Fisher Transform For ThinkOrSwim

Hey! So this is a two part question.

I have found this indicator "Fisher Transform" to be very useful in certain circumstances.

1. I wanted to know if the code only initiates the green arrow upon the completion of the NEXT bar.

I see the ftonebarback but am not 100% on the situation.

2. How I can get this to work in a scan and in a watchlist. I have been trying for the scan:

Fisher_Transform(). "FSTrendIndicatorUp" is true

but that yields NO results. If I use the bigpinkup instead, it does catch some symbols, but the pink arrow lags much more than the green arrow. By then the move is underway.

I've tried using a Squeeze indicator for the watchlist and substituting the fisher transform information in, but I get an error saying the function is too complex. So I tried removing the buy zone stuff but then it says that I need to have at least one plot...

I'm kind a lost. If anyone could at least steer me in a helpful direction, I would be very grateful!

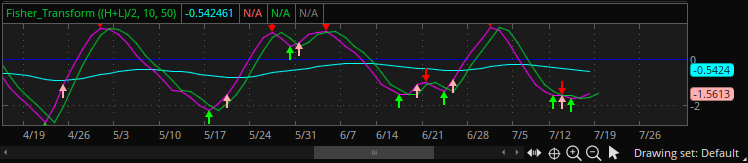

This is a picture of the Indicator if this helps

Hey! So this is a two part question.

I have found this indicator "Fisher Transform" to be very useful in certain circumstances.

Code:

declare lower;

input price = hl2;

input length = 10;

def maxHigh = Highest(price, length);

def minLow = Lowest(price, length);

def range = maxHigh - minLow;

rec value = if IsNaN(price)

then Double.NaN

else if IsNaN(range)

then value[1]

else if range == 0

then 0

else 0.66 * ((price - minLow) / range - 0.5) + 0.67 * value[1];

def truncValue = if value > 0.99 then 0.999 else if value < -0.99 then -0.999 else value;

rec fish = 0.5 * (Log((1 + truncValue) / (1 - truncValue)) + fish[1]);

#

# TD Ameritrade IP Company, Inc. (c) 2007-2019

#

plot FTOneBarBack = fish[1];

plot FT = fish;

plot ZeroLine = 0;

FTOneBarBack.SetDefaultColor(color.yellow);

FT.SetDefaultColor(GetColor(8));

ZeroLine.SetDefaultColor(GetColor(5));

input emalength = 50;

plot ema2 = ExpAverage(fish, emalength);

def bullish = if FT > ema2 then 1 else 0;

def bearish = if FT < ema2 then 1 else 0;

#####

#

# FisherTransformer Trend Up Indicator (Big Pink)

#

#

# TD Ameritrade IP Company, Inc. (c) 2017-2019

#

##### (2) Fisher Transformer setup for "FS17x5"(Big Pink) Up or Down

#Fisher_Transform_FW_Code().Scan for "FS17x5"

#The FT Code:

# Fisher Transform With First Wave (David Elliott) Signal Additions

# V01.04.2015

#

### START: FisherTransformer Initialization: Stochastic and SOAP

#

def FisherLen = 5;

def ObOs = 1.2;

def hideSoap = yes;

def h = high;

def l = low;

def c = close;

def CountChg;

def SOAPCount;

def BPmaxHigh = Highest(h, FisherLen);

def BPminLow = Lowest(l, FisherLen);

def k1v = Max(-100, Min(100, (StochasticFull(KPeriod = 5, slowing_period = 3))) - 50) / 50.01;

def k2v = Max(-100, Min(100, (StochasticFull(KPeriod = 8, slowing_period = 5))) - 50) / 50.01;

def k3v = Max(-100, Min(100, (StochasticFull(KPeriod = 17, slowing_period = 5))) - 50) / 50.01;

def R1v = Max(-100, Min(100, reference RSI(2)) - 50) / 50.01;

if k2v > 0

{

CountChg = if k1v <= k2v and k1v[1] > k2v[1] and k2v[1] > 0 then -1 else 0;

SOAPCount = CompoundValue(1, Min (0, SOAPCount[1]) + CountChg, 0);

}

else

{

CountChg = if k1v >= k2v and k1v[1] < k2v[1] and k2v[1] <= 0 then 1 else 0;

SOAPCount = CompoundValue (1, Max (0, SOAPCount[1]) + CountChg, 0);

}

def fish1 = CompoundValue(1, 0.5 * (Log((1 + k1v) / (1 - k1v)) + fish1[1]), 0);

def fish2 = CompoundValue(1, 0.5 * (Log((1 + k2v) / (1 - k2v)) + fish2[1]), 0);

def fish3 = CompoundValue(1, 0.5 * (Log((1 + k3v) / (1 - k3v)) + fish3[1]), 0);

def fish4 = CompoundValue(1, 0.5 * (Log((1 + R1v) / (1 - R1v)) + fish4[1]), 0);

def BPvalue = if BPmaxHigh - BPminLow == 0

then 0

else 0.66 * ((close - minLow) / (maxHigh - minLow) - 0.5) + 0.67 * value[1];

def BPtruncValue = if BPvalue > 0.99

then 0.999

else if BPvalue < -0.99

then -0.999

else BPvalue;

def BPfish = 0.5 * (Log((1 + BPtruncValue) / (1 - BPtruncValue)) + fish[1]);

#

### END: FisherTransformer Initialization: Stochastic and SOAP

#

### START:(2a) Fisher Transformer "FS17x5u" (Big Pink Up)is true for trade entry

#

Plot BigPinkup = if Sign (fish3 - fish3[1]) > Sign (fish3[1] - fish3[2]) then FT else Double.NaN;

BigPinkup.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BigPinkup.AssignValueColor(Color.pink);

Def BuySignal = if Sign (fish3 - fish3[1]) > Sign (fish3[1] - fish3[2])then 1 else 0;

#

# FisherTransform Trend Up Indicator

#

plot FSTrendIndicatorUp = if FT[-1] > FT and FT < FT[1] then FT else Double.NaN;

FSTrendIndicatorUp.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

FSTrendIndicatorUp.AssignValueColor(Color.Green);

#

# FisherTransform Trend Down Indicator

#

plot FSTrendIndicatorDown = if FT[-1] < FT and FT > FT[1] then FT else Double.NaN;

FSTrendIndicatorDown.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

FSTrendIndicatorDown.AssignValueColor(Color.RED);

#END CODE1. I wanted to know if the code only initiates the green arrow upon the completion of the NEXT bar.

I see the ftonebarback but am not 100% on the situation.

2. How I can get this to work in a scan and in a watchlist. I have been trying for the scan:

Fisher_Transform(). "FSTrendIndicatorUp" is true

but that yields NO results. If I use the bigpinkup instead, it does catch some symbols, but the pink arrow lags much more than the green arrow. By then the move is underway.

I've tried using a Squeeze indicator for the watchlist and substituting the fisher transform information in, but I get an error saying the function is too complex. So I tried removing the buy zone stuff but then it says that I need to have at least one plot...

Code:

def sqz = !TTM_Squeeze().SqueezeAlert;

def direction = TTM_Squeeze()>TTM_Squeeze()[1];

def count = if sqz and !sqz[1] then 1 else count[1]+1;

def isFired = if !sqz and sqz[1] then 1 else 0;

def firedCount = if isFired then 1 else firedCount[1]+1;

def firedDirection = if isFired then direction else firedDirection[1];

def sumIsFired = sum(isFired,5);

def isFiredDir = sumIsFired && firedDirection;

# look for close buy zone

def ema8 = reference movAvgExponential(length=8);

def ema21 = reference movAvgExponential(length=21);

def currPrice = close();

def highVal = Max(ema8, ema21);

def lowVal = Min(ema8, ema21);

def inBuyZone = currPrice >= lowVal && currPrice <= highVal;

def sqzBuy = sqz && inBuyZone;

def sqzNoBuy = sqz && !inBuyZone;

addLabel(yes, Concat(if sqzBuy then "Buy " else "", if sqz then "" + count else if sumIsFired then “” + firedCount + if firedDirection then ” Long” else ” Short” else “ ”), if sqzBuy then color.black else color.black);

AssignBackgroundColor(if sqzNoBuy then color.red else if sqzBuy then color.cyan else if sumIsFired then color.green else color.black);I'm kind a lost. If anyone could at least steer me in a helpful direction, I would be very grateful!

This is a picture of the Indicator if this helps

Last edited by a moderator: