Oscillator_Arrows (Stand Alone Arrows)

Savage_Oscillator_Upper (Stand Alone Candle Color Change)

Savage_Watchlist

EDIT: I have also added this MultiTimeframe Price action Savage Bands

Picture and script below

Sensitivity: You can change Sensitivity to whatever suits your trading method. At default I have it set to 1, but ive come to realize that some prefer 3 or 4 to get a smoother line and less consolidation signals. The Higher the number, the smoother it will get, but also the more delayed it will be

Price Color: Yes or No, this will change the color of the price action to show trends. Green up, Red down

Reversal Warning Candle: This will change the color of price action of JUST the candles that are overbought or oversold on the oscillator. These indicate potential reversals. Once the blue goes away is about the time to enter

Reversal Warning: This is the setting that will change the sensitivity of the reversal signals. You will set this setting from 1 to 10. 1 being the weakest and most signals, 10 being the strongest and minimal signals. I have defaulted this to 8. I would recommend 7 to 9 depending on what you want.

Below The pictures I have the Main Script that will give you the lower oscillator, along with option of changing candle color for trends and reversals.

Then a standalone Arrow indicator that will show just the arrows for the reversals

Then I will also have a Script JUST for Candle color change.

EDIT: I have also just added a full upper version for the reversals on price action. When approaching the outer walls could be nearing a reversal.

It has the option for the high volume (as requested) and will be displayed by changing the color of the midline.

Also has multi-Timeframe capabilities with option to turn off or on if desired

(This script will be posted in the end of this Post)

Savage_Oscillator

Code:

#https://usethinkscript.com/threads/savage-oscillator.4214/

#Assembled by FateOwnzYou on UseThinkscript.com

declare lower;

Input Price_Color = yes;

Input Sensitivity = 1;

Input Reversal_Warning_Candle = yes;

Input Reversal_Warning = 8;

Input AverageLine = yes;

Input HighVolume = yes;

Input VolumeAveragingLength = 20;

Input VolumePercentThreshold = 60;

Plot _High = 9;

Plot CautionHigh = Reversal_Warning;

Plot _Low = -9;

Plot CautionLow = (Reversal_Warning)*-1;

Plot Zero = 0;

##Stochastics

Def S1 = Max(-100, Min(100, (StochasticFull(KPeriod = 8, slowing_period = 5, averageType = AverageType.EXPONENTIAL))) - 50) / 50.01;

Def S2 = Max(-100, Min(100, (StochasticFull(KPeriod = 17, slowing_period = 5, averageType = AverageType.EXPONENTIAL))) - 50) / 50.01;

Def S3 = Max(-100, Min(100, reference RSI(2)) - 50) / 50.01;

Plot Bull =(expAverage((S1 + S2 + S3)/3,Sensitivity))*10;

Def SpdChng = if Bull < 1.5 then ((movingAverage(averageType.Weighted, Bull, 20))-1.5) else ((movingAverage(averageType.Weighted, Bull, 10))-1.5) ;

plot Bear = (SpdChng - Bull);

plot middle = if AverageLine then((bull - bear)/2)+bear else double.nan;

##Reversals

Plot Top = if Bull > Reversal_Warning then Bull else double.nan;

Plot Bottom = if Bull < (Reversal_Warning)*-1 then Bull else double.nan;

##High Volume

def aVol = Average(volume, volumeAveragingLength);

def pVol = 100 * ((volume - aVol[1]) /aVol[1]);

def pDot = pVol >= volumePercentThreshold;

#Paint

zero.assignValueColor(if pDot and HighVolume then color.CYAN else color.current);

zero.setlineWeight(2);

middle.setdefaultColor(color.white);

Bottom.setdefaultColor(Color.yellow);

Bottom.setPaintingStrategy(paintingStrategy.POINTS);

Bottom.setlineWeight(3);

Top.setdefaultColor(Color.yellow);

Top.setPaintingStrategy(paintingStrategy.POINTS);

Top.setlineWeight(3);

_High.setdefaultColor(color.gray);

_Low.setdefaultColor(color.gray);

Zero.setdefaultColor(color.gray);

Cautionhigh.setdefaultColor(color.gray);

Cautionlow.setdefaultColor(color.gray);

Bear.assignValueColor(color.red);

Bull.assignvalueColor(color.green);

Bear.assignValueColor(color.red);

Bull.assignvalueColor(color.green);

addLabel(yes, if Bull > Bear then "Bullish" else "Bearish", if Bull > Bear then Color.Green else color.red);

assignpriceColor(if Price_Color AND Bull > Bear then color.green else color.current);

assignpriceColor(if Price_Color AND Bull < Bear then color.red else color.current);

assignpriceColor(if Reversal_Warning_Candle AND Bull > Reversal_Warning then color.blue else color.current);

assignpriceColor(if Reversal_Warning_Candle AND Bull < (Reversal_Warning)*-1 then color.blue else color.current);

addcloud(cautionhigh,_high,color.yellow, color.yellow);

addcloud(cautionlow,_low,color.yellow, color.yellow);Savage_Oscillator_Arrows (Stand Alone Arrows)

Code:

#https://usethinkscript.com/threads/savage-oscillator.4214/

#Assembled by FateOwnzYou on UseThinkscript.com

Input Sensitivity = 1;

Input Reversal_Warning = 8;

Input Label = yes;

#Stochastics

Def S1 = Max(-100, Min(100, (StochasticFull(KPeriod = 8, slowing_period = 5, averageType = AverageType.EXPONENTIAL))) - 50) / 50.01;

Def S2 = Max(-100, Min(100, (StochasticFull(KPeriod = 17, slowing_period = 5, averageType = AverageType.EXPONENTIAL))) - 50) / 50.01;

Def S3 = Max(-100, Min(100, reference RSI(2)) - 50) / 50.01;

def Bull =(expAverage((S1 + S2 + S3)/3,Sensitivity))*10;

Def SpdChng = if Bull < 1.5 then ((movingAverage(averageType.Weighted, Bull, 20))-1.5) else ((movingAverage(averageType.Weighted, Bull, 10))-1.5) ;

def Bear = (SpdChng - Bull);

Plot Top = Bull > Reversal_Warning;

Plot Bottom = if Bull < (Reversal_Warning)*-1 then Bull else double.nan;

#Paint

Bottom.setdefaultColor(Color.Blue);

Bottom.setPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_UP);

Bottom.setlineWeight(3);

Top.setdefaultColor(Color.Blue);

Top.setPaintingStrategy(paintingStrategy.BOOLEAN_ARROW_DOWN);

Top.setlineWeight(3);

addLabel(Label, if Bull > Bear then "Bullish" else "Bearish", if Bull > Bear then Color.Green else color.red);Savage_Oscillator_Upper (Stand Alone Candle Color Change)

Code:

#https://usethinkscript.com/threads/savage-oscillator.4214/

#Assembled by FateOwnzYou on UseThinkscript.com

input Sensitivity = 1;

Input Reversal_Warning = 8;

input Label = yes;

Input HighVolume = yes;

input volumeAveragingLength = 20;

input volumePercentThreshold = 50;

def s1 = Max(-100, Min(100, (StochasticFull(KPeriod = 8, slowing_period = 5, averageType = AverageType.EXPONENTIAL))) - 50) / 50.01;

def s2 = Max(-100, Min(100, (StochasticFull(KPeriod = 17, slowing_period = 5, averageType = AverageType.EXPONENTIAL))) - 50) / 50.01;

def s3 = Max(-100, Min(100, reference RSI(2)) - 50) / 50.01;

def Bull =expAverage((s1 + s2 + s3)/3,sensitivity)*10;

def avg = if bull < 1.5 then ((movingAverage(averageType.Weighted, bull, 20))-1.5) else ((movingAverage(averageType.Weighted, bull, 10)))-1.5 ;

