I go back and forth but generally around premarket I will keep afterhours on to identify setups before open. After open if I like how the zones are plotting with AH turned on I will leave it on. If it is somewhat a difficult read with AH on after open I will turn it off and see which I prefer. Same goes with using the 3min 5min 10min etc. At times the trend is crystal clear and I will watch the 1min chart but normally 3 or 5 and the hourly.Do you typically use extended hours on or off on the 1 hour/3 min?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Confirmation Candles Indicator For ThinkorSwim

- Thread starter Christopher84

- Start date

- Status

- Not open for further replies.

That is definitely not uncommon. My laptop is high spec so I do not experience lagging but at times takes a second to get the studies loaded when I switch timeframes.I just used the last two that Hod put in and I am experiencing a lot of lag and chart freezes. My PC is extremely fast as well. Hopefully it will work out.

- if you have an NVDA 3080 or any high end GPU you need to change a setting in tos to prevent potential lag issues.

- change the memory settings before you put in your username and password in that window you will see the settings for min and max memory

- if your using my shared charts for active trader - remove the "gex" lower study and only add it when you need it and only use it on a daily chart with a 9 month period

- I noticed the loading time on my end become a slight issue when i added Bull_Bear_V5 to the C3_Max_Spark combined study I will separate them and share a new link so you can try to add the Bull_Bear_V5 separately to see if this helps just a side note: my recently shared hourly chart has the bull bear settings at 1hr/2hr (as opposed to the 5/10min default)

I will periodically go through and delete all user studys, setups, styles, and study sets that I do not use... if you want to keep some that you do not use just create a share link or copy the code and save it on your pc to use later if needed.

hope this helps.

wait what the JBS....84?! how dare you sir.Oops, front ran ya. All seriousness, thank you to Christopher for starting this thread and also Hodl for coming up with his own customized variants. I have been making it a habit to visit this thread daily, so much good info and eternally grateful for everyone involved. Hodl, one quick question if I may? I put two hourly and two three minute charts of your latest shares in here in one grid and they seem to be lagging badly (hourly candles aren't even really moving). It's not my memory usage and this is the only grid I have open. I've never experienced a lag like this with ToS. Have you experienced this at all?

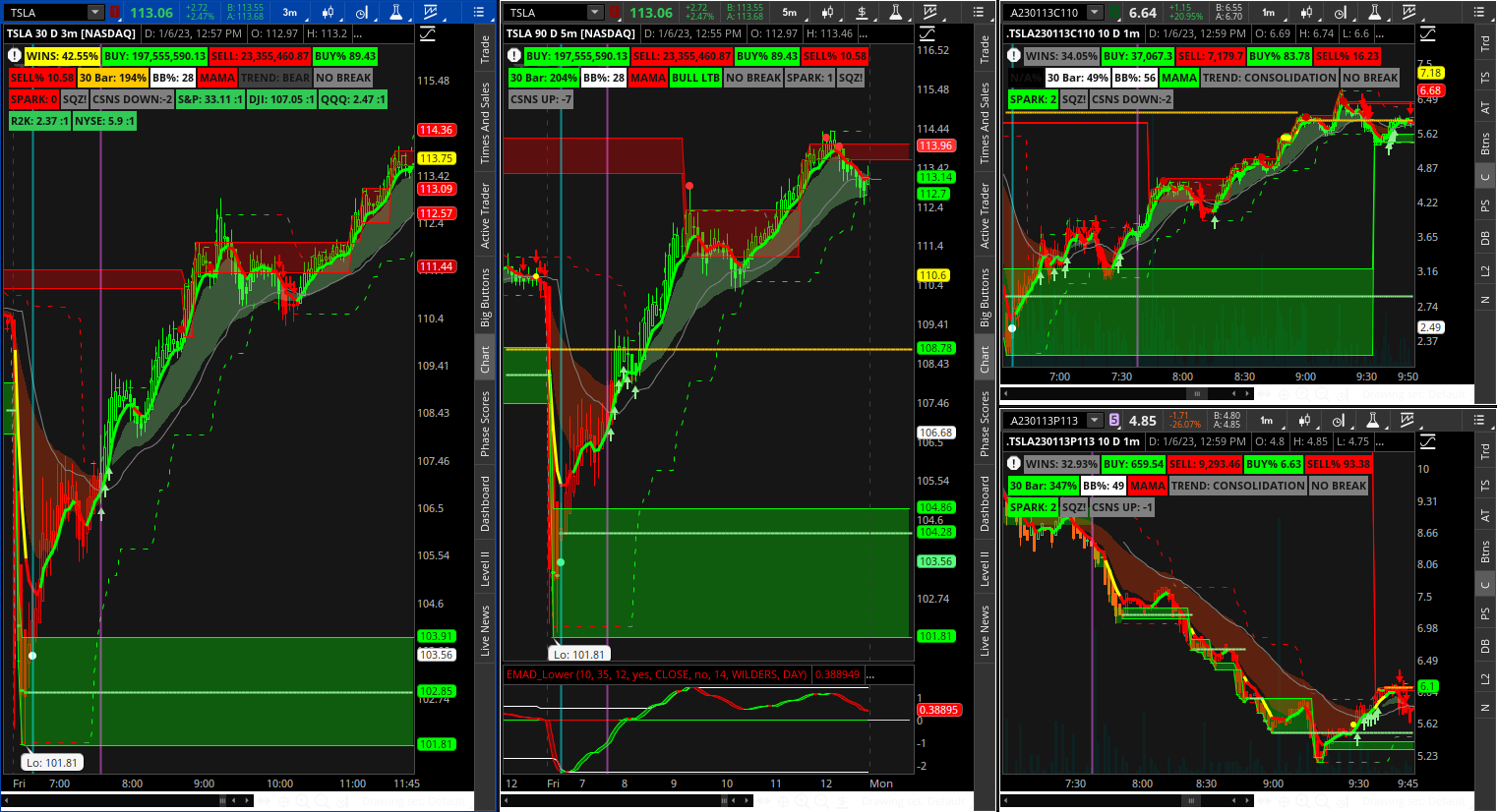

Beautiful entry… one of my preferred setups for entry at the moment…

- hourly showed a previous demand line inside the demand zone (indicates a significant level expect a bounce)

- 3min chart dump at open followed by exhaustion and spark up (lately I like to enter when exhaustion is follow by a spark up arrow or two) - TS_V9 cyan arrow appears to be promising as well especially when it aligns with a higher timeframe

- also when the price action is heavy and dumps above or below a zone with a long wick or two - the wick can make for a great entry if you like to be in and out of an option quick

Last edited:

Hi @METAL,I did have Hama strategy running on the same chart.

I have noticed that having multiple strategies loaded into the study set can trip up ToS from time to time. This could be responsible for what you are experiencing. Try removing Hama from your study set and running TS_v9 on its own and see if the issue persist.

Will do. I ran TS today with C4Max on a 1 min and TS repainted several times. I will try it by itself and let you know.Hi @METAL,

I have noticed that having multiple strategies loaded into the study set can trip up ToS from time to time. This could be responsible for what you are experiencing. Try removing Hama from your study set and running TS_v9 on its own and see if the issue persist.

Just to be clear are you referring to an arrow from previous bars repainting or as a bar is forming the arrow on the current bar comes and goes?Will do. I ran TS today with C4Max on a 1 min and TS repainted several times. I will try it by itself and let you know.

Hey I do not as I usually trade on mobile. I generally trade TSLA SPY AAPL things of that nature but the thread “daily watchlist” (search it) uses the scan for the “Blast off next day” indicator. I’ll have to find where they share the watchlist I know it’s a @BenTen watchlist for trading options.@HODL-Lay-HE-hoo! Do you have watchlist of stocks or do you scan for long/short entry signals ?

Anyway I have the watchlist column for blast off which works on mobile but I tend to stick to TSLA and SPY. I also use the “Relative Volume %” watchlist column that I watch premarket and sort the watchlist by that column.

These are good resources also:

https://www.barchart.com/options/unusual-activity/stocks

https://www.optionseducation.org/toolsoptionquotes/today-s-most-active-options

oldyoungguy

Member

I also use the “Relative Volume %” watchlist column that I watch premarket and sort the watchlist by that column.

I am searching "Relative Volume" indicator/scanner and trying to get one. If possible, do you mind sharing yours?

I only use the watchlist column. I’ll share it when I get around my computer.I am searching "Relative Volume" indicator/scanner and trying to get one. If possible, do you mind sharing yours?

Relative Volume % Watchlist Column: http://tos.mx/JVcHNEUI only use the watchlist column. I’ll share it when I get around my computer.

Blast Off Next Day Watchlist Column: http://tos.mx/nevRwWP

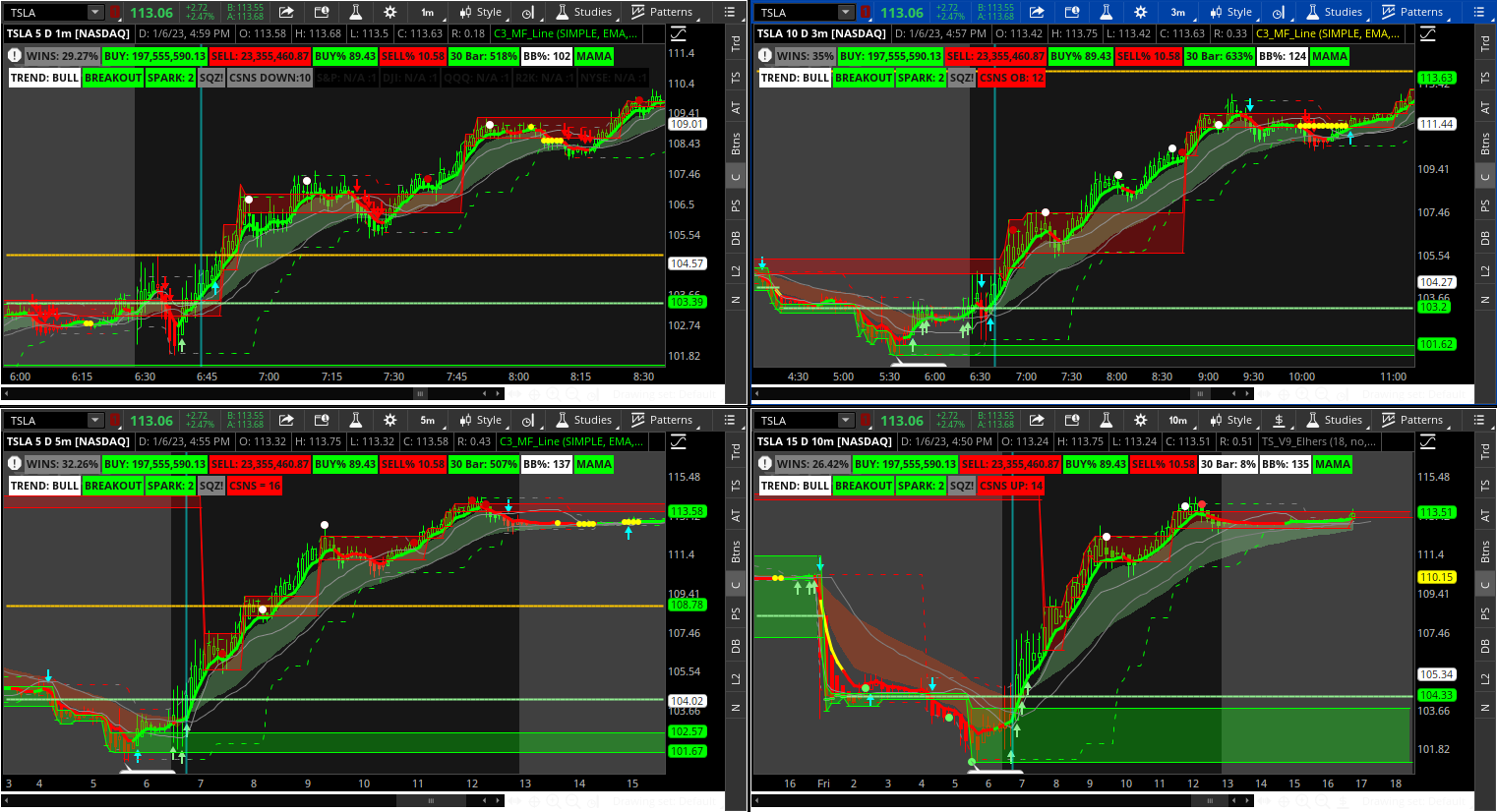

Messing with some grids... one of which with a call and put chart. Lately I have been entertaining the idea of trading the at or near the money call and put for SPY/TSLA without watching the actual chart for SPY/TSLA.

At the moment it seems a little busy with the labels but the labels on the option charts seem like they would be useful however I have not been able to watch during market hours here lately.

(also have not dialed in the TS_V9 study much however it seems to perform very well with after hours off)

An important note to whom it may concern: Notice the "Buy:" "Sell:" (volume) labels are the same on any timeframe thus the need for the 1 Bar Volume / 30 Bar Volume (aka 1 candle / 30 candles)

http://tos.mx/WsYwUCu

http://tos.mx/EP5YQVJ

At the moment it seems a little busy with the labels but the labels on the option charts seem like they would be useful however I have not been able to watch during market hours here lately.

(also have not dialed in the TS_V9 study much however it seems to perform very well with after hours off)

An important note to whom it may concern: Notice the "Buy:" "Sell:" (volume) labels are the same on any timeframe thus the need for the 1 Bar Volume / 30 Bar Volume (aka 1 candle / 30 candles)

http://tos.mx/WsYwUCu

http://tos.mx/EP5YQVJ

Last edited:

@Christopher84 everyone wants to know… when will Bull_Bear_V5 make its page 1 debut?

The people have spoken.

If this post get 1000 likes… divided by 1000.

The people have spoken.

If this post get 1000 likes… divided by 1000.

I may have one I’ll check. It will likely be more beneficial to use the TS_V9 scan but I’ll see if I can find it.I think somewhere I read about how to scan when price breaks the red/green cloud, but I can't seem to find it in this small thread. Would anyone mind reposting the scan or pointing me to the thread page that it is on?

TIA

I noticed in your latest grid shares, that your TS_V9 does not have the multiplier option in settings. I assume you removed that option. So, is this version for "regular" stocks only?I may have one I’ll check. It will likely be more beneficial to use the TS_V9 scan but I’ll see if I can find it.

Hey Chris, I found out it was coming and going on the same candle. My mistake. Once the candle finishes, it does not repaint. Also, I just figured out that I am supposed to tweak the settings on your strategies in order to get the best possible profit for that stock and even that day. With that said, Do you have a basic set of rules for your strategies that you use to help speed up the figuring out process? For instance: Using you Scalper V3, How do you typically set up the Lengths and the price for AAPL versus ES. Also, Do you focus on the Winners% as a main guide?Hi @METAL,

I have noticed that having multiple strategies loaded into the study set can trip up ToS from time to time. This could be responsible for what you are experiencing. Try removing Hama from your study set and running TS_v9 on its own and see if the issue persist.

Yeah I must have removed it… really just because I use the lines from C3_Max_Spark.I noticed in your latest grid shares, that your TS_V9 does not have the multiplier option in settings. I assume you removed that option. So, is this version for "regular" stocks only?

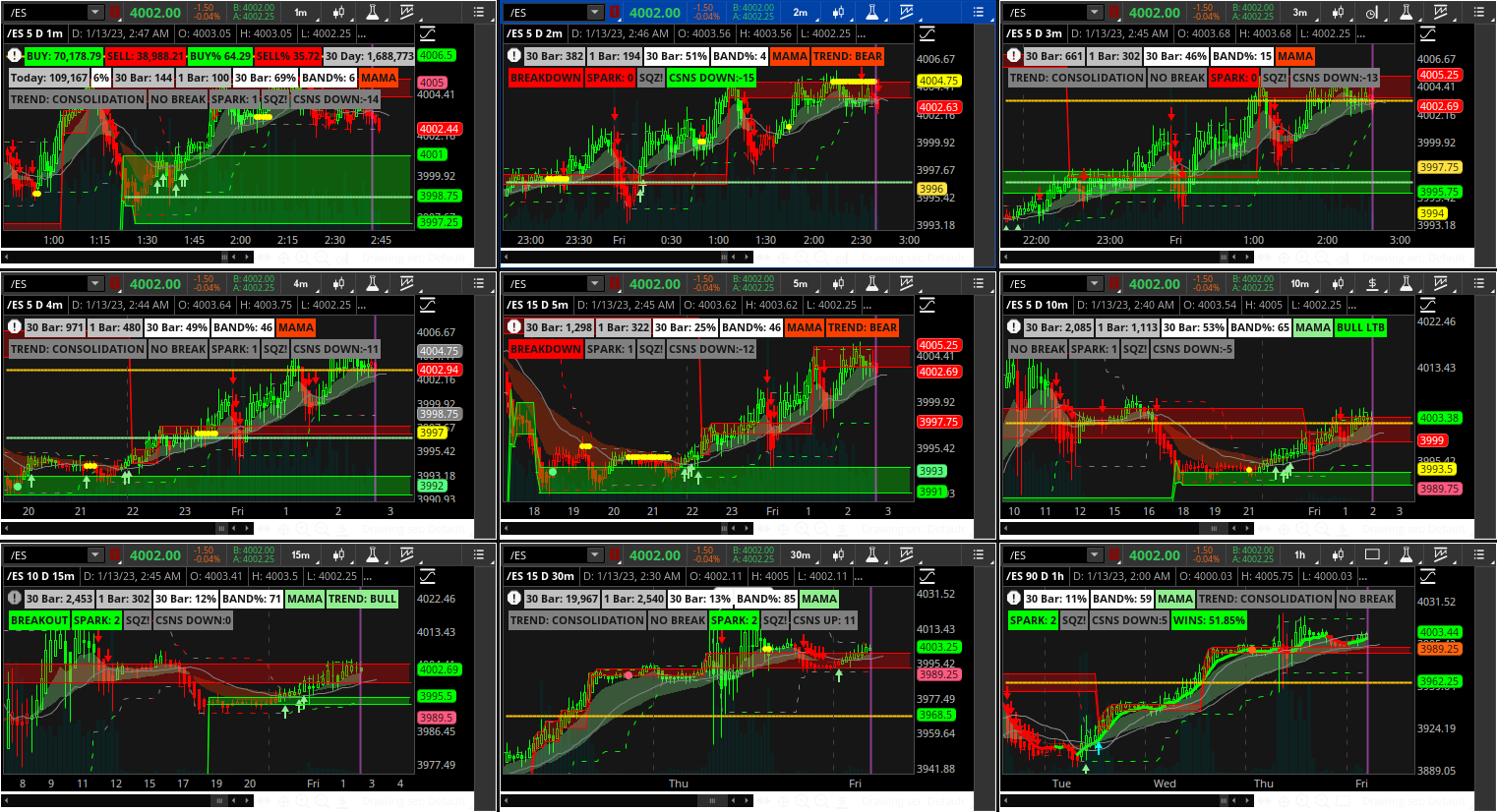

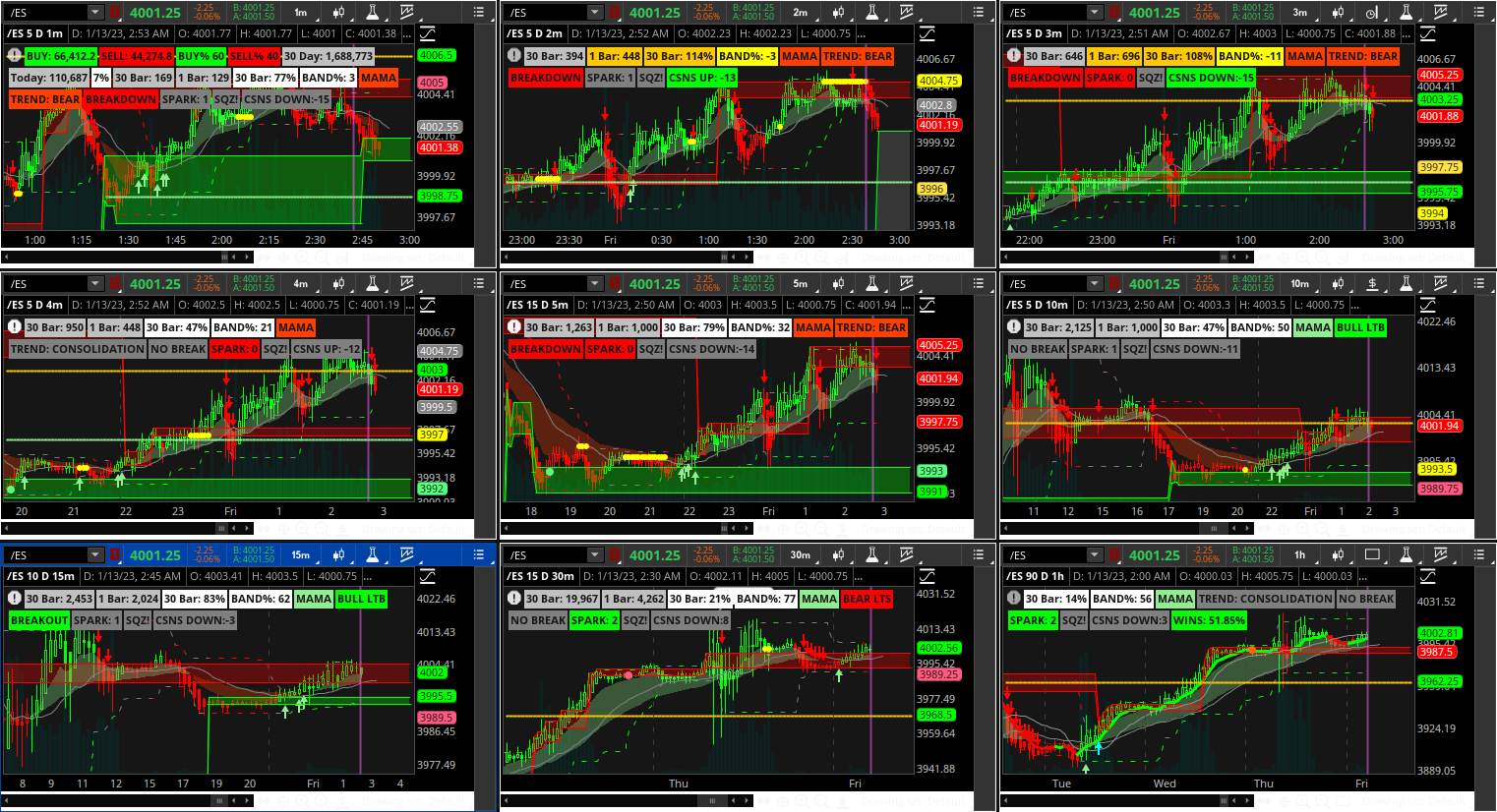

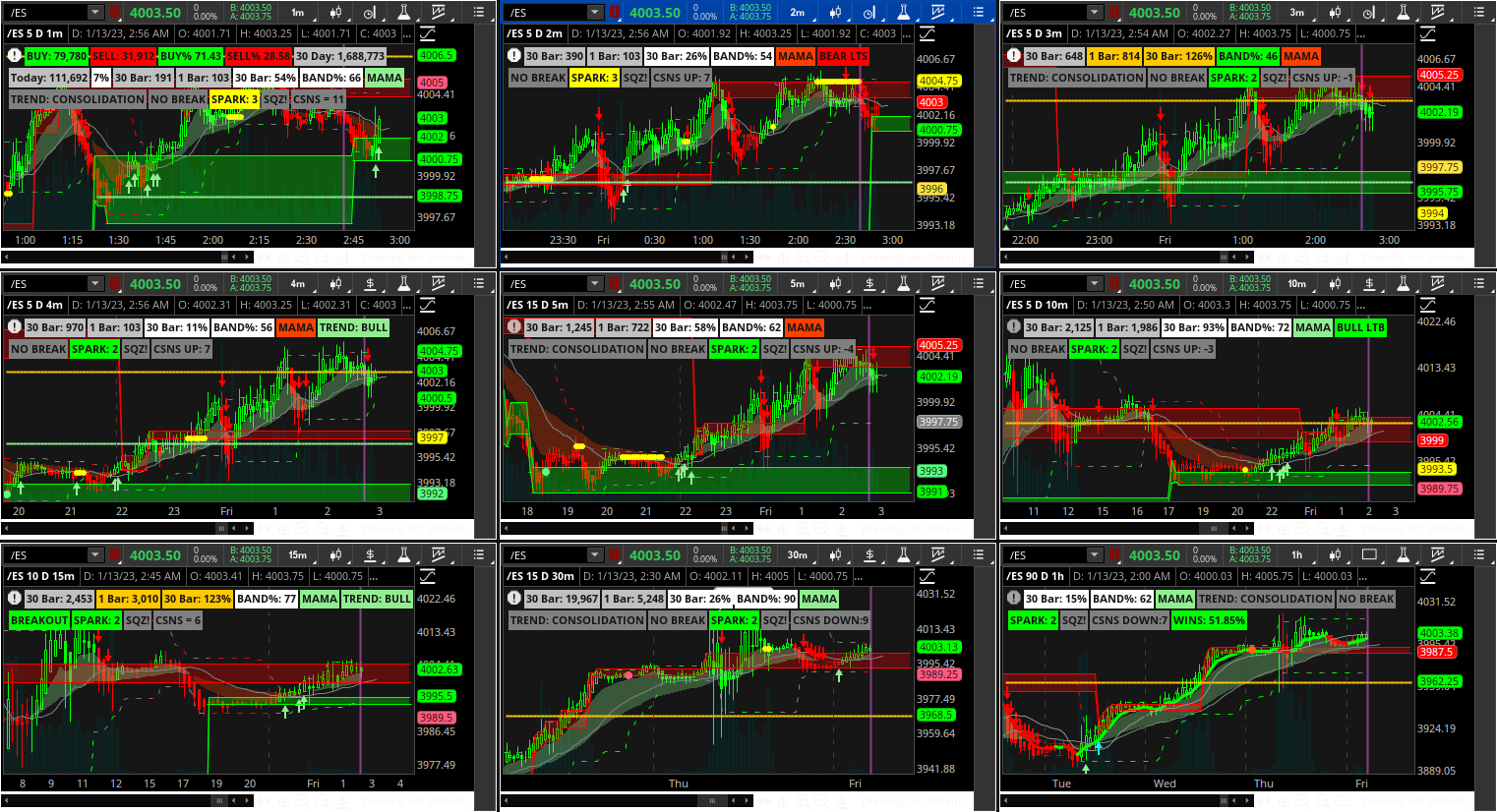

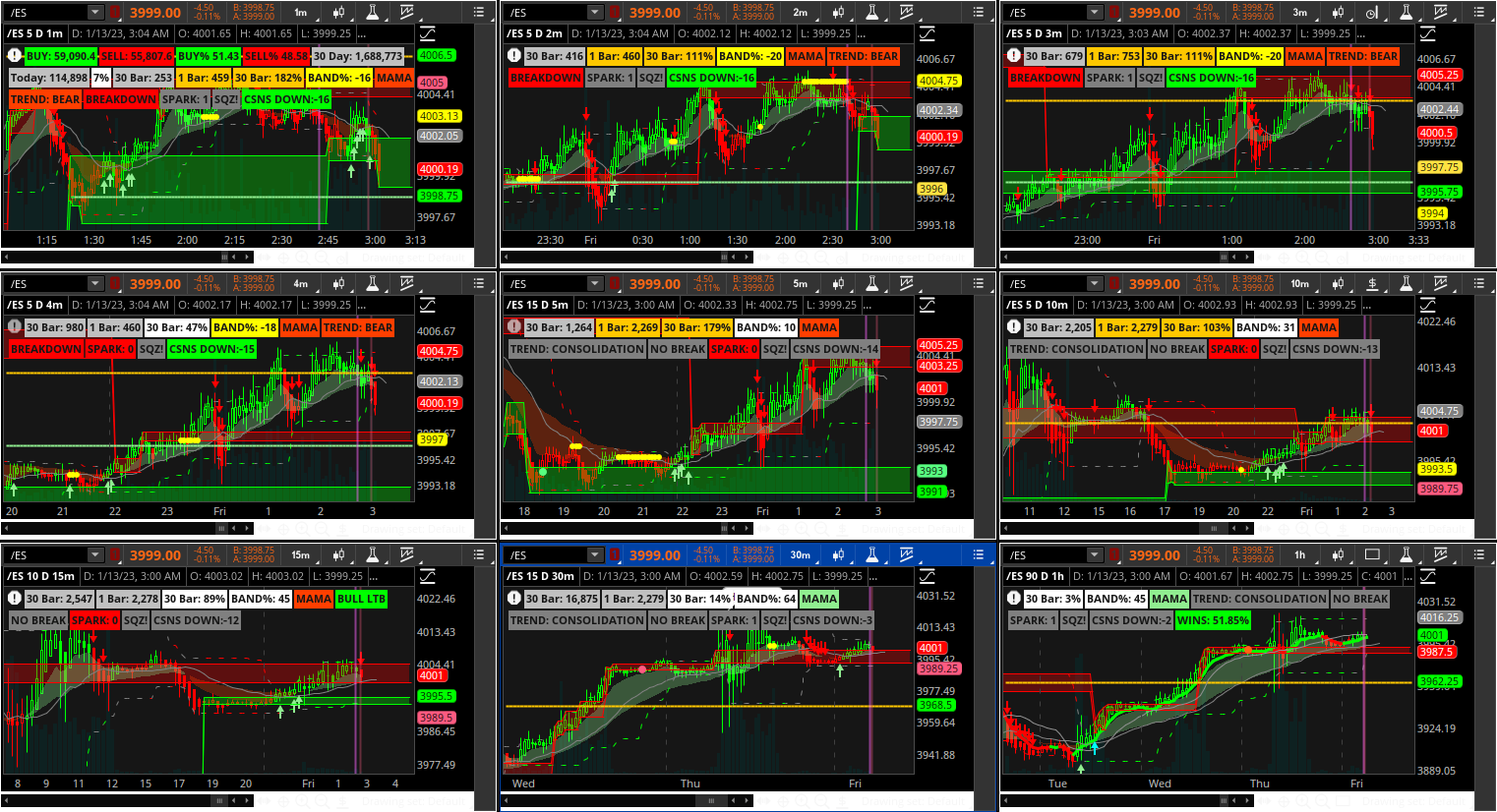

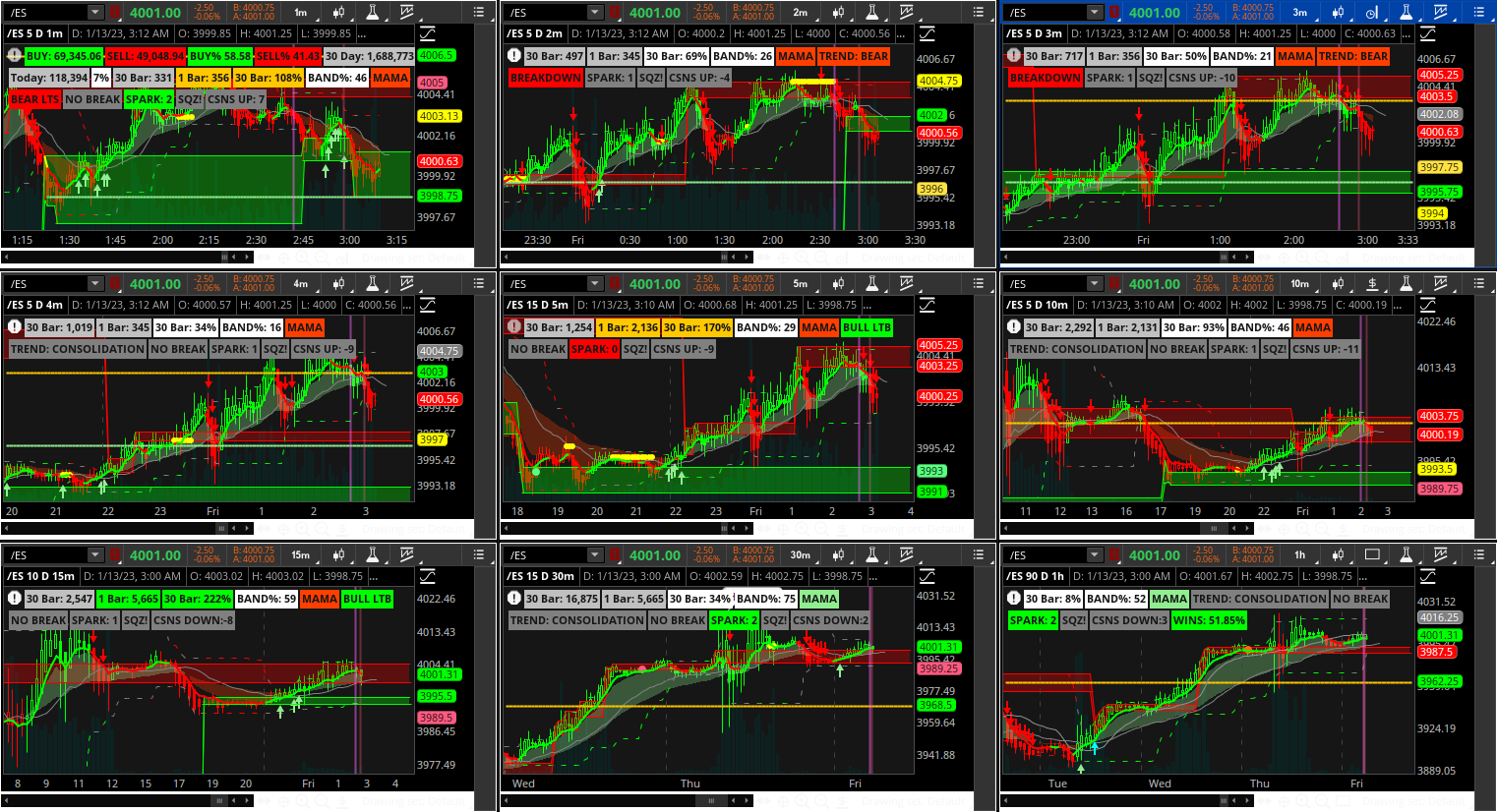

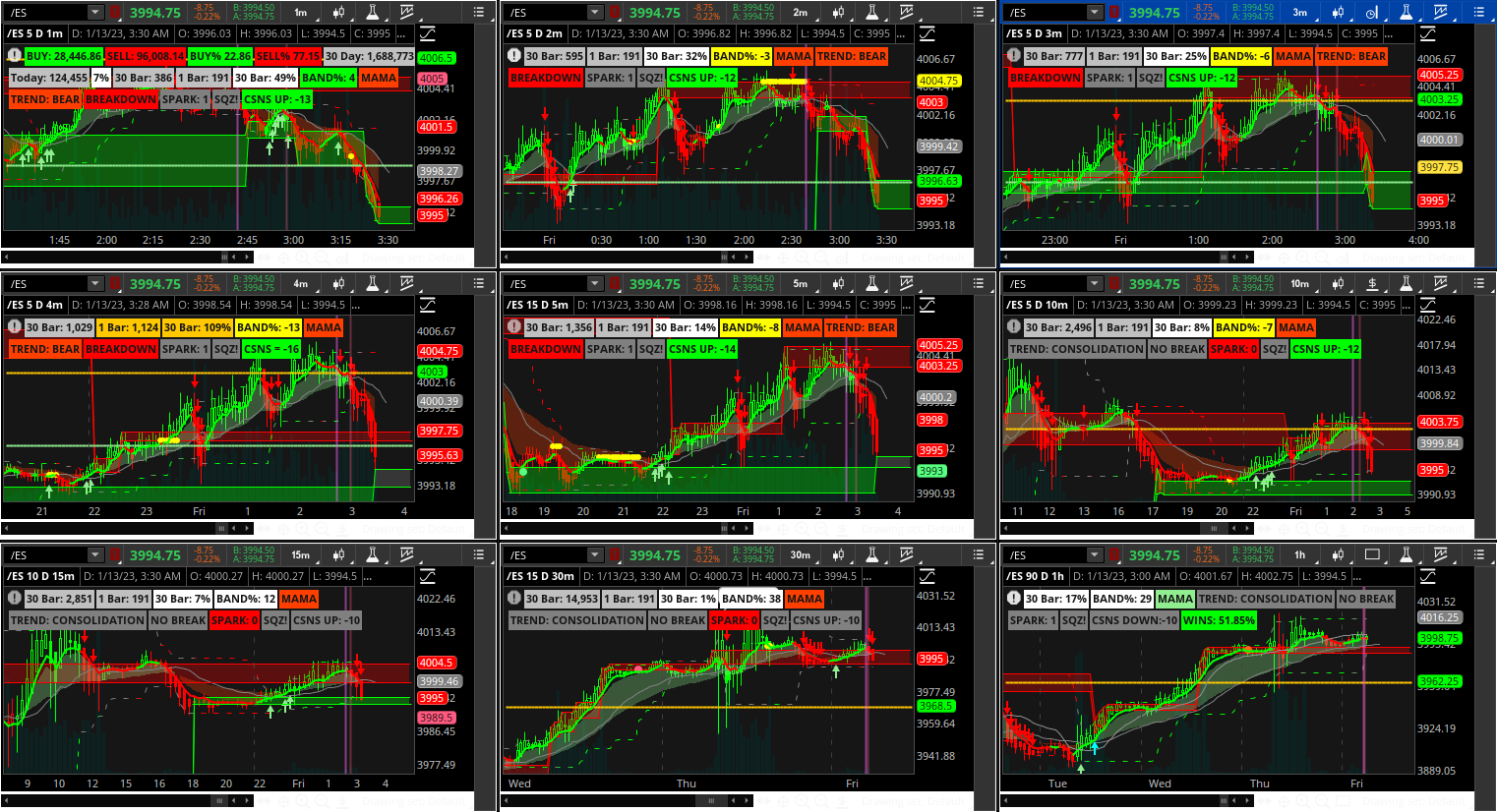

Been watching gridslybears… a grid. Thought it would be too busy for me, but it is surprisingly helpful.

In the screenshots you will see support begin to form as well as various levels of confirmation (not necessarily the number - I personally do not use the consensus/confirmation number label)

Notice some timeframes show the yellow and light green lines where you are able to see significant levels. When price starts to turn down on the 2min you can see it is still using that level as support on the 10min it bounces and eventually breaks below.

Recently started using at the "BAND%" Label (Bollinger bands) it seems like a useful indication.

Between the labels and coloring of candles, supply demand zones, etc. it makes for better entries by looking for agreement between multiple timeframes. (forgot to add the C3 line that is why it is only in the last screenshot ((might be out of order))

https://tos.mx/isJ2q1U

In the screenshots you will see support begin to form as well as various levels of confirmation (not necessarily the number - I personally do not use the consensus/confirmation number label)

Notice some timeframes show the yellow and light green lines where you are able to see significant levels. When price starts to turn down on the 2min you can see it is still using that level as support on the 10min it bounces and eventually breaks below.

Recently started using at the "BAND%" Label (Bollinger bands) it seems like a useful indication.

Between the labels and coloring of candles, supply demand zones, etc. it makes for better entries by looking for agreement between multiple timeframes. (forgot to add the C3 line that is why it is only in the last screenshot ((might be out of order))

https://tos.mx/isJ2q1U

Last edited:

thanks for sharing excepting the Floating P/L does not workHi @SuperContra,

Sorry to hear that you are having some difficulties. Here is a link to my chart setup https://tos.mx/TcBb4jI. It Is working properly for me. It may be that you need more than 2 Days on the chart history for it to work properly. Please let me know if this doesn't correct the issue.

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1501

Online

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

Similar threads

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

-

Confirmation Candle with Key Level and Weighted Paintbars Chart Setup For ThinkOrSwim

- Started by rip78

- Replies: 8

-

The Confirmation Trend Chart Setup | The End All Be All | For ThinkOrSwim

- Started by HODL-Lay-HE-hoo!

- Replies: 284

-

DEMA Crossover with Heikin-Ashi Candle Confirmation for ThinkorSwim

- Started by theelderwand

- Replies: 67

-

Repaints NSDT HAMA Candles + SSL Channel For ThinkOrSwim

- Started by samer800

- Replies: 61

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.