Hi @sEit89,My bad Christopher84, I meant if there is the possibility to add sound alerts on the C3_Max_v2 MA_Strategy.

Thank you!

Just updated the code to include sound alerts. Hope it helps!

Hi @sEit89,My bad Christopher84, I meant if there is the possibility to add sound alerts on the C3_Max_v2 MA_Strategy.

Thank you!

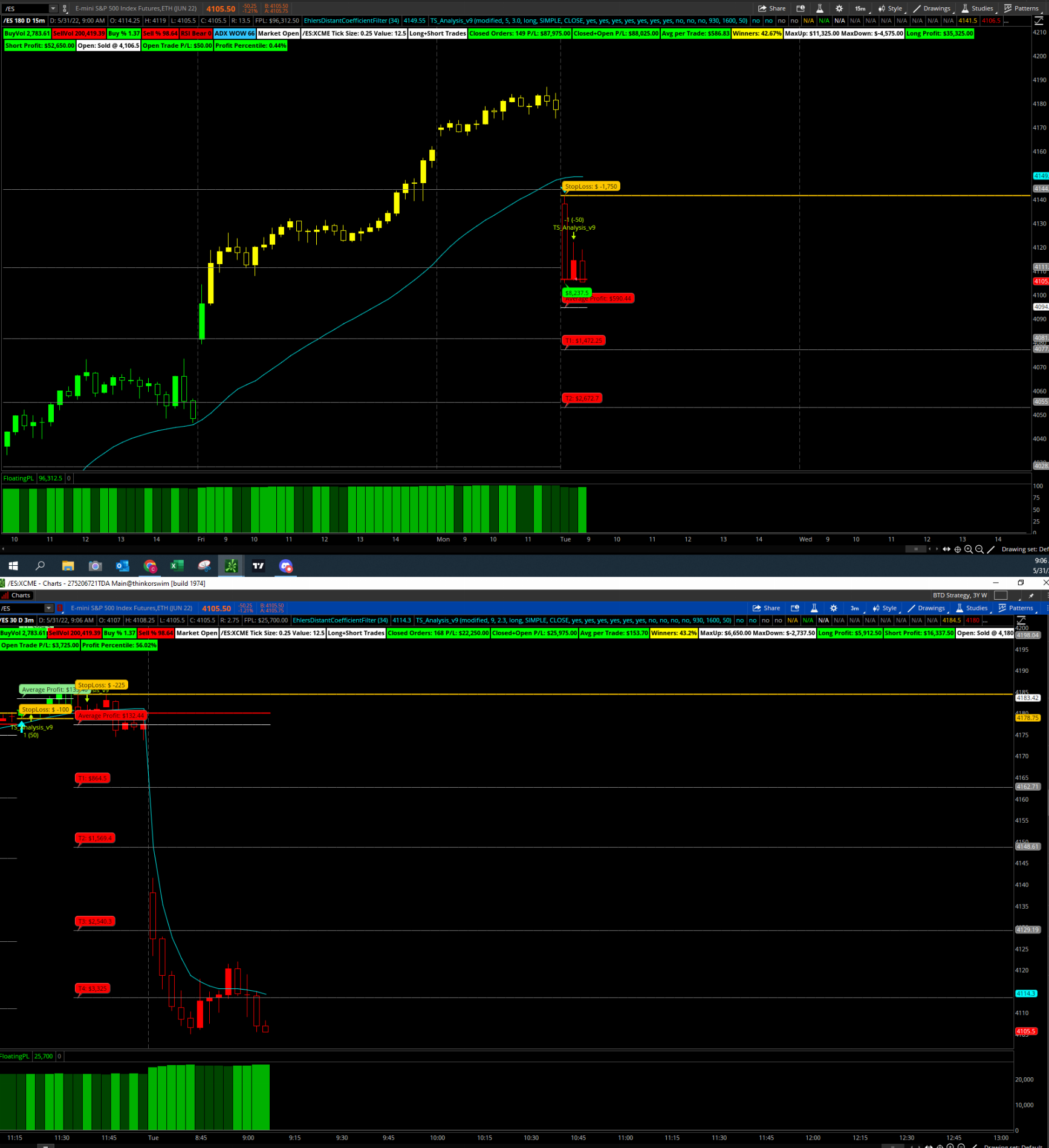

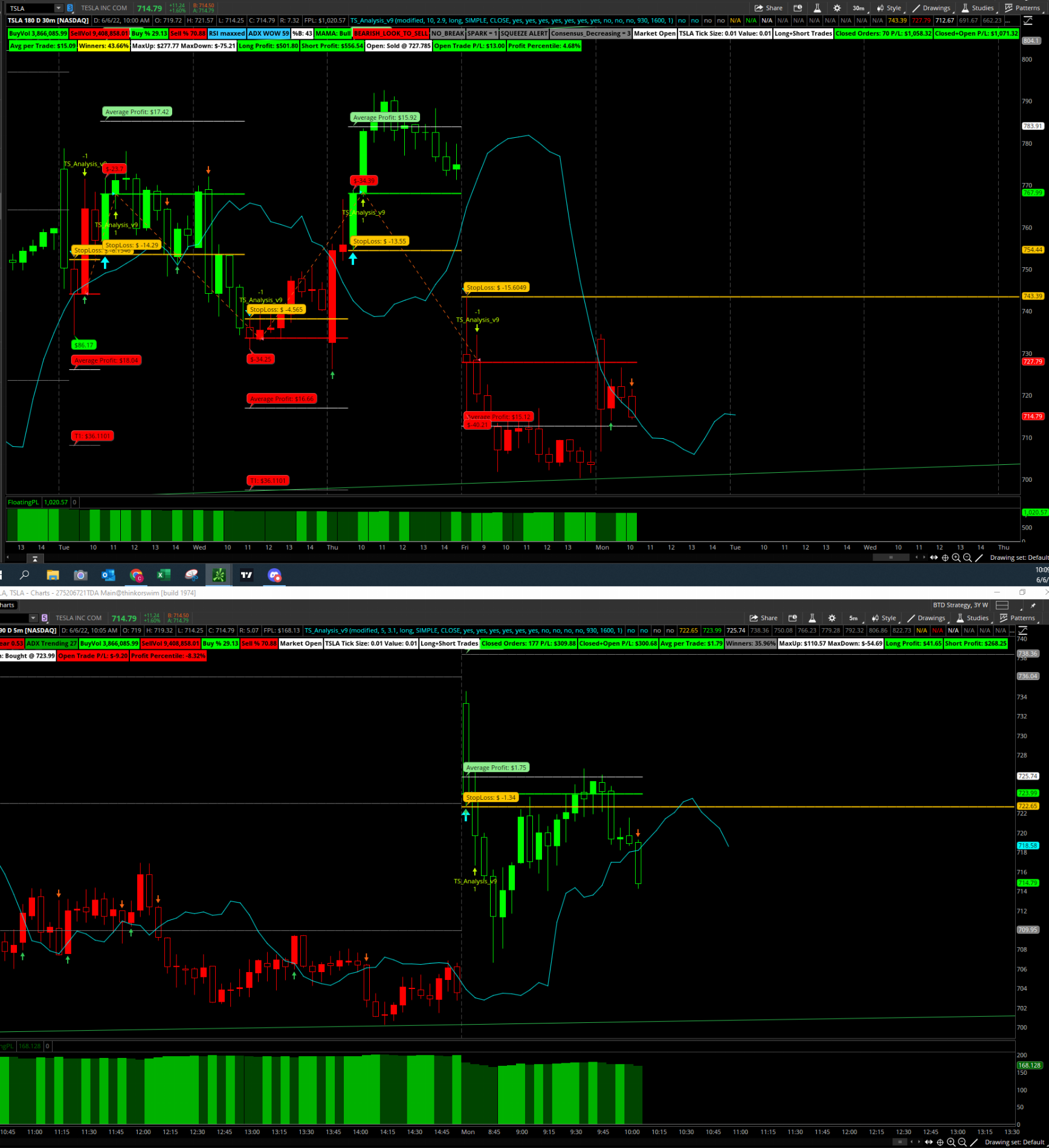

Chris, I don't understand your mean sync here. thanksThe 3 min and 15 min in sync this morning.

Both strategies entered a short position.Chris, I don't understand your mean sync here. thanks

Hi @krahsloop!

I just updated the code on pg.1 of the thread to include sound alerts for you. I'm really glad you have found my work useful.

https://usethinkscript.com/threads/...cator-for-thinkorswim.6316/page-38#post-72882Hey Christopher84, Wow! I have been reading the posts and see that you have MAD SKILLS! Can you please tell me which post had the hour plus video? I started to watch it, then my computer crashed. Now I cannot find it. Muchly appreciated. Thanks for all your generosity.

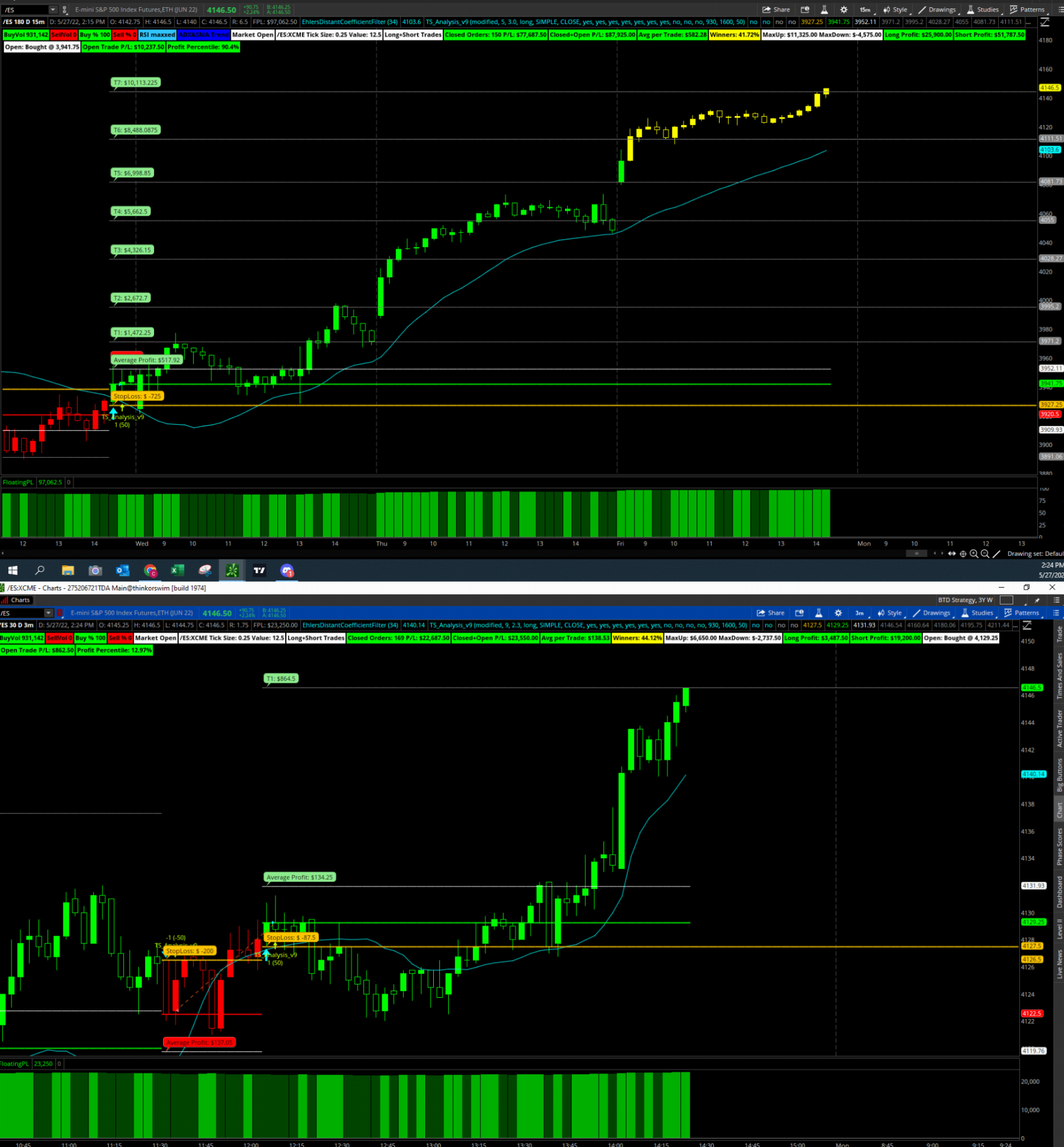

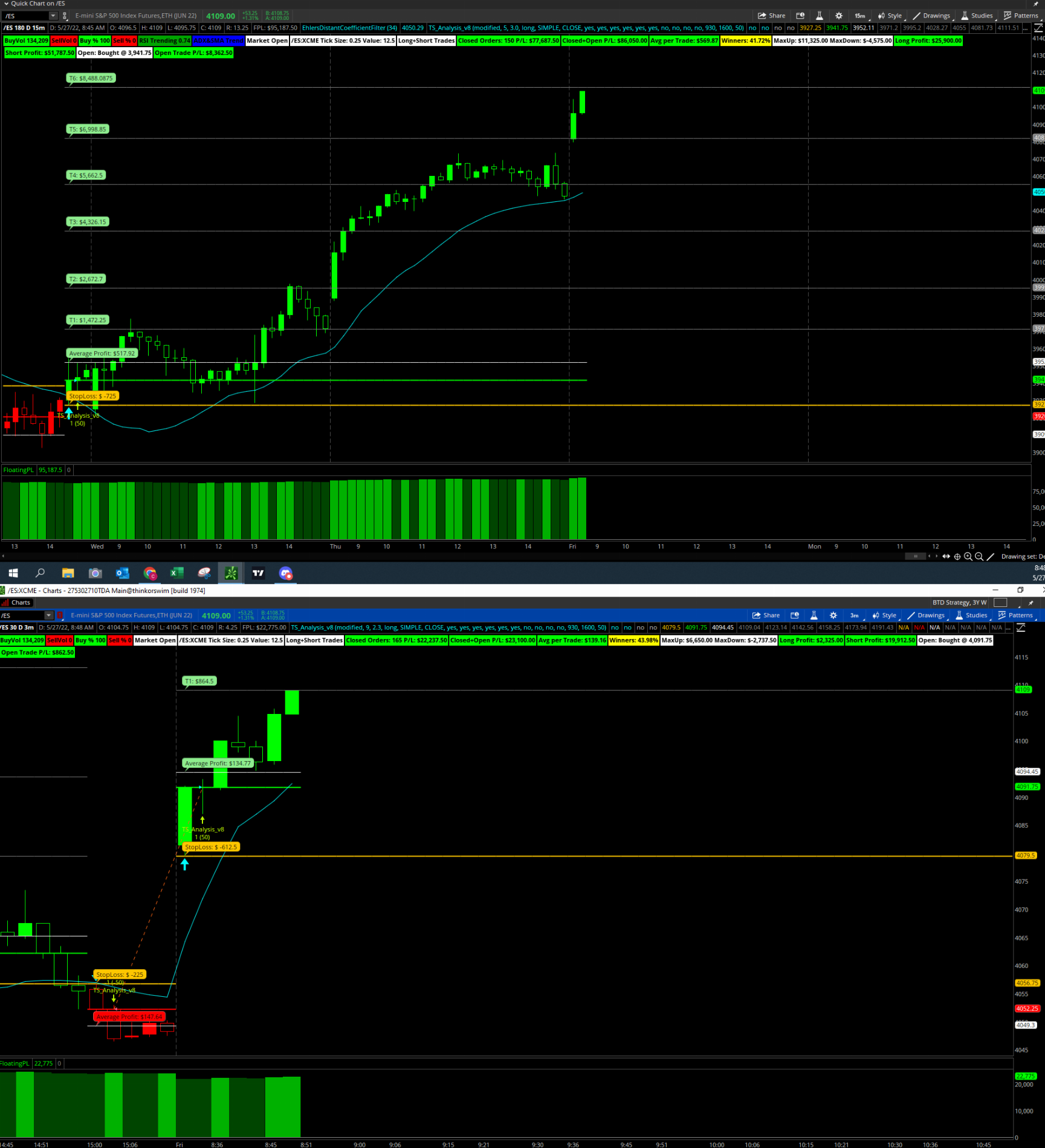

Wouldn't you have been stopped out on these, or am I reading it wrong?T7 hit on the 15 min while the 3min hit T1. Some nice trades leading into the holiday weekend!

Hi @lolreconlol,Wouldn't you have been stopped out on these, or am I reading it wrong?

