Thank you very much for your help. Stay safeThis script for ToS was created by Mobius.

thinkScript Code

Code:# PPO # Mobius # V01.03.2014 declare lower; input c = close; input AvgType = AverageType.Simple; input nFast = 8; input nSlow = 13; input nSmooth = 5; plot PPO = ((MovingAverage(AverageType = AvgType, c, nFast) - MovingAverage(AverageType = AvgType, c, nSlow)) / MovingAverage(AverageType = AvgType, c, nSlow)); PPO.SetPaintingStrategy(PaintingStrategy.Histogram); PPO.AssignValueColor(if PPO > 0 then color.green else color.red); plot smooth = MovingAverage(AverageType = AvgType, PPO, nSmooth); smooth.SetPaintingStrategy(PaintingStrategy.Line); smooth.SetDefaultColor(Color.Cyan); # End Code PPO

Shareable Link

https://tos.mx/hv8hVf

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

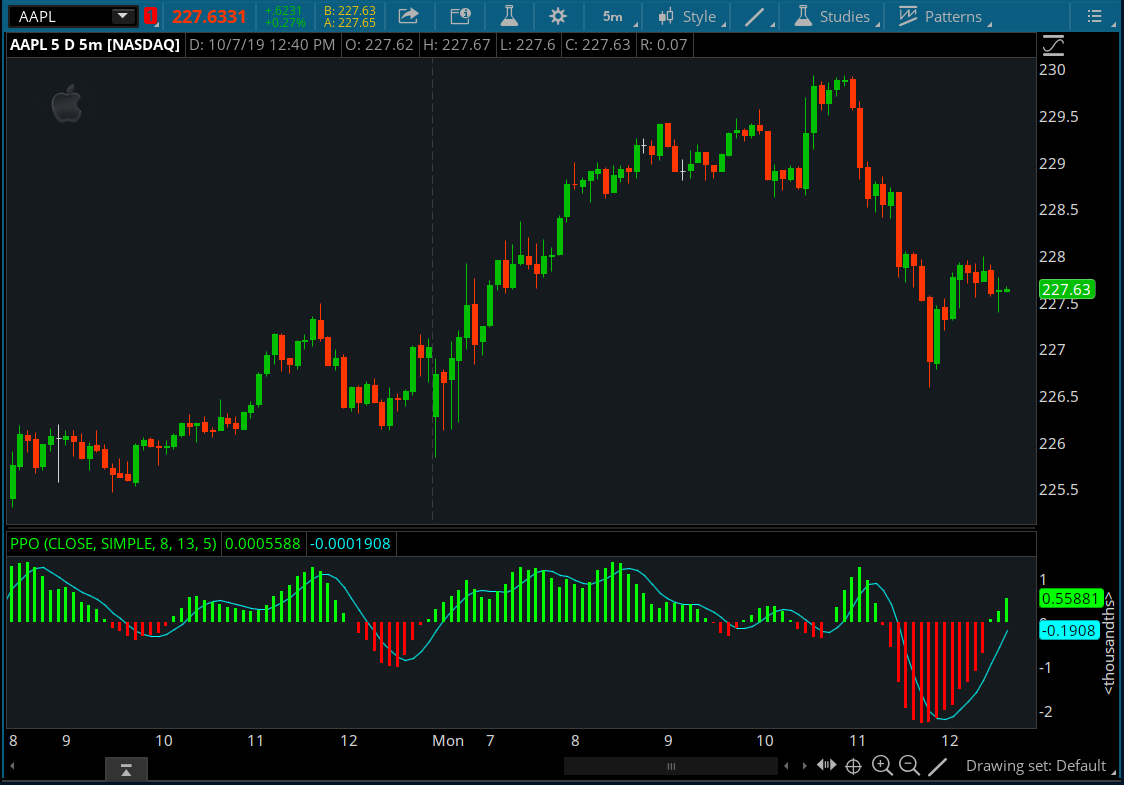

PPO (Price Percent Oscillator) for ThinkorSwim

- Thread starter BenTen

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Thank you very much for your help. Stay safe@thedoc556

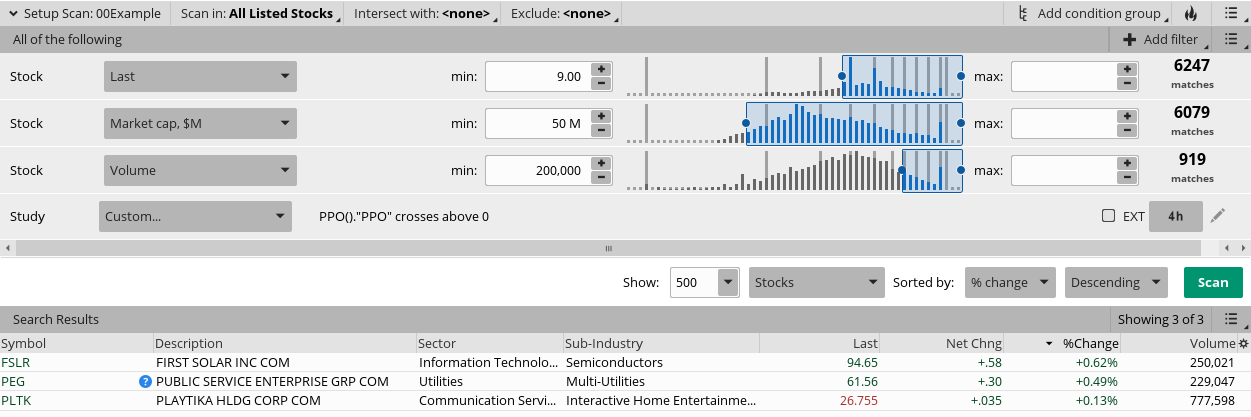

Here is an example of when PPO crosses above 0 to begin trend.

You can change the middle column to greater than, less than, crosses below, etc...

You can change the right column to any value

Shared Scan Link: http://tos.mx/7tShl17 Click here for --> Easiest way to load shared links

View attachment 1037

Thanks for sharing. Is it possible to add bullish/bearish arrows each time PPO (1) crosses above/below EMA (2) or when PPOH1 changes color from Down to UP (bullish) or from UP to Down (Bearish)? essentially , there will be two different set of arrows. (PPO/EMA) and PPOH1 UP/DOWN color change. Thanks again. Here is the shared link that indicator: http://tos.mx/zQ6P90@grasshopper123 @wpwright I did was a simple google search, I am assuming that you did also and already saw this Easycator PPO w/ fast and slow lines and it wasn't what you wanted.

However here it is for anyone in the future that has this request:

View attachment 2001Code:# # TD Ameritrade IP Company, Inc. (c) 2007-2016 # ## created by North Vanhooser declare lower; input fastPeriod = 12; input slowPeriod = 26; input signalPeriod = 9; input price = close; def fastEma = ExpAverage( price, fastPeriod ); def slowEma = ExpAverage( price, slowPeriod ); def periodOK = fastPeriod < slowPeriod; AddLabel( !periodOK, "ERROR: fastPeriod MUST be less than slowPeriod" ); def _ppo = if periodOK then ((fastEma - slowEma) / slowEma) * 100 else 0; def _signal = ExpAverage( _ppo, signalPeriod ); plot Ppo = _ppo; Ppo.SetDefaultColor( Color.BLUE ); Ppo.HideBubble(); plot PpoEma = _signal; PpoEma.SetDefaultColor( Color.CYAN ); PpoEma.HideBubble(); plot zeroLine = 0; zeroLine.HideBubble(); zeroLine.AssignValueColor( Color.BLACK ); plot PpoH1 = _ppo - _signal; PpoH1.SetPaintingStrategy( PaintingStrategy.HISTOGRAM ); PpoH1.DefineColor("Up", Color.UPTICK); PpoH1.DefineColor("Down", Color.DOWNTICK); PpoH1.DefineColor("Flat", Color.GRAY); PpoH1.AssignValueColor( if PpoH1 > PpoH1[1] then PpoH1.Color("Up") else if PpoH1 < PpoH1[1] then PpoH1.Color("Down") else PpoH1.Color("Flat")); PpoH1.HideBubble(); PpoH1.SetLineWeight( 3 );

Here is the shared link: http://tos.mx/zQ6P90

Last edited:

Nice oscillatorThe Percentage Price Oscillator (PPO) is similar to Moving Average Convergence Divergence (MACD).

They are both momentum indicators used to gauge the strength and direction of a trend in a stock's price. Many times, they present with the same signals.

The PPO is considered superior in that the PPO is expressed as a percentage, making it easier to compare across different stocks and timeframes. Whereas the MACD has little comparitive value.

View attachment 5664

This script for ToS was created by Mobius.

thinkScript Code

Code:# PPO # Mobius # V01.03.2014 declare lower; input c = close; input AvgType = AverageType.Simple; input nFast = 8; input nSlow = 13; input nSmooth = 5; plot PPO = ((MovingAverage(AverageType = AvgType, c, nFast) - MovingAverage(AverageType = AvgType, c, nSlow)) / MovingAverage(AverageType = AvgType, c, nSlow)); PPO.SetPaintingStrategy(PaintingStrategy.Histogram); PPO.AssignValueColor(if PPO > 0 then color.green else color.red); plot smooth = MovingAverage(AverageType = AvgType, PPO, nSmooth); smooth.SetPaintingStrategy(PaintingStrategy.Line); smooth.SetDefaultColor(Color.Cyan); # End Code PPO

Shareable Link

https://tos.mx/hv8hVf

The idea here is that while the stocks may have greatly different prices, the percentage difference between the averages are comparable. A 5% spread between the 12 and 26 ema is the same relative difference by percentage, regardless of the price differences between stocks.

My intent is to do away with the problem of trying to compare the MACD of different stocks that have widely different price levels.

So I converted the difference between the fast and slow ema into a percentage difference.

Here's my script...

My intent is to do away with the problem of trying to compare the MACD of different stocks that have widely different price levels.

So I converted the difference between the fast and slow ema into a percentage difference.

Here's my script...

Code:

declare lower;

input FastLength = 12; # Faster of the two moving averages

input SlowLength = 26; # Slower of the two moving averages

input FastAvgSmoothingLength = 9;

input FastEMA_Length = 8;

def FastEMAavg = ExpAverage(close,FastEMA_Length);

def P1L = 1;

def PP5L = 0.5;

def ZL = 0;

def MP5L = -0.5;

def M1L = -1;

def SlowAvg = ExpAverage(close,SlowLength); # ema of the slow moving average

def FastAvg = ExpAverage(close,FastLength); # ema of the fast moving average

plot FastSlowPctDiff = ((FastAvg-SlowAvg)/SlowAvg) * 100; # Percent difference between FastAvg and SlowAvg

def FastPctDiff = ((FastAvg - FastAvg[1])/FastAvg[1]) * 100; # Percent difference betwee current and previous bar

plot FastPctDiffAvg = ExpAverage(FastPctDiff,FastAvgSmoothingLength);

FastPctDiffAvg.SetDefaultColor(color.cyan);

def PDGTP = if FastSlowPctDiff > FastSlowPctDiff[1] then 1 else 0;

def PDLTP = if FastSlowPctDiff < FastSlowPctDiff[1] then 1 else 0;

FastSlowPctDiff.AssignValueColor(if PDGTP then Color.GREEN else if PDLTP then Color.RED else Color.YELLOW);

FastSlowPctDiff.SetLineWeight(2);

plot ZLine = ZL;

ZLine.SetDefaultColor(Color.white);

plot P1Line = P1L;

P1Line.SetDefaultColor(color.green);

Plot M1Line = M1L;

M1Line.SetDefaultColor(color.red);

Plot PP5Line = PP5L;

PP5Line.SetDefaultColor(Color.yellow);

PP5Line.SetPaintingStrategy(PaintingStrategy.DASHES);

Plot MP5Line = MP5L;

MP5Line.SetDefaultColor(color.yellow);

MP5Line.SetPaintingStrategy(PaintingStrategy.DASHES);

plot FastEMAImproving = if FastEMAavg > FastEMAavg[1] then 1 else 0;

FastEMAImproving.Hide();

AddLabel(yes,FastEMA_Length + " EMA Improving", if FastEMAImproving then color.green else if FastEMAavg == FastEMAavg[1] then color.gray else color.red);

AddLabel(yes,FastLength + " EMA Improving",if FastAvg > FastAvg[1] then color.green else color.red);

def BullConditionGo = if FastPctDiffAvg > FastPctDiffAvg[1] and FastSlowPctDiff > FastSlowPctDiff[1] and FastAvg > FastAvg[1] then 1 else 0;

AddLabel(yes, if BullConditionGo then " Bull Go " else "Bull No Go",if BullConditionGo then color.green else color.red);

def BullConditionGoPlus = if BullConditionGo and FastSlowPctDiff > 0 then 1 else 0;

AddLabel(yes,if BullConditionGoPlus then "Bull Go Plus" else " ", if BullConditionGoPlus then color.green else color.gray);

def BearConditionGo = if FastPctDiffAvg < FastPctDiffAvg[1] and FastSlowPctDiff < FastSlowPctDiff[1] and FastAvg < FastAvg[1] then 1 else 0;

AddLabel(yes, if BearConditionGo then " Bear Go " else "Bear No Go",if BearConditionGo then color.green else color.red);

def BearConditionGoPlus = if BearConditionGo and FastSlowPctDiff < 0 then 1 else 0;

AddLabel(yes,if BearConditionGoPlus then "Bear Go Plus" else " ", if BearConditionGoPlus then color.green else color.gray);

# Conditions for scanning

plot BullGoPlus = if BullConditionGoPlus then 1 else 0;

BullGoPlus.Hide();

plot BearGoPlus = if BearConditionGoPlus then 1 else 0;

BearGoPlus.Hide();

plot highestPos = if Highest(FastSlowPctDiff,5) <= 1 then 1 else 0;

highestPos.Hide();

plot lowestPos = if Highest(FastSlowPctDiff,5) >= 0 then 1 else 0;

lowestPos.Hide();

def TanAngle = ATan(close);

AddLabel(yes,"'Angle Improving'", if (TanAngle > TanAngle[1]) then color.green else color.red);

AddLabel(yes,"Previous 'Angle': " + TanAngle[1],color.gray);

AddLabel(yes,"Current 'Angle': " + TanAngle,color.gray);

Last edited by a moderator:

Very interesting indicator. Good work! When I use your code, my red and green zigzag line showing what is happening turns out to be much thinner than the one you show. Is there a way to thicken that line?

1. click on the beaker at the top of your chart

2. click on the gear icon to the right of your study

3. change the Width of the variable FastSlowPctDiff to your preference

4. click on Save as default to save your preference for all future charts

Thanks! That works.1. click on the beaker at the top of your chart

2. click on the gear icon to the right of your study

3. change the Width of the variable FastSlowPctDiff to your preference

4. click on Save as default to save your preference for all future charts

The idea here is that while the stocks may have greatly different prices, the percentage difference between the averages are comparable. A 5% spread between the 12 and 26 ema is the same relative difference by percentage, regardless of the price differences between stocks.

My intent is to do away with the problem of trying to compare the MACD of different stocks that have widely different price levels.

So I converted the difference between the fast and slow ema into a percentage difference.

Here's my script...

