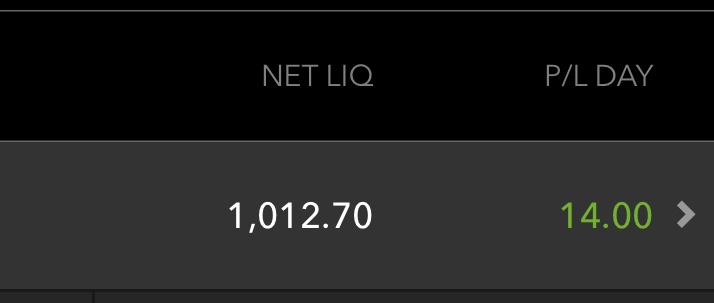

The paper trading testing phase of this strategy has gone very well so far and it is now time for the final stage of testing. After months of backtesting, watching, and alerting, I will now run a real account using the strategy I've developed. I have started an account with $1000. I still plan on tracking and calling out all plays that I see on the market, but I’ll also be playing some of the alerts as well. Continuing with the public record, I’ll put an asterisk by the ones my money is behind on this thread.

https://usethinkscript.com/threads/steves-flow-data-recommendations-for-october-2019.725/

The plays that I decide to enter aren’t “better” per say than the others on any basis of security or consistency, but just better fit my account size. As is usually the case, your account size is your biggest limiting factor.

I have a few goals for this final stage of testing. First, keeping a strict risk management with every position in mind. With that, even a bad loss in one position will never tank my account. Second, I have a strong preference on locking in small profits then risking my capital for more profits. There are so many plays available every day that it is simply not worth staying in a losing position. You can never lose if you have money to play another day. Third, I will continue to work on keeping a consistent log and improving the strategy. I work a full time job and may not be able to post every trade as they come in every day. Some days I’ll be busy at work and may only be able to post in the morning. Others, I'll be able to note when I enter and exit all of the plays. I’ll try my best to post the plays I’m watching every day if not during market hours, after market hours. My work in the market is my top priority. I am committed to improving my trading and working on my strategies. In addition, over the weekends I’ll post a recap of the plays I entered that I find noteworthy or interesting.

The most important thing to me is to develop and run a successful trading system for myself and to help other traders make profit. I will work as hard and as long as I have to in order to make that happen.

https://usethinkscript.com/threads/steves-flow-data-recommendations-for-october-2019.725/

The plays that I decide to enter aren’t “better” per say than the others on any basis of security or consistency, but just better fit my account size. As is usually the case, your account size is your biggest limiting factor.

I have a few goals for this final stage of testing. First, keeping a strict risk management with every position in mind. With that, even a bad loss in one position will never tank my account. Second, I have a strong preference on locking in small profits then risking my capital for more profits. There are so many plays available every day that it is simply not worth staying in a losing position. You can never lose if you have money to play another day. Third, I will continue to work on keeping a consistent log and improving the strategy. I work a full time job and may not be able to post every trade as they come in every day. Some days I’ll be busy at work and may only be able to post in the morning. Others, I'll be able to note when I enter and exit all of the plays. I’ll try my best to post the plays I’m watching every day if not during market hours, after market hours. My work in the market is my top priority. I am committed to improving my trading and working on my strategies. In addition, over the weekends I’ll post a recap of the plays I entered that I find noteworthy or interesting.

The most important thing to me is to develop and run a successful trading system for myself and to help other traders make profit. I will work as hard and as long as I have to in order to make that happen.

Last edited by a moderator: