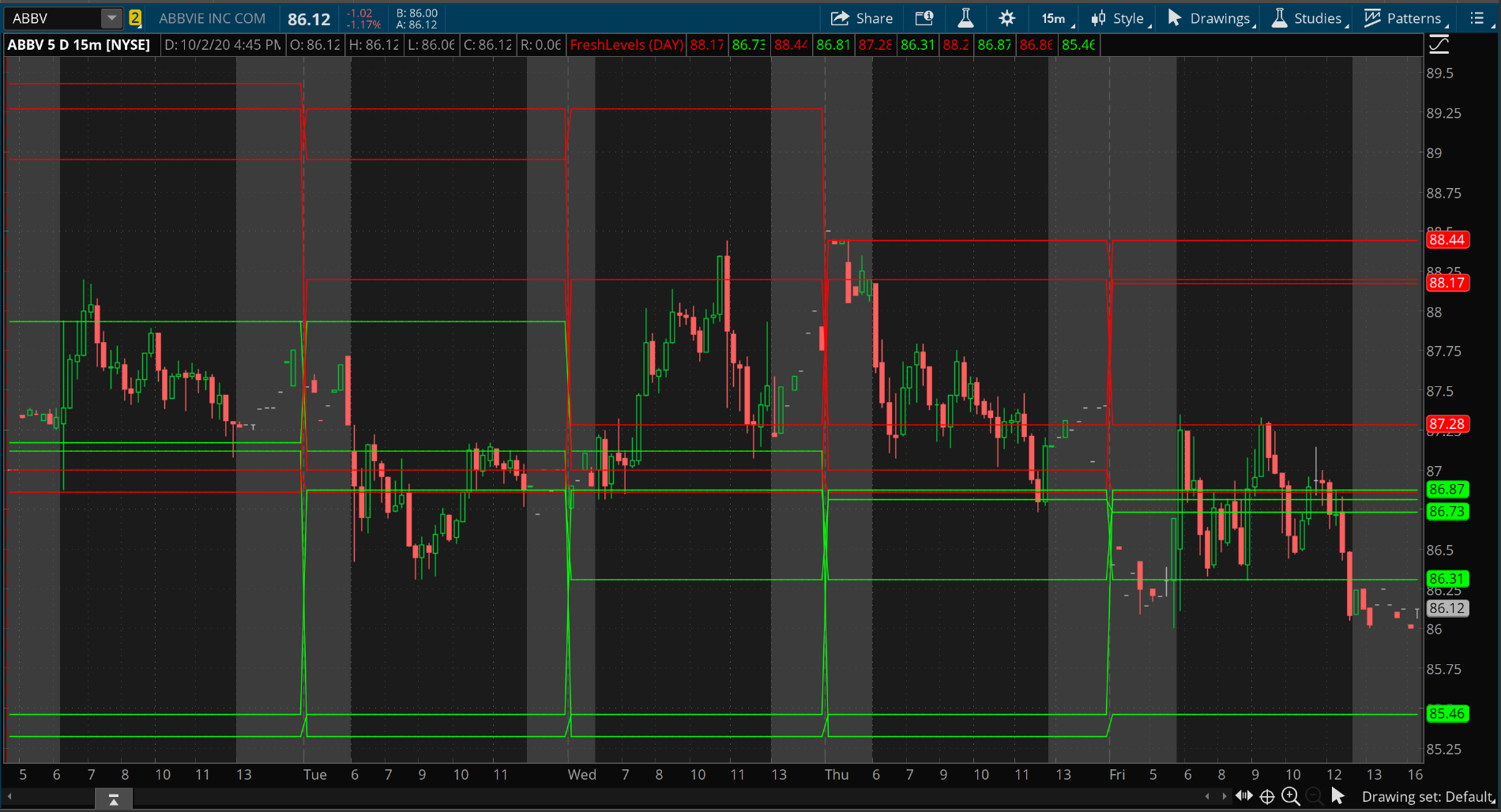

#Declare Hide_on_daily;

plot Data = close;#High and Lows per day for last 10 days on chart

# Put together by Horserider

input painthigh = 4;#Hint painthigh: 1=dots,2=dashes,3=squares,4=horizontal

def paintingStrategyhigh = if painthigh == 1 then PaintingStrategy.POINTS else if painthigh == 4 then PaintingStrategy.Horizontal else if painthigh == 3 then PaintingStrategy.SQUARES else PaintingStrategy.DASHES;

input paintlow = 4; #Hint paintlow: 1=dots,2=dashes,3=squares,4=horizontal

def paintingStrategylow = if paintlow == 1 then PaintingStrategy.POINTS else if paintlow == 2 then PaintingStrategy.DASHES else if paintlow == 3 then PaintingStrategy.SQUARES else PaintingStrategy.HORIZONTAL;

DefineGlobalColor("Global1", CreateColor(0, 0, 255));

#

input colorhigh = 7;#Hint colorhigh: 0=magenta,1=cyan,2=light-red,3=light_green,4=yellow,5=red,6=green,7=light_gray,8=gold,9=white

input colorlow = 7;#Hint colorlow: 0=magenta,1=cyan,2=light-red,3=light_green,4=yellow,5=red,6=green,7=light_gray,8=gold,9=white

input AggPeriod = AggregationPeriod.DAY;

rec high1 = if GetDay() == GetLastDay() then high(period = AggregationPeriod.DAY) else high1[1];

#rec high3 = if GetDay() == GetLastDay() then high(period = AggPeriod)[-3], 1) else high3[1];

plot h1 = high1;

h1.SetPaintingStrategy(paintingStrategyhigh);

h1.SetDefaultColor(GetColor(colorhigh));

rec high2 = if GetDay() == GetLastDay() - 1 then high(period = AggregationPeriod.DAY) else high2[1];

plot h2 = high2;

h2.SetPaintingStrategy(paintingStrategyhigh);

h2.SetDefaultColor(GetColor(colorhigh));

rec high3 = if GetDay() == GetLastDay() - 2 then high(period = AggregationPeriod.DAY) else high3[1];

plot h3 = high3;

h3.SetPaintingStrategy(paintingStrategyhigh);

h3.SetDefaultColor(GetColor(colorhigh));

rec high4 = if GetDay() == GetLastDay() - 3 then high(period = AggregationPeriod.DAY) else high4[1];

plot h4 = high4;

h4.SetPaintingStrategy(paintingStrategyhigh);

h4.SetDefaultColor(GetColor(colorhigh));

rec high5 = if GetDay() == GetLastDay() - 4 then high(period = AggregationPeriod.DAY) else high5[1];

plot h5 = high5;

h5.SetPaintingStrategy(paintingStrategyhigh);

h5.SetDefaultColor(GetColor(colorhigh));

rec high6 = if GetDay() == GetLastDay() - 5 then high(period = AggregationPeriod.DAY) else high6[1];

plot h6 = high6;

h6.SetPaintingStrategy(paintingStrategyhigh);

h6.SetDefaultColor(GetColor(colorhigh));

rec high7 = if GetDay() == GetLastDay() - 6 then high(period = AggregationPeriod.DAY) else high7[1];

plot h7 = high7;

h7.SetPaintingStrategy(paintingStrategyhigh);

h7.SetDefaultColor(GetColor(colorhigh));

rec high8 = if GetDay() == GetLastDay() - 7 then high(period = AggregationPeriod.DAY) else high8[1];

plot h8 = high8;

h8.SetPaintingStrategy(paintingStrategyhigh);

h8.SetDefaultColor(GetColor(colorhigh));

rec high9 = if GetDay() == GetLastDay() - 8 then high(period = AggregationPeriod.DAY) else high9[1];

plot h9 = high9;

h9.SetPaintingStrategy(paintingStrategyhigh);

h9.SetDefaultColor(GetColor(colorhigh));

rec high10 = if GetDay() == GetLastDay() - 9 then high(period = AggregationPeriod.DAY) else high10[1];

plot h10 = high10;

h10.SetPaintingStrategy(paintingStrategyhigh);

h10.SetDefaultColor(GetColor(colorhigh));

rec high11 = if GetDay() == GetLastDay() - 10 then high(period = AggregationPeriod.DAY) else high11[1];

plot h11 = high11;

h11.SetPaintingStrategy(paintingStrategyhigh);

h11.SetDefaultColor(GetColor(colorhigh));

rec high12 = if GetDay() == GetLastDay() - 11 then high(period = AggregationPeriod.DAY) else high12[1];

plot h12 = high12;

h12.SetPaintingStrategy(paintingStrategyhigh);

h12.SetDefaultColor(GetColor(colorhigh));

rec high13 = if GetDay() == GetLastDay() - 12 then high(period = AggregationPeriod.DAY) else high13[1];

plot h13 = high13;

h13.SetPaintingStrategy(paintingStrategyhigh);

h13.SetDefaultColor(GetColor(colorhigh));

rec high14 = if GetDay() == GetLastDay() - 13 then high(period = AggregationPeriod.DAY) else high14[1];

plot h14 = high14;

h14.SetPaintingStrategy(paintingStrategyhigh);

h14.SetDefaultColor(GetColor(colorhigh));

rec high15 = if GetDay() == GetLastDay() - 14 then high(period = AggregationPeriod.DAY) else high15[1];

plot h15 = high15;

h15.SetPaintingStrategy(paintingStrategyhigh);

h15.SetDefaultColor(GetColor(colorhigh));

rec low1 = if GetDay() == GetLastDay() then low(period = AggregationPeriod.DAY) else low1[1];

plot l1 = low1;

l1.SetPaintingStrategy(paintingStrategylow);

l1.SetDefaultColor(GetColor(colorlow));

rec low2 = if GetDay() == GetLastDay() - 1 then low(period = AggregationPeriod.DAY) else low2[1];

plot l2 = low2;

l2.SetPaintingStrategy(paintingStrategylow);

l2.SetDefaultColor(GetColor(colorlow));

rec low3 = if GetDay() == GetLastDay() - 2 then low(period = AggregationPeriod.DAY) else low3[1];

plot l3 = low3;

l3.SetPaintingStrategy(paintingStrategylow);

l3.SetDefaultColor(GetColor(colorlow));

rec low4 = if GetDay() == GetLastDay() - 3 then low(period = AggregationPeriod.DAY) else low4[1];

plot l4 = low4;

l4.SetPaintingStrategy(paintingStrategylow);

l4.SetDefaultColor(GetColor(colorlow));

rec low5 = if GetDay() == GetLastDay() - 4 then low(period = AggregationPeriod.DAY) else low5[1];

plot l5 = low5;

l5.SetPaintingStrategy(paintingStrategylow);

l5.SetDefaultColor(GetColor(colorlow));

rec low6 = if GetDay() == GetLastDay() - 5 then low(period = AggregationPeriod.DAY) else low5[1];

plot l6 = low6;

l6.SetPaintingStrategy(paintingStrategylow);

l6.SetDefaultColor(GetColor(colorlow));

rec low7 = if GetDay() == GetLastDay() - 6 then low(period = AggregationPeriod.DAY) else low7[1];

plot l7 = low7;

l7.SetPaintingStrategy(paintingStrategylow);

l7.SetDefaultColor(GetColor(colorlow));

rec low8 = if GetDay() == GetLastDay() - 7 then low(period = AggregationPeriod.DAY) else low8[1];

plot l8 = low8;

l8.SetPaintingStrategy(paintingStrategylow);

l8.SetDefaultColor(GetColor(colorlow));

rec low9 = if GetDay() == GetLastDay() - 8 then low(period = AggregationPeriod.DAY) else low9[1];

plot l9 = low9;

l9.SetPaintingStrategy(paintingStrategylow);

l9.SetDefaultColor(GetColor(colorlow));

rec low10 = if GetDay() == GetLastDay() - 9 then low(period = AggregationPeriod.DAY) else low10[1];

plot l10 = low10;

l10.SetPaintingStrategy(paintingStrategylow);

l10.SetDefaultColor(GetColor(colorlow));

rec low11 = if GetDay() == GetLastDay() - 10 then low(period = AggregationPeriod.DAY) else low11[1];

plot l11 = low11;

l11.SetPaintingStrategy(paintingStrategylow);

l11.SetDefaultColor(GetColor(colorlow));

rec low12 = if GetDay() == GetLastDay() - 11 then low(period = AggregationPeriod.DAY) else low12[1];

plot l12 = low12;

l12.SetPaintingStrategy(paintingStrategylow);

l12.SetDefaultColor(GetColor(colorlow));

rec low13 = if GetDay() == GetLastDay() - 12 then low(period = AggregationPeriod.DAY) else low13[1];

plot l13 = low13;

l13.SetPaintingStrategy(paintingStrategylow);

l13.SetDefaultColor(GetColor(colorlow));

rec low14 = if GetDay() == GetLastDay() - 13 then low(period = AggregationPeriod.DAY) else low14[1];

plot l14 = low14;

l14.SetPaintingStrategy(paintingStrategylow);

l14.SetDefaultColor(GetColor(colorlow));

rec low15 = if GetDay() == GetLastDay() - 14 then low(period = AggregationPeriod.DAY) else low15[1];

plot l15 = low15;

l15.SetPaintingStrategy(paintingStrategylow);

l15.SetDefaultColor(GetColor(colorlow));