Have you looked at page 1 of this thread? Coding isn't my thing but Christopher lays out his work so nicely that even I have been able to port many of his scripts for use on an alternate platform. (Being intentionally vague as mods understandably don't seem to appreciate discussion of other platforms.)Whether that happens or not, I am wondering if you could clarify a bit how the math is active here that makes this script possible? so that it could be cloned in some form in another platform?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Doesn’t get much better than that people… All systems go on that entry. @Christopher84

TSLA 1 Min (few mins after TRIPLE EXHAUSTION (the red/dark red dots)

TSLA 1 Min (few mins after TRIPLE EXHAUSTION (the red/dark red dots)

lolreconlol

Active member

Could you share a link to your current chart? I changed colors/unchecked stuff but it doesn't seem to look the same.. thank you!

Well my recent screenshots are from TOS Mobile. Which does not have full functionality (no candle painting, labels, or clouds) go back a few pages and load the share link for C4_Max_V5 - go to settings and uncheck all 4 labeled “AVG” … but yeah it looks different on mobile … closest you could get is to go to settings and under “show cloud” put “no” there will be lines and no clouds… change the “Regular_Buy” to green and “Regular_Sell” to red (as I think I have them both white)Could you share a link to your current chart? I changed colors/unchecked stuff but it doesn't seem to look the same.. thank you!

Post a screenshot if you want me to tell you what to change

Another profitable day following the strategy. It doesn't get much easier than this. Happy trading everyone!

Can you post or help me to locate the "Spark Up / Down arrow" code? I have searched for a while and cannot locate it. Thank you in advance. BTW, thank you for your instructions, They really helped me the last couple of trading days.Edited

The following are indications one will notice overtime using the various indicators in this thread. It is not a rules based system.

If you have trouble understanding all the various indicators THEN JUST GIVE UP! Joking people! Just a joke! But seriously if that is the case and you like to trade short term 1-3min charts just focus on the Bull Bear V5 candles and watch the other indications until you understand them. (You could turn everything off except for Bull Bear V5 candles and Spark Up/Down arrows on only and do well ((I would also add triple exhaustion))

* End edit *

This is generally my method (note: I use a watchlist column for high relative volume with only high liquidity tickers like AAPL TSLA SPY etc):

1. Determine the direction of the hourly trend (before market open) using one or more of the following indications:

A. C3 MF Line color

B. Spark Up / Down arrow

C. EMAD EMA color

D. PLD crossover

E. Price wrapping

- Trending up - take long trades only

- Trending down - take short trades only

** Exceptions to step 1 **

- Triple Exhaustion indication (dots)

- Significant levels (supply or demand zone with yellow or light green line inside the cloud of respective zone)if a supply zone with a yellow line inside the zone is acting as support in a bullish trend then the zone moves up and is now used as resistance —> wait for a breakdown or up from this level as it may go sideways at said level

Note

If your using one of the hourly indications that signal the trend change later than the others then be patient and wait for a good entry… if using an indication that alerts trend change rather quickly that goes against the slower indicator (like the upper EMA cloud) that is fine just know that it will likely be a short lived pullback as opposed to a full trend reversal.

2. Determine wether or not the 1Min - 3Min chart agrees with the hourly trend direction (look at both timeframes)

- If the hourly is bearish I’m waiting for a move in the opposite direction to reject the supply zone or for Triple Exhaustion indication and/or bull bear V5 candles turn from green to red to buy puts (make sure you do not trade opposite a zone that is wrapping)

- If the hourly is bearish and 1/3min trends agree I will buy puts if one or more of the following is true:

A. Candles wrapping at open

B. Major zone rejection premarket (near open)

C. PLD crossover reject before open (wicks)

D. Bull bear V5 candles red

E. C3 Line red

3. Exit trade when one of the following occurs:

- Triple Exhaustion indication (usually good to use as a “risk off” point (bought 5 contracts sell 4 let one ride if the trend is not broken)

- Supply / Demand zone moving horizontal (or hold until candle breaks out of the zone)

- Candles move above a zone (depending on price action)

- If price is moving towards a significant zone (zone with yellow or light green line inside) I will expect a bounce and risk off accordingly also if the lower line of the EMAD is stepping up while price is going down I will expect a bounce

** The triple exhaustion in particular shines on strong price action for high liquidity underlyings like TSLA NVDA etc. also I look for the indication on other timeframes as well but works best used on the 1-3min I find **

Test first trade later.

No problem sir.Can you post or help me to locate the "Spark Up / Down arrow" code? I have searched for a while and cannot locate it. Thank you in advance. BTW, thank you for your instructions, They really helped me the last couple of trading days.

Spark code is near the very bottom. (Of course the arrows in settings are labeled spark up spark down) the code is based on stacked EMAs

####################################################################################################################################################

#EMA_Candles

#Created by Christopher84 11/30/2021

input showBreakoutSignals = no;

input length8 = 10;

input length9 = 35;

input show_ema_cloud = yes;

plot AvgExp8 = ExpAverage(price[-displace], length8);

def UPD = AvgExp8[1] < AvgExp8;

AvgExp8.SetStyle(Curve.SHORT_DASH);

plot AvgExp9 = ExpAverage(price[-displace], length9);

def UPW = AvgExp9[1] < AvgExp9;

AvgExp9.SetStyle(Curve.short_dash);

def Below = AvgExp8 < AvgExp9;

def Spark = UPD + UPW + Below;

def UPEMA = AvgExp8[1] < AvgExp8;

def DOWNEMA = AvgExp8[1] > AvgExp8;

AvgExp8.AssignValueColor(if UPEMA then Color.LIGHT_GREEN else if DOWNEMA then Color.RED else Color.YELLOW);

def UPEMA2 = AvgExp9[1] < AvgExp9;

def DOWNEMA2 = AvgExp9[1] > AvgExp9;

AvgExp9.AssignValueColor(if UPEMA2 then Color.LIGHT_GREEN else if DOWNEMA2 then Color.RED else Color.YELLOW);

AddCloud(if show_ema_cloud and (AvgExp9 > AvgExp8) then AvgExp9 else Double.NaN, AvgExp8, Color.light_RED, Color.CURRENT);

AddCloud(if show_ema_cloud and (AvgExp8 > AvgExp9) then AvgExp8 else Double.NaN, AvgExp9, Color.light_GREEN, Color.CURRENT);

def UP8 = UPEMA and UPEMA2;

def DOWN8 = DOWNEMA and DOWNEMA2;

def priceColor8 = if UP8 then 1

else if DOWN8 then -1

else 0;

def UP11 = UPEMA;

def DOWN11 = DOWNEMA;

def priceColor11 = if UP11 then 1

else if DOWN11 then -1

else 0;

def UP12 = UPEMA2;

def DOWN12 = DOWNEMA2;

def priceColor12 = if UP12 then 1

else if DOWN12 then -1

else 0;

def UpCalc = (priceColor == 1) + (priceColor2 == 1) + (priceColor8 == 1) + (priceColor10 == 1);

def StrongUpCalc = (priceColor == 1) + (priceColor2 == 1) + (priceColor10 == 1) + (priceColor12 == 1);# + (priceColor12 == 1);

def CandleColor = if (priceColor2 == 1) and (Spark >= 2) then 1

else if (priceColor2 == -1) and (Spark < 2) then -1

#else if ((PriceColor8[2] == 1) and (PriceColor8 == 1)) then 1

#else if ((PriceColor8[2] == -1) and (PriceColor8 == -1))then -1

#else if (priceColor2 == 1) then 1

#else if (priceColor2 == -1) then -1

else 0;

#AssignPriceColor(if Color_Candles and (CandleColor == 1) then Color.GREEN else if Color_Candles and (CandleColor == -1) then Color.RED else Color.GRAY);

plot SparkUP = (Spark == 3) and (CandleColor == 1);

SparkUP.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

SparkUP.AssignValueColor(Color.LIGHT_GREEN);

plot SparkDN = (Spark == 0) and (CandleColor == -1);

SparkDN.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

SparkDN.AssignValueColor(Color.RED);

Is this a part of the C3_Max Strategy?No problem sir.

