TraderZen

Member

Updated 5:00 8/21/2022 - V3.0 --> D+ level MTF & Anticipated_Level VWAP and Price of Interest (POI) Profiles.

Updated 10:55 8/17/2022 PST - % change in Label.

Updated 12:45 8/6/2022 PST - A calculation correction.

Current Anticipated Level Indicator version is V3.

Current Anticipate Level VWAP and POI Profiler code version is V1.

Both of the studies should be added at the chart level, the plots overlap with right levels of translusence.

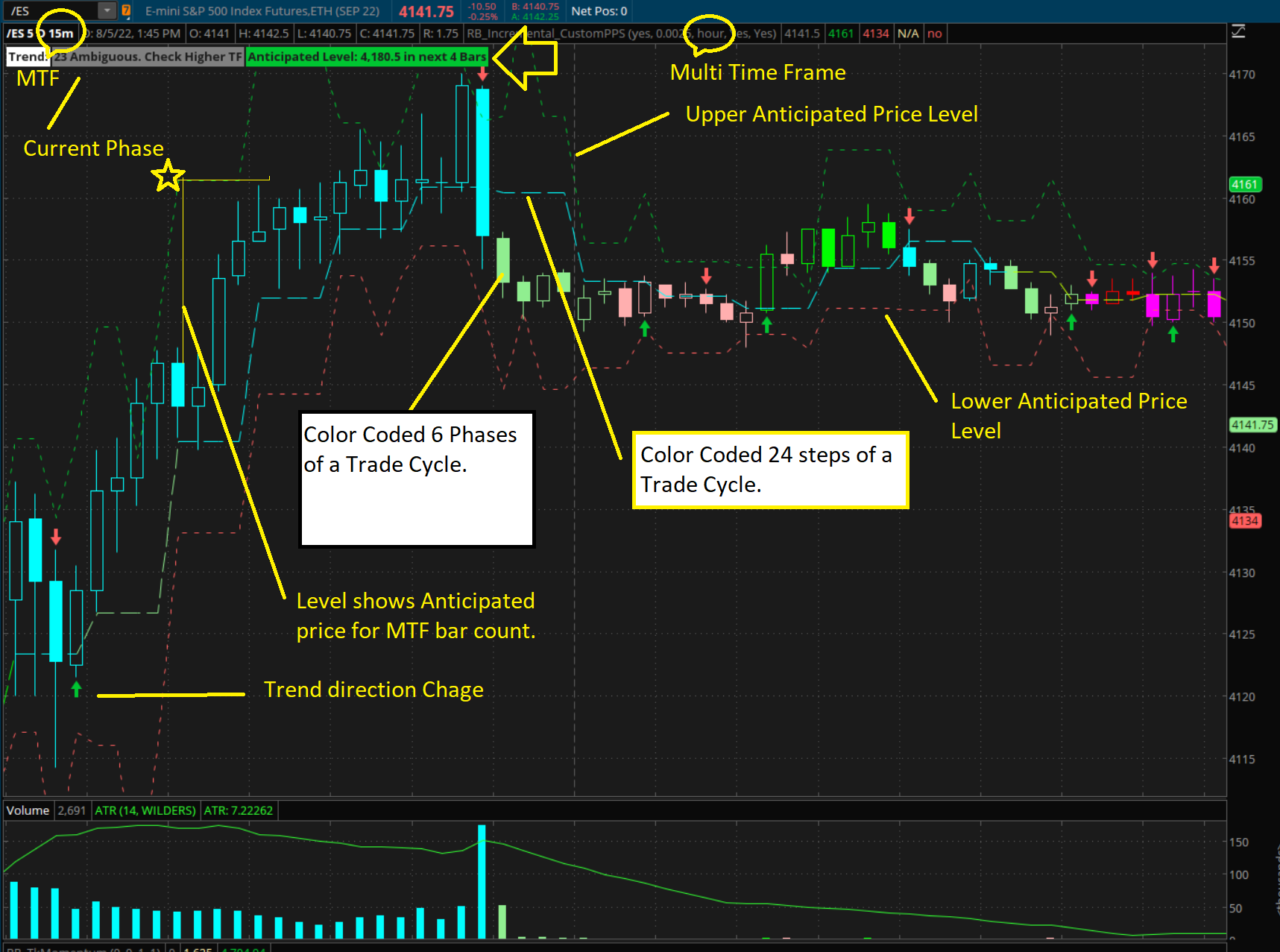

Multi Time Frame Anticipated Price Level Indicator.

Color Coded Twenty Four Steps of trend Cycles from Bearish to Bullish and vice-versa.

Color coded six phases of a trade cycle.

Entry and Exit Points.

Trend Reversal Indications.