def Bear = (avg - bull);

def aVol = Average(volume, volumeAveragingLength);

def pVol = 100 * ((volume - aVol[1]) /aVol[1]);

def pDot = pVol >= volumePercentThreshold;

plot volumeStrength = if pDot and (Bull or Bear) and HighVolume then hl2 else Double.NaN;

addLabel(Label, if Bull > Bear then "Bullish" else "Bearish", if Bull > Bear then Color.Green else color.red);

volumeStrength.SetPaintingStrategy(PaintingStrategy.POINTS);

volumeStrength.SetLineWeight(3);

volumeStrength.SetDefaultColor(color.cyan);

volumeStrength.hideBubble();

assignpriceColor(if Bull > Bear then color.GREEN else color.current);

assignpriceColor(if Bull < Bear then color.RED else color.current);

assignpricecolor(if Bull > Reversal_Warning then color.BLUE else color.current);

assignpricecolor(if Bull < (Reversal_Warning *-1) then color.BLUE else color.current);Savage_Watchlist

Code:

Input Sensitivity = 1;

Input Reversal_Warning = 8;

##Stochastics

Def S1 = Max(-100, Min(100, (StochasticFull(KPeriod = 8, slowing_period = 5, averageType = AverageType.EXPONENTIAL))) - 50) / 50.01;

Def S2 = Max(-100, Min(100, (StochasticFull(KPeriod = 17, slowing_period = 5, averageType = AverageType.EXPONENTIAL))) - 50) / 50.01;

Def S3 = Max(-100, Min(100, reference RSI(2)) - 50) / 50.01;

def Bull =(expAverage((S1 + S2 + S3)/3,Sensitivity))*10;

Def SpdChng = if Bull < 1.5 then ((movingAverage(averageType.Weighted, Bull, 20))-1.5) else ((movingAverage(averageType.Weighted, Bull, 10))-1.5) ;

def Bear = (SpdChng - Bull);

def middle = ((bull - bear)/2)+bear;

def condition1 = Bull > Reversal_Warning;

def condition2 = Bull < (Reversal_Warning * -1);

def crossing = middle + 1;

def crossing2 = middle - 1;

def between1 = middle > crossing2 and middle < crossing;

addLabel(yes, if condition1 or condition2 then "Reversal" else concat("",Bull), if condition1 or condition2 then color.black else if bull > 1.5 then color.Light_Green else if bull < -1.5 then color.Light_Red else if between1 then color.orange else color.current);

assignbackgroundcolor(if condition1 then color.light_red else if condition2 then color.light_green else color.current);EDIT: I have also added this MultiTimeframe Price action Savage Bands

Picture and script below

Code:

#The Official Savage Bands

#https://usethinkscript.com/threads/savage-oscillator.4214/

#Assembled by FateOwnzYou on UseThinkscript.com

###MTF###

input Sensitivity = 1;

input Distance = 5;

input Smoothness = 7;

input MTF = yes;

input currentTF = no;

input TimeFrame = aggregationPeriod.DAY;

input HighVolume = no;

input volumeAveragingLength = 20;

input volumePercentThreshold = 50;

def S1_MTF = Max(-100, Min(100, (StochasticFull(KPeriod = 8, slowing_period = 5, averageType = AverageType.EXPONENTIAL, priceh = high(period=TimeFrame), pricel = low(period=TimeFrame), pricec = close(period=TimeFrame)))) - 50) / 50.01;

def S2_MTF = Max(-100, Min(100, (StochasticFull(KPeriod = 17, slowing_period = 5, averageType = AverageType.EXPONENTIAL, priceh = high(period=TimeFrame), pricel = low(period=TimeFrame), pricec = close(period=TimeFrame)))) - 50) / 50.01;

def S3_MTF = Max(-100, Min(100, reference RSI(2, price = close(period=timeframe)))- 50) / 50.01;

