You should upgrade or use an alternative browser.

Indicator for Think or Swim based on Rob Smith's The STRAT

- Thread starter Pelonsax

- Start date

-

- Tags

- candlestick patterns

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Is there a way to use recursion to somewhat handle the repainting issue?

Would referencing the PRIOR higher time frame work for you?

e.g.: high/low of the prior hour, day, or week?

If not, you might have the same problem I do with back-testing multiple time frames:

Reference thread: https://usethinkscript.com/threads/...-data-back-testing-versus-live-testing.10366/

My understanding of the strat:I am completely overwhelmed by this thread. Mr. Einstein said, “If you can't explain it to a six-year-old, you don't understand it yourself.” I am willing to play the role of a six-year-old if anyone is willing to validate their understanding of THE STRAT.

the typical theSTRAT trader leverages three basic scenarios, combos, time frame continuity, and broadening formations to seek high probability trading setups.

three scenarios =

#1: price does not exceed high or low (known as an inside bar)

#2: price exceeds either the high or the low (known as an UP or DOWN bar)

[NOTE: UP or DOWN refers to the direction in which a high or low was broken, NOT the color of the bar]

#3: price exceeds both the high and the low.

combos = combinations of the scenarios. (example: 2-1-2, 2-2-2, 1-2-2, etc.)

full time frame continuity = lower and higher time frames in agreement (example: 15-minute, hour, and day are green)

broadening formation = price can expand to the upside and downside along trendlines, creating a megaphone pattern

high probability trading setup = scenario triggers a reversal combo into full time frame continuity near the edge of a broadening formation

frequent question #1: isn't this rear-view mirror/historical/after-the-fact trading?

no. I interpret theSTRAT as reactive, not historical, and definitely not predictive.

frequent question #2: The Entry is where?

the entry is made on the break of the next-to-last candle of the combo. example, if you are trading a 2-1-2 setup, your entry is when price breaks the high or low of the 1. you do not enter after the final 2. you should enter at the moment/point the 2 was triggered.

frequent question #3: Where does the stop loss go?

the stop loss should be placed according to where you would be wrong on that chosen time frame. example: you wanted to go long on a 2-1-2 combo, the stop-loss would be on the opposite side of the 1 after you triggered in. some strat advocates use really tight stop losses, as their rationale is that it should work right away and if not, just exit the trade and find another trade.

if my explanation is not simple enough, the best explanations I have found for theSTRAT are, in order from easy to hard: #1a. AlexOptions #1b. DangSTRAT #3. Sara Strat Sniper and #4. Rob Smith

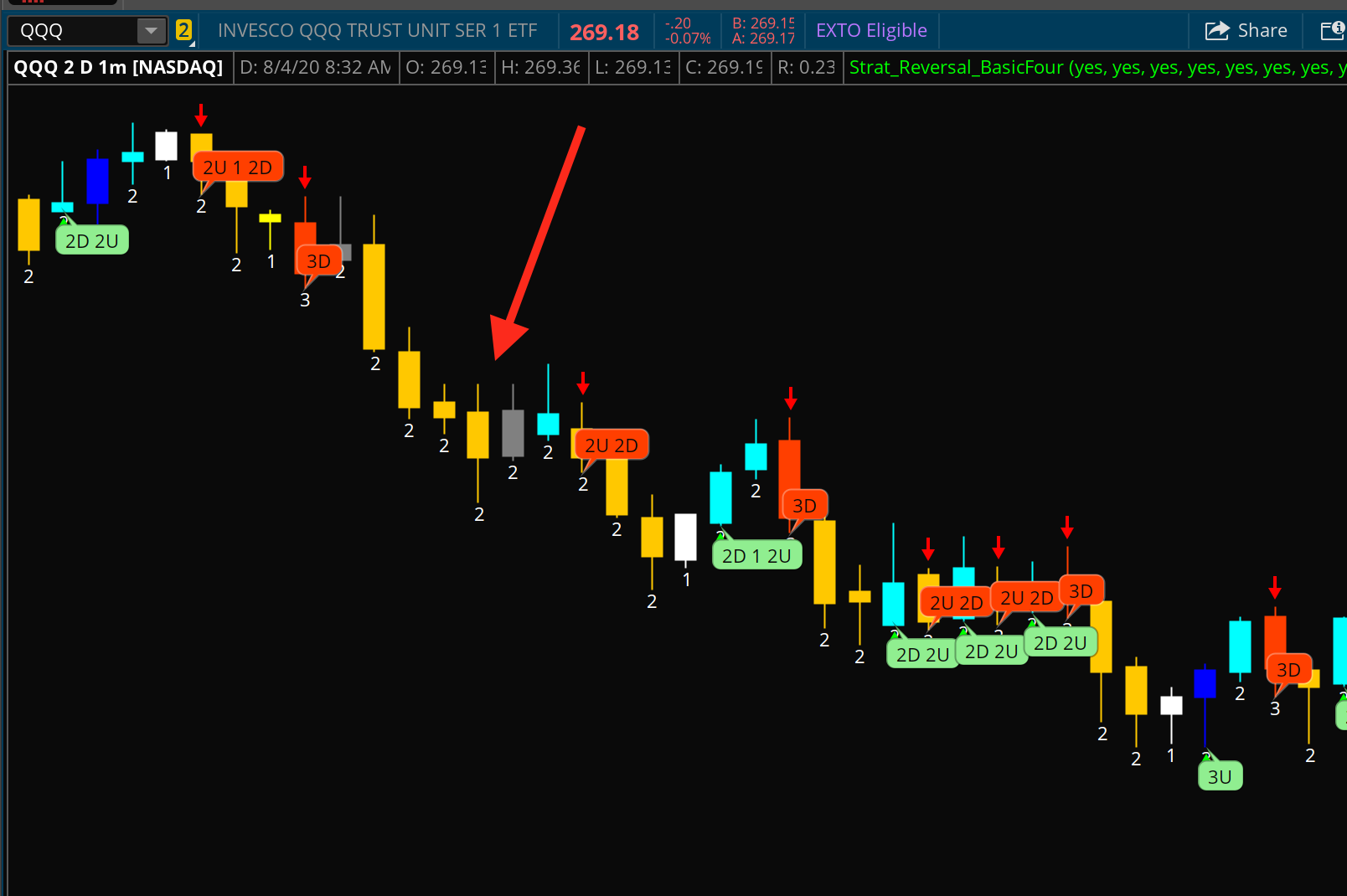

Pelonsax, thank you very much for your work on this/these Strat indicators which I have been using for quite a few months. I have to ask you a question about the indicators above however which I cannot find on either the Strat itself or the Remix. I have been through this thread three or four times and still have not found out how to turn this option on. I have the latest of both but still cannot find this balloon/label option. I am guessing it's in the Remix? Any guidance would be greatly appreciated and keep up the good work.Here's what it looks like when I use @akoplan 's code. But as you can see there are still ones that didn't take out one side or the other. Thoughts?

Kapitalk12

New member

@Pelonsax How can I get the label on TOS to show the W,M,Q FOR Timeframe continuity? Can't seem to find it@Pelonsax Awesome scan. However I think it needs to be changed so that the inside bar 1 bar ago and the twodown is the most current, because we want to catch the next day if it goes above the two that closes green. Current the scan is showing how it would work after thet fact. For example I pulled WIX from the scan today, it would have worked amazing!

bspratt22

Member

Excellent summary of the theory and application. However, I would love to hear from anyone in this forum who is consistently profitable using this strategy (not Rob, Sara, Alex or Dang) but a "regular joe" here putting this into practice. For a system that seems so awesome there doesn't appear to be many using?My understanding of the strat:

the typical theSTRAT trader leverages three basic scenarios, combos, time frame continuity, and broadening formations to seek high probability trading setups.

three scenarios =

#1: price does not exceed high or low (known as an inside bar)

#2: price exceeds either the high or the low (known as an UP or DOWN bar)

[NOTE: UP or DOWN refers to the direction in which a high or low was broken, NOT the color of the bar]

#3: price exceeds both the high and the low.

combos = combinations of the scenarios. (example: 2-1-2, 2-2-2, 1-2-2, etc.)

full time frame continuity = lower and higher time frames in agreement (example: 15-minute, hour, and day are green)

broadening formation = price can expand to the upside and downside along trendlines, creating a megaphone pattern

high probability trading setup = scenario triggers a reversal combo into full time frame continuity near the edge of a broadening formation

frequent question #1: isn't this rear-view mirror/historical/after-the-fact trading?

no. I interpret theSTRAT as reactive, not historical, and definitely not predictive.

frequent question #2: The Entry is where?

the entry is made on the break of the next-to-last candle of the combo. example, if you are trading a 2-1-2 setup, your entry is when price breaks the high or low of the 1. you do not enter after the final 2. you should enter at the moment/point the 2 was triggered.

frequent question #3: Where does the stop loss go?

the stop loss should be placed according to where you would be wrong on that chosen time frame. example: you wanted to go long on a 2-1-2 combo, the stop-loss would be on the opposite side of the 1 after you triggered in. some strat advocates use really tight stop losses, as their rationale is that it should work right away and if not, just exit the trade and find another trade.

if my explanation is not simple enough, the best explanations I have found for theSTRAT are, in order from easy to hard: #1a. AlexOptions #1b. DangSTRAT #3. Sara Strat Sniper and #4. Rob Smith

Candlestick patterns / price action trading is one of the oldest, basic, cleanest forms of trading. It has been profitable since the 1600s due to being in real-time with no-lag.Excellent summary of the theory and application. However, I would love to hear from anyone in this forum who is consistently profitable using this strategy (not Rob, Sara, Alex or Dang) but a "regular joe" here putting this into practice. For a system that seems so awesome there doesn't appear to be many using?

It can take a while to get adept at reading the charts. It is not for novice retail traders. This study does oversimplify the reading of some patterns.

It would be best to learn, practice, understand, and be comfortable with candlestick patterns before entering with this strategy.

https://usethinkscript.com/threads/price-action-toolbox-for-thinkorswim.10747/

I observe whether there is full time frame continuity on the weekly, monthly, and quarterly charts as a way of judging trend. But it does not control my trading - and I'm more likely to act based on daily/weekly fractal pivots (e.g., higher highs and higher lows) than full time-frame continuity.

You can find broadening formations everywhere if you draw lines without structure. Having said that, if I see a clean set of higher highs and lower lows and price is trending away from one of the lines, I often enter a trade (e.g., $AAPL short right now).

Finally, the STRAT has made me far more observant of other candle patterns.

bspratt22

Member

appreciate the real world experience/sharing!I use the STRAT when swing trading but not in a textbook way: (1) I color code my candles consistent with STRAT 1-2-3s instead of using standard colors. (2) I use the STRAT for entries only when something else is telling me to enter and I'm looking for another signal. But I'm more likely to enter on a STRAT continuation (e.g., 2U-2U) than a STRAT signal (e.g., 1U-2U). (3) I often add to holdings when there's a 1U-2U or 2D-2U candle pattern (or vice versa if going short) - and that's probably their greatest value to me. (4) I generally do not exit when a STRAT candle goes the wrong way unless it also crosses and closes below (or above) Merry Day's DSVWAP.

I observe whether there is full time frame continuity on the weekly, monthly, and quarterly charts as a way of judging trend. But it does not control my trading - and I'm more likely to act based on daily/weekly fractal pivots (e.g., higher highs and higher lows) than full time-frame continuity.

You can find broadening formations everywhere if you draw lines without structure. Having said that, if I see a clean set of higher highs and lower lows and price is trending away from one of the lines, I often enter a trade (e.g., $AAPL short right now).

Finally, the STRAT has made me far more observant of other candle patterns.

I will be quoting you in a couple of threads. Your summation is concise and on-point. Thank you for sharing.I use the STRAT when swing trading but not in a textbook way: (1) I color code my candles consistent with STRAT 1-2-3s instead of using standard colors. (2) I use the STRAT for entries only when something else is telling me to enter and I'm looking for another signal. But I'm more likely to enter on a STRAT continuation (e.g., 2U-2U) than a STRAT signal (e.g., 1U-2U). (3) I often add to holdings when there's a 1U-2U or 2D-2U candle pattern (or vice versa if going short) - and that's probably their greatest value to me. (4) I generally do not exit when a STRAT candle goes the wrong way unless it also crosses and closes below (or above) Merry Day's DSVWAP.

I observe whether there is full time frame continuity on the weekly, monthly, and quarterly charts as a way of judging trend. But it does not control my trading - and I'm more likely to act based on daily/weekly fractal pivots (e.g., higher highs and higher lows) than full time-frame continuity.

You can find broadening formations everywhere if you draw lines without structure. Having said that, if I see a clean set of higher highs and lower lows and price is trending away from one of the lines, I often enter a trade (e.g., $AAPL short right now).

Finally, the STRAT has made me far more observant of other candle patterns.

bspratt22

Member

link for your DSVWAP? what is it? : )Candlestick patterns / price action trading is one of the oldest, basic, cleanest forms of trading. It has been profitable since the 1600s due to being in real-time with no-lag.

It can take a while to get adept at reading the charts. It is not for novice retail traders. This study does oversimplify the reading of some patterns.

It would be best to learn, practice, understand, and be comfortable with candlestick patterns before entering with this strategy.

https://usethinkscript.com/threads/price-action-toolbox-for-thinkorswim.10747/

A deviation-scaled VWAP. Here's a link to one:link for your DSVWAP? what is it? : )

https://usethinkscript.com/threads/deviation-scaled-vwap-with-fractal-energy-for-thinkorswim.1270/

I use a length of 50, not 55, and it becomes my trailing stop for trend swing trades once initial targets have been hit.

True STRATters, generally set their stops at the previous candle, I believe, which are tighter than my stops, but they move them up like I do, just based on candle lows.

bspratt22

Member

Thanks!A deviation-scaled VWAP. Here's a link to one:

https://usethinkscript.com/threads/deviation-scaled-vwap-with-fractal-energy-for-thinkorswim.1270/

I use a length of 50, not 55, and it becomes my trailing stop for trend swing trades once initial targets have been hit.

True STRATters, generally set their stops at the previous candle, I believe, which are tighter than my stops, but they move them up like I do, just based on candle lows.

I'm not sure precisely what you mean, but below is the code that I use. If you see red or green on the STRAT candle label, you have a basic actionable signal. Cyan and magenta tell you you have an inside bar, and blue and violet tell you you have an outside bar that is not actionable. (The code paints the candles the same colors. Just delete the AssignPriceColor code if you don't want that.)Has anyone found a study for Strat Actionable Signals that works? All I get is a line at the bottom of my charts.

## NAME: STRAT CANDLES

## AUTHOR: DCT

## H/T: Pelonsax

## VERSION: 1.3 02.18.2022

# Candle Definitions

def insidebar = low >= low[1] and high <= high[1];

def insideupbar = insidebar and open < close;

def insidedownbar = insidebar and open > close;

def twoupbar = high > high[1] and low >= low[1];

def twodownbar = high <= high[1] and low < low[1];

def twobar = twoupbar or twodownbar;

def outsidebar = high > high[1] and low < low[1];

def outsideupbar = outsidebar and open < close;

def outsidedownbar = outsidebar and open > close;

# Price Bars

AssignPriceColor(

if insideupbar then Color.CYAN

else if insidedownbar then Color.MAGENTA

else if twoupbar then Color.GREEN

else if twodownbar then Color.RED

else if outsideupbar then Color.BLUE

else if outsidedownbar then Color.VIOLET

else Color.LIGHT_GRAY);

# Bar Label

AddLabel(yes, "STRAT CANDLES: ", Color.LIGHT_GRAY);

AddLabel(yes,

(if twoupbar[2] then “2U” else if twodownbar[2] then “2D” else if insideupbar[2] then “1U" else if insidedownbar[2] then “1D” else if outsideupbar[2] then “3U” else if outsidedownbar[2] then “3D” else if insidebar[2] and !insideupbar[2] and !insidedownbar[2] then "1" else if outsidebar[2] and !outsideupbar[2] and !outsidedownbar[2] then "3" else “”) + “-“ +

(if twoupbar[1] then “2U” else if twodownbar[1] then “2D” else if insideupbar[1] then “1U" else if insidedownbar[1] then “1D” else if outsideupbar[1] then “3U” else if outsidedownbar[1] then “3D” else if insidebar[1] and !insideupbar[1] and !insidedownbar[1] then "1" else if outsidebar[1] and !outsideupbar[1] and !outsidedownbar[1] then "3" else “”) + “-“ +

(if twoupbar then “2U” else if twodownbar then “2D” else if insideupbar then “1U" else if insidedownbar then “1D” else if outsideupbar then “3U” else if outsidedownbar then “3D” else if insidebar and !insideupbar and !insidedownbar then "1" else if outsidebar and !outsideupbar and !outsidedownbar then "3" else “”),

if insidebar[1] and twoupbar[0] then Color.GREEN

else if twodownbar[1] and twoupbar[0] then Color.GREEN

else if outsidedownbar[1] and twoupbar[0] then Color.GREEN

else if insidebar[1] and twodownbar[0] then Color.RED

else if twoupbar[1] and twodownbar[0] then Color.RED

else if outsideupbar[1] and twodownbar[0] then Color.RED

else if insideupbar then Color.CYAN

else if insidedownbar then Color.MAGENTA

else if outsideupbar then Color.BLUE

else if outsidedownbar then Color.VIOLET

else Color.WHITE);Thanks, but I keep getting just a chart with a line at the bottom?I'm not sure precisely what you mean, but below is the code that I use. If you see red or green on the STRAT candle label, you have a basic actionable signal. Cyan and magenta tell you you have an inside bar, and blue and violet tell you you have an outside bar that is not actionable. (The code paints the candles the same colors. Just delete the AssignPriceColor code if you don't want that.)

Code:## NAME: STRAT CANDLES ## AUTHOR: DCT ## H/T: Pelonsax ## VERSION: 1.3 02.18.2022 # Candle Definitions plot insidebar = low >= low[1] and high <= high[1]; plot insideupbar = insidebar and open < close; plot insidedownbar = insidebar and open > close; plot twoupbar = high > high[1] and low >= low[1]; plot twodownbar = high <= high[1] and low < low[1]; plot twobar = twoupbar or twodownbar; plot outsidebar = high > high[1] and low < low[1]; plot outsideupbar = outsidebar and open < close; plot outsidedownbar = outsidebar and open > close; # Price Bars AssignPriceColor( if insideupbar then Color.CYAN else if insidedownbar then Color.MAGENTA else if twoupbar then Color.GREEN else if twodownbar then Color.RED else if outsideupbar then Color.BLUE else if outsidedownbar then Color.VIOLET else Color.LIGHT_GRAY); # Bar Label AddLabel(yes, "STRAT CANDLES: ", Color.LIGHT_GRAY); AddLabel(yes, (if twoupbar[2] then “2U” else if twodownbar[2] then “2D” else if insideupbar[2] then “1U" else if insidedownbar[2] then “1D” else if outsideupbar[2] then “3U” else if outsidedownbar[2] then “3D” else if insidebar[2] and !insideupbar[2] and !insidedownbar[2] then "1" else if outsidebar[2] and !outsideupbar[2] and !outsidedownbar[2] then "3" else “”) + “-“ + (if twoupbar[1] then “2U” else if twodownbar[1] then “2D” else if insideupbar[1] then “1U" else if insidedownbar[1] then “1D” else if outsideupbar[1] then “3U” else if outsidedownbar[1] then “3D” else if insidebar[1] and !insideupbar[1] and !insidedownbar[1] then "1" else if outsidebar[1] and !outsideupbar[1] and !outsidedownbar[1] then "3" else “”) + “-“ + (if twoupbar then “2U” else if twodownbar then “2D” else if insideupbar then “1U" else if insidedownbar then “1D” else if outsideupbar then “3U” else if outsidedownbar then “3D” else if insidebar and !insideupbar and !insidedownbar then "1" else if outsidebar and !outsideupbar and !outsidedownbar then "3" else “”), if insidebar[1] and twoupbar[0] then Color.GREEN else if twodownbar[1] and twoupbar[0] then Color.GREEN else if outsidedownbar[1] and twoupbar[0] then Color.GREEN else if insidebar[1] and twodownbar[0] then Color.RED else if twoupbar[1] and twodownbar[0] then Color.RED else if outsideupbar[1] and twodownbar[0] then Color.RED else if insideupbar then Color.CYAN else if insidedownbar then Color.MAGENTA else if outsideupbar then Color.BLUE else if outsidedownbar then Color.VIOLET else Color.WHITE);

- Status

- Not open for further replies.

Similar threads

-

-

-

Repaints MTF Incredible Hulk Indicator For ThinkOrSwim

- Started by Bingy

- Replies: 13

-

NQ 1 minute Scalping Indicator For ThinkOrSwim

- Started by iAskQs

- Replies: 64

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

-

-

Repaints MTF Incredible Hulk Indicator For ThinkOrSwim

- Started by Bingy

- Replies: 13

-

NQ 1 minute Scalping Indicator For ThinkOrSwim

- Started by iAskQs

- Replies: 64

-

Similar threads

-

-

-

Repaints MTF Incredible Hulk Indicator For ThinkOrSwim

- Started by Bingy

- Replies: 13

-

NQ 1 minute Scalping Indicator For ThinkOrSwim

- Started by iAskQs

- Replies: 64

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/