@Gabrielx77 , At market close , Do you mind sharing the tickers in play for you today. thank you.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Relative Volume Strategy and Momentum Scanner for ThinkorSwim

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Gabrielx77

Active member

I was watching BBI, SRAX, and LUB. I chose BBI, but was given a fake out; LUB was the obvious choice, but I got in late and sold a little above the break over PM high. It ran quite well today.@Gabrielx77 , At market close , Do you mind sharing the tickers in play for you today. thank you.

Gabrielx77

Active member

Do you have a Pre Market Scan for these stocks? My range is between $0.5-$15, but the gapers are usually always between $1-$3.I havent posted in a while but I just want to say dont fall in love with lower priced low floats. I got caught up in maxing out my share positions on stocks under $3. While im up overall Ive noticed that the better moves are on the stocks that are over $4 to $12 and more. Plus an added bonus of the higher priced stocks is that all though im risking the same amount of money, im effectively reducing my risk per trade. Lower share size = lower risk.

I read since post #1 , by following your scan I got all the tickers you named. now I am still Paper trading yes LUB was my ticker and my Entrie was$1.81 at 09:48Do you have a Pre Market Scan for these stocks? My range is between $0.5-$15, but the gapers are usually always between $1-$3.

@Gabrielx77 this is a custom script from Mobius , now add your criteria

Code:

# Premarket Gap-Up Scan

# Run Scan at premarket on one minute aggregation.

# Will not be accurate after hours or prior to midnight

# Mobius

def MarketClosePrice = if getTime() crosses RegularTradingEnd(getYYYYMMDD())

then close

else MarketClosePrice[1];

plot PreMarketScan = getTime() < RegularTradingStart(getYYYYMMDD()) and

close(priceType = "LAST") > MarketClosePrice * 1.01;

# End Scan Code

T

Thomas

Guest

Here's,... share link, again...power scan...... http://tos.mx/x4eN0gF or Gappers,.. http://tos.mx/jYlLsV6

Last edited by a moderator:

Do you have a Pre Market Scan for these stocks? My range is between $0.5-$15, but the gapers are usually always between $1-$3.

I do. I am more talking about a stock that has the potential to move more than $1. Today CODX was sitting pretty for me. At 1030ish It was $9.30 when I saw it. It went to over $11 nearly $12. I look at it like this. $2.00 plus per share for CODX. Depending where you entered LUB was under $0.50 per share.

Its just a preference thing really. While the lower end stocks do run a bit, the big money(imo) is had at higher prices. Look at SDC and VVPR last week.

*while I didnt trade it SPRO did very well today too. And it was on the scanner.

Gabrielx77

Active member

I see what you're saying. Btw, LUB opened at $1.90 and ran to a high of $2.30. I get that it's not a $2 move per share, but I look at the percentage change rather than dollar per share change. Lub's change was $0.40/$1.90 = 21% and CODX opened at $8.90 with a high of $11.90. So even though it's change was around $3 per share, the percentage change was $3/$8.9 = 34%. Definitely performed better than LUB by 10%, but not that much of a difference imo. You are correct though; the biggest take away when comparing cheaper stocks to mid range stocks is the risk to reward (share sizes needed).I do. I am more talking about a stock that has the potential to move more than $1. Today CODX was sitting pretty for me. At 1030ish It was $9.30 when I saw it. It went to over $11 nearly $12. I look at it like this. $2.00 plus per share for CODX. Depending where you entered LUB was under $0.50 per share.

Its just a preference thing really. While the lower end stocks do run a bit, the big money(imo) is had at higher prices. Look at SDC and VVPR last week.

*while I didnt trade it SPRO did very well today too. And it was on the scanner.

P.S. Thank you Thomas and Gildes for your scans. I'm gonna try them out tomorrow.

I do. I am more talking about a stock that has the potential to move more than $1. Today CODX was sitting pretty for me. At 1030ish It was $9.30 when I saw it. It went to over $11 nearly $12. I look at it like this. $2.00 plus per share for CODX. Depending where you entered LUB was under $0.50 per share.

Its just a preference thing really. While the lower end stocks do run a bit, the big money(imo) is had at higher prices. Look at SDC and VVPR last week.

*while I didnt trade it SPRO did very well today too. And it was on the scanner.

@jezzer46 which scanner are you using ? if you can point me the #post ? Thanks

@jezzer46 which scanner are you using ? if you can point me the #post ? Thanks

The original scan on post 1. However I have a few changes.

Volume is 100,000 min

%change is at 3% min

No unusual volume

I use the lower numbers because it cast a wider net and then on the watchlist I sort by total volume and then look for the highest rv1 with substantial volume.

*also the lower numbers help populate the watchlist faster on opening bell

Last edited:

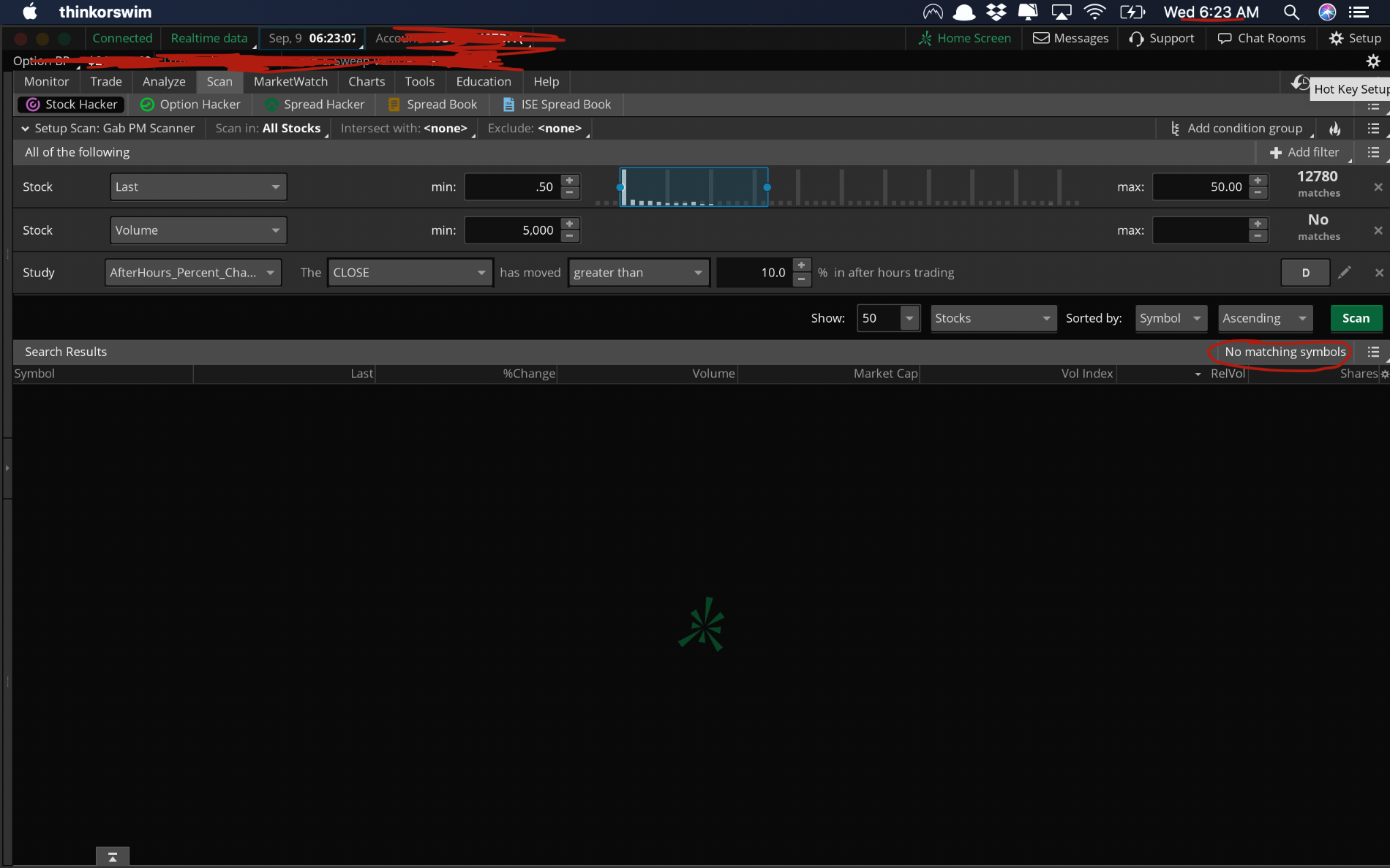

@Gabrielx77 thanks for the help first of all but I do have a quick question if you don't mind plz. So I was trying to find PM stocks to add it to my personal worklist and then narrow it down but your scanner didn't pull up any tickers for me. Can you please let me know what i am doing wrong?

the scanner settings i have are:

Last: 0.50 to 50

Volume: minimum 5000 to no max

Study: After Hour percent change The Close has moved greater than 10% in the after-hours trading.

I ran the scan at 6am (9m East coast time) and 6:21 am (9:21 am) with zero results.

what am i doing wrong?

thanks man

the scanner settings i have are:

Last: 0.50 to 50

Volume: minimum 5000 to no max

Study: After Hour percent change The Close has moved greater than 10% in the after-hours trading.

I ran the scan at 6am (9m East coast time) and 6:21 am (9:21 am) with zero results.

what am i doing wrong?

thanks man

slowmohockey

Member

This is an interesting scan (RV1), loaded it yesterday and watching today and the rest of this week. For those of you that have been using it, is there a minimum RV1 you have found to be effective/profitable? I.E., the highest RV1 stock showing up right now has an RV1 number of 17. I saw yesterday LUB had over 1000 RV1 number?

CDJay

Member

In the Study, there is a check box at the top to include extended hours trading session. Make sure it's checked for your scan.@Gabrielx77 thanks for the help first of all but I do have a quick question if you don't mind plz. So I was trying to find PM stocks to add it to my personal worklist and then narrow it down but your scanner didn't pull up any tickers for me. Can you please let me know what i am doing wrong?

the scanner settings i have are:

Last: 0.50 to 50

Volume: minimum 5000 to no max

Study: After Hour percent change The Close has moved greater than 10% in the after-hours trading.

I ran the scan at 6am (9m East coast time) and 6:21 am (9:21 am) with zero results.

what am i doing wrong?

thanks man

In the Study, there is a check box at the top to include extended hours trading session. Make sure it's checked for your scan.

So here is what my scan looks like: (i have selected as D since its default but i don't see the extended hours box, i might be missing something)

You need to change The "D" box on the right in the last section by clicking on it, it's aggregating on daily basis and not 1m "ext" basis after hours.. Bring it down to 1min & check the box next to "EXT". Don't forget to save the scan.So here is what my scan looks like: (i have selected as D since its default but i don't see the extended hours box, i might be missing something)

I am running it & I am getting STRM rv3.7, DKMR 2.8, RMTI 2.8 ( my price range is .20-15.00). Let me know, it should work.

Last edited:

You need to change The "D" box on the right in the last section by clicking on it, it's aggregating on daily basis and not 1m "ext" basis after hours.. Bring it down to 1min & check the box next to "EXT". Don't forget to save the scan.

I am running it & I am getting STRM rv3.7, DKMR 2.8, RMTI 2.8 ( my price range is .20-15.00). Let me know, it should work.

oh ok, i knew about changing to aggregation period and EXT i just wasn't sure what aggregation period this PM settings were supposed to be used with. Perfect i will try it out with 1min aggregation period thank you.

if u don't mind me asking, what were your top tickers (resulted from PM scanner) this am? were they STRM, DKMR and RMTI?

oh ok, i knew about changing to aggregation period and EXT i just wasn't sure what aggregation period this PM settings were supposed to be used with. Perfect i will try it out with 1min aggregation period thank you.

if u don't mind me asking, what were your top tickers (resulted from PM scanner) this am? were they STRM, DKMR and RMTI?

I didn't trade today so I can't answer the question. These (strm et al) are from running sonny's pm scan after hours around 6pm (et) today.

Gabrielx77

Active member

Well, today was a bad day for trading these low float stocks. All the stocks on my scanner were down 30min after the bell. Is there an indicator that can help measure market sentiment for these low float stocks?

I actually saw some pretty good movement; take a look at NWGI. That's the ticker I was watching for a break over VWAP and it almost played up to its PM high.

@Gabrielx77 thanks for the help first of all but I do have a quick question if you don't mind plz. So I was trying to find PM stocks to add it to my personal worklist and then narrow it down but your scanner didn't pull up any tickers for me. Can you please let me know what i am doing wrong?

the scanner settings i have are:

Last: 0.50 to 50

Volume: minimum 5000 to no max

Study: After Hour percent change The Close has moved greater than 10% in the after-hours trading.

I ran the scan at 6am (9m East coast time) and 6:21 am (9:21 am) with zero results.

what am i doing wrong?

thanks man

Hey sorry I didn't reply eariler, but yeah from the picture you have to change your agg from "D" to "1m". You probably found that out by now. If you want to double check, your PM scan this morning should've shown SCON, YTEN, JAGX and SHIP as your leading gappers.

Gabrielx77

Active member

Take a look through the whole thread, you should have some of your questions answered; however, anything between 0-5 is normal, 5-20 is solid, 20 < is strong..This is an interesting scan (RV1), loaded it yesterday and watching today and the rest of this week. For those of you that have been using it, is there a minimum RV1 you have found to be effective/profitable? I.E., the highest RV1 stock showing up right now has an RV1 number of 17. I saw yesterday LUB had over 1000 RV1 number?

Similar threads

-

Slingshot Relative Volume & Zones Setup For ThinkOrSwim

- Started by rip78

- Replies: 12

-

Relative Volume Spike Buy Sell Chart Setup For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 27

-

Next Gen Volume Momentum Oscillator For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 8

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Mastering Market Pullbacks: Volume Spikes, Moving Averages, Pull Backs and Crossovers For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 31

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

535

Online

Similar threads

-

Slingshot Relative Volume & Zones Setup For ThinkOrSwim

- Started by rip78

- Replies: 12

-

Relative Volume Spike Buy Sell Chart Setup For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 27

-

Next Gen Volume Momentum Oscillator For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 8

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Mastering Market Pullbacks: Volume Spikes, Moving Averages, Pull Backs and Crossovers For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 31

Similar threads

-

Slingshot Relative Volume & Zones Setup For ThinkOrSwim

- Started by rip78

- Replies: 12

-

Relative Volume Spike Buy Sell Chart Setup For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 27

-

Next Gen Volume Momentum Oscillator For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 8

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Mastering Market Pullbacks: Volume Spikes, Moving Averages, Pull Backs and Crossovers For ThinkOrSwim

- Started by UpTwoBucks

- Replies: 31

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.