#Basic RSI Indicator With Arrows, Label, & Alerts

Shared Link: http://tos.mx/vYwKbJ5

Click here for --> Easiest way to load shared links

Shared Link: http://tos.mx/vYwKbJ5

Click here for --> Easiest way to load shared links

Ruby:

#Basic RSI Indicator w/ arrows, label, & alerts

input OB = 70;

input OS = 30;

input rsi_length = 14 ;

input showLabel = yes ;

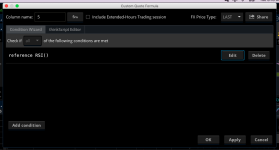

def rsi = reference RSI("length" = 14)."RSI" ;

# ########################################

# charting & formatting

plot UpArrow = if rsi crosses above OS then low else double.NaN ;

UpArrow .SetPaintingStrategy(PaintingStrategy.ARROW_up);

UpArrow .SetLineWeight(1);

UpArrow .SetDefaultColor(color.blue) ;

plot DownArrow = if rsi crosses below OB then high else double.NaN ;

DownArrow .SetPaintingStrategy(PaintingStrategy.ARROW_down);

DownArrow .SetLineWeight(1);

DownArrow .SetDefaultColor(color.magenta) ;

AddLabel(showLabel,

if rsi crosses above OS then "Buy" else

if rsi crosses below OB then "Sell" else "RSI: " +round(rsi,1),

if rsi crosses above OS then color.green else

if rsi crosses below OB then color.red else color.gray);

Alert( rsi crosses above OS, "Buy" , Alert.Bar, Sound.Bell);

Alert( rsi crosses below OB , "Sell" , Alert.Bar, Sound.Bell);

Last edited: