Author Message:

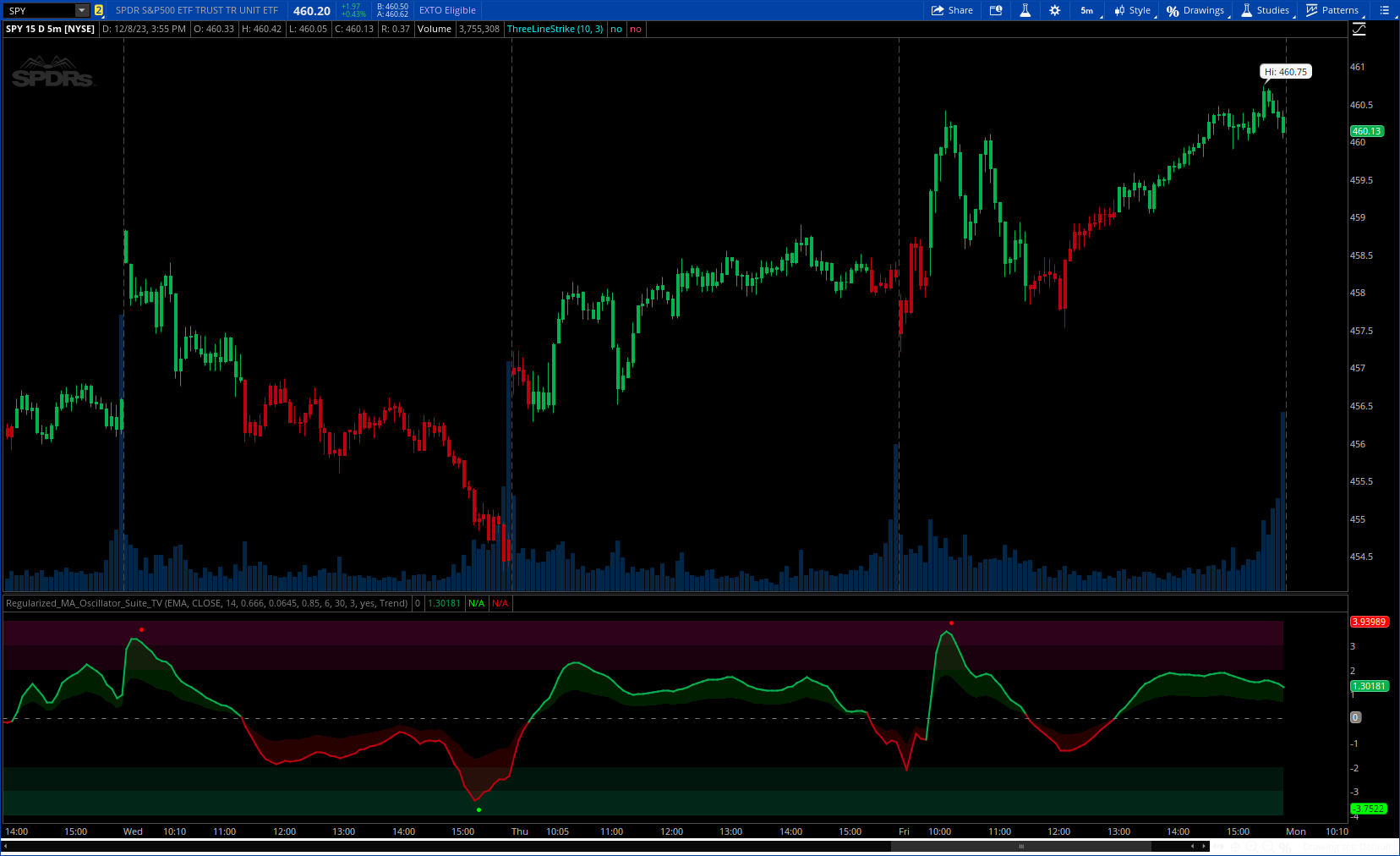

The Regularized MA Oscillator Suite calculates the moving average (MA) based on user-defined parameters such as length, moving average type, and custom smoothing factors. It then derives the mean and standard deviation of the MA using a normalized period. Finally, it computes the Z-Score by subtracting the mean from the MA and dividing it by the standard deviation.

CODE:

CSS:

#//https://www.tradingview.com/v/LAFDETZX/

#// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International

#// © EliCobra

#indicator("Regularized-MA Oscillator Suite", "{?} - MA Osc. Suite", false)

# Converted by Sam4Cok@Samer800 - 12/2023

declare lower;

input matype = {"SMA", default "EMA", "DEMA", "TEMA", "HMA", "EHMA", "THMA", "RMA", "WMA", "VWMA", "T3", "KAMA", "ALMA", "LSMA"};

input Source = close; # "Source"

input Length = 14; # "Length"

input KaufmanFast = 0.666; # "Kaufman Fast"

input KaufmanSlow = 0.0645; # "Kaufman Slow"

input almaOffset = 0.85; # "ALMA Offset"

input almaSigma = 6; # "ALMA Sigma"

input RegularizeLength = 30; # "Regularize Length"

input ReversionThreshold = {"1", "2", default "3"}; # "Reversion Threshold"

input ShowReversalSignals = yes; # "Show Reversal Signals"

input BarColoring = {default "None", "Trend", "Extremities", "Reversions", "Slope"}; # "Bar Coloring"

def na = Double.NaN;

def last = isNaN(Close);

DefineGlobalColor("up", CreateColor(0,179,80));

DefineGlobalColor("dn", CreateColor(187,0,16));

def revt;

Switch (ReversionThreshold) {

Case "3" : revt = 3;

Case "2" : revt = 2;

Default : revt = 1;

}

#f_kama(src, len, kamaf, kamas) =>

script f_kama {

input src = close;

input len = 14;

input kamaf = 0.666;

input kamas = 0.0645;

def white = AbsValue(src - src[1]);

def nsignal = AbsValue(src - src[len]);

def nnoise = Sum(white, len);

def nefratio = if nnoise != 0 then nsignal / nnoise else 0;

def nsmooth = Power(nefratio * (kamaf - kamas) + kamas, 2) ;

def ama = CompoundValue(1, ama[1] + nsmooth * (src - ama[1]), 0);

plot out = ama;

}

#f_t3(src, len) =>

script f_t3 {

input src = close;

input len = 14;

def x1 = ExpAverage(src, len);

def x2 = ExpAverage(x1, len);

def x3 = ExpAverage(x2, len);

def x4 = ExpAverage(x3, len);

def x5 = ExpAverage(x4, len);

def x6 = ExpAverage(x5, len);

def b = 0.7;

def c1 = - Power(b, 3);

def c2 = 3 * Power(b, 2) + 3 * Power(b, 3);

def c3 = -6 * Power(b, 2) - 3 * b - 3 * Power(b, 3);

def c4 = 1 + 3 * b + Power(b, 3) + 3 * Power(b, 2);

def f_t3 = c1 * x6 + c2 * x5 + c3 * x4 + c4 * x3;

plot out = f_t3;

}

#f_ehma(src, length) =>

script f_ehma {

input src = close;

input length = 14;

def ema1 = ExpAverage(src, length);

def ema2 = 2 * ExpAverage(src, length / 2);

def SqrtLen = Round(Sqrt(length), 0);

def f_ehma = ExpAverage(ema2 - ema1, SqrtLen);

plot out = f_ehma;

}

#f_thma(src, length) =>

script f_thma {

input src = close;

input length = 14;

def wma1 = WMA(src, length);

def wma2 = WMA(src, length / 2);

def wma3 = 3 * WMA(src, length / 3);

def f_thma = WMA(wma3 - wma2 - wma1, length);

plot out = f_thma;

}

script f_alma {

input series = close;

input windowsize = 9;

input offset = 0.85;

input sigma = 6;

def m = offset * (windowsize - 1);

def s = windowsize / sigma;

def norm = fold i = 0 to windowsize with p do

p + Exp(-1 * Sqr(i - m) / (2 * Sqr(s)));

def sum = fold j = 0 to windowsize with q do

q + GetValue(series, windowsize - j - 1) * Exp(-1 * Sqr(j - m) / (2 * Sqr(s)));

def f_alma = sum / norm;

plot out = f_alma;

}

#vwma(source, length)

script VWMA {

input src = close;

input len = 14;

input vol = volume;

def nom = Average(src * vol, len);

def den = Average(vol, len);

def VWMA = nom / den;

plot result = VWMA;

}

#f_ma(src, len, type, kamaf, kamas, offset, sigma) =>

script f_ma {

input src = close;

input len = 14;

input type = "EMA";

input kamaf = 0.666;

input kamas = 0.0645;

input offset = 0.85;

input sigma = 6;

def x =

if type == "SMA" then Average(src, len) else

if type == "EMA" then ExpAverage(src, len) else

if type == "HMA" then HullMovingAvg(src, len) else

if type == "RMA" then WildersAverage(src, len) else

if type == "WMA" then WMA(src, len) else

if type == "VWMA" then vwma(src, len) else

if type == "ALMA" then f_alma(src, len, offset, sigma) else

if type == "DEMA" then DEMA(src, len) else

if type == "TEMA" then TEMA(src, len) else

if type == "EHMA" then f_ehma(src, len) else

if type == "THMA" then f_thma(src, len) else

if type == "T3" then f_t3(src, len) else

if type == "KAMA" then f_kama(src, len, kamaf, kamas) else

if type == "LSMA" then Inertia(src, len) else ExpAverage(src, len);

def f_ma = x;

plot out = f_ma;

}

def ma = f_ma(Source, Length, matype, KaufmanFast, KaufmanSlow, almaOffset, almaSigma);

def mean = Average(ma, RegularizeLength);

def dev = stdev(ma, RegularizeLength);

def zmean = (ma - mean) / dev;

def max = if last then na else 4;

def hh = if last then na else 3;

def lh = if last then na else 2;

plot mid = if last then na else 0;#, "Mid Line"

def min = if last then na else -4;

def ll = if last then na else -3;

def hl = if last then na else -2;

mid.SetStyle(Curve.SHORT_DASH);

mid.SetDefaultColor(Color.GRAY);

AddCloud(max, hh, CreateColor(88, 4, 48));

AddCloud(max, lh, CreateColor(88, 4, 48));

AddCloud(ll, min, CreateColor(2, 75, 48));

AddCloud(hl, min, CreateColor(2, 75, 48));

plot z = zmean; # "Z"

z.AssignValueColor(if zmean > 0 then GlobalColor("up") else GlobalColor("dn"));

z.SetLineWeight(2);

def zh = z / 2;

AddCloud(z, zh, Color.DARK_GREEN, Color.DARK_RED);

def col;

Switch (BarColoring) {

Case "Trend" : col = if zmean > 0 then 1 else -1;#? #00b350 : #bb0010

Case "Extremities" :

col = if zmean > 2 then 1 else

if zmean < -2 then -1 else 0;

Case "Reversions":

col = if (zmean > revt and zmean < zmean[1]) and !(zmean[1] < zmean[2]) then -1 else

if (zmean < -revt and zmean > zmean[1]) and !(zmean[1] > zmean[2]) then 1 else 0;

Case "Slope" :

col = if zmean > zmean[1] then 1 else -1;

Default : col = na;

}

def color = col;

AssignPriceColor(if isNaN(color) then Color.CURRENT else

if color > 0 then GlobalColor("up") else

if color < 0 then GlobalColor("dn") else Color.GRAY);

def os = ShowReversalSignals and zmean < -revt and zmean > zmean[1] and !(zmean[1] > zmean[2]);

def ob = ShowReversalSignals and zmean > revt and zmean < zmean[1] and !(zmean[1] < zmean[2]);

plot OverSold = if os then z - 0.5 else na;

plot OverBought = if ob then z + 0.5 else na;

OverSold.SetPaintingStrategy(PaintingStrategy.POINTS);

OverBought.SetPaintingStrategy(PaintingStrategy.POINTS);

OverSold.SetDefaultColor(Color.GREEN);

OverBought.SetDefaultColor(Color.RED);

OverSold.SetLineWeight(2);

OverBought.SetLineWeight(2);

#-- END OF CODE