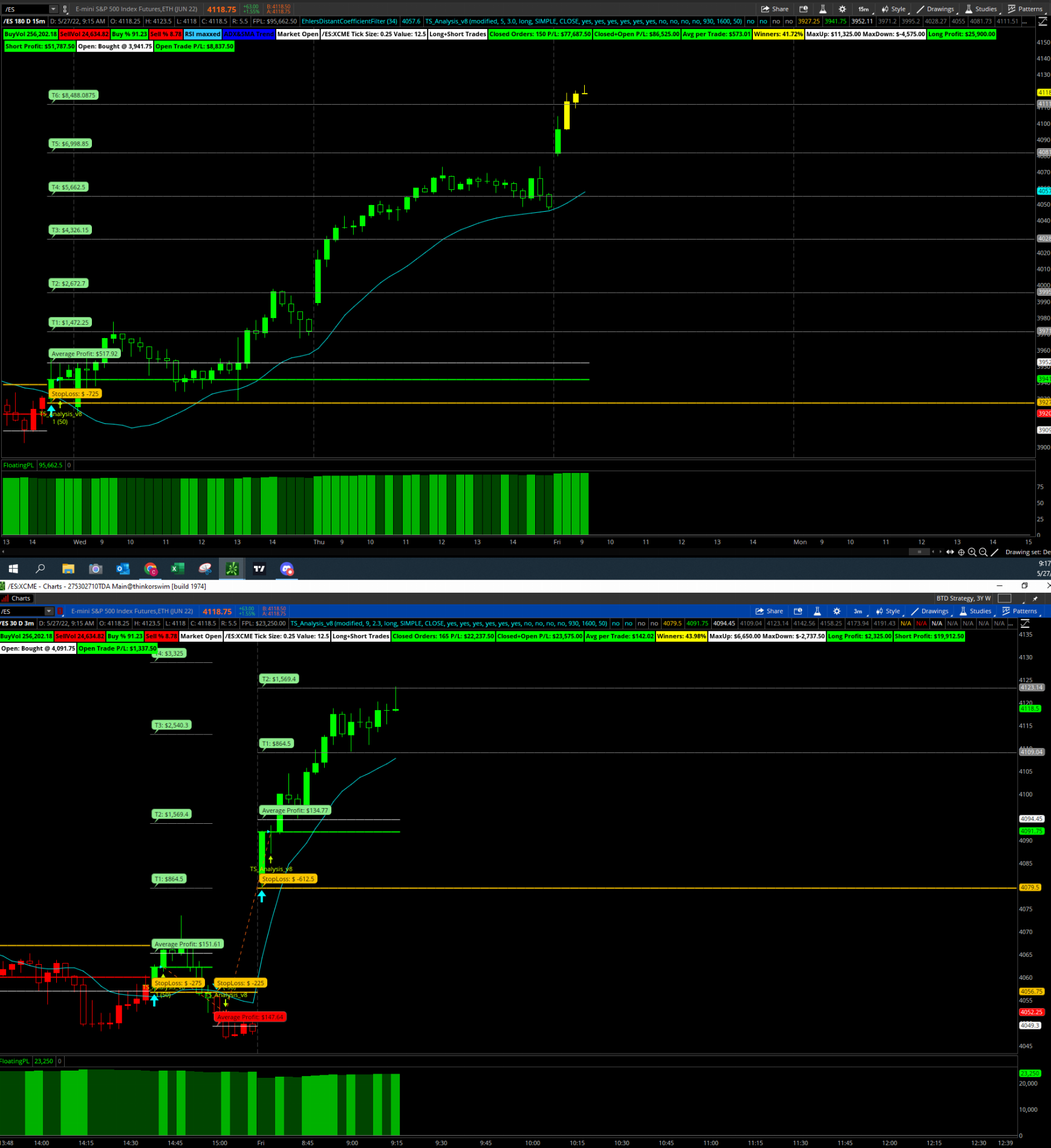

Looks dope. Do you mind sharing the link to this setup? Thanks in advance.For those of you that like to scalp, the 15 min with the 3 min are looking to be a pretty powerful combo.

Next target hit. 15 min chart is reaching the strategy extremes for profitability (candles turn yellow).

Hi @Lauri!Hey Christopher84, Wow! I have been reading the posts and see that you have MAD SKILLS! Can you please tell me which post had the hour plus video? I started to watch it, then my computer crashed. Now I cannot find it. Muchly appreciated. Thanks for all your generosity.

Hi @alexsmith3546!@Christopher84 loving the combo of the Ehlers coefficient line and the c3 max line, I had 2 good plays today (chickened out on both of them and sold early but profit is profit). Been trying to spend more time trying to understand the different labels and I was hoping I could get your logic behind some of what i see here

In the image below of spy on the daily chart

1. I see the label still says bearish, how is this calculated ? Its above the EMA and the c3 max line and the Ehlers coefficient so what is the logic used to determine if its bearish or bullish?

2. What does spark up mean here ? I also have seen spark down but just trying to understand the terminology here.

3. I am assuming the %B:94 (the left most label) indicates 94% buys or am I misunderstanding

Hi Sroo52,Looks dope. Do you mind sharing the link to this setup? Thanks in advance.

Should TS9 be used with extended hours off when dealing with stocks?TSLA out of sync this morning on it's 5 min and 30 min charts.

Hi @lolreconlol!Should TS9 be used with extended hours off when dealing with stocks?

Hi Kislayakanan!Hello @Christopher84,

Thank you for sharing the indicator. I tried to load the TS indicator you have posted on page 1. But I am not getting any lines of buy/sell signal. Can you help me with that?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.