You should upgrade or use an alternative browser.

ECI Gaussian Indicator for ThinkorSwim

- Thread starter horserider

- Start date

-

- Tags

- consolidation

https://usethinkscript.com/threads/support-and-resistance-fractal-pivots-for-thinkorswim.11639/I have tried to search useThinkScript side, but cannot find any reference to Fractal Pivots. Nor does TOS provide any default Fractal Pivots studies.

Musk335im3

Member

Given some of the recent discussion on consolidation and Mobius ECI study, for those folks that might be interested to scan the universe of stocks for such setups, I have converted Mobius ECI study into a scan. Two scan conditions are created - one for the bullish case and another for the bearish case. I have also removed extraneous variables not required for the scan.

Tested this on a scan of the S&P 500 (Daily aggregation) with the following results

Bullish scan - 138 hits, e.g. AMZN

Bearish scan - 20 hits e.go. PSX

Please remember that the scanner only expects one plot so comment out the scan plot statement you do not wish.

Here then is the scan code

Code:# ECI Scan # tomsk # 11.25.2019 # Given some of the recent discussion on consolidation and Mobius ECI study, # for those folks that might be interested to scan the universe of stocks for # such setups, I have converted Mobius ECI study into a scan. Two scan conditions # are created - one for the bullish case and another for the bearish case. I # have also removed variables not required for the scan. # Expansion Contraction Indication # Flags: Uses Fractal enregy to locate price compression or flag areas # Mobius # 3.18.2017 # User Inputs input EciLength = 5; #hint EciLength: Length for calculations. input AvgType = AverageType.Simple; #hint AvgType: Average Type input MeanValue = HL2; #hint MeanValue: Point of origen. input betaDev = 4; script G { input p = close; input n = 2; input b = 1.05; def w; def beta; def alpha; def G; w = (2 * Double.Pi / n); beta = (1 - Cos(w)) / (Power(1.414, 2.0 / b) - 1 ); alpha = (-beta + Sqrt(beta * beta + 2 * beta)); G = Power(alpha, 4) * p + 4 * (1 – alpha) * G[1] – 6 * Power( 1 - alpha, 2 ) * G[2] + 4 * Power( 1 - alpha, 3 ) * G[3] - Power( 1 - alpha, 4 ) * G[4]; plot data = G; } # Variables: def bar = barNumber(); def o = g(open, ECIlength, betaDev); def h = g(high, ECIlength, betaDev); def l = g(low, ECIlength, betaDev); def c = g(close, ECIlength, betaDev); def ECI = Log(Sum(Max(h, c[1]) - Min(l, c[1]), ECIlength) / (Highest(h, ECIlength) - Lowest(l, ECIlength))) / Log(ECIlength); def Avg = MovingAverage(AverageType = AvgType, ECI, ECILength); def S1 = if ECI crosses above Avg then MeanValue else S1[1]; def S = ECI > Avg; def SBars = if ECI > Avg then bar else Double.NaN; def StartBar = if ECI crosses above Avg then bar else StartBar[1]; def LastSBar = if ECI crosses below Avg then bar else LastSBar[1]; def PP = if ECI crosses above Avg then MeanValue else PP[1]; def Mean_Limit = if bar != StartBar then bar - StartBar else if bar == StartBar then Double.NaN else Mean_Limit[1]; def SHigh = if ECI crosses above Avg then h else SHigh[1]; def SHighBar = if S and h == SHigh then bar else SHighBar[1]; def SHigh_Limit = if bar == StartBar then Double.NaN else if bar > StartBar then bar - SHighBar else SHigh_Limit[1]; def SLow = if ECI crosses above Avg then l else SLow[1]; def SLowBar = if S and l == SLow then bar else SLowBar[1]; def SLow_Limit = if bar == StartBar then Double.NaN else if bar > StartBar then bar - SLowBar else SLow_Limit[1]; # Comment out (#) the ONE not needed plot BullScan = close crosses above SHigh; #plot BearScan = close crosses below SLow; # ECI Scan

Hi. Thanks for this cause this is a good script and a scanner.

Quick question: how to I modify this find tickers that are within the upper and lower bounds.

Thanks is advanced.

UPDATED:

Figured it out. Thanks much.

Added code.

# Comment out the bread-out/ bread-down; Use this instead if looking for a price within the bounds of the study;

plot BetweenScan = close >= SLow and close <= SHigh;Musk335im3

Member

Did not find this in a search. Sorry if it already was posted.

It is a compression study is very fast at showing compression. Has some hints of when compression turns into expansion.

Code:#hint: Expansion Contraction Indicator (ECI): \n ECI Identifies areas of price compression which leads to price expansion. ECI doesn't show the direction of a trend but does indicate when a trend is going to resume (price flagging) or if a change in trend polarity is happening.\n ECI plots the areas where price becomes compressed with colored and clouded bands. The indicator also leaves legacy points in areas of past compression. # ECI is based on the FE algorithm # Original plot style by Mobius # Note: Default Lengths are not optimized. My personal experience has been length ranges between 8 and 13 are generally effective. # Here's another way to look at Fractal Energy. This study plots it on the chart graph with clouded areas for the current price compression, exhaustion area and leaves colored points as a legacy plot for past areas. # Good CSA choices with this study are: # ECI + SuperTrend + Fractal Pivots # ECI + SuperTrend + RSI in Laguerre Time # ECI + SuperTrend + Standard Deviation Bands # ECI + Linear Regression Standard Deviation Bands # This version Modified to filter price to a normalized distribution # User Inputs input EciLength = 14; #hint EciLength: Length for calculations. input AvgLength = 10; #hint AvgLength: Length for smoothing. input AvgType = AverageType.Simple; #hint AvgType: Average Type input MeanValue = HL2; #hint MeanValue: Point of origen. input DisplayPoints = yes; #hint DisplayPoints: No Points. input OnExpansion = yes; #hint OnExpansion: Line extensions. # Variables script g { input data = close; def w = (2 * Double.Pi / 8); def beta = (1 - Cos(w)) / (Power(1.414, 2.0 / 4) - 1 ); def alpha = (-beta + Sqrt(beta * beta + 2 * beta)); def G = Power(alpha, 4) * data + 4 * (1 – alpha) * G[1] – 6 * Power( 1 - alpha, 2 ) * G[2] + 4 * Power( 1 - alpha, 3 ) * G[3] - Power( 1 - alpha, 4 ) * G[4]; plot Line = G; } def o = g(data = open); def h = g(data = high); def l = g(data = low); def c = g(data = close); def bar = BarNumber(); def HMax = Highest(Max(h, c[1]), EciLength); def LMax = Lowest(Min(l, c[1]), EciLength); def TR = HMax - LMax; def ECI = Round((Log(Sum(TrueRange(h, c, l), EciLength) / TR) / Log(EciLength)) / TickSize(), 0) * TickSize(); def Avg = MovingAverage(AverageType = AvgType, ECI, AvgLength); def S1 = if ECI crosses above Avg then MeanValue else S1[1]; def S = ECI > Avg; def SBars = if ECI > Avg then bar else Double.NaN; def StartBar = if ECI crosses above Avg then bar else StartBar[1]; def LastSBar = if ECI crosses below Avg then bar else LastSBar[1]; def PP = if ECI crosses above Avg then MeanValue else PP[1]; def Mean_Limit = if bar != StartBar then bar - StartBar else if bar == StartBar then Double.NaN else Mean_Limit[1]; def SHigh = if ECI crosses above Avg then h else SHigh[1]; def SHighBar = if S and h == SHigh then bar else SHighBar[1]; def SHigh_Limit = if bar == StartBar then Double.NaN else if bar > StartBar then bar - SHighBar else SHigh_Limit[1]; def SLow = if ECI crosses above Avg then l else SLow[1]; def SLowBar = if S and l == SLow then bar else SLowBar[1]; def SLow_Limit = if bar == StartBar then Double.NaN else if bar > StartBar then bar - SLowBar else SLow_Limit[1]; # Internal Script Reference script LinePlot { input LineLimit = 0; input OnExpansion = yes; input data = close; input bar = 0; def ThisBar = HighestAll(bar); def cLine = if bar == ThisBar then data else Double.NaN; def cond1 = CompoundValue(1, if IsNaN(data) then cond1[1] else data, data); plot P = if ThisBar - LineLimit <= bar then HighestAll(cLine) else Double.NaN; plot ExpLine = if OnExpansion and IsNaN(data[-1]) then cond1 else Double.NaN; } # Plots plot SD_Pivot = LinePlot(data = PP, LineLimit = Mean_Limit, OnExpansion = OnExpansion, bar = StartBar).P; plot SD_Pivot_X = LinePlot(data = PP, LineLimit = StartBar).ExpLine; SD_Pivot.SetDefaultColor(Color.CYAN); SD_Pivot_X.SetDefaultColor(Color.CYAN); plot SD_R1 = LinePlot(data = SHigh, LineLimit = SHigh_Limit, OnExpansion = OnExpansion, bar = SHighBar).P; plot SD_R1_X = LinePlot(data = SHigh, LineLimit = SHigh_Limit).ExpLine; SD_R1.SetDefaultColor(Color.Light_GREEN); SD_R1_X.SetDefaultColor(Color.Light_GREEN); plot SD_S1 = LinePlot(data = SLow, LineLimit = SLow_Limit, OnExpansion = OnExpansion, bar = SLowBar).P; plot SD_S1_X = LinePlot(data = SLow, LineLimit = SLow_Limit).ExpLine; SD_S1.SetDefaultColor(Color.Light_RED); SD_S1_X.SetDefaultColor(Color.Light_RED); plot SPlot = if S then S1 #l - (2 * TickSize()) else Double.NaN; SPlot.SetHiding(!DisplayPoints); SPlot.SetPaintingStrategy(PaintingStrategy.POINTS); SPlot.SetLineWeight(1); SPlot.SetDefaultColor(Color.Yellow); addCloud(SD_pivot, SD_R1, CreateColor(50,150,75), CreateColor(50,150,70)); addCloud(SD_S1, SD_pivot, CreateColor(175,0,50), CreateColor(175,0,50)); addCloud(SD_pivot_X, SD_R1_X, CreateColor(50,150,75), CreateColor(50,150,70)); addCloud(SD_S1_X, SD_pivot_X, CreateColor(175,0,50), CreateColor(175,0,50)); # Audible Alerts Alert(ECI crosses below Avg, "Exit", Alert.BAR, Sound.Bell); AddLabel(1, "Energy Level = " + ECI, color.white); # End Code Modified ECI

HI ALL. Thanks for this great community. Another study that I have found useful for a couple of years now. This bear market (hopefully bottoming already) is the best time to do some "housekeeping and upgrades".

Anyway, I just like to ask the originator poster (and also the community) on how to make this study to project on a MTF (multi-time frame) chart. Cause half of the time I am using a laptop when trading while also my entries/exits on 30min aggregation (or less). I need to see if the price is going in/out of the study range on a single screen setup on an intraday aggregation.

As a reference, I am posting a picture below of the SPY where the left image has the ECI study with some moving averages at daily aggregation. The right image, on the other hand, at 30 minute aggregation also has the daily 8 and 21 EMAs projected to it via MTF. I drew some lines (green, yellow, and red) to simulate what I was trying to achieve with the ECI study (similar to the 8, 21 MTF EMA's), but with hundreds of charts to look at, it's a bit taxing to do this manually.

I'm also posting the code below of the moving average MTF for reference. My thinkscript coding skills is still pretty amateurish to be able to combine the two (hopefully with Clouds). Though I tried with no luck.

Thank you in advance.

@horserider @theLEMband @SleepyZ

# MTF Moving Average

input Period = aggregationPeriod.HOUR;

input AvgType = averageType.EXPONENTIAL;

input Length = 50;

input priceclose = close;

plot AVG = MovingAverage(AvgType, close(period = Period), Length);

AVG.setdefaultcolor(color.yellow);Given the sub scripts iterations, I was not able to create an MTF version on this indicatorHI ALL. Thanks for this great community. Another study that I have found useful for a couple of years now. This bear market (hopefully bottoming already) is the best time to do some "housekeeping and upgrades".

Anyway, I just like to ask the originator poster (and also the community) on how to make this study to project on a MTF (multi-time frame) chart. Cause half of the time I am using a laptop when trading while also my entries/exits on 30min aggregation (or less). I need to see if the price is going in/out of the study range on a single screen setup on an intraday aggregation.

Musk335im3

Member

Thank you @MerryDay for taking a stab at it. I'm really at elementary school level in terms of thinkscript coding, but when taking a look at the code it seems it's possible. I've had some success when converting some studies in the past, but I mostly based my adjustments off similar ones. This one is pretty unique (IMHO) and beyond my grade.Given the sub scripts iterations, I was not able to create an MTF version on this indicator

So still waiting for our alpha coders here to take a chance.

Thanks again @MerryDay

TapthatAsk

Member

@BenTen @MerryDay Can labels be created for the ECI to show if when it's in contraction if it's trending more bearish or bullish, I figured it was possible since you can scan for either of the two.@Miket The notes in that indicator made it very clear what it does.

I don't think it shows support or resistance. Basically just where price consolidate and that suggests the stock will be making a move one way or the other soon.

Musk335im3

Member

ECIs (aka consolidation) are by definition are in sideways movement (not in upward or downward direction). The overall trend you either can see on the chart itself or by scanning for recent % change for X number of trading days. Or some other trend scanner.

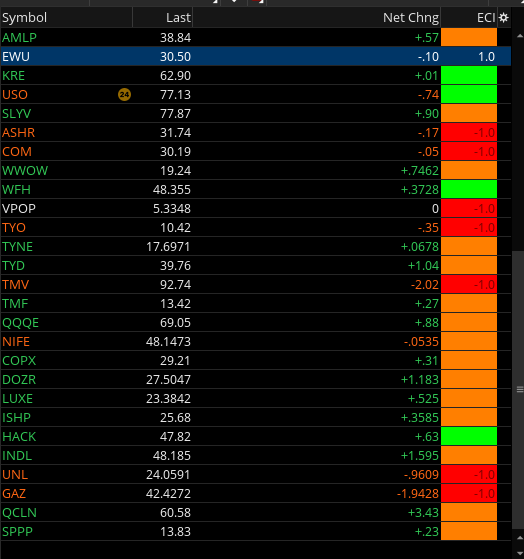

Having said that, here's a column label that I use. Green indicates current price is within the consolidation range, Orange is above, Red is below. I use this to easily sort my universe of tickers with recent significant movement and find which are within consolidation. Much faster than the scanner itself.

## Current mod by NeoEon

## For use in watchlist columns as label; Requisite: Daily aggregation only;

# Original: ECI Scan

# tomsk

# 11.25.2019

# https://usethinkscript.com/threads/eci-gaussian-indicator-for-thinkorswim.1160/

# Given some of the recent discussion on consolidation and Mobius ECI study,

# for those folks that might be interested to scan the universe of stocks for

# such setups, I have converted Mobius ECI study into a scan. Two scan conditions

# are created - one for the bullish case and another for the bearish case. I

# have also removed variables not required for the scan.

# Expansion Contraction Indication

# Flags: Uses Fractal enregy to locate price compression or flag areas

# Mobius

# 3.18.2017

# User Inputs

input EciLength = 8; #hint EciLength: Length for calculations.

input AvgType = AverageType.Exponential; #hint AvgType: Average Type

input MeanValue = HL2; #hint MeanValue: Point of origen.

input betaDev = 4;

script G {

input p = close;

input n = 2;

input b = 1.05;

def w;

def beta;

def alpha;

def G;

w = (2 * Double.Pi / n);

beta = (1 - Cos(w)) / (Power(1.414, 2.0 / b) - 1 );

alpha = (-beta + Sqrt(beta * beta + 2 * beta));

G = Power(alpha, 4) * p +

4 * (1 – alpha) * G[1] – 6 * Power( 1 - alpha, 2 ) * G[2] +

4 * Power( 1 - alpha, 3 ) * G[3] - Power( 1 - alpha, 4 ) * G[4];

plot data = G;

}

# Variables:

def bar = barNumber();

def o = g(open, ECIlength, betaDev);

def h = g(high, ECIlength, betaDev);

def l = g(low, ECIlength, betaDev);

def c = g(close, ECIlength, betaDev);

def ECI = Log(Sum(Max(h, c[1]) - Min(l, c[1]), ECIlength) /

(Highest(h, ECIlength) - Lowest(l, ECIlength))) /

Log(ECIlength);

def Avg = MovingAverage(AverageType = AvgType, ECI, ECILength);

def S1 = if ECI crosses above Avg

then MeanValue

else S1[1];

def S = ECI > Avg;

def SBars = if ECI > Avg

then bar

else Double.NaN;

def StartBar = if ECI crosses above Avg

then bar

else StartBar[1];

def LastSBar = if ECI crosses below Avg

then bar

else LastSBar[1];

def PP = if ECI crosses above Avg

then MeanValue

else PP[1];

def Mean_Limit = if bar != StartBar

then bar - StartBar

else if bar == StartBar

then Double.NaN

else Mean_Limit[1];

def SHigh = if ECI crosses above Avg

then h

else SHigh[1];

def SHighBar = if S and

h == SHigh

then bar

else SHighBar[1];

def SHigh_Limit = if bar == StartBar

then Double.NaN

else if bar > StartBar

then bar - SHighBar

else SHigh_Limit[1];

def SLow = if ECI crosses above Avg

then l

else SLow[1];

def SLowBar = if S and

l == SLow

then bar

else SLowBar[1];

def SLow_Limit = if bar == StartBar

then Double.NaN

else if bar > StartBar

then bar - SLowBar

else SLow_Limit[1];

# Comment out (#) the ONE not needed

## plot BullScan = close crosses above SHigh;

# or

## plot BearScan = close crosses below SLow;

## plot BetweenScan1 = Between (close, SHigh,SLow);

# plot BetweenScan = close >= SLow and close <= SHigh;

## plot status = if close >= SLow and close <= SHigh or close < SLow then 1 else 0;

plot status = if close > SHigh then 1 else if close >= SLow and close <= SHigh then 0 else -1;

## status.AssignValueColor(if status == 1 then Color.DARK_Green else Color.Black);

status.AssignValueColor(if status == 1 then Color.Dark_Orange else if status == 0 then Color.Green else Color.Dark_Red);

AssignBackgroundColor(if status == 1 then Color.Dark_Orange else if status ==0 then Color.Green else Color.Red);

Source: https://usethinkscript.com/threads/eci-gaussian-indicator-for-thinkorswim.1160/;TapthatAsk

Member

@NeoEon thanks this will most def help with what I'm wanting to see.ECIs (aka consolidation) are by definition are in sideways movement (not in upward or downward direction). The overall trend you either can see on the chart itself or by scanning for recent % change for X number of trading days. Or some other trend scanner.

Having said that, here's a column label that I use. Green indicates current price is within the consolidation range, Orange is above, Red is below. I use this to easily sort my universe of tickers with recent significant movement and find which are within consolidation. Much faster than the scanner itself.

Code:## Current mod by NeoEon ## For use in watchlist columns as label; Requisite: Daily aggregation only; # Original: ECI Scan # tomsk # 11.25.2019 # https://usethinkscript.com/threads/eci-gaussian-indicator-for-thinkorswim.1160/ # Given some of the recent discussion on consolidation and Mobius ECI study, # for those folks that might be interested to scan the universe of stocks for # such setups, I have converted Mobius ECI study into a scan. Two scan conditions # are created - one for the bullish case and another for the bearish case. I # have also removed variables not required for the scan. # Expansion Contraction Indication # Flags: Uses Fractal enregy to locate price compression or flag areas # Mobius # 3.18.2017 # User Inputs input EciLength = 8; #hint EciLength: Length for calculations. input AvgType = AverageType.Exponential; #hint AvgType: Average Type input MeanValue = HL2; #hint MeanValue: Point of origen. input betaDev = 4; script G { input p = close; input n = 2; input b = 1.05; def w; def beta; def alpha; def G; w = (2 * Double.Pi / n); beta = (1 - Cos(w)) / (Power(1.414, 2.0 / b) - 1 ); alpha = (-beta + Sqrt(beta * beta + 2 * beta)); G = Power(alpha, 4) * p + 4 * (1 – alpha) * G[1] – 6 * Power( 1 - alpha, 2 ) * G[2] + 4 * Power( 1 - alpha, 3 ) * G[3] - Power( 1 - alpha, 4 ) * G[4]; plot data = G; } # Variables: def bar = barNumber(); def o = g(open, ECIlength, betaDev); def h = g(high, ECIlength, betaDev); def l = g(low, ECIlength, betaDev); def c = g(close, ECIlength, betaDev); def ECI = Log(Sum(Max(h, c[1]) - Min(l, c[1]), ECIlength) / (Highest(h, ECIlength) - Lowest(l, ECIlength))) / Log(ECIlength); def Avg = MovingAverage(AverageType = AvgType, ECI, ECILength); def S1 = if ECI crosses above Avg then MeanValue else S1[1]; def S = ECI > Avg; def SBars = if ECI > Avg then bar else Double.NaN; def StartBar = if ECI crosses above Avg then bar else StartBar[1]; def LastSBar = if ECI crosses below Avg then bar else LastSBar[1]; def PP = if ECI crosses above Avg then MeanValue else PP[1]; def Mean_Limit = if bar != StartBar then bar - StartBar else if bar == StartBar then Double.NaN else Mean_Limit[1]; def SHigh = if ECI crosses above Avg then h else SHigh[1]; def SHighBar = if S and h == SHigh then bar else SHighBar[1]; def SHigh_Limit = if bar == StartBar then Double.NaN else if bar > StartBar then bar - SHighBar else SHigh_Limit[1]; def SLow = if ECI crosses above Avg then l else SLow[1]; def SLowBar = if S and l == SLow then bar else SLowBar[1]; def SLow_Limit = if bar == StartBar then Double.NaN else if bar > StartBar then bar - SLowBar else SLow_Limit[1]; # Comment out (#) the ONE not needed ## plot BullScan = close crosses above SHigh; # or ## plot BearScan = close crosses below SLow; ## plot BetweenScan1 = Between (close, SHigh,SLow); # plot BetweenScan = close >= SLow and close <= SHigh; ## plot status = if close >= SLow and close <= SHigh or close < SLow then 1 else 0; plot status = if close > SHigh then 1 else if close >= SLow and close <= SHigh then 0 else -1; ## status.AssignValueColor(if status == 1 then Color.DARK_Green else Color.Black); status.AssignValueColor(if status == 1 then Color.Dark_Orange else if status == 0 then Color.Green else Color.Dark_Red); AssignBackgroundColor(if status == 1 then Color.Dark_Orange else if status ==0 then Color.Green else Color.Red); Source: https://usethinkscript.com/threads/eci-gaussian-indicator-for-thinkorswim.1160/;

hellocucen

New member

hellocucen

New member

Hi @Dupre, I don't see any green or red levels from this indicator? Only see yellow dots? How can I enable the green and red levels in the script? Thanks in Advance.@tome10 At the top of the code, Mobius suggests other indicators (SuperTrend, RSI, Deviation Bands, Linear Regression, etc ...) to use in conjunction with the ECI study. I've previously seen Mobius say that he will go long at the lowest level (default color is red) of the ECI on an uptrend and go short at the highest level (default color is green) in a downtrend.

Hopefully this helps clarify some.

MatthewA

Active member

No the Expansion & Compression Indicator E.C.I will not repaint as the lengths are constant.But does ECI Gaussian Indicators yellow dots repaint ie, do they get disappeared?

So even if future price action is extremely different it will not change how the chart defined the past...

Please note that even though the users placed a Green and Red cloud above and below it is NOT bullish or bearsish. It is a Neutral indicator.

MatthewA

Active member

For example areas where certain BELL phone land Lines would fail would fail at the same pattern no matter how the speeds were changed and this created quite a curiosity.

That is the sort of thinking in these posts and therefore there really is no Bullish or Bearish. (Green or Red) sentiment.

don't see any green or red levels from this indicator? Only see yellow dots? How can I enable the green and red levels in the script? Thanks in Advance.

@Musk335im3 The following link looks to be for an MTF version of ECI that Mobius posted.HI ALL. Thanks for this great community. Another study that I have found useful for a couple of years now. This bear market (hopefully bottoming already) is the best time to do some "housekeeping and upgrades".

Anyway, I just like to ask the originator poster (and also the community) on how to make this study to project on a MTF (multi-time frame) chart. Cause half of the time I am using a laptop when trading while also my entries/exits on 30min aggregation (or less). I need to see if the price is going in/out of the study range on a single screen setup on an intraday aggregation.

As a reference, I am posting a picture below of the SPY where the left image has the ECI study with some moving averages at daily aggregation. The right image, on the other hand, at 30 minute aggregation also has the daily 8 and 21 EMAs projected to it via MTF. I drew some lines (green, yellow, and red) to simulate what I was trying to achieve with the ECI study (similar to the 8, 21 MTF EMA's), but with hundreds of charts to look at, it's a bit taxing to do this manually.

I'm also posting the code below of the moving average MTF for reference. My thinkscript coding skills is still pretty amateurish to be able to combine the two (hopefully with Clouds). Though I tried with no luck.

Thank you in advance.

@horserider @theLEMband @SleepyZ

View attachment 15032

Code:# MTF Moving Average input Period = aggregationPeriod.HOUR; input AvgType = averageType.EXPONENTIAL; input Length = 50; input priceclose = close; plot AVG = MovingAverage(AvgType, close(period = Period), Length); AVG.setdefaultcolor(color.yellow);

https://onedrive.live.com/redir?resid=2FF733D1BA1E1E79!404&authkey=!ABOXXFyQg1iUqFk&page=View&wd=target(10. Scripts by Author/Mobius.one|7498af59-388b-47c7-949b-927eb1c859d8/ECI or Flags at higher aggregation _Mobius|e30b6b45-e4c2-4346-8746-d3f33385d9c3/)&wdorigin=NavigationUrl

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Gaussian Channel Indicator For ThinkOrSwim | Indicators | 7 | |

|

|

Gaussian Rainbow MA Indicator for ThinkorSwim | Indicators | 13 | |

|

|

Repaints Cup and Handle Indicator for ThinkorSwim | Indicators | 25 | |

|

|

The Ultimate Buy and Sell Indicator for ThinkOrSwim | Indicators | 6 | |

| J | ATR Expected Move Indicator For ThinkOrSwim | Indicators | 17 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

Similar threads

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/