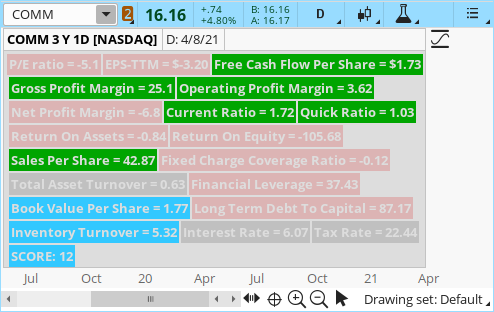

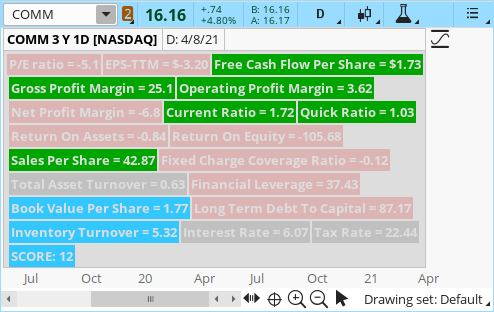

Thank you for this indicator of fundamental metrics. I can see it being very useful. Yet I am wondering if there is a way to plot each of these as a lower study, then you would easily be able to back test the metrics on a chart?This indicator displays fundamental data of a stock, including financial info such as Free Cash Flow, Profit Margin, etc., on your chart. Use on a Daily Chart. Useful for anyone interested in fundamental stock research.

Ruby:#Fundamental Data Labels _Mobius 4/26/20 (found on OneNote) # # @MerryDay revised 4/21: # my interpretation of positive/negative values; should be modified to meet your strategy # then calculated an overall weighted score based on: # https://tradestation.tradingappstore.com/products/FundamentalScore/document/Fundamental_Score.pdf # and other information found on the web declare lower; declare hide_on_intraday; input show_labels = yes ; input show_summaries = no ; DefineGlobalColor("Pre_Cyan", CreateColor(50, 200, 255)) ; DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ; DefineGlobalColor("LabelRed", CreateColor(225, 0, 0)) ; DefineGlobalColor("Violet", CreateColor (200, 125, 255)) ; DefineGlobalColor("GrayGreen", CreateColor(155, 167, 76)) ; DefineGlobalColor("LitePink", CreateColor (220, 180, 180)) ; DefineGlobalColor("neutral", color.light_gray) ; def fp = FiscalPeriod.YEAR; def EPS = EarningsPerShareTTM(fiscalPeriod = fp); def PE = round(close / EPS,1); AddLabel(show_labels and PE, "P/E ratio = " + Round(PE, 2), if PE < 0 then GlobalColor("LitePink") else if PE < 20 then GlobalColor("LabelGreen") else if PE < 40 then GlobalColor("GrayGreen") else GlobalColor("Pre_Cyan")); def EarnPerShare = if IsNaN(EarningsPerShareTTM()) then EarnPerShare[1] else EarningsPerShareTTM(); AddLabel(show_labels and EarnPerShare, "EPS-TTM = " + AsDollars(EarnPerShare), if EarnPerShare > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def FreeCashFlowPerSh = if isNaN(FreeCashFlowPerShare()) then FreeCashFlowPerSh[1] else FreeCashFlowPerShare(); AddLabel(show_labels and FreeCashFlowPerSh, "Free Cash Flow Per Share = " + AsDollars(FreeCashFlowPerSh), if FreeCashFlowPerSh > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_EarnCash = if PE <0 and FreeCashFlowPerSh < 0 and EarnPerShare < 0 then 0 else 5; def Gross_Profit_Margin = if IsNaN(GrossProfitMargin()) then Gross_Profit_Margin[1] else GrossProfitMargin(); AddLabel(show_labels and Gross_Profit_Margin, "Gross Profit Margin = " + Round(Gross_Profit_Margin, 2), if Gross_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Operating_Profit_Margin = if IsNaN(OperatingProfitMargin()) then Operating_Profit_Margin[1] else OperatingProfitMargin(); AddLabel(show_labels and Operating_Profit_Margin, "Operating Profit Margin = " + Round(Operating_Profit_Margin, 2), if Operating_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Net_Profit_Margin = if IsNaN(NetProfitMargin()) then Net_Profit_Margin[1] else NetProfitMargin(); AddLabel(show_labels and Net_Profit_Margin, "Net Profit Margin = " + Round(Net_Profit_Margin, 2), if Net_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Profits = if Gross_Profit_Margin>0 or Net_Profit_Margin>0 or Operating_Profit_Margin > 0 then 3 else 0 ; def CurRatio = if IsNaN(CurrentRatio()) then CurRatio[1] else CurrentRatio(); AddLabel(show_labels and CurRatio, "Current Ratio = " + Round(CurRatio, 2), if CurRatio > 2 then GlobalColor("GrayGreen") else if CurRatio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Quick_Ratio = if IsNaN(QuickRatio()) then Quick_Ratio[1] else QuickRatio(); AddLabel(show_labels and Quick_Ratio, "Quick Ratio = " + Round(Quick_Ratio, 2), if Quick_Ratio > 2 then GlobalColor("GrayGreen") else if Quick_Ratio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Ratios = if Quick_Ratio >= 1 or CurRatio >= 1 then 3 else 0; def Return_On_Assets = if IsNaN(ReturnOnAssets()) then Return_On_Assets[1] else ReturnOnAssets(); AddLabel(show_labels and Return_On_Assets, "Return On Assets = " + Round(Return_On_Assets), if Return_On_Assets >= 15 then GlobalColor("Pre_Cyan") else if Return_On_Assets >= 10 then GlobalColor("LabelGreen") else if Return_On_Assets > 0 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def Return_On_Equity = if IsNaN(ReturnOnEquity()) then Return_On_Equity[1] else ReturnOnEquity(); AddLabel(show_labels and Return_On_Equity, "Return On Equity = " + Round(Return_On_Equity), if Return_On_Equity >= 15 then GlobalColor("Pre_Cyan") else if Return_On_Equity >= 10 then GlobalColor("LabelGreen") else if Return_On_Equity > 0 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def score_Returns = if Return_On_Equity >= 10 or Return_On_Assets >=10 then 1 else 0 ; def Sales_Per_Share = if IsNaN(SalesPerShare()) then Sales_Per_Share[1] else SalesPerShare(); AddLabel(show_labels and Sales_Per_Share, "Sales Per Share = " + Round(Sales_Per_Share, 2), if Sales_Per_Share > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Sales_Per_Share = if Sales_Per_Share > 0 then 1 else 0; def FixChgCovRatio = if IsNaN(FixedChargeCoverageRatio()) then FixChgCovRatio[1] else FixedChargeCoverageRatio(); AddLabel(show_labels and FixChgCovRatio, "Fixed Charge Coverage Ratio = " + Round(FixChgCovRatio, 2), if FixChgCovRatio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Total_Asset_Turnover = if IsNaN(TotalAssetTurnover()) then Total_Asset_Turnover[1] else TotalAssetTurnover(); AddLabel(show_labels and Total_Asset_Turnover, "Total Asset Turnover = " + Round(Total_Asset_Turnover, 2), if Total_Asset_Turnover > 1 then GlobalColor("LabelGreen") else GlobalColor("neutral")); def FinLev = if IsNaN(FinancialLeverage()) then FinLev[1] else FinancialLeverage(); AddLabel(show_labels and FinLev, "Financial Leverage = " + Round(FinLev, 2), if FinLev > 0 and FinLev < 2 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_FinLev = if FinLev < 2 then 1 else 0; def BookValue = if IsNaN(BookValuePerShare()) then BookValue[1] else BookValuePerShare(); AddLabel(show_labels and BookValue, "Book Value Per Share = " + Round(BookValue), if BookValue < 2 then GlobalColor("Pre_Cyan") else if BookValue < 3 then GlobalColor("LabelGreen") else GlobalColor("neutral")); def Long_Term_Debt_To_Capital = if IsNaN(LongTermDebtToCapital()) then Long_Term_Debt_To_Capital[1] else LongTermDebtToCapital(); AddLabel(show_labels and Long_Term_Debt_To_Capital, "Long Term Debt To Capital = " + Round(Long_Term_Debt_To_Capital, 2), if Long_Term_Debt_To_Capital < 5 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Long_Term_Debt_To_Capital = if Long_Term_Debt_To_Capital < 5 then 1 else 0; def Inventory_Turnover = if IsNaN(InventoryTurnover()) then Inventory_Turnover[1] else InventoryTurnover(); AddLabel(show_labels and Inventory_Turnover, "Inventory Turnover = " + Round(Inventory_Turnover, 2), if Inventory_Turnover < 5 then GlobalColor("LitePink") else if Inventory_Turnover < 10 then GlobalColor("Pre_Cyan") else if Inventory_Turnover < 15 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def DivPayout = if IsNaN(DividendPayout()) then DivPayout[1] else DividendPayout(); AddLabel(show_labels and DivPayout, "Dividend Payout = " + AsDollars(DivPayout), GlobalColor("neutral")); def DivPerShare = if IsNaN(DividendsPerShareTTM()) then DivPerShare[1] else DividendsPerShareTTM(); AddLabel(show_labels and DivPerShare, "Dividend Per Share = " + AsDollars(DivPerShare), GlobalColor("neutral")); def Interest_Rate = if IsNaN(InterestRate()) then Interest_Rate[1] else InterestRate(); AddLabel(show_labels and Interest_Rate, "Interest Rate = " + Round(Interest_Rate, 2), GlobalColor("neutral")); def Tax_Rate = if IsNaN(TaxRate()) then Tax_Rate[1] else TaxRate(); AddLabel(show_labels and Tax_Rate, "Tax Rate = " + Round(Tax_Rate, 2), GlobalColor("neutral")); plot score = score_Returns + score_EarnCash + score_ratios + score_Profits + score_FinLev + score_Sales_Per_Share + score_Long_Term_Debt_To_Capital; AddLabel(show_summaries, "SCORE: " + score, if score >= 12 then GlobalColor("Pre_Cyan") else if score >= 10 then GlobalColor("LabelGreen") else if score >= 8 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); score.hide();

Link to shared study: http://tos.mx/zF4if7t

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Financial Fundamentals Labels for ThinkorSwim

- Thread starter merryDay

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

crazyturtle

New member

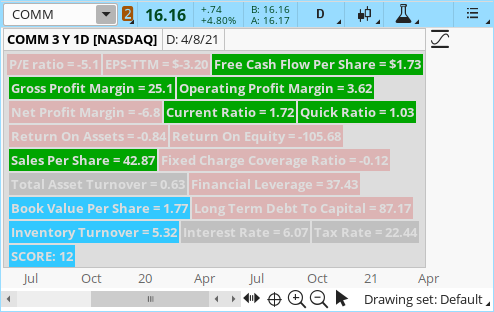

Any way to add the Short Interest?This indicator displays fundamental data of a stock, including financial info such as Free Cash Flow, Profit Margin, etc., on your chart. Use on a Daily Chart. Useful for anyone interested in fundamental stock research.

Ruby:#Fundamental Data Labels _Mobius 4/26/20 (found on OneNote) # # @MerryDay revised 4/21: # my interpretation of positive/negative values; should be modified to meet your strategy # then calculated an overall weighted score based on: # https://tradestation.tradingappstore.com/products/FundamentalScore/document/Fundamental_Score.pdf # and other information found on the web declare lower; declare hide_on_intraday; input show_labels = yes ; input show_summaries = no ; DefineGlobalColor("Pre_Cyan", CreateColor(50, 200, 255)) ; DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ; DefineGlobalColor("LabelRed", CreateColor(225, 0, 0)) ; DefineGlobalColor("Violet", CreateColor (200, 125, 255)) ; DefineGlobalColor("GrayGreen", CreateColor(155, 167, 76)) ; DefineGlobalColor("LitePink", CreateColor (220, 180, 180)) ; DefineGlobalColor("neutral", color.light_gray) ; def fp = FiscalPeriod.YEAR; def EPS = EarningsPerShareTTM(fiscalPeriod = fp); def PE = round(close / EPS,1); AddLabel(show_labels and PE, "P/E ratio = " + Round(PE, 2), if PE < 0 then GlobalColor("LitePink") else if PE < 20 then GlobalColor("LabelGreen") else if PE < 40 then GlobalColor("GrayGreen") else GlobalColor("Pre_Cyan")); def EarnPerShare = if IsNaN(EarningsPerShareTTM()) then EarnPerShare[1] else EarningsPerShareTTM(); AddLabel(show_labels and EarnPerShare, "EPS-TTM = " + AsDollars(EarnPerShare), if EarnPerShare > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def FreeCashFlowPerSh = if isNaN(FreeCashFlowPerShare()) then FreeCashFlowPerSh[1] else FreeCashFlowPerShare(); AddLabel(show_labels and FreeCashFlowPerSh, "Free Cash Flow Per Share = " + AsDollars(FreeCashFlowPerSh), if FreeCashFlowPerSh > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_EarnCash = if PE <0 and FreeCashFlowPerSh < 0 and EarnPerShare < 0 then 0 else 5; def Gross_Profit_Margin = if IsNaN(GrossProfitMargin()) then Gross_Profit_Margin[1] else GrossProfitMargin(); AddLabel(show_labels and Gross_Profit_Margin, "Gross Profit Margin = " + Round(Gross_Profit_Margin, 2), if Gross_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Operating_Profit_Margin = if IsNaN(OperatingProfitMargin()) then Operating_Profit_Margin[1] else OperatingProfitMargin(); AddLabel(show_labels and Operating_Profit_Margin, "Operating Profit Margin = " + Round(Operating_Profit_Margin, 2), if Operating_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Net_Profit_Margin = if IsNaN(NetProfitMargin()) then Net_Profit_Margin[1] else NetProfitMargin(); AddLabel(show_labels and Net_Profit_Margin, "Net Profit Margin = " + Round(Net_Profit_Margin, 2), if Net_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Profits = if Gross_Profit_Margin>0 or Net_Profit_Margin>0 or Operating_Profit_Margin > 0 then 3 else 0 ; def CurRatio = if IsNaN(CurrentRatio()) then CurRatio[1] else CurrentRatio(); AddLabel(show_labels and CurRatio, "Current Ratio = " + Round(CurRatio, 2), if CurRatio > 2 then GlobalColor("GrayGreen") else if CurRatio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Quick_Ratio = if IsNaN(QuickRatio()) then Quick_Ratio[1] else QuickRatio(); AddLabel(show_labels and Quick_Ratio, "Quick Ratio = " + Round(Quick_Ratio, 2), if Quick_Ratio > 2 then GlobalColor("GrayGreen") else if Quick_Ratio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Ratios = if Quick_Ratio >= 1 or CurRatio >= 1 then 3 else 0; def Return_On_Assets = if IsNaN(ReturnOnAssets()) then Return_On_Assets[1] else ReturnOnAssets(); AddLabel(show_labels and Return_On_Assets, "Return On Assets = " + Round(Return_On_Assets), if Return_On_Assets >= 15 then GlobalColor("Pre_Cyan") else if Return_On_Assets >= 10 then GlobalColor("LabelGreen") else if Return_On_Assets > 0 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def Return_On_Equity = if IsNaN(ReturnOnEquity()) then Return_On_Equity[1] else ReturnOnEquity(); AddLabel(show_labels and Return_On_Equity, "Return On Equity = " + Round(Return_On_Equity), if Return_On_Equity >= 15 then GlobalColor("Pre_Cyan") else if Return_On_Equity >= 10 then GlobalColor("LabelGreen") else if Return_On_Equity > 0 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def score_Returns = if Return_On_Equity >= 10 or Return_On_Assets >=10 then 1 else 0 ; def Sales_Per_Share = if IsNaN(SalesPerShare()) then Sales_Per_Share[1] else SalesPerShare(); AddLabel(show_labels and Sales_Per_Share, "Sales Per Share = " + Round(Sales_Per_Share, 2), if Sales_Per_Share > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Sales_Per_Share = if Sales_Per_Share > 0 then 1 else 0; def FixChgCovRatio = if IsNaN(FixedChargeCoverageRatio()) then FixChgCovRatio[1] else FixedChargeCoverageRatio(); AddLabel(show_labels and FixChgCovRatio, "Fixed Charge Coverage Ratio = " + Round(FixChgCovRatio, 2), if FixChgCovRatio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Total_Asset_Turnover = if IsNaN(TotalAssetTurnover()) then Total_Asset_Turnover[1] else TotalAssetTurnover(); AddLabel(show_labels and Total_Asset_Turnover, "Total Asset Turnover = " + Round(Total_Asset_Turnover, 2), if Total_Asset_Turnover > 1 then GlobalColor("LabelGreen") else GlobalColor("neutral")); def FinLev = if IsNaN(FinancialLeverage()) then FinLev[1] else FinancialLeverage(); AddLabel(show_labels and FinLev, "Financial Leverage = " + Round(FinLev, 2), if FinLev > 0 and FinLev < 2 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_FinLev = if FinLev < 2 then 1 else 0; def BookValue = if IsNaN(BookValuePerShare()) then BookValue[1] else BookValuePerShare(); AddLabel(show_labels and BookValue, "Book Value Per Share = " + Round(BookValue), if BookValue < 2 then GlobalColor("Pre_Cyan") else if BookValue < 3 then GlobalColor("LabelGreen") else GlobalColor("neutral")); def Long_Term_Debt_To_Capital = if IsNaN(LongTermDebtToCapital()) then Long_Term_Debt_To_Capital[1] else LongTermDebtToCapital(); AddLabel(show_labels and Long_Term_Debt_To_Capital, "Long Term Debt To Capital = " + Round(Long_Term_Debt_To_Capital, 2), if Long_Term_Debt_To_Capital < 5 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Long_Term_Debt_To_Capital = if Long_Term_Debt_To_Capital < 5 then 1 else 0; def Inventory_Turnover = if IsNaN(InventoryTurnover()) then Inventory_Turnover[1] else InventoryTurnover(); AddLabel(show_labels and Inventory_Turnover, "Inventory Turnover = " + Round(Inventory_Turnover, 2), if Inventory_Turnover < 5 then GlobalColor("LitePink") else if Inventory_Turnover < 10 then GlobalColor("Pre_Cyan") else if Inventory_Turnover < 15 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def DivPayout = if IsNaN(DividendPayout()) then DivPayout[1] else DividendPayout(); AddLabel(show_labels and DivPayout, "Dividend Payout = " + AsDollars(DivPayout), GlobalColor("neutral")); def DivPerShare = if IsNaN(DividendsPerShareTTM()) then DivPerShare[1] else DividendsPerShareTTM(); AddLabel(show_labels and DivPerShare, "Dividend Per Share = " + AsDollars(DivPerShare), GlobalColor("neutral")); def Interest_Rate = if IsNaN(InterestRate()) then Interest_Rate[1] else InterestRate(); AddLabel(show_labels and Interest_Rate, "Interest Rate = " + Round(Interest_Rate, 2), GlobalColor("neutral")); def Tax_Rate = if IsNaN(TaxRate()) then Tax_Rate[1] else TaxRate(); AddLabel(show_labels and Tax_Rate, "Tax Rate = " + Round(Tax_Rate, 2), GlobalColor("neutral")); plot score = score_Returns + score_EarnCash + score_ratios + score_Profits + score_FinLev + score_Sales_Per_Share + score_Long_Term_Debt_To_Capital; AddLabel(show_summaries, "SCORE: " + score, if score >= 12 then GlobalColor("Pre_Cyan") else if score >= 10 then GlobalColor("LabelGreen") else if score >= 8 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); score.hide();

Link to shared study: http://tos.mx/zF4if7t

ApeX Predator

Well-known member

@crazyturtle Short Interest is not a fundamental, neither is provided by TD or anybody else, in realtime.

-S

-S

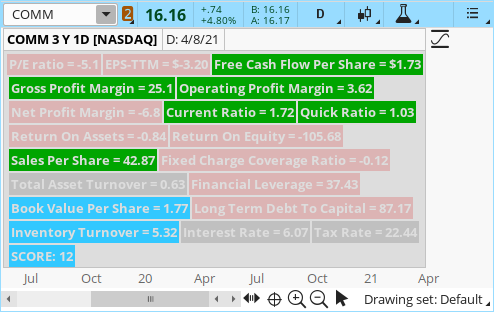

Can you please provide scripts for PEG data in thinkorswim. Basically , I want to include PEG label in the above codes. ThanksThis indicator displays fundamental data of a stock, including financial info such as Free Cash Flow, Profit Margin, etc., on your chart. Use on a Daily Chart. Useful for anyone interested in fundamental stock research.

Ruby:#Fundamental Data Labels _Mobius 4/26/20 (found on OneNote) # # @MerryDay revised 4/21: # my interpretation of positive/negative values; should be modified to meet your strategy # then calculated an overall weighted score based on: # https://tradestation.tradingappstore.com/products/FundamentalScore/document/Fundamental_Score.pdf # and other information found on the web declare lower; declare hide_on_intraday; input show_labels = yes ; input show_summaries = no ; DefineGlobalColor("Pre_Cyan", CreateColor(50, 200, 255)) ; DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ; DefineGlobalColor("LabelRed", CreateColor(225, 0, 0)) ; DefineGlobalColor("Violet", CreateColor (200, 125, 255)) ; DefineGlobalColor("GrayGreen", CreateColor(155, 167, 76)) ; DefineGlobalColor("LitePink", CreateColor (220, 180, 180)) ; DefineGlobalColor("neutral", color.light_gray) ; def fp = FiscalPeriod.YEAR; def EPS = EarningsPerShareTTM(fiscalPeriod = fp); def PE = round(close / EPS,1); AddLabel(show_labels and PE, "P/E ratio = " + Round(PE, 2), if PE < 0 then GlobalColor("LitePink") else if PE < 20 then GlobalColor("LabelGreen") else if PE < 40 then GlobalColor("GrayGreen") else GlobalColor("Pre_Cyan")); def EarnPerShare = if IsNaN(EarningsPerShareTTM()) then EarnPerShare[1] else EarningsPerShareTTM(); AddLabel(show_labels and EarnPerShare, "EPS-TTM = " + AsDollars(EarnPerShare), if EarnPerShare > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def FreeCashFlowPerSh = if isNaN(FreeCashFlowPerShare()) then FreeCashFlowPerSh[1] else FreeCashFlowPerShare(); AddLabel(show_labels and FreeCashFlowPerSh, "Free Cash Flow Per Share = " + AsDollars(FreeCashFlowPerSh), if FreeCashFlowPerSh > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_EarnCash = if PE <0 and FreeCashFlowPerSh < 0 and EarnPerShare < 0 then 0 else 5; def Gross_Profit_Margin = if IsNaN(GrossProfitMargin()) then Gross_Profit_Margin[1] else GrossProfitMargin(); AddLabel(show_labels and Gross_Profit_Margin, "Gross Profit Margin = " + Round(Gross_Profit_Margin, 2), if Gross_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Operating_Profit_Margin = if IsNaN(OperatingProfitMargin()) then Operating_Profit_Margin[1] else OperatingProfitMargin(); AddLabel(show_labels and Operating_Profit_Margin, "Operating Profit Margin = " + Round(Operating_Profit_Margin, 2), if Operating_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Net_Profit_Margin = if IsNaN(NetProfitMargin()) then Net_Profit_Margin[1] else NetProfitMargin(); AddLabel(show_labels and Net_Profit_Margin, "Net Profit Margin = " + Round(Net_Profit_Margin, 2), if Net_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Profits = if Gross_Profit_Margin>0 or Net_Profit_Margin>0 or Operating_Profit_Margin > 0 then 3 else 0 ; def CurRatio = if IsNaN(CurrentRatio()) then CurRatio[1] else CurrentRatio(); AddLabel(show_labels and CurRatio, "Current Ratio = " + Round(CurRatio, 2), if CurRatio > 2 then GlobalColor("GrayGreen") else if CurRatio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Quick_Ratio = if IsNaN(QuickRatio()) then Quick_Ratio[1] else QuickRatio(); AddLabel(show_labels and Quick_Ratio, "Quick Ratio = " + Round(Quick_Ratio, 2), if Quick_Ratio > 2 then GlobalColor("GrayGreen") else if Quick_Ratio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Ratios = if Quick_Ratio >= 1 or CurRatio >= 1 then 3 else 0; def Return_On_Assets = if IsNaN(ReturnOnAssets()) then Return_On_Assets[1] else ReturnOnAssets(); AddLabel(show_labels and Return_On_Assets, "Return On Assets = " + Round(Return_On_Assets), if Return_On_Assets >= 15 then GlobalColor("Pre_Cyan") else if Return_On_Assets >= 10 then GlobalColor("LabelGreen") else if Return_On_Assets > 0 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def Return_On_Equity = if IsNaN(ReturnOnEquity()) then Return_On_Equity[1] else ReturnOnEquity(); AddLabel(show_labels and Return_On_Equity, "Return On Equity = " + Round(Return_On_Equity), if Return_On_Equity >= 15 then GlobalColor("Pre_Cyan") else if Return_On_Equity >= 10 then GlobalColor("LabelGreen") else if Return_On_Equity > 0 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def score_Returns = if Return_On_Equity >= 10 or Return_On_Assets >=10 then 1 else 0 ; def Sales_Per_Share = if IsNaN(SalesPerShare()) then Sales_Per_Share[1] else SalesPerShare(); AddLabel(show_labels and Sales_Per_Share, "Sales Per Share = " + Round(Sales_Per_Share, 2), if Sales_Per_Share > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Sales_Per_Share = if Sales_Per_Share > 0 then 1 else 0; def FixChgCovRatio = if IsNaN(FixedChargeCoverageRatio()) then FixChgCovRatio[1] else FixedChargeCoverageRatio(); AddLabel(show_labels and FixChgCovRatio, "Fixed Charge Coverage Ratio = " + Round(FixChgCovRatio, 2), if FixChgCovRatio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Total_Asset_Turnover = if IsNaN(TotalAssetTurnover()) then Total_Asset_Turnover[1] else TotalAssetTurnover(); AddLabel(show_labels and Total_Asset_Turnover, "Total Asset Turnover = " + Round(Total_Asset_Turnover, 2), if Total_Asset_Turnover > 1 then GlobalColor("LabelGreen") else GlobalColor("neutral")); def FinLev = if IsNaN(FinancialLeverage()) then FinLev[1] else FinancialLeverage(); AddLabel(show_labels and FinLev, "Financial Leverage = " + Round(FinLev, 2), if FinLev > 0 and FinLev < 2 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_FinLev = if FinLev < 2 then 1 else 0; def BookValue = if IsNaN(BookValuePerShare()) then BookValue[1] else BookValuePerShare(); AddLabel(show_labels and BookValue, "Book Value Per Share = " + Round(BookValue), if BookValue < 2 then GlobalColor("Pre_Cyan") else if BookValue < 3 then GlobalColor("LabelGreen") else GlobalColor("neutral")); def Long_Term_Debt_To_Capital = if IsNaN(LongTermDebtToCapital()) then Long_Term_Debt_To_Capital[1] else LongTermDebtToCapital(); AddLabel(show_labels and Long_Term_Debt_To_Capital, "Long Term Debt To Capital = " + Round(Long_Term_Debt_To_Capital, 2), if Long_Term_Debt_To_Capital < 5 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Long_Term_Debt_To_Capital = if Long_Term_Debt_To_Capital < 5 then 1 else 0; def Inventory_Turnover = if IsNaN(InventoryTurnover()) then Inventory_Turnover[1] else InventoryTurnover(); AddLabel(show_labels and Inventory_Turnover, "Inventory Turnover = " + Round(Inventory_Turnover, 2), if Inventory_Turnover < 5 then GlobalColor("LitePink") else if Inventory_Turnover < 10 then GlobalColor("Pre_Cyan") else if Inventory_Turnover < 15 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def DivPayout = if IsNaN(DividendPayout()) then DivPayout[1] else DividendPayout(); AddLabel(show_labels and DivPayout, "Dividend Payout = " + AsDollars(DivPayout), GlobalColor("neutral")); def DivPerShare = if IsNaN(DividendsPerShareTTM()) then DivPerShare[1] else DividendsPerShareTTM(); AddLabel(show_labels and DivPerShare, "Dividend Per Share = " + AsDollars(DivPerShare), GlobalColor("neutral")); def Interest_Rate = if IsNaN(InterestRate()) then Interest_Rate[1] else InterestRate(); AddLabel(show_labels and Interest_Rate, "Interest Rate = " + Round(Interest_Rate, 2), GlobalColor("neutral")); def Tax_Rate = if IsNaN(TaxRate()) then Tax_Rate[1] else TaxRate(); AddLabel(show_labels and Tax_Rate, "Tax Rate = " + Round(Tax_Rate, 2), GlobalColor("neutral")); plot score = score_Returns + score_EarnCash + score_ratios + score_Profits + score_FinLev + score_Sales_Per_Share + score_Long_Term_Debt_To_Capital; AddLabel(show_summaries, "SCORE: " + score, if score >= 12 then GlobalColor("Pre_Cyan") else if score >= 10 then GlobalColor("LabelGreen") else if score >= 8 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); score.hide();

Link to shared study: http://tos.mx/zF4if7t

Complete newbie to thinkscript. Can anyone tell me how I can get the following script to work. Struggling with the SalesPerShare stock fundamental function (no such variable error). I want to add this script to a new marketwatch column. Basically all I want to do is divide the SalesPerShare value by the last share price. Thanks!

declare lower;

def rev_per_share = SalesPerShare / close;

AddLabel (yes, "" + Round(rev_per_share,3), if rev_per_share > 0 then Color.Green else Color.Red);

declare lower;

def rev_per_share = SalesPerShare / close;

AddLabel (yes, "" + Round(rev_per_share,3), if rev_per_share > 0 then Color.Green else Color.Red);

hello. there are a couple things to change in your code.

...not sure what you want to see by using this , in addlabel

, "" +

but it won't display anything. maybe this is what you want?

, "rev/share " +

...SalesPerShare() needs the () at the end.

...SalesPerShare() data does not exist on every candle. it shows up on 1 candle, once a year. so you need a way to keep the value after finding it.

take a look at this study. it displays several fundamental parameters of a stock.

https://usethinkscript.com/threads/fundamentals-labels-for-thinkorswim.5308/

this formula reads SalesPerShare() data.

if it finds data that isn't an error, it puts the value into x. if SalesPerShare() is an error, then x is equal the previous candle value of x. this is how to pass a value from one candle to the next, by using an offset of [1], to look at the previous candle.

def x = if IsNaN(SalesPerShare()) then x[1] else SalesPerShare();

...not sure what you want to see by using this , in addlabel

, "" +

but it won't display anything. maybe this is what you want?

, "rev/share " +

...SalesPerShare() needs the () at the end.

...SalesPerShare() data does not exist on every candle. it shows up on 1 candle, once a year. so you need a way to keep the value after finding it.

take a look at this study. it displays several fundamental parameters of a stock.

https://usethinkscript.com/threads/fundamentals-labels-for-thinkorswim.5308/

this formula reads SalesPerShare() data.

if it finds data that isn't an error, it puts the value into x. if SalesPerShare() is an error, then x is equal the previous candle value of x. this is how to pass a value from one candle to the next, by using an offset of [1], to look at the previous candle.

def x = if IsNaN(SalesPerShare()) then x[1] else SalesPerShare();

drewski408

New member

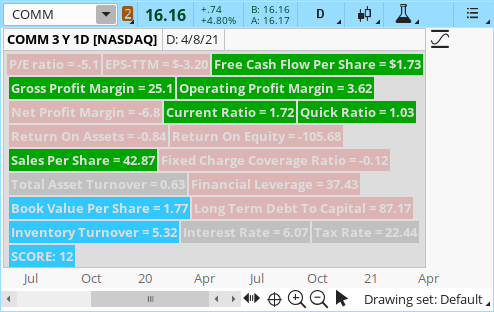

Hi so just to confirm the higher the score and more green labels the better right?This indicator displays fundamental data of a stock, including financial info such as Free Cash Flow, Profit Margin, etc., on your chart. Use on a Daily Chart. Useful for anyone interested in fundamental stock research.

Ruby:#Fundamental Data Labels _Mobius 4/26/20 (found on OneNote) # # @MerryDay revised 4/21: # my interpretation of positive/negative values; should be modified to meet your strategy # then calculated an overall weighted score based on: # https://tradestation.tradingappstore.com/products/FundamentalScore/document/Fundamental_Score.pdf # and other information found on the web declare lower; declare hide_on_intraday; input show_labels = yes ; input show_summaries = no ; DefineGlobalColor("Pre_Cyan", CreateColor(50, 200, 255)) ; DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ; DefineGlobalColor("LabelRed", CreateColor(225, 0, 0)) ; DefineGlobalColor("Violet", CreateColor (200, 125, 255)) ; DefineGlobalColor("GrayGreen", CreateColor(155, 167, 76)) ; DefineGlobalColor("LitePink", CreateColor (220, 180, 180)) ; DefineGlobalColor("neutral", color.light_gray) ; def fp = FiscalPeriod.YEAR; def EPS = EarningsPerShareTTM(fiscalPeriod = fp); def PE = round(close / EPS,1); AddLabel(show_labels and PE, "P/E ratio = " + Round(PE, 2), if PE < 0 then GlobalColor("LitePink") else if PE < 20 then GlobalColor("LabelGreen") else if PE < 40 then GlobalColor("GrayGreen") else GlobalColor("Pre_Cyan")); def EarnPerShare = if IsNaN(EarningsPerShareTTM()) then EarnPerShare[1] else EarningsPerShareTTM(); AddLabel(show_labels and EarnPerShare, "EPS-TTM = " + AsDollars(EarnPerShare), if EarnPerShare > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def FreeCashFlowPerSh = if isNaN(FreeCashFlowPerShare()) then FreeCashFlowPerSh[1] else FreeCashFlowPerShare(); AddLabel(show_labels and FreeCashFlowPerSh, "Free Cash Flow Per Share = " + AsDollars(FreeCashFlowPerSh), if FreeCashFlowPerSh > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_EarnCash = if PE <0 and FreeCashFlowPerSh < 0 and EarnPerShare < 0 then 0 else 5; def Gross_Profit_Margin = if IsNaN(GrossProfitMargin()) then Gross_Profit_Margin[1] else GrossProfitMargin(); AddLabel(show_labels and Gross_Profit_Margin, "Gross Profit Margin = " + Round(Gross_Profit_Margin, 2), if Gross_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Operating_Profit_Margin = if IsNaN(OperatingProfitMargin()) then Operating_Profit_Margin[1] else OperatingProfitMargin(); AddLabel(show_labels and Operating_Profit_Margin, "Operating Profit Margin = " + Round(Operating_Profit_Margin, 2), if Operating_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Net_Profit_Margin = if IsNaN(NetProfitMargin()) then Net_Profit_Margin[1] else NetProfitMargin(); AddLabel(show_labels and Net_Profit_Margin, "Net Profit Margin = " + Round(Net_Profit_Margin, 2), if Net_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Profits = if Gross_Profit_Margin>0 or Net_Profit_Margin>0 or Operating_Profit_Margin > 0 then 3 else 0 ; def CurRatio = if IsNaN(CurrentRatio()) then CurRatio[1] else CurrentRatio(); AddLabel(show_labels and CurRatio, "Current Ratio = " + Round(CurRatio, 2), if CurRatio > 2 then GlobalColor("GrayGreen") else if CurRatio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Quick_Ratio = if IsNaN(QuickRatio()) then Quick_Ratio[1] else QuickRatio(); AddLabel(show_labels and Quick_Ratio, "Quick Ratio = " + Round(Quick_Ratio, 2), if Quick_Ratio > 2 then GlobalColor("GrayGreen") else if Quick_Ratio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Ratios = if Quick_Ratio >= 1 or CurRatio >= 1 then 3 else 0; def Return_On_Assets = if IsNaN(ReturnOnAssets()) then Return_On_Assets[1] else ReturnOnAssets(); AddLabel(show_labels and Return_On_Assets, "Return On Assets = " + Round(Return_On_Assets), if Return_On_Assets >= 15 then GlobalColor("Pre_Cyan") else if Return_On_Assets >= 10 then GlobalColor("LabelGreen") else if Return_On_Assets > 0 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def Return_On_Equity = if IsNaN(ReturnOnEquity()) then Return_On_Equity[1] else ReturnOnEquity(); AddLabel(show_labels and Return_On_Equity, "Return On Equity = " + Round(Return_On_Equity), if Return_On_Equity >= 15 then GlobalColor("Pre_Cyan") else if Return_On_Equity >= 10 then GlobalColor("LabelGreen") else if Return_On_Equity > 0 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def score_Returns = if Return_On_Equity >= 10 or Return_On_Assets >=10 then 1 else 0 ; def Sales_Per_Share = if IsNaN(SalesPerShare()) then Sales_Per_Share[1] else SalesPerShare(); AddLabel(show_labels and Sales_Per_Share, "Sales Per Share = " + Round(Sales_Per_Share, 2), if Sales_Per_Share > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Sales_Per_Share = if Sales_Per_Share > 0 then 1 else 0; def FixChgCovRatio = if IsNaN(FixedChargeCoverageRatio()) then FixChgCovRatio[1] else FixedChargeCoverageRatio(); AddLabel(show_labels and FixChgCovRatio, "Fixed Charge Coverage Ratio = " + Round(FixChgCovRatio, 2), if FixChgCovRatio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Total_Asset_Turnover = if IsNaN(TotalAssetTurnover()) then Total_Asset_Turnover[1] else TotalAssetTurnover(); AddLabel(show_labels and Total_Asset_Turnover, "Total Asset Turnover = " + Round(Total_Asset_Turnover, 2), if Total_Asset_Turnover > 1 then GlobalColor("LabelGreen") else GlobalColor("neutral")); def FinLev = if IsNaN(FinancialLeverage()) then FinLev[1] else FinancialLeverage(); AddLabel(show_labels and FinLev, "Financial Leverage = " + Round(FinLev, 2), if FinLev > 0 and FinLev < 2 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_FinLev = if FinLev < 2 then 1 else 0; def BookValue = if IsNaN(BookValuePerShare()) then BookValue[1] else BookValuePerShare(); AddLabel(show_labels and BookValue, "Book Value Per Share = " + Round(BookValue), if BookValue < 2 then GlobalColor("Pre_Cyan") else if BookValue < 3 then GlobalColor("LabelGreen") else GlobalColor("neutral")); def Long_Term_Debt_To_Capital = if IsNaN(LongTermDebtToCapital()) then Long_Term_Debt_To_Capital[1] else LongTermDebtToCapital(); AddLabel(show_labels and Long_Term_Debt_To_Capital, "Long Term Debt To Capital = " + Round(Long_Term_Debt_To_Capital, 2), if Long_Term_Debt_To_Capital < 5 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Long_Term_Debt_To_Capital = if Long_Term_Debt_To_Capital < 5 then 1 else 0; def Inventory_Turnover = if IsNaN(InventoryTurnover()) then Inventory_Turnover[1] else InventoryTurnover(); AddLabel(show_labels and Inventory_Turnover, "Inventory Turnover = " + Round(Inventory_Turnover, 2), if Inventory_Turnover < 5 then GlobalColor("LitePink") else if Inventory_Turnover < 10 then GlobalColor("Pre_Cyan") else if Inventory_Turnover < 15 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def DivPayout = if IsNaN(DividendPayout()) then DivPayout[1] else DividendPayout(); AddLabel(show_labels and DivPayout, "Dividend Payout = " + AsDollars(DivPayout), GlobalColor("neutral")); def DivPerShare = if IsNaN(DividendsPerShareTTM()) then DivPerShare[1] else DividendsPerShareTTM(); AddLabel(show_labels and DivPerShare, "Dividend Per Share = " + AsDollars(DivPerShare), GlobalColor("neutral")); def Interest_Rate = if IsNaN(InterestRate()) then Interest_Rate[1] else InterestRate(); AddLabel(show_labels and Interest_Rate, "Interest Rate = " + Round(Interest_Rate, 2), GlobalColor("neutral")); def Tax_Rate = if IsNaN(TaxRate()) then Tax_Rate[1] else TaxRate(); AddLabel(show_labels and Tax_Rate, "Tax Rate = " + Round(Tax_Rate, 2), GlobalColor("neutral")); plot score = score_Returns + score_EarnCash + score_ratios + score_Profits + score_FinLev + score_Sales_Per_Share + score_Long_Term_Debt_To_Capital; AddLabel(show_summaries, "SCORE: " + score, if score >= 12 then GlobalColor("Pre_Cyan") else if score >= 10 then GlobalColor("LabelGreen") else if score >= 8 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); score.hide();

Link to shared study: http://tos.mx/zF4if7t

I see free cash flow per share, can you please provide the codes for cash flow per share?This indicator displays fundamental data of a stock, including financial info such as Free Cash Flow, Profit Margin, etc., on your chart. Use on a Daily Chart. Useful for anyone interested in fundamental stock research.

Ruby:#Fundamental Data Labels _Mobius 4/26/20 (found on OneNote) # # @MerryDay revised 4/21: # my interpretation of positive/negative values; should be modified to meet your strategy # then calculated an overall weighted score based on: # https://tradestation.tradingappstore.com/products/FundamentalScore/document/Fundamental_Score.pdf # and other information found on the web declare lower; declare hide_on_intraday; input show_labels = yes ; input show_summaries = no ; DefineGlobalColor("Pre_Cyan", CreateColor(50, 200, 255)) ; DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ; DefineGlobalColor("LabelRed", CreateColor(225, 0, 0)) ; DefineGlobalColor("Violet", CreateColor (200, 125, 255)) ; DefineGlobalColor("GrayGreen", CreateColor(155, 167, 76)) ; DefineGlobalColor("LitePink", CreateColor (220, 180, 180)) ; DefineGlobalColor("neutral", color.light_gray) ; def fp = FiscalPeriod.YEAR; def EPS = EarningsPerShareTTM(fiscalPeriod = fp); def PE = round(close / EPS,1); AddLabel(show_labels and PE, "P/E ratio = " + Round(PE, 2), if PE < 0 then GlobalColor("LitePink") else if PE < 20 then GlobalColor("LabelGreen") else if PE < 40 then GlobalColor("GrayGreen") else GlobalColor("Pre_Cyan")); def EarnPerShare = if IsNaN(EarningsPerShareTTM()) then EarnPerShare[1] else EarningsPerShareTTM(); AddLabel(show_labels and EarnPerShare, "EPS-TTM = " + AsDollars(EarnPerShare), if EarnPerShare > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def FreeCashFlowPerSh = if isNaN(FreeCashFlowPerShare()) then FreeCashFlowPerSh[1] else FreeCashFlowPerShare(); AddLabel(show_labels and FreeCashFlowPerSh, "Free Cash Flow Per Share = " + AsDollars(FreeCashFlowPerSh), if FreeCashFlowPerSh > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_EarnCash = if PE <0 and FreeCashFlowPerSh < 0 and EarnPerShare < 0 then 0 else 5; def Gross_Profit_Margin = if IsNaN(GrossProfitMargin()) then Gross_Profit_Margin[1] else GrossProfitMargin(); AddLabel(show_labels and Gross_Profit_Margin, "Gross Profit Margin = " + Round(Gross_Profit_Margin, 2), if Gross_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Operating_Profit_Margin = if IsNaN(OperatingProfitMargin()) then Operating_Profit_Margin[1] else OperatingProfitMargin(); AddLabel(show_labels and Operating_Profit_Margin, "Operating Profit Margin = " + Round(Operating_Profit_Margin, 2), if Operating_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Net_Profit_Margin = if IsNaN(NetProfitMargin()) then Net_Profit_Margin[1] else NetProfitMargin(); AddLabel(show_labels and Net_Profit_Margin, "Net Profit Margin = " + Round(Net_Profit_Margin, 2), if Net_Profit_Margin > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Profits = if Gross_Profit_Margin>0 or Net_Profit_Margin>0 or Operating_Profit_Margin > 0 then 3 else 0 ; def CurRatio = if IsNaN(CurrentRatio()) then CurRatio[1] else CurrentRatio(); AddLabel(show_labels and CurRatio, "Current Ratio = " + Round(CurRatio, 2), if CurRatio > 2 then GlobalColor("GrayGreen") else if CurRatio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Quick_Ratio = if IsNaN(QuickRatio()) then Quick_Ratio[1] else QuickRatio(); AddLabel(show_labels and Quick_Ratio, "Quick Ratio = " + Round(Quick_Ratio, 2), if Quick_Ratio > 2 then GlobalColor("GrayGreen") else if Quick_Ratio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Ratios = if Quick_Ratio >= 1 or CurRatio >= 1 then 3 else 0; def Return_On_Assets = if IsNaN(ReturnOnAssets()) then Return_On_Assets[1] else ReturnOnAssets(); AddLabel(show_labels and Return_On_Assets, "Return On Assets = " + Round(Return_On_Assets), if Return_On_Assets >= 15 then GlobalColor("Pre_Cyan") else if Return_On_Assets >= 10 then GlobalColor("LabelGreen") else if Return_On_Assets > 0 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def Return_On_Equity = if IsNaN(ReturnOnEquity()) then Return_On_Equity[1] else ReturnOnEquity(); AddLabel(show_labels and Return_On_Equity, "Return On Equity = " + Round(Return_On_Equity), if Return_On_Equity >= 15 then GlobalColor("Pre_Cyan") else if Return_On_Equity >= 10 then GlobalColor("LabelGreen") else if Return_On_Equity > 0 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def score_Returns = if Return_On_Equity >= 10 or Return_On_Assets >=10 then 1 else 0 ; def Sales_Per_Share = if IsNaN(SalesPerShare()) then Sales_Per_Share[1] else SalesPerShare(); AddLabel(show_labels and Sales_Per_Share, "Sales Per Share = " + Round(Sales_Per_Share, 2), if Sales_Per_Share > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Sales_Per_Share = if Sales_Per_Share > 0 then 1 else 0; def FixChgCovRatio = if IsNaN(FixedChargeCoverageRatio()) then FixChgCovRatio[1] else FixedChargeCoverageRatio(); AddLabel(show_labels and FixChgCovRatio, "Fixed Charge Coverage Ratio = " + Round(FixChgCovRatio, 2), if FixChgCovRatio >= 1 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def Total_Asset_Turnover = if IsNaN(TotalAssetTurnover()) then Total_Asset_Turnover[1] else TotalAssetTurnover(); AddLabel(show_labels and Total_Asset_Turnover, "Total Asset Turnover = " + Round(Total_Asset_Turnover, 2), if Total_Asset_Turnover > 1 then GlobalColor("LabelGreen") else GlobalColor("neutral")); def FinLev = if IsNaN(FinancialLeverage()) then FinLev[1] else FinancialLeverage(); AddLabel(show_labels and FinLev, "Financial Leverage = " + Round(FinLev, 2), if FinLev > 0 and FinLev < 2 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_FinLev = if FinLev < 2 then 1 else 0; def BookValue = if IsNaN(BookValuePerShare()) then BookValue[1] else BookValuePerShare(); AddLabel(show_labels and BookValue, "Book Value Per Share = " + Round(BookValue), if BookValue < 2 then GlobalColor("Pre_Cyan") else if BookValue < 3 then GlobalColor("LabelGreen") else GlobalColor("neutral")); def Long_Term_Debt_To_Capital = if IsNaN(LongTermDebtToCapital()) then Long_Term_Debt_To_Capital[1] else LongTermDebtToCapital(); AddLabel(show_labels and Long_Term_Debt_To_Capital, "Long Term Debt To Capital = " + Round(Long_Term_Debt_To_Capital, 2), if Long_Term_Debt_To_Capital < 5 then GlobalColor("LabelGreen") else GlobalColor("LitePink")); def score_Long_Term_Debt_To_Capital = if Long_Term_Debt_To_Capital < 5 then 1 else 0; def Inventory_Turnover = if IsNaN(InventoryTurnover()) then Inventory_Turnover[1] else InventoryTurnover(); AddLabel(show_labels and Inventory_Turnover, "Inventory Turnover = " + Round(Inventory_Turnover, 2), if Inventory_Turnover < 5 then GlobalColor("LitePink") else if Inventory_Turnover < 10 then GlobalColor("Pre_Cyan") else if Inventory_Turnover < 15 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); def DivPayout = if IsNaN(DividendPayout()) then DivPayout[1] else DividendPayout(); AddLabel(show_labels and DivPayout, "Dividend Payout = " + AsDollars(DivPayout), GlobalColor("neutral")); def DivPerShare = if IsNaN(DividendsPerShareTTM()) then DivPerShare[1] else DividendsPerShareTTM(); AddLabel(show_labels and DivPerShare, "Dividend Per Share = " + AsDollars(DivPerShare), GlobalColor("neutral")); def Interest_Rate = if IsNaN(InterestRate()) then Interest_Rate[1] else InterestRate(); AddLabel(show_labels and Interest_Rate, "Interest Rate = " + Round(Interest_Rate, 2), GlobalColor("neutral")); def Tax_Rate = if IsNaN(TaxRate()) then Tax_Rate[1] else TaxRate(); AddLabel(show_labels and Tax_Rate, "Tax Rate = " + Round(Tax_Rate, 2), GlobalColor("neutral")); plot score = score_Returns + score_EarnCash + score_ratios + score_Profits + score_FinLev + score_Sales_Per_Share + score_Long_Term_Debt_To_Capital; AddLabel(show_summaries, "SCORE: " + score, if score >= 12 then GlobalColor("Pre_Cyan") else if score >= 10 then GlobalColor("LabelGreen") else if score >= 8 then GlobalColor("GrayGreen") else GlobalColor("LitePink")); score.hide();

Link to shared study: http://tos.mx/zF4if7t

I see free cash flow per share, can you please provide the codes for cash flow per share?

Ruby:

def FreeCashFlowPerSh = if isNaN(FreeCashFlowPerShare())

then FreeCashFlowPerSh[1]

else FreeCashFlowPerShare();

AddLabel(show_labels and FreeCashFlowPerSh, "Free Cash Flow Per Share = " + AsDollars(FreeCashFlowPerSh),

if FreeCashFlowPerSh > 0 then GlobalColor("LabelGreen") else GlobalColor("LitePink"));Thanks. So we should set the fiscal period to quarter, correct?hello. there are a couple things to change in your code.

...not sure what you want to see by using this , in addlabel

, "" +

but it won't display anything. maybe this is what you want?

, "rev/share " +

...SalesPerShare() needs the () at the end.

...SalesPerShare() data does not exist on every candle. it shows up on 1 candle, once a year. so you need a way to keep the value after finding it.

take a look at this study. it displays several fundamental parameters of a stock.

https://usethinkscript.com/threads/fundamentals-labels-for-thinkorswim.5308/

this formula reads SalesPerShare() data.

if it finds data that isn't an error, it puts the value into x. if SalesPerShare() is an error, then x is equal the previous candle value of x. this is how to pass a value from one candle to the next, by using an offset of [1], to look at the previous candle.

def x = if IsNaN(SalesPerShare()) then x[1] else SalesPerShare();

Updated the 1st post w/ @wtf_dude revised dividend labels:

https://usethinkscript.com/threads/fundamentals-labels-for-thinkorswim.5308/page-2#post-62262

Inventory turnover, book value, and a few more. I originally left these off because how to interpret them varies drastically by sector. Example: What might be positive for the manufacturing sector might not be applicable or be VERY different for the service sector.

Bottom line: You need to decide what and which are important to you. I started out only investing in equities that had a profit and low debt. It was wrong-headed. Companies investing in the future might not have a current profit and may have significant but hopefully manageable debt. I still place some emphasis current & quick ratios but am now more interested in how companies are spending their money.

https://usethinkscript.com/threads/fundamentals-labels-for-thinkorswim.5308/page-2#post-62262

@drewski408 Yes, the higher the score, the better overall financial health of the company. As far as the more green labels the better? I would not make that an unequivocal statement. It is VERY IMPORTANT to google and understand these indicators if you are trading stocks. There has to be an understanding of the NUMBERS. You can NOT go by colors.Hi so just to confirm the higher the score and more green labels the better right?

Inventory turnover, book value, and a few more. I originally left these off because how to interpret them varies drastically by sector. Example: What might be positive for the manufacturing sector might not be applicable or be VERY different for the service sector.

Bottom line: You need to decide what and which are important to you. I started out only investing in equities that had a profit and low debt. It was wrong-headed. Companies investing in the future might not have a current profit and may have significant but hopefully manageable debt. I still place some emphasis current & quick ratios but am now more interested in how companies are spending their money.

Last edited:

"Companies investing in the future might not have a current profit and may have significant but hopefully manageable debt. I still place some emphasis current & quick ratios but am now more interested in how companies are spending their money."Updated the 1st post w/ @wtf_dude revised dividend labels:

https://usethinkscript.com/threads/fundamentals-labels-for-thinkorswim.5308/page-2#post-62262

@drewski408 Yes, the higher the score, the better overall financial health of the company. As far as the more green labels the better? I would not make that an unequivocal statement. It is VERY IMPORTANT to google and understand these indicators if you are trading stocks. There has to be an understanding of the NUMBERS. You can NOT go by colors.

Inventory turnover, book value, and a few more. I originally left these off because how to interpret them varies drastically by sector. Example: What might be positive for the manufacturing sector might not be applicable or be VERY different for the service sector.

Bottom line: You need to decide what and which are important to you. I started out only investing in equities that had a profit and low debt. It was wrong-headed. Companies investing in the future might not have a current profit and may have significant but hopefully manageable debt. I still place some emphasis current & quick ratios but am now more interested in how companies are spending their money.

One of my considerations for filtering good candidates are companies with accelerating EPS and sales growth and the positive future EPS expansion too.

Can check out this scanner too

https://usethinkscript.com/threads/scanner-based-on-the-canslim-conditions.4851/post-71596

@MerryDay like to know how or where do you sieve out this information >>" now more interested in how companies are spending their money"

Labels must be on a daily chart.Really like this indicator, but is there a reason it only works on the daily time frame? There's a few fundamentals I like to use for penny stocks and it would be great to throw up those labels on a 10 minute chart. Anyone know if that is possible? Thanks!

A workaround is to detach a daily chart w/ the labels and overlay it on your 10 min chart or put it anywhere else on your screen.

In the top right of the chart, there is a pin symbol. If you pin the chart it won't keep falling behind whatever it is overlaid on.

Last edited:

There are only two reasons that labels don't populate.I copied the whole codes with so many addlabels but it only produced EPS_TTM label. why it did not produce other addlabel?

Thanks,

- You are using the wrong aggregation, refer to post#1 for instructions of how to use.

- The equity is a small cap which doesn't publish that data.

Similar threads

-

-

-

-

Repaints Multi Time Frame MTF Squeeze PRO Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 45

-

Repaints Multi Time Frame MTF Squeeze HISTOGRAM Colored Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 25

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1554

Online

Similar threads

-

-

-

-

Repaints Multi Time Frame MTF Squeeze PRO Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 45

-

Repaints Multi Time Frame MTF Squeeze HISTOGRAM Colored Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 25

Similar threads

-

-

-

-

Repaints Multi Time Frame MTF Squeeze PRO Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 45

-

Repaints Multi Time Frame MTF Squeeze HISTOGRAM Colored Labels for ThinkOrSwim

- Started by caseyjbrett

- Replies: 25

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.