BTW Congratulations I think you're the first to publish a mod!very nice!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Indicator for Think or Swim based on Rob Smith's The STRAT

- Thread starter Pelonsax

- Start date

-

- Tags

- candlestick patterns

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Forsythe Investing

New member

If you disable this, doesn't it then take premarket into consideration? I thought you would want to start at market open. (now confused)For anyone having the issue I had, this video is a great way to set up the scan but you will still sometimes find incorrect returns unless you disable "start aggregations at market open" in the equities tab on chart settings. This fixed it for me.

@Pelonsax 1st thank you for all your hard work, this broadening formation help so much ... I looked but maybe I missed it .. is this the latest and if it is can I suggest an improvement (it might not make sense and please ket me know why not as I want to learn) since we want TFC we look at several charts like some of your other scripts you can have higher time frames drawn on a the same chart ... so if im trading the 60 min and I see the broadening formations on it ... I would love to see in a different color say the weekly or daily .... 1 do you think it will help and if it does can you update it. Again thank you for your hard work, sadly I can't do it yet but maybe one day3_1_Broadening_Formation

https://tos.mx/U6xvWgx

@avpatel When asking for help with code, please post the code itself, or a link to the code within the forums, not just a shared link... We shouldn't have to import code into our TOS to view it... I understand that you are new, and welcome to the forums, but the easier you make our ability to help you the faster said help can be provided...

bobbybones

New member

Sorry for the question, but how would i trade this? I watched a few videos and i understand the 1s 2s and 3s but im not sure what patterns there are, or how to read them. Im not really sure how to use the information i have tbh. Thanks for your help.

~Bones

~Bones

Watch that video I posted in the top post. The Benzinga video. Also Rob now has a full course available, I think it's on Ticker TockerSorry for the question, but how would i trade this? I watched a few videos and i understand the 1s 2s and 3s but im not sure what patterns there are, or how to read them. Im not really sure how to use the information i have tbh. Thanks for your help.

~Bones

i am trying to create a watchlist column that will show me hourly bars that "start aggrregation at market open. Im using "the Strat" strategy and the hourlys have to start on market open but seems the default for the watchlist column is not doing that as i get different results on my watchlist column then the chart. can anyone help me have this start the aggregation at market open?

Code:

def H = high;

def L = low;

def C = close;

def O = open;

def insidebar = (H < H[1] and L > L[1]) or (H == H[1] and L > L[1]) or (H < H[1] and L == L[1]) or (H == H[1] and L == L[1]);

def outsidebar = H > H[1] and L < L[1];

def twoup = H > H[1] and L >= L[1];

def twodown = H <= H[1] and L < L[1];

plot barType = if Show_Strat_Numbers and insideBar then 1 else if Show_Strat_Numbers and outsidebar then 3 else if !insidebar and !outsidebar and Show_Twos then 2 else double.nan;

bartype.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

barType.SetDefaultColor(color.cyan);

assignbackgroundColor(if insidebar then color.yellow else if outsidebar then color.magenta else if twodown then color.red else color.green);Ricorichie

New member

Hello,

Take a look at this link. https://www.hahn-tech.com/ans/how-t...ime-frame-to-start-at-the-bottom-of-the-hour/

This link talks about the ToS default settings for the platform. It seems that the watchlists start at the top of every hour, and not the half hour or anywhere else for that matter. So the watchlist would start at 9am Est instead of 9:30am Est. You can obviously affect the start period for the charts at market open but apparently that does not apply to the rest of the platform. It might not be possible, but we can wait for others to chime in on this.

R

Take a look at this link. https://www.hahn-tech.com/ans/how-t...ime-frame-to-start-at-the-bottom-of-the-hour/

This link talks about the ToS default settings for the platform. It seems that the watchlists start at the top of every hour, and not the half hour or anywhere else for that matter. So the watchlist would start at 9am Est instead of 9:30am Est. You can obviously affect the start period for the charts at market open but apparently that does not apply to the rest of the platform. It might not be possible, but we can wait for others to chime in on this.

R

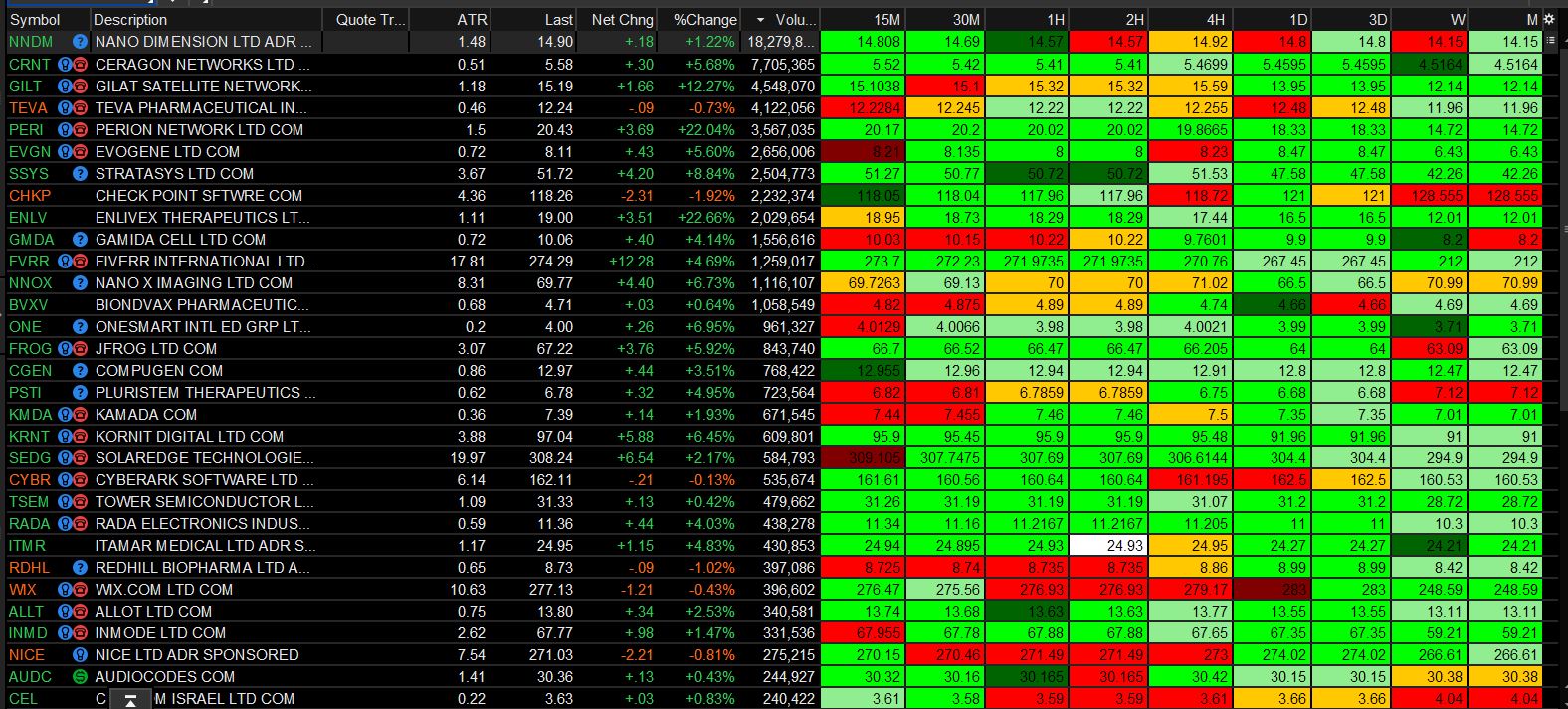

Have you noticed that the 1 hr bars do not match up with the strat strategy which is that 1 hr bars to "start aggregation on market open" it seems the watchlist colomns dont do that...they populate the bars at the "top of the hour" which would be wrong..was wondering if you had a solution for that?Excellent work and thank you for all of this! I was playing with watch list columns and saw the 1st titled Strat FTC didn't match up so I basically combined the 2 to show color codes with price. This plots more to my thinking as I want FTFC across the board as the individual frames will take care of themselves. Anyway it works for my brain. It loaded 50-70 symbols pretty quick (weekend), S&P 100 it started bogging down.

Code:#------------------------------------ # # M T F S T R A T # W A T C H L I S T # a Study by Ramon DV. aka Pelonsax # #------------------------------------ #------------------------------------ # S T R A T R E V E R S A L S # # A study by Ramon DV. aka Pelonsax # # Version 1.0 8/01/20 # # Version 2.0 8/4/20 Corrected errors in logic for scenarios # Version 2.1 8/15/20 Added Reversals # #------------------------------------ plot O = open; def H = high; def L = low; def C = close; #------------------------------------ # DEFINE SCENARIOS #------------------------------------ def insidebar = (H < H[1] and L > L[1]) or (H == H[1] and L > L[1]) or (H < H[1] and L == L[1]) or (H == H[1] and L == L[1]); def outsidebar = H > H[1] and L < L[1]; def insidebarup = insidebar and O < C; def twoup = H > H[1] and L >= L[1]; def outsidebarup = outsidebar and O < C; def insidebardown = insidebar and O > C; def twodown = H <= H[1] and L < L[1]; def outsidebardown = outsidebar and O > C; #------------------------------------ # LABEL SECTION #------------------------------------ AssignBackgroundColor( if twoup then Color.GREEN else if twodown then Color.RED else if outsidebarup then Color.DARK_GREEN else if insidebarup then Color.LIGHT_GREEN else if outsidebardown then Color.DARK_RED else if insidebardown then Color.ORANGE else if !insidebarup and !insidebardown and insidebar then Color.WHITE else if !outsidebardown and !outsidebarup and outsidebar then Color.YELLOW else Color.CURRENT); addlabel(yes, O, color.black);

bobbybones

New member

I watched the video but I’m still not sure exactly what an entry looks like. I believe it’s like there is a 3 candle and a 1 candle, and if a 2 breaks the bottom of the 1 short it.Watch that video I posted in the top post. The Benzinga video. Also Rob now has a full course available, I think it's on Ticker Tocker

I know there’s other patterns but I’m confused about one more thing, like how do you know which direction price might go or if it’s a continuation pattern. I know he also uses candle patterns like doji candles or hammers but I’m not sure where to even look to learn about this. The video was lowkey vague. sorry for making you put up with my stupidity.

~Bones

I have to say i agree it’s the worst video of the process of this. I dug a bit more and it seems like if you look on YouTube for “benzinga strat” videos...they made one on Friday with this guy Arturio something that he goes over it pretty well. To be honest i have looked at a lot of strategies and this one seems to make the most sense to me.I watched the video but I’m still not sure exactly what an entry looks like. I believe it’s like there is a 3 candle and a 1 candle, and if a 2 breaks the bottom of the 1 short it.

I know there’s other patterns but I’m confused about one more thing, like how do you know which direction price might go or if it’s a continuation pattern. I know he also uses candle patterns like doji candles or hammers but I’m not sure where to even look to learn about this. The video was lowkey vague. sorry for making you put up with my stupidity.

~Bones

could you share that script for the MTF labels? of the D W M Q? i cant seem to find it@Pelonsax Awesome scan. However I think it needs to be changed so that the inside bar 1 bar ago and the twodown is the most current, because we want to catch the next day if it goes above the two that closes green. Current the scan is showing how it would work after thet fact. For example I pulled WIX from the scan today, it would have worked amazing!

@Nicksmo I Recently made a few new videos on the STRAT and posted them on twitter as well as my youtube page. Check them out and if you still have trouble what I'm trying to do is schedule times to do one on one with folks that are newer to the strat on the discord channel so that we can all pull each other up at the same time.I watched the video but I’m still not sure exactly what an entry looks like. I believe it’s like there is a 3 candle and a 1 candle, and if a 2 breaks the bottom of the 1 short it.

I know there’s other patterns but I’m confused about one more thing, like how do you know which direction price might go or if it’s a continuation pattern. I know he also uses candle patterns like doji candles or hammers but I’m not sure where to even look to learn about this. The video was lowkey vague. sorry for making you put up with my stupidity.

~Bones

laperchaser

New member

Would love to be included on this. I purchased Rob's course but the videos aren't really as clear as I would have hoped. Arturo did a dope job on his webinar though. I'm currently trying to use the strat for swing trading options.@Nicksmo I Recently made a few new videos on the STRAT and posted them on twitter as well as my youtube page. Check them out and if you still have trouble what I'm trying to do is schedule times to do one on one with folks that are newer to the strat on the discord channel so that we can all pull each other up at the same time.

Would love to be included on this. I purchased Rob's course but the videos aren't really as clear as I would have hoped. Arturo did a dope job on his webinar though. I'm currently trying to use the strat for swing trading options.

Search YouTube for Pelonsax...

or follow the link on the top post and click on my channel. Go ahead and give it a subscribe while you're at it!Search YouTube for Pelonsax...

- Status

- Not open for further replies.

Similar threads

-

-

-

Repaints MTF Incredible Hulk Indicator For ThinkOrSwim

- Started by Bingy

- Replies: 13

-

NQ 1 minute Scalping Indicator For ThinkOrSwim

- Started by iAskQs

- Replies: 64

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

549

Online

Similar threads

-

-

-

Repaints MTF Incredible Hulk Indicator For ThinkOrSwim

- Started by Bingy

- Replies: 13

-

NQ 1 minute Scalping Indicator For ThinkOrSwim

- Started by iAskQs

- Replies: 64

-

Similar threads

-

-

-

Repaints MTF Incredible Hulk Indicator For ThinkOrSwim

- Started by Bingy

- Replies: 13

-

NQ 1 minute Scalping Indicator For ThinkOrSwim

- Started by iAskQs

- Replies: 64

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.