The Anticipated Level POI and WVAP Profiler code is available below -

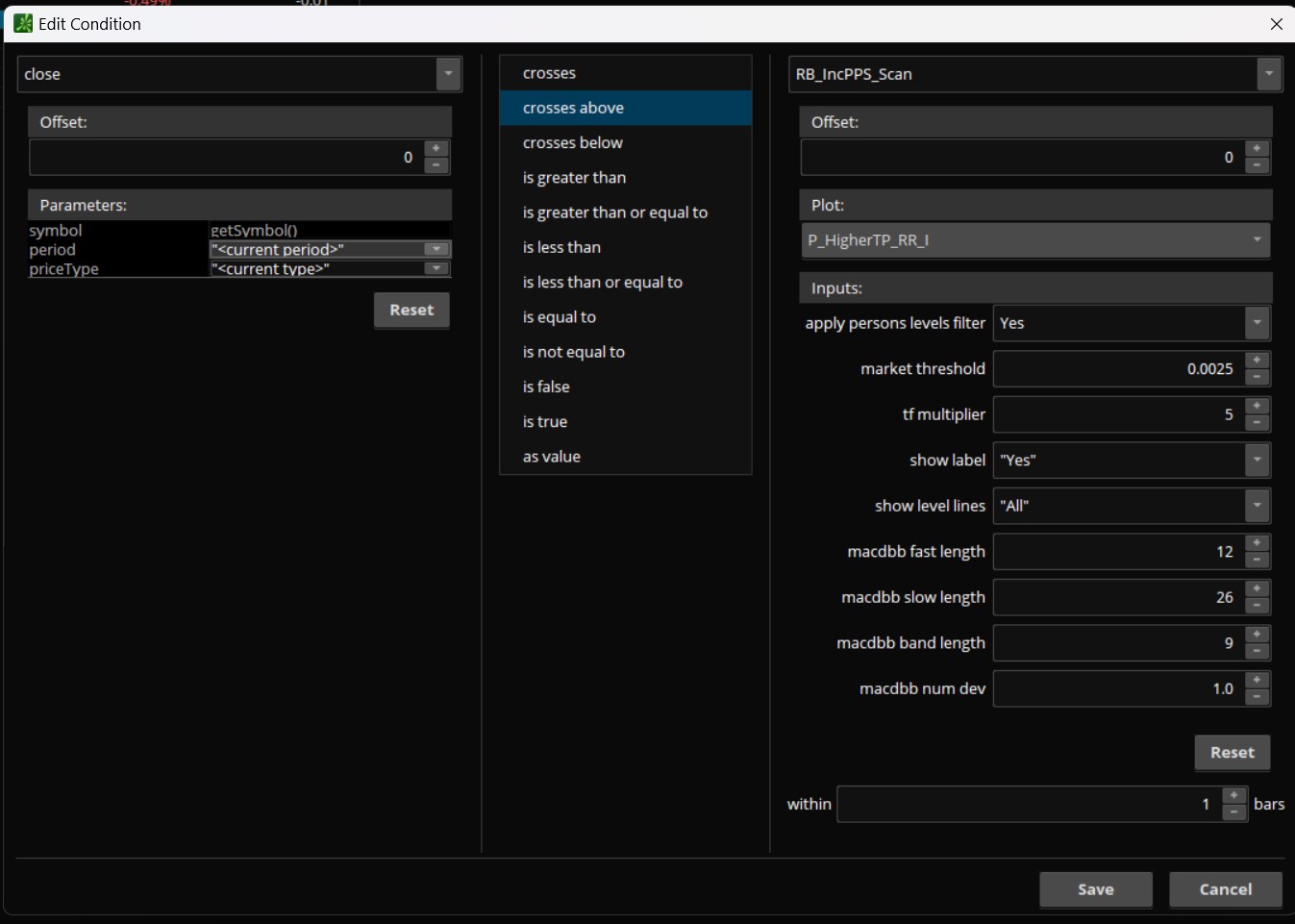

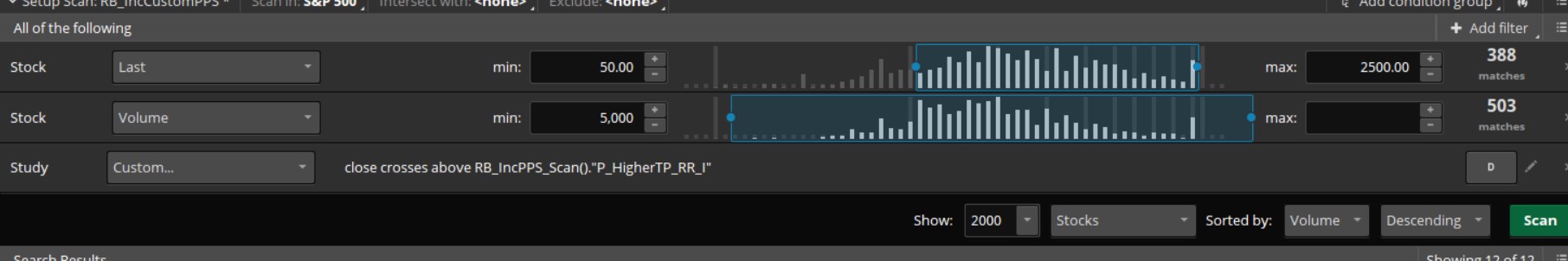

Scanner code --

Select a timeframe

Select a multiplier >=2 (default is 5) Scan will use anticipated price value Support and Resistances based on the multiplier (multiplier means the number of bars for the timeframe).

Updated 10:55 8/17/2022 PST - % change in Label.

Updated 12:45 8/6/2022 PST - A calculation correction.

Current Anticipated Level Indicator version is V3.

Current Anticipate Level VWAP and POI Profiler code version is V1.

Both of the studies should be added at the chart level, the plots overlap with right levels of translusence.

Multi Time Frame Anticipated Price Level Indicator.

Color Coded Twenty Four Steps of trend Cycles from Bearish to Bullish and vice-versa.

Color coded six phases of a trade cycle.

Entry and Exit Points.

Trend Reversal Indications.

Code:

#

# Anticipated Level Indicator

# Current Version: V3.0

# Created by TraderZen

# Last update 8/21/2022

#

input applyPersonsLevelsFilter = yes;

input marketThreshold = 0.0025;

input timeFrame = AggregationPeriod.Fifteen_MIN;

input showLabel = {default "Yes", "No"};

input Show_Level_Lines = {default "All", "Mid", "High-Low", "None"};

input Show_Profiles = yes;

def CurrentTP = GetAggregationPeriod();

def thisTP;

thisTP = CurrentTP;

Def HigherTP = TimeFrame;

def PP2TP = high(period = thisTP)[1] + low(period = thisTP)[1] + close(period = thisTP)[1];

def marketTypeTP = { DISABLED, NEUTRAL, BEARISH, default BULLISH};

marketTypeTP = if !applyPersonsLevelsFilter then marketTypeTP.DISABLED

else if PP2TP[-1] > (PP2TP[-1] + PP2TP + PP2TP[1]) / 3 + marketThreshold then marketTypeTP.BULLISH

else if PP2TP[-1] < (PP2TP[-1] + PP2TP + PP2TP[1]) / 3 - marketThreshold then marketTypeTP.BEARISH

else marketTypeTP.NEUTRAL;

def AlgoExec = if HigherTP <= thisTP then no else yes;

AddLabel(yes, if AlgoExec == no then "No Execution: The Current Time Period Should be Less then the Selected Time Period! " + HigherTP else "Trend:" ,

Color.WHITE) ;

def P = HigherTP / CurrentTP;

def Higher = fold nH = 1 to P + 1 with Top_high do Max(high(Period = thisTP)[P], high(Period = thisTP)[P + 1]) ;

def Lower = fold nL = 1 to P + 1 with Bottom_Low do Min(low(Period = thisTP)[P], low(Period = thisTP)[P + 1]);

def closer = close[1];

#def higher = high(period = HigherTP)[1];

#def Lower = low(period = HigherTP)[1];

#def Closer = close(period = HigherTP)[1];

#AddLabel(Yes, higher + " " + lower + " " + closer);

def PP2HP = Higher + Lower + closer;

def MarketTypeHP = { DISABLED, NEUTRAL, BEARISH, default BULLISH};

MarketTypeHP = if !applyPersonsLevelsFilter then MarketTypeHP.DISABLED

else if PP2HP[-1] > (PP2HP[-1] + PP2HP + PP2HP[1]) / 3 + marketThreshold then MarketTypeHP.BULLISH

else if PP2HP[-1] < (PP2HP[-1] + PP2HP + PP2HP[1]) / 3 - marketThreshold then MarketTypeHP.BEARISH

else MarketTypeHP.NEUTRAL;

#def paintingStrategy1 = if getAggregationPeriod() == AggregationPeriod.Min then PaintingStrategy.LINE_VS_TRIANGLES

# else if getAggregationPeriod() == AggregationPeriod.FIVE_MIN

# or getAggregationPeriod() == AggregationPeriod.FIFTEEN_MIN then

# PaintingStrategy.LINE_VS_SQUARES

# else PaintingStrategy.LINE;

def paintingStrategy1 = PaintingStrategy.LINE;

#def paintingStrategy2 = if HigherTP == AggregationPeriod.Min then PaintingStrategy.LINE_VS_TRIANGLES

# else if HigherTP == AggregationPeriod.Five_Min or HigherTP == AggregationPeriod.Fifteen_Min then PaintingStrategy.LINE_VS_SQUARES

# else PaintingStrategy.LINE;

def paintingStrategy2 = PaintingStrategy.LINE;

## -- Pivote points + Trigger points + phase to calculate Trend.

## -- Initiate Variables

def HigherTP_PP;

def HigherTP_R1;

def HigherTP_R2;

def HigherTP_R3;

def HigherTP_S1;

def HigherTP_S2;

def HigherTP_S3;

def HigherTP_RR;

def HigherTP_SS;

def HigherTP_PP_I;

def HigherTP_R1_I;

def HigherTP_R2_I;

def HigherTP_R3_I;

def HigherTP_S1_I;

def HigherTP_S2_I;

def HigherTP_S3_I;

def HigherTP_RR_I;

def HigherTP_SS_I;

## -- Conditionally Assign Values

if AlgoExec == no # or !IsNaN(close(period = HigherTP)[-1])

Then

{

HigherTP_PP = Double.NaN;

HigherTP_R1 = Double.NaN;

HigherTP_R2 = Double.NaN;

HigherTP_R3 = Double.NaN;

HigherTP_S1 = Double.NaN;

HigherTP_S2 = Double.NaN;

HigherTP_S3 = Double.NaN;

HigherTP_RR = Double.NaN;

HigherTP_SS = Double.NaN;

HigherTP_PP_I = Double.NaN;

;

HigherTP_R1_I = Double.NaN;

HigherTP_R2_I = Double.NaN;

;

HigherTP_R3_I = Double.NaN;

;

HigherTP_S1_I = Double.NaN;

;

HigherTP_S2_I = Double.NaN;

;

HigherTP_S3_I = Double.NaN;

;

HigherTP_RR_I = Double.NaN;

;

HigherTP_SS_I = Double.NaN;

;

}

else

{

HigherTP_PP = (high(period = HigherTP)[1] + low(period = HigherTP)[1] + close(period = HigherTP)[1]) / 3;

;

HigherTP_R1 = 2 * HigherTP_PP - low(period = HigherTP)[1];

;

HigherTP_R2 = HigherTP_PP + high(period = HigherTP)[1] - low(period = HigherTP)[1];

HigherTP_R3 = HigherTP_R2 + high(period = HigherTP)[1] - low(period = HigherTP)[1];

HigherTP_S1 = 2 * HigherTP_PP - high(period = HigherTP)[1];

HigherTP_S2 = HigherTP_PP - high(period = HigherTP)[1] + low(period = HigherTP)[1];

HigherTP_S3 = HigherTP_S2 - high(period = HigherTP)[1] + low(period = HigherTP)[1];

HigherTP_RR = if (MarketTypeHP == MarketTypeHP.BEARISH or MarketTypeHP == MarketTypeHP.NEUTRAL) then HigherTP_R1 else HigherTP_R2;

HigherTP_SS = if (MarketTypeHP == MarketTypeHP.BULLISH or MarketTypeHP == MarketTypeHP.NEUTRAL) then HigherTP_S1 else HigherTP_S2;

HigherTP_PP_I = (Higher[1] + Lower[1] + closer[1]) / 3;

;

HigherTP_R1_I = 2 * HigherTP_PP - Lower[1];

;

HigherTP_R2_I = HigherTP_PP + Higher[1] - Lower[1];

HigherTP_R3_I = HigherTP_R2 + Higher[1] - Lower[1];

HigherTP_S1_I = 2 * HigherTP_PP - Higher[1];

HigherTP_S2_I = HigherTP_PP - Higher[1] + Lower[1];

HigherTP_S3_I = HigherTP_S2 - Higher[1] + Lower[1];

HigherTP_RR_I = if (MarketTypeHP == MarketTypeHP.BEARISH or MarketTypeHP == MarketTypeHP.NEUTRAL) then HigherTP_R1 else HigherTP_R2;

HigherTP_SS_I = if (MarketTypeHP == MarketTypeHP.BULLISH or MarketTypeHP == MarketTypeHP.NEUTRAL) then HigherTP_S1 else HigherTP_S2;

}

plot P_HigherTP_PP = if (Show_Level_Lines == Show_Level_Lines."All" or Show_Level_Lines == Show_Level_Lines."Mid" ) then HigherTP_PP else Double.nan;

plot P_HigherTP_R1 = HigherTP_R1;

plot P_HigherTP_R2 = HigherTP_R2;

plot P_HigherTP_R3 = HigherTP_R3;

plot P_HigherTP_S1 = HigherTP_S1;

plot P_HigherTP_S2 = HigherTP_S2;

plot P_HigherTP_S3 = HigherTP_S3;

plot P_HigherTP_RR = if (Show_Level_Lines == Show_Level_Lines."All" or Show_Level_Lines == Show_Level_Lines."High-Low") then HigherTP_RR else double.nan;

plot P_HigherTP_SS = if (Show_Level_Lines == Show_Level_Lines."All" or Show_Level_Lines == Show_Level_Lines."High-Low") then HigherTP_SS else double.nan;

plot P_HigherTP_PP_I = HigherTP_PP_I;

plot P_HigherTP_R1_I = HigherTP_R1_I;

plot P_HigherTP_R2_I = HigherTP_R2_I;

plot P_HigherTP_R3_I = HigherTP_R3_I;

plot P_HigherTP_S1_I = HigherTP_S1_I;

plot P_HigherTP_S2_I = HigherTP_S2_I;

plot P_HigherTP_S3_I = HigherTP_S3_I;

plot P_HigherTP_RR_I = HigherTP_RR_I;

plot P_HigherTP_SS_I = HigherTP_SS_I;

P_HigherTP_RR.SetHiding(!applyPersonsLevelsFilter);

P_HigherTP_R1.SetHiding(applyPersonsLevelsFilter);

P_HigherTP_R2.SetHiding(applyPersonsLevelsFilter);

P_HigherTP_SS.SetHiding(!applyPersonsLevelsFilter);

P_HigherTP_S1.SetHiding(applyPersonsLevelsFilter);

P_HigherTP_S2.SetHiding(applyPersonsLevelsFilter);

P_HigherTP_PP.SetDefaultColor(GetColor(3));

P_HigherTP_R1.SetDefaultColor(GetColor(5));

P_HigherTP_R2.SetDefaultColor(GetColor(5));

P_HigherTP_R3.SetDefaultColor(GetColor(6));

P_HigherTP_S1.SetDefaultColor(GetColor(5));

P_HigherTP_S2.SetDefaultColor(GetColor(5));

P_HigherTP_S3.SetDefaultColor(GetColor(5));

P_HigherTP_SS.DefineColor("P_HigherTP_S1", GetColor(5));

P_HigherTP_SS.DefineColor("P_HigherTP_S2", GetColor(5));

P_HigherTP_SS.AssignValueColor(if P_HigherTP_SS == P_HigherTP_S1 then P_HigherTP_SS.Color("P_HigherTP_S1") else P_HigherTP_SS.Color("P_HigherTP_S2"));

P_HigherTP_RR.DefineColor("P_HigherTP_R1", GetColor(6));

P_HigherTP_RR.DefineColor("P_HigherTP_R2", GetColor(6));

P_HigherTP_RR.AssignValueColor(if P_HigherTP_RR == P_HigherTP_R1 then P_HigherTP_RR.Color("P_HigherTP_R1") else P_HigherTP_RR.Color("P_HigherTP_R2"));

P_HigherTP_PP.SetStyle(Curve.LONG_DASH);

P_HigherTP_RR.SetStyle(Curve.SHORT_DASH);

P_HigherTP_R1.SetStyle(Curve.SHORT_DASH);

P_HigherTP_R2.SetStyle(Curve.SHORT_DASH);

P_HigherTP_R3.SetStyle(Curve.SHORT_DASH);

P_HigherTP_SS.SetStyle(Curve.SHORT_DASH);

P_HigherTP_S1.SetStyle(Curve.SHORT_DASH);

P_HigherTP_S2.SetStyle(Curve.SHORT_DASH);

P_HigherTP_S3.SetStyle(Curve.SHORT_DASH);

P_HigherTP_PP.SetPaintingStrategy(paintingStrategy2);

P_HigherTP_RR.SetPaintingStrategy(paintingStrategy2);

P_HigherTP_R1.SetPaintingStrategy(paintingStrategy2);

P_HigherTP_R2.SetPaintingStrategy(paintingStrategy2);

P_HigherTP_R3.SetPaintingStrategy(paintingStrategy2);

P_HigherTP_SS.SetPaintingStrategy(paintingStrategy2);

P_HigherTP_S1.SetPaintingStrategy(paintingStrategy2);

P_HigherTP_S2.SetPaintingStrategy(paintingStrategy2);

P_HigherTP_S3.SetPaintingStrategy(paintingStrategy2);

P_HigherTP_S1.Hide();

P_HigherTP_S2.Hide();

P_HigherTP_S3.Hide();

P_HigherTP_R1.Hide();

P_HigherTP_R2.Hide();

P_HigherTP_R3.Hide();

#P_HigherTP_rr.hide();

#P_HigherTP_ss.hide();

#P_HigherTP_pp.hide();

P_HigherTP_S1_I.Hide();

P_HigherTP_S2_I.Hide();

P_HigherTP_S3_I.Hide();

P_HigherTP_R1_I.Hide();

P_HigherTP_R2_I.Hide();

P_HigherTP_R3_I.Hide();

P_HigherTP_RR_I.Hide();

P_HigherTP_SS_I.Hide();

P_HigherTP_PP_I.Hide();

## -- Arrangement to reference the higher timeframe data (AP = AggergationPeriod).

def BullCalc = MovingAverage(3, PP2TP[-1] / 3, 3);

def BearCalc = MovingAverage(3, ( (PP2TP[-1] + PP2TP + PP2TP[1]) / 3) / 3 , 3);

rec BullCalcHP = MovingAverage(3, PP2HP[-1] / 3, 3);

rec BearCalcHP = MovingAverage(3, ( (PP2HP[-1] + PP2HP + PP2HP[1]) / 3) / 3 , 3);

plot p_bullC = BullCalc;

p_bullC.AssignValueColor(Color.WHITE);

plot p_BearC = BearCalc;

p_BearC.AssignValueColor(Color.GRAY);

plot P_BullCHP = BullCalcHP;

P_BullCHP.AssignValueColor(Color.WHITE);

plot p_BearCHP = BearCalcHP;

p_BearCHP.AssignValueColor(Color.YELLOW);

plot P_Close = close(priceType = PriceType.LAST);

rec bull = if (BullCalc[-1] crosses above BearCalc[-1] - marketThreshold) then yes else Double.NaN;

rec bear = if (BearCalc[-1] crosses above BullCalc[-1] - marketThreshold) then yes else Double.NaN;

rec BullHP = if (BullCalcHP[-1] crosses above (BearCalcHP[-1] - marketThreshold)) then yes

else Double.NaN;

def BearHP = if (BearCalcHP[-1] crosses above (BullCalcHP[-1] - marketThreshold)) then yes else Double.NaN;

plot P_bull = bull;

plot p_bear = bear ;

plot P_BullHP = BullHP ;

plot p_BearHP = BearHP ;

P_bull.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

P_bull.SetDefaultColor(Color.GREEN);

p_bear.SetDefaultColor(Color.DARK_ORANGE);

p_bear.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

P_BullHP.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

P_BullHP.SetDefaultColor(Color.CYAN);

p_BearHP.SetDefaultColor(Color.MAGENTA);

p_BearHP.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

p_bullC.Hide();

p_BearC.Hide();

P_bull.Hide();

p_bear.Hide();

P_BullHP.Hide();

p_BearHP.Hide();

P_BullCHP.Hide();

p_BearCHP.Hide();

######################################### ------ Color coding

def C = P_Close;

def v50 = Round(SimpleMovingAvg(close, 50)); # MovAvgExponential(close, 50);

def v100 = Round(SimpleMovingAvg(close, 100));

def v200 = Round(SimpleMovingAvg(close, 200)); # MovAvgExponential(close, 200);

def F = v50; # Duplicate variable for v50 to code the SeqNum Logic.

def H = v100; # Duplicate variable for v100 to code the SeqNum Logic.

def T = v200; # Duplicate variable for v200 to code the seqNum Logic.

def BB = Round(BollingerBands()."MidLine");

def ROCFlag = if RateOfChange() > RateOfChange()[1] then 1

else if RateOfChange() < RateOfChange()[1] then -1

else 0;

def ROCFlag2 = if RateOfChange() > 0 then 1

else if RateOfChange() < 0 then -1

else 0;

def MACDOpen = if MACD()."value" >= MACD()."value"[1] and MACD()."value" > MACD()."avg" then 1

else if MACD()."value" < MACD()."value"[1] and MACD()."value" < MACD()."avg" then -1

else 0;

def PlayzoneFlag = if ROCFlag == 1 and MACDOpen == 1 then 2

else if ROCFlag2 == 1 and MACDOpen == 1 then 2

else if ROCFlag == -1 and MACDOpen == -1 then -2

else if ROCFlag2 == -1 and MACDOpen == -1 then -2

else 0;

def Phase = if (close >= v50 and close >= v200 and v50 >= v200) then 1 #Bullish

else if (close >= v50 and close >= v200 and v50 <= v200) then 2 #Accumulation

else if ( v50 <= v200 and close <= v200 and close >= v50) then 3 # Recovery

else if (close <= v50 and close >= v200 and v50 >= v200) then 4 # Warning

else if (close <= v50 and close <= v200 and v50 >= v200) then 5 #Distribution

else if ( v50 <= v200 and close <= v200 and close <= v50 ) then 6 #Bearish

else 7;

def ScalpCode = if ( (C >= BB) and (BB > BB[1]) and (BB >= F) ) then 101 # Bullish Superseed condition

else if ( (F >= BB) and (BB[1] >= BB) and (BB >= C) ) then -101 # Bearish Superseed condition

else if ( (C >= BB) and (BB >= F) ) then 100 #Still Bullish Strong

else if ( (F >= BB) and (BB >= C) ) then -100 #Still Bearish Strong

else if ( close >= Highest(close[1], 50)) then 75 #C50 Up

else if ( close <= Lowest(close[1], 50)) then -75 #c50 Down

else if ( BB >= BB[1]) then 50 #Uptrend

else if ( BB[1] >= BB) then -50 #DownTrend

else 0;

def SeqNum = if ((C >= F) and (F >= H) and (H >= T)) then 1 #Step-3 Bullish phase Confirmed [1] (C-F-H-T)

else if ((C >= F) and (F >= T) and (T >= H)) then 2 #Step-2 Bullish Confirmation AKA Accumuation [2] (C-F-T-H)

else if ((C >= H) and (H >= F) and (F >= T)) or

(close >= Highest(close[1], 50)) then 3 #Ambiguous Bullish. Check the C, Phase, Playzone and Higher Time-Frame. (C-H-F-T)

else if ((C >= H) and (H >= T) and (T >= F)) then 4 #Ambiguous Bullish. Check the Phase, Playzone and Higher Time-Frame. (C-H-T-F)

else if ((C >= T) and (T >= F) and (F >= H)) then 5 #Step-3 Bullish Breakout and re-test AKA Bullish [1] (C-T-F-H)

else if ((C >= T) and (T >= H) and (H >= F)) then 6 #Step-1 Bullish Initiation AKA Recovery [3] (C-T-H-F)

else if ((F >= C) and (C >= H) and (H >= T)) then 7 #Step-4.5 Bullish Maturation AKA Bullish (F-C-H-T)

else if ((F >= C) and (C >= T) and (T >= H)) or

(close <= Lowest(close[1], 50)) then 8 #step-9 Bearish Maturation AKA Bearish. Check the C.[6] (F-C-T-H)

else if ((F >= H) and (H >= C) and (C >= T)) then 9 #Step-4.5 Bullish Maturation [PullBack, Not Real Distribution] [4] (F-H-C-T)

else if ((F >= H) and (H >= T) and (T >= C)) then 10 #Step-6 Bearish Initiation AKA Warning [4] (F-H-T-C)

else if ((F >= T) and (T >= C) and (C >= H)) then 11 #Ambiguous-11 Check the Phase, Playzone and Higher Time-Frame(F-T-C-H)

else if ((F >= T) and (T >= H) and (H >= C)) then 12 #Step-7 Bearish Breakout and Re-test AKA Bearish [6]

else if ((H >= C) and (C >= F) and (F >= T)) then 13 #Step-4 Bullish Maturation AKA Bullish [1] (H-C-F-T)

else if ((H >= C) and (C >= T) and (T >= F)) then 14 #Ambiguous-14 Check the Phase, Playzone and Higher Time-Frame(H-C-T-F)

else if ((H >= F) and (F >= C) and (C >= T)) then 15 #Step-5 Bullish Exhaustion (H-F-C-T) Review!

else if ((H >= F) and (F >= T) and (T >= C)) then 16 #Step-6.5 Bearish Comfirmation AKA Distribution (H-F-T-C)

else if ((H >= T) and (T >= C) and (C >= F)) then 17 #Step-9.5 Bearish Exhaustion Confirmed (H-T-C-F)

else if ((H >= T) and (T >= F) and (F >= C)) then 18 #Ambiguous-18 Check the Phase, Playzone and Higher Time-Frame(H-T-F-C)

else if ((T >= C) and (C >= F) and (F >= H)) then 19 #Step-0.5 - Attempting to be Bullish. Watch ROC/MACD [1] (T-C-F-H)

else if ((T >= C) and (C >= H) and (H >= F)) then 20 #Step-10 - Attempting to be Bullish. Watch ROC/MACD [1] (T-C-H-F)

else if ((T >= F) and (F >= C) and (C >= H)) then 21 #Step-4.5 Bullish Maturation [PullBack, Not Real Distribution] [4] (T-F-C-H)

else if ((T >= F) and (F >= H) and (H >= C)) then 22 #Ambiguous Bearish. Check the Phase, Playzone and Higher Time-Frame. (T-G-H-C)

else if ((T >= H) and (H >= C) and (C >= F)) then 23 #Ambiguoua-23 (T-H-C-F)

else if ((T >= H) and (H >= F) and (F >= C)) then 24 #Step-9 Bearish Maturation [6] (T-H-F-c)

else 0;

P_Close.AssignValueColor( if ScalpCode == 100 or ScalpCode == 75 then Color.GREEN

else if ScalpCode == 101 then Color.CYAN

else if ScalpCode == -100 or ScalpCode == -75 then Color.RED

else if ScalpCode == -101 then Color.PLUM

else if ScalpCode == 50 then Color.LIGHT_GREEN

else if ScalpCode == -50 then Color.PINK

else Color.LIGHT_GRAY);

P_HigherTP_PP.AssignValueColor( if SeqNum == 1 or SeqNum == .5 then Color.CYAN

else if SeqNum == 2 or SeqNum == 2.5 then Color.LIGHT_GREEN

else if SeqNum == 3 then Color.GREEN

else if SeqNum == 4 or SeqNum == 4.5 then Color.LIGHT_GREEN

else if SeqNum == 5 or SeqNum == 5.1 then Color.CYAN

else if SeqNum == 6 then Color.GREEN

else if SeqNum == 7 then Color.LIME

else if SeqNum == 8 then Color.RED

else if SeqNum == 9 or SeqNum == 9.5 then Color.LIGHT_RED

else if SeqNum == 10 then Color.RED

else if SeqNum == 11 then Color.GRAY

else if SeqNum == 12 then Color.MAGENTA

else if SeqNum == 13 then Color.GREEN

else if SeqNum == 14 then Color.GRAY

else if SeqNum == 15 then Color.YELLOW

else if SeqNum == 16 then Color.MAGENTA

else if SeqNum == 17 then Color.YELLOW

else if SeqNum == 18 then Color.GRAY

else if SeqNum == 19 then Color.LIGHT_GREEN

else if SeqNum == 20 then Color.LIGHT_GREEN

else if SeqNum == 21 then Color.RED

else if SeqNum == 22 then Color.LIGHT_RED

else if SeqNum == 23 then Color.GRAY

else if SeqNum == 24 then Color.MAGENTA

else if SeqNum == 0 then Color.GRAY

else Color.LIGHT_GRAY

);

AddLabel(if showLabel == showLabel."Yes" then yes else no, SeqNum + " " +

if SeqNum == 1 then "Bullish Confirmed"

else if SeqNum == 2 then "Accumuation"

else if SeqNum == 3 then "Ambiguous+Bullish"

else if SeqNum == 4 then "Ambiguous+Bullish"

else if SeqNum == 5 then "Bullish Breakout & Re-test"

else if SeqNum == 6 then "Bullish Initiation"

else if SeqNum == 7 then "Bullish Maturation"

else if SeqNum == 8 then "Bearish Maturation"

else if SeqNum == 9 then "PullBack,Not Real Distribution"

else if SeqNum == 10 then "Bearish Initiation"

else if SeqNum == 11 then "Ambiguous! May be in a channel"

else if SeqNum == 12 then "Bearish Breakout & Re-test"

else if SeqNum == 13 then "Bullish Maturation"

else if SeqNum == 14 then "Ambiguous! May be in a channel"

else if SeqNum == 15 then "Potential Reversal! Bullish Exhaustion"

else if SeqNum == 16 then "Bearish Comfirmation/Distribution"

else if SeqNum == 17 then "Bearish Exhaustion Confirmed"

else if SeqNum == 18 then "Ambiguous-Bearish/Bearish Channel"

else if SeqNum == 19 and PlayzoneFlag == 2 then "About to be Bullish"

else if SeqNum == 19 and PlayzoneFlag == -2 then "About to be Bearish"

else if SeqNum == 19 and PlayzoneFlag == 0 then "Ambiguous. Check Higher TF"

else if SeqNum == 19 then "Ambiguous.Check Higher TF"

else if SeqNum == 20 and PlayzoneFlag == 2 then "Bullish Attempt may fail"

else if SeqNum == 20 and PlayzoneFlag == -2 then "Bearish attempt may fail"

else if SeqNum == 20 and PlayzoneFlag == 0 then "Ambiguous. *Check Higher TF"

else if SeqNum == 20 then "Ambiguous. Check Higher TF"

else if SeqNum == 21 then "Bullish Maturation/PullBack, Not Real Distribution"

else if SeqNum == 22 then "Ambiguous-Bearish. *Check Higher TF"

else if SeqNum == 23 then "Ambiguous. Check Higher TF"

else if SeqNum == 24 then "Bearish Trend. Check Higher TF"

else "*" ,

if SeqNum == 1 or SeqNum == .5 then Color.CYAN

else if SeqNum == 2 or SeqNum == 2.5 then Color.LIGHT_GREEN

else if SeqNum == 3 then Color.GREEN

else if SeqNum == 4 or SeqNum == 4.5 then Color.LIGHT_GREEN

else if SeqNum == 5 or SeqNum == 5.1 then Color.CYAN

else if SeqNum == 6 then Color.GREEN

else if SeqNum == 7 then Color.LIME

else if SeqNum == 8 then Color.RED

else if SeqNum == 9 or SeqNum == 9.5 then Color.LIGHT_RED

else if SeqNum == 10 then Color.RED

else if SeqNum == 11 then Color.GRAY

else if SeqNum == 12 then Color.MAGENTA

else if SeqNum == 13 then Color.GREEN

else if SeqNum == 14 then Color.GRAY

else if SeqNum == 15 then Color.YELLOW

else if SeqNum == 16 then Color.MAGENTA

else if SeqNum == 17 then Color.YELLOW

else if SeqNum == 18 then Color.GRAY

else if SeqNum == 19 then Color.LIGHT_GREEN

else if SeqNum == 20 then Color.LIGHT_GREEN

else if SeqNum == 21 then Color.RED

else if SeqNum == 22 then Color.LIGHT_RED

else if SeqNum == 23 then Color.GRAY

else if SeqNum == 24 then Color.MAGENTA

else if SeqNum == 0 then Color.GRAY

else Color.LIGHT_GRAY );

input MACDBB_FastLength = 12;

input MACDBB_SlowLength = 26;

input MACDBB_BandLength = 9;

input MACDBB_NumDev = 1.0;

Def HigherTP_PP_BB_High = reference BollingerBands(price = P_HigherTP_RR, length = MACDBB_BandLength,

Num_Dev_Dn = -MACDBB_NumDev, Num_Dev_Up = MACDBB_NumDev).UpperBand;

def HigherTP_PP_BB_LOW = reference BollingerBands(price = P_HigherTP_SS, length = MACDBB_BandLength,

Num_Dev_Dn = -MACDBB_NumDev, Num_Dev_Up = MACDBB_NumDev).Lowerband;

AddLabel(if showLabel == showLabel."Yes" then yes else no,

if P_Close >= HigherTP_PP and P_Close <= HigherTP_RR then "Anticipated Level: " + HigherTP_RR + " (" + roundup( ((HigherTP_RR - P_Close)/P_Close)*100,2) + " %)" + " in next " + p + " Bars"

else if P_Close <= HigherTP_PP and P_Close >= HigherTP_SS then "Anticipated Level: " + HigherTP_SS + " (" + roundup( ((HigherTP_SS - P_Close)/P_Close)*100,2) + " %)" + " in next " + p + " Bars"

else if P_Close >= P_HigherTP_PP and P_Close >= HigherTP_RR then "Anticipated Level: " + HigherTP_PP_Bb_HIgh + " (" + roundup( ((HigherTP_PP_BB_High - P_Close)/P_Close)*100, 2) + " %)" + "* in next " + p + " Bars"

else if P_Close <= P_HigherTP_PP and P_Close <= HigherTP_SS then "Anticipated Level: " +

HigherTP_PP_BB_Low + " (" + roundup( ((HigherTP_PP_BB_Low - P_Close)/P_Close)*100,2) + " %)" + "* in next " + p + " Bars"

else "Anticipated Level:",

if P_Close >= HigherTP_PP then GetColor(6) else GetColor(5) );

P_Close.SetPaintingStrategy(paintingStrategy2);

P_Close.SetLineWeight(1);

P_BullCHP.SetLineWeight(1);

P_BullCHP.AssignValueColor(Color.WHITE);

P_Close.Hide();

# --- Cross over logic --

rec _Cross_Up = if P_Close crosses above P_HigherTP_PP_I then yes else no;

def Cross_Up = if _Cross_Up != _Cross_Up[1] then _Cross_Up else Double.NaN;

def Cross_Dn = if P_Close crosses below P_HigherTP_PP_I then yes else no;

#Cross_Up.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#Cross_Dn.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

def upArrow = if Cross_up then low else double.NaN;

def dnArrow = if Cross_Dn then high else double.NaN;

plot PPSup = upArrow;

Plot PPSdown = dnArrow;

PPSup.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

PPSdown.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

PPSup.SetLineWeight(3);

PPSDown.SetLineWeight(3);

PPSUp.AssignValueColor(Color.White);

PPSDown.AssignValueColor(Color.White);

#-- Paint Bars logic --

input PaintBars = { default "Yes", "No" } ;

AssignPriceColor(

if PaintBars == PaintBars."Yes" then

if ScalpCode == 100 or ScalpCode == 75 then Color.GREEN

else if ScalpCode == 101 then Color.CYAN

else if ScalpCode == -100 or ScalpCode == -75 then Color.RED

else if ScalpCode == -101 then Color.MAGENTA

else if ScalpCode == 50 then Color.LIGHT_GREEN

else if ScalpCode == -50 then Color.PINK

else Color.LIGHT_GRAY

else Color.CURRENT# RB

);

#End 8/21/20222The Anticipated Level POI and WVAP Profiler code is available below -

Code:

# AL_Profiler

# Current Version: V1.0

# Goes with Anticipated Level Indicator

# Created by: TraderZen

# Last Update: 8/21/2022

# -- Show Profile ----

#------Start Function List---------------

input pricePerRowHeightMode = {AUTOMATIC, default TICKSIZE, CUSTOM};

input customRowHeight = 1.0;

input aggregationPeriod = {default "1 min", "2 min", "3 min", "4 min", "5 min", "10 min", "15 min", "20 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", "2 Days", "3 Days", "4 Days", "Week", "Month"};

input timePerProfile = {CHART, MINUTE, HOUR, DAY, WEEK, MONTH, "OPT EXP", default BAR, YEAR};

input multiplier = 6;

input onExpansion = no;

input profiles = 500;

input showMonkeyBar = yes;

input showThePlayground = yes;

input thePlaygroundPercent = 70;

input opacity = 25;

input emphasizeFirstDigit = no;

input markOpenPrice = no;

input markClosePrice = no;

input volumeShowStyle = MonkeyVolumeShowStyle.NONE;

input showVolumeVA = yes;

input showVolumePoc = yes;

input theVolumePercent = 70;

input showInitialBalance = no;

input initialBalanceRange = 1;

def period;

def yyyymmdd = GetYYYYMMDD();

def seconds = SecondsFromTime(0);

def month = GetYear() * 12 + GetMonth();

def day_number = DaysFromDate(First(yyyymmdd)) + GetDayOfWeek(First(yyyymmdd));

def dom = GetDayOfMonth(yyyymmdd);

def dow = GetDayOfWeek(yyyymmdd - dom + 1);

def expthismonth = (if dow > 5 then 27 else 20) - dow;

def exp_opt = month + (dom > expthismonth);

def periodMin = Floor(seconds / 60 + day_number * 24 * 60);

def periodHour = Floor(seconds / 3600 + day_number * 24);

def periodDay = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1;

def periodWeek = Floor(day_number / 7);

def periodMonth = month - First(month);

switch (timePerProfile) {

case CHART:

period = 0;

case MINUTE:

period = periodMin;

case HOUR:

period = periodHour;

case DAY:

period = periodDay;

case WEEK:

period = periodWeek;

case MONTH:

period = periodMonth;

case "OPT EXP":

period = exp_opt - First(exp_opt);

case BAR:

period = BarNumber() - 1;

case YEAR:

period = GetYear() - First(GetYear());

}

input RthBegin = 0930;

input RthEnd = 1600;

#input Minutes = 6;

#input showBubbles = no;

def OpenRange = SecondsFromTime(0930) >= 0 and

SecondsFromTime(1000) >= 0;

def bar = BarNumber();

def RTHBar1 = if SecondsFromTime(RthBegin) == 0 and

SecondsTillTime(RthBegin) == 0

then bar

else RTHBar1[1];

def RTHBarEnd = if SecondsFromTime(RthEnd) == 0 and

SecondsTillTime(RthEnd) == 0

then 1

else Double.NaN;

def RTH = SecondsFromTime(RthBegin) > 0 and

SecondsTillTime(RthEnd) > 0;

def start_t = if RTH and !RTH[1]

then GetTime()

else start_t[1];

def t = if start_t == GetTime()

then 1

else GetTime() % (Multiplier * 60 * 1000) == 0;

def cond = t;

def height;

switch (pricePerRowHeightMode) {

case AUTOMATIC:

height = PricePerRow.AUTOMATIC;

case TICKSIZE:

height = PricePerRow.TICKSIZE;

case CUSTOM:

height = customRowHeight;

}

def timeInterval;

def aggMultiplier;

switch (aggregationPeriod) {

case "1 min":

timeInterval = periodMin;

aggMultiplier = 1;

case "2 min":

timeInterval = periodMin;

aggMultiplier = 2;

case "3 min":

timeInterval = periodMin;

aggMultiplier = 3;

case "4 min":

timeInterval = periodMin;

aggMultiplier = 4;

case "5 min":

timeInterval = periodMin;

aggMultiplier = 5;

case "10 min":

timeInterval = periodMin;

aggMultiplier = 10;

case "15 min":

timeInterval = periodMin;

aggMultiplier = 15;

case "20 min":

timeInterval = periodMin;

aggMultiplier = 20;

case "30 min":

timeInterval = periodMin;

aggMultiplier = 30;

case "1 hour":

timeInterval = periodHour;

aggMultiplier = 1;

case "2 hours":

timeInterval = periodHour;

aggMultiplier = 2;

case "4 hours":

timeInterval = periodHour;

aggMultiplier = 4;

case "Day":

timeInterval = periodDay;

aggMultiplier = 1;

case "2 Days":

timeInterval = periodDay;

aggMultiplier = 2;

case "3 Days":

timeInterval = periodDay;

aggMultiplier = 3;

case "4 Days":

timeInterval = periodDay;

aggMultiplier = 4;

case "Week":

timeInterval = periodWeek;

aggMultiplier = 1;

case "Month":

timeInterval = periodMonth;

aggMultiplier = 1;

}

def agg_count = CompoundValue(1, if timeInterval != timeInterval[1]

then (GetValue(agg_count, 1) + timeInterval -

timeInterval[1]) % aggMultiplier

else GetValue(agg_count, 1), 0);

def agg_cond = CompoundValue(1, agg_count < agg_count[1] + timeInterval -

timeInterval[1], yes);

def digit = CompoundValue(1, if cond

then 1

else agg_cond + GetValue(digit, 1), 1);

profile monkey = MonkeyBars(digit,

"startNewProfile" = cond,

"onExpansion" = onExpansion,

"numberOfProfiles" = profiles,

"pricePerRow" = height,

"the playground percent" = thePlaygroundPercent,

"emphasize first digit" = emphasizeFirstDigit,

"volumeProfileShowStyle" = volumeShowStyle,

"volumePercentVA" = theVolumePercent,

"show initial balance" = showInitialBalance,

"initial balance range" = initialBalanceRange);

def con = CompoundValue(1, onExpansion, no);

def mbar = CompoundValue(1, if IsNaN(monkey.GetPointOfControl()) and con then GetValue(mbar, 1) else monkey.GetPointOfControl(), monkey.GetPointOfControl());

def hPG = CompoundValue(1, if IsNaN(monkey.GetHighestValueArea()) and con then GetValue(hPG, 1) else monkey.GetHighestValueArea(), monkey.GetHighestValueArea());

def lPG = CompoundValue(1, if IsNaN(monkey.GetLowestValueArea()) and con then GetValue(lPG, 1) else monkey.GetLowestValueArea(), monkey.GetLowestValueArea());

def hProfile = CompoundValue(1, if IsNaN(monkey.GetHighest()) and con then GetValue(hProfile, 1) else monkey.GetHighest(), monkey.GetHighest());

def lProfile = CompoundValue(1, if IsNaN(monkey.GetLowest()) and con then GetValue(lProfile, 1) else monkey.GetLowest(), monkey.GetLowest());

def plotsDomain = IsNaN(close) == onExpansion;

def VWAP_Data = vwap(period = getAggregationPeriod());

profile vwap_Profile = DataProfile(data = vwap_data,

"startNewProfile" = t,

"onExpansion" = onExpansion,

"numberOfProfiles" = profiles

);

plot vwap_poc = VWAP_Profile.getPointofControl();

vwap_poc.setpaintingStrategy(paintingStrategy.LINE_Vs_Triangles);

vwap_poc.assignValueColor(color.white);

plot vWap_p = vwap_data;

vwap_p.setpaintingStrategy(paintingStrategy.LINE_Vs_points);

vwap_p.setlineWeight(2);

VWAP_p.assignValueColor(if vwap_p >= vwap_p[1] then color.cyan else color.magenta);

vWAP_P.hide();

def VWAPbar = CompoundValue(1, if IsNaN(vwap_profile.GetPointOfControl()) and con then GetValue(VWAPBAR, 1) else vwap_profile.GetPointOfControl(), vwap_profile.GetPointOfControl());

profile tpo = TimeProfile("startNewProfile" = t,

"onExpansion" = 0,

"numberOfProfiles" = profiles,

"pricePerRow" = tickSize(),

"value area percent" = 70);

def showPointOfControl = yes;

def showValueArea = no;

plot ProfileHigh = if plotsDomain then hProfile else Double.NaN;

plot ProfileLow = if plotsDomain then lProfile else Double.NaN;

plot PGHigh = if plotsDomain then hPG else Double.NaN;

plot PGLow = if plotsDomain then lPG else Double.NaN;

DefineGlobalColor("Monkey Bar", GetColor(4));

DefineGlobalColor("The Playground", GetColor(3));

DefineGlobalColor("Open Price", GetColor(1));

DefineGlobalColor("Close Price", GetColor(1));

DefineGlobalColor("Volume", GetColor(8));

DefineGlobalColor("Volume Value Area", GetColor(2));

DefineGlobalColor("Volume Point of Control", GetColor(3));

DefineGlobalColor("Initial Balance", GetColor(7));

DefineGlobalColor("Profiles", GetColor(1));

tpo.Show(GlobalColor("Profiles"), if showPointOfControl

then GlobalColor("Volume Point Of Control")

else Color.CURRENT,

if showValueArea

then GlobalColor("Volume Value Area")

else Color.CURRENT, opacity);

plot MB = if plotsDomain then mbar else Double.NaN;

MB.SetDefaultColor(GlobalColor("Monkey Bar"));

MB.SetPaintingStrategy(PaintingStrategy.Line_vs_Points);

PGHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PGLow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PGHigh.SetDefaultColor(GlobalColor("The Playground"));

PGLow.SetDefaultColor(GlobalColor("The Playground"));

ProfileHigh.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ProfileLow.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ProfileHigh.SetDefaultColor(GetColor(3));

ProfileLow.SetDefaultColor(GetColor(3));

ProfileHigh.Hide();

ProfileLow.Hide();

PGHigh.hide();

PGLow.hide();

#-----end function list ---------------

#--- end 8/21/2022Scanner code --

Select a timeframe

Select a multiplier >=2 (default is 5) Scan will use anticipated price value Support and Resistances based on the multiplier (multiplier means the number of bars for the timeframe).

Code:

#

# Created by TraderZen

# Last update 8/23/2022

# Scanner for Anticipated Price Levels

#

#

input applyPersonsLevelsFilter = yes;

input marketThreshold = 0.0025;

input tf_Multiplier = 5;

input showLabel = {default "Yes", "No"};

input Show_Level_Lines = {default "All", "Mid", "High-Low", "None"};

def CurrentTP = GetAggregationPeriod();

def thisTP;

thisTP = GetAggregationPeriod();

Def HigherTP = ThisTp * tf_Multiplier;

def PP2TP = high(period = thisTP)[1] + low(period = thisTP)[1] + close(period = thisTP)[1];

def marketTypeTP = { DISABLED, NEUTRAL, BEARISH, default BULLISH};

marketTypeTP = if !applyPersonsLevelsFilter then marketTypeTP.DISABLED

else if PP2TP[-1] > (PP2TP[-1] + PP2TP + PP2TP[1]) / 3 + marketThreshold then marketTypeTP.BULLISH

else if PP2TP[-1] < (PP2TP[-1] + PP2TP + PP2TP[1]) / 3 - marketThreshold then marketTypeTP.BEARISH

else marketTypeTP.NEUTRAL;

def AlgoExec = if HigherTP <= thisTP then no else yes;

#AddLabel(yes, if AlgoExec == no then "No Execution: The Current Time Period Should be Less then the Selected Time Period! " + HigherTP else "Trend:" ,

# Color.WHITE) ;

def P = HigherTP / CurrentTP;

def Higher = fold nH = 1 to P + 1 with Top_high do Max(high(Period = thisTP)[P], high(Period = thisTP)[P + 1]) ;

def Lower = fold nL = 1 to P + 1 with Bottom_Low do Min(low(Period = thisTP)[P], low(Period = thisTP)[P + 1]);

def closer = close[1];

#AddLabel(Yes, higher + " " + lower + " " + closer);

def PP2HP = Higher + Lower + closer;

def MarketTypeHP = { DISABLED, NEUTRAL, BEARISH, default BULLISH};

MarketTypeHP = if !applyPersonsLevelsFilter then MarketTypeHP.DISABLED

else if PP2HP[-1] > (PP2HP[-1] + PP2HP + PP2HP[1]) / 3 + marketThreshold then MarketTypeHP.BULLISH

else if PP2HP[-1] < (PP2HP[-1] + PP2HP + PP2HP[1]) / 3 - marketThreshold then MarketTypeHP.BEARISH

else MarketTypeHP.NEUTRAL;

def paintingStrategy1 = PaintingStrategy.LINE;

#def paintingStrategy2 = if HigherTP == AggregationPeriod.Min then PaintingStrategy.LINE_VS_TRIANGLES

# else if HigherTP == AggregationPeriod.Five_Min or HigherTP == AggregationPeriod.Fifteen_Min then PaintingStrategy.LINE_VS_SQUARES

# else PaintingStrategy.LINE;

def paintingStrategy2 = PaintingStrategy.LINE;

## -- Pivote points + Trigger points + phase to calculate Trend.

## -- Initiate Variables

def HigherTP_PP_I;

def HigherTP_R1_I;

def HigherTP_R2_I;

def HigherTP_R3_I;

def HigherTP_S1_I;

def HigherTP_S2_I;

def HigherTP_S3_I;

def HigherTP_RR_I;

def HigherTP_SS_I;

## -- Conditionally Assign Values

if AlgoExec == no # or !IsNaN(close(period = HigherTP)[-1])

Then

{

HigherTP_PP_I = Double.NaN;

HigherTP_R1_I = Double.NaN;

HigherTP_R2_I = Double.NaN;

HigherTP_R3_I = Double.NaN;

HigherTP_S1_I = Double.NaN;

HigherTP_S2_I = Double.NaN;

HigherTP_S3_I = Double.NaN;

HigherTP_RR_I = Double.NaN;

HigherTP_SS_I = Double.NaN;

}

else

{

HigherTP_PP_I = (Higher[1] + Lower[1] + close[1]) / 3;

HigherTP_R1_I = 2 * HigherTP_PP_I - Lower[1];

HigherTP_R2_I = HigherTP_PP_I + Higher[1] - Lower[1];

HigherTP_R3_I = HigherTP_R2_I + Higher[1] - Lower[1];

HigherTP_S1_I = 2 * HigherTP_PP_I - Higher[1];

HigherTP_S2_I = HigherTP_PP_I - Higher[1] + Lower[1];

HigherTP_S3_I = HigherTP_S2_I - Higher[1] + Lower[1];

HigherTP_RR_I = if (MarketTypeHP == MarketTypeHP.BEARISH or MarketTypeHP == MarketTypeHP.NEUTRAL) then HigherTP_R1_I else HigherTP_R2_I;

HigherTP_SS_I = if (MarketTypeHP == MarketTypeHP.BULLISH or MarketTypeHP == MarketTypeHP.NEUTRAL) then HigherTP_S1_I else HigherTP_S2_I;

}

plot P_HigherTP_PP_I = HigherTP_PP_I;

plot P_HigherTP_R1_I = HigherTP_R1_I;

plot P_HigherTP_R2_I = HigherTP_R2_I;

plot P_HigherTP_R3_I = HigherTP_R3_I;

plot P_HigherTP_S1_I = HigherTP_S1_I;

plot P_HigherTP_S2_I = HigherTP_S2_I;

plot P_HigherTP_S3_I = HigherTP_S3_I;

plot P_HigherTP_RR_I = HigherTP_RR_I;

plot P_HigherTP_SS_I = HigherTP_SS_I;

#P_HigherTP_S1_I.Hide();

#P_HigherTP_S2_I.Hide();

#P_HigherTP_S3_I.Hide();

#P_HigherTP_R1_I.Hide();

#P_HigherTP_R2_I.Hide();

#P_HigherTP_R3_I.Hide();

#P_HigherTP_RR_I.Hide();

#P_HigherTP_SS_I.Hide();

#P_HigherTP_PP_I.Hide();

## -- Arrangement to reference the higher timeframe data (AP = AggergationPeriod).

plot P_Close = close(priceType = PriceType.LAST);

######################################### ------ Color coding

P_Close.AssignValueColor( Color.LIGHT_GRAY);

P_HigherTP_PP_I.AssignValueColor(Color.LIGHT_GRAY);

input MACDBB_FastLength = 12;

input MACDBB_SlowLength = 26;

input MACDBB_BandLength = 9;

input MACDBB_NumDev = 1.0;

Def HigherTP_PP_BB_High = reference BollingerBands(price = P_HigherTP_RR_I, length = MACDBB_BandLength,

Num_Dev_Dn = -MACDBB_NumDev, Num_Dev_Up = MACDBB_NumDev).UpperBand;

def HigherTP_PP_BB_LOW = reference BollingerBands(price = P_HigherTP_SS_I, length = MACDBB_BandLength,

Num_Dev_Dn = -MACDBB_NumDev, Num_Dev_Up = MACDBB_NumDev).Lowerband;

P_Close.SetPaintingStrategy(paintingStrategy2);

P_Close.SetLineWeight(1);

#End 8/23/20222

Last edited: