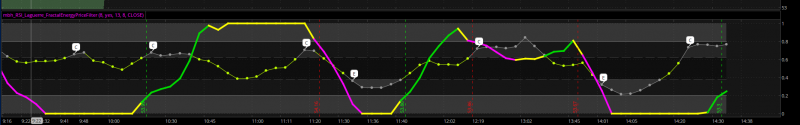

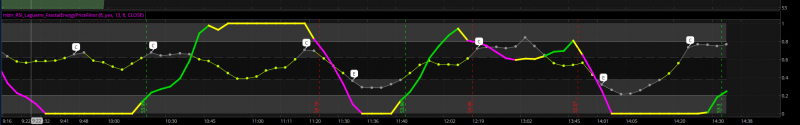

RED....YELLOW...PINK@markos

Made a few changes to the RSIlg. May be easier to understand and use. "C" = FE_Consolidation and "E" = FE_Exhaustion for the gamma line.

What do the different colors mean..?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

RSI Laguerre with Fractal Energy for ThinkorSwim

- Thread starter markos

- Start date

-

- Tags

- oscillator

Guess you are referring to the colors for RSI;

Magenta = short (yellow @ less than .20 = hold with caution)

Green = long (yellow @ more than .80 = hold with caution)

Yellow = between .20 and .80 no trade / close trade

This was may intent when I added the colors. I wait for the bar to close and use additional information for all my trades. This can be used with the "Trend Reversal Indicator" to confirm.

Looking at the code below may help you understand what I am looking for;

RSI.DefineColor("Up", CreateColor( 0, 220, 0));

RSI.DefineColor("Down", Color.MAGENTA);

RSI.SetLineWeight(3);

RSI.AssignValueColor(if RSI > RSI[1] and RSI[1] > RSI [2] then RSI.Color("Up") else if RSI < RSI[1] and RSI[1] < RSI [2] then RSI.Color("Down") else Color.YELLOW);

Magenta = short (yellow @ less than .20 = hold with caution)

Green = long (yellow @ more than .80 = hold with caution)

Yellow = between .20 and .80 no trade / close trade

This was may intent when I added the colors. I wait for the bar to close and use additional information for all my trades. This can be used with the "Trend Reversal Indicator" to confirm.

Looking at the code below may help you understand what I am looking for;

RSI.DefineColor("Up", CreateColor( 0, 220, 0));

RSI.DefineColor("Down", Color.MAGENTA);

RSI.SetLineWeight(3);

RSI.AssignValueColor(if RSI > RSI[1] and RSI[1] > RSI [2] then RSI.Color("Up") else if RSI < RSI[1] and RSI[1] < RSI [2] then RSI.Color("Down") else Color.YELLOW);

Last edited:

@mc01439 You clearly know what you are doing with the code.

But, I do feel that the above description of the colors may be mis-leading to some. It's ok if it works for you.

In other words, they dont match up well with my tutorial or my understanding.

RSILg between .20 and .80 is just the directional strength. FE is something different.

Please review The RSI Laguerre Tutorial to see what Mobius said in his notes.

Also, this code has been hacked by many & located here: Universe of thinkScript>03. Technical Analyssis>Momentum>Over 25 iterations.

But, I do feel that the above description of the colors may be mis-leading to some. It's ok if it works for you.

In other words, they dont match up well with my tutorial or my understanding.

RSILg between .20 and .80 is just the directional strength. FE is something different.

Please review The RSI Laguerre Tutorial to see what Mobius said in his notes.

Also, this code has been hacked by many & located here: Universe of thinkScript>03. Technical Analyssis>Momentum>Over 25 iterations.

Last edited:

@mc01439 You clearly know what you are doing with the code.

But, I do feel that the above description of the colors may be mis-leading to some. It's ok if it works for you.

In other words, they dont match up well with my tutorial or my understanding.

RSILg between .20 and .80 is just the directional strength. FE is something different.

Please review The RSI Laguerre Tutorial to see what Mobius said in his notes.

Also, this code has been hacked by many & located here: Universe of thinkScript>03. Technical Analyssis>Momentum>Over 25 iterations.

Thank You Markos - I know I am using RSILg in a different way than it was described by the writer. It fits my style and seems to work for me at this time.

What may be different with me is I trade only oil (/CL) futures and trade using tick charts. Matter of fact I do not use FE at all; does nothing for the way I trade.

What I like about this site is it allows you to enhance your coding skills for self reliance by learning from other like you. Very Grateful to you and the other major contributors on this site.

Don't use that one, use the one that is updated now in the post. As @mc01439 said, he trades /CL and has no need for FE.RED....YELLOW...PINK

The reason for two charts is because we need to keep in practice of watching multiple time frames. If you don't like 2 charts because of screen space, move it to a single chart. No Problem doing so, however it works best for you.

Last edited:

Would anyone have a watch list code for fractial energy below .38 to make column green and anything above is red...I've been working on it but no luck...Thanks

Craig, try to build it of off this. This is Doc's plain FE or Chop Indicator, there is a scan you can build off of. The RSILg is Good to make an indicator of. The Fractal Energy shouldn't be colored, as it is just a guide.

https://usethinkscript.com/threads/fractal-energy-aka-chop-index-for-thinkorswim.341/

https://usethinkscript.com/threads/fractal-energy-aka-chop-index-for-thinkorswim.341/

Last edited:

Is there are alert that can be set up for when RSI moves into the red zone in the indicator. thanks

Yes, please review the script. It is already baked into the pie!Is there are alert that can be set up for when RSI moves into the red zone in the indicator. thanks

Thanks Markos. It would have smacked me in the face if I had paid attention the first time I added the indicator.Yes, please review the script. It is already baked into the pie!

Thanks for posting this.Some may find this useful - does a nice job of explaining RSILg.

The Man doing the training was a senior exec with ToS before they were bought out by AMTD. It was Don Kaufman's job to do all of the swim lessons videos that were taken off of Youtube when TDameritrade bought them. Then he was the Head Corporate trainer in Singapore and Hong Kong, and finally, ThinkorSwim's Head of Risk Management, Options & Futures. Yeah, I guess I'm a big fan.Thanks for posting this.

I'll be watching more videos. It does appear he is more into options. I'm more into stocks.The Man doing the training was a senior exec with ToS before they were bought out by AMTD. It was Don Kaufman's job to do all of the swim lessons videos that were taken off of Youtube when TDameritrade bought them. Then he was the Head Corporate trainer in Singapore and Hong Kong, and finally, ThinkorSwim's Head of Risk Management, Options & Futures. Yeah, I guess I'm a big fan.

I mostly use options as a hedge to the downside, which they taught me. You can learn a lot from an options trader like Don. He teaches Expected move, which is important for us mainly stock people because it helps you to not get stopped out so easily! Even if I don't agree with some things, I watch their nightly video. Short and to the point. They have a number of swing trade instructors there as well.I'll be watching more videos. It does appear he is more into options. I'm more into stocks.

Appreciate the input and help. I'll take some time to do some more in depth research with them.I mostly use options as a hedge to the downside, which they taught me. You can learn a lot from an options trader like Don. He teaches Expected move, which is important for us mainly stock people because it helps you to not get stopped out so easily! Even if I don't agree with some things, I watch their nightly video. Short and to the point. They have a number of swing trade instructors there as well.

Will watch for sure. I remember seeing a Doc Severson presentation a few years ago where he was demonstrating this. Maybe that is one of these vids. He used an "anchor" chart of a longer term time frame and a "signal" chart on a smaller time frame. Anchor chart showed him the trend and the signal chart was used to pinpoint an entry. The two charts needed to be at factors of five: 2 minute/10 minute 3 minute/15 minute etc.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| D | RSI Laguerre Indicator without Fractal Energy, Red/Green | Indicators | 30 | |

| T | Repaints RSI in Laguerre Time MTF for ThinkorSwim | Indicators | 70 | |

|

|

SuperTrend and RSI Laguerre Indicator for ThinkorSwim | Indicators | 35 | |

|

|

Ultimate RSI [LuxAlgo] for ThinkOrSwim | Indicators | 20 | |

|

|

RSI Levels For ThinkOrSwim | Indicators | 13 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1254

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.