def savage_MTF = (ExpAverage((S1_MTF + S2_MTF + S3_MTF) / 3, Sensitivity)) * 10;

def bottom_MTF = Min(close(period=TimeFrame)[1], low(period=TimeFrame));

def tr_MTF = TrueRange(high(period=TimeFrame), close(period=TimeFrame), low(period=TimeFrame));

def ptr_MTF = tr_MTF / (bottom_MTF + tr_MTF / 2) * 100;

def APTR_MTF = (MovingAverage(AverageType.WILDERS, ptr_MTF, 14))*Distance;

def LowLine_MTF = ((0.0625*(((APTR_MTF*close(period=TimeFrame))/100)*-1))*(savage_MTF+7.75))+close(period=TimeFrame);

def HighLine_MTF = ((0.01*((APTR_MTF*close(period=TimeFrame))/100))*((-6.25*savage_MTF)+51.5625))+close(period=TimeFrame);

plot SmoothedLow_MTF = if MTF then (movingaverage(data = LowLine_MTF, averageType = AverageType.WEIGHTED, length = Smoothness)) else double.nan;

smoothedlow_MTF.setdefaultColor(color.red);

plot SmoothedHigh_MTF = if MTF then (movingaverage(data = HighLine_MTF, averageType = AverageType.WEIGHTED, length = Smoothness)) else double.nan;

smoothedhigh_MTF.setdefaultColor(color.red);

def aVol_MTF = Average(volume(period = TimeFrame), volumeAveragingLength);

def pVol_MTF = 100 * ((volume(period = TimeFrame) - aVol_MTF[1]) /aVol_MTF[1]);

def pDot_MTF = pVol_MTF >= volumePercentThreshold;

#plot volumeStrength = if pDot and HighVolume then hl2 else Double.NaN;

plot MidLine_MTF = ((SmoothedHigh_MTF - SmoothedLow_MTF)/2)+SmoothedLow_MTF;

MidLine_MTF.assignvalueColor(if pdot_MTF and HighVolume and MTF then color.yellow else color.red);

### End MTF

#Stochastics

def S1 = Max(-100, Min(100, (StochasticFull(KPeriod = 8, slowing_period = 5, averageType = AverageType.EXPONENTIAL, priceh = high, pricel = low, pricec = close))) - 50) / 50.01;

def S2 = Max(-100, Min(100, (StochasticFull(KPeriod = 17, slowing_period = 5, averageType = AverageType.EXPONENTIAL, priceh = high, pricel = low, pricec = close))) - 50) / 50.01;

def S3 = Max(-100, Min(100, reference RSI(2, price = close))- 50) / 50.01;

def savage = (ExpAverage((S1 + S2 + S3) / 3, Sensitivity)) * 10;

def bottom = Min(close[1], low);

def tr = TrueRange(high, close, low);

def ptr = tr / (bottom + tr / 2) * 100;

def APTR = (MovingAverage(AverageType.WILDERS, ptr, 14))*Distance;

def LowLine = ((0.0625*(((APTR*close)/100)*-1))*(savage+7.75))+close;

def HighLine = ((0.01*((APTR*close)/100))*((-6.25*savage)+51.5625))+close;

plot SmoothedLow = if CurrentTF then (movingaverage(data = LowLine, averageType = AverageType.WEIGHTED, length = Smoothness)) else double.nan;

smoothedlow.setdefaultColor(color.cyan);

plot SmoothedHigh = if CurrentTF then (movingaverage(data = HighLine, averageType = AverageType.WEIGHTED, length = Smoothness)) else double.nan;

smoothedhigh.setdefaultColor(color.cyan);

def aVol = Average(volume, volumeAveragingLength);

def pVol = 100 * ((volume - aVol[1]) /aVol[1]);

def pDot = pVol >= volumePercentThreshold;

plot MidLine = ((SmoothedHigh - SmoothedLow)/2)+SmoothedLow;

MidLine.assignvaluecolor(if pdot and HighVolume then color.yellow else color.cyan);

Last edited: