#/ This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

#// © HARRYDAN2

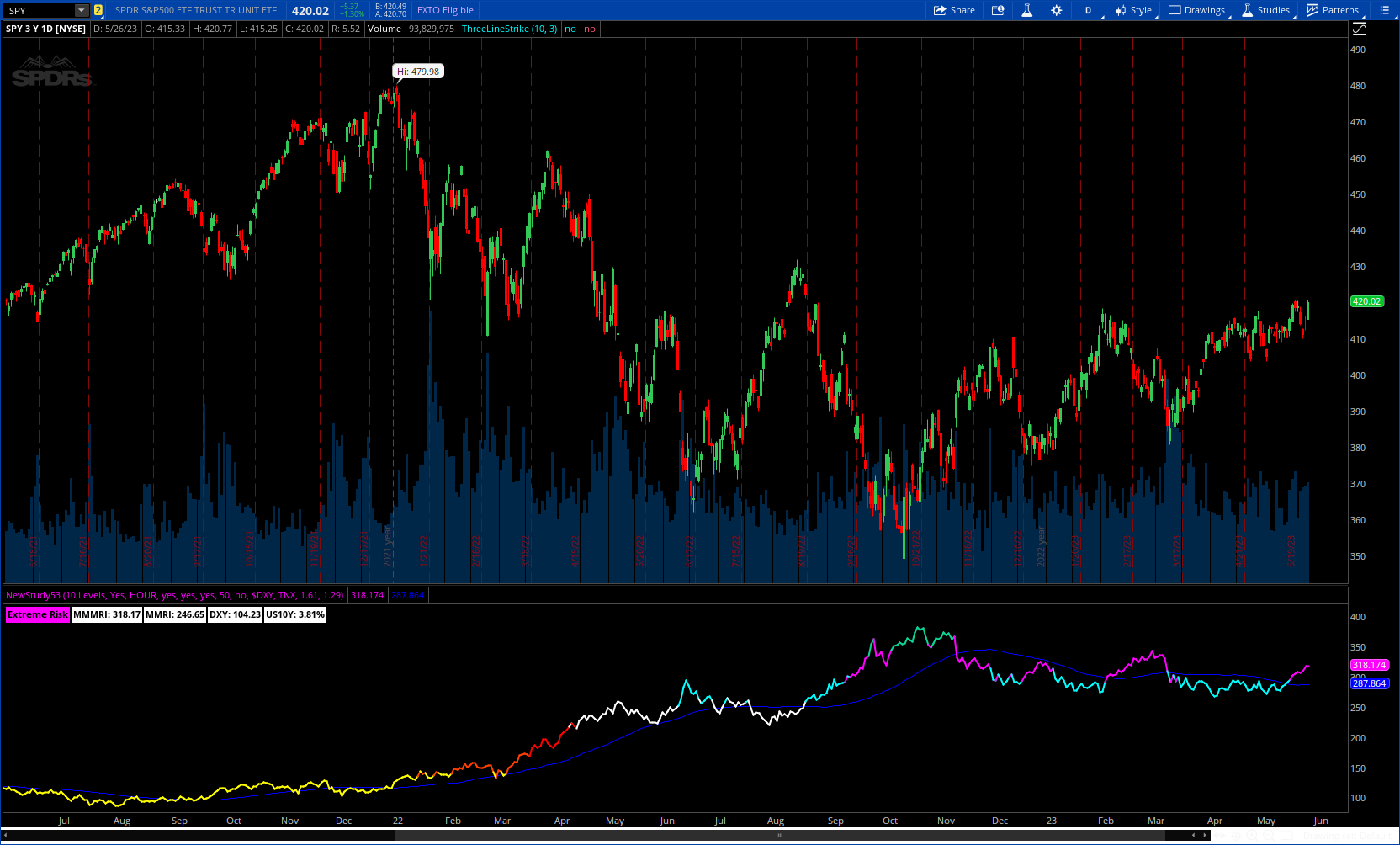

#indicator(title='Modified Mannarino Market Risk Indicator', shorttitle='MMMRI', overlay=false, scale=scale.right, format=format.price)

# Converted and mod by Sam4Cok@Samer800 - 05/2023

declare lower;

input LevelType = {Default "10 Levels", "5 Levels"};

input useChartTimeframe = {Default "Yes", "No"};

input ManualTimeframe = AggregationPeriod.FIFTEEN_MIN;

input ShowAlertLabel = yes;

input showDetailedLabel = yes;

input useModifiedMmri = yes;

input maLength = 50; # "SMA Length"

input hideSma = no; # "Hide SMA"

input dollarSymbol = "$DXY"; # 'Dollar Symbol'

input yieldSymbol = "TNX"; # 'Yield Symbol'

input mmriConstant = 1.61; # 'Divisor'

input debtGdpConstant = 1.29; # 'Multiplier'

def lowRisk = 80; # 'Low Risk'

def moderateRisk = 140; # 'Moderate Risk'

def highRisk = 180; # 'High Risk'

def extremeRisk = 220; # 'Extreme Risk'

def tardMode = 260; # 'Tard Mode'

def somethingsAwry = 300; # 'Somethings Awry'

def buyPuts = 350; # 'Buy Puts or Calls, RIsk is a Double Edged Sword'

def getStock = 400; # 'Request Stock Certificate'

def systemError = 500; # 'System Error Imminent'

def na = Double.NaN;

def theme = LevelType==LevelType."10 Levels";

def current = GetAggregationPeriod();

def isintraday = current < AggregationPeriod.DAY;

def RTH = if isintraday then SecondsTillTime(0830) < 0 and SEcondsTillTime(1500) > 0 else 1;

def RTH1 = if isintraday then SecondsTillTime(0830) < 0 and SEcondsTillTime(1600) > 0 else 1;

def dollarClose; def yieldClose;

switch (useChartTimeframe) {

case "Yes" :

dollarClose = close(Symbol = dollarSymbol);

yieldClose = close(Symbol = yieldSymbol);

case "No" :

dollarClose = close(Symbol = dollarSymbol, Period = ManualTimeframe);

yieldClose = close(Symbol = yieldSymbol, Period = ManualTimeframe);

}

def dxy = if RTH then dollarClose else dxy[1];

def yield = if RTH then yieldClose/10 else yield[1];

def mri = if RTH then ((dxy * yield)/(mmriConstant)) else mri[1];

def mmri = if RTH then ((dxy * yield)/(mmriConstant)) * (debtgdpConstant) else mmri[1];

def mmmri = if useModifiedMmri then mmri else mri;

def sma = if RTH then SimpleMovingAvg(mmmri, maLength) else sma[1];

def col1 =

if mmmri < 050 then 1 else

if mmmri >= 050 and mmmri < 100 then 2 else

if mmmri >= 100 and mmmri < 200 then 3 else

if mmmri >= 200 and mmmri < 300 then 4 else 0;

def col =

if mmmri > lowRisk and mmmri < moderateRisk then 1 else

if mmmri >= moderateRisk and mmmri < highRisk then 2 else

if mmmri >= highRisk and mmmri < extremeRisk then 3 else

if mmmri >= extremeRisk and mmmri < tardMode then 4 else

if mmmri >= tardMode and mmmri < somethingsawry then 5 else

if mmmri >= somethingsawry and mmmri < buyputs then 6 else

if mmmri >= buyputs and mmmri < getstock then 7 else

if mmmri >= getstock and mmmri < systemerror then 8 else

if mmmri > systemerror then 9 else 0;

def riskLevel =

if mmmri > lowRisk and mmmri < moderateRisk then 1 else

if mmmri >= moderateRisk and mmmri < highRisk then 2 else

if mmmri >= highRisk then 3 else

if mmmri >= extremeRisk then 4 else

if mmmri >= tardMode then 5 else

if mmmri >= somethingsawry then 6 else

if mmmri >= buyputs then 7 else

if mmmri >= getstock then 8 else 0;

plot MMRIline = if RTH1 then mmmri else na;#, title="MMRI", trackprice=false, color=highlight(mmmri))

plot SMAline = if hideSma or !RTH1 then na else sma;#(mmmri, maLength), title="SMA", color=color.new(color.blue, 50))

MMRIline.SetLineWeight(2);

MMRIline.AssignValueColor(if theme then

if col==1 then Color.YELLOW else

if col==2 then Color.LIGHT_RED else

if col==3 then Color.RED else

if col==4 then Color.WHITE else

if col==5 then Color.CYAN else

if col==6 then Color.MAGENTA else

if col==7 then CreateColor(12, 211, 151) else

if col==8 then CreateColor(95, 50, 255) else

if col==9 then CreateColor(255, 109, 52) else Color.GREEN else

if col1==1 then Color.CYAN else

if col1==2 then Color.GREEN else

if col1==3 then Color.GRAY else

if col1==4 then Color.DARK_ORANGE else Color.RED);

SMAline.SetDefaultColor(Color.BLUE);

AddLabel(ShowAlertLabel, if theme then

if riskLevel==1 then "Moderate Risk" else

if riskLevel==2 then "High Risk" else

if riskLevel==3 then "Extreme Risk" else

if riskLevel==4 then "Tard Mode" else

if riskLevel==5 then "Somethings Awry" else

if riskLevel==6 then "Buy Puts or Calls, RIsk is a Double Edged Sword" else

if riskLevel==7 then "Request Stock Certificate" else

if riskLevel==8 then "System Error Imminent" else "Low Risk" else

if col1==1 then "Slight Risk" else

if col1==2 then "Low Risk" else

if col1==3 then "Moderate Risk" else

if col1==4 then "High Risk" else "Extreme Risk" ,

if theme then

if col==1 then Color.YELLOW else

if col==2 then Color.LIGHT_RED else

if col==3 then Color.RED else

if col==4 then Color.WHITE else

if col==5 then Color.CYAN else

if col==6 then Color.MAGENTA else

if col==7 then CreateColor(12, 211, 151) else

if col==8 then CreateColor(95, 50, 255) else

if col==9 then CreateColor(255, 109, 52) else Color.GREEN else

if col1==1 then Color.CYAN else

if col1==2 then Color.GREEN else

if col1==3 then Color.GRAY else

if col1==4 then Color.DARK_ORANGE else Color.RED);

AddLabel(showDetailedLabel, "MMMRI: " + ROUND(mmri, 2), color.WHITE);

AddLabel(showDetailedLabel, "MMRI: " + ROUND(mri, 2), color.WHITE);

AddLabel(showDetailedLabel, "DXY: " + ROUND(dxy, 2), color.WHITE);

AddLabel(showDetailedLabel, "US10Y: " + ROUND(yield, 2) + "%", color.WHITE);

#-- END CODE