Hi, yes. But, now it overrides your Confirmation upper study candle color. Is there a way I can turn it off?I think you are referring to the B4. If so, here’s a link https://usethinkscript.com/threads/balanced-bb-breakout.5708/. It’s an excellent trading tool.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

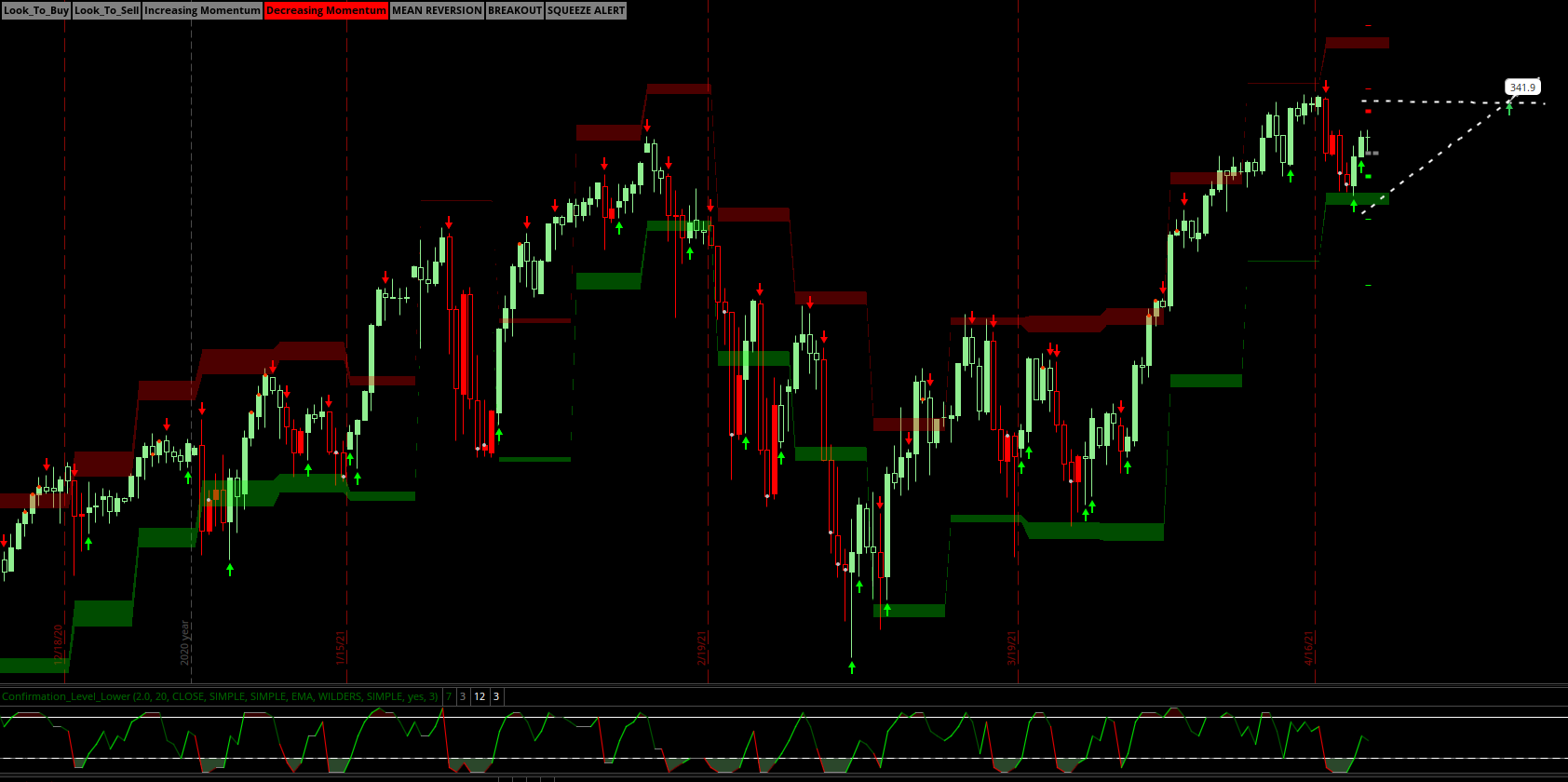

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

You can turn off the candle coloring in B4. Option is called "bar color". It is towards the bottom of the list of options.Hi, yes. But, now it overrides your Confirmation upper study candle color. Is there a way I can turn it off?

scalptrader115

New member

i have only found a handful of useful scripts, here and this is one of the top 3 so far very good job, amazing whom ever wrote and coded this masterpiece!# (Consensus Confirmation Candles) C3 v6 # # Created 04/28/2021 by Christopher84 # Based off of the Confirmation Candles Study. Main difference is that CC Candles weigh factors of positive # and negative price movement to create the Consensus_Level. The Consensus_Level is considered positive if # above zero and negative if below zero. # # v2 - 05/11/2021 - dialed in studies to give stronger signals. Removed reversal buy and sell signals with # OB/OS signals. Included OB/OS clouds to indicate favorable zones to buy or take profit. # Clouds can also indicate nearterm reversals. Cleaned up code. # v3 - 05/20/2021 - Removed Pivot Study and replaced with CIP. Reworked Labels to reflect mean reversion Look # to Buy/Look to Sell conditions. Removed Mean Reversion Label. Added new label to show the # Confirmation_Level and color coded it to show OB/OS conditions. # BETA - 05/21/2021 - (barbaros) Consensus Level filter set to above 4 and below -4 # v4 - 05/24/2021 - Consensus Level filter changed to above 6 and below -6 # BETA - 05/29/2021 - (barbaros) Bug fixes # v5 - 06/01/2021 - Consolidated labels. Added new squeeze condition based on NearTSupport and NearTResistance. # v5 - 06/04/2021 - Included Ichimoku cloud. # v6 - 06/09/2021 - Added Arrows using Confirmation_Factor #Keltner Channel declare upper; def displace = 0; def factorK = 2.0; def lengthK = 20; def price = close; input averageType = AverageType.SIMPLE; def trueRangeAverageType = AverageType.SIMPLE; def BulgeLengthPrice = 75; def SqueezeLengthPrice = 75; def BulgeLengthPrice2 = 20; def SqueezeLengthPrice2 = 20; def BulgeLengthPrice3 = 12; def SqueezeLengthPrice3 = 12; def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK); def averageK = MovingAverage(averageType, price, lengthK); def AvgK = averageK[-displace]; def Upper_BandK = averageK[-displace] + shift[-displace]; def Lower_BandK = averageK[-displace] - shift[-displace]; def conditionK1UP = price >= Upper_BandK; def conditionK2UP = (Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK); def conditionK3DN = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK); def conditionK4DN = price < Lower_BandK; def BandwidthK = (Upper_BandK - Lower_BandK) / AvgK * 100; plot IntermResistance = Highest(price, BulgeLengthPrice); IntermResistance.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); plot IntermSupport = Lowest(price, SqueezeLengthPrice); IntermSupport.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); plot NearTResistance = Highest(price, BulgeLengthPrice2); NearTResistance.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); NearTResistance.SetStyle(Curve.SHORT_DASH); plot NearTSupport = Lowest(price, SqueezeLengthPrice2); NearTSupport.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); NearTSupport.SetStyle(Curve.SHORT_DASH); def NearTResistance1 = Highest(price, BulgeLengthPrice3); def NearTSupport1 = Lowest(price, SqueezeLengthPrice3); #MACD with Price def fastLength = 12; def slowLength = 26; def MACDLength = 9; input MACD_AverageType = {SMA, default EMA}; def MACDLevel = 0.0; def fastEMA = ExpAverage(price, fastLength); def slowEMA = ExpAverage(price, slowLength); def Value; def Avg; switch (MACD_AverageType) { case SMA: Value = Average(price, fastLength) - Average(price, slowLength); Avg = Average(Value, MACDLength); case EMA: Value = fastEMA - slowEMA; Avg = ExpAverage(Value, MACDLength); } def Diff = Value - Avg; def Level = MACDLevel; def condition1 = Value[1] <= Value; def condition1D = Value[1] > Value; #RSI def RSI_length = 14; def RSI_AverageType = AverageType.WILDERS; def RSI_OB = 70; def RSI_OS = 30; def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length); def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true; def condition2D = (RSI[3] > RSI) is true or (RSI < 20) is true; def conditionOB1 = RSI > RSI_OB; def conditionOS1 = RSI < RSI_OS; #MFI def MFI_Length = 14; def MFIover_Sold = 20; def MFIover_Bought = 80; def movingAvgLength = 1; def MoneyFlowIndex = Average(MoneyFlow(high, close, low, volume, MFI_Length), movingAvgLength); def MFIOverBought = MFIover_Bought; def MFIOverSold = MFIover_Sold; def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true; def condition3D = (MoneyFlowIndex[2] > MoneyFlowIndex) is true or (MoneyFlowIndex < 20) is true; def conditionOB2 = MoneyFlowIndex > MFIover_Bought; def conditionOS2 = MoneyFlowIndex < MFIover_Sold; #Forecast def na = Double.NaN; def MidLine = 50; def Momentum = MarketForecast().Momentum; def NearT = MarketForecast().NearTerm; def Intermed = MarketForecast().Intermediate; def FOB = 80; def FOS = 20; def upperLine = 110; def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine); def condition4D = (Intermed[1] > Intermed) or (NearT < MidLine); def conditionOB3 = Intermed > FOB; def conditionOS3 = Intermed < FOS; def conditionOB4 = NearT > FOB; def conditionOS4 = NearT < FOS; #Change in Price def lengthCIP = 5; def CIP = (price - price[1]); def AvgCIP = ExpAverage(CIP[-displace], lengthCIP); def CIP_UP = AvgCIP > AvgCIP[1]; def CIP_DOWN = AvgCIP < AvgCIP[1]; def condition5 = CIP_UP; def condition5D = CIP_DOWN; #EMA_1 def EMA_length = 8; def AvgExp = ExpAverage(price[-displace], EMA_length); def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp); def condition6D = (price < AvgExp) and (AvgExp[2] > AvgExp); #EMA_2 def EMA_2length = 20; def displace2 = 0; def AvgExp2 = ExpAverage(price[-displace2], EMA_2length); def condition7 = (price >= AvgExp2) and (AvgExp2[2] <= AvgExp); def condition7D = (price < AvgExp2) and (AvgExp2[2] > AvgExp); #DMI Oscillator def DMI_length = 5;#Typically set to 10 input DMI_averageType = AverageType.WILDERS; def diPlus = DMI(DMI_length, DMI_averageType)."DI+"; def diMinus = DMI(DMI_length, DMI_averageType)."DI-"; def Osc = diPlus - diMinus; def Hist = Osc; def ZeroLine = 0; def condition8 = Osc >= ZeroLine; def condition8D = Osc < ZeroLine; #Trend_Periods def TP_fastLength = 3;#Typically 7 def TP_slowLength = 4;#Typically 15 def Periods = Sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength)); def condition9 = Periods > 0; def condition9D = Periods < 0; #Polarized Fractal Efficiency def PFE_length = 5;#Typically 10 def smoothingLength = 2.5;#Typically 5 def PFE_diff = close - close[PFE_length - 1]; def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / Sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1); def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength); def UpperLevel = 50; def LowerLevel = -50; def condition10 = PFE > 0; def condition10D = PFE < 0; def conditionOB5 = PFE > UpperLevel; def conditionOS5 = PFE < LowerLevel; #Bollinger Bands PercentB input BBPB_averageType = AverageType.SIMPLE; def BBPB_length = 20;#Typically 20 def Num_Dev_Dn = -2.0; def Num_Dev_up = 2.0; def BBPB_OB = 100; def BBPB_OS = 0; def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand; def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand; def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100; def HalfLine = 50; def UnitLine = 100; def condition11 = PercentB > HalfLine; def condition11D = PercentB < HalfLine; def conditionOB6 = PercentB > BBPB_OB; def conditionOS6 = PercentB < BBPB_OS; #STARC Bands def ATR_length = 15; def SMA_lengthS = 6; def multiplier_factor = 1.25; def valS = Average(price, SMA_lengthS); def average_true_range = Average(TrueRange(high, close, low), length = ATR_length); def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace]; def Middle_BandS = valS[-displace]; def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace]; def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS); def condition12D = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS); #Klinger Histogram def Klinger_Length = 13; def KVOsc = KlingerOscillator(Klinger_Length).KVOsc; def KVOH = KVOsc - Average(KVOsc, Klinger_Length); def condition13 = (KVOH > 0); def condition13D = (KVOH < 0); #Projection Oscillator def ProjectionOsc_length = 30;#Typically 10 def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length)); def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length)); def ProjectionOsc_diff = MaxBound - MinBound; def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0; def PROSC_OB = 80; def PROSC_OS = 20; def condition14 = PROSC > 50; def condition14D = PROSC < 50; def conditionOB7 = PROSC > PROSC_OB; def conditionOS7 = PROSC < PROSC_OS; #Trend Confirmation Calculator #Confirmation_Factor range 1-15. input coloredCandlesOn = yes; input Confirmation_Factor = 7; #Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1. #def Agreement_Level = condition1; def Agreement_LevelOB = 10; def Agreement_LevelOS = -10; def Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13 + condition14 + conditionK1UP + conditionK2UP; def Agreement_LevelD = (condition1D + condition2D + condition3D + condition4D + condition5D + condition6D + condition7D + condition8D + condition9D + condition10D + condition11D + condition12D + condition13D + condition14D + conditionK3DN + conditionK4DN); def Consensus_Level = Agreement_Level - Agreement_LevelD; def UP = Consensus_Level >= 6; def DOWN = Consensus_Level < -6; def priceColor = if UP then 1 else if DOWN then -1 else priceColor[1]; AssignPriceColor(if coloredCandlesOn and priceColor == 1 then Color.LIGHT_GREEN else if coloredCandlesOn and priceColor == -1 then Color.RED else Color.CURRENT); #Additional Signals #Keltner #2 input showCloud = yes; def factorK2 = 3.25; def lengthK2 = 20; def shiftK2 = factorK2 * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK2); def averageK2 = MovingAverage(averageType, price, lengthK2); def AvgK2 = averageK2[-displace]; def Upper_BandK2 = averageK2[-displace] + shiftK2[-displace]; def Lower_BandK2 = averageK2[-displace] - shiftK2[-displace]; def condition_BandRevDn = (Upper_BandS > Upper_BandK2); def condition_BandRevUp = (Lower_BandS < Lower_BandK2); AddCloud(if showCloud and condition_BandRevUp then Lower_BandK2 else Double.NaN, Lower_BandS, Color.LIGHT_GREEN, Color.CURRENT); AddCloud(if showCloud and condition_BandRevDn then Upper_BandS else Double.NaN, Upper_BandK2, Color.LIGHT_RED, Color.CURRENT); #Super_OB/OS Signal def OB_Level = conditionOB1 + conditionOB2 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7; def OS_Level = conditionOS1 + conditionOS2 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7; def Consensus_Line = OB_Level - OS_Level; def Zero_Line = 0; def Super_OB = 4; def Super_OS = -4; def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Consensus_Line > Super_OB); def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Consensus_Line < Super_OS); def OS_Buy = UP_OS; def OB_Sell = DOWN_OB; def neutral = Consensus_Line < Super_OB and Consensus_Line > Super_OS; #AddVerticalLine (OS_Buy and !OS_Buy[1], close, Color.GREEN, Curve.SHORT_DASH); #AddVerticalLine (Neutral and !neutral[1], close, Color.Gray, Curve.SHORT_DASH); #AddVerticalLine (OB_Sell and OB_Sell and !OB_Sell[1], close, Color.RED, Curve.SHORT_DASH); def Buy_Opportnity = if OS_Buy then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Buy_Opportnity, Neutral, Color.LIGHT_GREEN, Color.LIGHT_RED); def Sell_Opportnity = if OB_Sell then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Sell_Opportnity, Neutral, Color.LIGHT_RED, Color.LIGHT_RED); plot OB_Signal = Upper_BandS crosses above IntermResistance; OB_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); OB_Signal.SetLineWeight(3); OB_Signal.SetDefaultColor(Color.RED); plot OS_Signal = (condition_BandRevUp) and (Lower_BandS crosses below IntermSupport); OS_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); OS_Signal.SetLineWeight(3); OS_Signal.SetDefaultColor(Color.GREEN); #Squeeze Alert def BandwidthC3 = (NearTResistance1 - NearTSupport1); def IntermResistance2 = Highest(BandwidthC3,BulgeLengthPrice); def IntermSupport2 = Lowest(BandwidthC3, SqueezeLengthPrice); def sqzTrigger = BandwidthC3 <= IntermSupport2; def sqzLevel = if !sqzTrigger[1] and sqzTrigger then hl2 else if !sqzTrigger then Double.NaN else sqzLevel[1]; plot Squeeze_Alert = sqzLevel; Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.POINTS); Squeeze_Alert.SetLineWeight(3); Squeeze_Alert.SetDefaultColor(Color.YELLOW); #Trend Signals plot UPConfirmSignal = Agreement_Level crosses above Confirmation_Factor; UPConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); UPConfirmSignal.SetLineWeight(1); UPConfirmSignal.SetDefaultColor(Color.GREEN); plot DOWNConfirmSignal = Agreement_Level crosses below Confirmation_Factor; DOWNConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); DOWNConfirmSignal.SetLineWeight(1); DOWNConfirmSignal.SetDefaultColor(Color.RED); #Bollinger_Bands2 def lengthBB = 10; def Num_Dev_DnBB = -0.8; def Num_Dev_upBB = 0.8; def price1 = open; def sDev = StDev(data = price[-displace], length = lengthBB); def MidLineBB2 = MovingAverage(averageType, data = price[-displace], length = lengthBB); def LowerBandBB2 = MidLineBB2 + Num_Dev_DnBB * sDev; def UpperBandBB2 = MidLineBB2 + Num_Dev_upBB * sDev; input tenkan_period = 9; input kijun_period = 26; input show_Ichimoku_Cloud = yes; def Tenkan = (Highest(high, tenkan_period) + Lowest(low, tenkan_period)) / 2; def Kijun = (Highest(high, kijun_period) + Lowest(low, kijun_period)) / 2; def "Span A" = (Tenkan[kijun_period] + Kijun[kijun_period]) / 2; def "Span B" = (Highest(high[kijun_period], 2 * kijun_period) + Lowest(low[kijun_period], 2 * kijun_period)) / 2; def Chikou = close[-kijun_period]; AddCloud(if show_Ichimoku_Cloud and "Span A" then "Span A" else Double.NaN, "Span B", Color.WHITE, Color.GRAY); #AddCloud("Span A", "Span B", color.WHITE, color.GRAY); #Labels def Buy = UP_OS; def Sell = DOWN_OB; def conditionLTB = (ConditionK2UP and (Consensus_Level < 0)); def conditionLTS = (ConditionK3DN and (Consensus_Level > 0)); def conditionBO = ((Upper_BandS[1] < Upper_BandS) and (Lower_BandS[1] < Lower_BandS)) and ((Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK)); def conditionBD = ((Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS) and (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK)); def MomentumUP = Consensus_Level[1] < Consensus_Level; def MomentumDOWN = Consensus_Level[1] > Consensus_Level; def Squeeze_Signal = !isNaN(Squeeze_Alert); def conditionOB = (Consensus_Level >= 12) and (Consensus_Line >= 4); def conditionOS = (Consensus_Level <= -12) and (Consensus_Line <= -3); AddLabel(yes, if conditionLTB then "BULLISH_LOOK_To_BUY" else if conditionLTS then "BEARISH_LOOK_TO_SELL" else if conditionK2UP then "TREND_BULLISH" else if conditionK3DN then "TREND_BEARISH" else "TREND_CONSOLIDATION", if conditionLTB then Color.GREEN else if conditionLTS then Color.Red else if conditionK2UP then Color.WHITE else if conditionK3DN then Color.DARK_GRAY else Color.GRAY); AddLabel(yes, if conditionBD then "BREAKDOWN" else if conditionBO then "BREAKOUT" else "NO_BREAK", if conditionBD then Color.RED else if conditionBO then Color.Green else Color.Gray); AddLabel(yes, "SQUEEZE ALERT", if Squeeze_Signal then Color.YELLOW else Color.GRAY); AddLabel(yes, if MomentumUP then "Consensus_Increasing = " + round(Consensus_Level,1) else if MomentumUP or MomentumDOWN and conditionOB then "Consensus_OVERBOUGHT = " + round(Consensus_Level,1) else if MomentumDOWN then "Consensus_Decreasing = " + round(Consensus_Level,1) else if MomentumUP or MomentumDOWN and conditionOS then "Consensus_OVERSOLD = " + round(Consensus_Level,1)else "Consensus = " + round(Consensus_Level,1), if conditionOB then Color.RED else if conditionOS then Color.Green else color.GRAY);

scalptrader115

New member

another excellent master piece, thanks!Hi Everyone! Here is Confirmation Candles V.5. Added new reversal signals. Reversal buy (gray points), reversal sell (red points). They seem to be pretty decent (will not repaint once the candle is closed). Looking forward to feedback.

Code:#Confirmation Candles V.5 #Created 04/15/2021 by Christopher84 #Select the level of agreement among the 14 indicators included. #Changed 04/19/2021 to V.3 - Removed ChaikinOsc and replaced with STARCBands. Added squeeze alert. #Changed 04/20/2021 to V.4 - Added Keltner Channel, Labels, and Buy and Sell Zones. Mean Reversion and Breakout Labels added. Reversal_Alert points added. #Changed 4/22/2021 to V.4 - Removed Buy/Sell clouds. Created new reversal alert buy(gray points) and take profit (red points). Increase factorK. #Keltner Channel declare upper; def displace = 0; input factorK = 6.5; input lengthK = 20; input price = close; input averageType = AverageType.SIMPLE; input trueRangeAverageType = AverageType.SIMPLE; def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK); def averageK = MovingAverage(averageType, price, lengthK); def AvgK = averageK[-displace]; def Upper_BandK = averageK[-displace] + shift[-displace]; def Lower_BandK = averageK[-displace] - shift[-displace]; def conditionKup = price >= Upper_BandK; def conditionKdown = price <= Lower_BandK; #MACD with Price def fastLength = 12; def slowLength = 26; def MACDLength = 9; input MACD_AverageType = {SMA, default EMA}; def MACDLevel = 0.0; def fastEMA = ExpAverage(price, fastLength); def slowEMA = ExpAverage(price, slowLength); def Value; def Avg; switch (MACD_AverageType) { case SMA: Value = Average(price, fastLength) - Average(price, slowLength); Avg = Average(Value, MACDLength); case EMA: Value = fastEMA - slowEMA; Avg = ExpAverage(Value, MACDLength);} def Diff = Value - Avg; def Level = MACDLevel; def condition1 = Value[1] <= Value; #RSI def RSI_length = 14; def RSI_AverageType = AverageType.WILDERS; def RSI_OB = 70; def RSI_OS = 30; def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length); def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true; def conditionRSI_OB = RSI > RSI_OB; def conditionRSI_OS = RSI < RSI_OS; #MFI def MFI_Length = 14; def MFIover_Sold = 20; def MFIover_Bought = 80; def movingAvgLength = 1; def MoneyFlowIndex = Average(moneyflow(high, close, low, volume, MFI_Length), movingAvgLength); def MFIOverBought = MFIover_Bought; def MFIOverSold = MFIover_Sold; def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true; def conditionMFI_OB = MoneyFlowIndex > MFIover_Bought; def conditionMFI_OS = MoneyFlowIndex < MFIover_Sold; #Forecast def na = Double.NaN; def MidLine = 50; def Momentum = MarketForecast().Momentum; def NearT = MarketForecast().NearTerm; def Intermed = MarketForecast().Intermediate; def FOB = 80; def FOS = 20; def upperLine = 110; def condition4 = (Intermed[1] <= Intermed) and (NearT >= MidLine); def conditionFOB = Intermed > FOB; def conditionFOS = Intermed < FOS; #Pivot Signals def n = 20; def ticks = 2.0; def bnOK = barNumber() > n; def isHigher = fold i = 1 to n + 1 with p = 1 while p do high > GetValue(high, -i); def HH = if bnOK and isHigher and high == Highest(high, n)then high else Double.NaN; def isLower = fold j = 1 to n + 1 with q = 1 while q do low < GetValue(low, -j); def LL = if bnOK and isLower and low == Lowest(low, n) then low else Double.NaN; def PivH = if HH > 0 then HH else Double.NaN; def PivL = if LL > 0 then LL else Double.NaN; def UpPivotLow = !isNaN(PivL); #UpPivotLow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); #UpPivotLow.SetLineWeight(4); #UpPivotLow.SetDefaultColor(Color.GREEN); def DownPivotHigh = !isNaN(PivH); #DownPivotHigh.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); #DownPivotHigh.SetLineWeight(4); #DownPivotHigh.SetDefaultColor(Color.RED); def condition5 = !isNaN(PivL); #EMA_1 def EMA_length = 12; def AvgExp = ExpAverage(price[-displace], EMA_length); def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp); #EMA_2 def EMA_2length = 20; def displace2 = 0; def AvgExp2 = ExpAverage(price[-displace2], EMA_2length); def condition7 = (price >= AvgExp2) and (AvgExp[2] <= AvgExp); #DMI Oscillator def DMI_length = 5;#Typically set to 10 input DMI_averageType = AverageType.WILDERS; def diPlus = DMI(DMI_length, DMI_averageType)."DI+"; def diMinus = DMI(DMI_length, DMI_averageType)."DI-"; def Osc = diPlus - diMinus; def Hist = Osc; def ZeroLine = 0; def condition8 = Osc >= zeroline; #Trend_Periods def TP_fastLength = 3;#Typically 7 def TP_slowLength = 4;#Typically 15 def Periods = sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength)); def condition9 = Periods > 0; #Polarized Fractal Efficiency def PFE_length = 5;#Typically 10 def smoothingLength = 2.5;#Typically 5 def PFE_diff = close - close[PFE_length - 1]; def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1); def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength); def UpperLevel = 50; def LowerLevel = -50; def condition10 = PFE > 0; def conditionPFE_OB = PFE > UpperLevel; def conditionPFE_OS = PFE < LowerLevel; #Bollinger Bands PercentB input BBPB_averageType = AverageType.Simple; def BBPB_length = 5;#Typically 20 def Num_Dev_Dn = -2.0; def Num_Dev_up = 2.0; def BBPB_OB = 100; def BBPB_OS = 0; def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand; def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand; def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100; def HalfLine = 50; def UnitLine = 100; def condition11 = PercentB > HalfLine; def conditionBBPB_OB = PercentB > BBPB_OB; def conditionBBPB_OS = PercentB < BBPB_OS; #STARC Bands def ATR_length = 15; def SMA_lengthS = 6; def multiplier_factor = 1.5; def valS = Average(price, SMA_lengthS); def average_true_range = Average(TrueRange(high, close, low), length = ATR_length); def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace]; def Middle_BandS = valS[-displace]; def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace]; def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS); #Klinger Histogram def Klinger_Length = 8; def KVOsc = KlingerOscillator(Klinger_Length).KVOsc; def KVOH = KVOsc - Average(KVOsc, Klinger_Length); def condition13 = (KVOH > 0) and (KVOsc[1] <= KVOsc); #Projection Oscillator def ProjectionOsc_length = 9;#Typically 10 def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price=high, length=ProjectionOsc_length)); def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price=low, length=ProjectionOsc_length)); def ProjectionOsc_diff = MaxBound - MinBound; def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0; def PROSC_OB = 80; def PROSC_OS = 20; def condition14 = PROSC > 50; def conditionPROSC_OB = PROSC > PROSC_OB; def conditionPROSC_OS = PROSC < PROSC_OS; #Trend Confirmation Calculator #Confirmation_Factor range 1-15. input coloredCandlesOn = yes; input Confirmation_Factor = 3; #Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1. #def Agreement_Level = condition1; def Agreement_LevelOB = 12; def Agreement_LevelOS = 3; def Agreement_Level = condition1 + condition2 + condition3 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition13 + condition14 + conditionKup; def conditionChannel1 = Upper_BandK > price; def conditionChannel2 = Lower_BandK < price; def UP = if conditionChannel1 and conditionChannel2 then Agreement_Level >= Confirmation_Factor else 0; def DOWN = if conditionChannel1 and conditionChannel2 then Agreement_Level <= Confirmation_Factor else 0; AssignPriceColor(if coloredCandlesOn and UP or conditionKup then Color.LIGHT_GREEN else if coloredCandlesOn and DOWN or conditionkdown then Color.RED else Color.YELLOW); #Additional Signals #OB/OS Signal input Confirmation_OB = 2; def Agreement_OB = conditionRSI_OB + conditionMFI_OB + conditionFOB + conditionPFE_OB + conditionBBPB_OB + conditionPROSC_OB; input Confirmation_OS = 2; def Agreement_OS = conditionRSI_OS + conditionMFI_OS + conditionFOS + conditionPFE_OS + conditionBBPB_OS + conditionPROSC_OS; def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Agreement_OB > Confirmation_OB); def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Agreement_OS > Confirmation_OS); def OS_Buy = UP_OS; def OB_Sell = DOWN_OB; def neutral = Agreement_OB < Confirmation_OB and Agreement_OS < Confirmation_OS; #AddVerticalLine (OS_Buy and !OS_Buy[1], close, Color.GREEN, Curve.SHORT_DASH); #AddVerticalLine (Neutral and !neutral[1], close, Color.Gray, Curve.SHORT_DASH); #AddVerticalLine (OB_Sell and OB_Sell and !OB_Sell[1], close, Color.RED, Curve.SHORT_DASH); def Buy_Opportnity = if OS_Buy then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Buy_Opportnity, Neutral, Color.LIGHT_GREEN, Color.LIGHT_RED); def Sell_Opportnity = if OB_Sell then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Sell_Opportnity, Neutral, Color.LIGHT_RED, Color.LIGHT_RED); plot OB_Signal = price crosses below Upper_BandK;#(Agreement_OB crosses below Agreement_OS) or (Agreement_OB crosses below 5); OB_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); OB_Signal.SetLineWeight(1); OB_Signal.SetDefaultColor(Color.RED); plot OS_Signal = price crosses above Lower_BandK;#(Agreement_OB crosses above Agreement_OS); OS_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); OS_Signal.SetLineWeight(1); OS_Signal.SetDefaultColor(Color.GREEN); #Squeeze Alert def length = 20; def BulgeLength = 150; def SqueezeLength = 150; def upperBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).UpperBand; def lowerBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).LowerBand; def midLineBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).MidLine; def Bandwidth = (upperBandBB - lowerBandBB) / midLineBB * 100; def Bulge = Highest(Bandwidth, BulgeLength); def Squeeze = Lowest(Bandwidth, SqueezeLength); plot Squeeze_Alert = bandwidth <= squeeze; Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); Squeeze_Alert.SetLineWeight(3); Squeeze_Alert.SetDefaultColor(Color.YELLOW); #Trend Signals plot UPConfirmSignal = Agreement_Level crosses above Confirmation_Factor; UPConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); UPConfirmSignal.SetLineWeight(1); UPConfirmSignal.SetDefaultColor(Color.GREEN); plot DOWNConfirmSignal = Agreement_Level crosses below Confirmation_Factor; DOWNConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); DOWNConfirmSignal.SetLineWeight(1); DOWNConfirmSignal.SetDefaultColor(Color.RED); plot Reversal_Alert1 = (Agreement_Level crosses below 13); Reversal_Alert1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); Reversal_Alert1.SetLineWeight(1); Reversal_Alert1.SetDefaultColor(Color.RED); plot Reversal_Alert2 =(Agreement_Level crosses above 2); Reversal_Alert2.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); Reversal_Alert2.SetLineWeight(1); Reversal_Alert2.SetDefaultColor(Color.GREEN); plot Reversal_Buy = (Agreement_Level < 1) and (Agreement_Level[1] <= Agreement_Level);#conditionMR and price>= Middle_BandS; Reversal_Buy.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); Reversal_Buy.SetLineWeight(1); Reversal_Buy.SetDefaultColor(Color.LIGHT_GRAY); plot Reversal_Sell = (Agreement_Level > 12) and (Agreement_Level[1] >= Agreement_Level);#conditionMR and price>= Middle_BandS; Reversal_Sell.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); Reversal_Sell.SetLineWeight(1); Reversal_Sell.SetDefaultColor(Color.LIGHT_RED); #Labels def Buy = UP_OS; def Sell = DOWN_OB; AddLabel(yes, "Look_To_Buy", if Buy then Color.GREEN else Color.GRAY); AddLabel(yes, "Look_To_Sell", if Sell then Color.RED else Color.GRAY); def MomentumUP = Agreement_Level[1] < Agreement_Level; def MomentumDOWN = Agreement_Level[1] > Agreement_Level; AddLabel(yes, "Increasing Momentum", if MomentumUP then Color.Green else Color.GRAY); AddLabel(yes, "Decreasing Momentum", if MomentumDOWN then Color.RED else Color.GRAY); def conditionMR = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS); AddLabel(yes, "MEAN REVERSION", if conditionMR then Color.RED else Color.GRAY); def conditionBO = (Upper_BandS[1] < Upper_BandS) and (Lower_BandS[1] < Lower_BandS); AddLabel(yes, "BREAKOUT", if conditionBO then Color.GREEN else Color.GRAY); def Squeeze_Signal = Squeeze_Alert; AddLabel(yes, "SQUEEZE ALERT", if Squeeze_Signal then Color.YELLOW else Color.GRAY);

Thanks for the kind words @jaythedaytrader! I’m really glad you are putting my indicators to good use.i have only found a handful of useful scripts, here and this is one of the top 3 so far very good job, amazing whom ever wrote and coded this masterpiece!

I can't load a screenshot on here for some reason.

It's not that you can't, it's just that you don't know how... Head on over to the Questions forum and read the topic on posting images and then you'll know how...

Scottgray0827

New member

@Christopher84

Curious about Confirmation Candles V10 vs V6. On page 1 I noticed release notes as recent as 6/10 are included in V6, in V10 the most recent updates appear to be 5/20. Apologies if I am being dense and missing something. Amazing set of studies by the way!!

Curious about Confirmation Candles V10 vs V6. On page 1 I noticed release notes as recent as 6/10 are included in V6, in V10 the most recent updates appear to be 5/20. Apologies if I am being dense and missing something. Amazing set of studies by the way!!

Scottgray0827

New member

Thanks Christopher!Hi sparhawk,

You can still see the price action by looking at whether a candle is filling up or down. I make my candles fill up and empty out when moving down making the price action easy to see. Part of the purpose of using candle painting strategies is to mitigate the trend noise produced by alternating red/green candles that are seen on standard chart setups. You can use one of my lower studies and it won't change your candle color on your chart. Hope that helps!

That tip was very helpful. Now I can view whether the overall sentiment is bullish or bearish while still viewing each individual candle. I'll be working more with your indicator in my live trading this week.

@Christopher84

First off, let me say thank you for a fantastic indicator! The amount of information that you have managed to pack into a digestible package is truly amazing. I have a couple of questions. I have noticed that when using this in conjunction with the B4 study, the attached labels often produce conflicting signals in terms of bullish and bearish momentum. Is it best to wait for their alignment to enter trades? In trending price movements, it seems like the b4 lags a bit behind C3. Second, my current watchlist consists of around 250 small and mid-cap stocks. I'm hoping to pare down a bit. What do you feel like is a reasonably sized watchlist to properly use C3, and what types of assets are you typically trading?

Thanks again for your hard work!

First off, let me say thank you for a fantastic indicator! The amount of information that you have managed to pack into a digestible package is truly amazing. I have a couple of questions. I have noticed that when using this in conjunction with the B4 study, the attached labels often produce conflicting signals in terms of bullish and bearish momentum. Is it best to wait for their alignment to enter trades? In trending price movements, it seems like the b4 lags a bit behind C3. Second, my current watchlist consists of around 250 small and mid-cap stocks. I'm hoping to pare down a bit. What do you feel like is a reasonably sized watchlist to properly use C3, and what types of assets are you typically trading?

Thanks again for your hard work!

@toMatto, I've tested the various versions of Christopher's candles as they have been released. For a long time, I paired them with the B4. My experience** was just what you have observed, that the B4 lags. That can be a good thing if a trader is risk averse and price is making a big move. But it's not such a good thing when it gets you into a trade shortly before price peters out. I finally went back to what I was using before, the plain ol' MACD_BB. It pairs very well with Christopher's candles and MTF clouds. And, in my testing, it's the most accurate part of the B4, with the lower FST and RSI_IFT strategy signals (when they fire simultaneously) coming in second. Perhaps the latest versions of the B4 would lead to different results. That was my experience for the time I used it.In trending price movements, it seems like the b4 lags a bit behind C3.

Best wishes and happy trading.

**FWIW, I trade futures every day but stocks only once a week or so. I have seen the lag on both.

Also @Christopher84 : The MTF Lower studies do not work with SPX, unless I'm missing something. Thanks all!@Trader Raider thanks for the suggestions! I'll give it a shot this week!

@toMatto, you're very welcome. Here's a trade I took this morning. It shows how well the MACD_BB (I took the dots off) plays with Christopher's indicators. The yellow line is just a markup of my logic for my journal. Since you trade stocks more than I do, I'd be curious to hear any insights you have as you use Christopher's indicators. Thanks in advance  Best wishes and happy trading!

Best wishes and happy trading!

Hi toMatto!@Christopher84

First off, let me say thank you for a fantastic indicator! The amount of information that you have managed to pack into a digestible package is truly amazing. I have a couple of questions. I have noticed that when using this in conjunction with the B4 study, the attached labels often produce conflicting signals in terms of bullish and bearish momentum. Is it best to wait for their alignment to enter trades? In trending price movements, it seems like the b4 lags a bit behind C3. Second, my current watchlist consists of around 250 small and mid-cap stocks. I'm hoping to pare down a bit. What do you feel like is a reasonably sized watchlist to properly use C3, and what types of assets are you typically trading?

Thanks again for your hard work!

I try to keep my list to 30 or less. Of the 250 on your watchlist, which ones are making higher highs? Which stocks are actually performing? Once you answer that question, you will notice 90% of your list will become irrelevant. You want to focus your efforts on the assets that are consistently performing. Hope that helps!

Yep you've got it!

Hi @rfb!Also @Christopher84 : The MTF Lower studies do not work with SPX, unless I'm missing something. Thanks all!

Here's a version that should work for you. Enjoy!

Code:

#MTF Moving Average Lower Created by Christopher84 05/01/2021

#Modified 07/06/2021 to be compatible with SPX and FOREX

#Keltner Channel

declare lower;

def displace = 0;

def factorK = 2.0;

def lengthK = 20;

plot price = close;

input averageType = AverageType.SIMPLE;

def trueRangeAverageType = AverageType.SIMPLE;

def BulgeLengthK = 250;

def SqueezeLengthK = 250;

def BulgeLengthK2 = 150;

def SqueezeLengthK2 = 150;

def BulgeLengthPrice = 75;

def SqueezeLengthPrice = 75;

def BulgeLengthPrice2 = 20;

def SqueezeLengthPrice2 = 20;

def BulgeLengthPrice3 = 12;

def SqueezeLengthPrice3 = 12;

def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK);

def averageK = MovingAverage(averageType, price, lengthK);

def AvgK = averageK[-displace];

def Upper_BandK = averageK[-displace] + shift[-displace];

def Lower_BandK = averageK[-displace] - shift[-displace];

def conditionK1UP = price >= Upper_BandK;

def conditionK2UP = (Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK);

def conditionK3DN = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK);

def conditionK4DN = price < Lower_BandK;

def BandwidthK = (Upper_BandK - Lower_BandK) / AvgK * 100;

def BandwidthKS = (Bandwidthk[2]+ Bandwidthk[1] + BandwidthK) / 3;

def BulgeK = Highest(BandwidthKS, BulgeLengthK);

def SqueezeK = Lowest(BandwidthKS, SqueezeLengthK);

def BulgeK2 = Highest(BandwidthKS, BulgeLengthK2);

def SqueezeK2 = Lowest(BandwidthKS, SqueezeLengthK2);

def condition_Keltner_Squeeze = BandwidthKS <= SqueezeK;

plot IntermResistance = Highest(price, BulgeLengthPrice);

IntermResistance.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY);

plot IntermSupport = Lowest(price, SqueezeLengthPrice);

IntermSupport.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY);

def NearTResistance = Highest(price, BulgeLengthPrice2);

#NearTResistance.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY);

#NearTResistance.SetStyle(Curve.SHORT_DASH);

def NearTSupport = Lowest(price, SqueezeLengthPrice2);

#NearTSupport.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY);

#NearTSupport.SetStyle(Curve.SHORT_DASH);

def NearTResistance1 = Highest(price, BulgeLengthPrice3);

def NearTSupport1 = Lowest(price, SqueezeLengthPrice3);

#MACD with Price

def fastLength = 12;

def slowLength = 26;

def MACDLength = 9;

input MACD_AverageType = {SMA, default EMA};

def MACDLevel = 0.0;

def fastEMA = ExpAverage(price, fastLength);

def slowEMA = ExpAverage(price, slowLength);

def Value;

def Avg;

switch (MACD_AverageType) {

case SMA:

Value = Average(price, fastLength) - Average(price, slowLength);

Avg = Average(Value, MACDLength);

case EMA:

Value = fastEMA - slowEMA;

Avg = ExpAverage(Value, MACDLength);

}

def Diff = Value - Avg;

def Level = MACDLevel;

def condition1 = Value[1] <= Value;

def condition1D = Value[1] > Value;

#RSI

def RSI_length = 14;

def RSI_AverageType = AverageType.WILDERS;

def RSI_OB = 70;

def RSI_OS = 30;

def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length);

def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true;

def condition2D = (RSI[3] > RSI) is true or (RSI < 20) is true;

def conditionOB1 = RSI > RSI_OB;

def conditionOS1 = RSI < RSI_OS;

#MFI

#def MFI_Length = 14;

#def MFIover_Sold = 20;

#def MFIover_Bought = 80;

#def movingAvgLength = 1;

#def MoneyFlowIndex = Average(MoneyFlow(high, close, low, volume, MFI_Length), movingAvgLength);

#def MFIOverBought = MFIover_Bought;

#def MFIOverSold = MFIover_Sold;

#def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true;

#def condition3D = (MoneyFlowIndex[2] > MoneyFlowIndex) is true or (MoneyFlowIndex < 20) is true;

#def conditionOB2 = MoneyFlowIndex > MFIover_Bought;

#def conditionOS2 = MoneyFlowIndex < MFIover_Sold;

#Forecast

def na = Double.NaN;

def MidLine = 50;

def Momentum = MarketForecast().Momentum;

def NearT = MarketForecast().NearTerm;

def Intermed = MarketForecast().Intermediate;

def FOB = 80;

def FOS = 20;

def upperLine = 110;

def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine);

def condition4D = (Intermed[1] > Intermed) or (NearT < MidLine);

def conditionOB3 = Intermed > FOB;

def conditionOS3 = Intermed < FOS;

def conditionOB4 = NearT > FOB;

def conditionOS4 = NearT < FOS;

#Change in Price

def lengthCIP = 5;

def CIP = (price - price[1]);

def AvgCIP = ExpAverage(CIP[-displace], lengthCIP);

def CIP_UP = AvgCIP > AvgCIP[1];

def CIP_DOWN = AvgCIP < AvgCIP[1];

def condition5 = CIP_UP;

def condition5D = CIP_DOWN;

#EMA_1

def EMA_length = 8;

def AvgExp = ExpAverage(price[-displace], EMA_length);

def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp);

def condition6D = (price < AvgExp) and (AvgExp[2] > AvgExp);

#EMA_2

def EMA_2length = 20;

def displace2 = 0;

def AvgExp2 = ExpAverage(price[-displace2], EMA_2length);

def condition7 = (price >= AvgExp2) and (AvgExp2[2] <= AvgExp);

def condition7D = (price < AvgExp2) and (AvgExp2[2] > AvgExp);

#DMI Oscillator

def DMI_length = 5;#Typically set to 10

input DMI_averageType = AverageType.WILDERS;

def diPlus = DMI(DMI_length, DMI_averageType)."DI+";

def diMinus = DMI(DMI_length, DMI_averageType)."DI-";

def Osc = diPlus - diMinus;

def Hist = Osc;

def ZeroLine = 0;

def condition8 = Osc >= ZeroLine;

def condition8D = Osc < ZeroLine;

#Trend_Periods

def TP_fastLength = 3;#Typically 7

def TP_slowLength = 4;#Typically 15

def Periods = Sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength));

def condition9 = Periods > 0;

def condition9D = Periods < 0;

#Polarized Fractal Efficiency

def PFE_length = 5;#Typically 10

def smoothingLength = 2.5;#Typically 5

def PFE_diff = close - close[PFE_length - 1];

def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / Sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1);

def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength);

def UpperLevel = 50;

def LowerLevel = -50;

def condition10 = PFE > 0;

def condition10D = PFE < 0;

def conditionOB5 = PFE > UpperLevel;

def conditionOS5 = PFE < LowerLevel;

#Bollinger Bands PercentB

input BBPB_averageType = AverageType.SIMPLE;

def BBPB_length = 20;#Typically 20

def Num_Dev_Dn = -2.0;

def Num_Dev_up = 2.0;

def BBPB_OB = 100;

def BBPB_OS = 0;

def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand;

def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100;

def HalfLine = 50;

def UnitLine = 100;

def condition11 = PercentB > HalfLine;

def condition11D = PercentB < HalfLine;

def conditionOB6 = PercentB > BBPB_OB;

def conditionOS6 = PercentB < BBPB_OS;

#STARC Bands

def ATR_length = 15;

def SMA_lengthS = 6;

def multiplier_factor = 1.25;

def valS = Average(price, SMA_lengthS);

def average_true_range = Average(TrueRange(high, close, low), length = ATR_length);

def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace];

def Middle_BandS = valS[-displace];

def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace];

def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS);

def condition12D = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS);

#Klinger Histogram

#def Klinger_Length = 13;

#def KVOsc = KlingerOscillator(Klinger_Length).KVOsc;

#def KVOH = KVOsc - Average(KVOsc, Klinger_Length);

#def condition13 = (KVOH > 0);

#def condition13D = (KVOH < 0);

#Projection Oscillator

def ProjectionOsc_length = 30;#Typically 10

def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length));

def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length));

def ProjectionOsc_diff = MaxBound - MinBound;

def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0;

def PROSC_OB = 80;

def PROSC_OS = 20;

def condition14 = PROSC > 50;

def condition14D = PROSC < 50;

def conditionOB7 = PROSC > PROSC_OB;

def conditionOS7 = PROSC < PROSC_OS;

#Trend Confirmation Calculator

#Confirmation_Factor range 1-15.

input coloredCandlesOn = yes;

def Confirmation_Factor = 7;

#Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1.

#def Agreement_Level = condition1;

def Agreement_LevelOB = 10;

def Agreement_LevelOS = -10;

def Agreement_Level = condition1 + condition2 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition14 + conditionK1UP + conditionK2UP;

def Agreement_LevelD = condition1D + condition2D + condition4D + condition5D + condition6D + condition7D + condition8D + condition9D + condition10D + condition11D + condition12D + condition14D + conditionK3DN + conditionK4DN;

def Consensus_Level = Agreement_Level - Agreement_LevelD;

def UP = Consensus_Level >= 4;

def DOWN = Consensus_Level < -4;

def priceColor = if UP then 1

else if DOWN then -1

else priceColor[1];

price.AssignValueColor(if priceColor == 1 then Color.LIGHT_GREEN else if priceColor == -1 then Color.RED else Color.CURRENT);

#Additional Signals

#Keltner #2

input showCloud = yes;

def factorK2 = 3.25;

def lengthK2 = 20;

def shiftK2 = factorK2 * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK2);

def averageK2 = MovingAverage(averageType, price, lengthK2);

def AvgK2 = averageK2[-displace];

def Upper_BandK2 = averageK2[-displace] + shiftK2[-displace];

def Lower_BandK2 = averageK2[-displace] - shiftK2[-displace];

def condition_BandRevDn = (Upper_BandS > Upper_BandK2);

def condition_BandRevUp = (Lower_BandS < Lower_BandK2);

AddCloud(if showCloud and condition_BandRevUp then Lower_BandK2 else Double.NaN, Lower_BandS, Color.LIGHT_GREEN, Color.CURRENT);

AddCloud(if showCloud and condition_BandRevDn then Upper_BandS else Double.NaN, Upper_BandK2, Color.LIGHT_RED, Color.CURRENT);

#Super_OB/OS Signal

def OB_Level = conditionOB1 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7;

def OS_Level = conditionOS1 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7;

def Consensus_Line = OB_Level - OS_Level;

def Zero_Line = 0;

def Super_OB = 4;

def Super_OS = -4;

def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Consensus_Line > Super_OB);

def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Consensus_Line < Super_OS);

def OS_Buy = UP_OS;

def OB_Sell = DOWN_OB;

def neutral = Consensus_Line < Super_OB and Consensus_Line > Super_OS;

#AddVerticalLine (OS_Buy and !OS_Buy[1], close, Color.GREEN, Curve.SHORT_DASH);

#AddVerticalLine (Neutral and !neutral[1], close, Color.Gray, Curve.SHORT_DASH);

#AddVerticalLine (OB_Sell and OB_Sell and !OB_Sell[1], close, Color.RED, Curve.SHORT_DASH);

def Buy_Opportnity = if OS_Buy then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY;

#AddCloud(Buy_Opportnity, Neutral, Color.LIGHT_GREEN, Color.LIGHT_RED);

def Sell_Opportnity = if OB_Sell then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY;

#AddCloud(Sell_Opportnity, Neutral, Color.LIGHT_RED, Color.LIGHT_RED);

def OB_Signal = Upper_BandS crosses above IntermResistance;

#OB_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

#OB_Signal.SetLineWeight(3);

#OB_Signal.SetDefaultColor(Color.RED);

def OS_Signal = (condition_BandRevUp) and (Lower_BandS crosses below IntermSupport);

#OS_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS);

#OS_Signal.SetLineWeight(3);

#OS_Signal.SetDefaultColor(Color.GREEN);

#Squeeze Alert

def length = 20;

def BulgeLength = 150;

def SqueezeLength = 150;

def upperBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).UpperBand;

def lowerBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).LowerBand;

def midLineBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).MidLine;

def Bandwidth = (upperBandBB - lowerBandBB) / midLineBB * 100;

def Bulge = Highest(Bandwidth, BulgeLength);

def Squeeze = Lowest(Bandwidth, SqueezeLength);

def BandwidthC3 = (NearTResistance1 - NearTSupport1);

def IntermResistance2 = Highest(BandwidthC3,BulgeLengthPrice);

def IntermSupport2 = Lowest(BandwidthC3, SqueezeLengthPrice);

#def NearTResistance2 = Highest(BandwidthC3, BulgeLengthPrice2);

#def NearTSupport2 = Lowest(BandwidthC3, SqueezeLengthPrice2);

def sqzTrigger = BandwidthC3 <= IntermSupport2;

def sqzLevel = if !sqzTrigger[1] and sqzTrigger then hl2

else if !sqzTrigger then Double.NaN

else sqzLevel[1];

plot Squeeze_Alert = sqzLevel;

Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.POINTS);

Squeeze_Alert.SetLineWeight(3);

Squeeze_Alert.SetDefaultColor(Color.YELLOW);

#Trend Signals

#plot UPConfirmSignal = Agreement_Level crosses above Confirmation_Factor;

#UPConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#UPConfirmSignal.SetLineWeight(1);

#UPConfirmSignal.SetDefaultColor(Color.GREEN);

#plot DOWNConfirmSignal = Agreement_Level crosses below Confirmation_Factor;

#DOWNConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#DOWNConfirmSignal.SetLineWeight(1);

#DOWNConfirmSignal.SetDefaultColor(Color.RED);

#Bollinger_Bands2

def lengthBB = 10;

def Num_Dev_DnBB = -0.8;

def Num_Dev_upBB = 0.8;

def price1 = open;

def sDev = StDev(data = price[-displace], length = lengthBB);

def MidLineBB2 = MovingAverage(averageType, data = price[-displace], length = lengthBB);

def LowerBandBB2 = MidLineBB2 + Num_Dev_DnBB * sDev;

def UpperBandBB2 = MidLineBB2 + Num_Dev_upBB * sDev;

#Labels

def Buy = UP_OS;

def Sell = DOWN_OB;

def conditionLTB = (ConditionK2UP and (Consensus_Level < 0));

def conditionLTS = (ConditionK3DN and (Consensus_Level > 0));

def conditionBO = ((Upper_BandS[1] < Upper_BandS) and (Lower_BandS[1] < Lower_BandS)) and ((Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK));

def conditionBD = ((Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS) and (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK));

def MomentumUP = Consensus_Level[1] < Consensus_Level;

def MomentumDOWN = Consensus_Level[1] > Consensus_Level;

def Squeeze_Signal = !isNaN(Squeeze_Alert);

def conditionOB = (Consensus_Level >= 12) and (Consensus_Line >= 4);

def conditionOS = (Consensus_Level <= -12) and (Consensus_Line <= -3);

AddLabel(yes, if conditionLTB then "BULLISH_LOOK_To_BUY" else if conditionLTS then "BEARISH_LOOK_TO_SELL" else if conditionK2UP then "TREND_BULLISH" else if conditionK3DN then "TREND_BEARISH" else "TREND_CONSOLIDATION", if conditionLTB then Color.GREEN else if conditionLTS then Color.Red else if conditionK2UP then Color.WHITE else if conditionK3DN then Color.DARK_GRAY else Color.GRAY);

AddLabel(yes, if conditionBD then "BREAKDOWN" else if conditionBO then "BREAKOUT" else "NO_BREAK", if conditionBD then Color.RED else if conditionBO then Color.Green else Color.Gray);

AddLabel(yes, "SQUEEZE ALERT", if Squeeze_Signal then Color.YELLOW else Color.GRAY);

AddLabel(yes, if MomentumUP then "Consensus_Increasing = " + round(Consensus_Level,1) else if MomentumUP or MomentumDOWN and conditionOB then "Consensus_OVERBOUGHT = " + round(Consensus_Level,1) else if MomentumDOWN then "Consensus_Decreasing = " + round(Consensus_Level,1) else if MomentumUP or MomentumDOWN and conditionOS then "Consensus_OVERSOLD = " + round(Consensus_Level,1)else "Consensus = " + round(Consensus_Level,1), if conditionOB then Color.RED else if conditionOS then Color.Green else color.GRAY);

#EMA's

input lengthEMA = 10;

input agperiod1 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", default "Day", "Week"};

input agperiod2 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", default "Week"};

plot avg1 = ExpAverage(close(period = agperiod1), lengthEMA);

def height = avg - avg[lengthEMA];

avg1.SetStyle(Curve.SHORT_DASH);

avg1.SetLineWeight(1);

def UP1 = avg1[1] < avg1;

def DOWN1 = avg1[1] > avg1;

Avg1.AssignValueColor(if UP1 then Color.LIGHT_GREEN else if DOWN1 then Color.RED else Color.YELLOW);

plot avg2 = ExpAverage(close(period = agperiod2), lengthEMA);

def height2 = avg2 - avg2[lengthEMA];

avg2.SetStyle(Curve.SHORT_DASH);

avg2.SetLineWeight(1);

def UP2 = avg2[1] < avg2;

def DOWN2 = avg2[1] > avg2;

Avg2.AssignValueColor(if UP2 then Color.LIGHT_GREEN else if DOWN2 then Color.RED else Color.YELLOW);

AddCloud(avg2, avg1, Color.LIGHT_RED, Color.CURRENT);

AddCloud(avg1, avg2, Color.LIGHT_GREEN, Color.CURRENT);@Christopher84, the revised code for the lower MTF cloud works great and looks great on the chart. Thanks for accommodating @rfb's request so quickly. The labels are a nice touch ... love 'em... especially the "no break" warning, which will probably help quite a few. What you have shared with all of us is really quite remarkable. Thank you.

Last edited:

Thanks for your contributions to this thread as well @Trader Raider . I will have more to release soon.@Christopher84, the revised code for the lower MTF cloud works great and looks great on the chart. Thanks for accommodating @rfb's request so quickly. The labels are a nice touch ... love 'em... especially the "no break" warning, which will probably help quite a few. What you have shared with all of us is really quite remarkable. Thank you.

Thanks! I'll load it tonight!Hi @rfb!

Here's a version that should work for you. Enjoy!

Code:#MTF Moving Average Lower Created by Christopher84 05/01/2021 #Modified 07/06/2021 to be compatible with SPX and FOREX #Keltner Channel declare lower; def displace = 0; def factorK = 2.0; def lengthK = 20; plot price = close; input averageType = AverageType.SIMPLE; def trueRangeAverageType = AverageType.SIMPLE; def BulgeLengthK = 250; def SqueezeLengthK = 250; def BulgeLengthK2 = 150; def SqueezeLengthK2 = 150; def BulgeLengthPrice = 75; def SqueezeLengthPrice = 75; def BulgeLengthPrice2 = 20; def SqueezeLengthPrice2 = 20; def BulgeLengthPrice3 = 12; def SqueezeLengthPrice3 = 12; def shift = factorK * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK); def averageK = MovingAverage(averageType, price, lengthK); def AvgK = averageK[-displace]; def Upper_BandK = averageK[-displace] + shift[-displace]; def Lower_BandK = averageK[-displace] - shift[-displace]; def conditionK1UP = price >= Upper_BandK; def conditionK2UP = (Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK); def conditionK3DN = (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK); def conditionK4DN = price < Lower_BandK; def BandwidthK = (Upper_BandK - Lower_BandK) / AvgK * 100; def BandwidthKS = (Bandwidthk[2]+ Bandwidthk[1] + BandwidthK) / 3; def BulgeK = Highest(BandwidthKS, BulgeLengthK); def SqueezeK = Lowest(BandwidthKS, SqueezeLengthK); def BulgeK2 = Highest(BandwidthKS, BulgeLengthK2); def SqueezeK2 = Lowest(BandwidthKS, SqueezeLengthK2); def condition_Keltner_Squeeze = BandwidthKS <= SqueezeK; plot IntermResistance = Highest(price, BulgeLengthPrice); IntermResistance.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); plot IntermSupport = Lowest(price, SqueezeLengthPrice); IntermSupport.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); def NearTResistance = Highest(price, BulgeLengthPrice2); #NearTResistance.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); #NearTResistance.SetStyle(Curve.SHORT_DASH); def NearTSupport = Lowest(price, SqueezeLengthPrice2); #NearTSupport.AssignValueColor(if (conditionK2UP) then Color.GREEN else if (conditionK3DN) then Color.RED else Color.GRAY); #NearTSupport.SetStyle(Curve.SHORT_DASH); def NearTResistance1 = Highest(price, BulgeLengthPrice3); def NearTSupport1 = Lowest(price, SqueezeLengthPrice3); #MACD with Price def fastLength = 12; def slowLength = 26; def MACDLength = 9; input MACD_AverageType = {SMA, default EMA}; def MACDLevel = 0.0; def fastEMA = ExpAverage(price, fastLength); def slowEMA = ExpAverage(price, slowLength); def Value; def Avg; switch (MACD_AverageType) { case SMA: Value = Average(price, fastLength) - Average(price, slowLength); Avg = Average(Value, MACDLength); case EMA: Value = fastEMA - slowEMA; Avg = ExpAverage(Value, MACDLength); } def Diff = Value - Avg; def Level = MACDLevel; def condition1 = Value[1] <= Value; def condition1D = Value[1] > Value; #RSI def RSI_length = 14; def RSI_AverageType = AverageType.WILDERS; def RSI_OB = 70; def RSI_OS = 30; def NetChgAvg = MovingAverage(RSI_AverageType, price - price[1], RSI_length); def TotChgAvg = MovingAverage(RSI_AverageType, AbsValue(price - price[1]), RSI_length); def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0; def RSI = 50 * (ChgRatio + 1); def condition2 = (RSI[3] < RSI) is true or (RSI >= 80) is true; def condition2D = (RSI[3] > RSI) is true or (RSI < 20) is true; def conditionOB1 = RSI > RSI_OB; def conditionOS1 = RSI < RSI_OS; #MFI #def MFI_Length = 14; #def MFIover_Sold = 20; #def MFIover_Bought = 80; #def movingAvgLength = 1; #def MoneyFlowIndex = Average(MoneyFlow(high, close, low, volume, MFI_Length), movingAvgLength); #def MFIOverBought = MFIover_Bought; #def MFIOverSold = MFIover_Sold; #def condition3 = (MoneyFlowIndex[2] < MoneyFlowIndex) is true or (MoneyFlowIndex > 85) is true; #def condition3D = (MoneyFlowIndex[2] > MoneyFlowIndex) is true or (MoneyFlowIndex < 20) is true; #def conditionOB2 = MoneyFlowIndex > MFIover_Bought; #def conditionOS2 = MoneyFlowIndex < MFIover_Sold; #Forecast def na = Double.NaN; def MidLine = 50; def Momentum = MarketForecast().Momentum; def NearT = MarketForecast().NearTerm; def Intermed = MarketForecast().Intermediate; def FOB = 80; def FOS = 20; def upperLine = 110; def condition4 = (Intermed[1] <= Intermed) or (NearT >= MidLine); def condition4D = (Intermed[1] > Intermed) or (NearT < MidLine); def conditionOB3 = Intermed > FOB; def conditionOS3 = Intermed < FOS; def conditionOB4 = NearT > FOB; def conditionOS4 = NearT < FOS; #Change in Price def lengthCIP = 5; def CIP = (price - price[1]); def AvgCIP = ExpAverage(CIP[-displace], lengthCIP); def CIP_UP = AvgCIP > AvgCIP[1]; def CIP_DOWN = AvgCIP < AvgCIP[1]; def condition5 = CIP_UP; def condition5D = CIP_DOWN; #EMA_1 def EMA_length = 8; def AvgExp = ExpAverage(price[-displace], EMA_length); def condition6 = (price >= AvgExp) and (AvgExp[2] <= AvgExp); def condition6D = (price < AvgExp) and (AvgExp[2] > AvgExp); #EMA_2 def EMA_2length = 20; def displace2 = 0; def AvgExp2 = ExpAverage(price[-displace2], EMA_2length); def condition7 = (price >= AvgExp2) and (AvgExp2[2] <= AvgExp); def condition7D = (price < AvgExp2) and (AvgExp2[2] > AvgExp); #DMI Oscillator def DMI_length = 5;#Typically set to 10 input DMI_averageType = AverageType.WILDERS; def diPlus = DMI(DMI_length, DMI_averageType)."DI+"; def diMinus = DMI(DMI_length, DMI_averageType)."DI-"; def Osc = diPlus - diMinus; def Hist = Osc; def ZeroLine = 0; def condition8 = Osc >= ZeroLine; def condition8D = Osc < ZeroLine; #Trend_Periods def TP_fastLength = 3;#Typically 7 def TP_slowLength = 4;#Typically 15 def Periods = Sign(ExpAverage(close, TP_fastLength) - ExpAverage(close, TP_slowLength)); def condition9 = Periods > 0; def condition9D = Periods < 0; #Polarized Fractal Efficiency def PFE_length = 5;#Typically 10 def smoothingLength = 2.5;#Typically 5 def PFE_diff = close - close[PFE_length - 1]; def val = 100 * Sqrt(Sqr(PFE_diff) + Sqr(PFE_length)) / Sum(Sqrt(1 + Sqr(close - close[1])), PFE_length - 1); def PFE = ExpAverage(if PFE_diff > 0 then val else -val, smoothingLength); def UpperLevel = 50; def LowerLevel = -50; def condition10 = PFE > 0; def condition10D = PFE < 0; def conditionOB5 = PFE > UpperLevel; def conditionOS5 = PFE < LowerLevel; #Bollinger Bands PercentB input BBPB_averageType = AverageType.SIMPLE; def BBPB_length = 20;#Typically 20 def Num_Dev_Dn = -2.0; def Num_Dev_up = 2.0; def BBPB_OB = 100; def BBPB_OS = 0; def upperBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).UpperBand; def lowerBand = BollingerBands(price, displace, BBPB_length, Num_Dev_Dn, Num_Dev_up, BBPB_averageType).LowerBand; def PercentB = (price - lowerBand) / (upperBand - lowerBand) * 100; def HalfLine = 50; def UnitLine = 100; def condition11 = PercentB > HalfLine; def condition11D = PercentB < HalfLine; def conditionOB6 = PercentB > BBPB_OB; def conditionOS6 = PercentB < BBPB_OS; #STARC Bands def ATR_length = 15; def SMA_lengthS = 6; def multiplier_factor = 1.25; def valS = Average(price, SMA_lengthS); def average_true_range = Average(TrueRange(high, close, low), length = ATR_length); def Upper_BandS = valS[-displace] + multiplier_factor * average_true_range[-displace]; def Middle_BandS = valS[-displace]; def Lower_BandS = valS[-displace] - multiplier_factor * average_true_range[-displace]; def condition12 = (Upper_BandS[1] <= Upper_BandS) and (Lower_BandS[1] <= Lower_BandS); def condition12D = (Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS); #Klinger Histogram #def Klinger_Length = 13; #def KVOsc = KlingerOscillator(Klinger_Length).KVOsc; #def KVOH = KVOsc - Average(KVOsc, Klinger_Length); #def condition13 = (KVOH > 0); #def condition13D = (KVOH < 0); #Projection Oscillator def ProjectionOsc_length = 30;#Typically 10 def MaxBound = HighestWeighted(high, ProjectionOsc_length, LinearRegressionSlope(price = high, length = ProjectionOsc_length)); def MinBound = LowestWeighted(low, ProjectionOsc_length, LinearRegressionSlope(price = low, length = ProjectionOsc_length)); def ProjectionOsc_diff = MaxBound - MinBound; def PROSC = if ProjectionOsc_diff != 0 then 100 * (close - MinBound) / ProjectionOsc_diff else 0; def PROSC_OB = 80; def PROSC_OS = 20; def condition14 = PROSC > 50; def condition14D = PROSC < 50; def conditionOB7 = PROSC > PROSC_OB; def conditionOS7 = PROSC < PROSC_OS; #Trend Confirmation Calculator #Confirmation_Factor range 1-15. input coloredCandlesOn = yes; def Confirmation_Factor = 7; #Use for testing conditions individually. Remove # from line below and change Confirmation_Factor to 1. #def Agreement_Level = condition1; def Agreement_LevelOB = 10; def Agreement_LevelOS = -10; def Agreement_Level = condition1 + condition2 + condition4 + condition5 + condition6 + condition7 + condition8 + condition9 + condition10 + condition11 + condition12 + condition14 + conditionK1UP + conditionK2UP; def Agreement_LevelD = condition1D + condition2D + condition4D + condition5D + condition6D + condition7D + condition8D + condition9D + condition10D + condition11D + condition12D + condition14D + conditionK3DN + conditionK4DN; def Consensus_Level = Agreement_Level - Agreement_LevelD; def UP = Consensus_Level >= 4; def DOWN = Consensus_Level < -4; def priceColor = if UP then 1 else if DOWN then -1 else priceColor[1]; price.AssignValueColor(if priceColor == 1 then Color.LIGHT_GREEN else if priceColor == -1 then Color.RED else Color.CURRENT); #Additional Signals #Keltner #2 input showCloud = yes; def factorK2 = 3.25; def lengthK2 = 20; def shiftK2 = factorK2 * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), lengthK2); def averageK2 = MovingAverage(averageType, price, lengthK2); def AvgK2 = averageK2[-displace]; def Upper_BandK2 = averageK2[-displace] + shiftK2[-displace]; def Lower_BandK2 = averageK2[-displace] - shiftK2[-displace]; def condition_BandRevDn = (Upper_BandS > Upper_BandK2); def condition_BandRevUp = (Lower_BandS < Lower_BandK2); AddCloud(if showCloud and condition_BandRevUp then Lower_BandK2 else Double.NaN, Lower_BandS, Color.LIGHT_GREEN, Color.CURRENT); AddCloud(if showCloud and condition_BandRevDn then Upper_BandS else Double.NaN, Upper_BandK2, Color.LIGHT_RED, Color.CURRENT); #Super_OB/OS Signal def OB_Level = conditionOB1 + conditionOB3 + conditionOB4 + conditionOB5 + conditionOB6 + conditionOB7; def OS_Level = conditionOS1 + conditionOS3 + conditionOS4 + conditionOS5 + conditionOS6 + conditionOS7; def Consensus_Line = OB_Level - OS_Level; def Zero_Line = 0; def Super_OB = 4; def Super_OS = -4; def DOWN_OB = (Agreement_Level > Agreement_LevelOB) and (Consensus_Line > Super_OB); def UP_OS = (Agreement_Level < Agreement_LevelOS) and (Consensus_Line < Super_OS); def OS_Buy = UP_OS; def OB_Sell = DOWN_OB; def neutral = Consensus_Line < Super_OB and Consensus_Line > Super_OS; #AddVerticalLine (OS_Buy and !OS_Buy[1], close, Color.GREEN, Curve.SHORT_DASH); #AddVerticalLine (Neutral and !neutral[1], close, Color.Gray, Curve.SHORT_DASH); #AddVerticalLine (OB_Sell and OB_Sell and !OB_Sell[1], close, Color.RED, Curve.SHORT_DASH); def Buy_Opportnity = if OS_Buy then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Buy_Opportnity, Neutral, Color.LIGHT_GREEN, Color.LIGHT_RED); def Sell_Opportnity = if OB_Sell then Double.POSITIVE_INFINITY else Double.NEGATIVE_INFINITY; #AddCloud(Sell_Opportnity, Neutral, Color.LIGHT_RED, Color.LIGHT_RED); def OB_Signal = Upper_BandS crosses above IntermResistance; #OB_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); #OB_Signal.SetLineWeight(3); #OB_Signal.SetDefaultColor(Color.RED); def OS_Signal = (condition_BandRevUp) and (Lower_BandS crosses below IntermSupport); #OS_Signal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_POINTS); #OS_Signal.SetLineWeight(3); #OS_Signal.SetDefaultColor(Color.GREEN); #Squeeze Alert def length = 20; def BulgeLength = 150; def SqueezeLength = 150; def upperBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).UpperBand; def lowerBandBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).LowerBand; def midLineBB = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_up, averageType).MidLine; def Bandwidth = (upperBandBB - lowerBandBB) / midLineBB * 100; def Bulge = Highest(Bandwidth, BulgeLength); def Squeeze = Lowest(Bandwidth, SqueezeLength); def BandwidthC3 = (NearTResistance1 - NearTSupport1); def IntermResistance2 = Highest(BandwidthC3,BulgeLengthPrice); def IntermSupport2 = Lowest(BandwidthC3, SqueezeLengthPrice); #def NearTResistance2 = Highest(BandwidthC3, BulgeLengthPrice2); #def NearTSupport2 = Lowest(BandwidthC3, SqueezeLengthPrice2); def sqzTrigger = BandwidthC3 <= IntermSupport2; def sqzLevel = if !sqzTrigger[1] and sqzTrigger then hl2 else if !sqzTrigger then Double.NaN else sqzLevel[1]; plot Squeeze_Alert = sqzLevel; Squeeze_Alert.SetPaintingStrategy(PaintingStrategy.POINTS); Squeeze_Alert.SetLineWeight(3); Squeeze_Alert.SetDefaultColor(Color.YELLOW); #Trend Signals #plot UPConfirmSignal = Agreement_Level crosses above Confirmation_Factor; #UPConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP); #UPConfirmSignal.SetLineWeight(1); #UPConfirmSignal.SetDefaultColor(Color.GREEN); #plot DOWNConfirmSignal = Agreement_Level crosses below Confirmation_Factor; #DOWNConfirmSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN); #DOWNConfirmSignal.SetLineWeight(1); #DOWNConfirmSignal.SetDefaultColor(Color.RED); #Bollinger_Bands2 def lengthBB = 10; def Num_Dev_DnBB = -0.8; def Num_Dev_upBB = 0.8; def price1 = open; def sDev = StDev(data = price[-displace], length = lengthBB); def MidLineBB2 = MovingAverage(averageType, data = price[-displace], length = lengthBB); def LowerBandBB2 = MidLineBB2 + Num_Dev_DnBB * sDev; def UpperBandBB2 = MidLineBB2 + Num_Dev_upBB * sDev; #Labels def Buy = UP_OS; def Sell = DOWN_OB; def conditionLTB = (ConditionK2UP and (Consensus_Level < 0)); def conditionLTS = (ConditionK3DN and (Consensus_Level > 0)); def conditionBO = ((Upper_BandS[1] < Upper_BandS) and (Lower_BandS[1] < Lower_BandS)) and ((Upper_BandK[1] < Upper_BandK) and (Lower_BandK[1] < Lower_BandK)); def conditionBD = ((Upper_BandS[1] > Upper_BandS) and (Lower_BandS[1] > Lower_BandS) and (Upper_BandK[1] > Upper_BandK) and (Lower_BandK[1] > Lower_BandK)); def MomentumUP = Consensus_Level[1] < Consensus_Level; def MomentumDOWN = Consensus_Level[1] > Consensus_Level; def Squeeze_Signal = !isNaN(Squeeze_Alert); def conditionOB = (Consensus_Level >= 12) and (Consensus_Line >= 4); def conditionOS = (Consensus_Level <= -12) and (Consensus_Line <= -3); AddLabel(yes, if conditionLTB then "BULLISH_LOOK_To_BUY" else if conditionLTS then "BEARISH_LOOK_TO_SELL" else if conditionK2UP then "TREND_BULLISH" else if conditionK3DN then "TREND_BEARISH" else "TREND_CONSOLIDATION", if conditionLTB then Color.GREEN else if conditionLTS then Color.Red else if conditionK2UP then Color.WHITE else if conditionK3DN then Color.DARK_GRAY else Color.GRAY); AddLabel(yes, if conditionBD then "BREAKDOWN" else if conditionBO then "BREAKOUT" else "NO_BREAK", if conditionBD then Color.RED else if conditionBO then Color.Green else Color.Gray); AddLabel(yes, "SQUEEZE ALERT", if Squeeze_Signal then Color.YELLOW else Color.GRAY); AddLabel(yes, if MomentumUP then "Consensus_Increasing = " + round(Consensus_Level,1) else if MomentumUP or MomentumDOWN and conditionOB then "Consensus_OVERBOUGHT = " + round(Consensus_Level,1) else if MomentumDOWN then "Consensus_Decreasing = " + round(Consensus_Level,1) else if MomentumUP or MomentumDOWN and conditionOS then "Consensus_OVERSOLD = " + round(Consensus_Level,1)else "Consensus = " + round(Consensus_Level,1), if conditionOB then Color.RED else if conditionOS then Color.Green else color.GRAY); #EMA's input lengthEMA = 10; input agperiod1 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", default "Day", "Week"}; input agperiod2 = {"1 min", "2 min", "3 min", "5 min", "10 min", "15 min", "30 min", "1 hour", "2 hours", "4 hours", "Day", default "Week"}; plot avg1 = ExpAverage(close(period = agperiod1), lengthEMA); def height = avg - avg[lengthEMA]; avg1.SetStyle(Curve.SHORT_DASH); avg1.SetLineWeight(1); def UP1 = avg1[1] < avg1; def DOWN1 = avg1[1] > avg1; Avg1.AssignValueColor(if UP1 then Color.LIGHT_GREEN else if DOWN1 then Color.RED else Color.YELLOW); plot avg2 = ExpAverage(close(period = agperiod2), lengthEMA); def height2 = avg2 - avg2[lengthEMA]; avg2.SetStyle(Curve.SHORT_DASH); avg2.SetLineWeight(1); def UP2 = avg2[1] < avg2; def DOWN2 = avg2[1] > avg2; Avg2.AssignValueColor(if UP2 then Color.LIGHT_GREEN else if DOWN2 then Color.RED else Color.YELLOW); AddCloud(avg2, avg1, Color.LIGHT_RED, Color.CURRENT); AddCloud(avg1, avg2, Color.LIGHT_GREEN, Color.CURRENT);

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

866

Online

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.