@Ronathan Edwards Hey, us grandparents have to stick togetherAmazing, amazing, amazing! You made my weekend! Thank you sooo much! I owe you a Scotch!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Repaints Hull Moving Average Turning Points and Concavity (2nd Derivatives)

- Thread starter mashume

- Start date

Repaints

- Status

- Not open for further replies.

I put the newest (v4) code into a new section in post 1 for this thread. For those who do not want mobile support, I left v3 in there as well.

-mashume

Thanks for the new V4Code, is there a major difference between V3 and V4 of the indicatorI put the newest (v4) code into a new section in post 1 for this thread. For those who do not want mobile support, I left v3 in there as well.

-mashume

If I recall, the v4 has support for plotting colors on mobile. It does it by having separate plots (which you can then colour differently).Thanks for the new V4Code, is there a major difference between V3 and V4 of the indicator

-mashume

Kapitalk12

New member

Is there a way to have a label that calculates The outstanding shares multiplied by the current price of the stock??Thank you for sharing this. Since ToS shareable links are still not working, I went ahead and posted the source code for both the upper and lower study directly into the post. I hope you don't mind

A poster requested a scan of turning points. Ma_min is a turning point. Read through the thread for more information. Pay attention to the discussion as to the lag.

You can change the scan to trigger on buy signal and review charts to determine which fits your strategy better

HTH

You can change the scan to trigger on buy signal and review charts to determine which fits your strategy better

HTH

@leelee Did you check out this post?

https://usethinkscript.com/threads/...cavity-2nd-derivatives.1803/page-5#post-17554

https://usethinkscript.com/threads/...cavity-2nd-derivatives.1803/page-5#post-17554

Got it, Thanks alots@leelee Did you check out this post?

https://usethinkscript.com/threads/...cavity-2nd-derivatives.1803/page-5#post-17554

Disregard previous request found it. TYThank you all for your comments and encouragement.

I have a laundry list of things in this post:

- Variations to scripts

- Scanner

- Testing

Script Variations

@chillc15, I'm intrigued by the Arnaud Legoux MA, and so here is a variant of the upper study that will allow you to choose between Hull, Simple, Exponential, Williams, and ALMA. I haven't gone through the various permutations, but bear in mind that the 'overshoot' and smoothing of the Hull is part of what makes the turning point signal so attractive.

@Miket Used your posted code for the ALMA. Hope you're good with this use. Thanks!

Code:# # Multiple Moving Average Concavity and Turning Points # or # The Second Derivative of the A Moving Average # # via useThinkScript # request from chillc15 # Added Arnaud Legoux MA and other Moving Averages # # Author: Seth Urion (Mahsume) # Version: 2020-02-22 V2 # # This code is licensed (as applicable) under the GPL v3 # # ---------------------- declare upper; input price = HL2; input MA_Length = 21; input lookback = 2; input MovingAverage = {default "HMA", "EMA", "SMA", "WMA", "ALMA"}; script ALMA { # Attributed to Miket # https://tos.mx/9mznij # https://usethinkscript.com/threads/alma-arnaud-legoux-ma-indicator-for-thinkorswim.174/ input Data = close; input Window = 9; input Sigma = 6; input Offset = 0.85; def m = (Offset * (Window - 1)); def s = Window/Sigma; def SumVectorData = fold y = 0 to Window with WS do WS + Exp(-(sqr(y-m))/(2*sqr(s))) * getvalue(Data, (Window-1)-y); def SumVector = fold z = 0 to Window with CW do CW + Exp(-(sqr(z-m))/(2*sqr(s))); plot ALMA = SumVectorData / SumVector; } plot MA; switch (MovingAverage) { case EMA: MA = MovAvgExponential(price, length = MA_Length); case SMA: MA = simpleMovingAvg(price, length = MA_Length); case WMA: MA = wma(price, length = MA_Length); case ALMA: MA = ALMA(Data = price, window = MA_Length); default: MA = HullMovingAvg(price = price, length = MA_Length); } def delta = MA[1] - MA[lookback + 1]; def delta_per_bar = delta / lookback; def next_bar = MA[1] + delta_per_bar; def concavity = if MA > next_bar then 1 else -1; plot turning_point = if concavity[-1] != concavity then MA else double.nan; MA.AssignValueColor(color = if concavity == -1 then if MA > MA[1] then color.dark_orange else color.red else if MA < MA[1] then color.dark_green else color.green); MA.SetLineWeight(3); turning_point.SetLineWeight(4); turning_point.SetPaintingStrategy(paintingStrategy = PaintingStrategy.POINTS); turning_point.SetDefaultColor(color.white); plot MA_Max = if MA[-1] < MA and MA > MA[1] then MA else Double.NaN; MA_Max.SetDefaultColor(Color.WHITE); MA_Max.SetPaintingStrategy(PaintingStrategy.SQUARES); MA_Max.SetLineWeight(3); plot MA_Min = if MA[-1] > MA and MA < MA[1] then MA else Double.Nan; MA_Min.SetDefaultColor(Color.WHITE); MA_Min.SetPaintingStrategy(PaintingStrategy.TRIANGLES); MA_Min.SetLineWeight(3); plot sell = if turning_point and concavity == 1 then high else double.nan; sell.SetDefaultColor(Color.DARK_ORANGE); sell.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); sell.SetLineWeight(3); plot buy = if turning_point and concavity == -1 then low else double.nan; buy.SetDefaultColor(Color.CYAN); buy.SetPaintingStrategy(PaintingStrategy.ARROW_UP); buy.SetLineWeight(3); def divergence = MA - next_bar; addLabel(yes, concat("DIVERGENCE: " , divergence), color = if concavity < 0 then if divergence[1] > divergence then Color.RED else color.PINK else if divergence[1] < divergence then color.green else color.yellow);

SCANS

@mailbagman2000 , Scans, yes...

Scan 1 -- Buy signals.

This scan relies on the upper study being called "Concavity" and is entered on the scan page as a custom.

Code:Concavity("hma length" = 55, price = CLOSE)."buy" is true within 2 bars

Scan 2 -- Stocks approaching possible Buy signals

I thought that, since the lower indicator crossovers can generate signals, that an 'early warning' scan might be of interest. We can scan for any HMA that has a negative convergence, and look for a decrease in the distance below zero. It may be a long way off, it may never get there, but we are alerted before the trade entry.

Code:script ConcavityDivergence { # # Hull Moving Average Concavity Divergence # or # The Second Derivative of the Hull Moving Average # # Author: Seth Urion (Mahsume) # Version: 2020-02-21 Initial Public # # This code is licensed (as applicable) under the GPL v3 # # ---------------------- declare lower; input price = HL2; input HMA_length = 34; input lookback = 2; def HMA = HullMovingAvg(length = HMA_length, price = price); def delta = HMA[1] - HMA[lookback + 1]; def delta_per_bar = delta / lookback; def next_bar = HMA[1] + delta_per_bar; def concavity = if HMA > next_bar then 1 else -1; plot zero = 0; zero.setdefaultcolor(color.gray); zero.setpaintingstrategy(PaintingStrategy.DASHES); plot divergence = displacer(-1, HMA - next_bar); divergence.setDefaultColor(Color.LIME); divergence.SetLineweight(2); plot cx_up = if divergence crosses above zero then 0 else double.nan; cx_up.SetPaintingStrategy(PaintingStrategy.POINTS); cx_up.SetDefaultColor(Color.LIGHT_GREEN); cx_up.SetLineWeight(4); plot cx_down = if divergence crosses below zero then 0 else double.nan; cx_down.SetPaintingStrategy(PaintingStrategy.POINTS); cx_down.SetDefaultColor(Color.RED); cx_down.SetLineWeight(4); } def signal = ConcavityDivergence("hma length" = 55)."concavity"; def HMA = ConcavityDivergence("hma length" = 55)."HMA"; def next = ConcavityDivergence("hma length" = 55)."next_bar"; plot buy = signal < 0 and (HMA - next) > (HMA[1] - next[1]);

TESTING

I used the built-in strategy feature of thinkorswim, with block sizes of 100. All tests were run on 1 year Daily charts, with an HMA length of 55 and set price to CLOSE

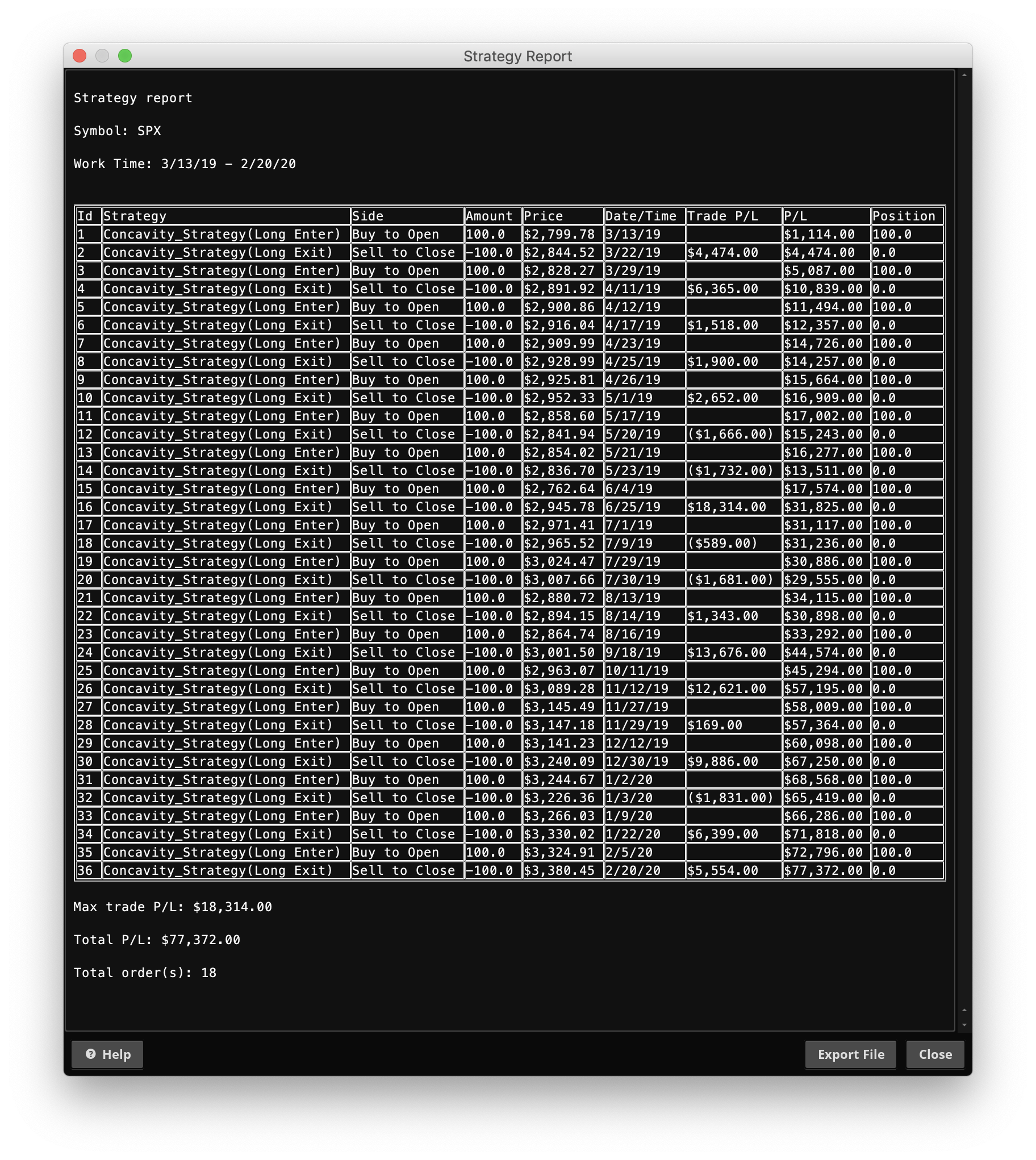

First SPX

Buy and Hold: $55,600

Strategy: $77,372

Delta + $21772

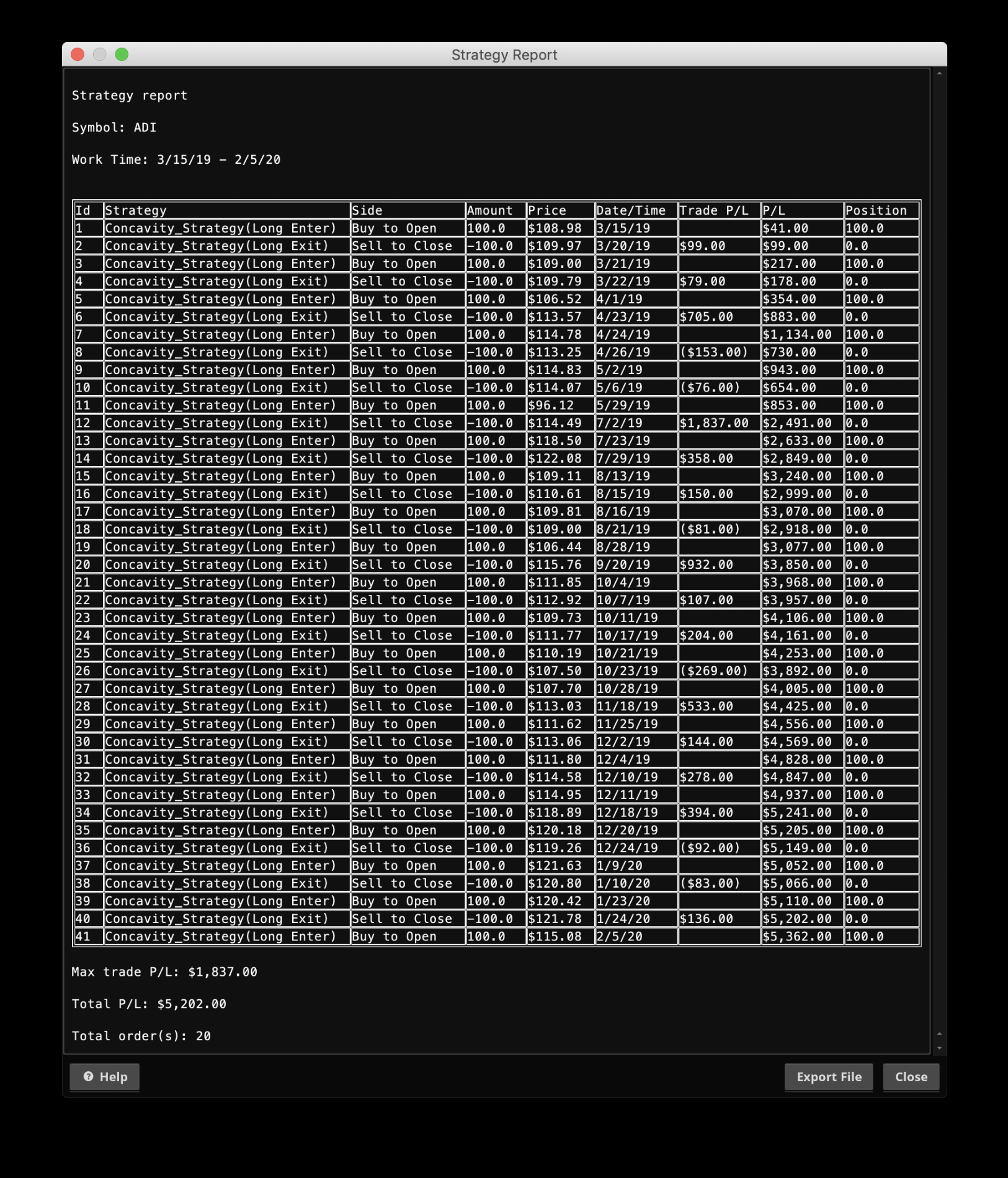

Next ADI

Buy and Hold: $1718

Strategy: $5202

Delta: + $3483

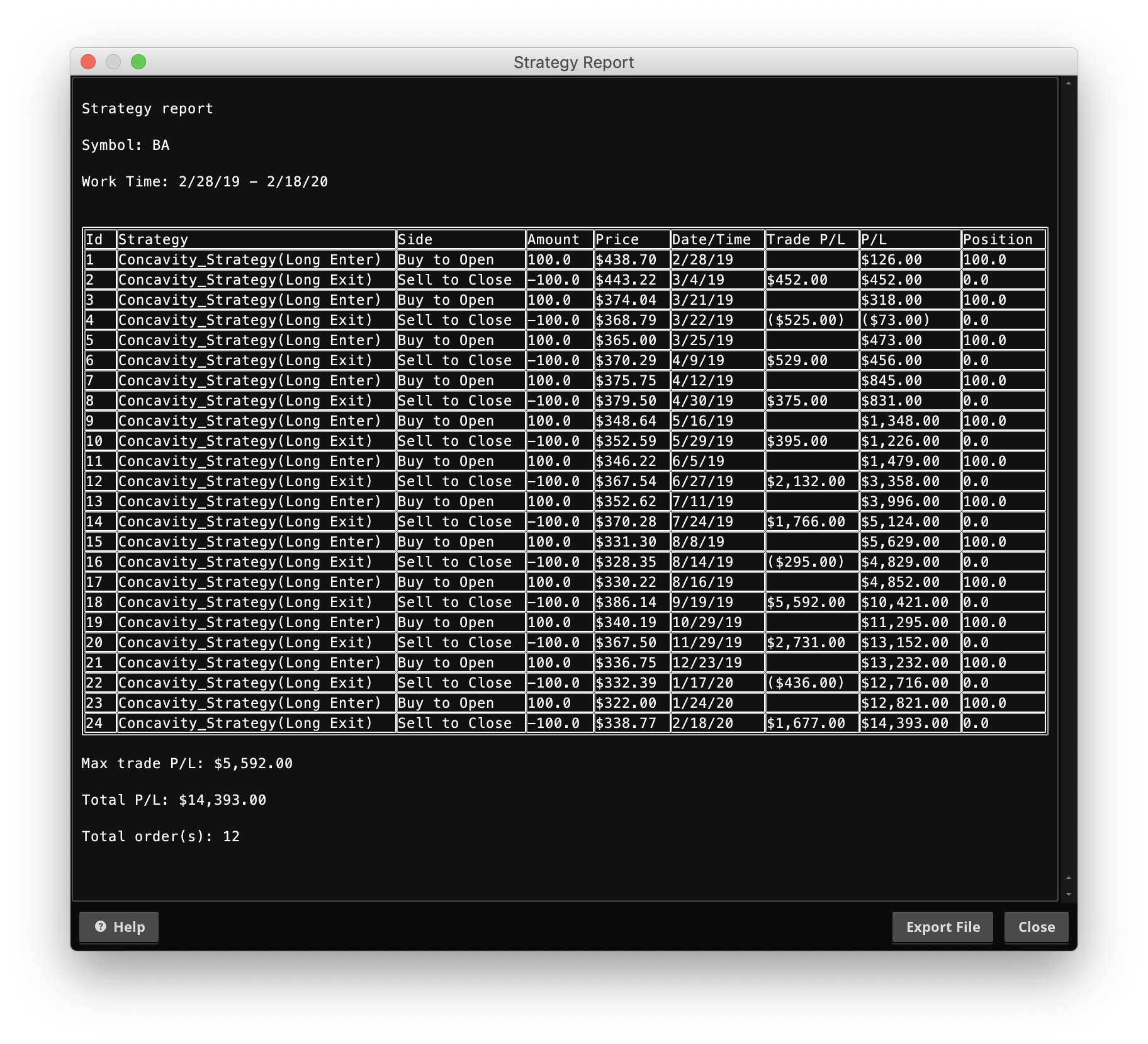

Last BA

Buy and Hold: ($9322)

Strategy: $14393

Delta: + $23715

SHORT TIME FRAMES

I did not take time today to test shorter timeframes, though I imagine the results would be good. If there is interest, I'll try to post up some another time.

If you've read this far, thank you.

Happy trading and good luck.

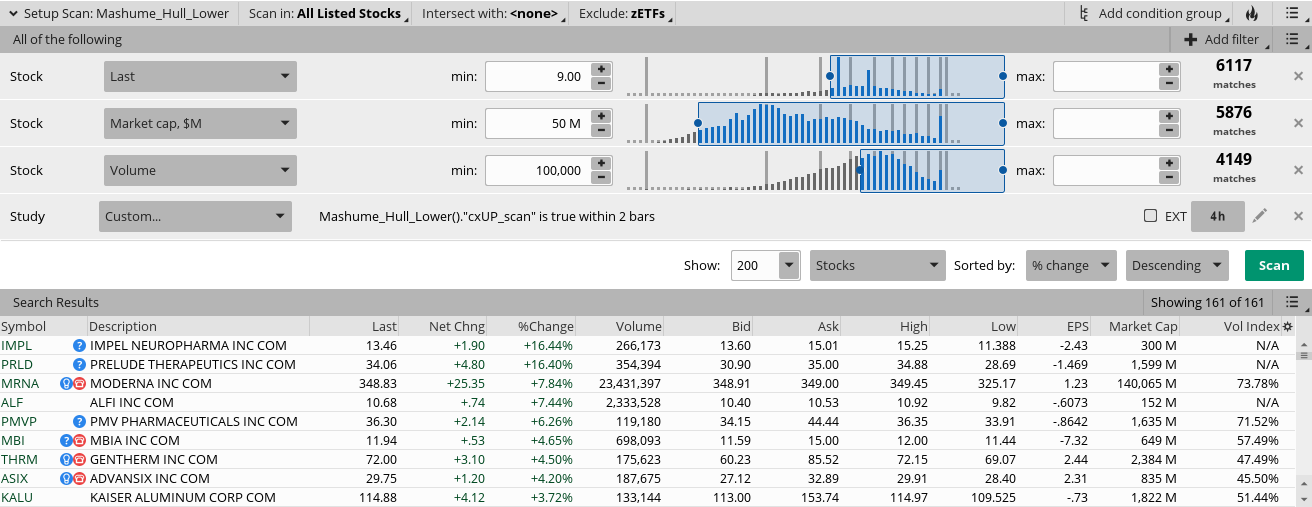

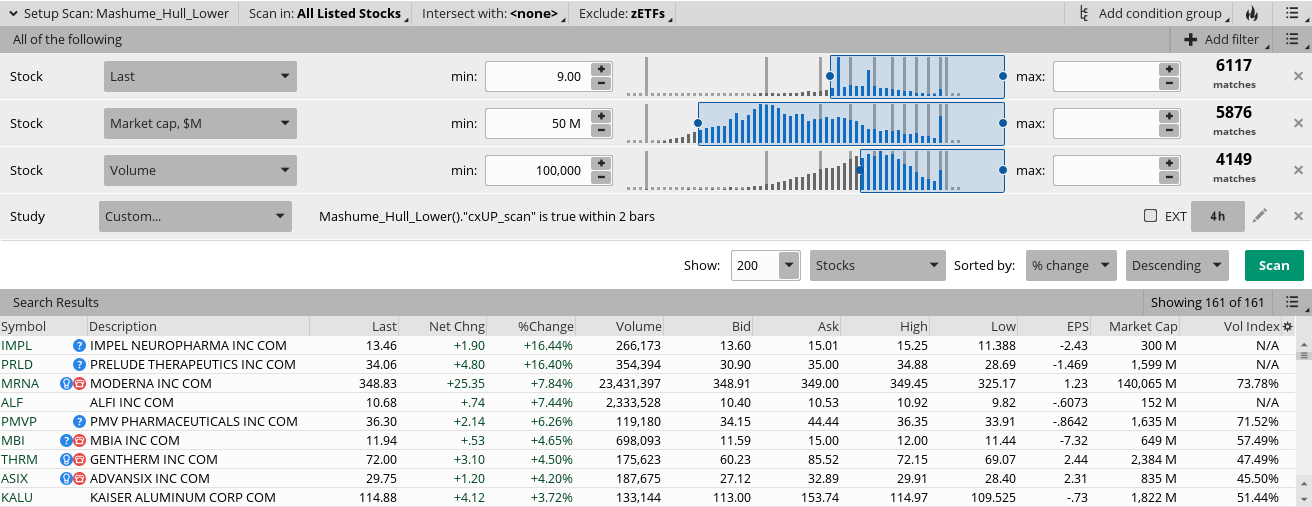

To Scan For Lower Study Divergences

Part One --

Load Shared Link: http://tos.mx/11zv4QA Save the study under the name: Mashume_Hull_Lower. (if you skip this part the scanner in part two will not work)

Click here for --> Easiest way to load shared links

Part Two --

Import the link for the scanner:

Shared Link: http://tos.mx/xbNexZB

It goes without saying, but I will say it anyway ... No trade should ever be entered into based on one indicator or one time frame

... No trade should ever be entered into based on one indicator or one time frame

Read more: Basic Tenets Of A Good Strategy

Part One --

Load Shared Link: http://tos.mx/11zv4QA Save the study under the name: Mashume_Hull_Lower. (if you skip this part the scanner in part two will not work)

Click here for --> Easiest way to load shared links

Part Two --

Import the link for the scanner:

Shared Link: http://tos.mx/xbNexZB

It goes without saying, but I will say it anyway

Read more: Basic Tenets Of A Good Strategy

NewBeginnings

New member

Thank you. Is working now.To Scan For Lower Study Divergences

Part One --

Load Shared Link: http://tos.mx/11zv4QA Save the study under the name: Mashume_Hull_Lower. (if you skip this part the scanner in part two will not work)

Click here for --> Easiest way to load shared links

Part Two --

Import the link for the scanner:

Shared Link: http://tos.mx/xbNexZB

It goes without saying, but I will say it anyway... No trade should ever be entered into based on one indicator or one time frame

Read more: Basic Tenets Of A Good Strategy

There are a bunch of scans scattered around, but I don't have off the top of my head. Sorry. You can find some good threads about how to use studies in scans here abouts somewhere too.@mashume Do you have a script for scanning for the sell and buy signals/point at which the arrows are plotted please?

-mashume

Thanks for your prompt reply. My question was specifically about concavity. None of the scans I have come across specifically picks out the buy/sell signals.There are a bunch of scans scattered around, but I don't have off the top of my head. Sorry. You can find some good threads about how to use studies in scans here abouts somewhere too.

-mashume

@MerryDay Thank you - that's the missing piece I was looking for.

@BenTen is there any easier way for when setting up a new Usethinkscript thread that all posts can be more ORGANIZED and in CHRONOLOGICAL ORDER so as to not confuse people that are not experts and have all posts that have SCRIPTS and LINKS with MULTIPLE VERSIONS again MORE ORGANIZED AND IN ORDER so as to research, learn and experience this sites content a hell of a lot easier??

Thanks!!

@JPIMP The indicator in the 1st post is the most updated script of the basic indicator. Posters unselfishly add and modify many flavors of their take on indicators and then there are subsequent conversations as to the caveats to using those flavors. This flow is important so the different flavors need to be embedded where they are. The posts that follow are important to understanding how to use them.

Whether using indicators from this forum or found elsewhere, it is important to read everything you can about the indicator. If after reading the threads, you are still confused. You can plug and play the different versions. There is no better way to learn more about how and what an indicator does than by using it.

Last edited:

TY_Joe

New member

Need some help with Hull Watchlist column, New to coding, I have put together a codes from mashuame's Hull MA. I want Ma_Max, Ma_min or Turning point and concavity to show on watchlist column. I'm getting yellow color only on watchlist. Thank you in Advance.

input price = HL2;

input HMA_Length = 21;

input lookback = 2;

def HMA = HullMovingAvg(price = price, length = HMA_Length);

def delta = HMA[1] - HMA[lookback + 1];

def delta_per_bar = delta / lookback;

def next_bar = HMA[1] + delta_per_bar;

def concavity = if HMA > next_bar then 1 else -1;

def turning_point = if concavity[-1] != concavity then HMA else Double.NaN;

def MA_Min = hMA[-1] > hMA and hMA < hMA[1];

def MA_Max = hMA[-1] < hMA and hMA > hMA[1];

plot buy = if turning_point and concavity == -1 then low else double.nan;

buy.SetDefaultColor(Color.CYAN);

plot sell = if turning_point and concavity == 1 then high else double.nan;

def Bulltrigger = Ma_min;

def BearTrigger = Ma_Max;

AssignBackgroundColor(if buy then color.YELLOW else if sell then color.LIGHT_RED else color.WHITE);

AddLabel(yes, if Bulltrigger then " " else if BearTrigger then "

" else if BearTrigger then " " else " - ", if BearTrigger then Color.dark_red else if Bulltrigger then Color.dark_GREEN else Color.ORANGE);

" else " - ", if BearTrigger then Color.dark_red else if Bulltrigger then Color.dark_GREEN else Color.ORANGE);

AssignBackgroundColor(color.light_ORANGE);

input price = HL2;

input HMA_Length = 21;

input lookback = 2;

def HMA = HullMovingAvg(price = price, length = HMA_Length);

def delta = HMA[1] - HMA[lookback + 1];

def delta_per_bar = delta / lookback;

def next_bar = HMA[1] + delta_per_bar;

def concavity = if HMA > next_bar then 1 else -1;

def turning_point = if concavity[-1] != concavity then HMA else Double.NaN;

def MA_Min = hMA[-1] > hMA and hMA < hMA[1];

def MA_Max = hMA[-1] < hMA and hMA > hMA[1];

plot buy = if turning_point and concavity == -1 then low else double.nan;

buy.SetDefaultColor(Color.CYAN);

plot sell = if turning_point and concavity == 1 then high else double.nan;

def Bulltrigger = Ma_min;

def BearTrigger = Ma_Max;

AssignBackgroundColor(if buy then color.YELLOW else if sell then color.LIGHT_RED else color.WHITE);

AddLabel(yes, if Bulltrigger then "

AssignBackgroundColor(color.light_ORANGE);

@TY_Joe Did you try loading this watchlist: https://usethinkscript.com/threads/...cavity-2nd-derivatives.1803/page-5#post-17554

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

-

-

-

Farey Sequence Weighted Moving Average For ThinkOrSwim

- Started by AlphaOptions

- Replies: 16

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1394

Online

Similar threads

-

-

-

-

Farey Sequence Weighted Moving Average For ThinkOrSwim

- Started by AlphaOptions

- Replies: 16

-

Similar threads

-

-

-

-

Farey Sequence Weighted Moving Average For ThinkOrSwim

- Started by AlphaOptions

- Replies: 16

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.