# RSIwithFractalPivots_Amalia

# reposted to chatroom 04.18.2018

########START Code

declare lower;

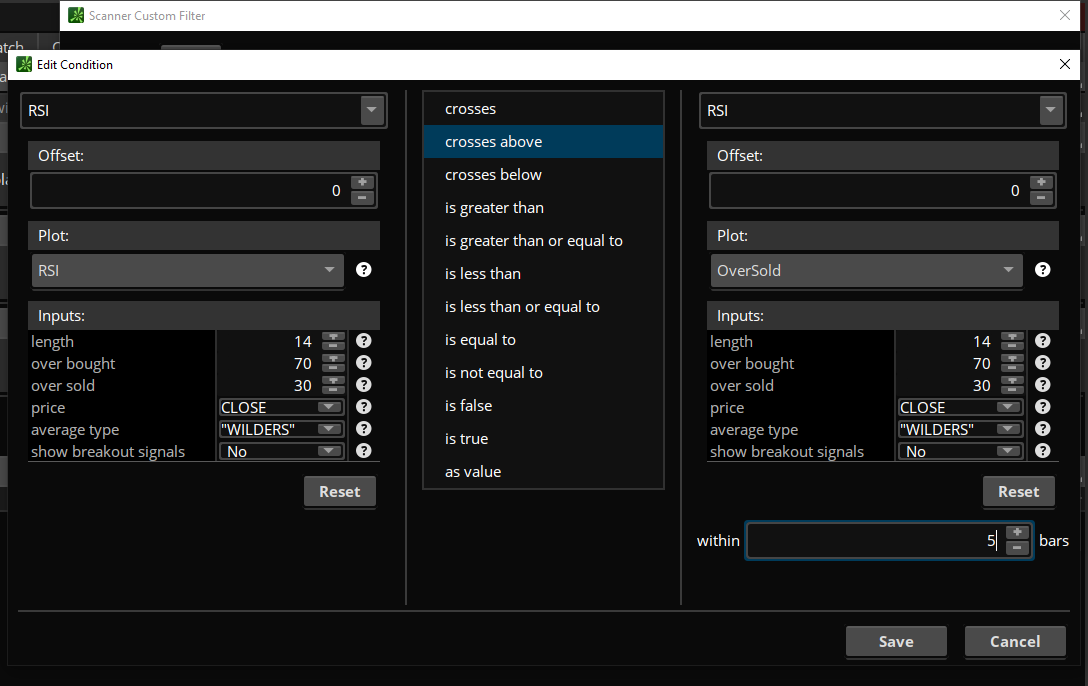

input length = 14;

input over_Bought = 70;

input over_Sold = 30;

input price = close;

input averageType = AverageType.WILDERS;

input New_HI_LO = 30;

def NetChgAvg = MovingAverage(averageType, price - price[1], length);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

plot RSI = 50 * (ChgRatio + 1);

plot OverSold = over_Sold;

plot OverBought = over_Bought;

RSI.DefineColor("OverBought", GetColor(5));

RSI.DefineColor("Normal", GetColor(7));

RSI.DefineColor("OverSold", GetColor(1));

RSI.AssignValueColor(if RSI > over_Bought then RSI.color("OverBought") else if RSI < over_Sold then RSI.color("OverSold") else RSI.color("Normal"));

OverSold.SetDefaultColor(GetColor(8));

OverBought.SetDefaultColor(GetColor(8));

plot NEWHIGH = if RSI == highest(RSI, new_HI_LO) then RSI else Double.NAN;

NEWHIGH.setpaintingStrategy(paintingStrategy.POINTS);

NEWHIGH.setdefaultColor(color.light_green);

NewHIGH.setlineWeight(1);

plot NEWLOW = if RSI == lowest(RSI, new_HI_LO) then RSI else Double.NAN;

NEWLOW.setpaintingStrategy(paintingStrategy.POINTS);

NEWLOW.setdefaultColor(color.light_RED);

NEWLOW.setlineWeight(1);

# Fractals

# 1/5/17 Amalia added Aggregation periods?

def H = RSI;

def L = RSI;

input sequenceCount = 10;

def maxSideLength = sequenceCount + 10;

def upRightSide = fold i1 = 1 to maxSideLength + 1

with count1

while count1 != sequenceCount and

count1 != -1

do if GetValue(H, -i1) > H or

(GetValue(H, -i1) == H and

count1 == 0)

then -1

else if GetValue(H, -i1) < H

then count1 + 1

else count1;

def upLeftSide = fold i2 = 1 to maxSideLength + 1

with count2

while count2 != sequenceCount and

count2 != -1

do if GetValue(H, i2) > H or

(GetValue(H, i2) == H and

count2 >= 1)

then -1

else if GetValue(H, i2) < H

then count2 + 1

else count2;

def downRightSide = fold i3 = 1 to maxSideLength + 1

with count3

while count3 != sequenceCount and

count3 != -1

do if GetValue(L, -i3) < L or

(GetValue(L, -i3) == L and

count3 == 0)

then -1

else if GetValue(H, -i3) > L

then count3 + 1

else count3;

def downLeftSide = fold i4 = 1 to maxSideLength + 1

with count4

while count4 != sequenceCount and

count4 != -1

do if GetValue(L, i4) < L or

(GetValue(L, i4) == L and

count4 >= 1)

then -1

else if GetValue(L, i4) > L

then count4 + 1

else count4;

plot UpFractal = if upRightSide == sequenceCount and

upLeftSide == sequenceCount

then RSI

else Double.NaN;

plot DownFractal = if downRightSide == sequenceCount and

downLeftSide == sequenceCount

then RSI

else Double.NaN;

UpFractal.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

UpFractal.SetDefaultColor(color.RED);

UpFractal.SetLineWeight(2);

DownFractal.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

DownFractal.SetDefaultColor(color.GREEN);

DownFractal.SetLineWeight(2);

def Pre_hi = if !isnan(upfractal) then upfractal else pre_hi[1];

plot high_line = pre_hi;

high_line.setpaintingStrategy(paintingStrategy.DASHES);

high_line.setdefaultColor(color.CYAN);

def Pre_lo = if !isnan(downFractal) then downFractal else pre_lo[1];

plot lo_line = pre_lo;

lo_line.setpaintingStrategy(paintingStrategy.DASHES);

lo_line.setdefaultColor(color.MAGENTA);

addlabel(yes,

if RSI >= OverBought && RSI >= RSI[1]

then "RSI OB & Rising: " +round(RSI, 2)

else if RSI >= OverBought && RSI < RSI[1]

then "RSI OB & Falling: " +round(RSI, 2)

else if RSI <= OverSold && RSI < RSI[1]

then "RSI OS & Falling: " +round(RSI, 2)

else if RSI <= OverSold && RSI >= RSI[1]

then "RSI OS & Rising: " +round(RSI, 2)

else if RSI < OverBought && RSI > OverSold && RSI >= RSI[1]

then "RSI Rising: " +round(RSI, 2)

else if RSI < OverBought && RSI > OverSold && RSI < RSI[1]

then "RSI Falling: " +round(RSI, 2)

else "",

if RSI >= OverBought && RSI >= RSI[1]

then color.dark_orange

else if RSI >= OverBought && RSI < RSI[1]

then color.yellow

else if RSI <= OverSold && RSI < RSI[1]

then createcolor(000, 100, 100)

else if RSI <= OverSold && RSI >= RSI[1]

then color.cyan

else if RSI < OverBought && RSI > OverSold && RSI >= RSI[1]

then color.green

else if RSI < OverBought && RSI > OverSold && RSI < RSI[1]

then color.red

else color.gray);

plot Buffer = if RSI <= OverSold then RSI - 10 else if RSI >= OverBought then RSI + 10 else double.nan;

Buffer.setdefaultColor(color.black);

Buffer.hidetitle();

Buffer.hidebubble();

####END Code