Spark code is near the very bottom. (Of course the arrows in settings are labeled spark up spark down) the code is based on stacked EMAs

####################################################################################################################################################

#EMA_Candles

#Created by Christopher84 11/30/2021

input showBreakoutSignals = no;

input length8 = 10;

input length9 = 35;

input show_ema_cloud = yes;

plot AvgExp8 = ExpAverage(price[-displace], length8);

def UPD = AvgExp8[1] < AvgExp8;

AvgExp8.SetStyle(Curve.SHORT_DASH);

plot AvgExp9 = ExpAverage(price[-displace], length9);

def UPW = AvgExp9[1] < AvgExp9;

AvgExp9.SetStyle(Curve.short_dash);

def Below = AvgExp8 < AvgExp9;

def Spark = UPD + UPW + Below;

def UPEMA = AvgExp8[1] < AvgExp8;

def DOWNEMA = AvgExp8[1] > AvgExp8;

AvgExp8.AssignValueColor(if UPEMA then Color.LIGHT_GREEN else if DOWNEMA then Color.RED else Color.YELLOW);

def UPEMA2 = AvgExp9[1] < AvgExp9;

def DOWNEMA2 = AvgExp9[1] > AvgExp9;

AvgExp9.AssignValueColor(if UPEMA2 then Color.LIGHT_GREEN else if DOWNEMA2 then Color.RED else Color.YELLOW);

AddCloud(if show_ema_cloud and (AvgExp9 > AvgExp8) then AvgExp9 else Double.NaN, AvgExp8, Color.light_RED, Color.CURRENT);

AddCloud(if show_ema_cloud and (AvgExp8 > AvgExp9) then AvgExp8 else Double.NaN, AvgExp9, Color.light_GREEN, Color.CURRENT);

def UP8 = UPEMA and UPEMA2;

def DOWN8 = DOWNEMA and DOWNEMA2;

def priceColor8 = if UP8 then 1

else if DOWN8 then -1

else 0;

def UP11 = UPEMA;

def DOWN11 = DOWNEMA;

def priceColor11 = if UP11 then 1

else if DOWN11 then -1

else 0;

def UP12 = UPEMA2;

def DOWN12 = DOWNEMA2;

def priceColor12 = if UP12 then 1

else if DOWN12 then -1

else 0;

def UpCalc = (priceColor == 1) + (priceColor2 == 1) + (priceColor8 == 1) + (priceColor10 == 1);

def StrongUpCalc = (priceColor == 1) + (priceColor2 == 1) + (priceColor10 == 1) + (priceColor12 == 1);# + (priceColor12 == 1);

def CandleColor = if (priceColor2 == 1) and (Spark >= 2) then 1

else if (priceColor2 == -1) and (Spark < 2) then -1

#else if ((PriceColor8[2] == 1) and (PriceColor8 == 1)) then 1

#else if ((PriceColor8[2] == -1) and (PriceColor8 == -1))then -1

#else if (priceColor2 == 1) then 1

#else if (priceColor2 == -1) then -1

else 0;

#AssignPriceColor(if Color_Candles and (CandleColor == 1) then Color.GREEN else if Color_Candles and (CandleColor == -1) then Color.RED else Color.GRAY);

plot SparkUP = (Spark == 3) and (CandleColor == 1);

SparkUP.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

SparkUP.AssignValueColor(Color.LIGHT_GREEN);

plot SparkDN = (Spark == 0) and (CandleColor == -1);

SparkDN.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

SparkDN.AssignValueColor(Color.RED);

@METAL

I believe so I use “Max_Spark” version (found in comments posted by @Christopher84) but it’s just different settings I think. It will be at the bottom of the code above the add labels

I believe so I use “Max_Spark” version (found in comments posted by @Christopher84) but it’s just different settings I think. It will be at the bottom of the code above the add labels

@Christopher84 could you share your chart with indicators?

@ulle73 -please refer to page#92, post 1,828 for the setup shared by Christopher84. Hope this help.@Christopher84 could you share your chart with indicators?

You can also find the code in page #1.

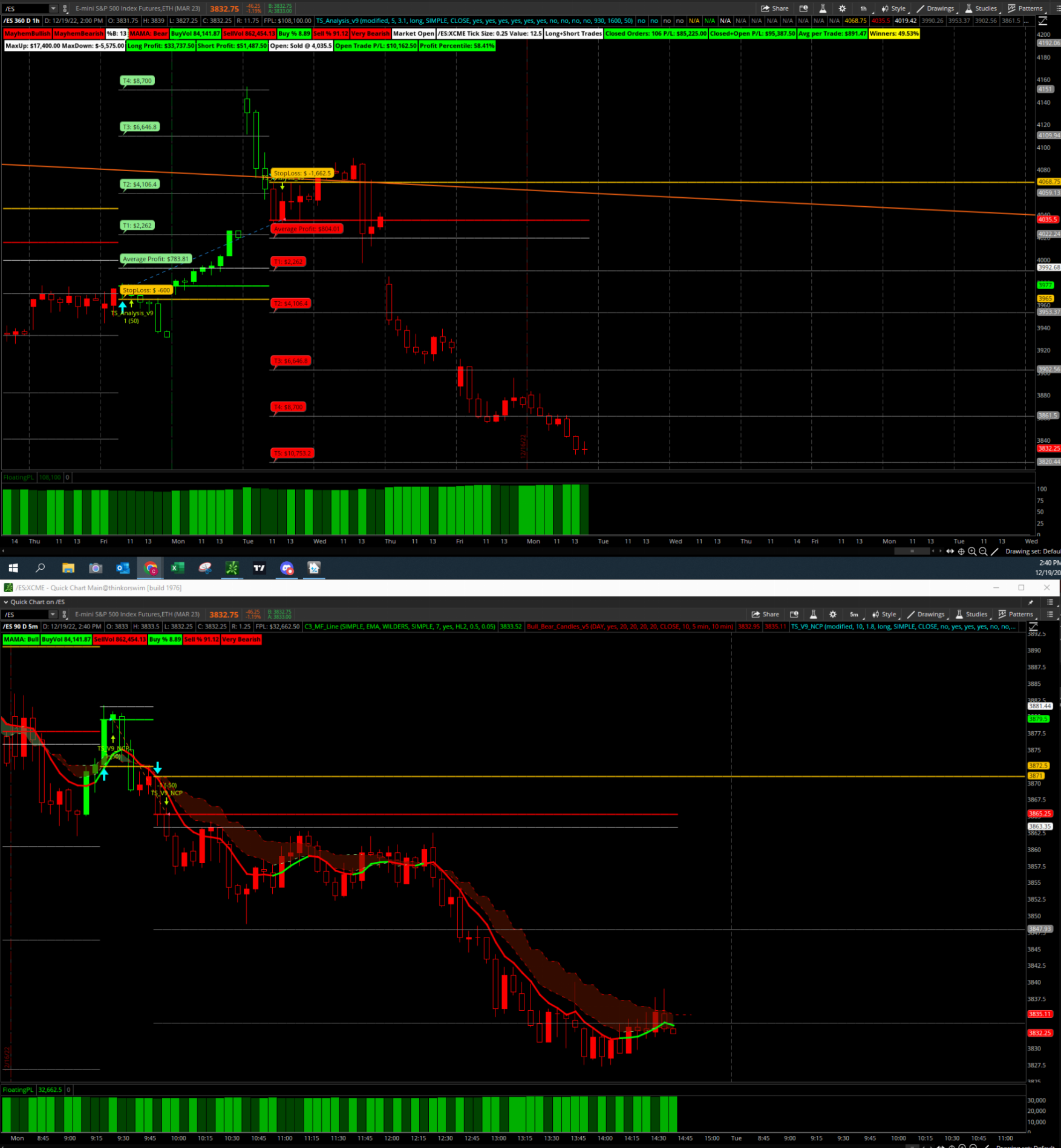

@mtlyon23 - There are excellent options provided by Christopher84 in page#1 . It depends on your trading style. Please see below some comments provided by Christopher 84 related to TS strategy and thing to consider extracted from post 1,808, page #91. Hope this help.I have read through a lot of this. I scalp mainly the /es on 2min and 5min. Any thoughts on the best way to trade that or which strategy to put on the charts?

Thanks!

Hi @lolreconlol,I'll give this a shot! Is this your main trading setup at the moment? Have you had more success with this vs the 3/15 setup you posted earlier? Will you go long when your 1 hour shows a buy, or are you only shorting at this time until the C3_Max shows a green arrow?

Also - in the TS9 settings - if I'm trading SPY, should 'trade daytime only' be on or off? The winning % changes by about 20% if you change it to yes.

I still use both setups. I utilize the 3min/15min setup is for scalping only, and I only scalp in the direction of the larger trend. This helps me to avoid trying to scalp counter trend in choppy markets which can really be difficult to be profitable. The 1 hour chart averages a trade about every 3 days (however, the current trade has gone 12 days), and it really holds into the trend well. The 1 hour chart is showing enough stability to trade both directions, however I still have a preference for trading the larger trend. I leave daytime only on due to it drastically improving strategy performance and reducing trend noise. Happy trading @lolreconlol!

Have you looked at page 1 of this thread? Coding isn't my thing but Christopher lays out his work so nicely that even I have been able to port many of his scripts for use on an alternate platform. (Being intentionally vague as mods understandably don't seem to appreciate discussion of other platforms.)

yes but have not seen the specifics in regards to the math and theory behind the PLD Bands Strategy. I am super happy with how it works and think indeed that Christopher has done incredible work here. no question. that's not what this is about. Thanks for your thoughts Trader Raider, but im really looking to find out what the concepts and math are behind this script so as to simply understand it better at bottom. Whatever indicator or charting system i use, this is crucial for me. For example if im using the VWAP its not just a line I pop on the chart so as to be in accordance with some article online or some famous guru breakout trader, i use it with a more comprehensive understanding of what it is(volume weighted, etc.). Same with Ichimoku. i dont just plop the tenkan and kijun lines on and go oh wow what a miracle these things are or gee whiz how bizarre they are. I work with understanding that they are plotted with a math that works with medians, not averages and has quite some extensive implications, visually and in real time as to understand what you are looking at on the chart, and hence has real value to trade well with them, as such. So Trader Raider, if you can shed some light on the math and concepts that are at work in this script, PLD Bands Strategy, let me know! thanks againHave you looked at page 1 of this thread? Coding isn't my thing but Christopher lays out his work so nicely that even I have been able to port many of his scripts for use on an alternate platform. (Being intentionally vague as mods understandably don't seem to appreciate discussion of other platforms.)

yes but have not seen the specifics in regards to the math and theory behind the PLD Bands Strategy. I am super happy with how it works and think indeed that Christopher has done incredible work here. no question. that's not what this is about. Thanks for your thoughts Trader Raider, but im really looking to find out what the concepts and math are behind this script so as to simply understand it better at bottom. Whatever indicator or charting system i use, this is crucial for me. For example if im using the VWAP its not just a line I pop on the chart so as to be in accordance with some article online or some famous guru breakout trader, i use it with a more comprehensive understanding of what it is(volume weighted, etc.). Same with Ichimoku. i dont just plop the tenkan and kijun lines on and go oh wow what a miracle these things are or gee whiz how bizarre they are. I work with understanding that they are plotted with a math that works with medians, not averages and has quite some extensive implications, visually and in real time as to understand what you are looking at on the chart, and hence has real value to trade well with them, as such. So Trader Raider, if you can shed some light on the math and concepts that are at work in this script, PLD Bands Strategy, let me know! thanks again

The PLD is a displaced moving average nothing too crazy

To whom it may concern… NFLX beautiful setup.

This image shows a pull back about to happen it was a small pullback and did not cross the PLD (of course it was pretty obvious it would not be a large pullback seeing as the EMAD is still above the zero line and EMA was pushing the EMAD top range up)

This image shows a pull back about to happen it was a small pullback and did not cross the PLD (of course it was pretty obvious it would not be a large pullback seeing as the EMAD is still above the zero line and EMA was pushing the EMAD top range up)

Last edited:

Thanks for sharing the results.To whom it may concern… NFLX beautiful setup.

This image shows a pull back about to happen it was a small pullback and did not cross the PLD

I am using the same set up you are using , my 3 min netflex chart is not same as yours.

Also can you please confirm what is the setting for yellow dotted line which is appearing in 3 min chart?

Another profitable day ....

Indeed! Just wanted to take a moment and wish you a Merry Christmas if you celebrate! All the best to you in the new year, @Christopher84.

THANK YOU for inspiring me to learn how to code. THANK YOU for being so generous on this thread and for totally rocking my trading world.

Last edited:

- Status

- Not open for further replies.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

799

Online

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.