Code:declare lower; input FastLength = 12; # Faster of the two moving averages input SlowLength = 26; # Slower of the two moving averages input FastAvgSmoothingLength = 9; input FastEMA_Length = 8; def FastEMAavg = ExpAverage(close,FastEMA_Length); def P1L = 1; def PP5L = 0.5; def ZL = 0; def MP5L = -0.5; def M1L = -1; def SlowAvg = ExpAverage(close,SlowLength); # ema of the slow moving average def FastAvg = ExpAverage(close,FastLength); # ema of the fast moving average plot FastSlowPctDiff = ((FastAvg-SlowAvg)/SlowAvg) * 100; # Percent difference between FastAvg and SlowAvg def FastPctDiff = ((FastAvg - FastAvg[1])/FastAvg[1]) * 100; # Percent difference betwee current and previous bar plot FastPctDiffAvg = ExpAverage(FastPctDiff,FastAvgSmoothingLength); FastPctDiffAvg.SetDefaultColor(color.cyan); def PDGTP = if FastSlowPctDiff > FastSlowPctDiff[1] then 1 else 0; def PDLTP = if FastSlowPctDiff < FastSlowPctDiff[1] then 1 else 0; FastSlowPctDiff.AssignValueColor(if PDGTP then Color.GREEN else if PDLTP then Color.RED else Color.YELLOW); FastSlowPctDiff.SetLineWeight(2); plot ZLine = ZL; ZLine.SetDefaultColor(Color.white); plot P1Line = P1L; P1Line.SetDefaultColor(color.green); Plot M1Line = M1L; M1Line.SetDefaultColor(color.red); Plot PP5Line = PP5L; PP5Line.SetDefaultColor(Color.yellow); PP5Line.SetPaintingStrategy(PaintingStrategy.DASHES); Plot MP5Line = MP5L; MP5Line.SetDefaultColor(color.yellow); MP5Line.SetPaintingStrategy(PaintingStrategy.DASHES); plot FastEMAImproving = if FastEMAavg > FastEMAavg[1] then 1 else 0; FastEMAImproving.Hide(); AddLabel(yes,FastEMA_Length + " EMA Improving", if FastEMAImproving then color.green else if FastEMAavg == FastEMAavg[1] then color.gray else color.red); AddLabel(yes,FastLength + " EMA Improving",if FastAvg > FastAvg[1] then color.green else color.red); def BullConditionGo = if FastPctDiffAvg > FastPctDiffAvg[1] and FastSlowPctDiff > FastSlowPctDiff[1] and FastAvg > FastAvg[1] then 1 else 0; AddLabel(yes, if BullConditionGo then " Bull Go " else "Bull No Go",if BullConditionGo then color.green else color.red); def BullConditionGoPlus = if BullConditionGo and FastSlowPctDiff > 0 then 1 else 0; AddLabel(yes,if BullConditionGoPlus then "Bull Go Plus" else " ", if BullConditionGoPlus then color.green else color.gray); def BearConditionGo = if FastPctDiffAvg < FastPctDiffAvg[1] and FastSlowPctDiff < FastSlowPctDiff[1] and FastAvg < FastAvg[1] then 1 else 0; AddLabel(yes, if BearConditionGo then " Bear Go " else "Bear No Go",if BearConditionGo then color.green else color.red); def BearConditionGoPlus = if BearConditionGo and FastSlowPctDiff < 0 then 1 else 0; AddLabel(yes,if BearConditionGoPlus then "Bear Go Plus" else " ", if BearConditionGoPlus then color.green else color.gray); # Conditions for scanning plot BullGoPlus = if BullConditionGoPlus then 1 else 0; BullGoPlus.Hide(); plot BearGoPlus = if BearConditionGoPlus then 1 else 0; BearGoPlus.Hide(); plot highestPos = if Highest(FastSlowPctDiff,5) <= 1 then 1 else 0; highestPos.Hide(); plot lowestPos = if Highest(FastSlowPctDiff,5) >= 0 then 1 else 0; lowestPos.Hide(); def TanAngle = ATan(close); AddLabel(yes,"'Angle Improving'", if (TanAngle > TanAngle[1]) then color.green else color.red); AddLabel(yes,"Previous 'Angle': " + TanAngle[1],color.gray); AddLabel(yes,"Current 'Angle': " + TanAngle,color.gray);

just as an fyi, your conversion to the percentage basis is an old indicator called the PPO (price percent oscillator) just in case you want to see what others have done with that in the past

@Thinker

Here is my version of the scan https://tos.mx/!8x7f3iCTI really like the

I'm not sure why but my scan is always empty unless I set the parameters to within 3 bars. 2 and 1 bar gets zero results. Please help.

I added some other confirmations and labelling - very cool original from Mobius and @BenTen !!! https://tos.mx/!PK3dRaD1

Both scripts implement PPO (Percentage Price Oscillator) — a normalized version of MACD — but they are structurally and functionally different in purpose and flexibility.

Major Differences Between the Two PPO Scripts

Interpretation Style Differences

So the core signal is the same — but the new version is better suited (I feel) for:

Both scripts implement PPO (Percentage Price Oscillator) — a normalized version of MACD — but they are structurally and functionally different in purpose and flexibility.

Major Differences Between the Two PPO Scripts

| Feature | New Script (PPO + ROC Dashboard) | TD Ameritrade Default PPO (BenTen, Mobius) |

| Normalization | PPO shown as raw decimal (e.g., 0.08) | PPO scaled as percentage (e.g., 8%) |

| Signal Smoothing Options | Customizable smoothing via nSmooth, ROC | Fixed exponential smoothing for signal |

| ROC Integration | Integrated ROC (Rate of Change) | No ROC |

| Momentum Labels | Dashboard labels (PPO, signal, ROC, etc.) | None |

| Momentum Arrows | Bullish/Bearish signal arrows on crossover | None |

| Scan/Strategy Ready | Designed with conditional logic for scanning | Not optimized for scanner/strategy use |

| Color Customization | Clean histogram coloring + user toggles | Uses default uptick/downtick/gray |

| Zero Line Handling | Implicit | Explicit zero line plot |

| Error Catching (Invalid Inputs) | None | Checks if fast < slow and warns |

| PPO Display | Clean modernized label-based dashboard | Classic MACD-style histogram display |

Interpretation Style Differences

| New (Dashboard) | TD Mobius, BenTen PPO Script | |

| Designed for | Modern trader: multi-confirmation setup | Classic MACD/PPO traders |

| Readability | Faster at-a-glance interpretation | Better for studying histogram momentum shifts |

| Volatility Sensitivity | More sensitive due to ROC | More stable as it's just PPO |

So the core signal is the same — but the new version is better suited (I feel) for:

- Swing or intraday traders looking for trend confirmation

- Strategy building or scanning

- Reduced chart clutter with actionable labels

| Use Case | Recommended Script |

| You want multi-confirmation trend analysis | New PPO + ROC dashboard |

| You want a basic PPO display only | TDA PPO by Mobius, BenTen |

| You're building scans or automated strategy | New PPO version |

Last edited:

@grasshopper123 @wpwright I did was a simple google search, I am assuming that you did also and already saw this Easycator PPO w/ fast and slow lines and it wasn't what you wanted.

However here it is for anyone in the future that has this request:

View attachment 2001Code:# # TD Ameritrade IP Company, Inc. (c) 2007-2016 # ## created by North Vanhooser declare lower; input fastPeriod = 12; input slowPeriod = 26; input signalPeriod = 9; input price = close; def fastEma = ExpAverage( price, fastPeriod ); def slowEma = ExpAverage( price, slowPeriod ); def periodOK = fastPeriod < slowPeriod; AddLabel( !periodOK, "ERROR: fastPeriod MUST be less than slowPeriod" ); def _ppo = if periodOK then ((fastEma - slowEma) / slowEma) * 100 else 0; def _signal = ExpAverage( _ppo, signalPeriod ); plot Ppo = _ppo; Ppo.SetDefaultColor( Color.BLUE ); Ppo.HideBubble(); plot PpoEma = _signal; PpoEma.SetDefaultColor( Color.CYAN ); PpoEma.HideBubble(); plot zeroLine = 0; zeroLine.HideBubble(); zeroLine.AssignValueColor( Color.BLACK ); plot PpoH1 = _ppo - _signal; PpoH1.SetPaintingStrategy( PaintingStrategy.HISTOGRAM ); PpoH1.DefineColor("Up", Color.UPTICK); PpoH1.DefineColor("Down", Color.DOWNTICK); PpoH1.DefineColor("Flat", Color.GRAY); PpoH1.AssignValueColor( if PpoH1 > PpoH1[1] then PpoH1.Color("Up") else if PpoH1 < PpoH1[1] then PpoH1.Color("Down") else PpoH1.Color("Flat")); PpoH1.HideBubble(); PpoH1.SetLineWeight( 3 );

Here is the shared link: http://tos.mx/zQ6P90

what is the yellow bar?

what is the yellow bar?

Good question!

There is no candle painting in the PPO script, so it must have been another script added to the chart.

The post to too old to know what the conversation was back then.

However, did you notice that the painted orange candles "seem" to coincide with the cross of the fast & slow lines?

If you wanted to test that theory and find out if it contributes toward your analysis; you can add the following code snippet to the bottom of your script.

If you are looking for a specific candle-painting condition. Please articulate the specification in detail and provide an image highlighting the congruence.input paintCandles = yes;

AssignPriceColor(if !paintCandles then color.current else

if slowEMA crosses fastEma then color.orange else color.current);

Keep in mind, ToS supports ONLY one script attempting to paint candles. Multiple painting scripts in your setup will result in an error exclamation point in the upper left-hand corner and provide screwy candle painting.

Splinter

Member

Very nice work! I use the PPO and your additions are indeed welcome ones! I was hoping in order to see the trend more clearly, and quickly, you would be able to have the RoC line change color when going up or down.

Very nice work! I use the PPO and your additions are indeed welcome ones! I was hoping in order to see the trend more clearly, and quickly, you would be able to have the RoC line change color when going up or down? I know it seems trivial but at a quick glance it would be a big help. Thanks again for the time you put in to this indicator!I added some other confirmations and labelling - very cool original from Mobius and @BenTen !!! https://tos.mx/!PK3dRaD1

Both scripts implement PPO (Percentage Price Oscillator) — a normalized version of MACD — but they are structurally and functionally different in purpose and flexibility.

Major Differences Between the Two PPO Scripts

Feature New Script (PPO + ROC Dashboard) TD Ameritrade Default PPO (BenTen, Mobius) Normalization PPO shown as raw decimal (e.g., 0.08) PPO scaled as percentage (e.g., 8%) Signal Smoothing Options Customizable smoothing via nSmooth, ROC Fixed exponential smoothing for signal ROC Integration Integrated ROC (Rate of Change) No ROC Momentum Labels Dashboard labels (PPO, signal, ROC, etc.) None Momentum Arrows Bullish/Bearish signal arrows on crossover None Scan/Strategy Ready Designed with conditional logic for scanning Not optimized for scanner/strategy use Color Customization Clean histogram coloring + user toggles Uses default uptick/downtick/gray Zero Line Handling Implicit Explicit zero line plot Error Catching (Invalid Inputs) None Checks if fast < slow and warns PPO Display Clean modernized label-based dashboard Classic MACD-style histogram display

Interpretation Style Differences

New (Dashboard) TD Mobius, BenTen PPO Script Designed for Modern trader: multi-confirmation setup Classic MACD/PPO traders Readability Faster at-a-glance interpretation Better for studying histogram momentum shifts Volatility Sensitivity More sensitive due to ROC More stable as it's just PPO

So the core signal is the same — but the new version is better suited (I feel) for:

Which One to Use?

- Swing or intraday traders looking for trend confirmation

- Strategy building or scanning

- Reduced chart clutter with actionable labels

Use Case Recommended Script You want multi-confirmation trend analysis New PPO + ROC dashboard You want a basic PPO display only TDA PPO by Mobius, BenTen You're building scans or automated strategy New PPO version

View attachment 24998

Very nice work! I use the PPO and your additions are indeed welcome ones! I was hoping in order to see the trend more clearly, and quickly, you would be able to have the RoC line change color when going up or down? I know it seems trivial but at a quick glance it would be a big help. Thanks again for the time you put in to this indicator!

Code:

# PPO + ROC Momentum Dashboard with Arrows

# Created by ANTWERKS from Mobius and BENTEN | June 2025

# Enhanced: Color-coded ROC trend (June 2025)

declare lower;

# === INPUTS ===

input price = close;

input avgType = AverageType.Simple;

input nFast = 8;

input nSlow = 13;

input nSmooth = 5;

input rocLength = 10;

input rocSmoothingLength = 3;

input rocOB = 5.0;

input rocOS = -5.0;

input showDashboard = yes;

input showArrows = yes;

# === PPO CALCULATION ===

def maFast = MovingAverage(avgType, price, nFast);

def maSlow = MovingAverage(avgType, price, nSlow);

def PPO = (maFast - maSlow) / maSlow;

plot PPOhist = PPO * 200;

PPOhist.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

PPOhist.AssignValueColor(if PPO > 0 then Color.GREEN else Color.RED);

PPOhist.SetLineWeight(3);

def PPOsignal = MovingAverage(avgType, PPO, nSmooth);

plot SignalLine = PPOsignal;

SignalLine.SetDefaultColor(Color.CYAN);

SignalLine.SetLineWeight(1);

# === ROC CALCULATION ===

def ROCraw = (price - price[rocLength]) / price[rocLength] * 100;

def ROCsmoothed = Average(ROCraw, rocSmoothingLength);

plot ROCplot = ROCsmoothed;

# NEW COLORING: green if rising, red if falling, gray if flat

ROCplot.AssignValueColor(

if ROCsmoothed > ROCsmoothed[1] then Color.GREEN

else if ROCsmoothed < ROCsmoothed[1] then Color.RED

else Color.GRAY);

ROCplot.SetLineWeight(2);

# === MOMENTUM SIGNAL LOGIC ===

def isBullish = PPO > PPOsignal and ROCsmoothed > 0;

def isBearish = PPO < PPOsignal and ROCsmoothed < 0;

# === ARROWS ON CHART ===

plot BullArrow = if showArrows and isBullish and !isBullish[1] then 0 else Double.NaN;

BullArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BullArrow.SetDefaultColor(Color.GREEN);

BullArrow.SetLineWeight(2);

plot BearArrow = if showArrows and isBearish and !isBearish[1] then 0 else Double.NaN;

BearArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

BearArrow.SetDefaultColor(Color.RED);

BearArrow.SetLineWeight(2);

# === LABELS ===

AddLabel(showDashboard, "PPO: " + Round(PPO, 2), if PPO > 0 then Color.GREEN else Color.RED);

AddLabel(showDashboard, "Signal: " + Round(PPOsignal, 2), Color.CYAN);

AddLabel(showDashboard, "ROC: " + Round(ROCsmoothed, 2) + "%",

if ROCsmoothed >= rocOB then Color.LIGHT_GREEN

else if ROCsmoothed <= rocOS then Color.PINK

else Color.GRAY);

AddLabel(showDashboard,

if isBullish then "Momentum: Bullish"

else if isBearish then "Momentum: Bearish"

else "Momentum: Neutral",

if isBullish then Color.GREEN

else if isBearish then Color.RED

else Color.YELLOW);

Last edited by a moderator:

Similar threads

-

-

Repaints MTF Anticipated Price Level Indicator For ThinkOrSwim

- Started by TraderZen

- Replies: 35

-

find gaps, more than some %. reduce gap when price crosses into it for ThinkOrSwim

- Started by halcyonguy

- Replies: 25

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

828

Online

Similar threads

-

-

Repaints MTF Anticipated Price Level Indicator For ThinkOrSwim

- Started by TraderZen

- Replies: 35

-

find gaps, more than some %. reduce gap when price crosses into it for ThinkOrSwim

- Started by halcyonguy

- Replies: 25

-

-

Similar threads

-

-

Repaints MTF Anticipated Price Level Indicator For ThinkOrSwim

- Started by TraderZen

- Replies: 35

-

find gaps, more than some %. reduce gap when price crosses into it for ThinkOrSwim

- Started by halcyonguy

- Replies: 25

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.