Hi all

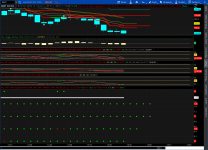

To give back a little to the community, I developed a MTF squeeze indicator for ThinkOrSwim as an alternative to the overpriced internet version . TTM squeeze code is not available on TOS but luckily Mobius provided a replication of TTM squeeze on onedrive.

The base scrip is as follows:

To give back a little to the community, I developed a MTF squeeze indicator for ThinkOrSwim as an alternative to the overpriced internet version . TTM squeeze code is not available on TOS but luckily Mobius provided a replication of TTM squeeze on onedrive.

The base scrip is as follows:

thinkScript Code

Code:

# the script develped by laketrader trying to replicate multitimeframe squeeze

# indicator as an alternative to the overpriced internet version.

# TTM squeeze code is not available on TOS but luckily Mobius provided a excellent

# replication of TTM squeeze on onedrive. Thus, the squeeze logic was based on Mobius's

# code.

#

# changing the first line dStr to diffeent timeframe will switch to different timeframe.

# e.g.

# dStr = "Weekly" wil change to weekly squeeze

input dStr ="Day";

script MySqueeze{

def length = 20;

def AtrMult = 1.5;

def SdMult = 2.0;

input period ="Daily";

def valueClose = close(period = period);

def valueHigh = high(period = period);

def valueLow = low(period = period);

def SD = StDev(valueClose, length);

def Avg = Average(valueClose, length);

def ATR = Average(TrueRange(valueHigh, valueClose, valueLow), length);

def SDup = Avg + (SdMult * SD);

def ATRup = Avg + (AtrMult * ATR);

plot Squeeze = if SDup < ATRup

then 1

else 0;

}

def dSQ= MySqueeze(dStr);

AddLabel(yes, dStr, if dSQ

then Color.RED else Color.GREEN); # display label red if has squeeze